GFA 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive gfa review examines the various entities operating under the GFA brand. It reveals a complex landscape of financial service providers with different specializations and operational backgrounds that spans multiple decades of operation. GFA encompasses multiple organizations including GFA Financial Group, established in 1989 as an independent financial advisory firm specializing in personal and retirement portfolio management. Gallagher Fiduciary Advisors LLC also operates under the GFA name, founded in 2008 as a registered investment adviser subsidiary of Gallagher Benefits Services.

The evaluation reveals that while GFA entities have established histories in financial services, there remains limited publicly available information regarding specific trading conditions, regulatory oversight, and detailed service offerings for retail forex and CFD trading. GFA Federal Credit Union also operates under this brand umbrella. It provides traditional banking services to its members through various financial products and services.

Based on available information, GFA appears to target individual investors seeking portfolio management services and retirement planning solutions. However, potential clients should exercise caution due to the lack of comprehensive regulatory transparency and specific trading terms disclosure across different GFA entities. This creates challenges for investors trying to make informed decisions about their financial partnerships.

Important Notice

Due to the existence of multiple entities operating under the GFA brand name, potential clients should carefully verify which specific organization they are engaging with. Trading conditions, services, and regulatory oversight may vary significantly between different GFA entities depending on their operational focus and regulatory requirements. This review is based on publicly available information and user feedback. Specific trading conditions and regulatory details remain limited in available documentation across all GFA entities.

The assessment acknowledges that information gaps exist regarding crucial aspects such as specific regulatory compliance, detailed trading terms, and comprehensive user experience data. These gaps may impact the completeness of this evaluation and should be considered when making investment decisions.

Rating Framework

Broker Overview

GFA represents a collection of financial service entities with varying establishment dates and service focuses. GFA Financial Group was founded in 1989 by William D. and operates as an independent financial advisory firm specializing in the design and management of personal and retirement portfolios. This entity has maintained a focus on traditional investment management services for over three decades. It positions itself within the fee-only financial advisory space with emphasis on client-centered service delivery.

Gallagher Fiduciary Advisors LLC was established in 2008 as the registered investment adviser subsidiary of Gallagher Benefits Services, one of the world's largest employee benefits consulting firms. This entity operates under the ownership structure of Arthur J. Gallagher & Co. It provides institutional-level investment advisory services with a focus on fiduciary responsibilities and compliance with SEC regulations.

The business model across GFA entities appears to center on personalized investment management and advisory services. Specific details about forex and CFD trading capabilities remain unclear in available documentation due to limited public disclosure. According to available information, GFA entities have updated their assets under management to include balances from recent acquisitions. This suggests ongoing business expansion and consolidation activities within the organization.

Trading platform specifications, asset class coverage beyond traditional investments, and regulatory oversight details are not comprehensively detailed in publicly available materials. This gfa review notes that potential clients seeking specific forex and CFD trading services should request detailed information directly from the relevant GFA entity. They need to understand available offerings and regulatory protections before making any commitments.

Regulatory Jurisdiction: Available information does not specify detailed regulatory oversight beyond the mention of SEC registration for Gallagher Fiduciary Advisors LLC. The regulatory status of other GFA entities requires direct verification with the respective organizations to ensure compliance and protection.

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and associated fees is not detailed in available public documentation.

Minimum Deposit Requirements: Minimum account funding requirements are not specified in available materials and would need to be confirmed directly with the service provider.

Bonuses and Promotions: No information about promotional offers or bonus structures is available in current documentation.

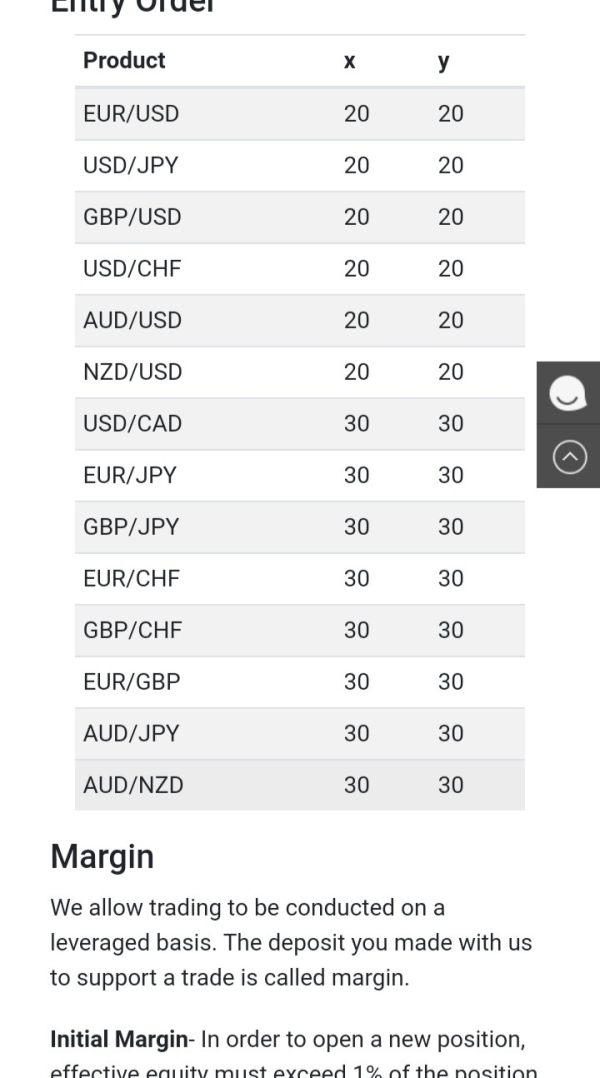

Tradeable Assets: Based on available information, GFA entities focus on traditional investment management services. Specific asset classes and trading instruments require direct confirmation from the service providers.

Cost Structure: Detailed information about spreads, commissions, management fees, and other cost components is not comprehensively available in public materials.

Leverage Ratios: Leverage specifications for trading services are not detailed in available documentation.

Platform Options: Specific trading platform information is not provided in current public materials.

Geographic Restrictions: Service availability by region is not detailed in available documentation.

Customer Support Languages: Specific language support information is not available in current materials.

This gfa review emphasizes the need for potential clients to request comprehensive service details directly from GFA representatives. They must obtain accurate and current information about trading conditions and service offerings before making any financial commitments.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for GFA entities reveals significant information gaps that impact the assessment quality. Available documentation does not provide specific details about account types, minimum deposit requirements, or tiered service structures that would typically be expected from a comprehensive trading service provider. This lack of transparency creates challenges for potential clients seeking to understand the basic requirements for engagement.

Based on the limited information available, GFA entities appear to focus on traditional investment advisory services rather than standardized retail trading accounts. The mention of personal and retirement portfolio management suggests that account structures may be customized based on individual client needs and investment objectives. This approach differs from standardized trading account models commonly found in retail forex and CFD trading.

The lack of publicly available information about account opening procedures, verification requirements, and ongoing account maintenance conditions represents a significant limitation for potential clients. They need to understand the commitment required to engage with GFA services before making decisions. This gfa review notes that the absence of clear account condition disclosure may indicate either a focus on institutional clients or a preference for direct consultation rather than standardized retail offerings.

Without specific information about Islamic account options, account currency choices, or special features designed for different trading styles, potential clients cannot adequately assess whether GFA account structures align with their specific requirements. This creates additional uncertainty for investors considering GFA services for their trading and investment needs.

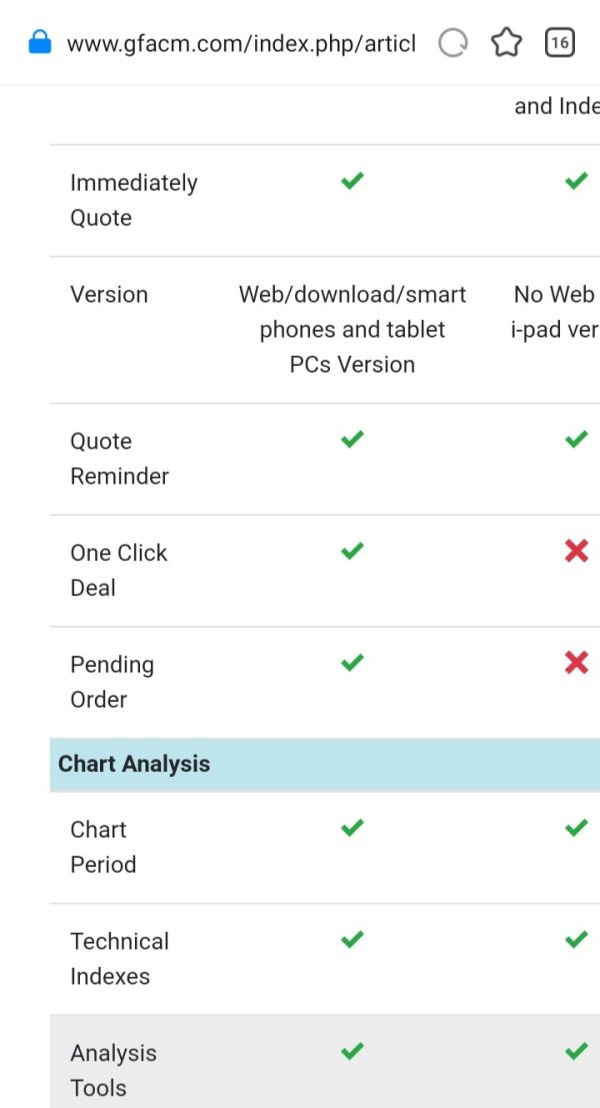

The assessment of trading tools and analytical resources available through GFA entities is significantly limited by the lack of detailed public information about platform capabilities and research offerings. Available documentation does not specify whether GFA provides proprietary trading platforms, third-party platform integration, or web-based trading solutions for their clients. This absence of information makes it difficult to evaluate the technological capabilities and competitive positioning of GFA services.

Research and analytical resource availability remains unclear, with no specific mention of market analysis, economic calendars, technical analysis tools, or fundamental research capabilities in available materials. This absence of information about analytical support tools may indicate either a focus on different service models or insufficient public disclosure about available resources. Potential clients seeking comprehensive market analysis and research support cannot determine whether GFA services meet their analytical requirements.

Educational resource availability is not detailed in current documentation. This leaves potential clients without information about training materials, webinars, market education programs, or trading guides that might be available to support their trading development. The lack of educational resource information represents a significant gap for clients seeking to improve their trading knowledge and skills.

The lack of information about automated trading support, API access, or algorithmic trading capabilities suggests that GFA entities may not prioritize these features. Direct confirmation would be required to verify the availability of advanced trading tools and automation options for clients seeking sophisticated trading capabilities.

Customer Service and Support Analysis

Customer service evaluation for GFA entities is challenged by limited specific feedback and unclear service delivery structures across different organizational entities. Available review platforms show mixed feedback, though specific details about response times, service quality, and issue resolution effectiveness are not comprehensively documented across all service areas. This makes it difficult to assess the overall quality and consistency of customer support services.

The presence of multiple GFA entities with different operational focuses may result in varying customer service experiences depending on which organization clients engage with. This structural complexity could potentially impact service consistency and client experience quality across different service lines. Clients may encounter different support standards and procedures depending on their specific service provider within the GFA network.

Available information does not specify customer service availability hours, supported communication channels, or multilingual support capabilities. The absence of clear customer service specifications makes it difficult for potential clients to understand what level of support they can expect during their engagement with GFA services. This lack of transparency creates uncertainty about accessibility and responsiveness of support services.

Without detailed information about dedicated account management, technical support availability, or escalation procedures, potential clients cannot adequately assess whether GFA customer service capabilities align with their expected service levels. They need to understand support requirements before committing to services that may require ongoing assistance and communication.

Trading Experience Analysis

The evaluation of trading experience quality is significantly limited by the absence of detailed information about platform performance, execution quality, and overall trading environment characteristics. Available documentation does not provide specific details about order execution speeds, slippage rates, or platform stability metrics that are crucial for assessing trading effectiveness. This lack of performance data makes it challenging to evaluate the technical quality of GFA trading services.

Platform functionality assessment is not possible based on available information, as specific details about trading interface design, order types, charting capabilities, and mobile trading options are not documented in accessible materials. Potential clients cannot determine whether platform features and functionality meet their trading requirements and preferences. This represents a significant limitation for traders seeking to understand the tools and capabilities available through GFA services.

User feedback regarding trading experience quality is limited, with insufficient detail about platform reliability, execution satisfaction, or technical performance issues that might impact trading effectiveness. The absence of comprehensive user reviews and performance feedback makes it difficult to assess real-world trading experience quality. Potential clients lack insight into common issues or positive aspects of the trading environment.

This gfa review notes that the lack of comprehensive trading experience information may indicate that GFA entities focus primarily on investment management services rather than active trading platforms. Direct verification would be required to confirm the scope and quality of available trading services for clients seeking active trading capabilities.

Trust and Reliability Analysis

Trust assessment for GFA entities reveals a mixed picture with established operational history but limited regulatory transparency in available public documentation. The mention of SEC registration for Gallagher Fiduciary Advisors LLC provides some regulatory foundation, though comprehensive regulatory oversight details are not fully disclosed across all entities. This creates uncertainty about the level of regulatory protection and oversight available to clients.

Company transparency varies across different GFA entities, with some organizations providing basic operational information while others maintain limited public disclosure about their specific services and regulatory compliance measures. This inconsistency in transparency makes it challenging to assess the overall reliability and accountability of GFA services. Potential clients may find it difficult to obtain comprehensive information about the organizations they are considering for their financial services.

The established operational history dating back to 1989 for GFA Financial Group suggests institutional stability and longevity in the financial services industry. Recent acquisition activities and business expansion efforts may introduce operational changes that could impact service consistency and client experience quality. These changes may affect established procedures and service delivery standards.

Without detailed information about client fund segregation, insurance coverage, or specific regulatory protections, potential clients cannot fully assess the safety and security measures in place. They need to understand how their investments and trading capital are protected before making financial commitments to GFA services.

User Experience Analysis

User experience evaluation is significantly limited by the scarcity of detailed user feedback and comprehensive satisfaction data across different GFA entities. Available review information provides limited insight into overall client satisfaction levels and specific experience quality metrics that would help potential clients understand what to expect. This lack of comprehensive feedback makes it difficult to assess the real-world user experience quality.

Interface design and usability assessment cannot be adequately performed based on available information, as specific details about platform navigation, account management interfaces, and mobile accessibility are not documented in accessible materials. Potential clients cannot determine whether the user interfaces and navigation systems meet their usability requirements and preferences. This represents a significant gap in understanding the practical aspects of using GFA services.

Registration and verification process information is not detailed in available documentation. This leaves potential clients without clear expectations about onboarding procedures and account activation timelines that are important for planning their engagement. The absence of process information creates uncertainty about the time and effort required to begin using GFA services.

The absence of comprehensive user feedback about common issues, service quality concerns, or positive experience highlights makes it difficult to provide balanced assessment of user experience quality. Potential clients lack insight into both positive aspects and potential challenges they might encounter when using GFA service offerings across different entities.

Conclusion

This comprehensive gfa review reveals a complex landscape of financial service entities operating under the GFA brand, with established operational histories but significant information gaps regarding specific trading conditions and service offerings. While GFA entities demonstrate institutional stability through decades of operation, the lack of detailed regulatory disclosure and specific trading terms represents a notable limitation for potential clients seeking transparency. The multiple entities operating under the GFA brand create additional complexity for clients trying to understand which services and protections apply to their specific situation.

GFA services appear most suitable for investors seeking traditional investment management and portfolio advisory services rather than active retail trading platforms. The focus on personal and retirement portfolio management suggests alignment with long-term investment strategies. It differs significantly from short-term trading activities that many retail clients seek in today's financial markets.

The primary advantages include established company history and institutional backing through decades of operation in the financial services industry. The main disadvantages center on limited transparency regarding trading conditions, regulatory oversight, and specific service terms that are crucial for informed decision-making. Potential clients should conduct thorough due diligence and request comprehensive service details directly from GFA representatives before making engagement decisions to ensure their needs and expectations align with available services.