Grinta Invest 2025 Review: Everything You Need to Know

Executive Summary

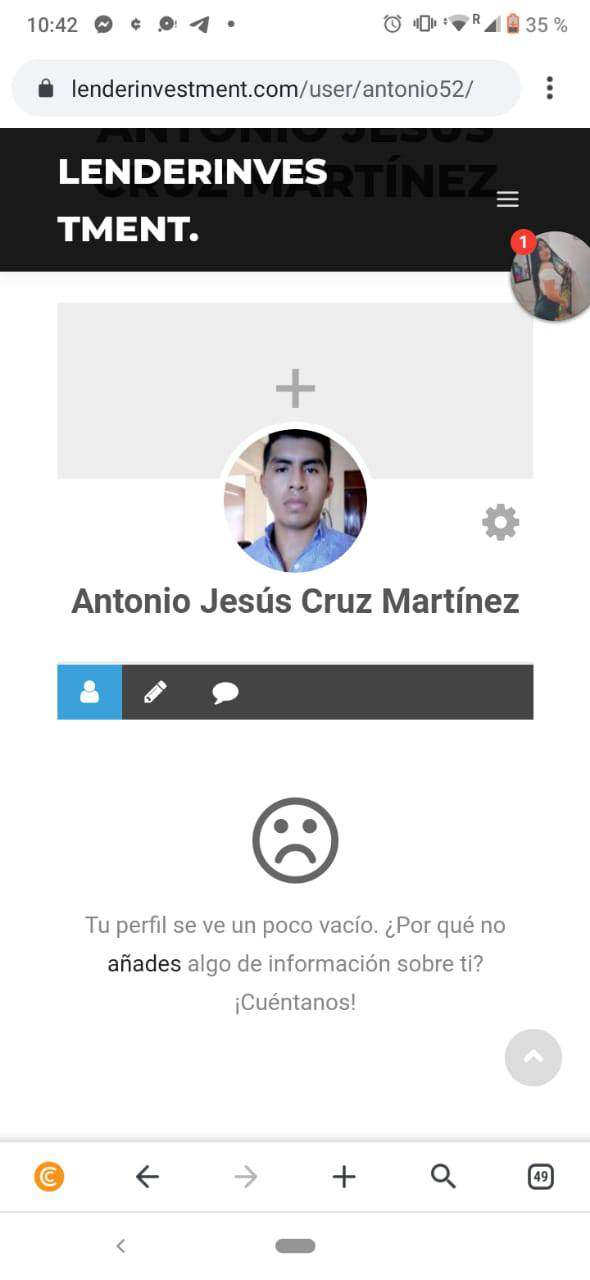

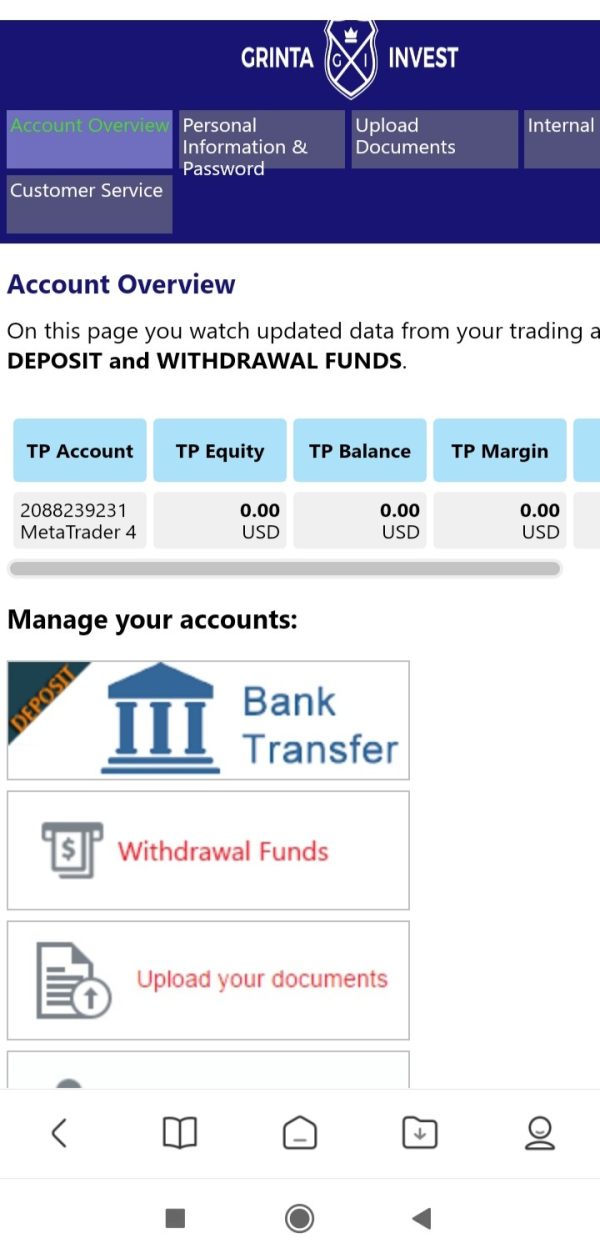

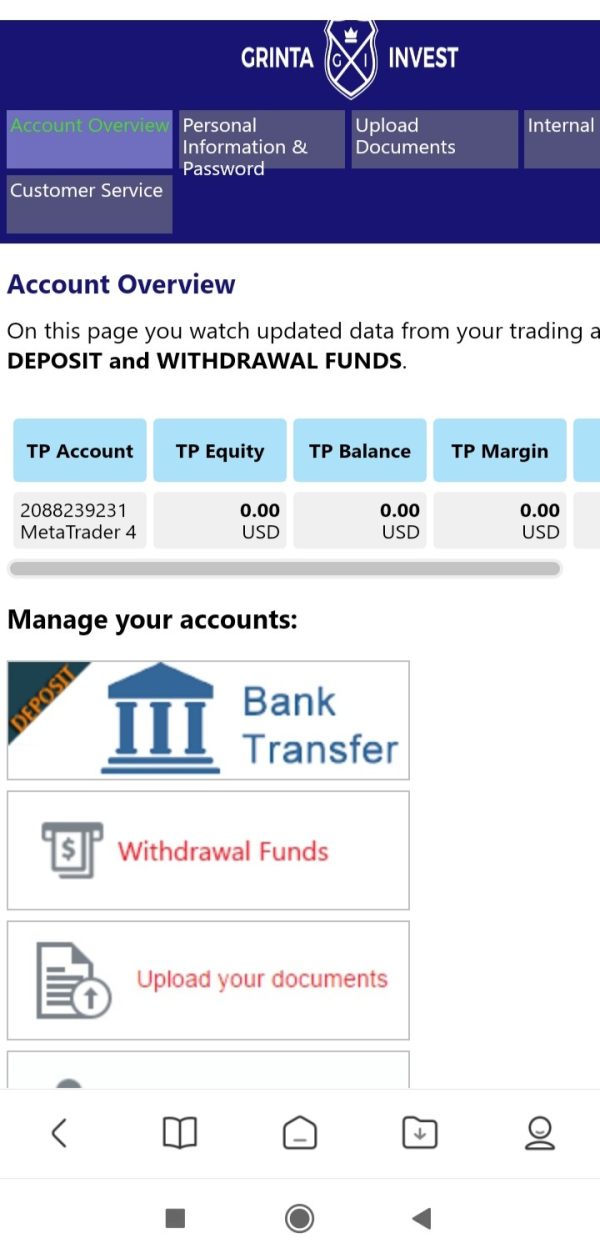

Grinta Invest is a Marshall Islands-based STP/ECN forex broker. It has gotten mixed attention in the trading community. This grinta invest review shows a broker that offers high leverage up to 1:500 and commission-free account options, mainly targeting active traders who want to maximize their trading potential with lower costs. The broker works through the popular MetaTrader 4 platform. It positions itself as an ECN broker with managed account services.

Trustpilot shows that Grinta Invest keeps a 5-star rating. This suggests positive user experiences. However, the broker faces questions about its regulatory status and legitimacy concerns. The company's business model focuses on providing STP/ECN execution with competitive spreads starting from 1.3 pips. This appeals to traders who prioritize cost-effective trading conditions.

The main target group includes experienced traders who value high leverage opportunities and low transaction costs. While the broker offers attractive trading conditions, potential clients should carefully consider the regulatory uncertainties before putting in funds.

Important Notice

Regulatory Disclaimer: Grinta Invest operates from the Marshall Islands without clear mention of specific regulatory oversight from major financial authorities. This regulatory gap presents risks that traders should carefully evaluate before opening accounts.

Review Methodology: This complete evaluation is based on available user feedback, market analysis, and publicly accessible information. Due to limited regulatory transparency, some parts of this review rely heavily on user experiences and third-party assessments rather than verified regulatory documentation.

Rating Overview

Broker Overview

Grinta Invest entered the forex market in 2015. It established its headquarters in the Marshall Islands. The company operates as an ECN/STP broker, offering clients direct market access and managed account options. The broker's business model focuses on providing transparent pricing through its ECN execution while maintaining STP processing for retail clients.

The company positions itself as a technology-driven broker. It emphasizes its "unique technology" in managed account services. Grinta Invest targets traders seeking institutional-grade execution with retail accessibility, combining competitive spreads with high leverage opportunities.

Operating mainly through MetaTrader 4, Grinta Invest provides access to multiple asset classes. However, specific details about the complete range of tradeable instruments remain limited in available documentation. The broker's approach emphasizes cost-effective trading through commission-free account structures and competitive spread pricing. However, this grinta invest review must note the absence of clear regulatory oversight from recognized financial authorities, which significantly impacts the broker's credibility assessment.

Regulatory Status: Grinta Invest claims operations from the Marshall Islands but lacks specific regulatory authority oversight. This creates uncertainty about legal compliance and client protection measures.

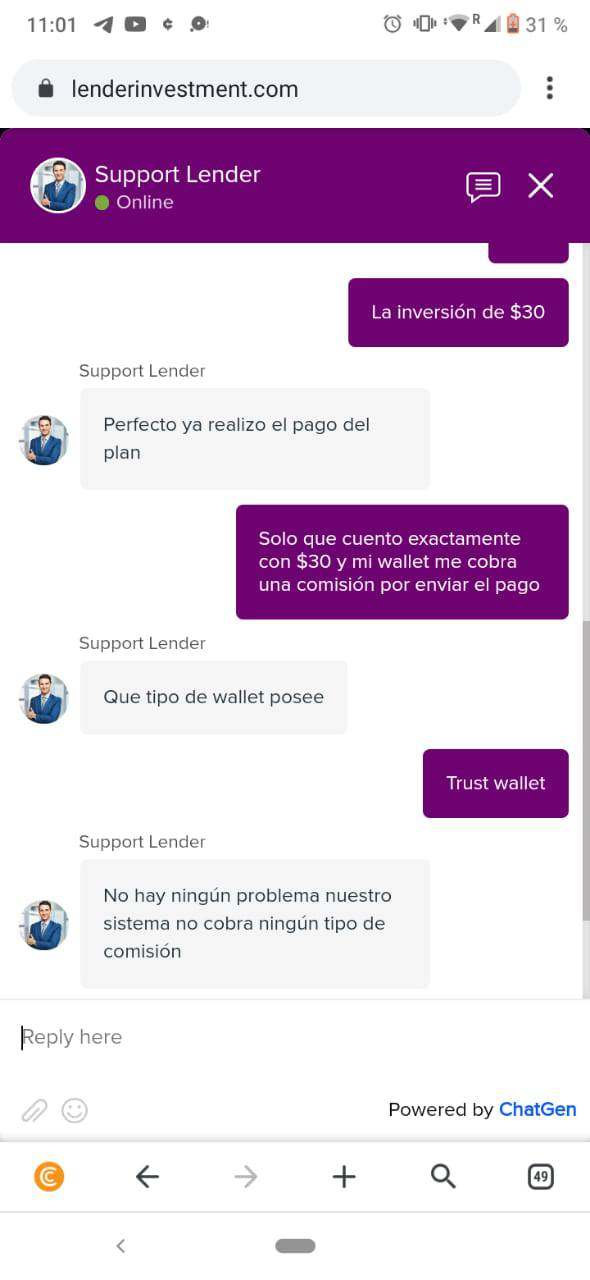

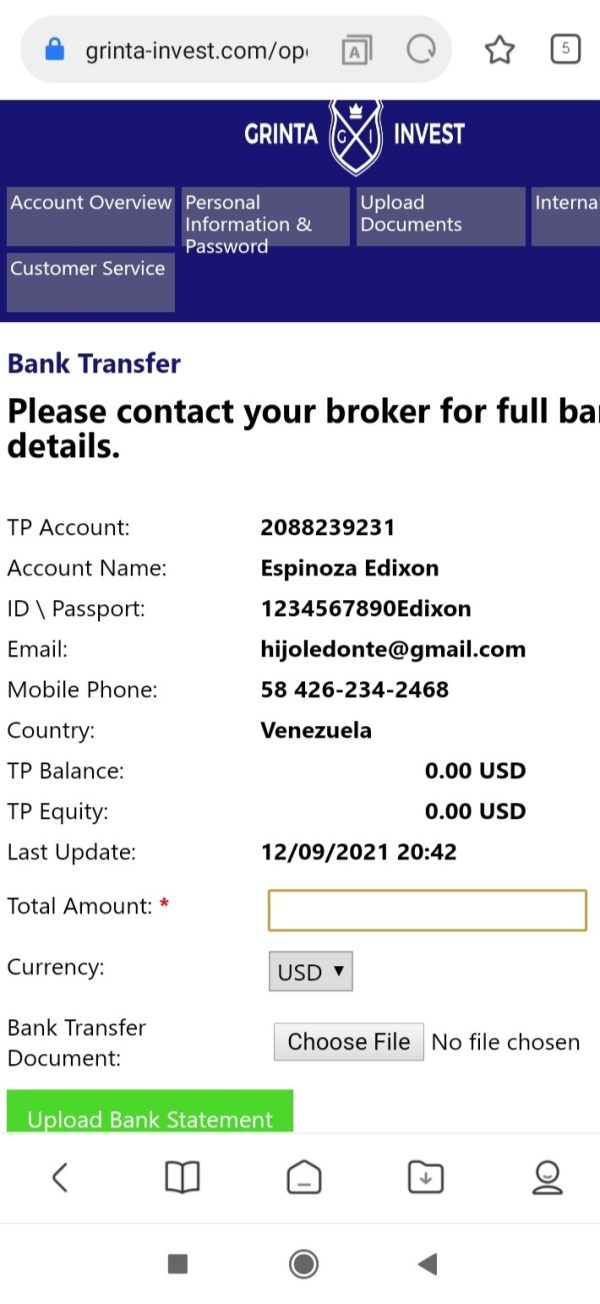

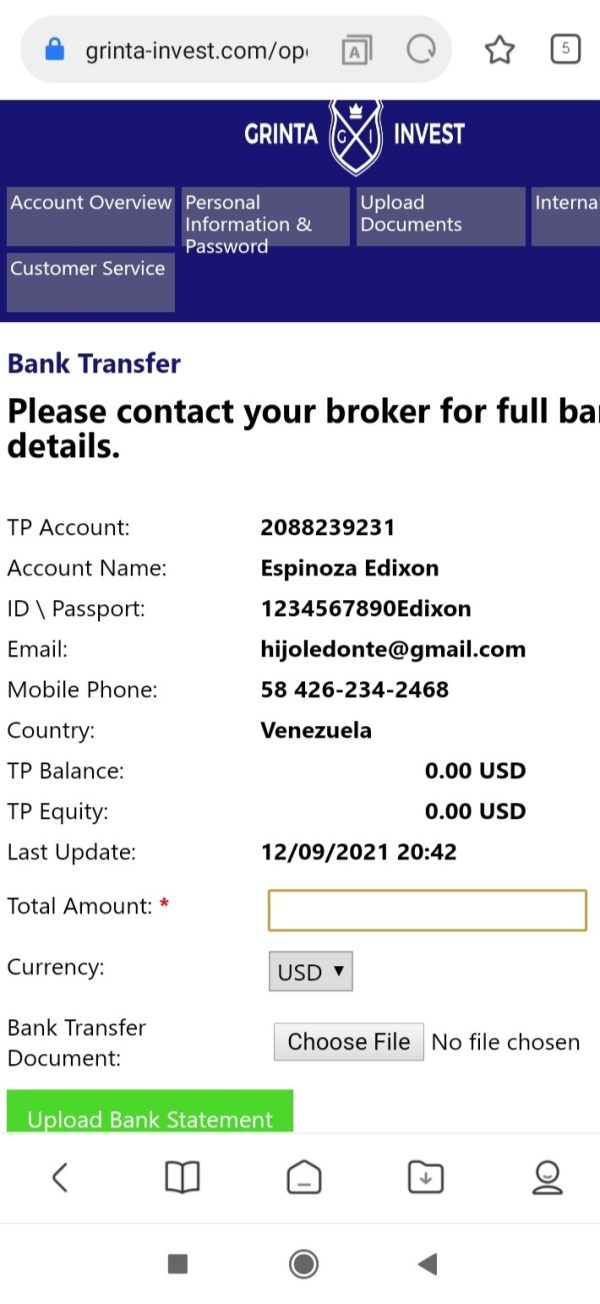

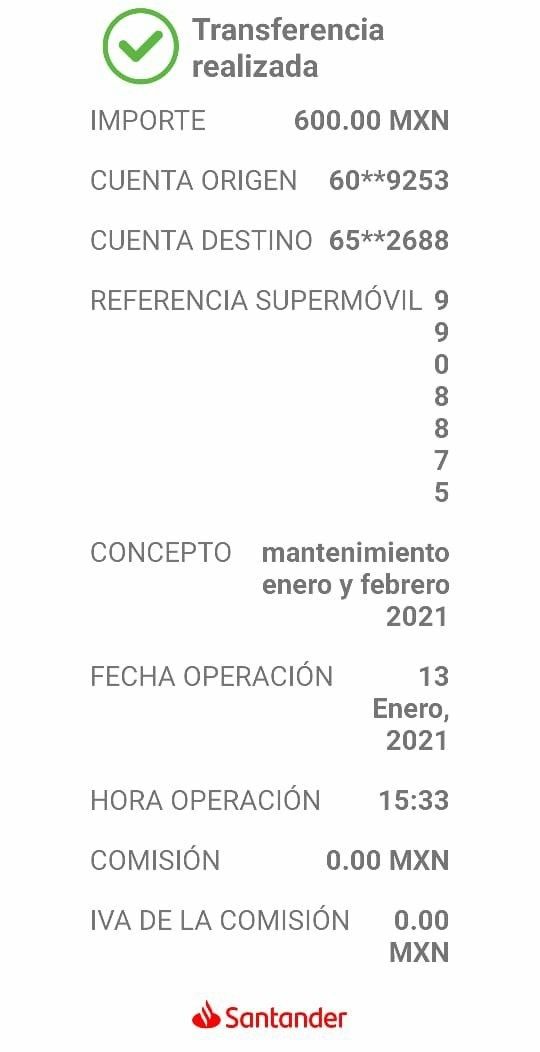

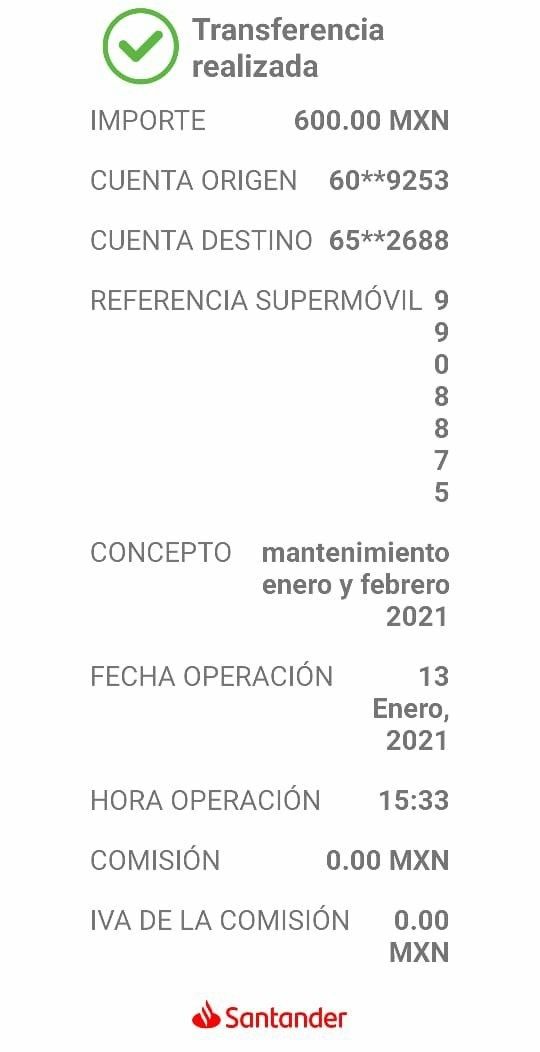

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in available information. This requires direct contact with the broker for clarification on supported payment methods.

Minimum Deposit Requirements: The minimum deposit threshold is not specified in available documentation. This indicates a need for improved transparency in account opening requirements.

Bonus and Promotions: Current promotional offerings and bonus structures are not mentioned in accessible materials. This suggests either absence of such programs or limited marketing disclosure.

Tradeable Assets: The broker offers multiple asset classes beyond forex. However, specific categories and instruments are not fully detailed in available sources.

Cost Structure: Trading costs begin with spreads from 1.3 pips. They are complemented by commission-free account options that appeal to cost-conscious traders seeking reduced transaction expenses.

Leverage Options: Maximum leverage reaches 1:500. This provides significant trading power for experienced traders who understand the associated risks of high leverage trading.

Platform Options: MetaTrader 4 serves as the primary trading platform. It offers familiar functionality and extensive technical analysis tools for traders.

Geographic Restrictions: Specific regional limitations are not clearly outlined in available information.

Customer Support Languages: Supported languages for customer service are not specified in accessible documentation.

This grinta invest review highlights the need for enhanced transparency in several operational aspects.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Grinta Invest's account structure centers around commission-free options. This represents a significant advantage for traders seeking to minimize transaction costs. The broker offers multiple account types without charging commissions, making it attractive for high-frequency traders and those operating with smaller capital bases.

However, the lack of transparency regarding minimum deposit requirements creates uncertainty for potential clients. This information gap prevents traders from properly planning their account funding and comparing costs with other brokers. User feedback suggests that account opening is relatively straightforward, but the absence of clear deposit thresholds in promotional materials indicates room for improvement in transparency.

The commission-free structure, while appealing, requires careful examination of spread markups to understand the true cost of trading. Compared to other brokers in the market, Grinta Invest's account conditions show promise but lack the comprehensive disclosure that experienced traders expect. This grinta invest review notes that while the basic account structure appears competitive, enhanced transparency would significantly improve the overall offering.

The MetaTrader 4 platform serves as Grinta Invest's primary technological offering. It provides traders with a well-established and widely recognized trading environment. User feedback consistently highlights the platform's stability and comprehensive functionality, including advanced charting tools, technical indicators, and automated trading capabilities.

The platform's reliability receives positive mentions from users who appreciate its consistent performance and familiar interface. MetaTrader 4's extensive customization options allow traders to adapt the platform to their specific trading strategies and preferences.

However, available information lacks details about additional research resources, educational materials, or proprietary trading tools that might distinguish Grinta Invest from competitors. The absence of information regarding economic calendars, market analysis, or educational content represents a potential weakness in the broker's resource offering.

Industry experts generally regard MetaTrader 4 as a robust platform choice. Grinta Invest's implementation appears to meet standard expectations. The platform's support for expert advisors and automated trading strategies adds value for algorithmic traders, though specific details about these capabilities require direct verification with the broker.

Customer Service and Support Analysis (5/10)

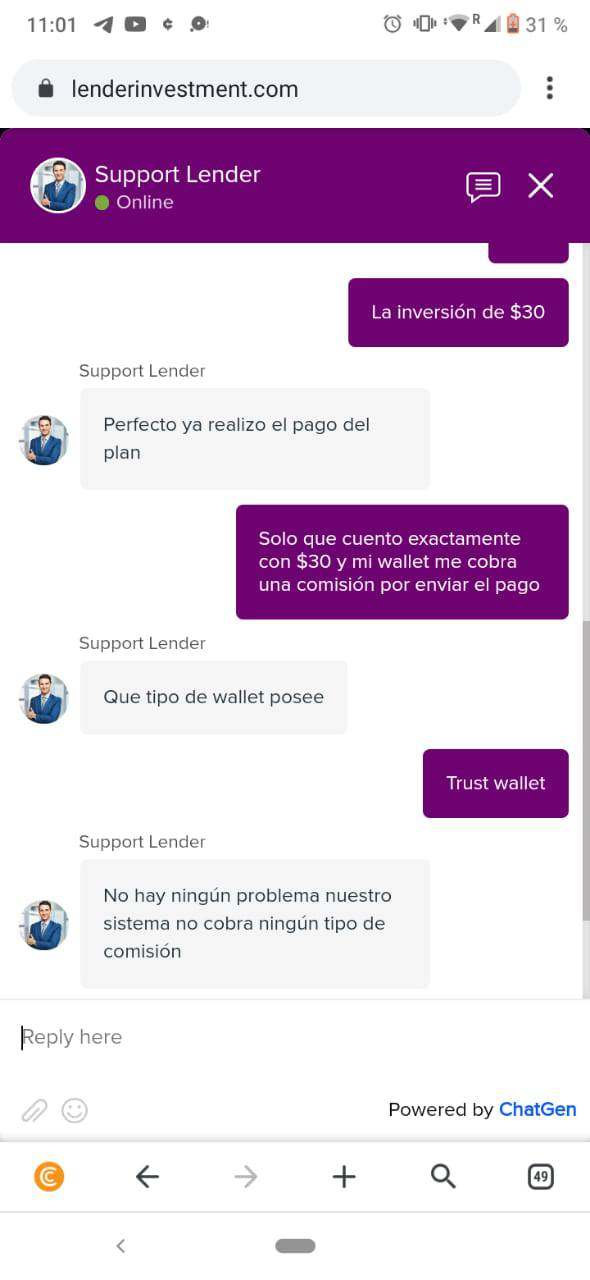

Customer service feedback presents a mixed picture for Grinta Invest. User experiences vary significantly across different service aspects. While some clients report satisfactory interactions with support staff, others express concerns about response times and problem resolution effectiveness.

The absence of detailed information about available customer service channels limits this assessment. Standard industry practice includes multiple contact methods such as live chat, email, and phone support, but Grinta Invest's specific offerings in this area remain unclear from available sources.

User feedback suggests inconsistency in service quality. Some traders report helpful assistance while others question the support team's ability to resolve complex issues effectively. The lack of specified customer service hours and multilingual support information further complicates the service assessment.

Response time feedback varies among users. This indicates potential staffing or system limitations that affect service delivery. This inconsistency in customer support quality represents an area requiring attention, particularly given the importance of reliable support in the forex trading environment where issues can have immediate financial implications.

Trading Experience Analysis (7/10)

The overall trading experience with Grinta Invest receives generally positive feedback from users. This is particularly true regarding platform stability and execution quality. Traders consistently report that the MetaTrader 4 platform operates smoothly with minimal technical disruptions, contributing to a reliable trading environment.

Spread competitiveness and leverage availability earn positive user comments. Many traders appreciate the 1:500 maximum leverage and starting spreads from 1.3 pips. The combination of high leverage and competitive costs creates an attractive trading environment for active traders seeking to maximize their position sizes.

Platform functionality receives praise for its comprehensive features and user-friendly interface. The familiar MetaTrader 4 environment allows traders to implement various strategies without learning new platform mechanics, contributing to overall satisfaction.

However, mobile trading experience details are not extensively covered in available feedback. This represents a gap in the comprehensive assessment of trading experience. Modern traders increasingly rely on mobile platforms, making this information particularly relevant for potential clients.

Order execution quality appears satisfactory based on user reports. Traders note acceptable slippage levels and reliable trade processing. This grinta invest review finds that the trading experience generally meets industry standards, though enhanced mobile platform information would strengthen the overall assessment.

Trust and Security Analysis (4/10)

Trust and security represent the most significant concerns in this Grinta Invest evaluation. The absence of clear regulatory oversight from recognized financial authorities creates substantial uncertainty about client protection measures and operational compliance standards.

The Marshall Islands location, while legal, does not provide the same regulatory framework and investor protection that traders typically expect from major financial centers. This regulatory gap significantly impacts the broker's credibility and raises questions about fund safety and dispute resolution mechanisms.

Available information lacks details about client fund segregation, insurance coverage, or other standard security measures that regulated brokers typically implement. These omissions create additional uncertainty about the safety of client deposits and the broker's operational integrity.

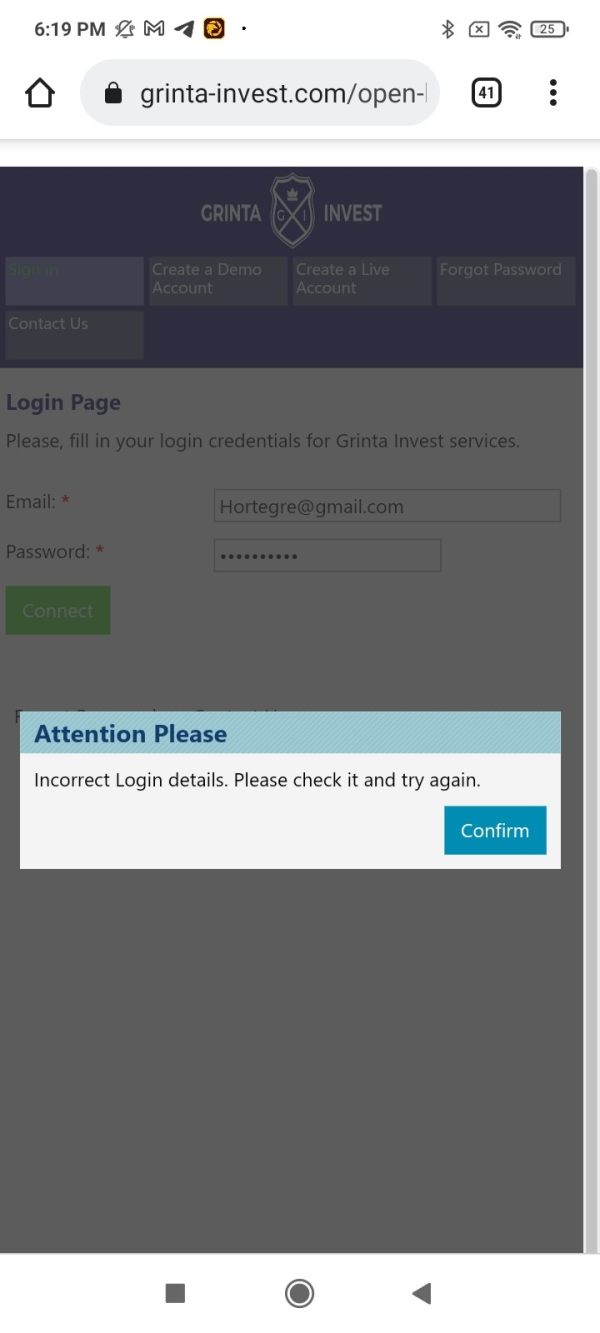

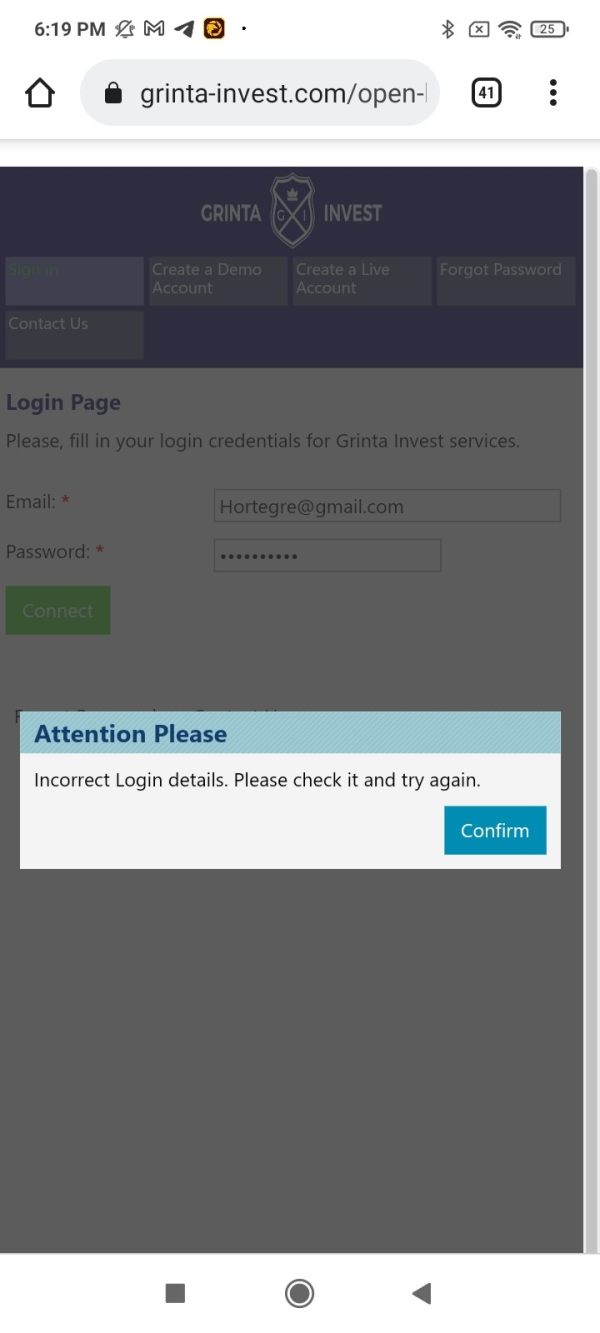

User concerns about legitimacy and safety appear in various feedback sources. This indicates that the regulatory uncertainty affects trader confidence. Some users express specific doubts about the broker's legal status and operational transparency, further complicating the trust assessment.

Third-party verification of the broker's claims remains limited due to the regulatory situation. This makes independent assessment of safety measures difficult. This trust deficit represents the most significant challenge facing potential Grinta Invest clients.

User Experience Analysis (6/10)

Overall user satisfaction presents a complex picture. Grinta Invest achieves a 5-star rating on Trustpilot while simultaneously facing legitimacy concerns from some users. This contrast highlights the varied experiences and expectations within the trader community.

The MetaTrader 4 interface design receives positive feedback for its familiar layout and comprehensive functionality. Traders appreciate the platform's intuitive navigation and extensive customization options, contributing to a positive user experience for those comfortable with the platform.

Account registration and verification processes appear streamlined based on user reports. Traders note relatively simple onboarding procedures. However, the lack of detailed information about required documentation and verification timelines limits the complete assessment of this process.

Fund management experience requires improvement in transparency, particularly regarding deposit and withdrawal methods, processing times, and associated fees. Users express desire for clearer information about financial transactions and associated procedures.

The broker's target demographic of active traders seeking high leverage appears well-served by the current offering. However, enhanced transparency and regulatory clarity would significantly improve the overall user experience. User feedback balance suggests room for improvement in communication and operational transparency.

Conclusion

Grinta Invest operates as a Marshall Islands-based STP/ECN forex broker offering competitive trading conditions through MetaTrader 4. It has particular appeal for active traders seeking high leverage and low-cost trading opportunities. The broker's 1:500 leverage and commission-free account structure create attractive conditions for experienced traders.

However, significant concerns regarding regulatory oversight and operational transparency limit the broker's overall appeal. The absence of clear regulatory authority supervision creates substantial risks that potential clients must carefully weigh against the attractive trading conditions offered.

Key Advantages: High leverage availability, commission-free account options, competitive spreads, and stable MetaTrader 4 platform performance.

Primary Concerns: Lack of regulatory oversight, limited operational transparency, and mixed customer service feedback.

This broker may suit experienced traders who prioritize trading conditions over regulatory security. However, most traders would benefit from choosing regulated alternatives with comparable offerings.