Fxonus 2025 Review: Everything You Need to Know

Executive Summary

Fxonus is an unregulated offshore broker. It poses significant risks to traders, according to multiple industry assessments and expert evaluations. This fxonus review reveals that while the platform focuses on forex and cryptocurrency CFD trading, it operates without proper regulatory oversight. This raises serious concerns about trader protection and fund security across all trading activities.

The broker targets traders seeking diversified trading opportunities in volatile markets. It particularly appeals to those interested in crypto assets alongside traditional forex pairs and currency trading. However, the lack of regulatory compliance and transparency issues make it unsuitable for risk-averse investors who prioritize safety. Industry ratings consistently place Fxonus in the high-risk category, with a rating of 2.5 out of 10 from established review platforms.

According to ForexBrokerz reports, the platform's offshore status means traders have limited recourse in case of disputes. WikiBit's analysis further emphasizes the safety concerns, categorizing the broker as potentially unsafe for retail trading activities. The absence of proper licensing from recognized financial authorities creates an environment where trader funds lack adequate protection.

Important Notice

This evaluation is based on available public information and industry reports as of 2025. Fxonus operates as an offshore entity, which means it may not be subject to the same regulatory standards as licensed brokers in major financial jurisdictions around the world. The regulatory landscape varies significantly across regions, and what may be acceptable in one jurisdiction could be prohibited in another location.

Our assessment methodology relies on publicly available data, user feedback from review platforms, and industry analysis. We have not conducted direct testing of the platform's services or verified all claims made by the broker through independent verification. Traders should conduct their own due diligence and consider consulting with financial advisors before engaging with any unregulated broker.

Rating Framework

Broker Overview

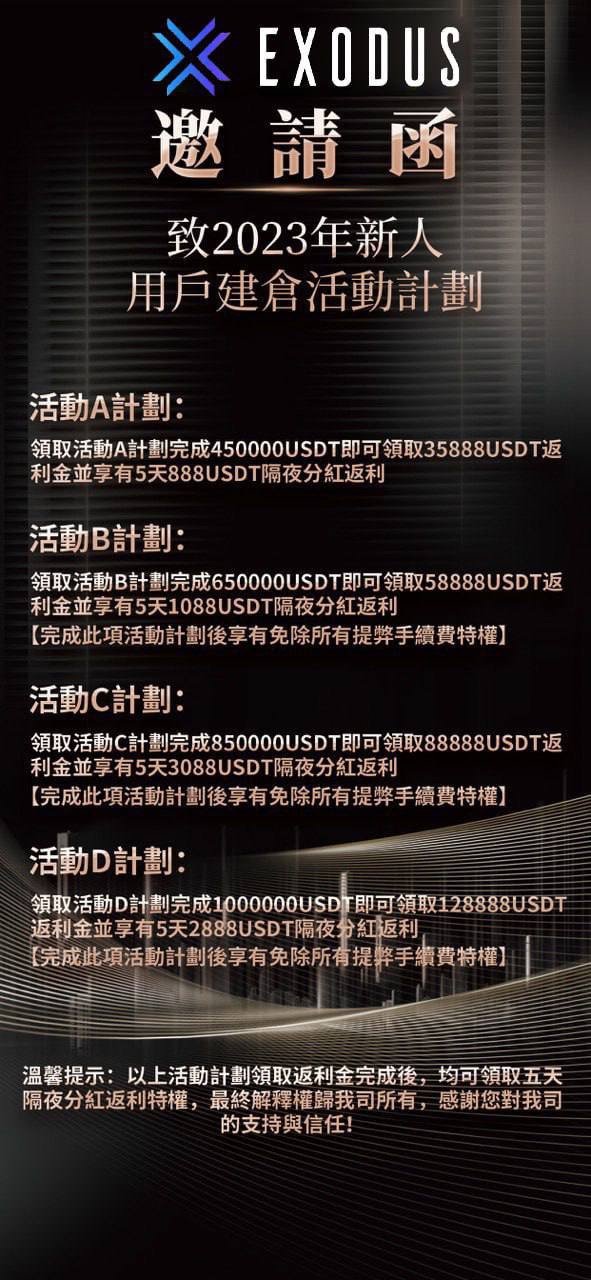

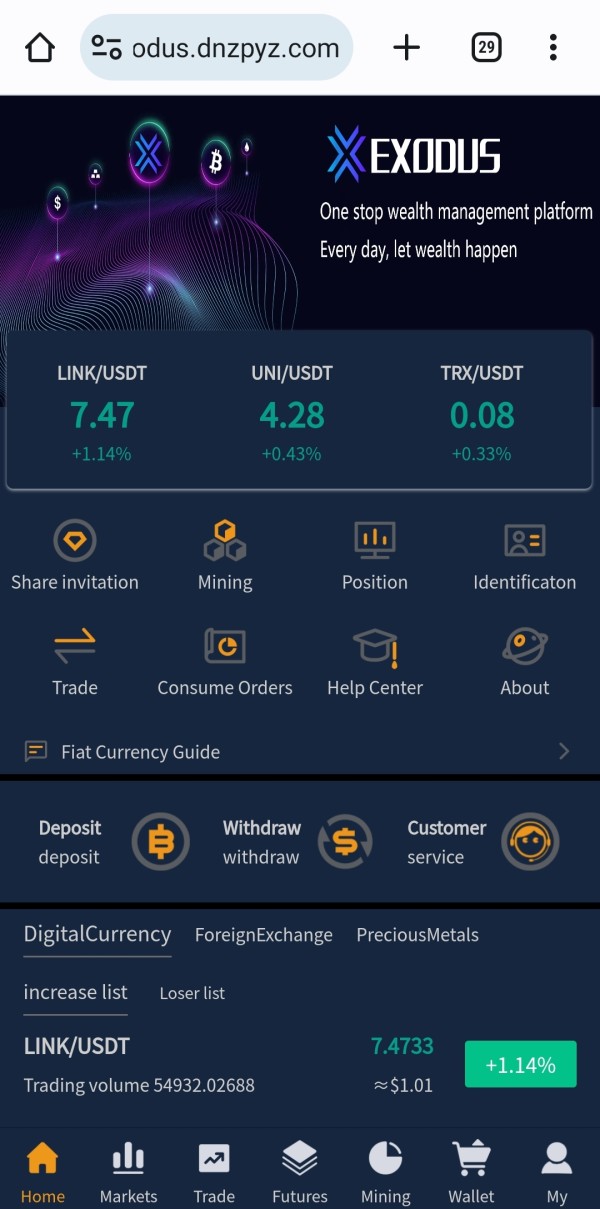

Fxonus positions itself as a specialized trading platform. It focuses primarily on forex and cryptocurrency CFD trading for retail and institutional clients. According to Forexexplore reports, the broker operates as an offshore entity without proper regulatory authorization from major financial authorities. The platform's business model centers around providing access to volatile markets, particularly appealing to traders seeking exposure to cryptocurrency movements alongside traditional currency pairs and forex instruments.

The broker's operational structure reflects typical offshore characteristics. It shows limited transparency regarding company ownership, physical location, and operational procedures across all business activities. This fxonus review indicates that while the platform offers trading services, the lack of regulatory oversight creates significant gaps in trader protection protocols. The absence of deposit insurance schemes or investor compensation funds further compounds the risk profile for all users.

Industry analysis suggests that Fxonus targets primarily retail traders in regions where regulatory enforcement may be less stringent. The platform's focus on high-volatility instruments like cryptocurrency CFDs aligns with a business model that potentially benefits from increased trading frequency and market activity. However, specific details about revenue structure remain undisclosed in available documentation and public records.

Regulatory Status

Fxonus operates without authorization from recognized financial regulatory bodies. Unlike licensed brokers that must comply with strict capital requirements, segregation of client funds, and regular auditing, this platform lacks such oversight mechanisms completely. The absence of regulatory compliance means traders have no access to compensation schemes typically available with authorized brokers.

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods remains undisclosed in available materials. This lack of transparency regarding financial transactions represents a significant concern for potential users who need reliable payment processing. Legitimate brokers typically provide clear information about supported payment methods, processing times, and associated fees.

Minimum Deposit Requirements

Available documentation does not specify minimum deposit requirements. This makes it difficult for potential traders to assess accessibility and account tier structures for different investment levels.

Trading Assets

According to Forexexplore analysis, the platform specializes in forex and cryptocurrency CFD trading. This focus suggests a limited asset selection compared to full-service brokers that typically offer stocks, commodities, and indices alongside currency pairs and digital assets.

Cost Structure

Specific information about spreads, commissions, and other trading costs is not detailed in available sources. This represents another transparency concern for this fxonus review and potential platform users.

Technical specifications regarding trading platforms, execution speeds, and system reliability are not documented in accessible materials. This creates uncertainty about platform performance and trading capabilities.

Account Conditions Analysis

The evaluation of Fxonus account conditions reveals significant information gaps. These gaps raise concerns about transparency and operational standards across all service offerings. Unlike established brokers that provide detailed account specifications, this platform lacks comprehensive documentation regarding account types, features, and requirements for different trader segments.

Available sources do not specify whether multiple account tiers exist. They also fail to detail what distinguishing features might be available to different trader segments or investment levels. The absence of information about demo accounts, which are standard offerings from reputable brokers, suggests limited commitment to trader education and platform familiarization for new users.

Minimum deposit requirements remain undisclosed. This makes it impossible to assess accessibility for retail traders or compare competitiveness with industry standards and market benchmarks. This fxonus review notes that legitimate brokers typically provide clear deposit thresholds to help traders make informed decisions about account opening.

The lack of information about Islamic accounts or other specialized account types suggests limited accommodation for diverse trading preferences and religious requirements. Additionally, no details are available regarding account maintenance fees, inactivity charges, or other potential costs that could affect trader profitability over time.

Assessment of trading tools and educational resources reveals limited available information. This information concerns Fxonus's offerings in this critical area of trader support and platform functionality. Established brokers typically provide comprehensive trading platforms, analytical tools, and educational materials to support trader success, but documentation of such resources from this broker remains sparse and incomplete.

The platform's focus on forex and cryptocurrency CFDs suggests some level of market analysis capability. However, specific details about charting tools, technical indicators, or fundamental analysis resources are not documented in available sources or public materials. This absence of information about analytical capabilities represents a significant gap in trader support infrastructure.

Educational resources, which are fundamental for trader development, appear to be undocumented or potentially absent. Reputable brokers typically offer webinars, tutorials, market commentary, and educational articles to help traders improve their skills and market understanding through comprehensive learning programs.

Research capabilities, including economic calendars, market news feeds, and expert analysis, are not detailed in accessible materials. The lack of transparency regarding these essential trading support tools raises questions about the platform's commitment to trader success and market education for all user levels.

Customer Service Analysis

Customer service evaluation reveals concerning gaps in support infrastructure and transparency. Unlike regulated brokers that must maintain specific customer service standards, Fxonus lacks documented support protocols and service level commitments for user assistance and problem resolution.

Available sources do not specify customer support channels, operating hours, or response time commitments. The absence of clear contact information, including phone numbers, email addresses, or live chat availability, creates significant concerns about accessibility when traders need assistance with account issues or technical problems.

Multi-language support capabilities remain undocumented. This could limit accessibility for international traders who require support in their native languages. Established brokers typically provide support in multiple languages to serve diverse client bases effectively and maintain high satisfaction levels.

The lack of documented complaint resolution procedures represents another significant concern. Regulated brokers must maintain formal complaint handling processes and often provide access to ombudsman services, protections that appear absent with this offshore operator and its business model.

Trading Experience Analysis

The trading experience assessment for Fxonus reveals substantial information gaps. These gaps concern platform performance, execution quality, and user interface design across all trading activities. This fxonus review finds that critical technical specifications remain undocumented, making it difficult to evaluate the platform's suitability for serious trading activities and professional use.

Platform stability and execution speed data are not available in accessible sources. This represents significant concerns for traders who require reliable order processing and consistent platform performance. Professional traders typically demand sub-second execution times and minimal slippage, but no performance metrics are documented for this platform or its trading infrastructure.

Mobile trading capabilities, which are essential in today's trading environment, are not detailed in available materials. The absence of information about mobile apps or responsive web platforms suggests potential limitations in trading accessibility and convenience for modern traders who need flexible access.

Order types and trading features that experienced traders rely on are not specified in documented sources. These include stop-loss orders, take-profit levels, and advanced order management tools that professional traders consider essential. This lack of transparency about trading functionality raises questions about platform sophistication and feature completeness.

Trust and Safety Analysis

Trust and safety analysis reveals the most significant concerns in this fxonus review. Operating without regulatory authorization from recognized financial authorities creates fundamental safety issues that cannot be overlooked when evaluating broker credibility and platform reliability for trader fund protection.

The absence of license numbers, regulatory oversight, or compliance with established financial standards means traders lack essential protections. These protections are typically associated with legitimate brokers and regulated financial service providers. Regulated brokers must segregate client funds, maintain adequate capital reserves, and submit to regular auditing procedures—protections that appear absent with this offshore operator.

Fund security measures, including deposit insurance or investor compensation schemes, are not documented or likely unavailable. This unavailability stems from the unregulated status of the platform and its offshore operational structure. This creates significant risk for trader deposits and account balances in case of operational difficulties or business closure.

Company transparency regarding ownership, management, and operational procedures remains limited. Legitimate brokers typically provide detailed company information, regulatory filings, and management team credentials, transparency elements that appear insufficient with this platform and its business operations.

Third-party verification of business practices, financial stability, and operational integrity is not available. This verification would typically come through recognized industry oversight bodies, further compounding trust and safety concerns for potential users and their investment protection.

User Experience Analysis

User experience evaluation reveals limited positive feedback and significant concerns. These concerns relate to overall platform satisfaction and user interaction with the trading environment. Industry review platforms consistently rate Fxonus poorly, with ForexBrokerz assigning a rating of 2.5 out of 10, indicating substantial user experience deficiencies across multiple service areas.

Interface design and platform usability information are not detailed in available sources. This makes it difficult to assess whether the platform meets modern trading interface standards and user expectations. Contemporary traders expect intuitive navigation, customizable dashboards, and responsive design elements that enhance their trading efficiency and overall experience.

Account registration and verification processes are not documented in accessible materials. This creates uncertainty about onboarding procedures and compliance requirements for new users. Legitimate brokers typically provide clear guidance about account opening steps and required documentation to ensure smooth user onboarding.

User feedback aggregation from multiple sources indicates predominantly negative experiences. These experiences show particular concerns about fund safety and customer service responsiveness across different user interactions. The consistent pattern of poor ratings across review platforms suggests systemic issues with user satisfaction and service quality.

Mobile experience capabilities and cross-device synchronization features are not documented. This potentially limits trading flexibility for users who require multi-platform access and seamless integration across different devices and operating systems.

Conclusion

This comprehensive fxonus review reveals a high-risk offshore broker. It lacks essential regulatory protections and transparency standards expected from legitimate trading platforms in today's financial markets. While the platform offers access to forex and cryptocurrency CFD markets, the absence of proper authorization creates significant safety concerns for potential users and their investment security.

The broker may appeal to traders seeking exposure to volatile cryptocurrency markets alongside traditional forex trading. However, the risks substantially outweigh potential benefits for most retail and institutional investors. The lack of regulatory oversight, limited transparency, and poor industry ratings make Fxonus unsuitable for serious traders who prioritize fund safety and reliable service delivery.

Traders are strongly advised to consider regulated alternatives. These alternatives provide proper investor protections, transparent operations, and established customer support infrastructure for comprehensive trading support. The offshore status and documented concerns make this platform inappropriate for risk-conscious investors seeking reliable trading environments and secure fund management.