Tamam Brokerage Services 2025 Review: Everything You Need to Know

Executive Summary

Tamam Brokerage Services LLC is a regulated forex broker registered in St. Kitts and Nevis. This tamam brokerage services review shows a fintech firm that has received both positive user feedback and concerning negative reviews, which creates a complex picture for potential traders to navigate. The broker stands out through competitive spreads and responsive customer support.

It positions itself as a multi-asset trading platform serving forex and cryptocurrency traders globally. According to available ratings, Tamam Brokerage Services holds a 4 out of 5 rating based on 13 user reviews. However, this positive rating contrasts with some negative feedback found across various platforms.

As a fintech firm with global reach, Tamam Brokerage Services offers brokerage services across commodities, indices, forex, and digital currencies. The broker appears to target traders seeking cryptocurrency integration alongside traditional forex trading. However, the regulatory environment of St. Kitts and Nevis may present different protections compared to major financial centers.

User testimonials highlight particular strengths in withdrawal and deposit processes. Some clients praise the broker as offering the best spreads and transaction methods in their region. However, the limited regulatory information and mixed user experiences warrant careful consideration for prospective traders.

Important Disclaimers

Due to Tamam Brokerage Services' registration in St. Kitts and Nevis, users must understand that the regulatory environment may differ significantly from other major financial jurisdictions. The regulatory framework in this Caribbean nation may offer different levels of trader protection compared to authorities like the FCA, ASIC, or CySEC.

This evaluation is based on user feedback, market research, and publicly available information. Given the limited transparent information available about the broker's operations, traders should conduct additional due diligence before committing funds. The assessment reflects available data as of 2025 and may not capture recent operational changes.

Rating Framework

Broker Overview

Tamam Brokerage Services LLC operates as a fintech company registered in St. Kitts and Nevis. The company provides brokerage services for various financial instruments. While specific founding details remain undisclosed in available materials, the company positions itself as a global-reach broker serving international clients across multiple asset classes.

The broker's business model centers on providing access to forex, commodities, indices, and digital currencies through its trading platform. This multi-asset approach suggests targeting of diversified traders who seek exposure to both traditional forex markets and the growing cryptocurrency sector. The company's registration in St. Kitts and Nevis indicates operation under Caribbean financial regulations.

According to available information, Tamam Brokerage Services has achieved a 4 out of 5 rating based on 13 user evaluations. This suggests generally positive user experiences. However, this tamam brokerage services review must note that the sample size remains relatively small for definitive conclusions about overall service quality.

The broker's focus on digital currencies alongside traditional forex trading reflects current market trends. However, specific platform details and technological infrastructure information remain limited in publicly available sources.

Regulatory Jurisdiction: Tamam Brokerage Services LLC operates under St. Kitts and Nevis registration. Specific regulatory license numbers are not detailed in available information.

Deposit and Withdrawal Methods: Available information does not specify the exact deposit and withdrawal options. User feedback suggests competitive transaction processing.

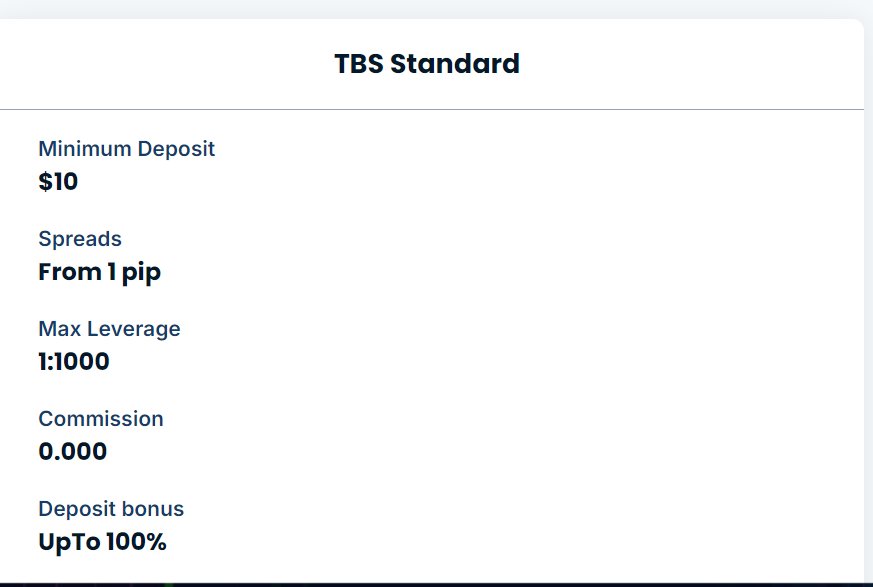

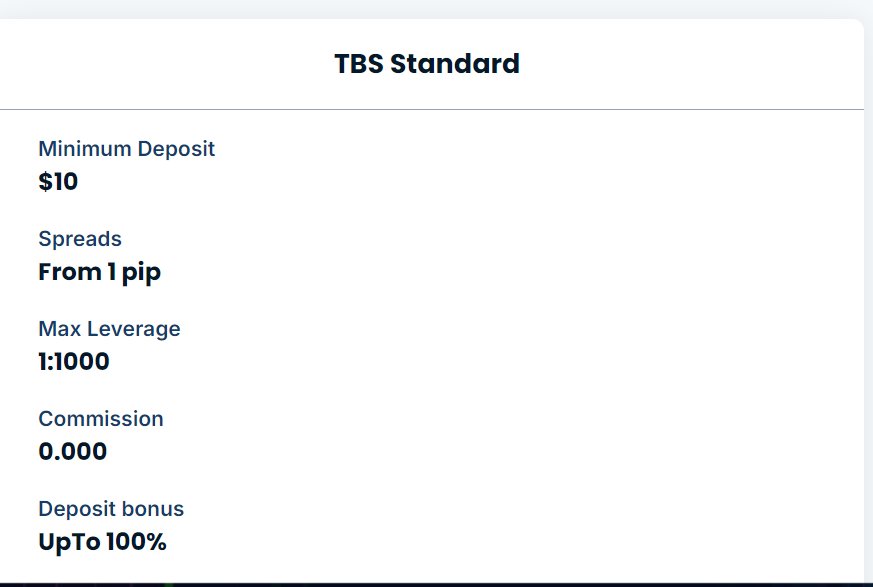

Minimum Deposit Requirements: Specific minimum deposit information is not provided in available sources. This requires direct broker contact for clarification.

Bonus and Promotions: Current promotional offerings are not detailed in accessible materials.

Tradeable Assets: The broker offers access to commodities, indices, forex, and digital currencies. This provides a diversified trading environment for multi-asset strategies.

Cost Structure: Users report competitive spreads. However, detailed commission structures and fee schedules are not publicly available. This tamam brokerage services review notes the lack of transparent pricing information.

Leverage Ratios: Specific leverage offerings are not detailed in available information.

Platform Options: Trading platform specifications are not provided in accessible sources.

Geographic Restrictions: Regional limitations are not specified in available materials.

Customer Service Languages: Supported languages for customer service are not detailed in current information.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

The account conditions evaluation for Tamam Brokerage Services reveals a mixed picture with significant information gaps. User feedback suggests competitive spreads that position the broker favorably in regional comparisons. However, the lack of transparent information about account types, minimum deposits, and specific trading conditions limits comprehensive assessment.

Available user testimonials indicate satisfaction with spread competitiveness. One long-term client states their spreads are "the best in the region." However, without detailed account specifications, traders cannot adequately compare offerings against industry standards. The absence of information about Islamic accounts, VIP tiers, or specialized account features represents a significant transparency gap.

The account opening process details remain undisclosed. This makes it difficult for prospective clients to understand verification requirements, documentation needs, or approval timeframes. This tamam brokerage services review emphasizes that the limited account information available necessitates direct broker contact for essential trading details.

Professional traders requiring specific account features or institutional-level services will find insufficient information to make informed decisions based on publicly available materials.

The evaluation of trading tools and resources reveals substantial gaps in available information about Tamam Brokerage Services' technological offerings. Without detailed specifications about trading platforms, analytical tools, or research resources, traders cannot adequately assess the broker's technological capabilities.

Educational resources, which are crucial for trader development, are not documented in available materials. The absence of information about market analysis, trading guides, webinars, or educational content suggests either limited offerings or poor transparency in communicating available resources.

Automated trading support, including Expert Advisor compatibility or API access, remains unspecified. For algorithmic traders or those requiring advanced trading automation, this information gap presents significant limitations in broker evaluation.

The lack of detailed platform information, including charting capabilities, technical indicators, or order types, makes it challenging for traders to assess whether the broker's technological infrastructure meets their trading requirements. This tamam brokerage services review notes that such transparency gaps are concerning for serious traders.

Customer Service and Support Analysis (8/10)

Customer service emerges as a relative strength for Tamam Brokerage Services based on available user feedback. Multiple users have specifically praised the broker's customer support responsiveness, which indicates efficient problem resolution and communication.

User testimonials suggest that support team response times are notably quick. This is crucial for traders requiring immediate assistance with time-sensitive issues. This responsiveness appears to be a consistent theme across available feedback, which suggests systematic attention to customer service quality.

However, specific details about support channels, availability hours, or multilingual capabilities are not provided in available information. The absence of information about support methods—whether through live chat, phone, email, or ticket systems—limits understanding of accessibility options.

While user feedback indicates positive support experiences, the lack of detailed service level agreements, escalation procedures, or specialized support for different account types represents an information gap. This could be important for institutional or high-volume traders.

Trading Experience Analysis (7/10)

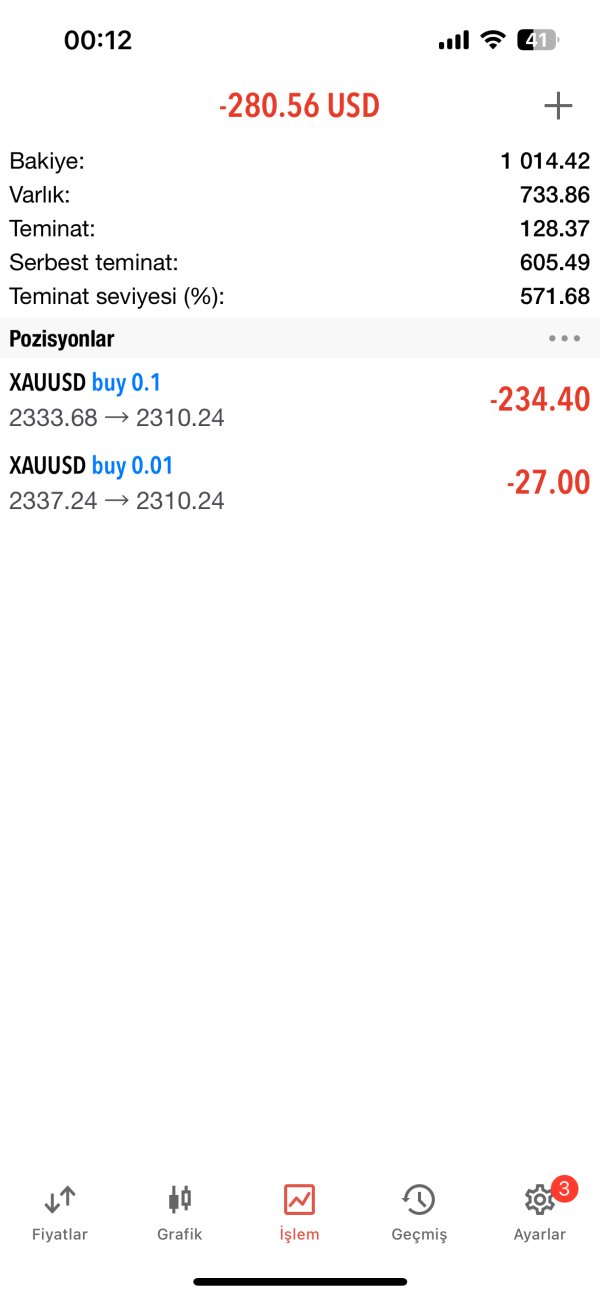

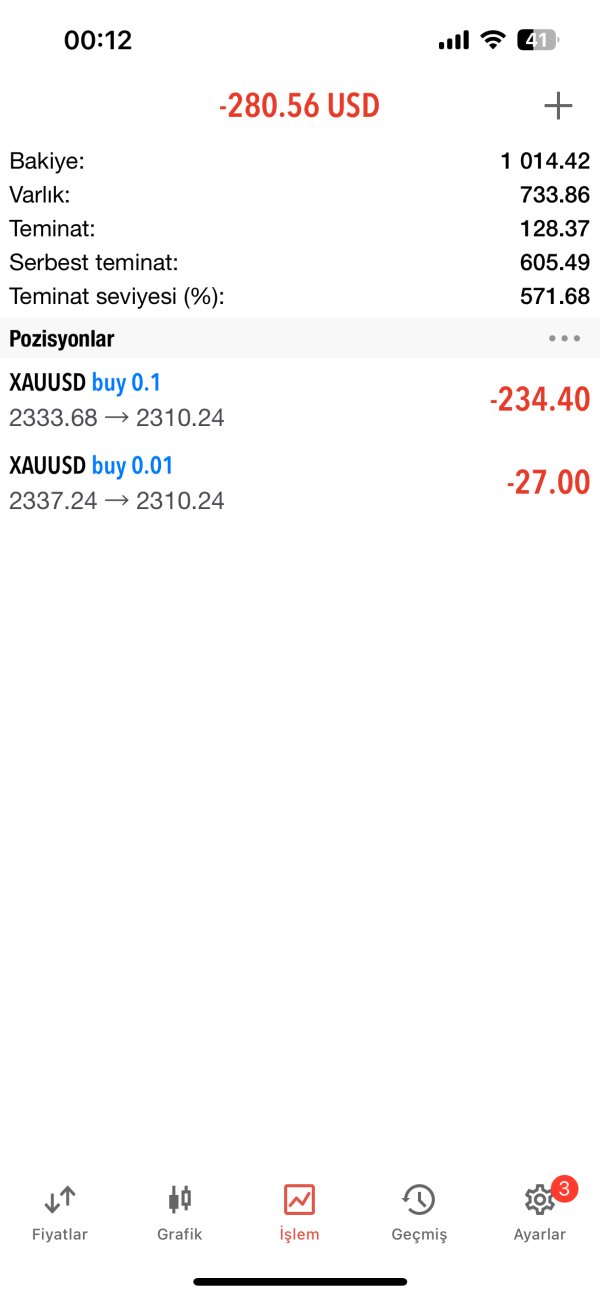

The trading experience evaluation reveals positive user feedback regarding execution quality. Reports indicate instant trade execution and immediate deposit processing. These factors suggest reliable operational infrastructure that supports efficient trading activities.

User testimonials indicate satisfaction with transaction processing speed, particularly for deposits and withdrawals. These are critical components of the overall trading experience. The reported instant execution suggests adequate liquidity provision and technological infrastructure supporting order processing.

However, platform stability information, system uptime statistics, and detailed execution quality metrics are not available in current sources. Without comprehensive platform performance data, traders cannot fully assess reliability during volatile market conditions or high-volume trading periods.

Mobile trading capabilities, platform customization options, and advanced order types remain unspecified in available materials. This tamam brokerage services review notes that while basic execution appears satisfactory, the lack of detailed platform information limits comprehensive trading experience assessment.

Trustworthiness Analysis (5/10)

Trustworthiness presents the most complex aspect of Tamam Brokerage Services evaluation. Significantly mixed user feedback creates uncertainty about reliability. The broker's registration in St. Kitts and Nevis provides some regulatory framework, though this jurisdiction may offer different protections compared to major financial centers.

Positive user reviews highlight satisfactory service experiences. Negative feedback raises concerns about potential operational issues. This polarization in user experiences suggests either inconsistent service delivery or possible targeted negative reviewing, which requires careful evaluation of feedback authenticity.

The regulatory environment of St. Kitts and Nevis, while providing legal framework, may not offer the same level of trader protection as major regulatory authorities like the FCA or CySEC. This regulatory consideration impacts overall trustworthiness assessment for international traders.

Fund security measures, segregation policies, and compensation schemes are not detailed in available information. This represents significant transparency gaps that affect trustworthiness evaluation. The limited corporate transparency and operational disclosure create additional concerns for risk-conscious traders.

User Experience Analysis (6/10)

User experience evaluation reveals mixed feedback patterns that suggest variable service quality across different client interactions. Some users report positive experiences with deposits and withdrawals. Others have expressed concerns about service reliability and operational transparency.

The broker appears to attract cryptocurrency-focused traders based on user demographics. This suggests platform features that support digital currency trading. However, specific user interface details, platform navigation, and accessibility features are not documented in available sources.

Registration and verification processes remain undisclosed. This makes it impossible to assess account opening efficiency or documentation requirements. This information gap affects prospective user planning and expectation setting.

Some user feedback suggests concerns about review authenticity and potential misleading information. This indicates possible reputation management issues that could affect genuine user experience assessment. Traders should carefully evaluate available feedback sources and consider direct platform testing before committing significant funds.

Conclusion

Tamam Brokerage Services presents a complex evaluation profile with both promising elements and significant information gaps. As a regulated broker offering multi-asset trading including cryptocurrency integration, the platform appears suitable for traders seeking diversified trading opportunities, particularly in digital currencies.

The broker's strengths lie in competitive spreads and responsive customer support, based on available user feedback. However, substantial transparency gaps regarding account conditions, platform specifications, and regulatory details create challenges for comprehensive evaluation.

This broker may suit forex and cryptocurrency traders willing to work with limited public information and Caribbean regulatory framework. However, traders requiring detailed operational transparency, extensive educational resources, or major jurisdiction regulatory protection should consider alternatives with more comprehensive disclosure standards.