Fsds 2025 Review: Everything You Need to Know

Executive Summary

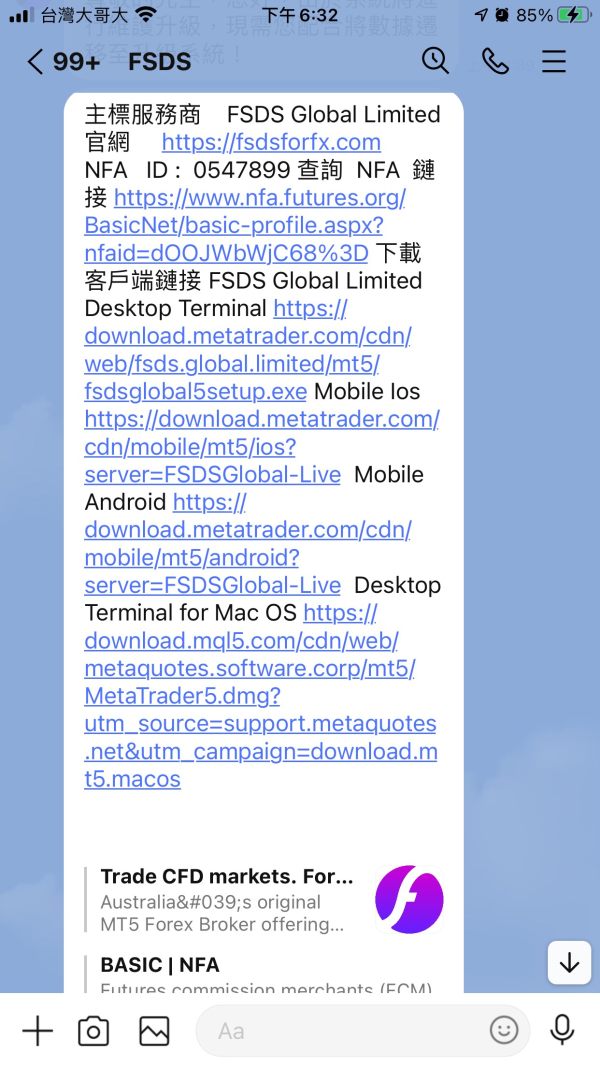

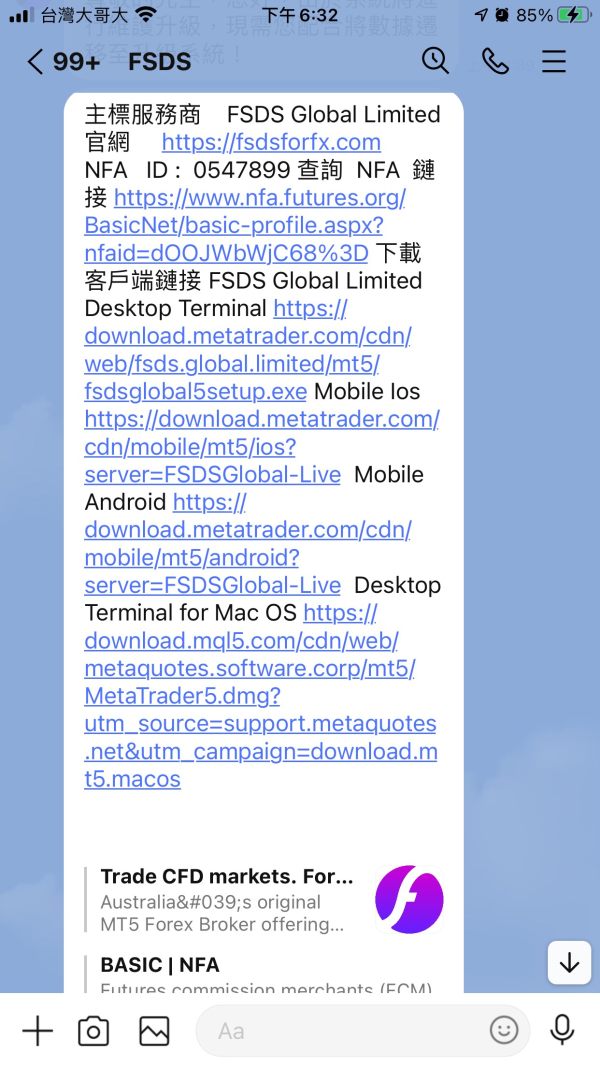

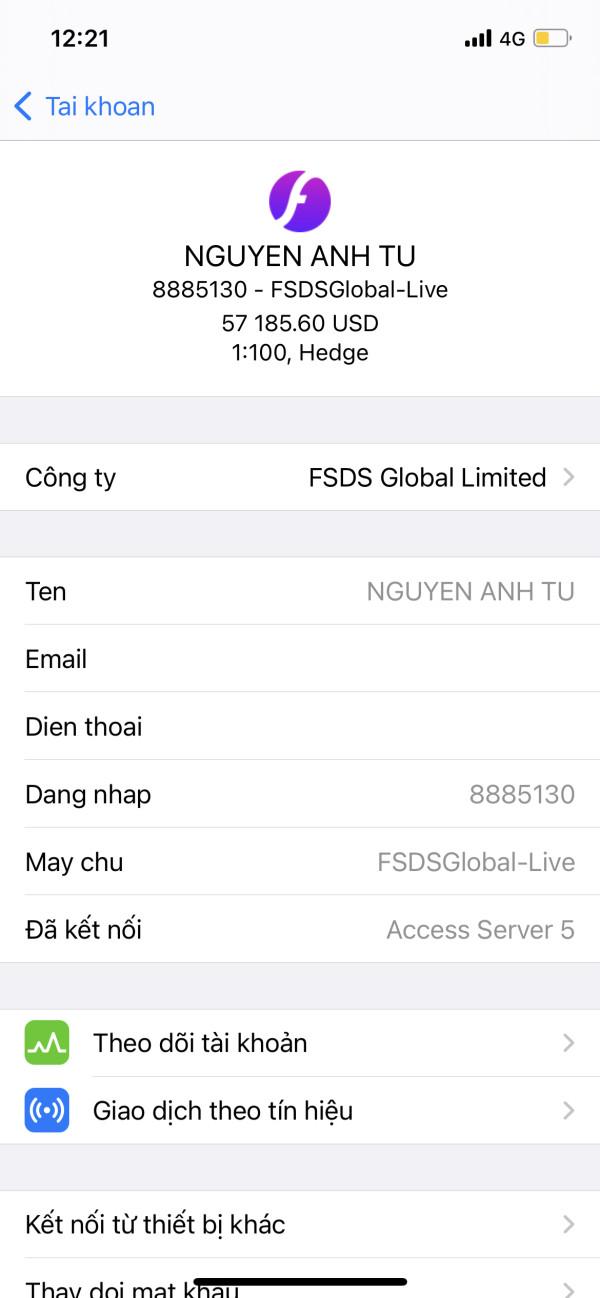

FSDS Global Limited presents a complex case in the forex brokerage landscape. Significant concerns overshadow its claimed achievements, raising serious questions about its credibility and operational integrity. This Fsds review reveals a broker registered in the United Kingdom that faces substantial regulatory controversies and predominantly negative user feedback.

The broker claims to offer 350 trading assets. It previously asserted winning the 2011 Best Forex Broker Award, though these claims require careful scrutiny given the surrounding controversies. According to available data, only 49% of employees on Glassdoor recommend the company. This indicates internal challenges that may affect service quality.

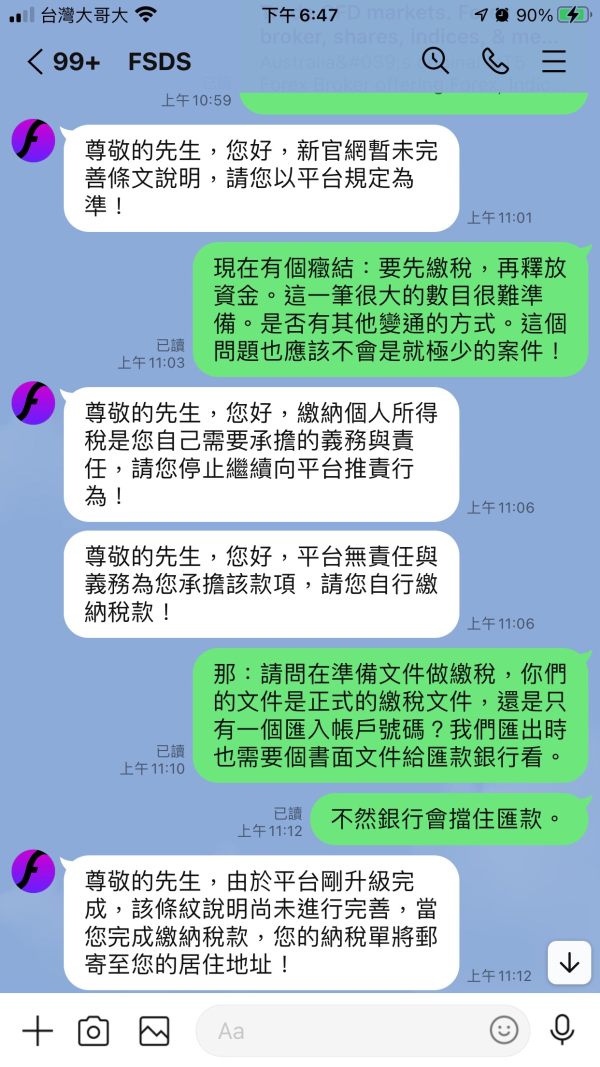

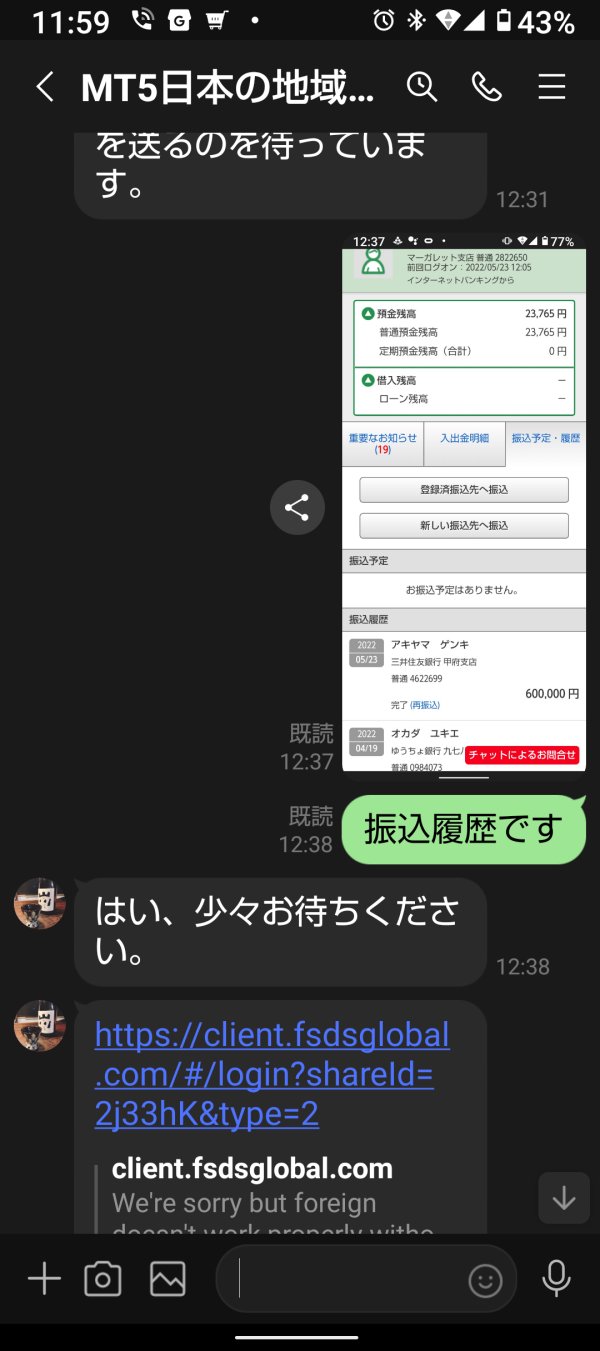

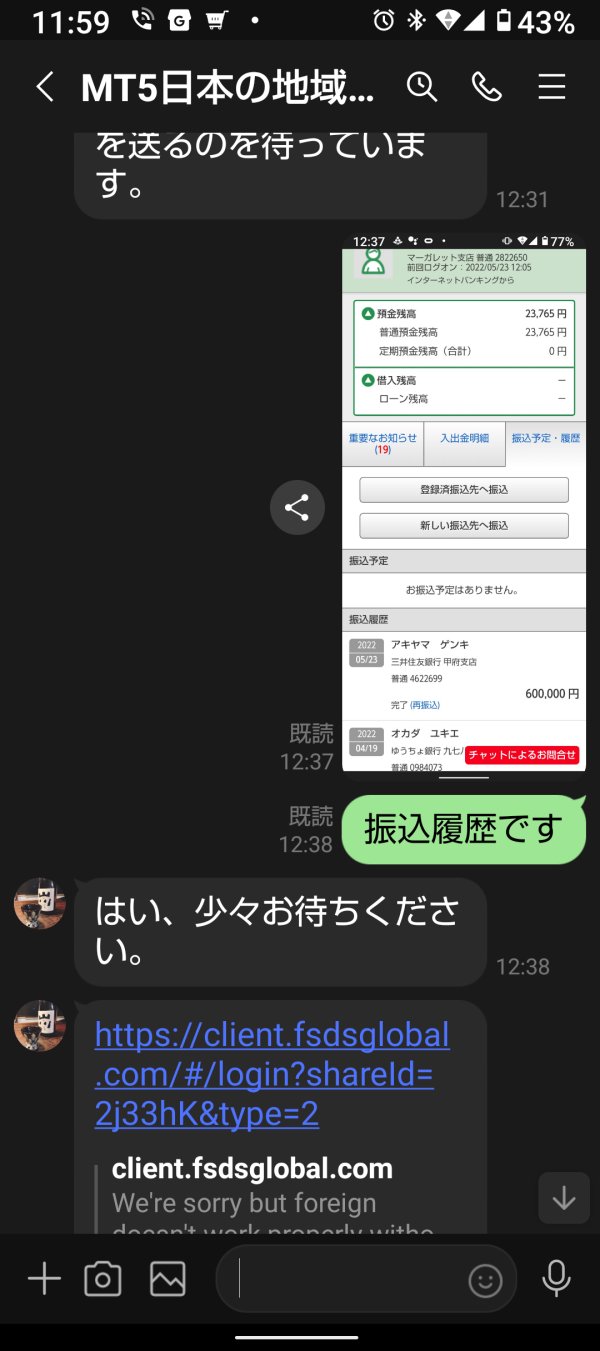

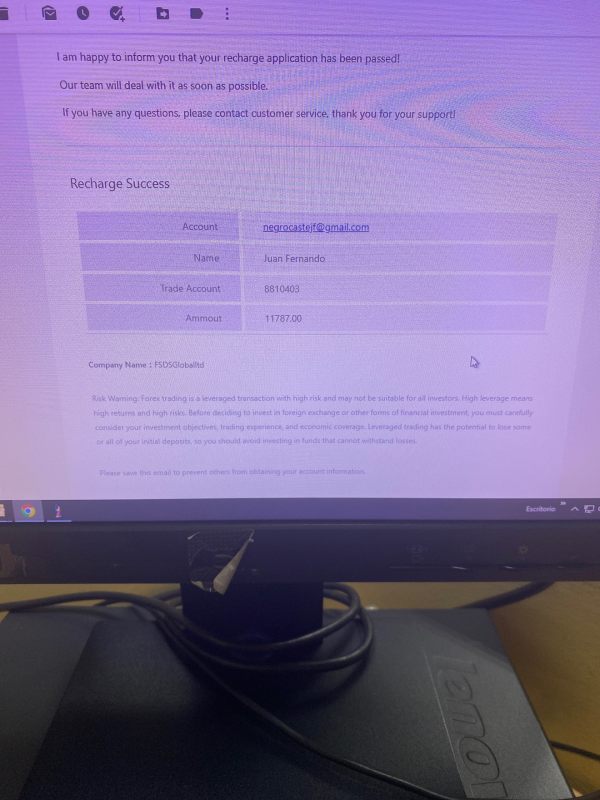

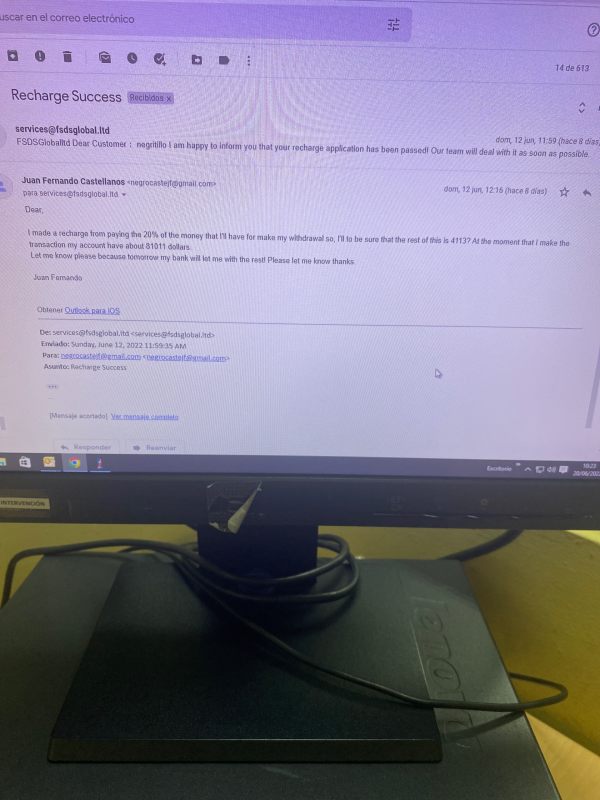

The primary concern surrounding FSDS Global Limited involves allegations from users who have accused the platform of fraudulent practices. These accusations, combined with disputed regulatory status, create a high-risk environment for potential investors. The company's establishment in 2020 means it lacks the long-term track record that typically builds trust in the forex industry.

Given the regulatory uncertainties and negative user experiences reported across various platforms, this broker appears unsuitable for traders prioritizing security and regulatory compliance. The combination of fraud allegations and questionable regulatory standing suggests that prospective clients should exercise extreme caution when considering FSDS Global Limited for their trading activities.

Important Notice

Regional Entity Differences: FSDS Global Limited operates as a UK-registered entity. However, its regulatory status remains disputed and may significantly impact trading security for users across different jurisdictions. The lack of clear regulatory oversight creates potential risks for international clients seeking reliable forex trading services.

Review Methodology: This evaluation is based on publicly available information, user feedback, and official documentation. Every effort has been made to present an objective analysis, though readers should conduct independent verification of all claims and regulatory status before making any investment decisions.

Rating Framework

Broker Overview

FSDS Global Limited entered the forex market in 2020 as a UK-registered entity. The company positioned itself as a provider of comprehensive foreign exchange trading services, attempting to establish credibility by claiming historical achievements. It alleged winning a 2011 Best Forex Broker Award, though the verification of such claims remains questionable given the timeline inconsistencies.

The broker's business model centers around offering forex trading services with claims of providing access to 350 different trading assets. However, the company faces significant challenges regarding its regulatory standing, with ongoing disputes about the legitimacy of its oversight status. These regulatory concerns have become a critical factor affecting user confidence and overall market perception.

The platform's operational approach appears to target investors seeking forex trading opportunities. However, the mounting evidence of user dissatisfaction and fraud allegations suggests serious operational deficiencies. The company's relatively recent establishment, combined with the absence of transparent operational data, raises questions about its long-term viability and commitment to client protection.

This Fsds review indicates that while the broker presents itself as offering diverse trading opportunities, the fundamental issues surrounding regulatory compliance and user trust create substantial barriers to establishing a positive reputation in the competitive forex market.

Regulatory Jurisdiction: FSDS operates under UK registration. However, significant disputes exist regarding the legitimacy and effectiveness of its regulatory oversight, potentially compromising client protection standards.

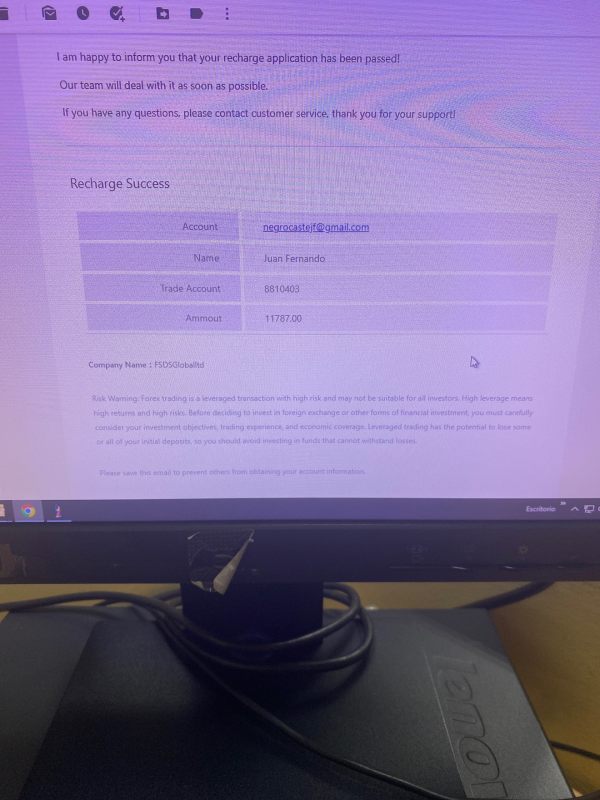

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods has not been detailed in available documentation. This creates uncertainty about transaction processes.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit requirements in publicly available materials. This limits transparency for potential clients.

Bonus and Promotions: Current promotional offerings and bonus structures remain unspecified in available documentation. This prevents accurate assessment of value propositions.

Tradeable Assets: The platform claims to provide access to 350 trading assets, encompassing forex pairs and CFD instruments. However, detailed asset specifications are not readily available.

Cost Structure: Comprehensive information regarding spreads, commissions, and other trading costs has not been disclosed in available materials. This hinders cost comparison analysis.

Leverage Ratios: Specific leverage offerings and maximum ratios available to clients remain unspecified in current documentation.

Platform Options: Details regarding trading platform choices and technological infrastructure have not been comprehensively outlined in available resources.

Regional Restrictions: Specific geographical limitations and jurisdictional restrictions have not been clearly defined in accessible documentation.

Customer Support Languages: Available customer service language options remain unspecified in current materials.

This Fsds review highlights the significant information gaps that potential clients face when evaluating this broker. These gaps contribute to the overall uncertainty surrounding the platform's offerings.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by FSDS Global Limited present significant transparency issues. These issues severely impact the overall assessment, as available documentation fails to provide specific details regarding account types, their distinctive features, or the requirements for accessing different service levels. This lack of transparency creates immediate concerns for potential clients seeking to understand their options and obligations.

The absence of clearly stated minimum deposit requirements represents a fundamental gap in essential information that traders require for decision-making. Professional forex brokers typically provide comprehensive details about account tiers, minimum funding requirements, and associated benefits. Yet FSDS has not made such information readily accessible through standard channels.

Account opening procedures remain undocumented in available materials. This leaves potential clients uncertain about verification requirements, processing times, and necessary documentation. This opacity extends to special account features such as Islamic accounts or professional trader designations, which are standard offerings among reputable brokers.

The lack of detailed account condition information suggests either poor transparency practices or potential operational deficiencies that could affect client experience. This Fsds review emphasizes that the absence of clear account terms creates unnecessary barriers for potential clients and raises questions about the broker's commitment to transparent operations.

FSDS Global Limited's trading tools and resources present a mixed picture. Limited publicly available information hampers comprehensive evaluation, while the broker claims to offer 350 trading assets. The specific tools and analytical resources supporting these assets remain largely undocumented in accessible materials.

The absence of detailed information regarding research and analysis resources represents a significant gap for traders who rely on market insights and analytical tools for decision-making. Professional trading platforms typically provide comprehensive market analysis, economic calendars, and research reports. Yet FSDS has not demonstrated the availability of such resources.

Educational resources, which are crucial for trader development and platform familiarization, have not been detailed in available documentation. This absence is particularly concerning for newer traders who depend on educational support to develop their skills and understanding of market dynamics.

Automated trading support and algorithmic trading capabilities remain unspecified. This limits assessment of the platform's technological sophistication, as the lack of information regarding API access, expert advisor support, or automated trading tools suggests potential limitations in advanced trading functionality.

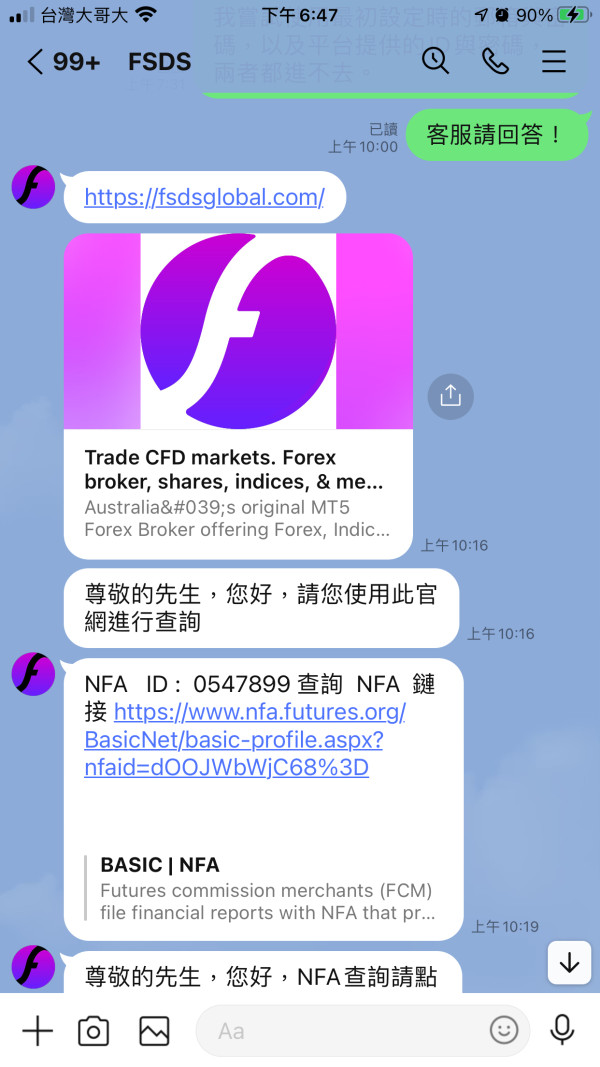

Customer Service and Support Analysis (Score: 3/10)

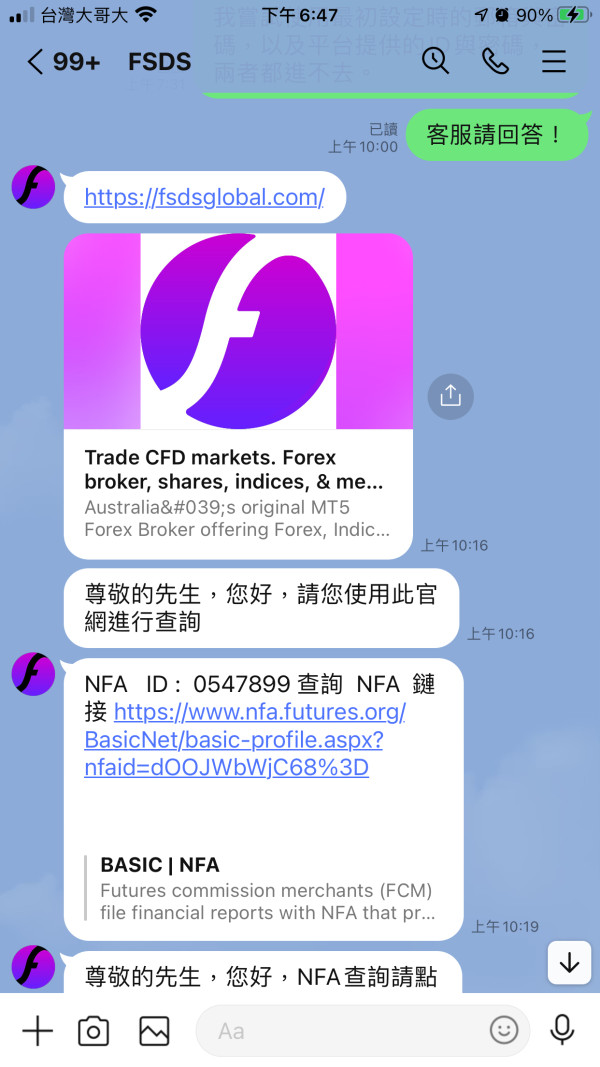

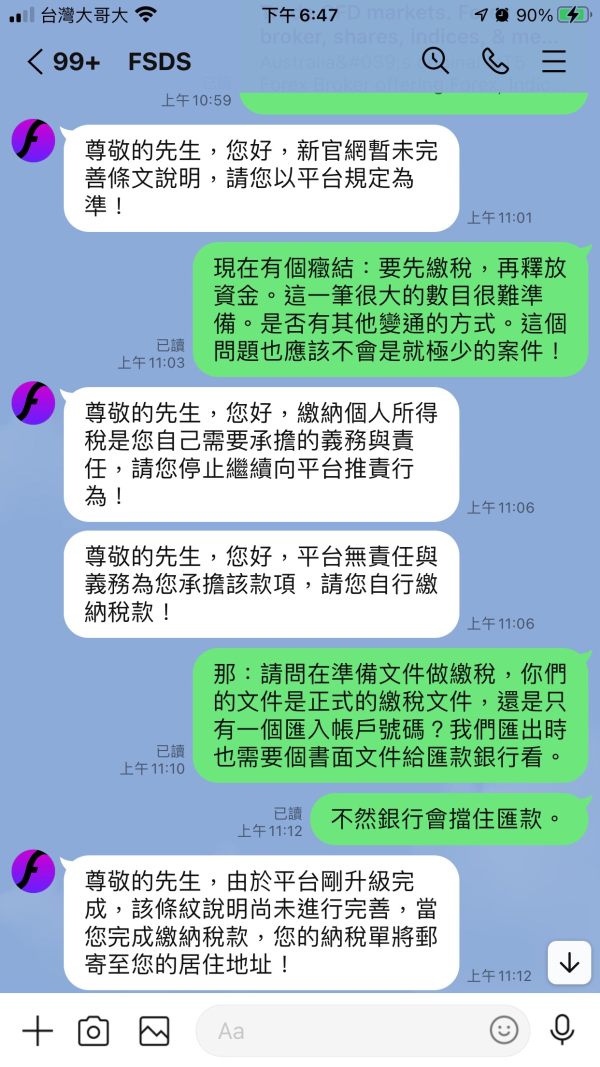

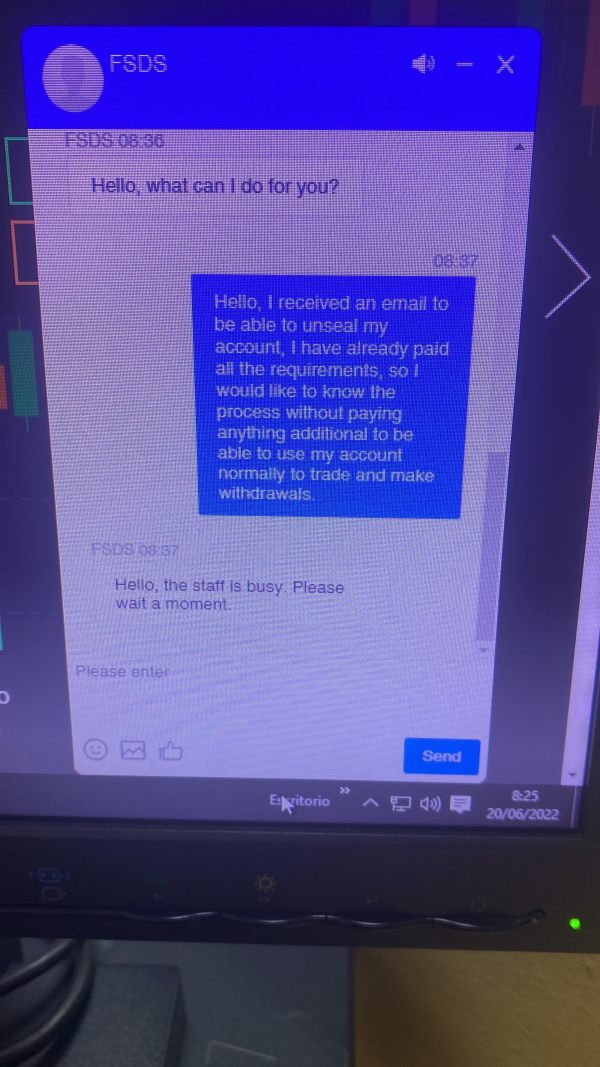

Customer service quality represents one of the most concerning aspects of FSDS Global Limited's operations. User feedback indicates significant deficiencies in support quality and accessibility, with available information suggesting that client service experiences have been predominantly negative. This contributes to overall dissatisfaction with the platform.

Response times and service availability have not been documented in accessible materials. This creates uncertainty about support accessibility during critical trading periods, as professional forex brokers typically provide 24/5 or 24/7 support with clearly defined response time commitments. Yet FSDS has not demonstrated such standards.

The quality of service interactions, based on available user feedback, appears to fall short of industry standards. Users have expressed frustration with support quality, though specific details regarding problem resolution and service effectiveness remain limited in available documentation.

Multi-language support capabilities and customer service hours have not been clearly defined. This potentially limits accessibility for international clients, as the absence of comprehensive support information suggests either inadequate service infrastructure or poor communication of available support options.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by FSDS Global Limited faces significant evaluation challenges due to limited available information regarding platform performance and user experience metrics. User feedback has not provided detailed insights into platform stability, execution speed, or overall trading environment quality.

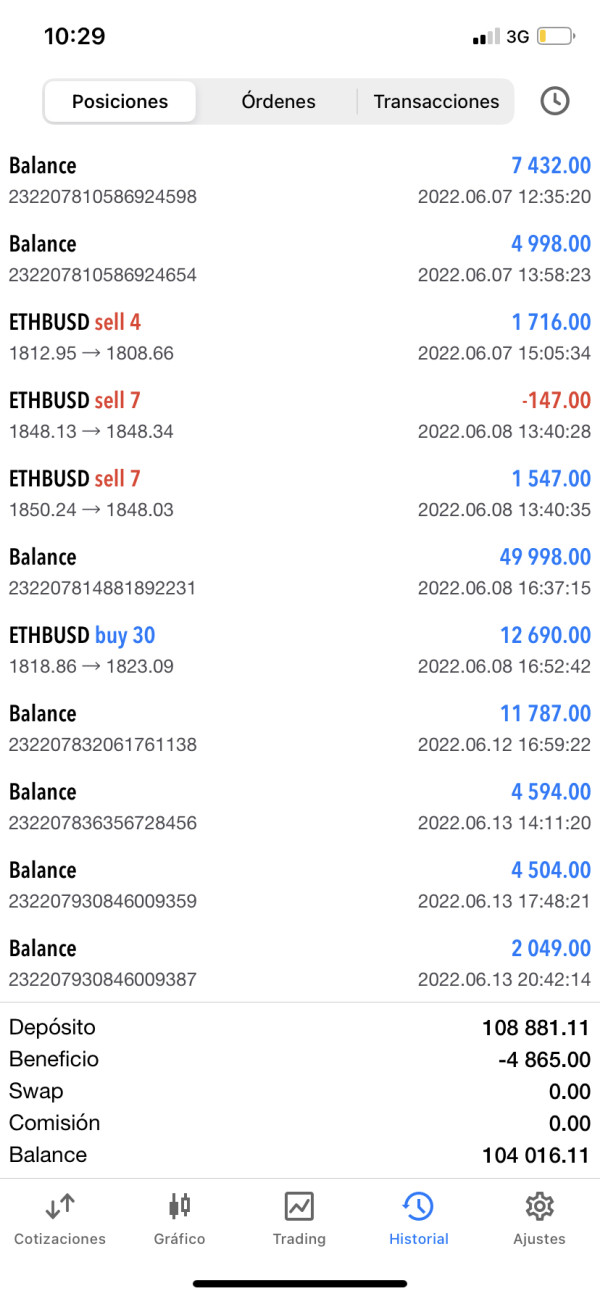

Order execution quality, a critical factor in forex trading success, remains undocumented in available materials. Professional traders require information about execution speeds, slippage rates, and order fill quality. Yet FSDS has not provided transparent data regarding these crucial performance metrics.

Platform functionality and feature completeness cannot be adequately assessed based on available information. The absence of detailed platform specifications, charting capabilities, and analytical tools creates uncertainty about the trading environment's sophistication and reliability.

Mobile trading experience, increasingly important for modern traders, has not been documented in accessible materials. The lack of information regarding mobile platform capabilities, synchronization features, and mobile-specific tools suggests potential limitations in trading flexibility.

This Fsds review indicates that the trading experience evaluation is significantly hampered by information gaps. These gaps prevent comprehensive assessment of platform capabilities and performance standards.

Trust Factor Analysis (Score: 2/10)

The trust factor surrounding FSDS Global Limited presents the most significant concern in this evaluation. Multiple elements contribute to a severely compromised trust rating, with regulatory disputes surrounding the broker's oversight status creating fundamental questions about client protection and operational legitimacy.

While registered in the United Kingdom, the effectiveness and scope of regulatory oversight remain disputed. This potentially leaves clients without adequate protection, as legitimate regulatory oversight provides essential safeguards including segregated client funds, dispute resolution mechanisms, and operational standards compliance.

Fund security measures have not been detailed in available documentation. This creates uncertainty about client asset protection, as professional brokers typically provide comprehensive information about client fund segregation, insurance coverage, and security protocols. Yet FSDS has not demonstrated such safeguards.

Company transparency regarding financial reporting, management structure, and operational practices appears limited based on available information. The absence of transparent corporate governance information raises questions about accountability and operational integrity.

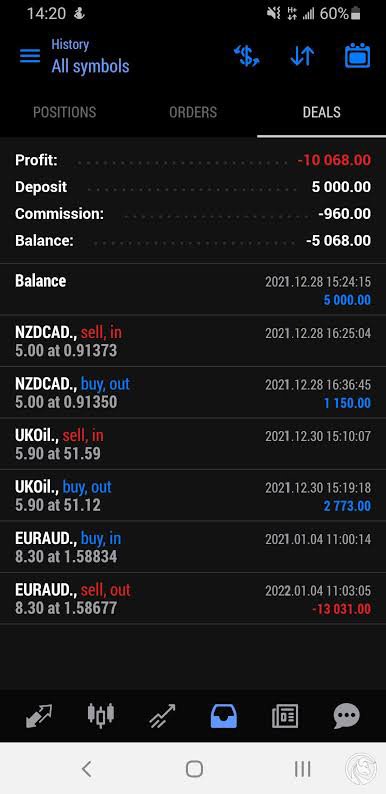

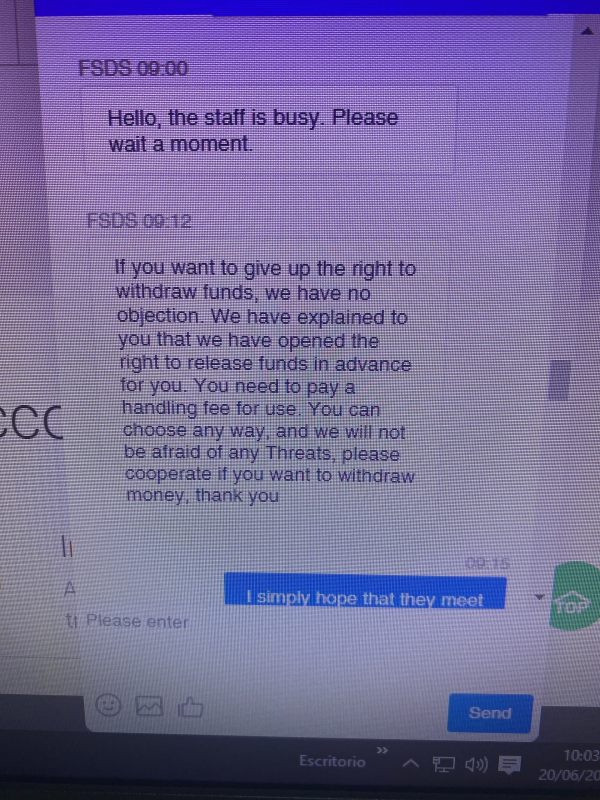

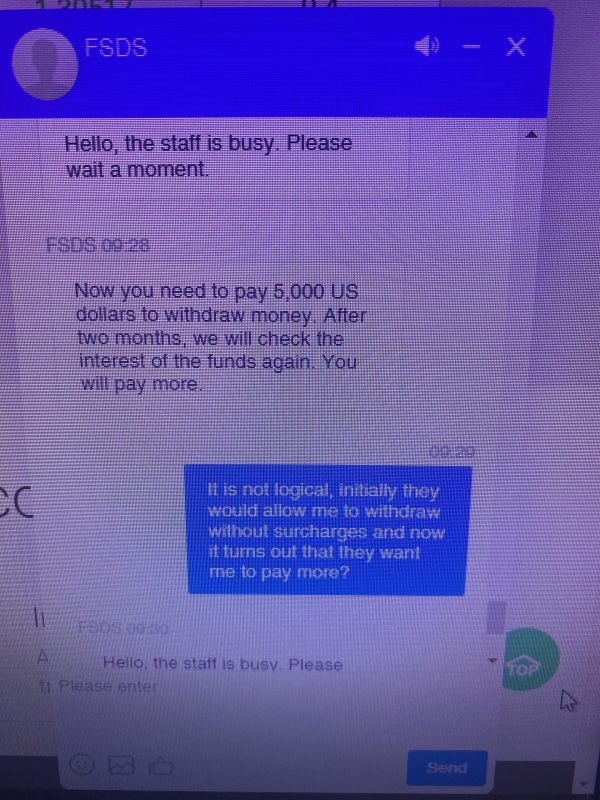

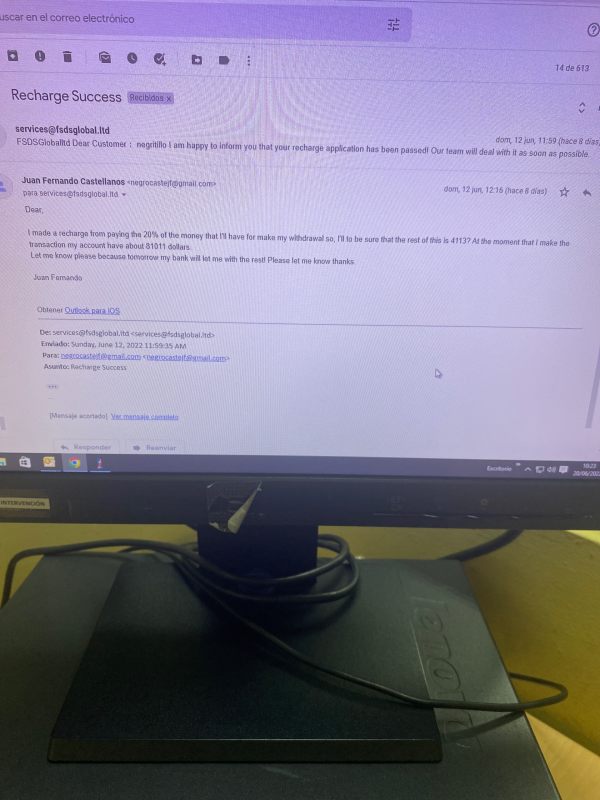

The most serious concern involves user allegations of fraudulent practices. Regardless of their ultimate validity, these allegations indicate significant trust issues within the client base. These allegations, combined with regulatory uncertainties, create a high-risk environment for potential clients.

User Experience Analysis (Score: 3/10)

User experience with FSDS Global Limited appears predominantly negative based on available feedback. Satisfaction levels fall significantly below industry standards, with the concentration of negative reviews and fraud allegations indicating systematic issues affecting client experience across multiple touchpoints.

Interface design and platform usability cannot be comprehensively evaluated due to limited available information. However, user feedback suggests potential deficiencies in user-friendly design and intuitive navigation. Professional trading platforms typically prioritize user experience through intuitive interfaces and streamlined workflows.

Registration and verification processes remain undocumented in available materials. This creates uncertainty about onboarding efficiency and user-friendliness, as the absence of clear process documentation suggests potential complications in account establishment and verification procedures.

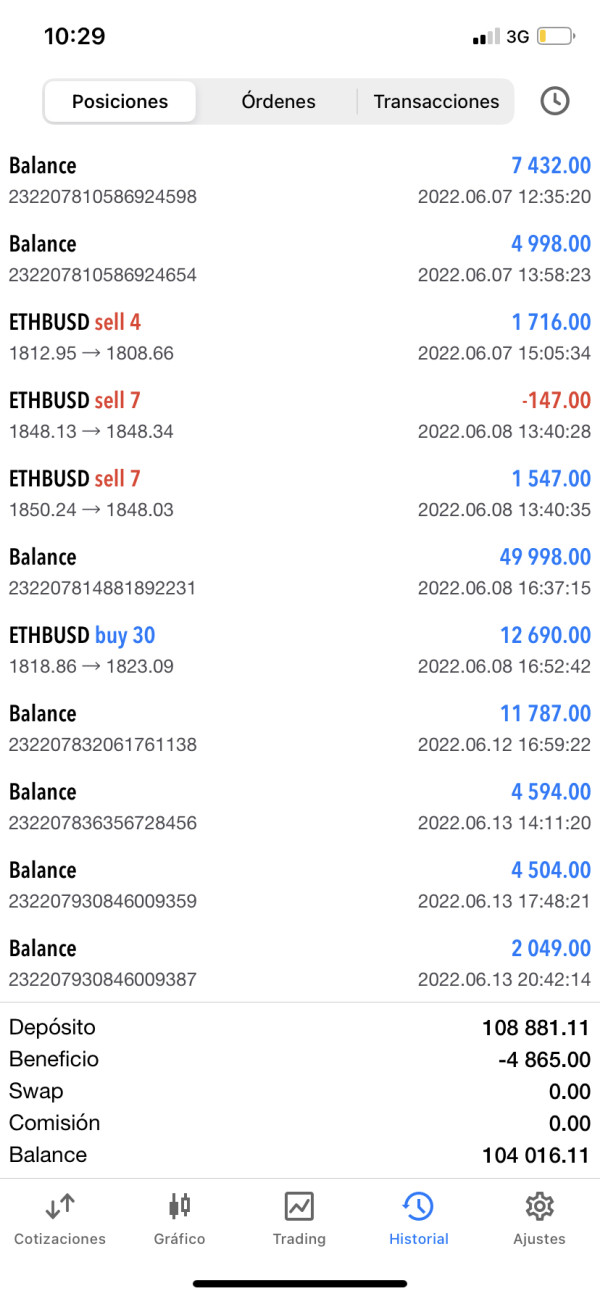

Fund operation experiences, including deposit and withdrawal processes, have not been detailed in available user feedback. However, the overall negative sentiment suggests potential issues with transaction efficiency and reliability.

Common user complaints center around fraud allegations and service quality concerns. These indicate systematic issues affecting multiple aspects of the client experience, as the predominance of negative feedback suggests fundamental operational deficiencies requiring significant improvement to achieve acceptable user satisfaction levels.

Conclusion

This comprehensive Fsds review reveals a broker facing significant challenges across multiple operational dimensions. Regulatory disputes and negative user feedback create substantial concerns for potential clients, with FSDS Global Limited's disputed regulatory status and user fraud allegations indicating high-risk factors that prudent investors should carefully consider.

The broker appears unsuitable for investors prioritizing security, regulatory compliance, and reliable customer service. While the claimed availability of 350 trading assets represents a potential advantage, the fundamental trust and regulatory issues overshadow any potential benefits the platform might offer.

The primary advantages include asset variety claims. However, significant disadvantages encompass regulatory disputes, negative user reputation, fraud allegations, and limited operational transparency. These factors combine to create an investment environment that poses substantial risks for client funds and trading security.