OPG 2025 Review: Everything You Need to Know

Executive Summary

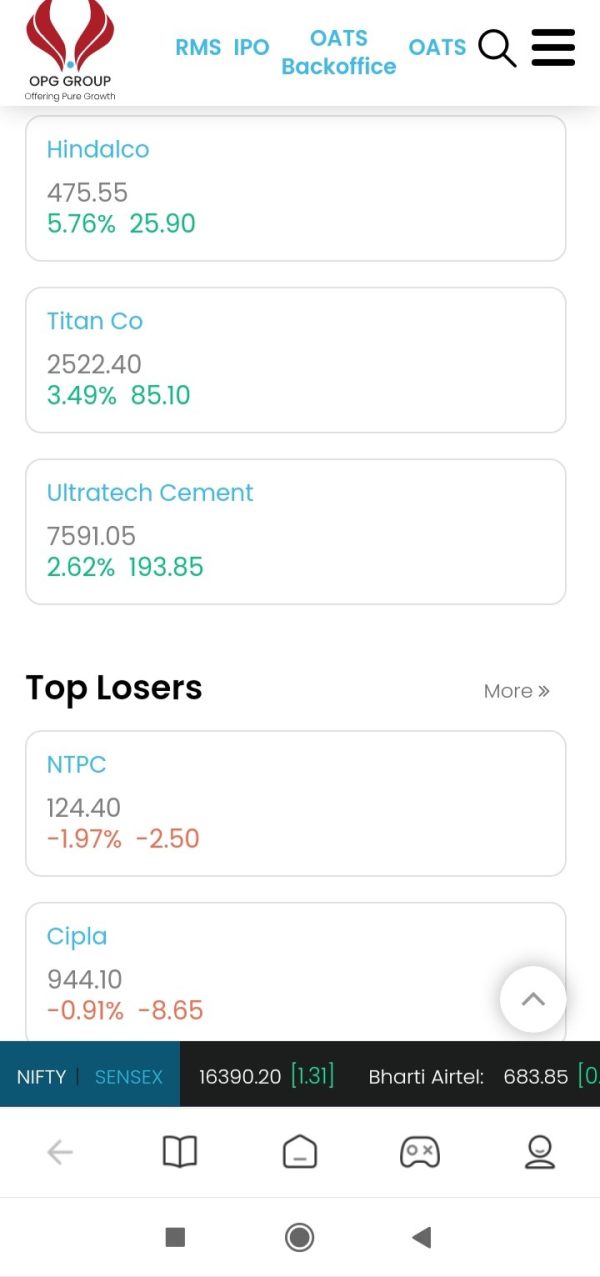

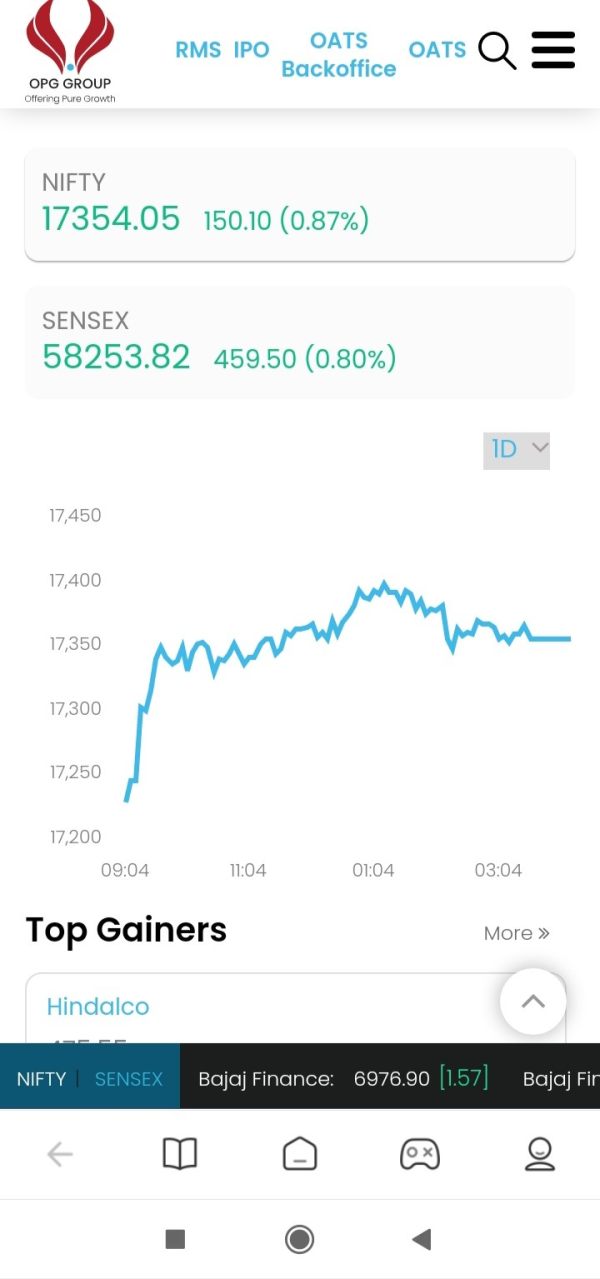

This opg review gives you a complete look at OPG as a trading platform provider. However, we found major gaps in the information available about their forex and trading services, which makes our assessment challenging. OPG seems to focus mainly on securities trading through their platform, and this platform supports market-on-open and limit-on-open orders with different time-in-force options.

We cannot give you a clear assessment because important details about regulatory status, trading conditions, and service offerings are missing. OPG does offer trading order execution with multiple time-in-force options, which shows they have some technical infrastructure for securities trading. But the missing information about spreads, leverage, regulatory compliance, and customer support makes us question how well they compete in the forex and CFD trading market.

This review gives traders an honest assessment based on what information we could find. We also point out the major information gaps that potential clients should know about before they consider OPG for their trading needs.

Important Notice

This evaluation uses only the limited public information available about OPG's trading services. Potential clients should know that we could not find specific details about regulatory compliance, regional service differences, and complete trading conditions in sources we could access. Our assessment method relies on industry standards and available technical details, but traders should strongly consider doing their own verification of all services, regulations, and terms before they engage with any trading platform.

The information we present reflects what public data is currently available. You should not consider this as investment advice or a complete research report.

Rating Framework

Broker Overview

OPG works as a trading platform provider that focuses on securities trading order execution. The platform supports market-on-open and limit-on-open order types according to available technical documentation, which shows some level of institutional-grade order management capabilities. However, we cannot find clear information about the company's background, when it was established, or its complete business model from public sources.

The platform's technical infrastructure seems to handle various time-in-force selections. This suggests some sophistication in order handling, which is typically found in more established trading platforms that serve both retail and institutional clients. But without detailed information about the company's history, regulatory status, or market position, we cannot assess their overall market presence or reliability.

The missing comprehensive information about OPG's corporate structure, founding principles, or strategic focus areas creates a significant limitation for this opg review. Potential clients who consider OPG should contact the company directly to get essential details about their services, regulatory compliance, and business operations.

Regulatory Status: We found no specific regulatory information in accessible sources, which raises concerns about compliance and oversight.

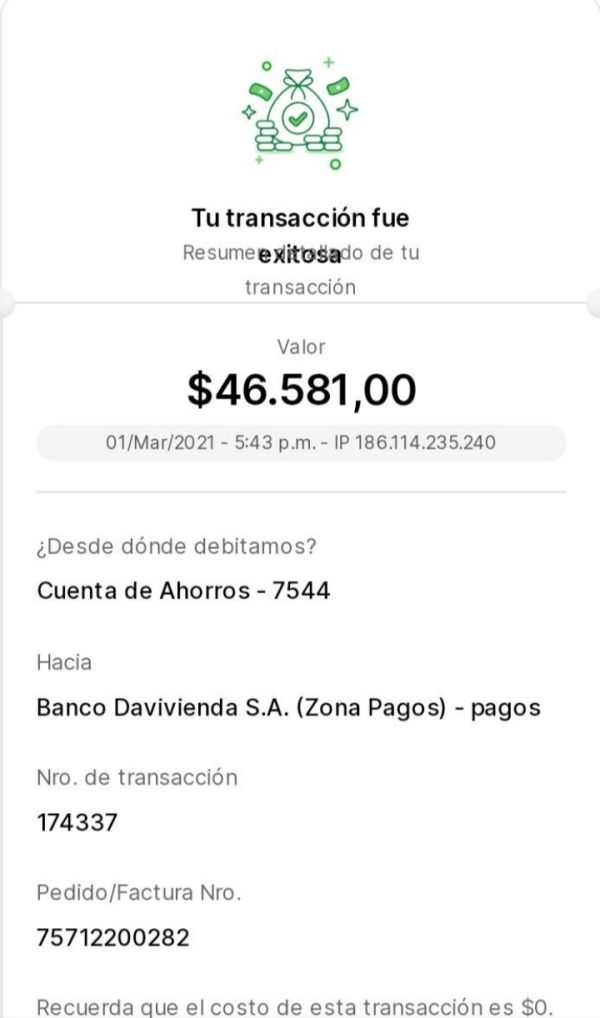

Deposit and Withdrawal Methods: Information about funding options, processing times, and fees is not available in public documentation.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not disclosed in available materials.

Promotions and Bonuses: We found no information about promotional offers, welcome bonuses, or trading incentives.

Tradeable Assets: The platform mentions securities trading capabilities, but the specific range of instruments, forex pairs, or CFDs available is not detailed.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not available in public sources.

Leverage Options: No information about maximum leverage ratios or margin requirements is provided.

Platform Options: The main platform appears to be the OPG securities trading system with order execution capabilities.

Geographic Restrictions: Information about service availability by region or country-specific limitations is not available.

Customer Support Languages: No details about multilingual support or customer service languages are provided.

This opg review highlights significant information gaps that potential traders should address through direct inquiry with the company.

Detailed Rating Analysis

Account Conditions Analysis

Our assessment of OPG's account conditions faces major limitations because we lack information about account types, structures, or features. We cannot evaluate how competitive or suitable their offerings are for different trader profiles without details about minimum deposit requirements, account tiers, or special features.

Industry standards typically include multiple account types that serve various experience levels and capital requirements. These range from basic retail accounts to premium institutional offerings, and the absence of such information in OPG's public materials suggests either limited service diversity or poor information transparency.

Professional trading platforms usually provide clear documentation about account opening procedures, verification requirements, and ongoing account management features. The lack of such details makes it difficult for potential clients to understand what to expect from the onboarding process or ongoing account administration.

This opg review cannot provide a meaningful assessment of account conditions without access to fundamental information about account structures, requirements, and features. Established brokers typically make this information readily available.

OPG's platform shows some technical capabilities through its support for market-on-open and limit-on-open orders with multiple time-in-force selections. This suggests a level of order management sophistication that could appeal to traders who need specific execution timing controls.

However, our evaluation of trading tools and resources remains severely limited by the lack of information about analytical tools, charting capabilities, research resources, or educational materials. Modern trading platforms typically offer comprehensive technical analysis tools, economic calendars, market news feeds, and educational content to support trader decision-making.

The absence of details about automated trading support, API access, or third-party platform integration represents another significant gap in understanding OPG's technological offerings. Professional traders often require these advanced features for strategy implementation and portfolio management.

We cannot assess the accessibility and convenience of OPG's trading environment for different user preferences and trading styles without information about mobile applications, web-based platforms, or downloadable software options.

Customer Service and Support Analysis

Our evaluation of OPG's customer service capabilities is severely limited by the complete absence of information about support channels, availability, or service quality standards. Professional trading platforms typically provide multiple contact methods including live chat, phone support, email assistance, and comprehensive FAQ resources.

Response time commitments, service level agreements, and escalation procedures are standard features that established brokers communicate clearly to their clients. The lack of such information raises questions about OPG's commitment to customer support excellence.

Multilingual support capabilities are crucial for international trading platforms, yet no information is available about language options or regional support teams. This gap is particularly concerning for traders who may require assistance in their native language during critical trading situations.

The absence of information about support hours, time zone coverage, or emergency contact procedures represents a significant limitation for traders. These traders may need assistance during various market sessions or urgent situations.

Trading Experience Analysis

Assessing OPG's trading experience requires evaluation of platform stability, execution speed, and overall user interface quality, yet none of this information is available in accessible sources. The mention of order execution capabilities suggests some level of trading infrastructure, but we cannot evaluate performance quality without details about execution speeds, slippage rates, or platform reliability.

Modern trading platforms are expected to provide seamless execution across multiple devices, real-time market data, and intuitive user interfaces. The absence of information about these fundamental features makes it difficult to assess whether OPG meets contemporary trading platform standards.

Order management features beyond the mentioned market-on-open and limit-on-open capabilities remain unclear. This includes stop-loss orders, take-profit levels, trailing stops, and other risk management tools that professional traders rely upon for effective position management.

This opg review cannot adequately assess the trading experience without access to user testimonials, platform demonstrations, or detailed feature specifications. Established trading platform providers typically make this information available.

Trust and Regulation Analysis

Our evaluation of trustworthiness faces significant challenges due to the complete absence of regulatory information in available sources. Regulatory oversight is fundamental to trader protection and platform credibility, which makes this information gap particularly concerning for potential clients.

Established trading platforms typically hold licenses from recognized financial authorities such as the FCA, CySEC, ASIC, or other reputable regulators. These regulatory relationships provide important protections including segregated client funds, compensation schemes, and operational oversight.

Transparency about company ownership, financial backing, and operational history is standard practice among reputable brokers. The lack of such information makes it difficult to assess OPG's stability, longevity, or commitment to regulatory compliance.

Potential clients cannot adequately assess the safety of their capital or the recourse available in case of operational issues without information about fund segregation, insurance coverage, or dispute resolution procedures.

User Experience Analysis

Our assessment of user experience is limited by the absence of comprehensive user feedback, platform usability information, or interface design details. Modern trading platforms prioritize user experience through intuitive design, customizable interfaces, and seamless functionality across devices.

Registration and account verification processes are crucial touchpoints that significantly impact user experience, yet no information is available about OPG's onboarding procedures. We also lack details about documentation requirements or verification timelines.

Funding and withdrawal experiences often determine overall user satisfaction, but we cannot evaluate this critical aspect of the user journey without details about payment processing, transaction times, or fee structures.

The lack of user testimonials, case studies, or independent reviews represents a significant limitation in understanding real-world user experiences. We cannot assess satisfaction levels with OPG's services without this feedback.

Conclusion

This opg review reveals significant limitations in available information about OPG's trading services, regulatory status, and operational details. The platform demonstrates some technical capabilities through order execution features, but the absence of comprehensive information about crucial aspects such as regulation, costs, customer support, and trading conditions makes it difficult to recommend OPG to potential traders.

The limited information available suggests that OPG may be suitable for traders specifically seeking basic order execution capabilities. This is particularly true for those interested in market-on-open and limit-on-open order types, but the lack of transparency about fundamental broker characteristics represents a significant concern for most trading requirements.

Potential clients should conduct thorough independent research and direct communication with OPG to obtain essential information about regulatory compliance, trading conditions, and service offerings. They should do this before making any commitment to their platform.