Is FSDS safe?

Business

License

Is FSDS Safe or a Scam?

Introduction

FSDS, also known as FSDS Global Limited, positions itself as an online forex broker catering to traders seeking access to a wide range of financial instruments. Established in 2020, FSDS claims to provide an extensive trading environment featuring forex, commodities, indices, and cryptocurrencies. However, the forex market is fraught with risks, and the presence of numerous unregulated brokers makes it essential for traders to exercise caution when selecting a trading partner. This article aims to evaluate whether FSDS is a legitimate broker or a potential scam by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall safety measures.

To conduct this investigation, we utilized a comprehensive assessment framework that includes gathering information from various reputable sources, including regulatory bodies, user reviews, and industry analyses. By synthesizing this data, we aim to provide a balanced view of FSDS's safety and reliability.

Regulation and Legitimacy

When assessing the safety of any forex broker, regulatory status is a crucial factor. A regulated broker is typically subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects traders' interests. Unfortunately, FSDS does not hold any valid regulatory licenses, raising red flags regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0547899 | USA | Not a member |

| FCA | N/A | UK | Not registered |

| ASIC | N/A | Australia | Not authorized |

The above table highlights that FSDS claims to be regulated by the National Futures Association (NFA) under license number 0547899. However, upon verification, it was discovered that FSDS is not a member of the NFA, casting doubt on its claims of regulatory compliance. Additionally, FSDS does not appear in the registers of the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), which further indicates a lack of legitimate oversight.

The absence of regulation is a significant concern, as it means that traders' funds may not be protected. Furthermore, FSDS's claims of being an award-winning financial service provider are questionable, especially considering that its domain was only created in April 2022, suggesting that it could not have received any awards prior to its establishment.

Company Background Investigation

Understanding the company behind a broker is vital for determining its reliability. FSDS Global Limited is a relatively new entity, having been established in 2020. The company claims to be based in the United Kingdom, but there is little transparency regarding its ownership structure or management team.

The management teams background is essential in assessing the broker's credibility. Unfortunately, information about the individuals behind FSDS is scarce, making it difficult to evaluate their experience and expertise in the financial services industry. This lack of transparency raises concerns regarding the company's integrity and accountability.

Moreover, the overall level of information disclosure by FSDS is inadequate. Potential clients should be wary of brokers that do not provide clear information about their ownership, management, and operational practices. The obscurity surrounding FSDS's corporate structure and management team is a significant factor that contributes to the skepticism surrounding its legitimacy.

Trading Conditions Analysis

An essential aspect of evaluating a forex broker is its trading conditions, including fees, spreads, and overall cost structure. FSDS offers a trading environment that includes various account types and trading instruments. However, the specifics of its fee structure are not transparently disclosed, which is a common red flag among potentially fraudulent brokers.

| Fee Type | FSDS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable, starting from 1.5 pips | 1.0 - 1.5 pips |

| Commission Model | None on standard accounts | Varies widely |

| Overnight Interest Range | Not specified | 2% - 5% |

The table above indicates that FSDS offers variable spreads starting from 1.5 pips for major currency pairs, which is at the higher end of the industry average. Moreover, there is no clear information regarding commission fees, which can often lead to unexpected costs for traders.

Additionally, there have been reports of unusual fees associated with withdrawals and account maintenance, which are common tactics used by scams to deter clients from accessing their funds. The lack of transparency in fee structures is a significant concern for potential traders considering whether FSDS is safe.

Client Fund Security

The safety of client funds is paramount when evaluating a forex broker. FSDS has not provided sufficient information regarding its fund security measures, which raises concerns about the safety of traders' investments. A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection policies to safeguard client funds.

Unfortunately, FSDS has not disclosed whether it uses segregated accounts to separate client funds from its operational capital. This lack of information is troubling, as it leaves traders vulnerable to potential losses if the broker encounters financial difficulties.

Moreover, there have been no documented cases of investor protection or any measures in place to secure clients' funds. The absence of these fundamental safety measures poses a significant risk to traders, further questioning whether FSDS is a safe option for forex trading.

Customer Experience and Complaints

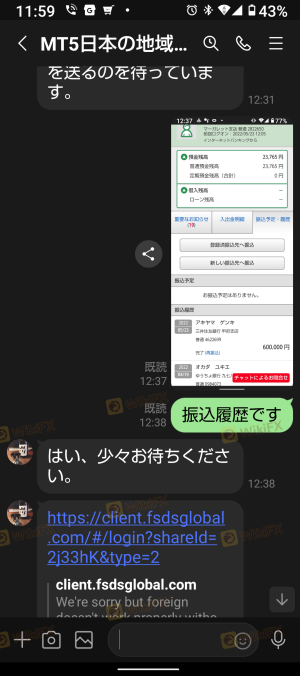

Customer feedback is a valuable resource for assessing the reliability and performance of a broker. Unfortunately, FSDS has garnered numerous complaints from users regarding withdrawal issues, unresponsive customer support, and unexpected fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Hidden Fees | High | Nonexistent |

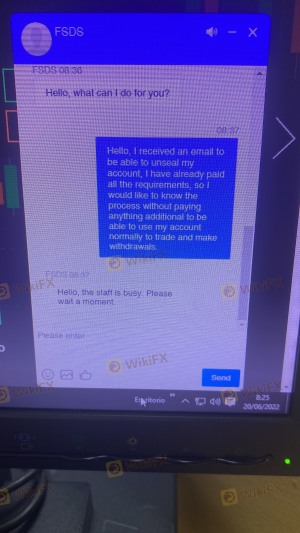

The above table summarizes the primary complaints against FSDS. Many users have reported difficulties withdrawing their funds, with some claiming they were asked to pay additional fees before they could access their money. This tactic is often indicative of fraudulent practices, where brokers create barriers to prevent clients from withdrawing their funds.

Case studies of users who attempted to withdraw their funds only to be met with resistance and vague explanations further illustrate the potential risks associated with FSDS. These negative experiences contribute to a growing consensus that FSDS may not be a reliable trading partner.

Platform and Trade Execution

The trading platform used by a broker plays a critical role in the overall trading experience. FSDS offers the MetaTrader 5 (MT5) platform, which is widely recognized for its advanced features and user-friendly interface. However, the quality of trade execution, including slippage and order rejections, is equally important.

Reports from users indicate that while the MT5 platform itself is stable, there have been instances of significant slippage and order rejections, particularly during volatile market conditions. Such issues can severely impact a trader's ability to execute strategies effectively, raising further concerns about whether FSDS can be considered a safe trading environment.

Additionally, there are no indications of platform manipulation, but the lack of transparency regarding execution quality and potential issues can lead to a lack of trust among traders.

Risk Assessment

Using FSDS presents various risks that potential traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight. |

| Fund Security | High | Lack of transparency regarding fund protection measures. |

| Customer Support | Medium | Reports of unresponsive support and unresolved complaints. |

| Trading Conditions | High | Unclear fee structures and high spreads. |

The assessment indicates that engaging with FSDS carries a high level of risk, particularly due to the absence of regulation and insufficient client fund security measures. Traders should approach with caution and consider these risks seriously.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that FSDS may not be a safe option for traders. The lack of regulation, unclear trading conditions, and numerous customer complaints raise significant concerns about the broker's legitimacy. Traders should be particularly wary of the potential for withdrawal issues and hidden fees.

For those seeking reliable forex trading options, it is advisable to consider regulated brokers with a proven track record. Alternatives such as brokers regulated by the FCA or ASIC, which provide transparent fee structures and robust customer support, may offer a safer trading environment.

In summary, is FSDS safe? The overwhelming evidence points to a lack of safety and reliability, and potential traders should exercise extreme caution before engaging with this broker.

Is FSDS a scam, or is it legit?

The latest exposure and evaluation content of FSDS brokers.

FSDS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FSDS latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.