Is Foxi safe?

Pros

Cons

Is Foxi Safe or Scam?

Introduction

Foxi is a forex broker that has recently emerged in the trading landscape, offering a range of trading options across various financial instruments, including forex, commodities, and cryptocurrencies. As the forex market continues to attract traders worldwide, it is crucial for potential investors to thoroughly evaluate the legitimacy and safety of brokers like Foxi. The rise of online trading has led to an increase in both legitimate platforms and scams, making it essential for traders to conduct comprehensive research before committing their funds. This article aims to provide an objective analysis of Foxi, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk assessment. Our investigation is based on a review of multiple credible sources, including user feedback and expert opinions, to determine whether Foxi is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy and safety. A well-regulated broker is typically subject to strict oversight, ensuring that it adheres to industry standards and provides a level of protection for its clients. In the case of Foxi, it claims to be regulated; however, investigations reveal discrepancies regarding its licensing.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | N/A | UK | Not Verified |

| Australian Securities and Investments Commission (ASIC) | N/A | Australia | Not Verified |

| Marshall Islands (Unregulated) | N/A | Marshall Islands | Not Verified |

Foxi asserts that it is regulated by both the FCA and ASIC, but verification with these authorities indicates that the licenses referenced are no longer valid. Furthermore, the Marshall Islands, where Foxi is registered, lacks a robust regulatory framework for forex trading, raising significant concerns about the broker's legitimacy. Given that Foxi does not have a valid regulatory license, traders should approach this broker with caution. The absence of regulatory oversight means that clients may have limited recourse in the event of disputes or financial losses, making it imperative to consider whether Foxi is safe to trade with.

Company Background Investigation

Foxi operates under the name Foxi Trade Limited, which is registered in the Marshall Islands. The companys history is relatively short, having been established recently, and it lacks substantial information regarding its ownership and management structure. This lack of transparency is concerning, as reputable brokers typically disclose information about their leadership teams and their professional backgrounds.

The absence of clear information about the management team raises questions about the broker's accountability and commitment to ethical trading practices. Moreover, the fact that the company is based in an offshore jurisdiction known for lax regulations further complicates the assessment of its legitimacy. Investors should be wary of brokers that do not provide adequate information about their operations and ownership, as this can be a red flag indicating potential fraudulent activities. Therefore, it is crucial for traders to thoroughly investigate the background of Foxi before considering it as a trading option.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its overall attractiveness and safety. Foxi claims to provide competitive spreads and a variety of trading instruments; however, the specifics of these conditions are often vague and lack transparency.

| Fee Type | Foxi | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread for major currency pairs at Foxi is reported to be around 2 pips, which is higher than the industry average of 1.5 pips. Additionally, the lack of clarity regarding commission structures and overnight interest rates is concerning. This ambiguity can lead to unexpected costs for traders, which is a common tactic used by less reputable brokers to obscure their true pricing models. Therefore, it is essential for potential clients to carefully review and understand the trading conditions before committing to Foxi, as this could impact the overall profitability of their trading activities.

Customer Fund Safety

When evaluating a broker, the safety of customer funds is paramount. Traders need to know that their investments are secure and that the broker has measures in place to protect their assets. Foxi's website does not provide clear information about its fund safety protocols, which is a significant concern.

The broker does not appear to offer segregated accounts for client funds, meaning that clients' money may not be kept separate from the broker's operational funds. This lack of segregation increases the risk of loss in the event of financial difficulties faced by the broker. Additionally, the absence of investor protection schemes raises further concerns, as traders may have no recourse to recover their funds in the event of insolvency. Historical issues related to fund safety have also been reported, with claims of withdrawal difficulties and unresponsive customer service. For these reasons, it is essential for traders to consider whether Foxi is safe for their investments, as the lack of robust safety measures could lead to significant financial risks.

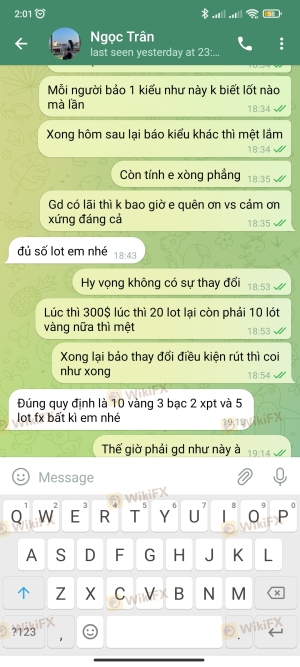

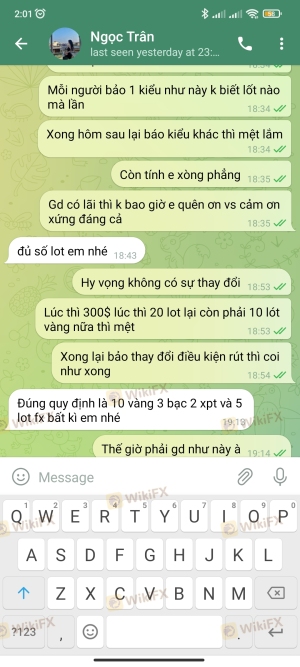

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the overall reliability of a broker. Reviews of Foxi reveal a pattern of complaints related to withdrawal issues, unresponsive customer service, and difficulties in accessing funds.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include delayed withdrawal requests, with some users reporting that their funds were inaccessible for extended periods. Additionally, there are concerns about the quality of customer support, as many users have expressed frustration over unreturned calls and emails. These issues indicate a troubling trend that could signal deeper operational problems within the broker. Therefore, potential clients should be cautious and consider the experiences of existing users when evaluating whether Foxi is safe for trading.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's offering, as it directly impacts the user experience and trade execution quality. Foxi claims to provide access to popular trading platforms, such as MetaTrader 4, but user reviews suggest mixed experiences regarding platform stability and execution quality.

Traders have reported instances of slippage and order rejections, which can significantly affect trading outcomes. Such issues may indicate underlying problems with the broker's execution systems or market manipulation practices. If traders experience frequent slippage or rejections, it raises concerns about the broker's integrity and reliability. Therefore, it is essential for potential clients to thoroughly test the platform and assess its performance before deciding to trade with Foxi.

Risk Assessment

Using Foxi as a trading platform presents several risks that potential investors should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Safety Risk | High | Lack of fund segregation and protection. |

| Service Risk | Medium | Complaints about support and withdrawal issues. |

The regulatory risk associated with Foxi is high, given its unregulated status and the dubious claims regarding its licensing. Additionally, the lack of safety measures for client funds compounds the risk, as traders may find themselves without recourse in the event of financial issues. Service risks are also present, as evidenced by user complaints regarding customer support and withdrawal difficulties. To mitigate these risks, traders should consider using well-regulated brokers with a proven track record of reliability and customer service.

Conclusion and Recommendations

In conclusion, the evidence suggests that Foxi may not be a safe option for forex trading. The broker's lack of valid regulation, unclear trading conditions, and numerous customer complaints raise significant red flags. Potential investors should exercise extreme caution and conduct thorough research before engaging with Foxi.

For those seeking reliable alternatives, it is advisable to consider well-established brokers that are regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers typically offer a higher level of transparency, customer support, and safety for client funds. Ultimately, while Foxi may present an attractive trading platform, the risks associated with its operations suggest that it may not be worth the investment. Therefore, traders should prioritize their financial safety and consider whether Foxi is safe for their trading activities before making any commitments.

Is Foxi a scam, or is it legit?

The latest exposure and evaluation content of Foxi brokers.

Foxi Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Foxi latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.