ForexDana Review 2

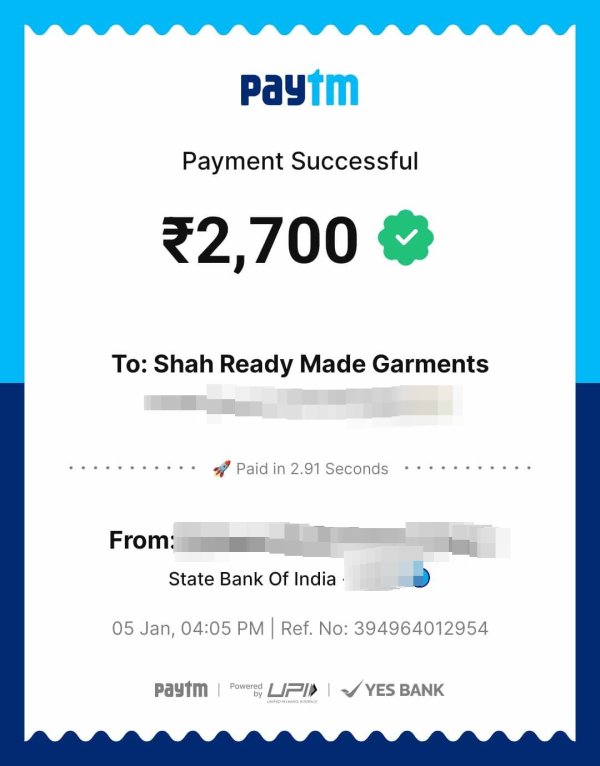

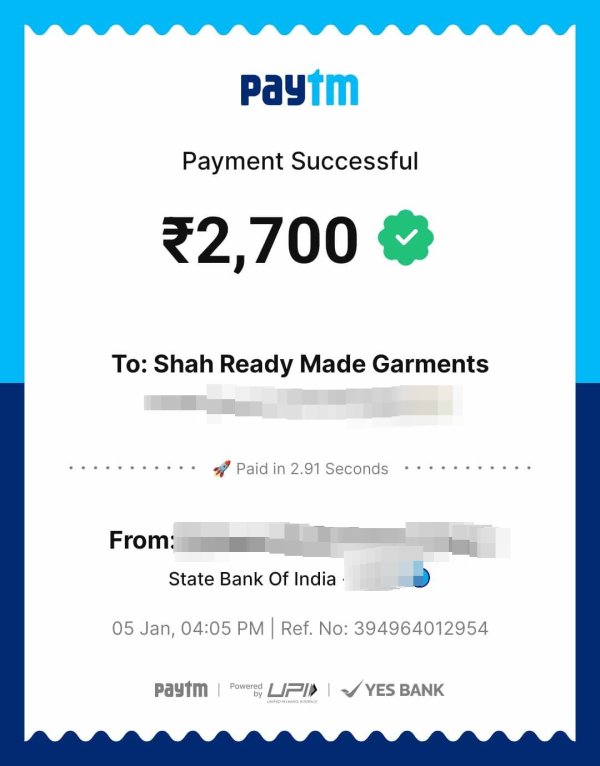

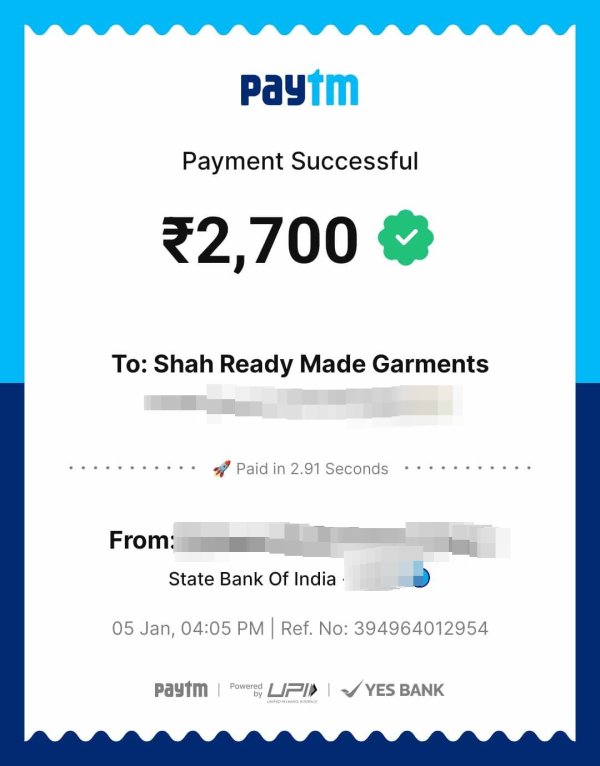

I have deposited $30 to forexdana but amount not updated, and response from customer support, what should i do

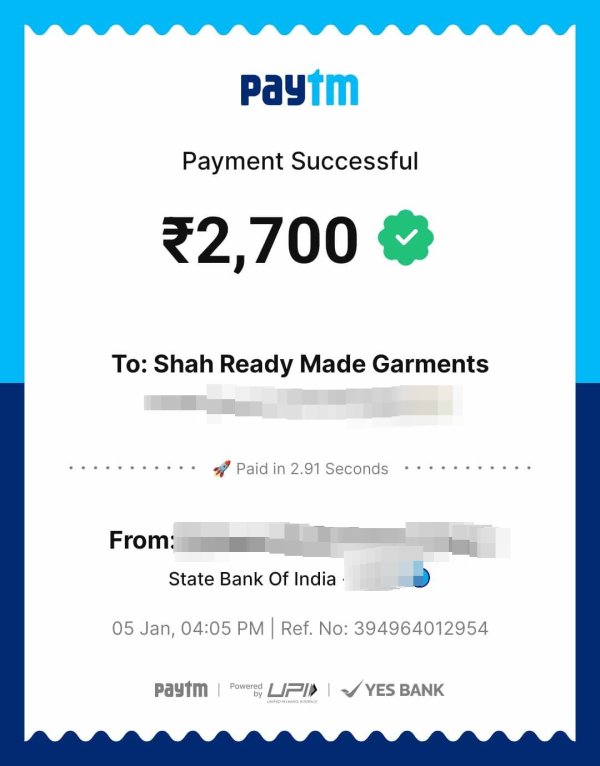

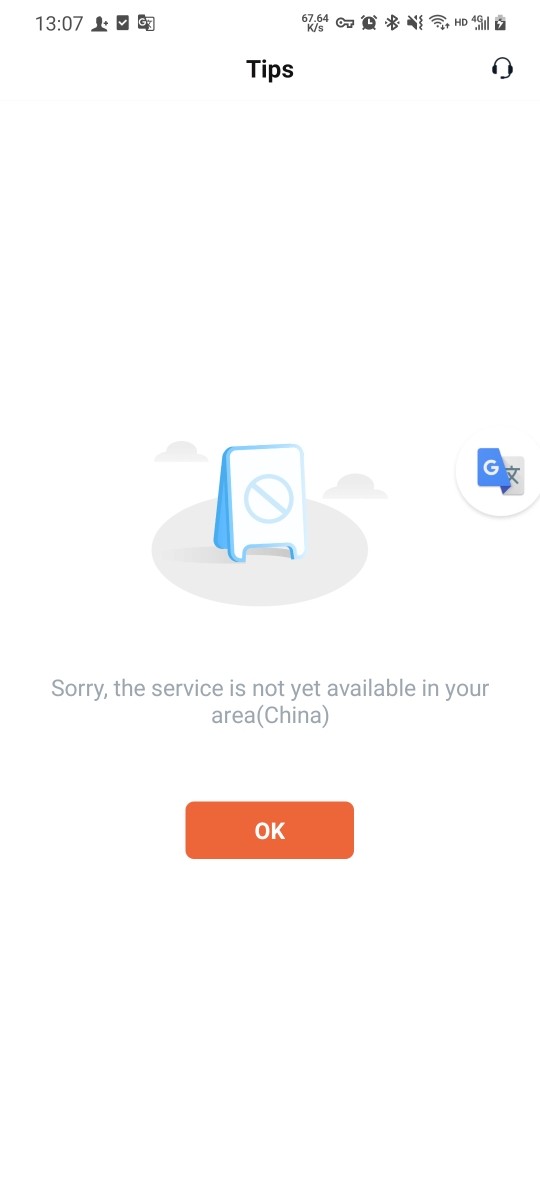

This is a clone firm. I've been cheated of nearly a million. Now they witdraw from Chinese market

ForexDana Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

I have deposited $30 to forexdana but amount not updated, and response from customer support, what should i do

This is a clone firm. I've been cheated of nearly a million. Now they witdraw from Chinese market

This comprehensive Forexdana review reveals serious concerns about this forex broker. Potential investors should carefully consider these issues before opening accounts. Based on extensive user feedback and available information, Forexdana receives an overall negative assessment due to persistent fund withdrawal delays and a concerning lack of regulatory transparency.

The broker operates with MetaTrader 4 platform and claims to offer over 500 CFD trading instruments. These instruments cover various asset classes including forex, cryptocurrencies, and precious metals.

However, user experiences paint a troubling picture that contradicts the broker's marketing claims. With a disappointing rating of just 1.8 out of 5 based on user reviews, Forexdana faces serious allegations including withdrawal processing delays, unexplained account restrictions, and insufficient regulatory oversight. Multiple traders have reported difficulties accessing their funds and receiving adequate customer support when issues arise.

The target audience primarily consists of investors seeking to trade forex, cryptocurrencies, and precious metals. However, the broker's reliability concerns make it unsuitable for risk-averse traders who prioritize fund security and transparent operations.

Regulatory Notice: Forexdana does not provide clear information about specific regulatory oversight. This raises significant concerns about investor protection that potential clients should carefully consider. Traders should be aware that regulatory differences across jurisdictions may substantially impact trading safety and fund security.

The absence of transparent regulatory information represents a major red flag for potential investors. Professional brokers typically provide detailed regulatory credentials to demonstrate proper oversight and client protection measures.

Review Limitations: This evaluation is based on available user feedback and publicly accessible information. Due to limited transparency from Forexdana itself, we cannot independently verify all operational claims or financial data presented by the broker.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 2/10 | Lack of transparency regarding spreads, commissions, minimum deposits, and leverage information |

| Tools and Resources | 7/10 | Offers over 500 CFD trading instruments and MetaTrader 4 platform access |

| Customer Service | 2/10 | User reports indicate withdrawal delays and account restrictions with poor support quality |

| Trading Experience | 3/10 | User feedback suggests significant trading delays and platform stability issues |

| Trust and Safety | 1/10 | User rating of 1.8/5 with fraud allegations and regulatory transparency concerns |

| User Experience | 2/10 | Widespread user dissatisfaction with fund withdrawal processes and account limitations |

Forexdana presents itself as a forex broker headquartered in the United Kingdom. However, specific establishment details remain unclear in available documentation, which creates transparency concerns for potential investors. The company operates primarily as a CFD and forex trading service provider, positioning itself in the competitive online trading market.

The broker's background information lacks the transparency typically expected from reputable financial service providers. This absence of clear operational details should concern potential clients who need to verify broker legitimacy before investing.

The company's business model centers on providing access to international financial markets through derivative products. These products focus particularly on contracts for difference that allow traders to speculate on price movements without owning underlying assets. While Forexdana claims to serve global clients, the absence of clear regulatory information raises questions about its operational legitimacy and client fund protection measures.

Forexdana utilizes the widely recognized MetaTrader 4 trading platform. This platform is considered an industry standard for retail forex trading and provides robust functionality for most trading strategies. The broker advertises access to multiple asset categories including foreign exchange pairs, cryptocurrency derivatives, precious metals, and other commodities.

However, despite offering a diverse range of trading instruments, the broker's reputation has been significantly damaged by user complaints and regulatory concerns. Available documentation does not specify primary regulatory oversight, which represents a critical gap in investor protection information that serious traders should not ignore.

Regulatory Status: Available information does not specify regulatory oversight agencies or license numbers. This creates significant transparency concerns for potential investors who need to verify broker legitimacy and client protection measures.

Deposit and Withdrawal Methods: Specific payment processing options and supported withdrawal methods are not detailed in available documentation. This lack of information makes it difficult for potential clients to plan their account funding and withdrawal strategies.

Minimum Deposit Requirements: The broker has not disclosed minimum account funding requirements in accessible materials. Professional brokers typically provide clear deposit information to help clients choose appropriate account types for their investment levels.

Bonus and Promotions: No information regarding welcome bonuses, promotional offers, or incentive programs is available in current documentation. This absence of promotional details may indicate limited marketing efforts or poor communication standards.

Available Trading Assets: Forexdana offers access to forex currency pairs, cryptocurrency CFDs, precious metals including gold and silver, and various commodity derivatives. The broker claims to provide access to more than 500 instruments across these asset categories.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs remains undisclosed in available materials. This lack of pricing transparency makes it impossible for traders to calculate their potential trading costs accurately.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible broker documentation. Professional traders require this information to plan their risk management and position sizing strategies effectively.

Platform Selection: The broker exclusively offers MetaTrader 4 platform access without additional proprietary or third-party trading software options. This limitation may restrict traders who prefer alternative platforms or specialized trading tools.

Geographic Restrictions: Specific country limitations and regional access restrictions are not clearly outlined in available information. International traders need this information to determine their eligibility for account opening and service access.

Customer Support Languages: Available customer service language options are not specified in current documentation. This lack of clarity may indicate limited international support capabilities or poor service planning.

This Forexdana review highlights significant information gaps that potential clients should consider before opening trading accounts.

Forexdana's account conditions present serious transparency issues that should concern potential investors. The broker fails to provide essential information about account types, making it impossible for traders to make informed decisions about their investment options.

Unlike reputable brokers who clearly outline different account tiers with specific features and requirements, Forexdana's documentation lacks these fundamental details. This absence of clear account information suggests either poor operational standards or deliberate obfuscation of important terms and conditions.

The absence of minimum deposit information represents another significant red flag for potential clients. Established brokers typically provide clear deposit requirements for different account levels, allowing investors to plan their initial funding appropriately.

This lack of transparency suggests either poor operational standards or deliberate hiding of important account terms. Professional brokers understand that clients need clear information to make informed investment decisions.

Account opening procedures remain undefined in available materials. This creates uncertainty about verification requirements, documentation needs, and approval timeframes that can affect account establishment planning.

Professional brokers usually outline clear onboarding processes to help clients understand what to expect during account establishment. Forexdana's failure to provide this information indicates poor client communication standards.

Specialized account features such as Islamic trading accounts, professional trader classifications, or managed account options are not mentioned in accessible documentation. This suggests either limited service offerings or inadequate communication of available features that may be important for specific trader types.

User feedback indicates significant dissatisfaction with account management, particularly regarding withdrawal processing and account access restrictions. These complaints suggest that even basic account operations may be problematic, regardless of the specific account type obtained.

The lack of clear account condition information, combined with negative user experiences, makes Forexdana's account offerings highly questionable for serious traders. This Forexdana review finding emphasizes the importance of choosing brokers with transparent account structures and clear terms of service.

Forexdana demonstrates some strength in its trading tools and resources offering. The broker provides MetaTrader 4 platform access and an extensive selection of over 500 CFD trading instruments that cover multiple asset classes.

MetaTrader 4 remains one of the most widely used and respected trading platforms in the industry. It offers robust charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors that most traders find familiar and effective.

The broker's instrument diversity represents a notable positive aspect of their service offering. The platform covers major asset classes including forex pairs, cryptocurrency derivatives, precious metals, and commodity CFDs that allow portfolio diversification.

This broad selection allows traders to diversify their portfolios and explore different market opportunities from a single platform. The availability of over 500 instruments compares favorably with many competitors in the retail trading space and provides substantial trading flexibility.

However, significant limitations become apparent when examining additional resources beyond basic platform access. Available documentation does not mention research and analysis resources, daily market commentary, economic calendars, or fundamental analysis tools that professional traders typically expect from their brokers.

Educational resources, trading tutorials, and market insights appear to be absent from the broker's offerings. Modern traders often rely on these additional resources to improve their skills and stay informed about market developments.

Advanced trading features such as algorithmic trading support, custom indicator development, or institutional-grade analysis tools are not specified in available materials. While MetaTrader 4 provides basic automated trading capabilities, the broker does not appear to offer enhanced or proprietary trading technologies that could differentiate their service.

User feedback regarding tool quality and platform performance is limited. However, some traders have reported technical issues that may impact the overall trading experience and platform reliability.

The concentration on MetaTrader 4 without additional platform options may limit traders who prefer alternative trading environments. Some traders require specialized tools for specific trading strategies that may not be available through this single platform option.

Customer service represents one of Forexdana's most significant weaknesses. User feedback consistently highlights poor support quality and responsiveness that creates serious problems for traders who need assistance.

Multiple traders have reported experiencing substantial delays when attempting to withdraw funds. These delays suggest either inadequate staffing or deliberate obstruction of withdrawal requests that can create serious financial stress for traders who need timely access to their capital.

The broker's support infrastructure appears insufficient to handle client inquiries effectively. Available documentation does not specify customer service channels, operating hours, or response time commitments, which indicates poor service planning and client communication standards that fall below industry expectations.

Professional brokers typically provide multiple contact methods including live chat, email support, and telephone assistance. They also maintain clearly defined availability schedules that help clients know when they can expect support assistance.

Account restriction issues represent another major concern that affects client satisfaction and fund access. Users report unexpected limitations placed on their trading accounts without adequate explanation or resolution support that can prevent normal trading operations.

These restrictions can prevent traders from executing their intended strategies and accessing their funds. Such limitations create significant operational difficulties that can result in missed opportunities and financial losses.

Language support options remain unspecified in available documentation. This lack of clarity potentially limits accessibility for international clients who may need support in their native languages.

Quality brokers usually offer multilingual support to serve their global client base effectively. Forexdana's lack of clarity in this area suggests limited international service capabilities that may exclude many potential clients.

Problem resolution processes appear inadequate based on user experiences and complaint patterns. Traders report difficulty obtaining satisfactory responses to their concerns, with many issues remaining unresolved for extended periods that create ongoing frustration.

This pattern suggests systemic customer service problems rather than isolated incidents. The overall customer service experience contributes significantly to Forexdana's poor reputation and low user satisfaction ratings, making it unsuitable for traders who value reliable support and timely issue resolution.

The trading experience with Forexdana presents significant concerns that potential investors should carefully evaluate. User feedback indicates persistent issues with trading delays, which can severely impact execution quality and profitability, particularly for strategies requiring precise timing or during volatile market conditions.

These delays suggest either inadequate technological infrastructure or deliberate manipulation of order processing. Professional trading requires fast, reliable execution to maintain strategy effectiveness and protect against market volatility.

Platform stability represents another critical issue based on user reports that affect normal trading operations. While MetaTrader 4 is generally considered a reliable platform, the broker's implementation appears to suffer from technical problems that compromise trading effectiveness.

Unstable trading environments can lead to missed opportunities, unexpected losses, and increased trading costs through slippage and requotes. Traders need consistent platform performance to execute their strategies effectively and manage risk appropriately.

Order execution quality remains questionable given the reported technical difficulties and user complaints. Professional trading requires consistent, fast execution at or near requested prices, but user experiences suggest that Forexdana may not meet these basic standards that are essential for profitable trading.

Poor execution can significantly impact trading profitability and strategy effectiveness. Traders may experience slippage, requotes, or execution delays that increase their trading costs and reduce potential profits.

Mobile trading experience information is not available in current documentation. However, this represents a crucial component of modern trading services that most serious traders require for portfolio management.

Most serious traders require reliable mobile access to manage positions and respond to market developments. The absence of clear mobile trading information suggests either limited mobile capabilities or poor communication of available features.

The trading environment appears compromised by the broker's operational issues. These problems create additional risks beyond normal market volatility that can affect trading outcomes and account performance.

Traders report concerns about platform reliability during important market events. Such reliability issues could result in substantial losses if positions cannot be managed effectively during volatile market conditions.

This Forexdana review reveals that the trading experience falls well below industry standards. The combination of technical issues, execution problems, and reliability concerns makes the broker unsuitable for serious traders who require consistent platform performance and reliable execution quality.

Trust and safety represent Forexdana's most critical weaknesses. Multiple factors contribute to serious concerns about the broker's reliability and legitimacy that potential investors should carefully consider before opening accounts.

The absence of clear regulatory information creates a fundamental transparency problem for potential clients. Legitimate brokers typically provide detailed regulatory credentials to demonstrate oversight and client protection measures that help investors verify broker legitimacy.

Fund security measures remain unspecified in available documentation. This lack of transparency is particularly concerning given user reports of withdrawal difficulties that suggest potential problems with fund management and client asset protection.

Reputable brokers typically maintain segregated client accounts, deposit insurance, or other protection mechanisms. They also clearly communicate these protections to clients to demonstrate their commitment to fund security and regulatory compliance.

Forexdana's lack of transparency in this area suggests inadequate fund protection. This absence of clear security information should concern potential clients who need assurance about their deposit safety and withdrawal capabilities.

The company's operational transparency falls well below industry standards. Limited information is available about management, financial backing, or business operations that makes it difficult to assess broker stability and legitimacy.

This opacity makes it difficult for potential clients to assess the broker's stability and long-term viability. These assessments are essential considerations for trading account selection and long-term investment planning.

Industry reputation has been severely damaged by fraud allegations and consistently poor user reviews. The 1.8 out of 5 user rating reflects widespread dissatisfaction and suggests systematic problems rather than isolated incidents that affect most client interactions.

Such low ratings typically indicate serious operational or ethical issues. These problems affect client satisfaction and suggest fundamental problems with business operations and client service standards.

Negative event handling appears inadequate based on user experiences and public allegations. The broker has not provided satisfactory responses to fraud claims or demonstrated effective resolution of client complaints that could restore confidence.

This pattern suggests either inability or unwillingness to address legitimate client concerns. Professional brokers typically maintain clear complaint resolution procedures and work actively to resolve client issues.

Third-party verification through platforms like Trustpilot confirms the negative user sentiment. Multiple complaints about fund access and service quality appear across different review platforms, indicating genuine operational problems rather than isolated disputes.

The consistency of these complaints across different review platforms indicates genuine operational problems. This pattern suggests systematic issues that affect most client interactions rather than isolated incidents that could be easily resolved.

User experience with Forexdana demonstrates consistently poor satisfaction levels across multiple operational areas. Overall user satisfaction remains extremely low, with the 1.8 out of 5 rating reflecting widespread dissatisfaction with the broker's services and reliability.

This rating places Forexdana among the poorest-performing brokers in terms of client satisfaction. Such low ratings typically indicate fundamental problems with service delivery and client relationship management.

Interface design and usability information for the broker's website and client portal are not detailed in available documentation. However, MetaTrader 4 platform access provides a familiar trading environment for most users who are accustomed to this industry-standard platform.

Platform access quality appears compromised by technical issues reported by users. These problems can affect the overall user experience despite the familiarity of the MetaTrader 4 interface.

Registration and verification processes remain unclear in available materials. This creates uncertainty about account opening requirements and approval timeframes that can affect new client onboarding and account establishment planning.

Professional brokers typically provide clear guidance about documentation needs and processing expectations. They help clients prepare for account establishment and understand what to expect during the verification process.

Fund management represents the most significant user experience problem for Forexdana clients. Widespread complaints about withdrawal processing delays and unexpected account restrictions create substantial stress and financial uncertainty for traders who cannot access their capital when needed.

These issues affect fundamental aspects of the trading relationship and client satisfaction. The consistency of these complaints suggests systematic problems with fund management procedures that affect most client interactions.

Common user complaints center on withdrawal difficulties, account access restrictions, and poor customer support responsiveness. These issues affect fundamental aspects of the trading experience and indicate serious operational deficiencies that impact most client interactions.

The pattern of complaints suggests systematic problems rather than isolated incidents. Professional brokers typically maintain effective procedures to prevent such widespread client dissatisfaction.

The user demographic appears to include traders seeking diverse asset access and MetaTrader 4 platform functionality. However, the broker's reliability issues make it unsuitable for risk-conscious investors who prioritize fund security and reliable service delivery.

Most users would benefit from choosing more transparent and reliable alternatives. These alternatives should provide better fund security and customer service standards that meet professional trading requirements.

Improvement recommendations include implementing transparent regulatory compliance and establishing reliable fund processing procedures. The broker should also develop responsive customer support systems to address client concerns effectively and restore confidence in their service delivery.

This comprehensive Forexdana review reveals a broker with significant operational and transparency issues. These problems make it unsuitable for most traders who prioritize fund security and reliable service delivery.

While the platform offers access to over 500 trading instruments through MetaTrader 4, these advantages are overshadowed by serious concerns. Fund security, regulatory transparency, and customer service quality issues create unacceptable risks for most trading strategies.

The broker may only be appropriate for highly risk-tolerant traders who prioritize instrument diversity over security and reliability. However, most investors would benefit from choosing regulated alternatives that provide better client protection and transparent operations.

The absence of clear regulatory oversight creates fundamental transparency problems for potential investors. Combined with persistent user complaints about fund withdrawals and account restrictions, these issues create unacceptable risks for serious trading activities.

Primary advantages include diverse trading instrument access and MetaTrader 4 platform availability. However, critical disadvantages include withdrawal processing delays, lack of regulatory transparency, poor customer service quality, and widespread user dissatisfaction.

These significant disadvantages outweigh any potential benefits for most traders. Serious investors should consider regulated alternatives that provide better fund protection and transparent operations for their trading activities.

FX Broker Capital Trading Markets Review