Is ForexDana safe?

Pros

Cons

Is Forexdana a Scam?

Introduction

In the ever-evolving foreign exchange market, the emergence of numerous brokers has led traders to be more cautious than ever before. One such broker is Forexdana, which positions itself as a platform for trading forex, CFDs, and various other financial instruments. As traders look for opportunities to capitalize on currency fluctuations, it becomes crucial to evaluate the credibility and safety of brokers like Forexdana. This article aims to provide a comprehensive analysis of Forexdana, assessing its regulatory status, company background, trading conditions, and overall safety. The evaluation is based on a thorough investigation of available online resources, user reviews, and expert opinions.

Regulation and Legitimacy

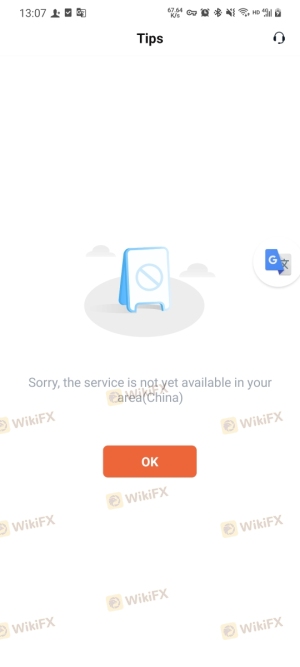

The regulatory framework of a broker is critical in determining its legitimacy and the safety of its clients' funds. Forexdana claims to operate from the United Kingdom, a jurisdiction known for its stringent financial regulations. However, upon investigation, it becomes apparent that Forexdana lacks proper regulation. The absence of a valid license raises significant concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulatory oversight implies that Forexdana may not adhere to the industry standards designed to protect traders. This absence of regulation can expose clients to various risks, including potential fraud and mismanagement of funds. Furthermore, the company's failure to disclose any regulatory affiliations or compliance history adds to the skepticism surrounding its operations. Traders must exercise caution when dealing with unregulated brokers, as their funds may not be safeguarded under any investor protection schemes.

Company Background Investigation

Forexdana's history and ownership structure are equally important when assessing its credibility. The company does not provide clear information regarding its founding year or the individuals behind its operations, leading to concerns about transparency. A lack of information about the management team and their professional backgrounds further exacerbates these concerns.

Many reputable brokers highlight their management's qualifications and experience in the financial sector, but Forexdana appears to fall short in this regard. This opacity can be a red flag for potential investors, as it raises questions about the company's operational integrity and commitment to ethical practices. Transparency is a hallmark of trustworthy brokers, and Forexdana's failure to disclose essential information may indicate a lack of accountability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its overall value. Forexdana presents a variety of trading instruments, including forex pairs, commodities, and indices. However, the specifics of its fee structure and trading costs are less clear.

| Fee Type | Forexdana | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding fees can lead to unexpected costs for traders. Moreover, some user reviews suggest that Forexdana may impose unusual or hidden charges, which could significantly impact trading profitability. Traders should be wary of brokers that do not clearly outline their fee structures, as this can often lead to disputes and dissatisfaction.

Client Fund Security

The safety of client funds is paramount in the trading industry. Forexdana's approach to fund security is another area of concern. The company does not provide detailed information about its measures for safeguarding client funds. This lack of clarity raises serious questions about the effectiveness of its fund protection policies, such as fund segregation and negative balance protection.

Historically, many unregulated brokers have faced allegations related to mishandling client funds, leading to substantial losses for traders. Without a robust framework for protecting client assets, traders using Forexdana may be at risk of losing their investments. Therefore, it is essential for potential clients to inquire about the specific safety measures implemented by the broker before committing their funds.

Customer Experience and Complaints

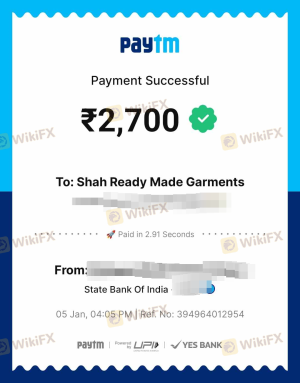

Customer feedback is a critical component of assessing a broker's reliability. Reviews for Forexdana reveal a mix of experiences, with some users expressing satisfaction with the platform's usability while others report significant issues. Common complaints include difficulties in withdrawing funds and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

These complaints highlight potential operational inefficiencies that could lead to frustration for traders. In particular, issues related to fund withdrawals are particularly alarming, as they directly affect traders' access to their capital. The overall response from the company to these complaints appears to be inadequate, further diminishing trust in its services.

Platform and Trade Execution

The trading platform's performance is crucial for a positive trading experience. Forexdana offers a platform that is reportedly user-friendly, but there are concerns about its stability and execution quality. Users have reported instances of slippage and order rejections, which can adversely affect trading outcomes.

Traders rely on timely executions and accurate pricing to maximize their profits, and any signs of manipulation or instability on the platform can be detrimental. It is essential for potential users to consider these factors before engaging with Forexdana.

Risk Assessment

Engaging with Forexdana presents several risks that traders should carefully evaluate. The absence of regulation, unclear fee structures, and mixed customer feedback contribute to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated broker |

| Fund Security | High | Lack of transparency |

| Customer Support | Medium | Poor response rates |

Traders should consider implementing risk mitigation strategies, such as using smaller account sizes and diversifying their investments, to minimize potential losses when trading with Forexdana.

Conclusion and Recommendations

In conclusion, the evidence suggests that Forexdana may not be a safe broker for traders. The lack of regulatory oversight, transparency issues, and mixed customer experiences raise significant red flags. While some traders may find success with the platform, the potential risks involved make it a less than ideal choice for most.

For those seeking reliable trading options, it may be advisable to explore alternative brokers that offer robust regulatory protections, transparent fee structures, and a proven track record of customer satisfaction. Brokers such as IG, OANDA, and Forex.com are often recommended for their strong reputations and comprehensive services.

In summary, is Forexdana safe? The overwhelming evidence suggests that it is essential to proceed with caution, as there are numerous indicators that this broker may not provide the level of security and transparency that traders require.

Is ForexDana a scam, or is it legit?

The latest exposure and evaluation content of ForexDana brokers.

ForexDana Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ForexDana latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.