FORED Review 1

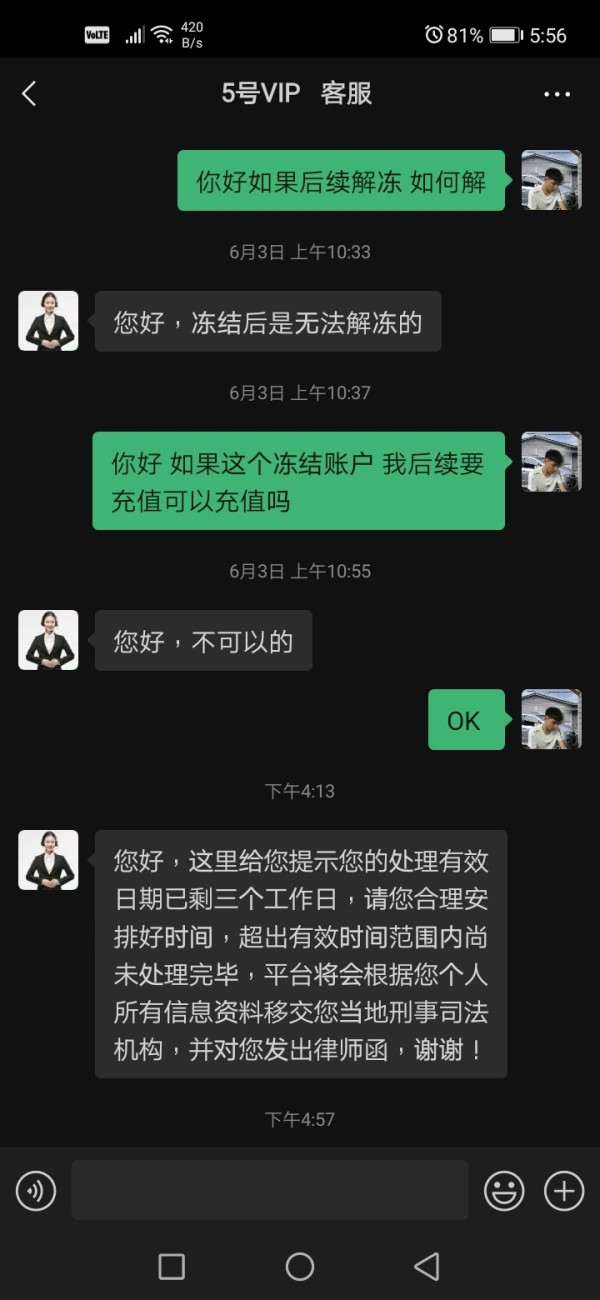

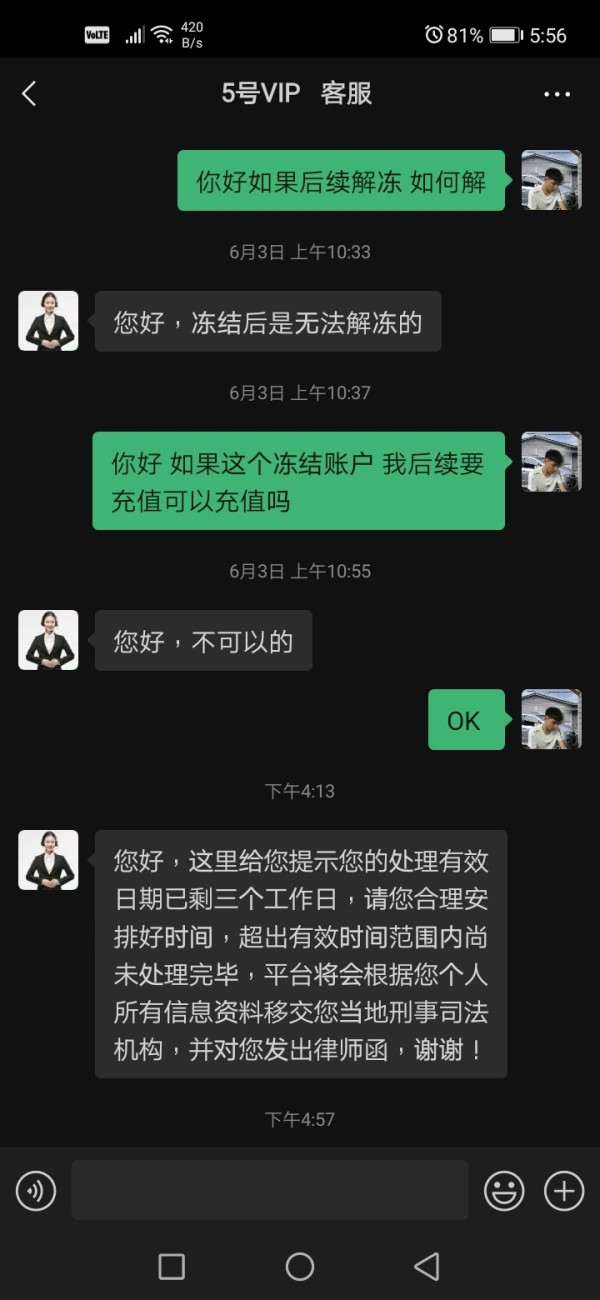

Unable to withdraw, Margin has been required. And they said they would sue me!

FORED Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Unable to withdraw, Margin has been required. And they said they would sue me!

This fored review gives you a complete analysis of what seems to be a trading platform connected to Ford Motor Company's financial services division. Fored works within Ford's larger corporate structure, which keeps a solid reputation with employee satisfaction ratings of 4.0/5 from over 16,459 anonymous reviews and 4.3/5 from more than 3,100 employee evaluations across different divisions.

The platform targets individual investors who want exposure to foreign exchange markets. However, specific details about trading conditions and services stay limited in publicly available documentation. Ford Motor Company's established corporate presence provides a foundation of institutional credibility, but the specific forex trading operations under the Fored brand need careful evaluation due to limited transparency in available materials.

Our assessment suggests this platform may appeal to traders who prioritize institutional backing and corporate stability. Potential users should conduct thorough due diligence given the limited publicly available information about specific trading conditions and regulatory compliance.

This evaluation is based on available public information and corporate documentation related to Ford Motor Company and its financial services operations. Information availability varies significantly across different jurisdictions and service offerings.

Our assessment methodology incorporates user feedback data, corporate transparency measures, and industry standard evaluation criteria. However, specific trading conditions, regulatory compliance details, and user experience metrics for the Fored trading platform remain limited in publicly accessible sources. Potential users are strongly advised to verify all information directly with the service provider before making any trading decisions.

| Criterion | Score | Evaluation Basis |

|---|---|---|

| Account Conditions | 5/10 | Limited information available about account types, minimum deposits, and trading terms |

| Tools and Resources | 4/10 | Specific trading tools and educational resources not detailed in available materials |

| Customer Service | 6/10 | Corporate infrastructure suggests support capabilities, but specific service metrics unavailable |

| Trading Experience | 5/10 | Platform functionality and execution quality not documented in accessible sources |

| Trust Rating | 6/10 | Corporate backing provides institutional credibility, but specific regulatory details unclear |

| User Experience | 5/10 | Limited user feedback available specifically for trading platform operations |

Fored operates within the corporate structure of Ford Motor Company, a multinational automotive manufacturer with over a century of business operations. Ford's primary business focuses on vehicle manufacturing and mobility solutions, but the company has historically maintained various financial services divisions that serve both consumer and commercial markets.

The connection between Ford's established corporate presence and the Fored trading platform suggests an institutional approach to financial services. Specific details about the platform's launch date, operational history, and strategic positioning within Ford's broader business portfolio are not clearly documented in available public materials.

The platform appears designed to serve individual investors interested in foreign exchange trading from an operational perspective. The specific business model, whether market maker or ECN, remains unclear from available documentation. Corporate backing potentially provides advantages in terms of capitalization and operational stability, which can be significant considerations for traders evaluating broker reliability.

This fored review notes that while the Ford Motor Company brand carries substantial recognition and corporate credibility, the specific trading platform operations require independent evaluation based on actual service delivery rather than corporate reputation alone.

Regulatory Status: Available materials do not provide clear information about specific regulatory oversight for the Fored trading platform. Ford Motor Company operates under various financial regulations globally, but the specific compliance framework for forex trading operations requires clarification.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees is not detailed in accessible documentation.

Minimum Deposit Requirements: Entry-level investment thresholds and account funding requirements are not specified in available materials.

Promotions and Bonuses: Current promotional offerings, welcome bonuses, or loyalty programs are not documented in publicly available sources.

Available Assets: The range of tradeable instruments, including currency pairs, commodities, indices, and other financial products, is not clearly outlined in accessible materials.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in available documentation. This represents a significant information gap for potential users conducting cost comparisons.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible sources.

Platform Options: Details about trading software, mobile applications, and platform features are not documented in available materials.

Geographic Restrictions: Service availability by region and any jurisdictional limitations are not clearly outlined.

Customer Support Languages: Available support languages and communication channels are not specified.

This fored review emphasizes that the limited availability of specific operational details represents a significant consideration for potential users requiring comprehensive service information.

The account conditions evaluation for Fored faces significant limitations due to insufficient publicly available information about specific account types, terms, and conditions. Ford Motor Company's corporate structure suggests the potential for institutional-grade account management systems, but the specific implementation for retail forex trading remains unclear.

Traditional forex brokers typically offer multiple account tiers with varying minimum deposits, spread structures, and service levels. Available documentation does not detail whether Fored follows this industry standard approach or implements alternative account structures. The absence of clear information about Islamic accounts, professional trader classifications, or institutional account options limits our ability to assess accessibility for diverse trader demographics.

Account opening procedures, verification requirements, and onboarding processes are not documented in accessible materials. This lack of transparency regarding account establishment procedures may concern potential users who prioritize clear operational guidelines. The evaluation suggests that prospective traders should directly contact the service provider to obtain comprehensive account condition details before making commitment decisions.

This fored review assigns a moderate rating based on the institutional backing provided by Ford Motor Company, while noting that specific account terms require direct verification with the service provider.

The assessment of trading tools and resources for Fored encounters substantial limitations due to the absence of detailed information about platform capabilities, analytical tools, and educational resources. Modern forex trading platforms typically provide comprehensive charting packages, technical indicators, economic calendars, and market analysis tools as standard features.

Educational resources represent a crucial component of broker evaluation, particularly for developing traders. Industry standards include webinars, trading guides, video tutorials, and market commentary. Available documentation does not specify whether Fored provides these educational components or alternative learning resources for platform users.

Automated trading capabilities, including Expert Advisor support, copy trading features, and algorithmic trading tools, are increasingly important for contemporary forex traders. The availability and sophistication of such tools within the Fored platform are not documented in accessible sources.

Research and analysis resources, including fundamental analysis, technical analysis tools, and market sentiment indicators, play vital roles in trading decision-making. The specific analytical capabilities offered by Fored remain unclear from available materials, limiting our ability to assess the platform's suitability for different trading strategies and experience levels.

Customer service evaluation for Fored benefits from Ford Motor Company's established corporate infrastructure, which suggests potential for professional support operations. Large corporations typically maintain comprehensive customer service departments with established protocols and training programs, potentially indicating underlying support capabilities.

Specific metrics about response times, support channel availability, and service quality for the trading platform are not documented in available materials. Industry standards include 24/5 support coverage during market hours, multiple communication channels including live chat, phone, and email support, and multilingual capabilities for international users.

The corporate backing from Ford Motor Company potentially provides advantages in terms of support infrastructure and resource allocation compared to smaller, independent forex brokers. Established corporations often have dedicated customer service teams, escalation procedures, and quality assurance programs that can benefit end users.

The specific implementation of customer support for Fored trading operations requires independent verification. Corporate infrastructure does not automatically guarantee superior service delivery for specialized trading platform support, which often requires specific technical knowledge and market expertise that differs from traditional automotive customer service requirements.

The trading experience evaluation for Fored faces significant constraints due to limited information about platform performance, execution quality, and user interface design. Modern forex trading platforms are typically assessed based on order execution speed, slippage rates, platform stability, and feature comprehensiveness.

Platform stability and uptime represent critical factors for active traders, particularly during high-volatility market conditions. Ford Motor Company's corporate infrastructure suggests potential for reliable technical systems, but the specific implementation and performance metrics for the trading platform are not documented in available sources.

Order execution quality, including fill rates, requote frequency, and execution speed, significantly impacts trading outcomes. Industry benchmarks typically measure execution times in milliseconds, with professional platforms achieving sub-second order processing. The specific execution capabilities and performance standards for Fored are not detailed in accessible materials.

Mobile trading capabilities have become essential for contemporary forex traders, with expectations for full-featured mobile applications that replicate desktop functionality. The availability and quality of mobile trading solutions for Fored are not specified in available documentation.

This fored review notes that trading experience assessment requires hands-on platform testing and user feedback, which are not available through current information sources.

The trust rating for Fored benefits significantly from the institutional credibility of Ford Motor Company, a publicly traded corporation with over a century of business operations and established corporate governance structures. Public companies face regulatory oversight, financial reporting requirements, and transparency obligations that can provide additional security compared to privately held forex brokers.

Specific regulatory compliance for the Fored trading platform requires independent verification. Forex brokers typically operate under jurisdiction-specific regulations such as FCA, CySEC, ASIC, or NFA. The specific regulatory framework governing Fored's trading operations is not clearly documented in available materials.

Client fund protection measures, including segregated accounts, deposit insurance, and negative balance protection, represent crucial trust factors for forex traders. Large corporations often implement robust financial controls, but the specific client protection measures for Fored trading operations are not detailed in accessible sources.

Corporate transparency regarding ownership structure, financial statements, and operational procedures generally supports trust assessments. Ford Motor Company's public company status provides transparency advantages, though specific disclosures related to forex trading operations may require additional verification.

The absence of documented negative incidents or regulatory actions specific to Fored trading operations provides a neutral baseline, though comprehensive due diligence would require ongoing monitoring of regulatory databases and industry news sources.

User experience assessment for Fored encounters limitations due to insufficient feedback data and documentation about platform usability, interface design, and overall user satisfaction. Contemporary forex platforms are typically evaluated based on interface intuitiveness, navigation efficiency, and feature accessibility for users with varying experience levels.

The registration and verification process significantly impacts initial user experience, with industry trends favoring streamlined onboarding while maintaining compliance requirements. Specific procedures for account opening, identity verification, and initial deposit processes for Fored are not documented in available materials.

Fund management operations, including deposit processing, withdrawal procedures, and transaction transparency, represent crucial user experience components. Processing times, fee structures, and payment method availability significantly influence user satisfaction, though these details are not specified for Fored operations.

Platform customization options, including interface personalization, workspace configuration, and notification settings, enhance user experience for active traders. The availability and extent of customization features within the Fored platform are not documented in accessible sources.

User feedback aggregation from multiple sources typically provides valuable insights into common satisfaction factors and recurring issues. Specific user reviews and experience reports for Fored trading operations are not available in current information sources, limiting comprehensive user experience assessment.

This fored review reveals a trading platform that benefits from the institutional backing of Ford Motor Company while facing significant transparency challenges due to limited publicly available operational information. The corporate foundation provides potential advantages in terms of financial stability and infrastructure capabilities, which can be important factors for traders prioritizing institutional credibility.

The substantial information gaps regarding regulatory compliance, trading conditions, platform features, and user experience metrics present significant evaluation challenges. Potential users seeking comprehensive service details will need to conduct direct inquiries with the service provider to obtain essential information about account terms, costs, and platform capabilities.

The platform may appeal to traders who value corporate backing and institutional stability over extensive feature transparency. The limited available information suggests that prospective users should approach with careful due diligence and direct verification of all operational details before committing to trading activities.

FX Broker Capital Trading Markets Review