Executive Summary

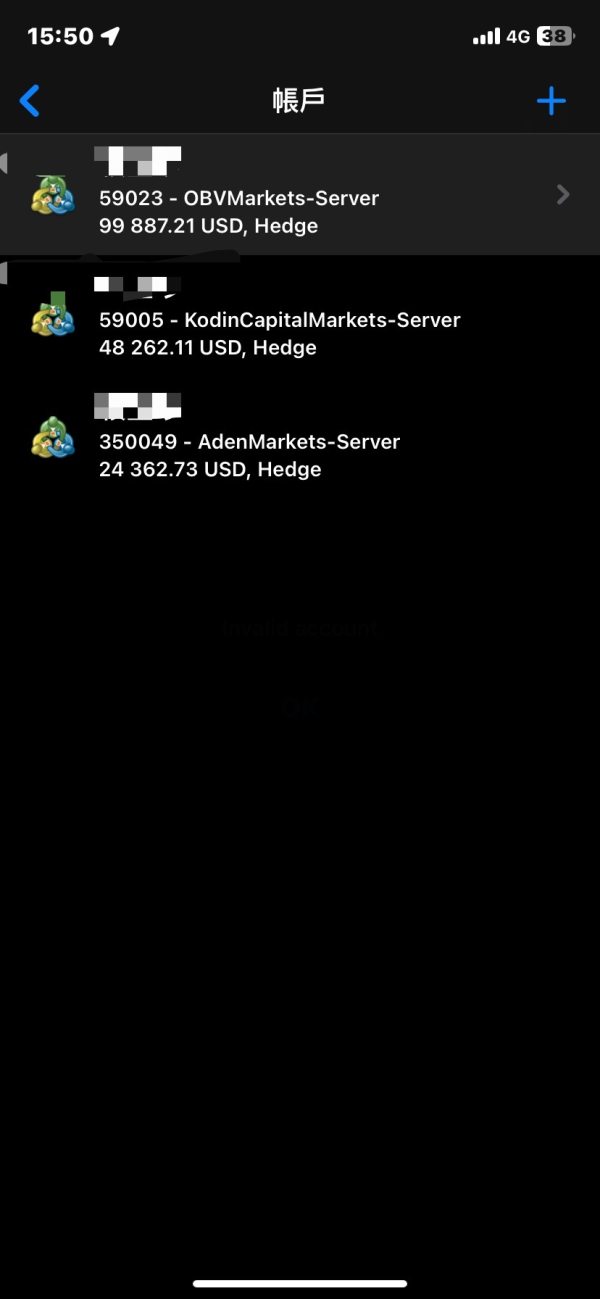

Kodin Capital Markets is a new player in online forex trading. The company started in 2023 and is registered in Mauritius. This kodin capital markets review shows a broker with mixed credentials and limited transparency that raises concerns. While the company offers many trading instruments including forex, spot metals, cryptocurrencies, spot indices, commodities, and futures, its overall reputation has significant problems for potential traders.

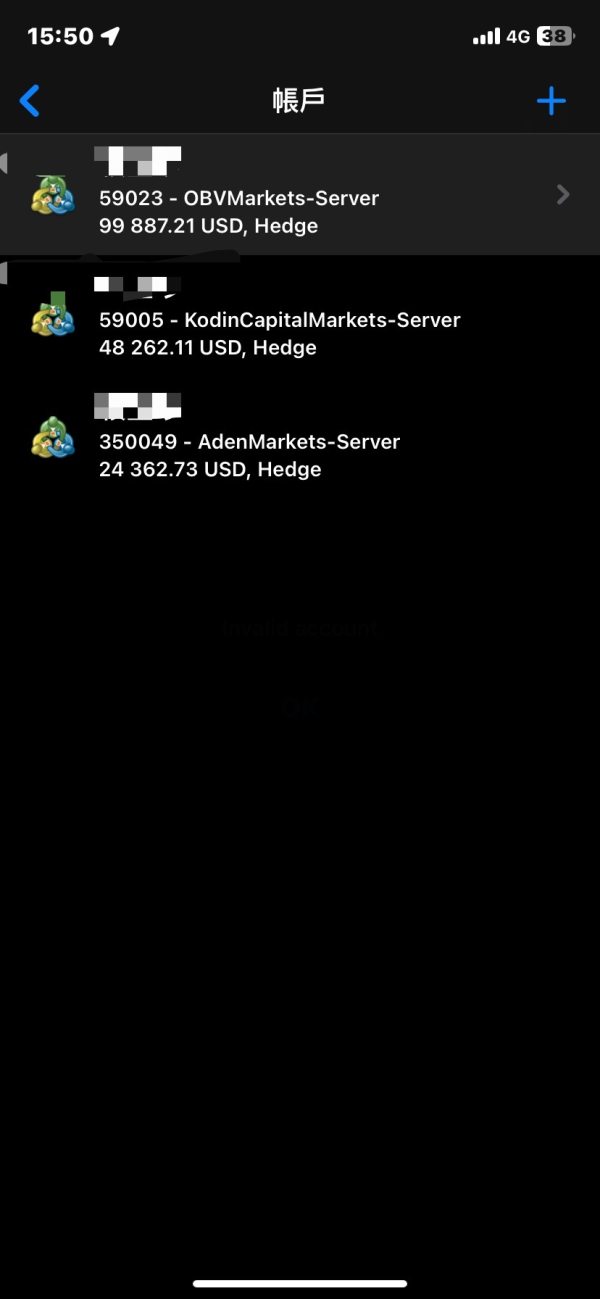

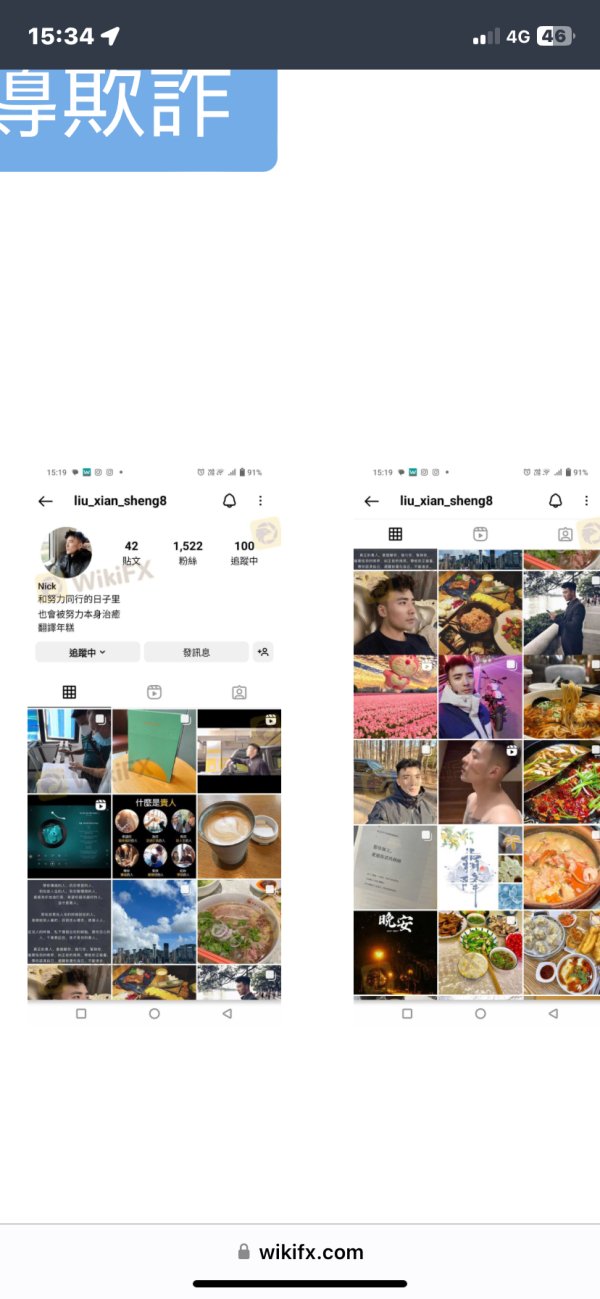

WikiFX gives Kodin Capital Markets a low score of 1 out of 10. This rating shows major trust and reliability issues. However, the broker's Chennai, India operations show a different picture with local reviews showing a 5-star rating based on 4 customer reviews. This suggests that service quality and user satisfaction vary by region.

The broker mainly targets experienced traders who want diverse trading instruments across multiple asset classes. However, the lack of clear regulatory information, limited transparency about trading conditions, and poor overall ratings from major review platforms suggest that traders should be very careful when considering this broker. The big difference between global ratings and local Indian reviews shows the importance of understanding regional operational differences before making any trading commitments.

Important Notice

Traders should know that Kodin Capital Markets operates with notable regional differences. These differences may significantly impact the trading experience. While the company is registered in Mauritius, its Indian subsidiary in Chennai appears to maintain higher service standards and customer satisfaction levels.

This difference suggests that the quality of services, regulatory oversight, and customer support may vary considerably depending on the operational jurisdiction. This review is based on publicly available information and user feedback from various sources. Due to limited official disclosure from the broker regarding key operational details, some aspects of this evaluation may lack comprehensive data.

Potential clients are strongly advised to conduct independent verification of all trading conditions, regulatory status, and service quality before opening any trading accounts.

Rating Overview

Broker Overview

Kodin Capital Markets entered the competitive forex brokerage sector in 2023. The company positions itself as a multi-asset trading platform with Mauritius-based registration. The company operates under a business model that emphasizes diversity in trading instruments, offering clients access to traditional forex pairs alongside modern cryptocurrency markets and commodity trading opportunities.

Despite its recent establishment, the broker has attempted to establish a presence in multiple markets. The company has particular focus on the Indian subcontinent region. The company's business approach centers on providing comprehensive market access through a single trading platform, targeting traders who prefer consolidated access to multiple asset classes rather than specialized single-market trading.

This kodin capital markets review indicates that while the broker offers extensive instrument variety, the execution and service quality supporting these offerings remain questionable based on available user feedback and third-party evaluations. The broker's asset portfolio encompasses foreign exchange currency pairs, precious metals trading, cryptocurrency markets, stock indices, commodity futures, and various derivative instruments. However, specific details regarding trading platform technology, execution methods, and operational infrastructure remain largely undisclosed in public documentation.

The lack of comprehensive regulatory information and limited transparency regarding core trading conditions raises significant concerns about the broker's operational standards and commitment to client protection.

Regulatory Status and Jurisdiction: Kodin Capital Markets operates from Mauritius registration. However, specific regulatory oversight details are not clearly disclosed in available documentation. The absence of prominent regulatory authority licensing creates uncertainty regarding client fund protection and operational compliance standards.

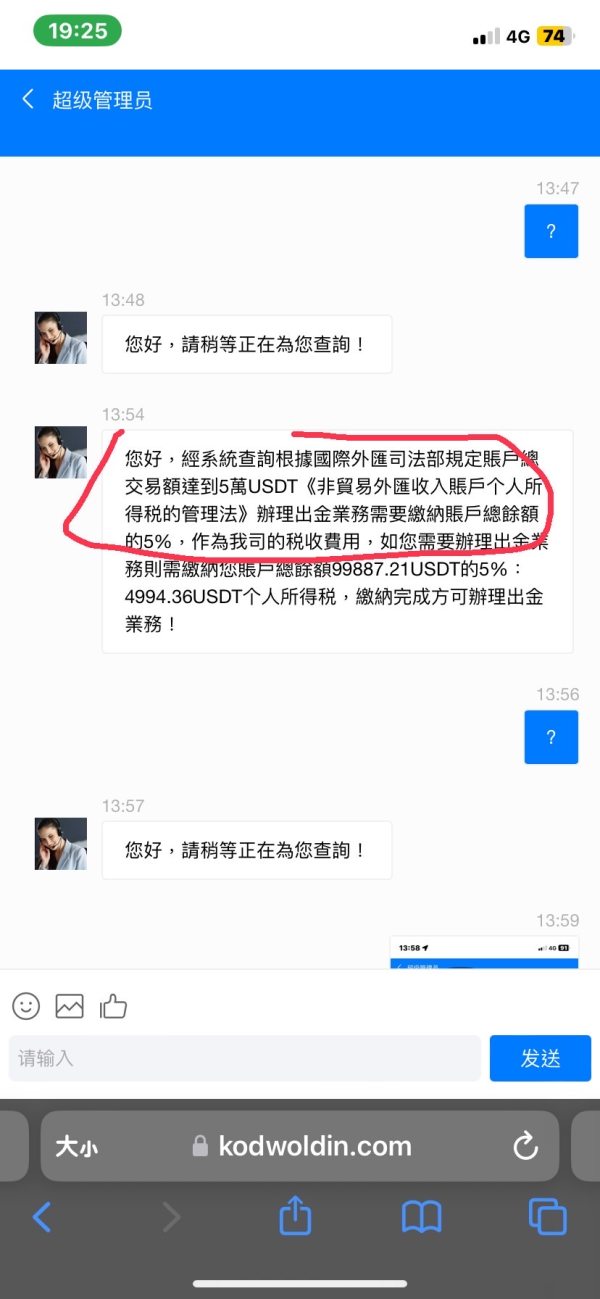

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing timeframes, and associated fees for deposits and withdrawals has not been detailed in available broker documentation. This creates potential concerns for clients regarding fund accessibility.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit amounts for different account types. This makes it difficult for potential clients to assess entry-level investment requirements and account accessibility.

Promotional Offers and Bonuses: Current information does not indicate specific bonus programs, promotional campaigns, or incentive structures offered to new or existing clients. This suggests either limited marketing initiatives or poor communication of available benefits.

Available Trading Assets: The platform provides access to forex currency pairs, spot precious metals, major cryptocurrencies, global stock indices, commodity futures, and various derivative instruments. This offers substantial diversity for multi-market trading strategies.

Cost Structure and Fees: Critical information regarding spreads, commission rates, overnight financing charges, and additional trading costs remains undisclosed in this kodin capital markets review. This creates transparency concerns for cost-conscious traders.

Leverage Options: Maximum leverage ratios, margin requirements, and position sizing limitations have not been specified in available broker materials. This potentially impacts risk management planning for prospective clients.

Trading Platform Selection: Specific trading platform options, mobile applications, and technological infrastructure details are not clearly communicated in public broker information. This raises questions about execution quality and user interface standards.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Kodin Capital Markets present significant transparency challenges. These challenges substantially impact the overall trading proposition. Available information fails to specify the variety of account types, their respective features, or the minimum deposit requirements for different trading levels.

This lack of clarity makes it extremely difficult for potential clients to understand what they can expect from their trading relationship with the broker. The absence of detailed information regarding account opening procedures, verification requirements, and documentation processes creates additional uncertainty. Most reputable brokers provide comprehensive account comparison tables, clearly outlining the differences between basic, premium, and professional account tiers.

The failure to provide such fundamental information suggests either poor communication standards or potentially problematic operational practices. Furthermore, there is no mention of specialized account options such as Islamic accounts for Muslim traders, managed accounts, or institutional trading solutions. The lack of information regarding account protection measures, such as negative balance protection or segregated client funds, raises serious concerns about client safety and regulatory compliance.

This kodin capital markets review finds the account conditions transparency to be severely inadequate for informed decision-making. The overall assessment of account conditions remains poor due to the fundamental lack of accessible information that traders require to evaluate the suitability of the broker for their specific needs and risk tolerance levels.

Kodin Capital Markets demonstrates its strongest performance in the tools and resources category. This is primarily due to the diverse range of trading instruments available across multiple asset classes. The broker provides access to traditional forex markets, precious metals trading, cryptocurrency markets, stock indices, commodities, and futures contracts, offering traders significant diversification opportunities within a single platform environment.

The variety of available instruments suggests that the broker has invested in establishing connections with multiple liquidity providers and market makers across different asset classes. This diversity can be particularly valuable for traders who employ cross-market arbitrage strategies or those seeking to build diversified portfolios without managing multiple brokerage relationships. However, the positive aspects of instrument diversity are significantly undermined by the complete lack of information regarding research and analysis resources, educational materials, or trading tools beyond basic market access.

Most competitive brokers provide economic calendars, market analysis, trading signals, expert advisor support, and comprehensive educational resources to support client trading success. The absence of details regarding automated trading support, API access for algorithmic trading, or advanced charting capabilities suggests that the broker may be lacking in technological sophistication. Additionally, there is no mention of risk management tools, position sizing calculators, or other analytical resources that experienced traders typically expect from professional trading platforms.

Customer Service and Support Analysis (Score: 4/10)

The customer service and support infrastructure at Kodin Capital Markets presents concerning gaps in accessibility and transparency. These gaps significantly impact the overall client experience. Available information fails to specify the customer support channels, operating hours, or response time commitments that clients can expect when requiring assistance with their trading accounts or technical issues.

Professional forex brokers typically offer multiple communication channels including live chat, telephone support, email assistance, and comprehensive FAQ sections. The absence of clearly communicated support options suggests either limited customer service infrastructure or poor communication of available resources, both of which create potential problems for traders requiring timely assistance. The lack of information regarding multilingual support capabilities raises additional concerns for international clients who may require assistance in their native languages.

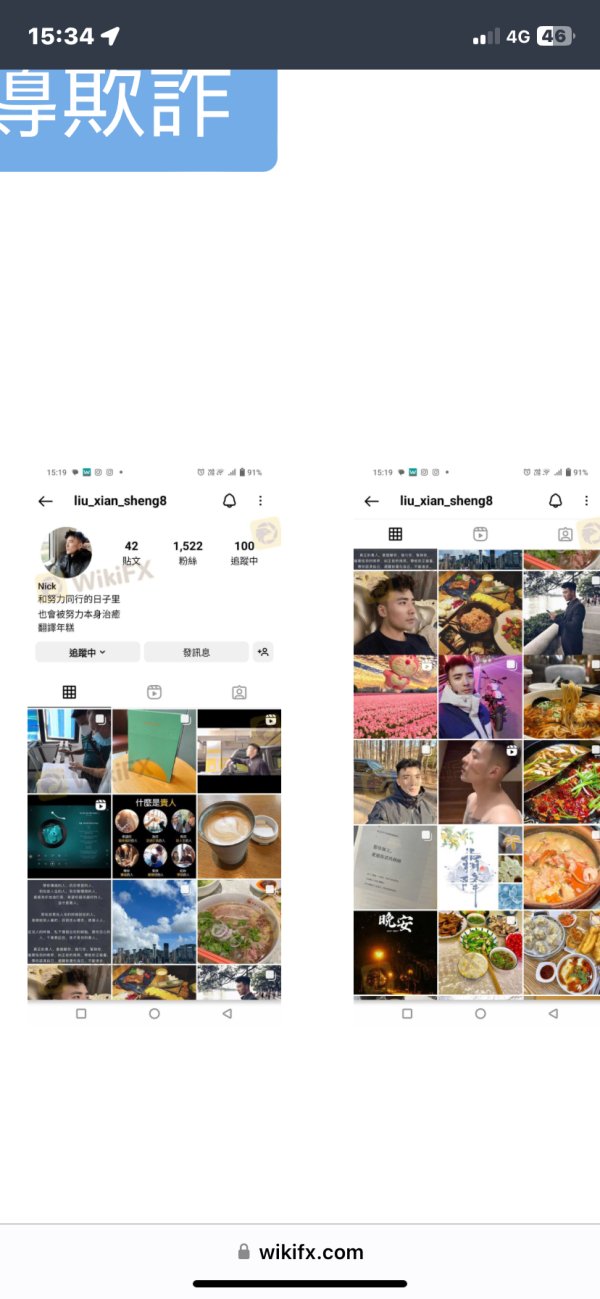

Given the broker's apparent focus on diverse international markets, the absence of clear language support information represents a significant service gap. Furthermore, there is no indication of specialized support for different account types, such as dedicated account managers for premium clients or technical support specialists for platform-related issues. The contrast between poor global ratings and positive local Chennai reviews suggests that support quality may vary significantly by region, creating inconsistent service experiences for clients in different jurisdictions.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by Kodin Capital Markets suffers from a fundamental lack of transparency regarding platform performance, execution quality, and technological infrastructure. Critical aspects such as order execution speed, slippage rates, platform stability, and server uptime statistics are not documented in available broker materials. This makes it impossible to assess the actual trading environment quality.

Platform functionality details, including charting capabilities, technical analysis tools, order types, and execution methods, remain undisclosed. This information gap is particularly concerning for active traders who require sophisticated platform features and reliable execution for successful trading strategies. The absence of mobile trading application details further limits the assessment of trading accessibility and convenience.

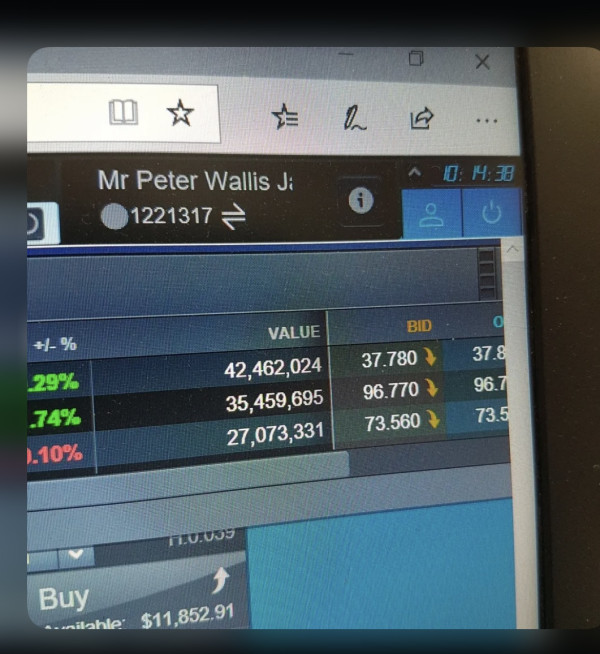

User feedback regarding trading experience appears limited and contradictory, with significant variations between global ratings and regional reviews. The extremely low WikiFX rating suggests serious concerns about execution quality, platform reliability, or client satisfaction, while localized positive reviews indicate potential regional differences in service delivery. The lack of information regarding trading conditions such as spreads, commission structures, and financing costs makes it impossible to evaluate the true cost of trading with this broker.

This kodin capital markets review finds that the overall trading experience transparency falls well below industry standards, creating significant uncertainty for potential clients regarding what they can expect from the actual trading environment.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability represent the most concerning aspects of Kodin Capital Markets' operational profile. There are multiple red flags that should give potential clients serious pause. The WikiFX rating of 1 out of 10 indicates severe concerns about the broker's credibility, operational standards, or client treatment, representing one of the lowest possible ratings from this evaluation platform.

The absence of clear regulatory information, including specific licensing details, regulatory authority oversight, and compliance standards, creates fundamental uncertainty about client protection measures. Reputable brokers typically prominently display their regulatory credentials, license numbers, and compliance commitments as core trust-building elements. Fund security measures, such as segregated client accounts, deposit insurance, or compensation scheme participation, are not detailed in available information.

This lack of transparency regarding client fund protection represents a critical concern for traders considering depositing significant amounts with the broker. The company's recent establishment in 2023 means there is limited operational history to evaluate long-term reliability and client treatment standards. Combined with poor third-party ratings and limited transparency, the overall trust profile suggests significant risks for potential clients.

User Experience Analysis (Score: 5/10)

User experience evaluation reveals a complex picture with notable contradictions between different feedback sources and regional variations. The stark contrast between WikiFX's 1-point rating and the 5-star Chennai reviews suggests that user experience may vary dramatically depending on the operational jurisdiction and service delivery model. The positive local reviews from Chennai indicate that at least some clients have experienced satisfactory service levels.

However, the limited number of reviews makes it difficult to draw comprehensive conclusions about overall user satisfaction patterns. These positive experiences suggest that the broker may have operational capabilities but struggles with consistency or broader service delivery. However, the extremely poor global rating indicates that the majority of user experiences may be significantly negative, potentially involving issues with fund withdrawals, platform performance, customer service responsiveness, or trading condition disputes.

The limited available information makes it difficult to identify specific user experience pain points or areas of satisfaction. The lack of detailed user interface information, account management tools, and client portal features further limits the assessment of overall user experience quality. Most modern brokers provide sophisticated client portals with comprehensive account management, reporting, and analytical tools that enhance the overall trading relationship.

Conclusion

This comprehensive kodin capital markets review reveals a broker with significant operational and transparency challenges. These issues should give potential clients considerable pause. While Kodin Capital Markets offers an appealing variety of trading instruments across multiple asset classes, the fundamental lack of transparency regarding trading conditions, regulatory status, and operational standards creates substantial concerns about client safety and service quality.

The dramatic contrast between extremely poor global ratings and positive local Chennai reviews suggests inconsistent service delivery that may leave many clients with unsatisfactory experiences. The absence of clear regulatory information, undefined trading costs, and limited customer service details indicate that this broker may not meet the standards expected by experienced traders seeking reliable, professional trading relationships. Kodin Capital Markets may be suitable only for highly experienced traders who can navigate uncertain regulatory environments and are comfortable with limited operational transparency.

However, most traders would be better served by choosing established brokers with clear regulatory oversight, transparent trading conditions, and consistent positive user feedback across all operational jurisdictions.