FTUK 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

FinUK is a proprietary trading firm offering traders the opportunity for instant funding and competitive trading conditions, positioning itself as a promising alternative within the trading community. However, while its offerings may appeal to experienced traders seeking fast and flexible options, there is a significant dark side to its operations that cannot be ignored. Issues surrounding regulatory clarity, numerous customer grievances, particularly related to the withdrawal process, and sudden changes to trading rules create an atmosphere of caution for potential users. This review aims to delve into the pros and cons of trading with FinUK, providing an insightful analysis for seasoned traders who may consider utilizing this platform.

⚠️ Important Risk Advisory & Verification Steps

Caution is advised when considering FinUK:

- Regulatory Clarity: Lack of robust oversight may lead to risks associated with fund safety.

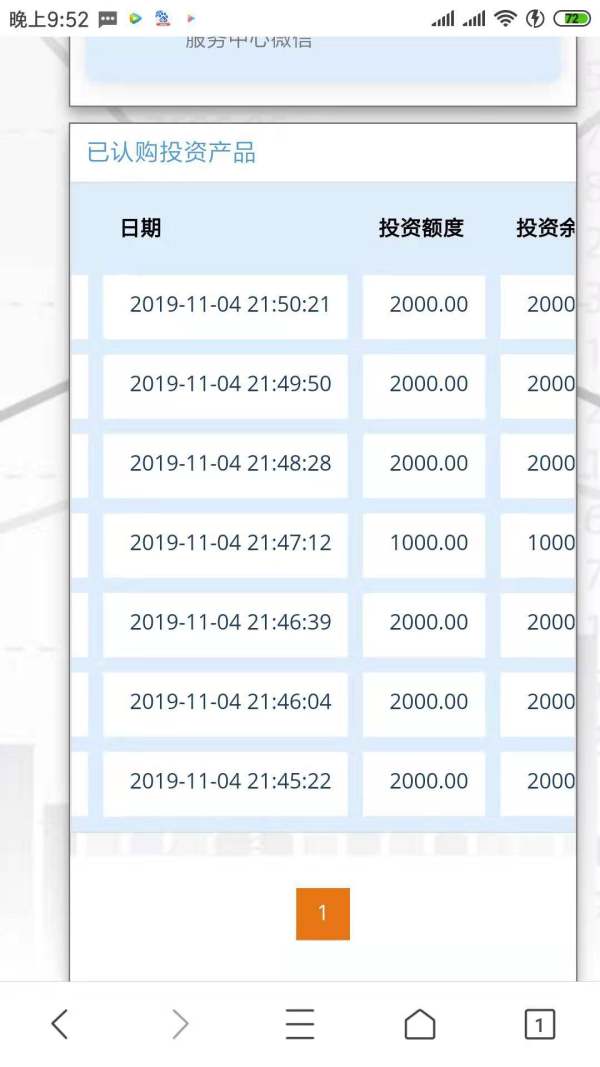

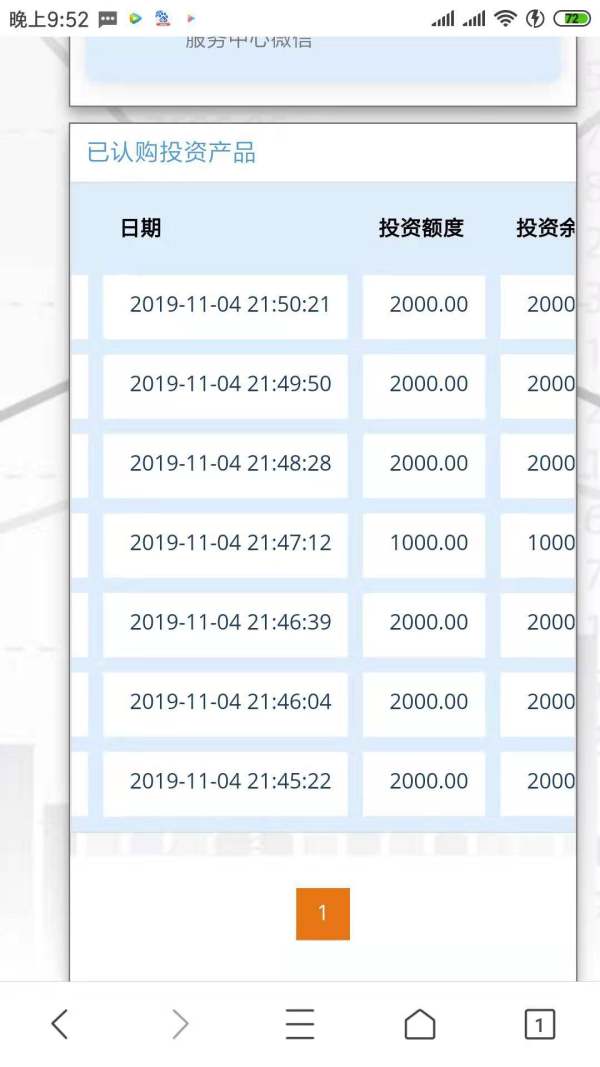

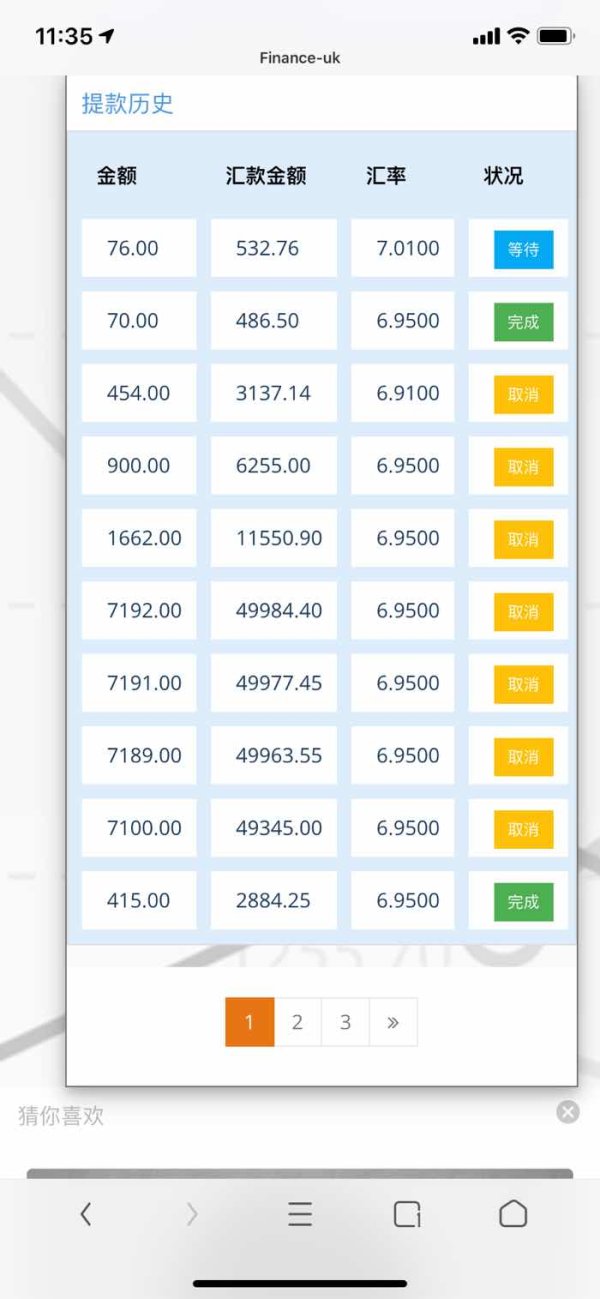

- Withdrawal Complaints: Multiple reports indicate difficulties in accessing funds after trading.

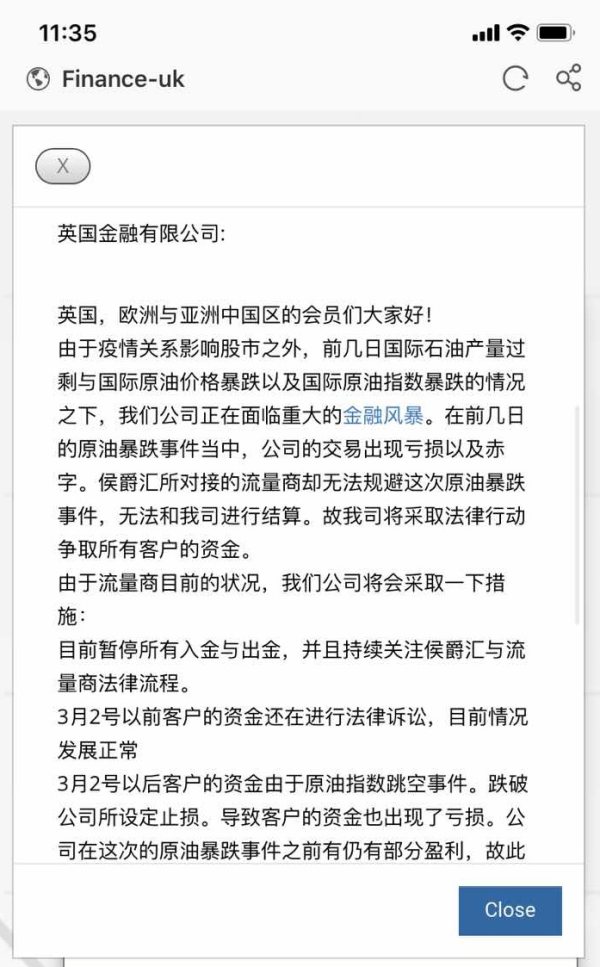

- Changing Rules: The firm has implemented sudden adjustments to trading conditions.

Steps for Self-Verification:

- Confirm Regulatory Status:

- Check the FCA‘s register to verify the broker’s license.

- Review Client Feedback:

- Utilize platforms like Trustpilot or Forex Forum to gauge user experiences.

- Test Customer Support:

- Reach out through the provided contact options to assess response reliability.

- Examine Withdrawal Terms:

- Deep dive into the firm's policies regarding withdrawal processes and associated fees.

- Research Peer Reviews:

- Look for independent reviews on websites dedicated to broker evaluations.

Potential Harms:

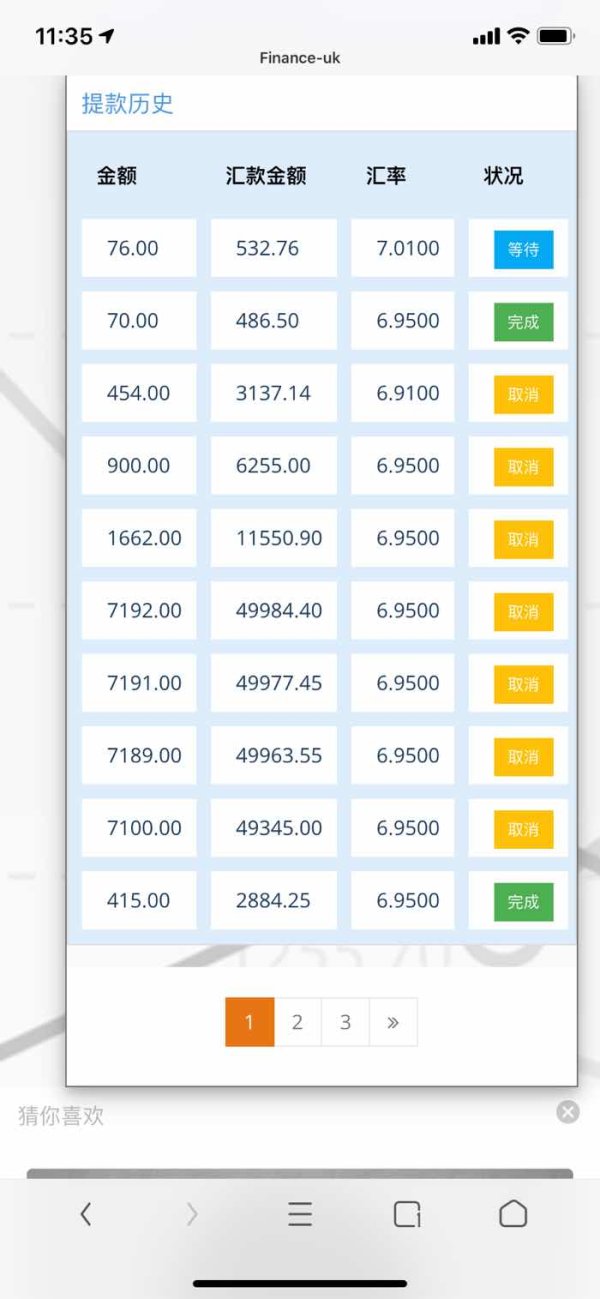

- Difficulty withdrawing funds

- Changes to the rules affecting your account

- Lack of transparency regarding fund management

Rating Framework

Broker Overview

Company Background and Positioning

FinUK, established in 2021, operates out of Atlanta, GA, USA, and aims to provide capital to talented traders while reducing entry barriers into trading. This proprietary trading firm has quickly positioned itself as a viable option for skilled traders by providing favorable conditions such as flexible funding options, a diverse array of financial instruments, and the promise of minimal restrictions on trading strategies.

Core Business Overview

The firm primarily focuses on proprietary trading, allowing traders to engage with asset classes including forex, cryptocurrencies, commodities, and indices. FinUK claims associations with reputable regulatory bodies, aiming to instill trust among users while competing with other industry leaders. However, the lack of clarity regarding which regulations it adheres to raises concerns.

Quick-Look Details Table

In-depth Analysis of Key Dimensions

1. Trustworthiness Analysis

Challenges regarding regulatory clarity emerge primarily from conflicting information on FinUK's registration. Users have reported that the firm does not maintain the same level of transparency that is typically expected from regulated entities. This lack of clarity raises significant risk to potential users.

- Self-Verification Steps:

- Go to FCA's register and search for FinUK.

- Assess other local broker reviews for accountability.

- Contact customer service to evaluate responsiveness.

- Industry Reputation and Summary:

User feedback has illuminated significant concerns. For instance:

“Despite their promises of fast withdrawals, I faced multiple delays and unresponsive support during my transaction requests.” [Source: User Feedback]

2. Trading Costs Analysis

Advantages in Commissions

FinUK's commission structure is largely competitive, appealing particularly to active traders. Users note reasonable trading costs compared to industry standards.

The "Traps" of Non-Trading Fees

However, many have voiced concerns regarding high withdrawal fees. Notably, complaints include:

“I never expected to be charged $30 every time I attempted to withdraw.” [Source: User Complaints]

Cost Structure Summary

For different types of traders, this can represent both a benefit and a hindrance. While the initial trading fees are appealing, the hidden costs may detract from an otherwise profitable trading experience.

Platform Diversity

FinUK incorporates several notable trading platforms including MatchTrader and DXTrade, each equipped with robust features suited for both novice and experienced traders. Users report satisfaction with the functionality of these platforms.

Quality of Tools and Resources

Although FinUK provides necessary trading tools, it lacks more advanced educational materials and user-centric resources often provided by its competitors.

Platform Experience Summary

User experiences indicate that while the platform functions well, it lacks the intuitiveness that seasoned traders expect.

“The platform is decent, but theres definitely room for improvement in the user interface.” [Source: Feedback]

4. User Experience Analysis

Platform Experience and Functionality

User feedback suggests certain recurring issues with connection stability and order execution, which can significantly impair trading efficiency.

5. Customer Support Analysis

Overall Assessment

Customer support has been flagged as an area needing improvement. With limited service hours and slow response times, traders may find themselves frustrated when seeking assistance.

6. Account Conditions Analysis

Overview of Conditions

FinUK offers various account types designed to cater to different trading strategies, but they come with strict guidelines that can be difficult for traders to navigate.

Conclusion

In weighing the benefits and risks associated with trading through FinUK, it‘s clear that while the firm offers enticing opportunities for experienced traders involved in proprietary trading scenarios, it’s essential to approach with caution. Regulatory deficiencies, reports of withdrawal issues, and evolving trading conditions can lead to substantial risks.

If youre considering FinUK, ensure thorough self-verification and continuous monitoring of user feedback to safeguard your investments. Therefore, whether FinUK represents a genuine opportunity or an imminent trap is ultimately contingent on your risk tolerance and trading experience.