Is FinUK safe?

Pros

Cons

Is Finuk Safe or Scam?

Introduction

Finuk is a forex broker that positions itself in the competitive landscape of online trading, offering a range of financial instruments including currencies, commodities, and indices. As the forex market continues to grow, traders are increasingly drawn to opportunities that promise high returns. However, this also means that the risk of encountering unregulated or fraudulent brokers is significant. Therefore, it is essential for traders to conduct thorough due diligence before committing their funds. This article aims to provide an objective analysis of whether Finuk is a safe broker or a potential scam. Our investigation is based on a comprehensive review of regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulatory and Legitimacy

The regulatory framework under which a broker operates is a crucial aspect that determines its legitimacy and trustworthiness. Finuk claims to be regulated by the Seychelles Financial Services Authority (FSA). However, the FSA is often considered a low-tier regulator, which raises questions about the level of oversight and investor protection provided.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | N/A | Seychelles | Verified |

While Finuk is operational under this regulatory umbrella, it is important to note that many brokers in offshore jurisdictions like Seychelles face fewer regulatory requirements. This lack of stringent oversight can lead to questionable practices, making it essential for traders to exercise caution when dealing with such brokers. The historical compliance of Finuk with regulatory standards is also a point of concern, as there is limited information available regarding any past issues or regulatory actions taken against them.

Company Background Investigation

Understanding the company behind the broker is equally important for assessing its credibility. Finuk is operated by a relatively new entity, which may not have a long track record in the industry. The ownership structure and management team are often indicative of a broker's reliability. Unfortunately, detailed information about Finuk's management team and their professional backgrounds is sparse, which can be a red flag for potential investors.

Moreover, the transparency of the company is another critical factor. A lack of clear information regarding the company's history, ownership, and operational practices can lead to mistrust among traders. For a broker to be considered safe, it should provide comprehensive details about its operations, including its financial health and corporate governance. In the case of Finuk, the information available does not sufficiently establish a strong foundation of trust.

Trading Conditions Analysis

The trading conditions offered by a broker directly impact a trader's profitability and overall experience. Finuk's fee structure includes spreads on various trading instruments, but the specifics of these fees can often be confusing. Transparency in fee structures is vital for traders to make informed decisions.

| Fee Type | Finuk | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

The above table highlights that Finuk's spreads may be higher than the industry average, which could affect trading profitability. Additionally, the absence of a commission model could be misleading, as brokers often compensate for this through wider spreads or hidden fees. Traders should be vigilant about understanding the full cost of trading with Finuk to avoid unexpected expenses.

Client Funds Security

The safety of client funds is paramount when assessing a broker's reliability. Finuk claims to implement various safety measures, including segregated accounts for client funds, which is a standard practice among reputable brokers. This means that client funds are kept separate from the broker's operational funds, reducing the risk of misuse.

Furthermore, Finuk offers negative balance protection, ensuring that traders cannot lose more than their initial deposit. This is a critical feature that adds a layer of security for traders, especially in the volatile forex market. However, it is essential to investigate any historical issues related to fund security or disputes that may have arisen with clients. A brokers track record in handling client funds can significantly influence its reputation and trustworthiness.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the real experiences of traders using Finuk. Many reviews indicate mixed experiences, with some users praising the platform's user-friendly interface while others raise concerns about withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Customer Support Issues | Medium | Average |

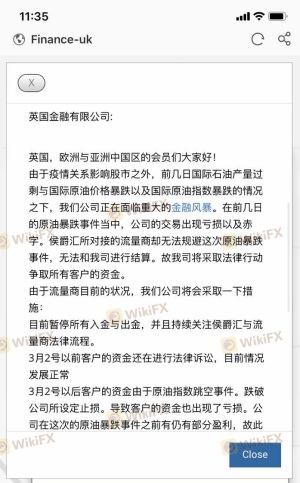

Common complaints include delays in processing withdrawals and challenges in reaching customer support. These issues can be detrimental to a trader's experience and may indicate underlying operational inefficiencies. For example, one user reported a significant delay in withdrawing funds, which raised concerns about the broker's reliability. Such experiences can lead to a perception that Finuk may not be entirely safe for traders.

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. Finuk offers a web-based trading platform that is generally well-received for its ease of use. However, traders must consider the quality of order execution, including slippage and rejection rates.

Many users have reported issues with slippage during high volatility periods, which can affect trading outcomes. A broker that frequently experiences slippage or rejects orders may not provide the level of service that traders expect. Additionally, any signs of platform manipulation should be scrutinized as they can indicate deeper issues within the broker's operational practices.

Risk Assessment

Using Finuk as a trading platform comes with inherent risks, primarily due to its regulatory status and mixed customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Low-tier regulation raises concerns. |

| Financial Risk | Medium | Higher spreads may affect profitability. |

| Operational Risk | Medium | Complaints about withdrawals and support. |

Traders should be aware of these risks and implement strategies to mitigate them. For instance, starting with a small investment can help minimize exposure while assessing the broker's reliability. Additionally, traders should keep abreast of any changes in Finuk's regulatory status or operational practices.

Conclusion and Recommendations

In conclusion, while Finuk presents itself as a viable option for forex trading, several factors raise concerns about its safety. The lack of robust regulation, mixed customer feedback, and potential issues with trading conditions suggest that traders should proceed with caution.

If you are considering trading with Finuk, it is advisable to conduct further research and possibly start with a demo account to gauge the platform's reliability. For those seeking safer alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC should be prioritized. These firms typically offer stronger investor protections and a more transparent trading environment. Ultimately, the decision to trade with Finuk should be made with a clear understanding of the associated risks and a commitment to safeguarding your capital.

Is FinUK a scam, or is it legit?

The latest exposure and evaluation content of FinUK brokers.

FinUK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FinUK latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.