U Trade Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive u trade markets review examines an unregulated forex broker that has generated mixed feedback from the trading community since its establishment in 2022. UTrade Markets operates as an ECN/STP broker headquartered in Mauritius. The company offers high leverage trading up to 1:500 with a minimum deposit requirement of $1,000. The platform provides access to Web Trader and MetaTrader trading platforms. This enables clients to trade forex, stocks, commodities, and indices.

However, our analysis reveals significant concerns regarding the broker's regulatory status and user experiences. Multiple sources indicate potential fraudulent activities. Some traders report substantial losses. The broker's lack of proper regulatory oversight from major financial authorities presents considerable risks for potential clients. User feedback ranges from positive experiences to serious allegations of scam activities. This results in a moderate risk rating of 6 out of 10.

This review is particularly relevant for traders with high risk tolerance who seek high-leverage trading opportunities. Extreme caution is advised given the regulatory concerns and mixed user testimonials.

Important Disclaimers

UTrade Markets operates from Mauritius without oversight from major regulatory bodies such as the FCA, ASIC, or CySEC. This lack of regulation means the broker's legal status may vary significantly across different jurisdictions. Traders may have limited recourse in case of disputes. The regulatory environment in Mauritius may not provide the same level of investor protection as established financial centers.

This evaluation is based on publicly available information, user feedback, and industry reports current as of 2025. Market conditions, regulatory status, and broker policies may change. This could potentially affect the accuracy of this assessment. Traders should conduct independent research and consider their risk tolerance before engaging with any unregulated financial service provider.

Rating Framework

Broker Overview

UTrade Markets entered the forex market in 2022 as U Trade Markets Ltd. The company positions itself as a modern ECN/STP broker serving international clients from its Mauritius headquarters. The company has operated for over three years. It attempts to establish its presence in the competitive forex brokerage landscape. As an ECN/STP broker, UTrade Markets claims to provide direct market access with minimal intervention in trade execution. However, user experiences suggest varying levels of execution quality.

The broker targets retail traders seeking high-leverage opportunities. It offers maximum leverage of 1:500 across multiple asset classes. UTrade Markets provides access to traditional forex pairs alongside expanded offerings including stocks, commodities, and indices. The platform supports both Web Trader and MetaTrader environments. This caters to different trader preferences and experience levels. However, the absence of regulation from recognized financial authorities remains a significant concern that overshadows the broker's technical offerings and market access capabilities.

Regulatory Status: UTrade Markets operates without oversight from major financial regulatory bodies. The company is registered in Mauritius but lacks authorization from established regulators such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or Cyprus Securities and Exchange Commission (CySEC).

Deposit Requirements: The broker maintains a minimum deposit threshold of $1,000. Some users consider this relatively high compared to industry standards. This requirement may limit accessibility for beginning traders or those with smaller capital allocations.

Available Assets: Trading opportunities span multiple asset classes including major and minor forex pairs, individual stocks, various commodities, and stock indices. The specific number of available instruments and market depth information requires direct inquiry with the broker.

Leverage Options: Maximum leverage reaches 1:500. This provides significant amplification potential for experienced traders while simultaneously increasing risk exposure. This high leverage ratio appeals to traders seeking enhanced position sizing capabilities.

Trading Platforms: The broker supports Web Trader for browser-based trading and MetaTrader platforms. Specific MetaTrader versions (MT4 or MT5) require clarification. Platform-specific features and customization options are not detailed in available materials.

Cost Structure: Specific information regarding spreads, commissions, and additional fees is not comprehensively detailed in available sources. This requires direct contact with the broker for complete pricing transparency.

This u trade markets review emphasizes the importance of thorough due diligence given the limited transparent information available about key trading conditions.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

UTrade Markets' account structure presents mixed value propositions for different trader segments. The $1,000 minimum deposit requirement represents a significant barrier for entry-level traders. This is particularly true when compared to regulated brokers offering lower thresholds. According to user feedback analyzed in various forums, this deposit level has generated negative responses from potential clients who view it as unnecessarily restrictive for initial market exploration.

The broker's account opening process lacks detailed public documentation. This creates uncertainty about verification requirements, processing times, and approval criteria. Available information does not specify whether multiple account types exist or if Islamic accounts are available for traders requiring swap-free trading conditions. This information gap limits traders' ability to assess account suitability before initiating the registration process.

User experiences regarding account functionality vary considerably. Some report satisfactory basic operations while others express concerns about account management limitations. The absence of detailed account specifications, including minimum trade sizes, maximum position limits, and margin requirements, further complicates account evaluation for potential clients.

The moderate rating reflects the broker's basic account functionality balanced against higher deposit requirements and limited transparency regarding account features and conditions. This u trade markets review recommends thorough inquiry about specific account terms before deposit commitment.

The platform's tool ecosystem centers around Web Trader and MetaTrader access. This provides fundamental trading infrastructure without extensive proprietary enhancements. User feedback suggests basic functionality across both platforms. However, specific performance metrics and advanced feature availability require direct testing to evaluate comprehensively.

Market analysis and research resources are not prominently featured in available broker materials. This potentially limits traders who rely on integrated fundamental and technical analysis tools. The absence of detailed educational content, market commentary, or research reports may disadvantage less experienced traders seeking comprehensive learning resources alongside trading access.

Automated trading support through MetaTrader platforms provides algorithmic trading capabilities. The extent of Expert Advisor (EA) functionality and any platform-specific restrictions remain unclear from available documentation. Some users have questioned the reliability and speed of tool execution, particularly during volatile market conditions.

The moderate rating reflects basic platform access with standard industry tools. It acknowledges the lack of enhanced research resources, educational materials, and detailed tool specifications that characterize more comprehensive broker offerings.

Customer Service and Support Analysis (5/10)

Customer service represents a significant weakness in UTrade Markets' operational framework. User feedback consistently highlights response delays and service quality concerns. Multiple trader reports indicate prolonged wait times for inquiry responses and inadequate resolution of technical or account-related issues.

Available communication channels are not comprehensively detailed in public materials. This creates uncertainty about support accessibility during different time zones or market sessions. The absence of clear multilingual support information may limit service effectiveness for international clients requiring assistance in their native languages.

User testimonials reveal frustration with customer service professionalism and technical competency. Some traders report unhelpful responses to legitimate concerns about platform functionality or account access. The lack of transparent escalation procedures or dedicated account management for higher-tier clients further compounds service limitations.

The below-average rating reflects consistent user dissatisfaction with support quality, response times, and issue resolution effectiveness. This represents a critical operational weakness that impacts overall broker reliability.

Trading Experience Analysis (6/10)

Platform stability and execution quality generate mixed user feedback. Experiences range from satisfactory basic functionality to concerning technical issues during active trading periods. Some traders report acceptable order execution under normal market conditions, while others cite problematic slippage and requote occurrences that impact trading effectiveness.

The trading environment's competitive positioning remains unclear due to limited transparent information about typical spreads, execution speeds, and liquidity provider relationships. User reports suggest variable trading conditions that may depend on market volatility, account size, or trading frequency. However, systematic performance data is not publicly available.

Mobile trading capabilities through MetaTrader mobile applications provide basic on-the-go access. Specific mobile platform optimization and feature parity with desktop versions require direct evaluation. Some users indicate satisfactory mobile experience while others report connectivity or functionality limitations.

The moderate rating acknowledges functional basic trading capabilities while recognizing significant concerns about execution consistency, technical reliability, and the absence of transparent performance metrics. These would enable informed trading environment assessment.

This u trade markets review emphasizes the importance of demo testing before live trading to evaluate platform performance under individual trading styles and market conditions.

Trustworthiness Analysis (3/10)

UTrade Markets' trustworthiness faces severe challenges due to its unregulated status and concerning user reports about potential fraudulent activities. The absence of oversight from recognized financial authorities eliminates crucial investor protections and dispute resolution mechanisms that regulated brokers must provide.

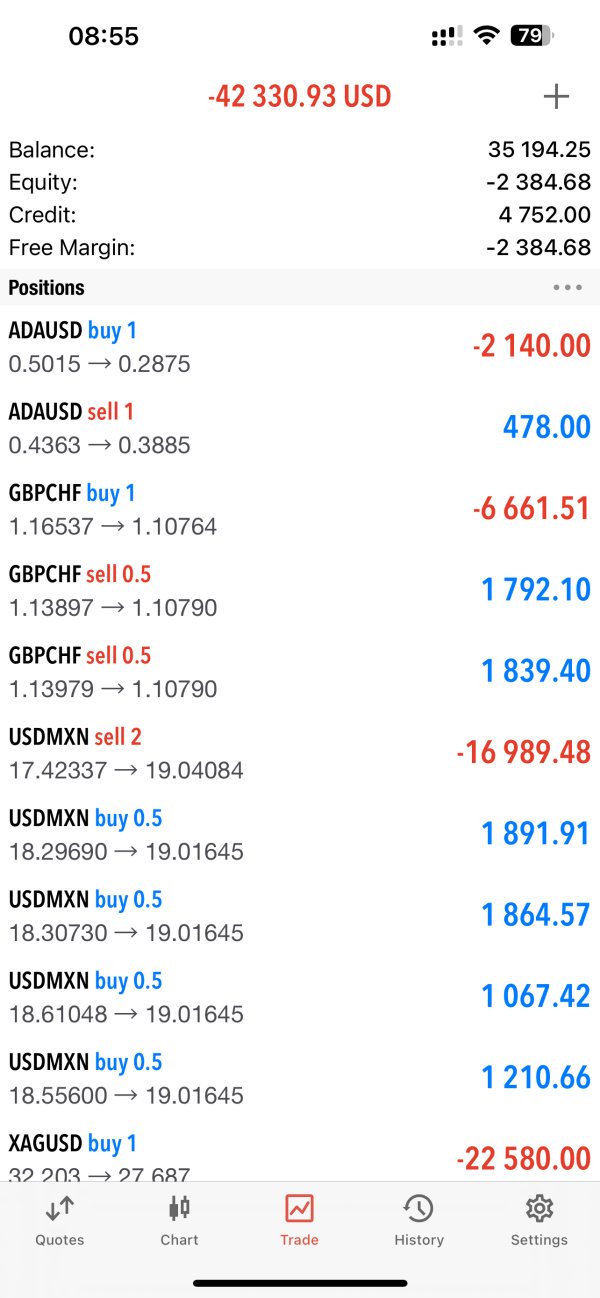

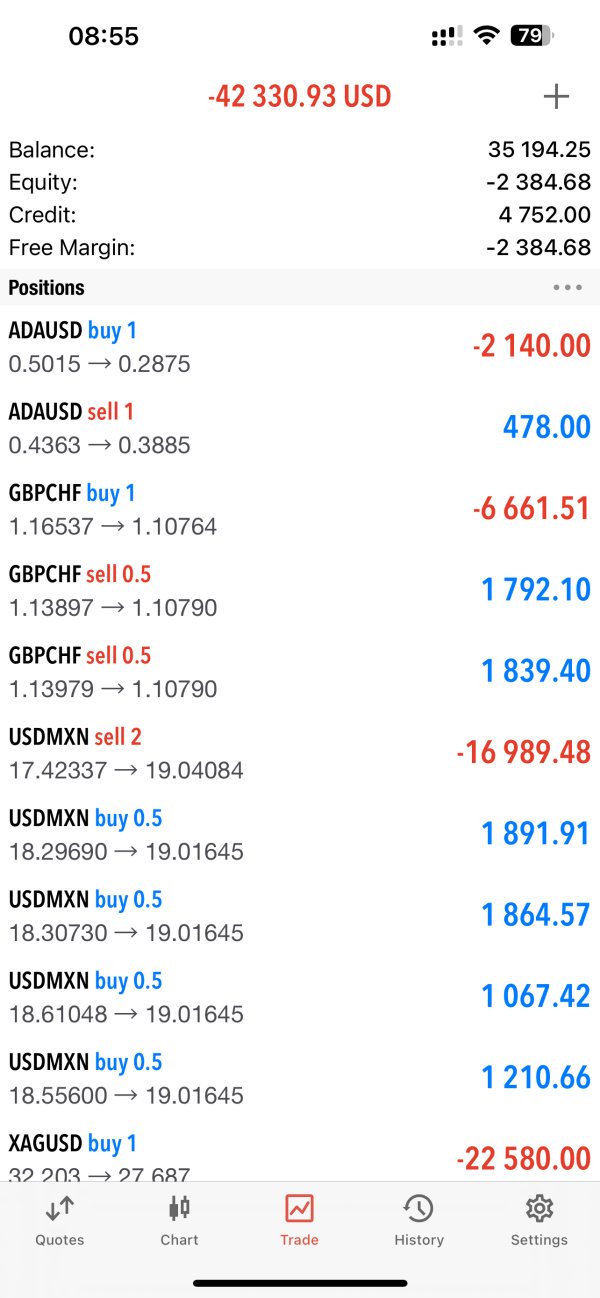

Multiple sources, including trader testimonials and industry watchdog reports, have flagged UTrade Markets as a potential scam operation. One particularly concerning user report documents a loss of $27,808. This highlights the serious financial risks associated with this broker. The lack of transparent financial reporting, segregated client fund protection, or deposit insurance further amplifies trust concerns.

Company transparency remains problematic. Limited information is available about management structure, financial backing, or operational procedures. The broker's registration in Mauritius, while legal, does not provide the regulatory framework or investor protections associated with major financial centers.

Industry reputation analysis reveals predominantly negative assessments from forex community watchdogs and review platforms. Multiple warnings exist about potential fraudulent behavior. The absence of positive third-party endorsements from reputable financial industry sources further undermines credibility.

The poor rating reflects serious trust deficits stemming from regulatory absence, concerning user experiences, and negative industry assessments. These suggest high probability of fraudulent operations.

User Experience Analysis (5/10)

Overall user satisfaction with UTrade Markets presents a polarized picture. Experiences range from basic functionality acceptance to severe dissatisfaction culminating in fraud allegations. The user community appears divided between those reporting adequate basic services and others warning of significant problems.

Interface design and platform usability information is limited in available feedback. MetaTrader integration provides familiar navigation for experienced users of these industry-standard platforms. Web Trader functionality receives minimal detailed feedback, making comprehensive usability assessment challenging.

Registration and verification processes generate mixed reviews. Some users report straightforward account opening while others cite complications or unexpected requirements during onboarding. The lack of transparent process documentation contributes to inconsistent user expectations and experiences.

Withdrawal and deposit experiences represent major user concern areas. Multiple reports exist of difficulties accessing funds or completing transactions. These operational issues significantly impact user confidence and satisfaction, particularly when combined with customer service limitations.

The below-average rating reflects significant user experience inconsistencies. Particular weaknesses in fund operations and customer support overshadow any positive platform functionality feedback.

Conclusion

This comprehensive evaluation reveals UTrade Markets as a high-risk broker with significant concerns that outweigh its limited positive features. The broker offers high leverage trading and multiple platform options that may appeal to experienced traders seeking aggressive position sizing. However, the absence of regulatory oversight and concerning user testimonials create substantial risk factors.

The broker may suit traders with exceptional risk tolerance who prioritize high leverage access over regulatory protection. Such traders represent a very limited market segment. The combination of unregulated status, negative user experiences, and industry fraud warnings makes UTrade Markets unsuitable for most retail traders.

Primary advantages include diverse trading platforms and maximum leverage of 1:500. Critical disadvantages encompass regulatory absence, poor customer service, trust concerns, and multiple fraud allegations. The risk-reward profile strongly favors avoiding this broker in favor of regulated alternatives with transparent operations and positive industry reputations.

Potential clients should exercise extreme caution and consider regulated brokers with established track records, comprehensive investor protections, and positive user feedback before engaging with UTrade Markets or similar unregulated entities.