Dillon Gage 2025 Review: Everything You Need to Know

Executive Summary

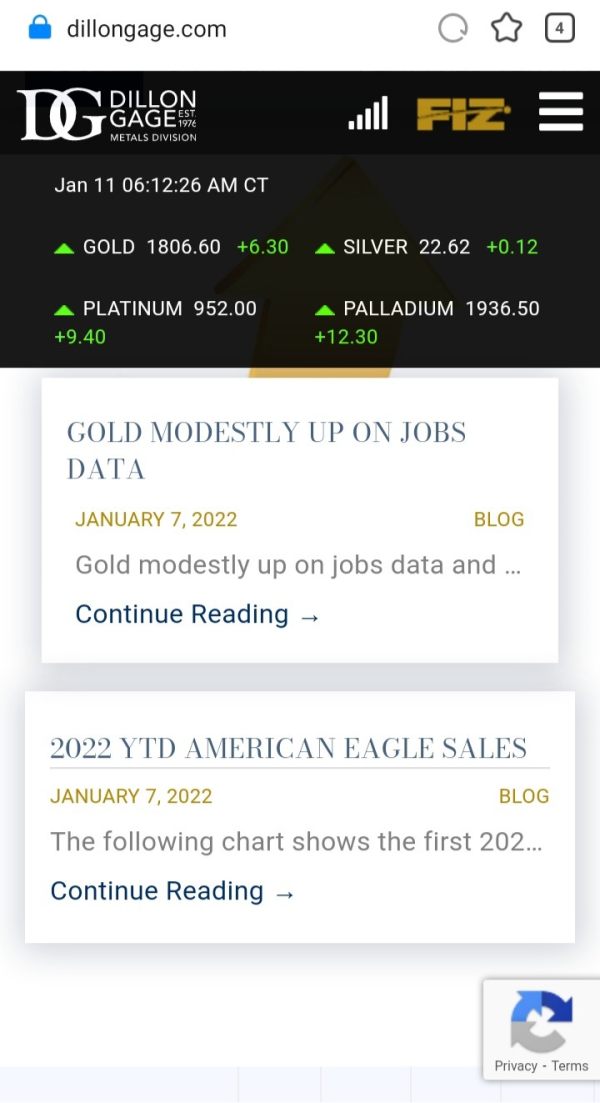

This comprehensive Dillon Gage review provides an in-depth analysis of a precious metals trading company. The company has operated for 45 years in the industry. Dillon Gage is based in Dallas, Texas, and primarily serves precious metals dealers, financial institutions, banks, and brokerage houses with wholesale precious metals trading and refining services. The company's standout feature is its proprietary FizTrade online platform. This platform delivers real-time physical precious metals trading capabilities directly to desktop browsers and mobile devices.

Dillon Gage demonstrates expertise in precious metals trading with nearly half a century of experience. However, our evaluation reveals significant gaps in publicly available information regarding regulatory oversight, specific trading conditions, and customer service protocols. The company appears to target institutional clients and serious precious metals investors rather than retail forex traders. The lack of detailed disclosure about account conditions, fees, and regulatory compliance raises concerns for potential clients seeking transparency in their trading relationships.

Important Notice

This Dillon Gage review is based on publicly available information and may contain gaps due to limited disclosure from the company. The gaps relate to regulatory status and specific trading conditions. Different jurisdictions may have varying legal and compliance requirements that could affect the services available to clients in different regions. Readers should conduct their own due diligence and verify all information directly with Dillon Gage before making any investment decisions. The evaluation methodology relies on accessible public data and user feedback. This may not represent the complete picture of the company's operations and services.

Rating Framework

Company Overview

Dillon Gage Metals established its operations in Dallas, Texas, approximately 45 years ago. The company positioned itself as a specialized provider in the precious metals industry. According to available company information, the firm has built its reputation by serving precious metals dealers, financial institutions, banks, and brokerage houses around the globe with carefully developed wholesale precious metals trading and refining services. The company's business model focuses primarily on institutional clients rather than individual retail traders. This distinguishes it from traditional forex brokers.

The company operates through multiple service locations, including facilities in Dallas, New Castle, and Toronto. These locations provide precious metals storage services to complement its trading operations. Dillon Gage has developed strategic partnerships with prominent IRA custodians to facilitate precious metals investments for retirement accounts. Their proprietary FizTrade platform represents one of the industry's first online platforms for real-time physical precious metals trading. This demonstrates the company's commitment to technological innovation within the traditional precious metals sector. This Dillon Gage review examines how these services translate into practical trading opportunities for different types of investors.

Regulatory Status: Available information does not specify particular regulatory oversight or licensing details. This represents a significant concern for transparency and client protection.

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and associated fees is not detailed in publicly available materials.

Minimum Deposit Requirements: The company has not disclosed minimum deposit amounts or account opening requirements in accessible documentation.

Bonuses and Promotions: No information is available regarding promotional offers, bonuses, or incentive programs for new or existing clients.

Tradeable Assets: The company specializes exclusively in precious metals trading, including gold, silver, platinum, and palladium. They offer both spot and forward contract capabilities.

Cost Structure: Detailed information about spreads, commissions, overnight fees, or other trading costs is not publicly disclosed. This makes it difficult to assess the competitiveness of their pricing.

Leverage Options: Leverage ratios and margin requirements are not specified in available company materials.

Platform Selection: The primary trading platform is FizTrade, a proprietary online system developed specifically for precious metals trading. It is accessible via desktop browsers and mobile devices.

Geographic Restrictions: Specific information about countries or regions where services are restricted is not clearly outlined in available documentation.

Customer Support Languages: The range of languages supported by customer service representatives is not specified in this Dillon Gage review materials.

Account Conditions Analysis

The evaluation of Dillon Gage's account conditions reveals significant information gaps. These gaps make it challenging to provide a comprehensive assessment. Available materials do not detail specific account types, minimum deposit requirements, or account opening procedures. These are fundamental considerations for potential clients. This lack of transparency in account conditions contributes to the below-average rating in this category.

Prospective traders cannot adequately compare Dillon Gage's offerings with other precious metals dealers or trading platforms without clear information. The missing details include different account tiers, trading minimums, and special features available to various client categories. The company's focus on institutional clients may explain the limited public disclosure of retail account conditions. However, this approach creates uncertainty for individual investors seeking to understand their options.

The absence of detailed account information also extends to verification requirements, account maintenance fees, and inactivity policies. For a company operating in the financial services sector for 45 years, the lack of readily available account condition details represents a significant transparency issue. Potential clients should consider this carefully. This Dillon Gage review recommends that interested parties contact the company directly to obtain comprehensive account information before proceeding with any investment decisions.

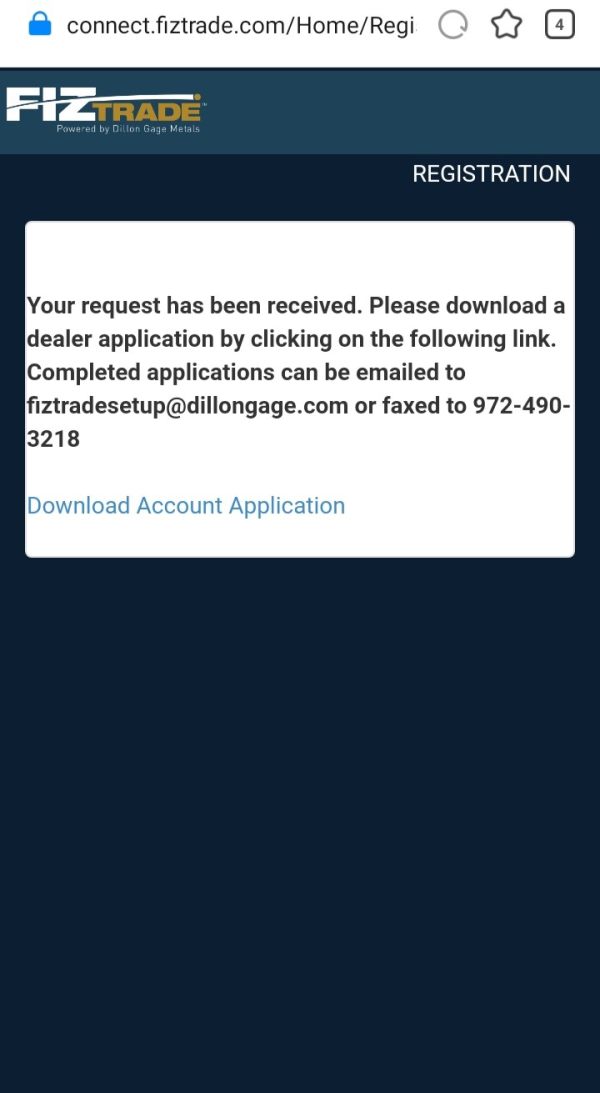

Dillon Gage's technological offering centers around their proprietary FizTrade platform. This platform represents one of the industry's pioneering efforts in online precious metals trading. According to company information, FizTrade delivers real-time physical precious metals trading capabilities that bring institutional-level trading power directly to users' desktop browsers and mobile devices. This technological innovation demonstrates the company's commitment to modernizing traditional precious metals trading processes.

The platform appears to focus specifically on physical precious metals transactions rather than derivative products. This aligns with the company's core business model of serving dealers and institutions requiring actual metal delivery capabilities. However, detailed information about analytical tools, charting capabilities, research resources, or educational materials is not extensively documented in publicly available sources.

The absence of comprehensive tool descriptions limits our ability to fully evaluate the platform's capabilities. Missing details include technical analysis features, market research reports, and trading education resources. While the FizTrade platform represents a significant technological achievement for precious metals trading, the lack of detailed feature documentation prevents a more thorough assessment. We cannot compare its competitive advantages to other trading platforms in the precious metals sector.

Customer Service and Support Analysis

The evaluation of Dillon Gage's customer service capabilities is hampered by limited publicly available information. Missing details include support channels, response times, and service quality metrics. The company's 45-year operational history suggests established client relationships, particularly within institutional markets. However, specific details about customer support infrastructure are not comprehensively documented.

Available information does not specify customer service hours, available communication channels, or response time commitments. Communication channels typically include phone, email, and live chat options. For a company serving global clients across different time zones, the lack of clear support availability information represents a significant gap in transparency. The absence of multilingual support details also raises questions about the company's ability to serve international clients effectively.

It becomes difficult to assess the actual quality of customer support provided by Dillon Gage without user testimonials, service quality ratings, or specific examples of problem resolution processes. The institutional focus of their business model may mean that support is primarily delivered through dedicated account managers rather than traditional retail customer service channels. However, this information is not clearly communicated in available materials.

Trading Experience Analysis

The trading experience evaluation focuses primarily on the FizTrade platform. This platform serves as Dillon Gage's primary interface for client transactions. As one of the industry's first online platforms for real-time physical precious metals trading, FizTrade represents a significant technological advancement in a traditionally relationship-driven industry. The platform's ability to deliver institutional trading capabilities to desktop and mobile environments suggests a focus on accessibility and user convenience.

Specific information about platform stability, execution speeds, order types, or user interface design is not detailed in available documentation. The lack of user feedback or performance metrics makes it challenging to assess the actual trading experience provided by the FizTrade platform. Critical factors such as order execution quality, platform downtime, and mobile app functionality are not addressed in accessible company materials.

The focus on physical precious metals trading distinguishes Dillon Gage from traditional forex brokers. However, this specialization may limit the platform's appeal to traders seeking diversified asset exposure. This Dillon Gage review notes that the trading experience appears tailored to institutional clients and serious precious metals investors rather than retail traders. These retail traders typically seek educational resources and advanced analytical tools.

Trust and Reliability Analysis

The trust and reliability assessment of Dillon Gage reveals concerning gaps in regulatory transparency and public disclosure. The most significant issue is the absence of clearly stated regulatory oversight or licensing information in publicly available materials. For a financial services company operating for 45 years, the lack of prominent regulatory disclosure raises questions about compliance transparency and client protection measures.

Clients cannot easily verify the company's compliance status or understand their legal protections in case of disputes without specific regulatory authority oversight. The absence of regulatory information also makes it difficult to assess the company's adherence to industry standards. These standards cover client fund protection, business conduct, and operational transparency.

The company's longevity in the precious metals industry suggests some level of operational stability and industry acceptance, particularly among institutional clients. However, the lack of third-party ratings, regulatory disclosures, or independent audits limits the ability to verify claims about business practices and financial stability. This transparency gap significantly impacts the trust rating and represents a major consideration for potential clients evaluating Dillon Gage's services.

User Experience Analysis

The user experience evaluation is constrained by limited feedback and interface information available in public sources. While the FizTrade platform represents technological innovation in precious metals trading, specific details about user interface design, navigation ease, or overall user satisfaction are not comprehensively documented. The platform's availability across desktop and mobile environments suggests attention to accessibility. However, detailed usability assessments are not available.

The registration and account verification processes are not clearly outlined in available materials. This makes it difficult to assess the onboarding experience for new clients. Similarly, specific information about fund transfer procedures, account management features, or user support tools is not detailed in accessible documentation.

The institutional focus of Dillon Gage's business model may mean that user experience priorities differ from typical retail trading platforms. However, the lack of user testimonials, interface screenshots, or detailed feature descriptions prevents a thorough evaluation of the actual user experience provided by the company's services. Potential clients seeking user-friendly interfaces and comprehensive support resources may find the limited public information insufficient for making informed decisions.

Conclusion

This Dillon Gage review reveals a company with significant experience in the precious metals industry but concerning gaps in transparency and public disclosure. While the company's 45-year operational history and proprietary FizTrade platform demonstrate industry expertise and technological innovation, the absence of regulatory information and detailed service descriptions creates uncertainty for potential clients.

Dillon Gage appears most suitable for institutional clients and serious precious metals investors. These clients can conduct direct due diligence through personal contact with the company. The specialized focus on physical precious metals trading may appeal to investors seeking alternatives to traditional financial markets. However, the lack of comprehensive public information makes it challenging for individual investors to fully evaluate the offering.

The primary advantages include industry expertise, technological innovation through FizTrade, and established institutional relationships. However, significant disadvantages include limited regulatory transparency, insufficient disclosure of trading conditions, and minimal publicly available user feedback. Potential clients should conduct thorough direct inquiries with Dillon Gage to obtain detailed information before making investment decisions.