Executive Summary

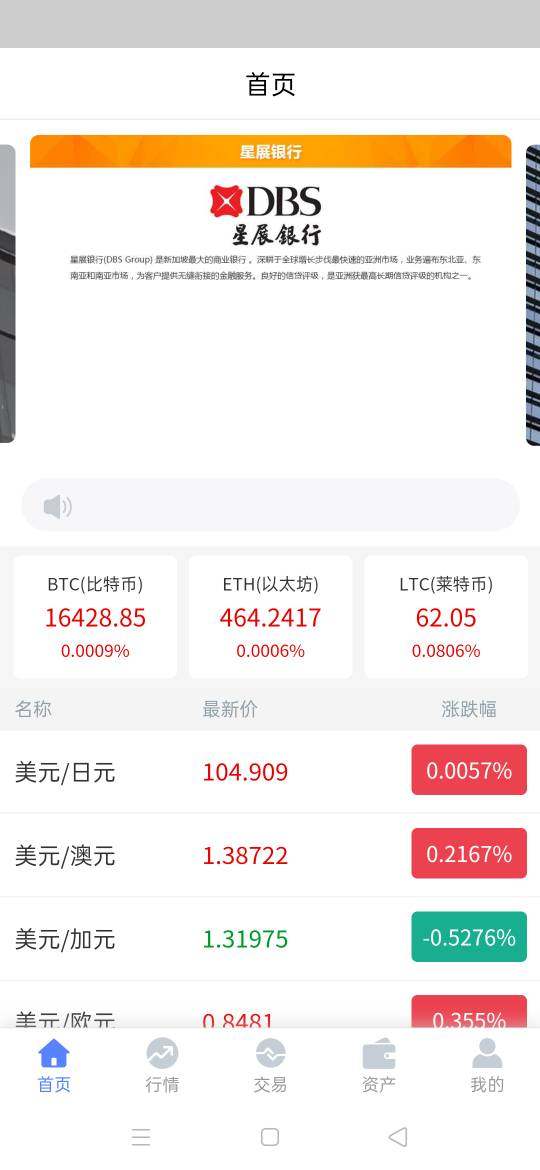

DBS Vickers Securities stands out as a beginner-friendly brokerage that offers competitive rates and comprehensive trading solutions for both novice and experienced traders. This dbs vickers securities review reveals a platform that combines the reliability of traditional banking with modern trading technology, creating a seamless experience for users. The broker provides both online trading platforms and mobile applications. It supports securities and derivatives trading across multiple markets.

Based on available information, DBS Vickers Securities primarily targets beginners and retail investors seeking accessible entry points into financial markets, while also catering to more sophisticated traders requiring advanced trading tools. The platform's integration with DBS banking services creates a seamless experience for users already within the DBS ecosystem, making account management simple and efficient.

Key highlights include competitive fee structures, user-friendly interfaces, and robust mobile trading capabilities through the DBS Vickers app. The broker's focus on providing educational resources and intuitive trading tools makes it particularly attractive for those new to trading. It maintains the sophistication required by more experienced market participants.

Important Notice

Due to limited regulatory information available in current sources, users should independently verify compliance requirements in their respective jurisdictions before opening accounts. Different regions may have varying regulatory frameworks that could affect service availability and trading conditions, making personal research essential.

This review is based on publicly available information and user feedback as of 2025. Trading conditions, fees, and service offerings may vary and are subject to change without notice. Potential users should conduct their own due diligence and consider their individual trading needs before making decisions.

Rating Framework

Broker Overview

Company Background and Establishment

DBS Vickers Securities operates as a securities and derivatives brokerage platform headquartered in Singapore. As part of the larger DBS banking group, the broker leverages decades of financial services expertise to provide comprehensive trading solutions that meet diverse client needs. The platform serves as a bridge between traditional banking services and modern trading requirements. It offers clients access to multiple asset classes through integrated financial services.

The broker's business model focuses on providing accessible trading services while maintaining the security and reliability associated with established banking institutions. This approach has positioned DBS Vickers Securities as a trusted name in the Asian financial markets, particularly among retail investors seeking reliable brokerage services with proven track records.

Trading Infrastructure and Asset Coverage

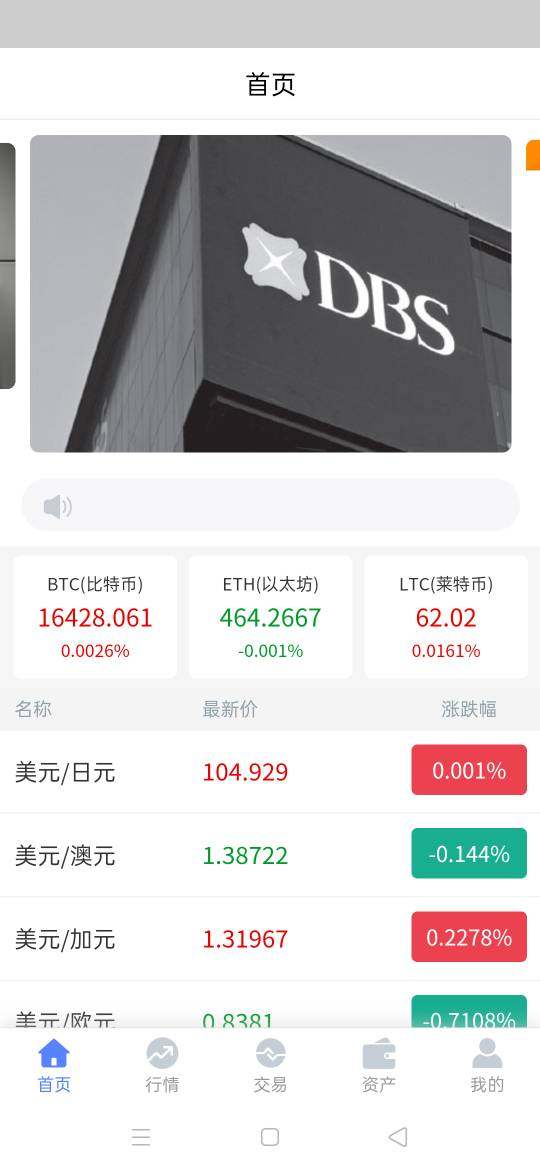

DBS Vickers Securities offers both online trading platforms and mobile applications, specifically the DBS Vickers mobile app, ensuring traders can access markets anytime, anywhere. The platform supports securities and derivatives trading, providing exposure to various financial instruments across different market segments for comprehensive portfolio building.

The broker's technology infrastructure combines user-friendly interfaces with robust trading capabilities. It makes the platform suitable for both beginners learning to trade and experienced investors requiring advanced features. According to available sources, the platform emphasizes ease of use while maintaining the functionality necessary for effective market participation.

Regulatory Framework: Specific regulatory information is not detailed in available sources, though the broker operates under Singapore's financial regulatory environment as part of the DBS group.

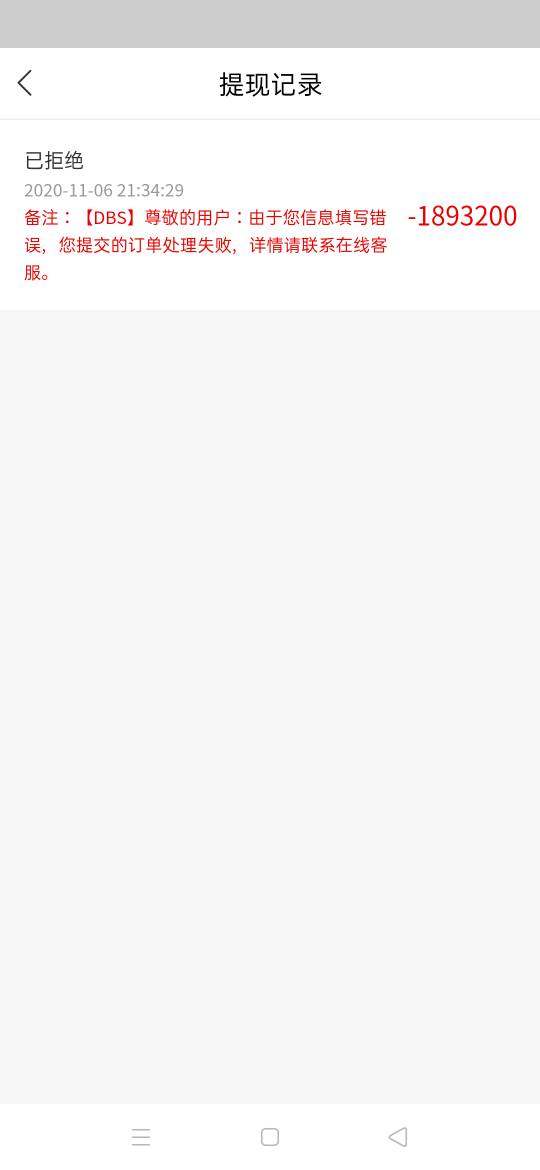

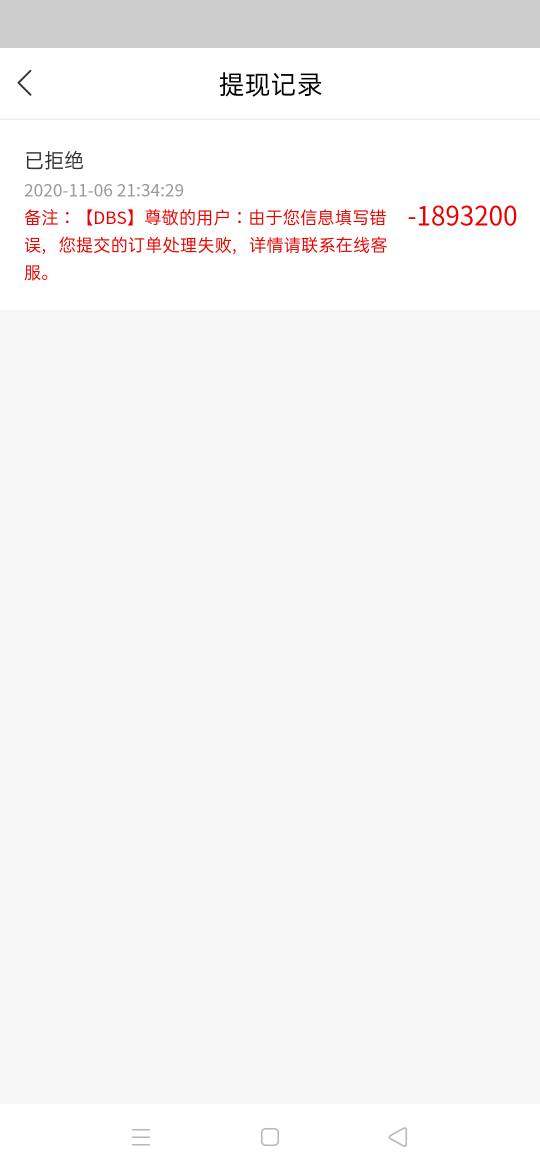

Deposit and Withdrawal Methods: Available sources do not specify particular deposit and withdrawal options. Integration with DBS banking services likely provides multiple funding channels for user convenience.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in current available information.

Promotional Offers: Current sources do not detail specific bonus or promotional programs offered by the broker.

Available Trading Assets: The platform supports securities and derivatives trading. It provides access to multiple asset classes for diversified portfolio construction.

Cost Structure: While sources indicate competitive rates, specific spread or commission details are not provided in available information.

Leverage Options: Leverage ratios and margin requirements are not specified in current sources.

Platform Selection: DBS Vickers Securities provides both online trading platforms and dedicated mobile applications for comprehensive market access.

Geographic Restrictions: Specific regional limitations are not detailed in available sources.

Customer Support Languages: Language support details are not mentioned in current available information.

This dbs vickers securities review highlights the broker's focus on accessibility and competitive pricing. Specific operational details require direct verification with the broker for complete accuracy.

Account Conditions Analysis

DBS Vickers Securities account conditions remain largely unspecified in available public sources, creating challenges for potential clients seeking detailed account information. The broker's integration with DBS banking services suggests streamlined account opening processes for existing DBS customers, though specific account types and their respective features are not detailed in current documentation for public review.

Without explicit information about minimum deposit requirements, account tiers, or special account features such as Islamic accounts, potential traders must contact the broker directly for comprehensive account details. This lack of publicly available account information may reflect the broker's personalized approach to client onboarding. Account conditions are tailored based on individual trading needs and experience levels.

The absence of detailed account condition information in this dbs vickers securities review underscores the importance of direct communication with the broker's representatives to understand specific terms, conditions, and requirements. Prospective clients should inquire about account opening procedures, documentation requirements, and any special features available for different trader categories to make informed decisions.

Given the broker's beginner-friendly positioning, account conditions likely accommodate new traders while providing scalability for growing trading activities. However, without specific details about account minimums, fee structures, or special account types, traders cannot make fully informed comparisons with other brokerage options available in the market.

DBS Vickers Securities provides essential trading infrastructure through its online trading platform and mobile application, though detailed information about specific trading tools remains limited in available sources. The DBS Vickers app enables mobile trading, allowing users to monitor markets and execute trades from anywhere, which represents a crucial feature for active traders requiring constant market access throughout the day.

The platform's tool suite appears designed with beginner accessibility in mind, though advanced traders may find the publicly available information insufficient to evaluate sophisticated trading capabilities. Without detailed specifications about charting tools, technical analysis features, or automated trading support, traders requiring advanced functionality must investigate these capabilities directly with the broker for comprehensive evaluation.

Research and analytical resources are not specifically detailed in current sources, though the broker's association with DBS banking infrastructure suggests access to institutional-grade market research and analysis. Educational resources, which would be particularly valuable given the broker's beginner-friendly positioning, are not explicitly mentioned in available documentation for public review.

The absence of detailed tool specifications in this review reflects limited public disclosure about the platform's capabilities. Traders should directly evaluate the platform's functionality through demo accounts or direct consultation to understand the full scope of available tools and resources.

Customer Service and Support Analysis

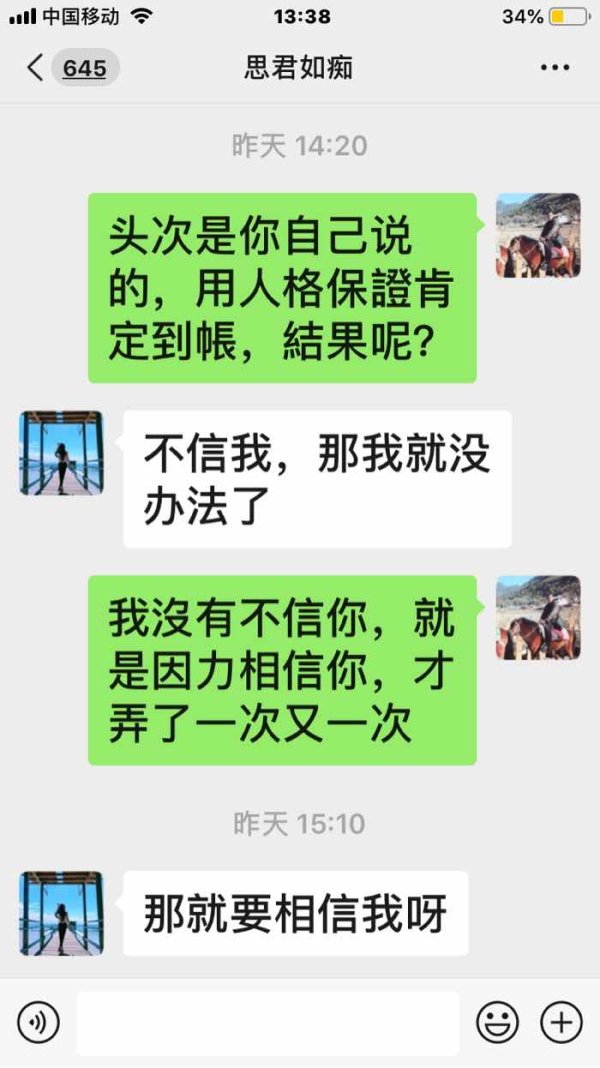

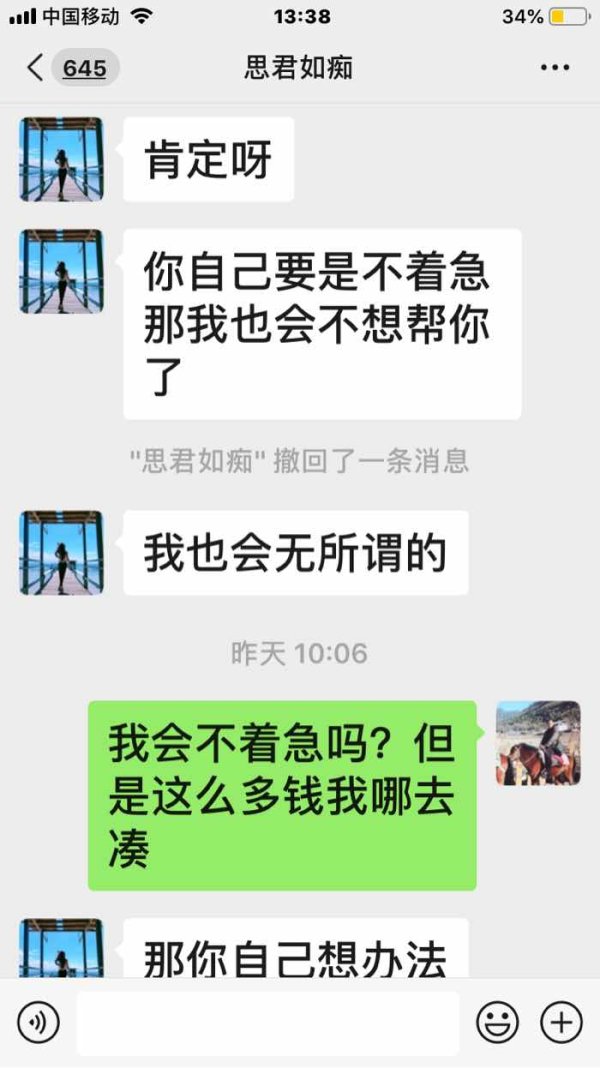

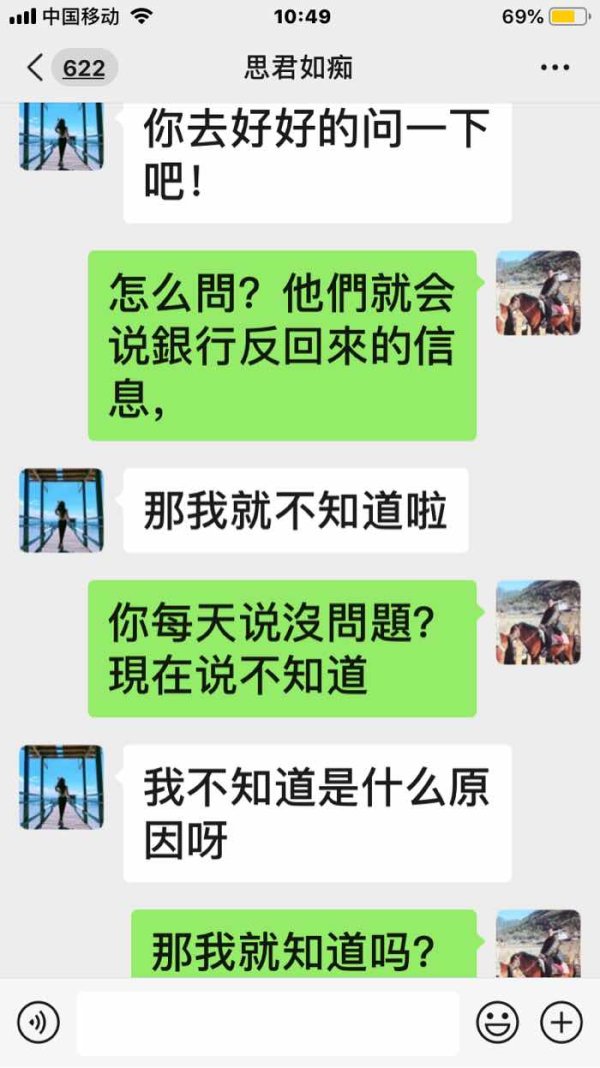

Customer service details for DBS Vickers Securities are not comprehensively covered in available sources, creating uncertainty about support quality and accessibility. The broker's integration with DBS banking services suggests potential access to established customer service infrastructure, though specific support channels, response times, and service quality metrics are not detailed in current documentation for public assessment.

Without information about available customer service channels such as phone support, live chat, email assistance, or in-person consultations, potential clients cannot adequately assess the broker's commitment to customer support. Response time expectations, service availability hours, and multilingual support capabilities remain unspecified in available sources, making evaluation difficult.

The lack of customer service information may reflect varying service levels based on account types or client relationships, which is common among brokers offering personalized services. However, this absence of publicly available customer service details makes it challenging for potential clients to set appropriate expectations about support availability and quality standards.

Given the broker's positioning as beginner-friendly, robust customer support would be expected to assist new traders with platform navigation, trading education, and problem resolution. Prospective clients should specifically inquire about customer service capabilities, including available channels, response time commitments, and support for their preferred languages to ensure adequate assistance.

Trading Experience Analysis

The trading experience with DBS Vickers Securities appears positive based on user discussions, though specific performance metrics and detailed user feedback are not extensively documented in available sources. The broker's provision of both online and mobile trading platforms suggests flexibility in trading execution, allowing users to choose their preferred trading environment based on circumstances and preferences for optimal market participation.

Platform stability, execution speed, and order quality details are not specifically mentioned in current sources, making it difficult to assess the technical performance aspects that significantly impact trading success. The mobile application's availability indicates the broker's commitment to providing accessible trading solutions. Specific app functionality and performance characteristics require direct evaluation for comprehensive assessment.

Trading environment factors such as spreads, liquidity provision, and execution policies are not detailed in available information, limiting the ability to assess the overall trading conditions offered by the broker. The competitive rates mentioned in sources suggest favorable cost structures. Specific pricing details are not provided for complete transparency.

This dbs vickers securities review indicates generally positive trading experiences based on available user discussions, though comprehensive trading performance evaluation requires direct platform testing. Traders should consider demo accounts or small initial positions to evaluate the trading environment's suitability for their specific needs and trading styles before committing significant capital.

Trustworthiness Analysis

Assessing DBS Vickers Securities' trustworthiness presents challenges due to limited regulatory information in available sources. While the broker operates under the DBS banking umbrella in Singapore, specific regulatory licenses, compliance frameworks, and oversight mechanisms are not detailed in current documentation for public verification.

This absence of explicit regulatory information makes it difficult to evaluate the broker's regulatory standing comprehensively. Fund safety measures, client money protection protocols, and segregation practices are not specifically outlined in available sources, though association with the established DBS banking group suggests institutional-grade security measures for client protection.

The broker's integration with traditional banking infrastructure likely provides enhanced security compared to standalone brokerage operations, though specific protective measures require verification. Company transparency regarding operations, fee structures, and business practices appears limited based on publicly available information for independent assessment.

Industry recognition, awards, or third-party certifications are not mentioned in current sources, making it challenging to assess peer recognition or industry standing. The lack of detailed regulatory and safety information in this review reflects the need for potential clients to independently verify the broker's regulatory status, fund protection measures, and compliance frameworks in their specific jurisdictions before committing funds.

User Experience Analysis

User experience assessment for DBS Vickers Securities relies on limited available feedback, with sources indicating mixed user discussions without specific satisfaction metrics or detailed user testimonials. The broker's beginner-friendly positioning suggests emphasis on user-friendly interfaces and simplified trading processes, though specific usability features are not detailed in current documentation for comprehensive evaluation.

Interface design, navigation ease, and platform intuitiveness are not specifically described in available sources, making it challenging to evaluate the actual user experience quality. The availability of mobile applications indicates attention to modern trading preferences. Specific app functionality and user interface quality require direct evaluation for accurate assessment.

Account opening and verification processes are not detailed in current sources, though integration with DBS banking services likely streamlines these procedures for existing bank customers. Fund management experiences, including deposit and withdrawal convenience, are not specifically addressed in available information for complete transparency.

Common user complaints or areas for improvement are not identified in current sources, limiting the ability to highlight potential user experience challenges. The absence of detailed user feedback in this review emphasizes the importance of trial usage or direct consultation with existing users to understand the platform's practical usability and user satisfaction levels before making final decisions.

Conclusion

DBS Vickers Securities emerges as a beginner-friendly brokerage option offering competitive rates and integrated banking services through its association with the established DBS group. This dbs vickers securities review reveals a broker that prioritizes accessibility while maintaining the reliability expected from traditional financial institutions, creating value for diverse trader types.

The platform appears most suitable for beginning traders and retail investors seeking straightforward market access combined with the security of established banking infrastructure. Additionally, existing DBS banking customers may find particular value in the integrated services and streamlined account management capabilities that simplify their overall financial management.

Primary advantages include competitive fee structures, mobile trading capabilities, and the reliability associated with established banking operations. However, notable limitations include limited publicly available information about specific trading conditions, regulatory details, and comprehensive user feedback, which may require potential clients to conduct additional due diligence before making final decisions about their brokerage choice.