Is DBS VICKERS SECURITIES safe?

Pros

Cons

Is DBS Vickers Securities Safe or a Scam?

Introduction

DBS Vickers Securities is a prominent brokerage firm based in Singapore, known for its extensive services in the securities and derivatives markets. As a subsidiary of DBS Bank, one of Asia's largest and most reputable banks, DBS Vickers aims to provide a secure trading environment for both institutional and retail investors. However, the financial landscape is fraught with risks, and traders must exercise due diligence when selecting a brokerage. Evaluating a broker's credibility is essential to safeguarding one's investments, as the wrong choice can lead to significant financial losses. This article will investigate whether DBS Vickers Securities is a safe choice for traders or if it exhibits characteristics typical of a scam. Our assessment will be based on regulatory compliance, company background, trading conditions, client fund security, customer experiences, platform performance, and risk factors.

Regulation and Legitimacy

The regulatory framework within which a brokerage operates is a crucial indicator of its legitimacy and safety. A well-regulated broker is typically subject to stringent oversight, which helps to protect investors from fraud and malpractice. DBS Vickers Securities is regulated by the Monetary Authority of Singapore (MAS) and the Securities and Exchange Commission (SEC) of Thailand.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MAS | Not specified | Singapore | Verified |

| SEC | 0029/2540 | Thailand | Verified |

The presence of reputable regulatory oversight from MAS, a Tier-1 regulator, enhances the credibility of DBS Vickers Securities. The MAS is known for its strict regulatory standards, ensuring that brokers adhere to high levels of transparency and financial integrity. Moreover, DBS Vickers is a member of the Securities Investor Protection Fund (SIPF), which provides additional security for client funds. This regulatory framework indicates that DBS Vickers Securities is safe for traders, as it operates under the watchful eye of a respected financial authority.

Company Background Investigation

DBS Vickers Securities was established as a subsidiary of DBS Bank, which has a long-standing history dating back to 1968. The brokerage has evolved to become a significant player in the Asian financial markets, with a focus on providing comprehensive brokerage services. The management team comprises seasoned professionals with extensive experience in finance and investment, contributing to the firm's strong reputation.

Transparency is a vital aspect of any brokerage's operations. DBS Vickers Securities demonstrates a commitment to openness through regular disclosures and updates on its services. The firm provides clients with access to a wealth of market data, research reports, and educational resources, further solidifying its position as a trustworthy broker. Given its reputable parent company and solid track record, DBS Vickers Securities is not a scam but rather a legitimate entity in the financial services sector.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. DBS Vickers Securities has a competitive fee structure, although it may vary depending on the asset class and trading volume.

| Fee Type | DBS Vickers Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.11% - 0.15% | 0.10% - 0.20% |

| Commission Structure | Variable | Variable |

| Overnight Interest Range | Not applicable | Varies |

DBS Vickers employs a tiered commission model, where fees decrease as trading volume increases. While this structure is common among brokers, potential clients should be aware of any hidden fees associated with specific account types or services. Overall, the trading conditions at DBS Vickers are competitive, and the firm has made efforts to keep costs reasonable, indicating that DBS Vickers Securities is safe for active traders.

Client Fund Security

The safety of client funds is paramount in the brokerage industry. DBS Vickers Securities takes several measures to ensure the security of client assets. One of the primary safeguards is the segregation of client funds from the broker's operational funds, which is a regulatory requirement in Singapore. This segregation ensures that client assets are protected even in the event of the broker's insolvency.

Additionally, DBS Vickers participates in the SIPF, which provides compensation to clients in case the broker faces financial difficulties. The fund covers up to THB 1 million per client, offering an extra layer of protection. Furthermore, the firm employs advanced security measures, including encryption protocols, to safeguard client data and transactions. Given these factors, it is reasonable to conclude that DBS Vickers Securities is safe in terms of client fund security.

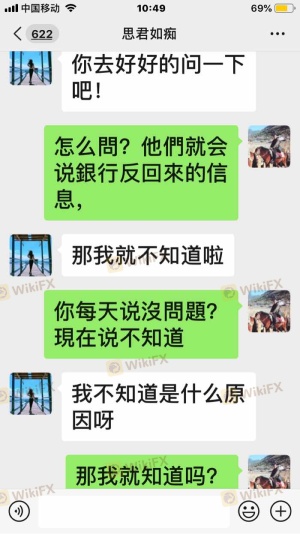

Customer Experience and Complaints

Customer feedback is a crucial element in assessing a brokerage's reputation. Reviews of DBS Vickers Securities reveal a mixed bag of experiences. While many clients appreciate the firm's robust trading platform and access to diverse markets, some have raised concerns about customer service responsiveness and the clarity of the fee structure.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Customer Service Delays | Moderate | Addressed |

| Fee Transparency Issues | High | Under Review |

Common complaints include delayed responses to inquiries and confusion regarding fee structures. For instance, some users reported difficulties in understanding the commission rates associated with different trading activities. However, the company has made efforts to address these issues by enhancing its customer support and providing clearer information on its website. Overall, while there are areas for improvement, the general sentiment is that DBS Vickers Securities is not a scam, but rather a broker that is working to improve its customer experience.

Platform and Trade Execution

The performance of a brokerage's trading platform is critical for a smooth trading experience. DBS Vickers Securities offers a user-friendly online trading platform and a mobile app that provides access to various markets. The platform is equipped with essential trading tools, including real-time data, charting capabilities, and market analysis resources.

In terms of trade execution, DBS Vickers Securities has generally received positive reviews, with clients noting timely order execution and minimal slippage. However, like many brokers, there may be occasional instances of order rejections during periods of high volatility. Overall, the platform's performance indicates that DBS Vickers Securities is safe for traders seeking reliable execution.

Risk Assessment

While DBS Vickers Securities presents many positive attributes, potential clients should remain aware of the inherent risks associated with trading.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | Low | Strong regulatory oversight |

| Customer Service Issues | Medium | Mixed feedback on support quality |

| Fee Transparency | Medium | Complexity in fee structures |

To mitigate risks, traders should thoroughly read all terms and conditions before opening an account. Additionally, it is advisable to start with a small investment to gauge the platform's performance and customer service before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that DBS Vickers Securities is safe for traders, supported by its strong regulatory framework, reputable parent company, and commitment to client fund security. While there are areas for improvement, particularly in customer service and fee transparency, the overall assessment points to a legitimate brokerage rather than a scam.

For traders considering DBS Vickers, it is recommended to familiarize themselves with the fee structure and utilize the available resources to enhance their trading experience. If you are looking for alternatives, brokers with strong reputations and competitive fees include Interactive Brokers and Saxo Capital Markets. Always conduct thorough research and consider your trading needs before making a decision.

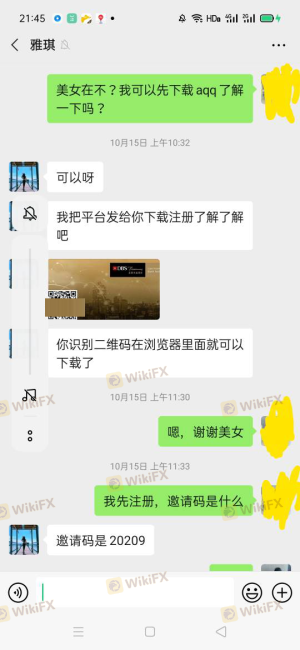

Is DBS VICKERS SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of DBS VICKERS SECURITIES brokers.

DBS VICKERS SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DBS VICKERS SECURITIES latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.