Connext 2025 Review: Everything You Need to Know

Executive Summary

This detailed connext review looks at Connext Global, a newer forex broker that has received good feedback from users and shows high employee satisfaction rates, which means the company has a positive work environment. The broker works as an online Contract for Difference (CFD) trading platform under Connext LLC. It gives traders access to many different types of investments including forex, precious metals, cryptocurrencies, and energy through the MetaTrader 5 platform.

Connext Global sees itself as a flexible trading solution for traders who want different investment choices. This is especially true for those interested in cryptocurrency and precious metals trading. The broker is registered in Saint Vincent and the Grenadines under registration number 2652 LLC 2022. Its main office is located at The Aspin Commercial Tower in Dubai's Trade Centre district.

Based on employee feedback data, the company has an impressive 4.0 overall rating with 100% of employees willing to recommend the company. However, potential clients should know that the broker operates under the less strict rules of Saint Vincent and the Grenadines, which may be important for traders who want strong oversight.

Important Notice

Connext Global operates under registration in Saint Vincent and the Grenadines. This provides a less strict regulatory environment compared to major financial jurisdictions such as the UK's FCA or Australia's ASIC. Potential clients should carefully think about their risk tolerance and regulatory preferences when looking at this broker.

This review is based on publicly available information, user feedback, and official company disclosures. The analysis aims to provide objective insights for potential clients while acknowledging limitations in available data. Traders should do their own research and think about their individual trading needs and risk tolerance before making any decisions.

Rating Framework

Broker Overview

Connext Global represents a modern approach to online CFD trading. It operates under Connext LLC with its main office located in Dubai's prestigious Trade Centre district. While specific founding details are not well documented in available materials, the broker has established itself as a multi-asset trading platform that serves diverse investment preferences.

The company's business model focuses on providing Contract for Difference (CFD) trading services across multiple financial markets. According to official information, Connext Global also helps businesses set up support teams in the Philippines and Latin America. This suggests a broader business scope beyond direct retail trading services. This diverse approach may help the company's operational stability and growth prospects.

Connext Global stands out through its comprehensive asset offering. It provides access to traditional forex markets alongside emerging cryptocurrency markets, precious metals, and energy commodities. The broker uses the industry-standard MetaTrader 5 platform, ensuring traders have access to professional-grade trading tools and functionality. The company's registration in Saint Vincent and the Grenadines under number 2652 LLC 2022 provides operational flexibility, though it operates under less strict rules compared to major financial centers.

Regulatory Jurisdiction: Connext Global operates under registration in Saint Vincent and the Grenadines. This is a jurisdiction known for its business-friendly regulatory environment but with limited oversight compared to tier-one financial regulators.

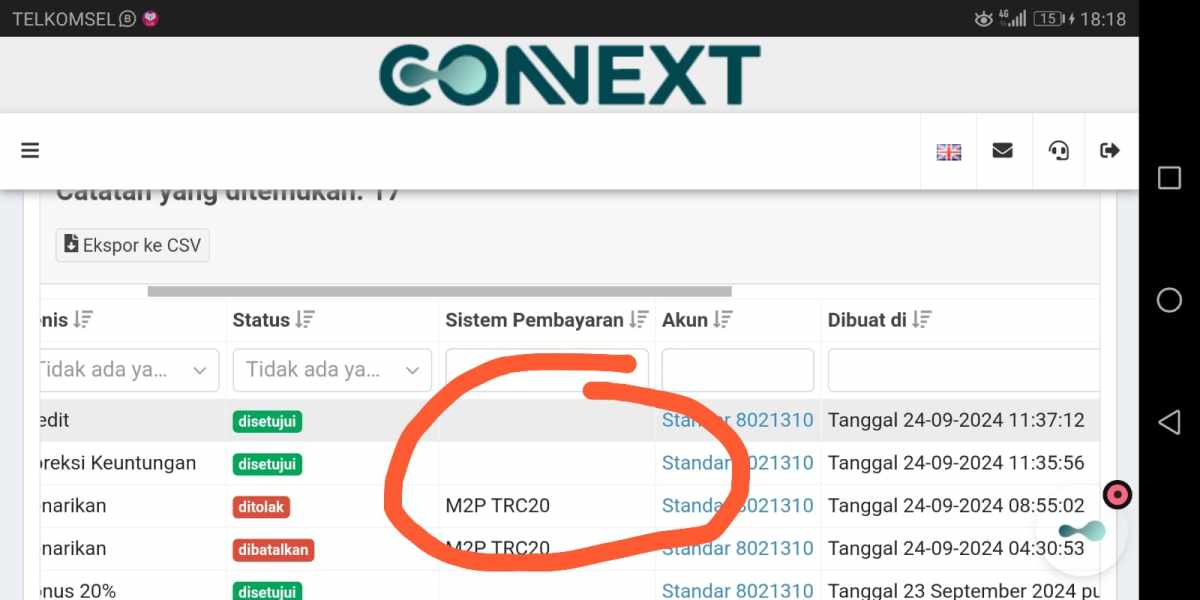

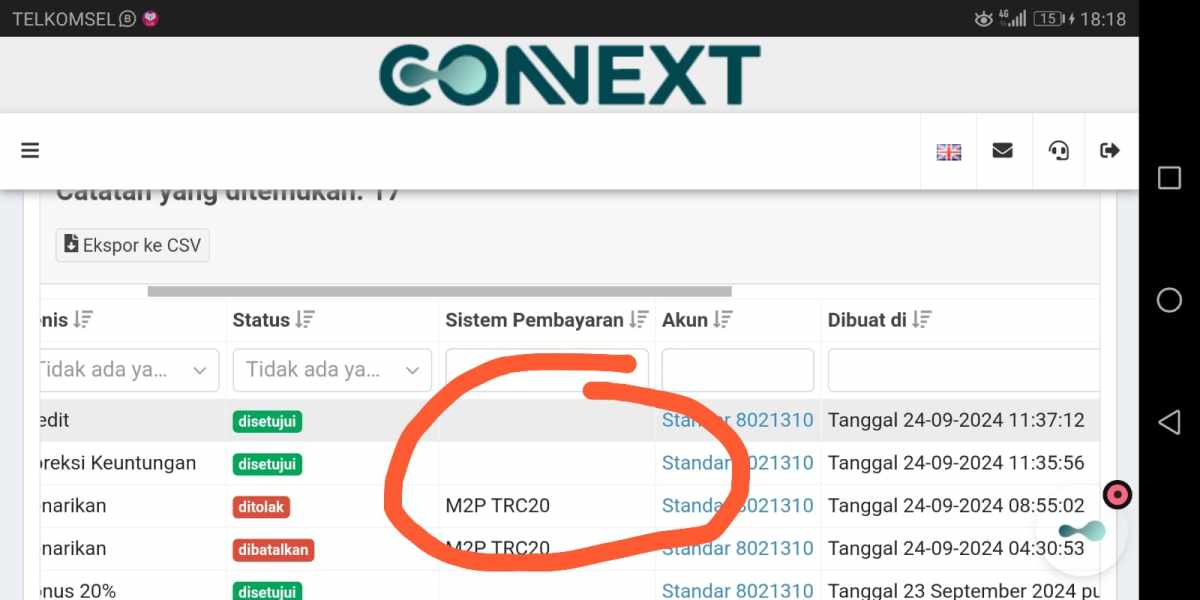

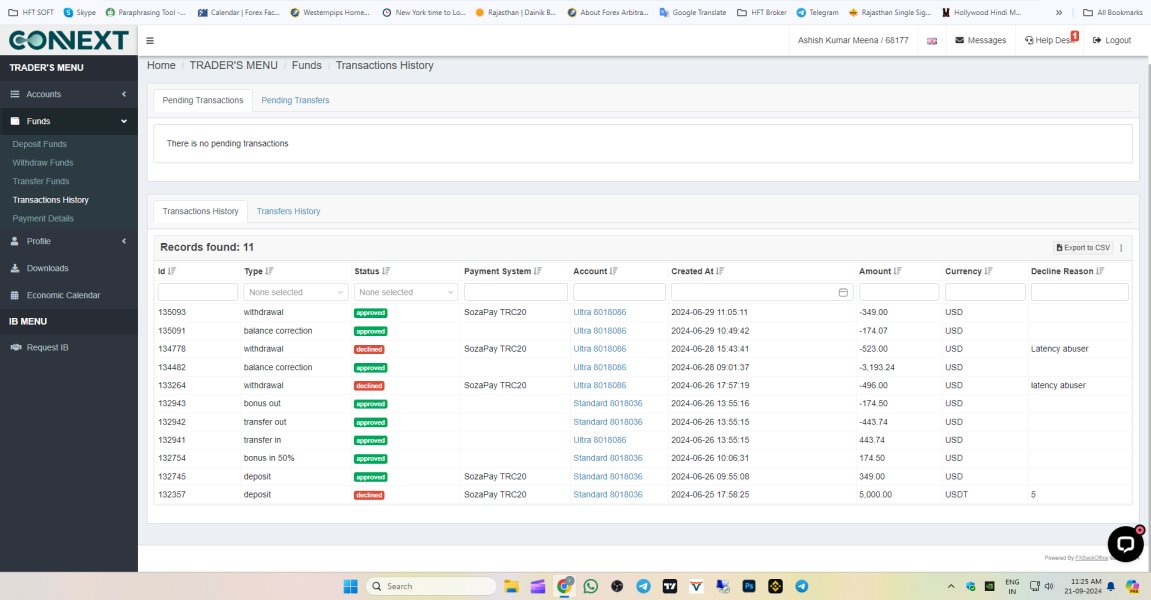

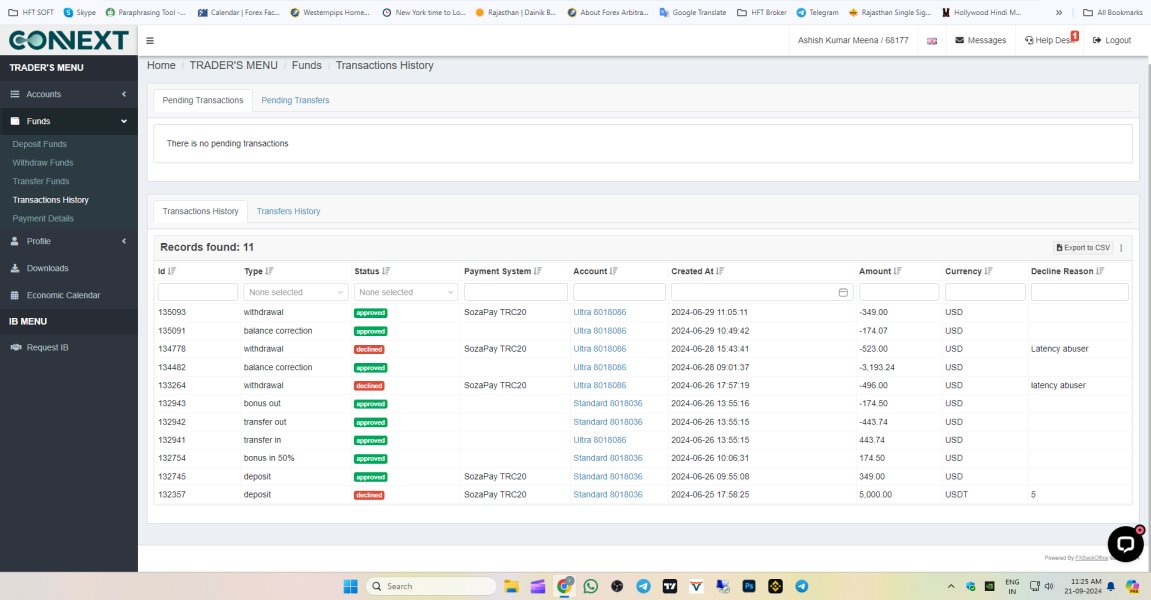

Deposit and Withdrawal Methods: Specific information about payment methods and processing procedures is not detailed in available materials. This requires direct inquiry with the broker for comprehensive details.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This suggests potential variation based on account types or promotional offers.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not detailed in available materials. This indicates the need for direct consultation regarding available incentives.

Tradeable Assets: The platform supports a comprehensive range of financial instruments including major and minor forex pairs, precious metals (gold, silver), various cryptocurrencies, and energy commodities. This provides diversification opportunities for different trading strategies.

Cost Structure: Specific information about spreads, commissions, and additional fees is not detailed in available materials. This requires direct inquiry for accurate pricing information.

Leverage Ratios: Available leverage levels are not specified in current documentation. However, this information would typically be available during the account opening process.

Platform Options: Connext Global provides the MetaTrader 5 trading platform. It offers comprehensive charting tools, technical indicators, and automated trading capabilities.

Geographic Restrictions: Specific information about restricted jurisdictions is not detailed in available materials.

Customer Support Languages: The broker offers multilingual customer support. However, specific languages supported are not comprehensively listed in available documentation.

This connext review continues with detailed analysis of each performance dimension to provide comprehensive insights for potential clients.

Detailed Rating Analysis

The evaluation of Connext Global's account conditions faces limitations due to insufficient detailed information in available materials. This is about specific account types, their features, and associated requirements. This represents a significant information gap that potential clients should address through direct inquiry with the broker.

Typically, forex brokers offer multiple account tiers designed to accommodate different trader profiles, from beginners to institutional clients. These usually include variations in minimum deposit requirements, spread structures, and available features. However, without specific documentation of Connext Global's account hierarchy, it's challenging to assess the competitiveness and suitability of their offerings.

The absence of clearly published account opening procedures, verification requirements, and special account features such as Islamic accounts or professional trader classifications limits the ability to provide comprehensive guidance. Potential clients should directly contact Connext Global to understand available account options, minimum funding requirements, and any special features that might align with their trading needs.

This connext review recommends that interested traders specifically ask about account types, minimum deposits, and any special conditions before proceeding with account opening procedures.

Connext Global demonstrates strong performance in the tools and resources category. This is primarily through its provision of the MetaTrader 5 platform, which represents one of the industry's leading trading environments. MetaTrader 5 offers comprehensive functionality including advanced charting capabilities, extensive technical indicator libraries, and robust automated trading support through Expert Advisors.

The platform's multi-asset capabilities align well with Connext Global's diverse offering of forex, precious metals, cryptocurrencies, and energy commodities. This integration allows traders to manage diversified portfolios within a single platform environment, enhancing operational efficiency and portfolio oversight.

However, available materials do not detail additional research resources, market analysis tools, or educational content that many modern brokers provide to support trader development and decision-making. The absence of information regarding proprietary tools, market research, or educational resources represents an area where additional information would benefit potential clients.

The MetaTrader 5 platform itself provides substantial analytical capabilities. However, supplementary broker-provided resources such as market commentary, economic calendars, or trading webinars could enhance the overall value proposition for clients seeking comprehensive trading support.

Customer Service and Support Analysis (Rating: 7/10)

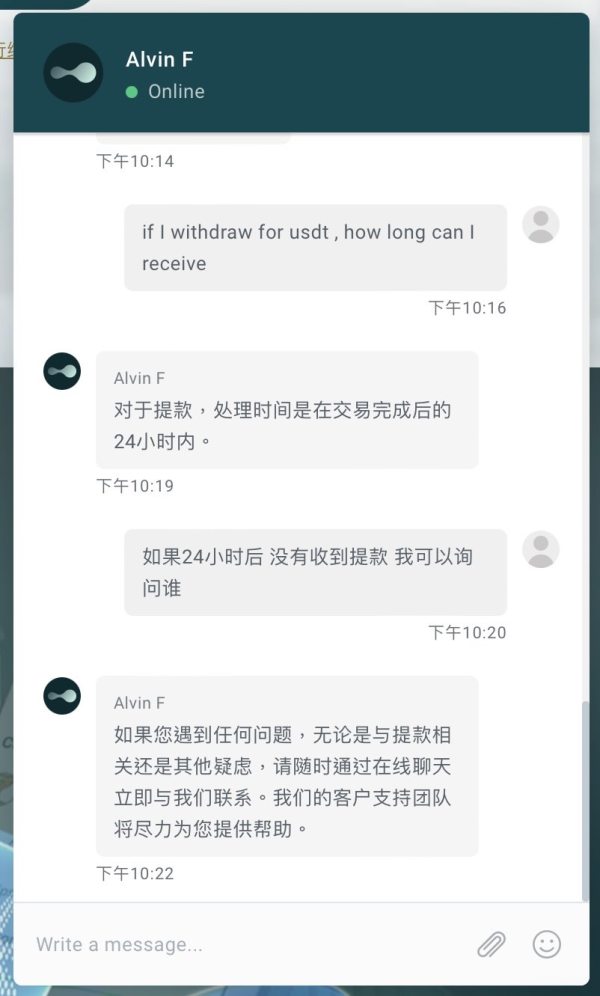

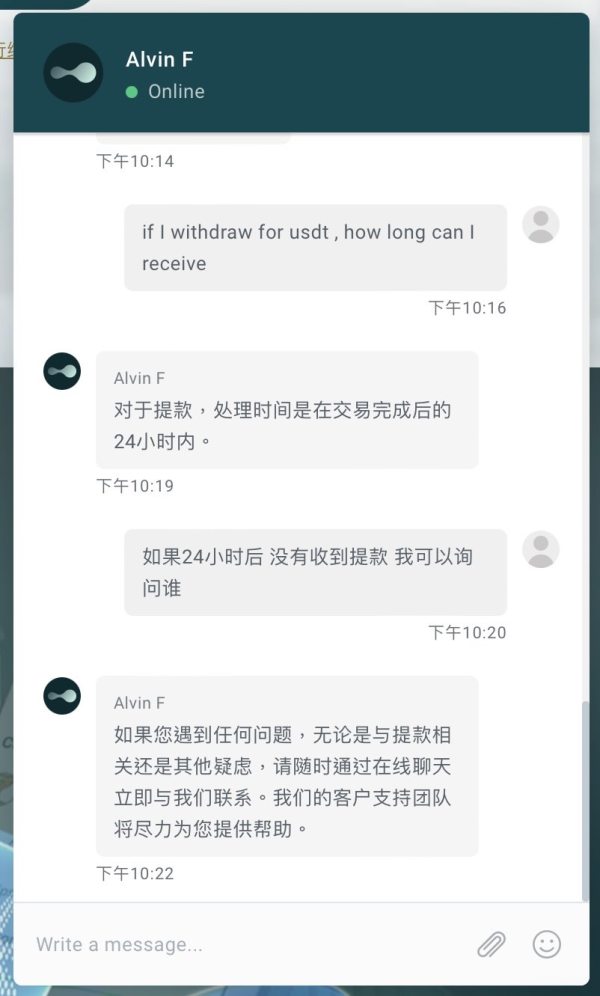

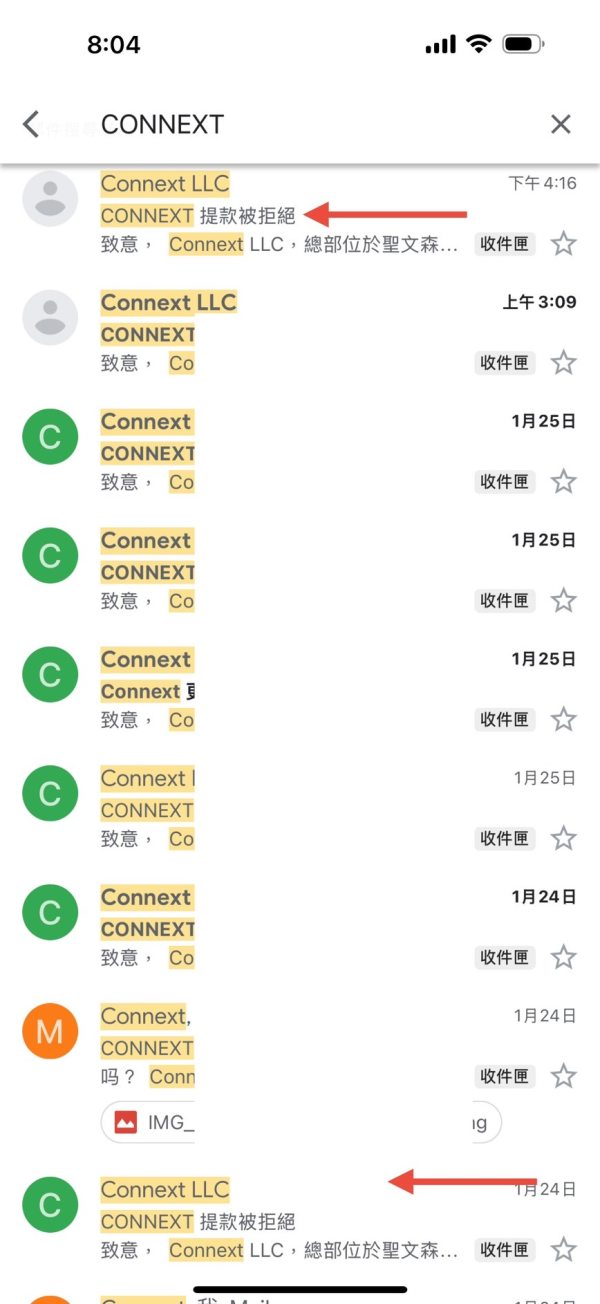

User feedback regarding Connext Global's customer service indicates generally positive experiences with responsive support teams. The broker reportedly provides multiple communication channels including telephone, email, and live chat support. This offers flexibility for clients with different communication preferences.

The multilingual support capability represents a significant advantage for international clients. However, specific languages supported are not comprehensively documented in available materials. Quick response times mentioned in user feedback suggest adequate staffing and efficient support processes, which are crucial for time-sensitive trading environments.

However, detailed information regarding support hours, escalation procedures, or specialized support for different client categories is not extensively documented. The quality and consistency of support across different communication channels and time zones would benefit from more comprehensive documentation.

Professional competency of support staff, as mentioned in user feedback, indicates appropriate training and knowledge levels among customer service representatives. This suggests that clients can expect informed assistance with both technical and account-related inquiries.

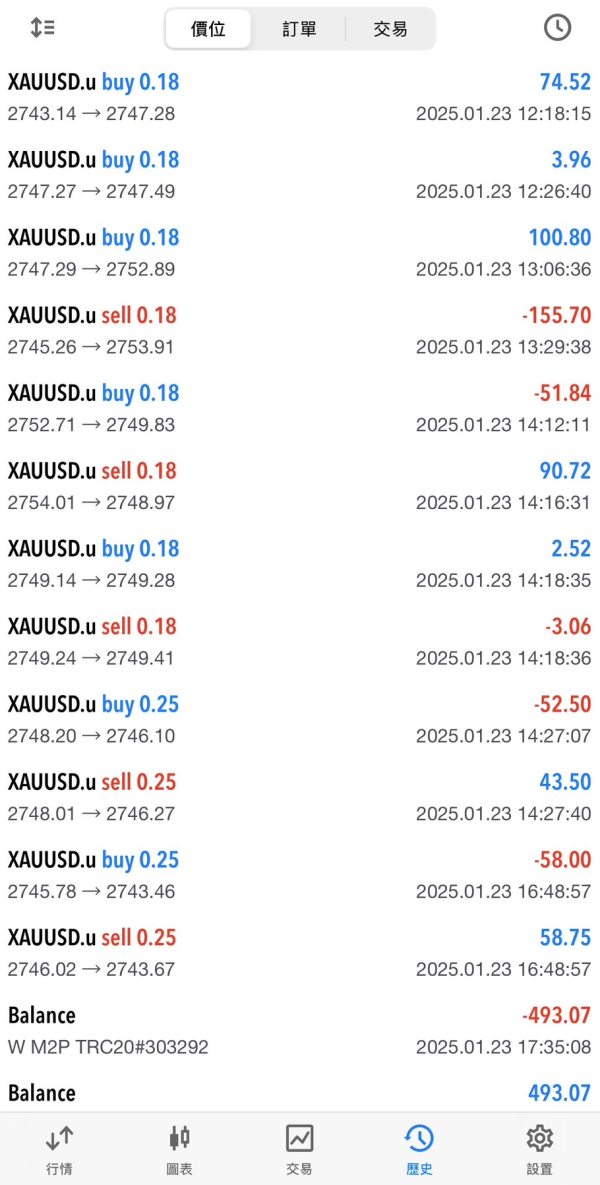

Trading Experience Analysis (Rating: 8/10)

User feedback indicates that Connext Global provides a stable and reliable trading environment through its MetaTrader 5 platform implementation. Platform stability represents a crucial factor for trader success. Positive user reports in this area suggest adequate technical infrastructure and platform management.

The MetaTrader 5 platform offers comprehensive trading functionality including advanced order types, one-click trading, and sophisticated risk management tools. These features support both manual and automated trading strategies, accommodating different trader preferences and experience levels.

However, specific information regarding order execution quality, typical slippage rates, or execution speed metrics is not detailed in available materials. These technical performance indicators are crucial for traders, particularly those employing scalping or high-frequency strategies.

The multi-asset trading capability provided through the platform allows for portfolio diversification and cross-market analysis. This enhances the overall trading experience for clients interested in multiple financial markets. Mobile trading capabilities and platform accessibility across different devices would require direct verification with the broker.

This connext review notes that while user feedback is generally positive regarding trading experience, more detailed technical performance data would strengthen the evaluation.

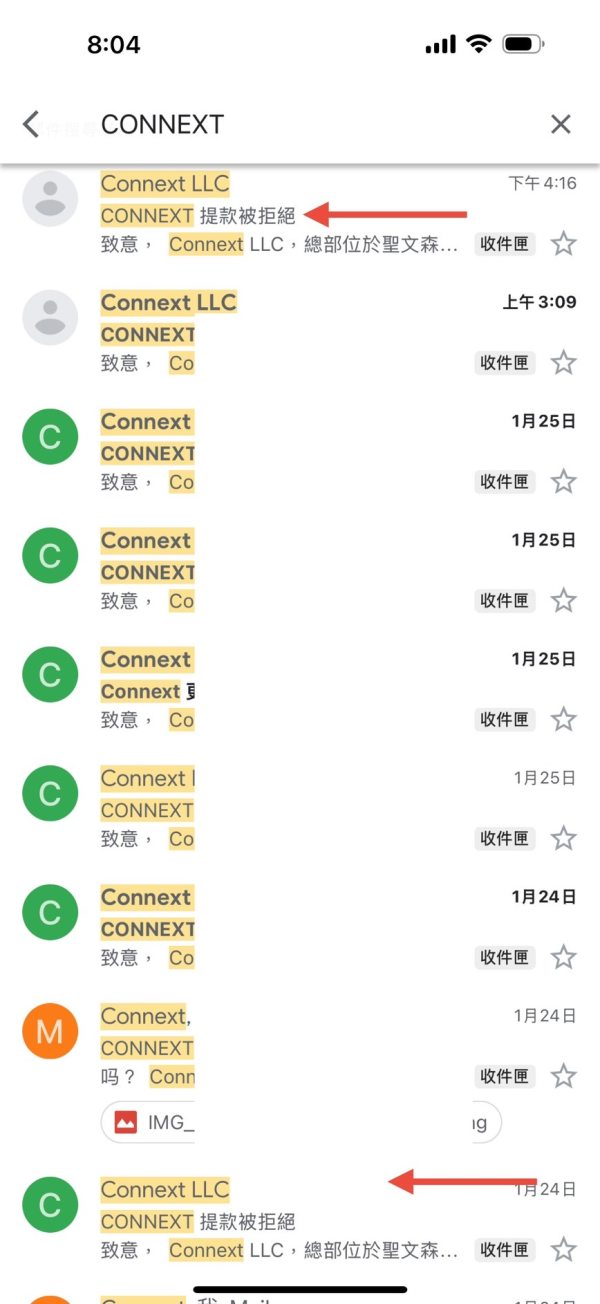

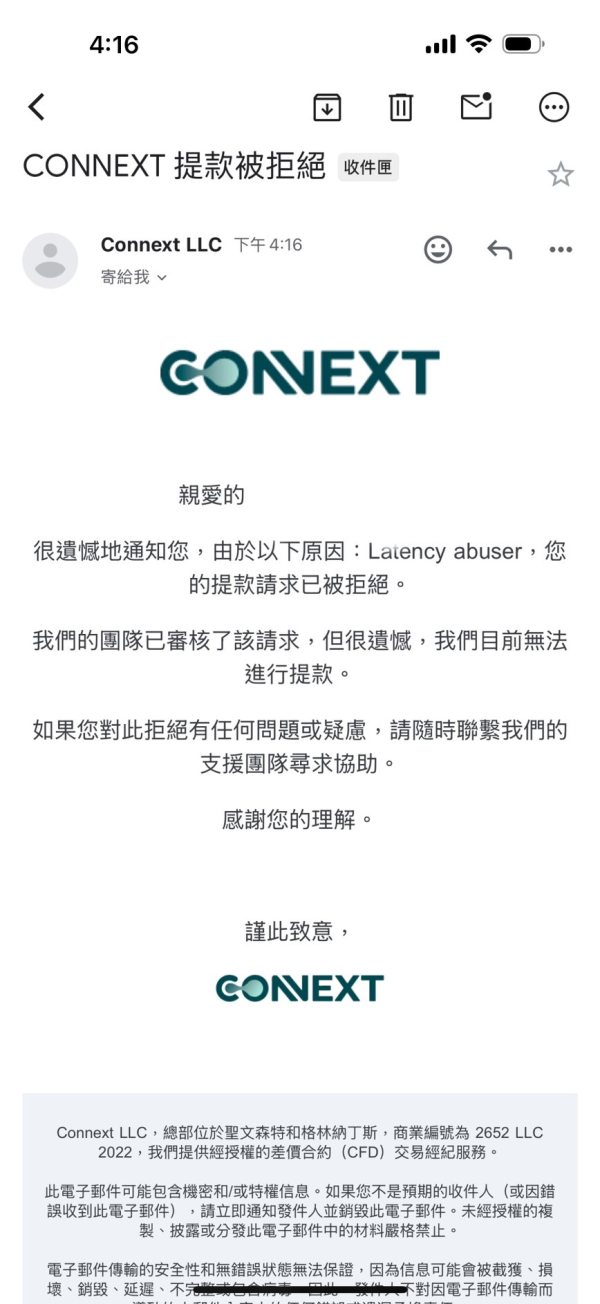

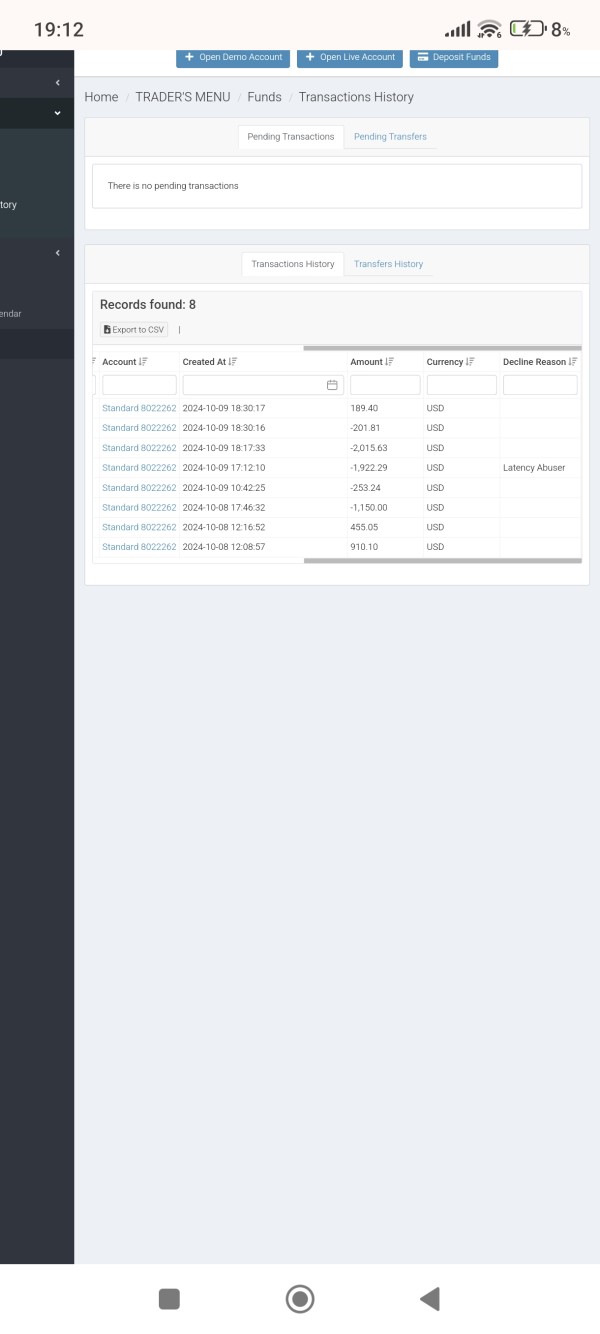

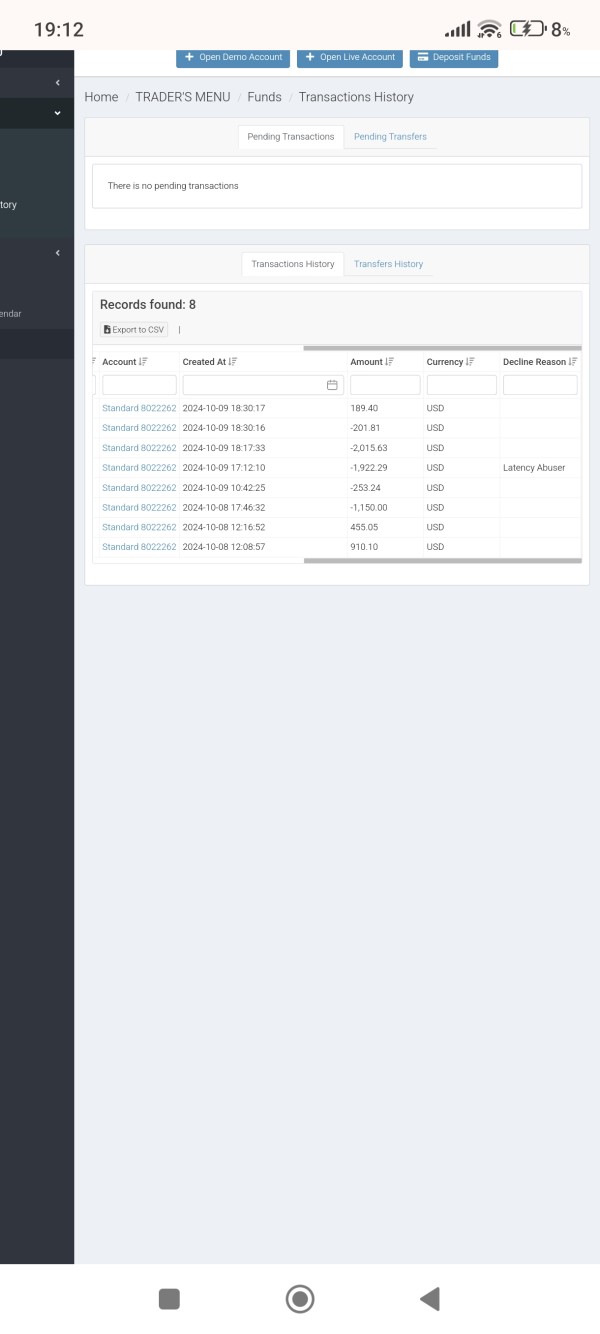

Trust and Reliability Analysis (Rating: 6/10)

Connext Global's trust and reliability assessment reflects the regulatory environment in which it operates. Registration in Saint Vincent and the Grenadines under number 2652 LLC 2022 provides legal operational status. However, it lacks the comprehensive oversight and client protection measures associated with tier-one financial regulators.

The regulatory framework in Saint Vincent and the Grenadines is generally considered business-friendly but provides limited investor protection compared to jurisdictions such as the UK, Australia, or the European Union. This regulatory environment may present considerations for traders prioritizing maximum regulatory protection and oversight.

Available materials do not detail specific client fund protection measures, segregation policies, or insurance coverage that might enhance client security. Transparency regarding company ownership, financial reporting, or third-party auditing is also not extensively documented in available sources.

The company's operational presence in Dubai through The Aspin Commercial Tower provides a physical business location. This adds some operational transparency. However, comprehensive due diligence regarding company background, financial stability, and regulatory compliance history would require additional investigation.

User Experience Analysis (Rating: 7/10)

Overall user satisfaction with Connext Global appears generally positive based on available feedback. Particular strengths are noted in platform stability and customer service responsiveness. The employee satisfaction metrics, showing 4.0 overall rating and 100% recommendation rate, suggest a positive internal culture that often translates to better client service.

However, the presence of some negative feedback indicates areas for potential improvement. Specific user concerns are not detailed in available materials, but the existence of mixed reviews suggests that experiences may vary among different client segments or service areas.

The broker's focus on multi-asset trading appeals to traders seeking diversification opportunities. This is particularly true for those interested in cryptocurrency and precious metals markets. This positioning attracts clients with specific investment interests beyond traditional forex trading.

Interface design, ease of use, and account management processes are not extensively documented in available materials. The registration and verification process efficiency, fund transfer experiences, and overall platform navigation would benefit from more detailed user feedback analysis.

Potential improvements based on user feedback patterns could include enhanced communication regarding account procedures, expanded educational resources, or improved transparency in operational policies and procedures.

Conclusion

This comprehensive connext review reveals Connext Global as a developing broker with several strengths and areas requiring consideration. The broker demonstrates competency in platform provision through MetaTrader 5, offers diverse asset classes for trading, and maintains generally positive user satisfaction levels with strong internal employee satisfaction metrics.

However, the regulatory environment in Saint Vincent and the Grenadines and limited publicly available information regarding account conditions, fee structures, and operational procedures present considerations for potential clients. The broker appears most suitable for traders interested in cryptocurrency and precious metals trading alongside traditional forex markets, particularly those comfortable with less stringent regulatory oversight.

The main advantages include diverse trading assets, platform stability, and responsive customer service. The primary limitations involve regulatory concerns and limited transparency regarding specific trading conditions. Potential clients should conduct thorough due diligence and direct inquiry to address information gaps before making trading decisions.