Regarding the legitimacy of Connext forex brokers, it provides FSA and WikiBit, .

Is Connext safe?

Pros

Cons

Is Connext markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Connext Ltd

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.connextfx.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 7A, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4377028Licensed Institution Certified Documents:

Is Connext A Scam?

Introduction

Connext is a relatively new player in the forex market, operating as an online brokerage that offers a variety of trading instruments, including forex, precious metals, and cryptocurrencies. Established in 2022 and registered in Saint Vincent and the Grenadines, Connext presents itself as a platform catering to both novice and experienced traders. However, the forex market is notorious for its high risks, and traders must exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as unregulated or poorly regulated brokers can expose traders to significant financial risks, including fraud and loss of funds.

This article aims to provide a comprehensive analysis of Connext, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on a review of multiple sources, including user feedback, regulatory filings, and expert reviews, to present a balanced view of whether Connext is a legitimate trading platform or a potential scam.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining the legitimacy of a forex broker. A broker's regulatory status can provide insights into its operational integrity and the protections available to traders. Connext claims to be regulated by the Financial Services Authority (FSA) of Seychelles; however, it is essential to note that Seychelles is often considered a less stringent regulatory environment compared to jurisdictions like the UK or the US.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | 2652 | Seychelles | Unverified |

The regulatory quality of a broker plays a significant role in establishing trust. While Connext holds a license from the Seychelles FSA, the effectiveness of this regulation is often questioned due to the lack of stringent oversight. Furthermore, multiple reviews indicate that Connext operates without valid regulation in key financial markets, raising concerns about its credibility. The lack of a robust regulatory framework can expose traders to risks, including potential fraud and difficulty in recovering funds.

Company Background Investigation

Connext LLC, the company behind the trading platform, is relatively new, having been established in 2022. The company is registered in Saint Vincent and the Grenadines, a location often associated with offshore financial services. The ownership structure and management team of Connext remain somewhat opaque, as there is limited publicly available information regarding its founders or key executives.

The absence of transparency regarding the company's leadership raises red flags. A strong management team with a proven track record is crucial for establishing trust in a trading platform. The lack of detailed information about the team behind Connext makes it challenging to assess their qualifications and experience in the financial services industry.

Moreover, the companys website does not provide comprehensive information about its operations, which can further deter potential clients. Transparency in business operations, including clear information about the management team and ownership, is vital for building trust with clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall appeal. Connext claims to provide competitive trading conditions, including low spreads and high leverage. However, the lack of transparency regarding fees and commissions raises concerns.

Core Trading Costs Table

| Cost Type | Connext | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0-2.0 pips |

| Commission Model | $6 per lot (varies by account) | $5-$10 per lot |

| Overnight Interest Range | Not specified | Varies widely |

The trading fees at Connext appear attractive at first glance, particularly with spreads starting from 0.0 pips. However, traders should be cautious of potential hidden fees or unfavorable commission structures that could impact profitability. Furthermore, the lack of clarity regarding overnight interest rates and other costs can lead to unexpected expenses for traders.

It is essential for traders to thoroughly understand the fee structure before committing funds to ensure that they are not subject to excessive costs that could erode their profits.

Client Funds Security

The safety of client funds is paramount when selecting a forex broker. Connext claims to implement various security measures, including segregated accounts to protect client funds. However, the effectiveness of these measures remains uncertain due to the broker's regulatory status.

Traders should be aware of the following aspects regarding fund safety:

- Segregated Accounts: Connext states that client funds are kept in separate accounts from the company's operational funds. This is a standard practice aimed at protecting client assets in the event of company insolvency.

- Investor Protection: There is no indication that Connext offers any form of investor compensation scheme, which is often a safety net provided by regulated brokers in more stringent jurisdictions.

- Negative Balance Protection: The broker advertises negative balance protection, which can prevent clients from losing more than their deposited funds. However, the lack of regulatory oversight may complicate the enforcement of such policies.

Any historical issues related to fund safety or disputes have not been well-documented, but the overall lack of regulatory oversight raises concerns about the potential risks associated with trading through Connext.

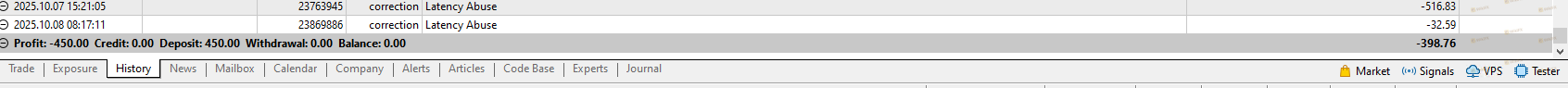

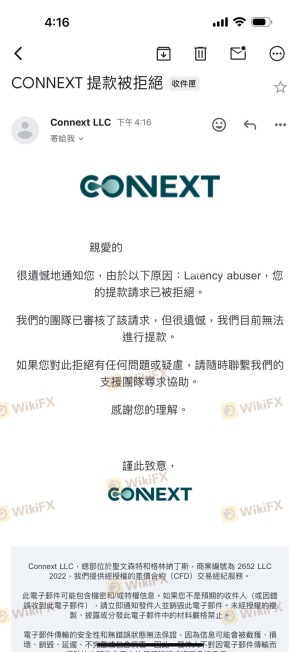

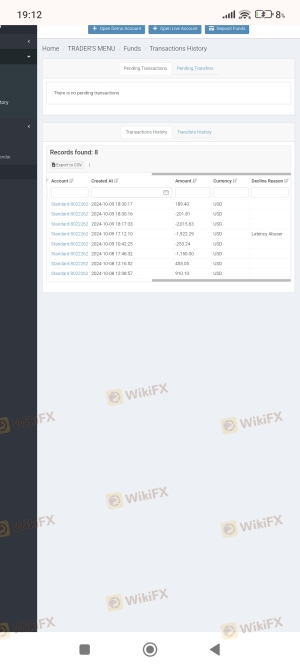

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. Reviews of Connext reveal a mixed bag of experiences, with some users praising its trading conditions while others express dissatisfaction with customer support and withdrawal processes.

Major Complaint Types Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow, often unresponsive |

| Customer Support Issues | Medium | Limited availability |

| Account Closure | High | Poor communication |

Common complaints include significant delays in processing withdrawals, which can be a major concern for traders. Many users report challenges in receiving timely responses from customer support, indicating that the broker may not be adequately equipped to handle client inquiries effectively.

Case Examples

- Withdrawal Issues: One user reported that after submitting a withdrawal request, the process took several weeks, with little communication from Connext. This delay raised concerns about the broker's reliability and transparency.

- Customer Support: Another trader noted that while the trading conditions were favorable, reaching customer support was often a frustrating experience, leading to delays in resolving issues.

- Limit Initial Investments: Start with a minimal deposit to gauge the broker's reliability before committing larger amounts.

- Conduct Thorough Research: Continuously monitor reviews and feedback from other traders to stay informed about any emerging issues.

- Explore Alternatives: If concerns persist, consider switching to a more reputable and regulated broker.

These complaints highlight the importance of evaluating a broker's customer service capabilities before investing.

Platform and Trade Execution

The performance of a trading platform can significantly influence a trader's experience. Connext offers popular trading platforms, including MetaTrader 5 (MT5) and cTrader, which are known for their advanced features and user-friendly interfaces.

However, the quality of order execution is a critical factor to assess. Reports of slippage and rejected orders have surfaced, raising concerns about the platform's reliability during volatile market conditions. Traders should be cautious of any signs of platform manipulation, which can adversely affect trading outcomes.

Risk Assessment

Engaging with Connext carries inherent risks, primarily due to its lack of robust regulatory oversight and transparency about its operations.

Risk Rating Card

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated or poorly regulated |

| Financial Risk | Medium | Potential for withdrawal issues |

| Operational Risk | High | Lack of transparency and support |

To mitigate these risks, traders should consider the following strategies:

Conclusion and Recommendations

In conclusion, while Connext presents itself as an appealing option for traders with its low spreads and diverse trading instruments, significant concerns regarding its regulatory status, customer support, and overall transparency cannot be overlooked. The evidence suggests that Connext may not provide the level of security and reliability that traders expect from a forex broker.

Given the potential risks associated with trading through Connext, it is advisable for traders, especially those new to the forex market, to exercise caution. For those seeking a more secure trading environment, consider exploring alternative brokers that are well-regulated and have a proven track record of customer satisfaction.

Ultimately, the decision to trade with Connext should be made with careful consideration of the risks involved and a thorough evaluation of the available information.

Is Connext a scam, or is it legit?

The latest exposure and evaluation content of Connext brokers.

Connext Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Connext latest industry rating score is 3.18, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.18 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.