NETX Review 1

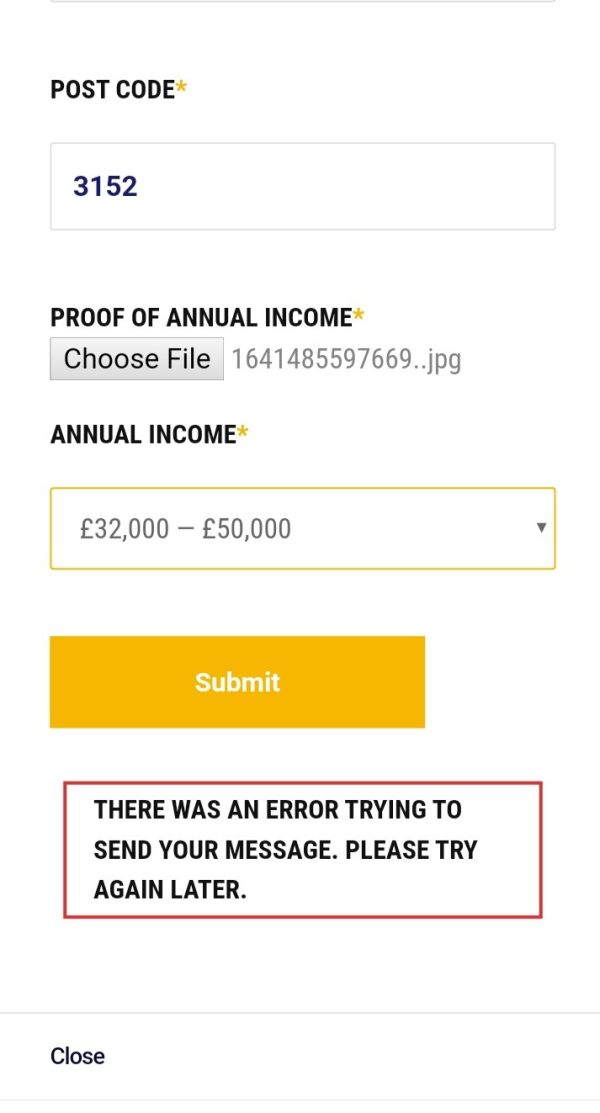

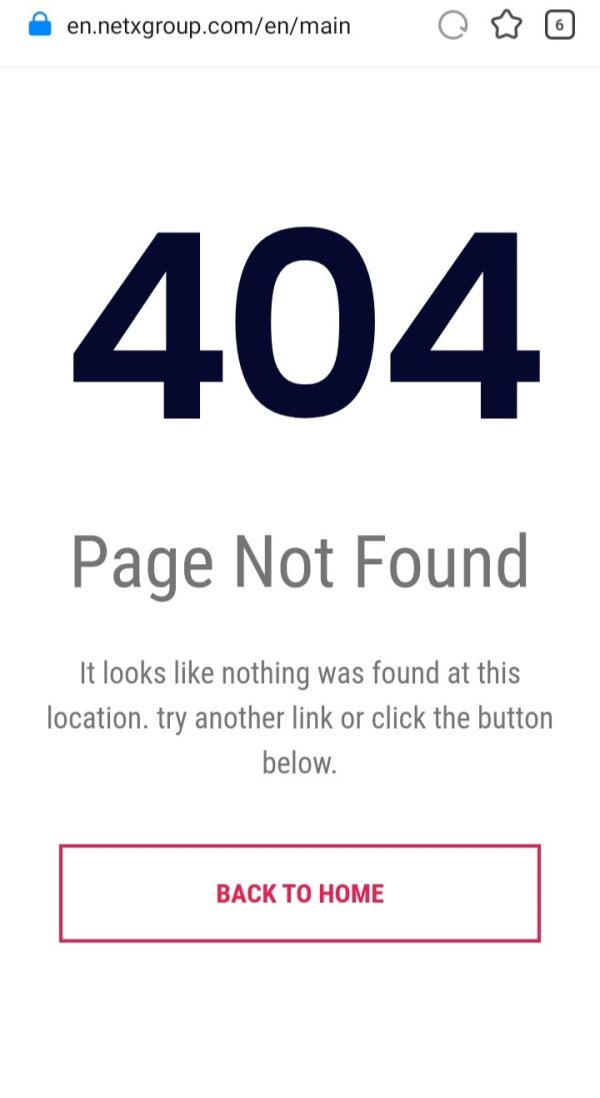

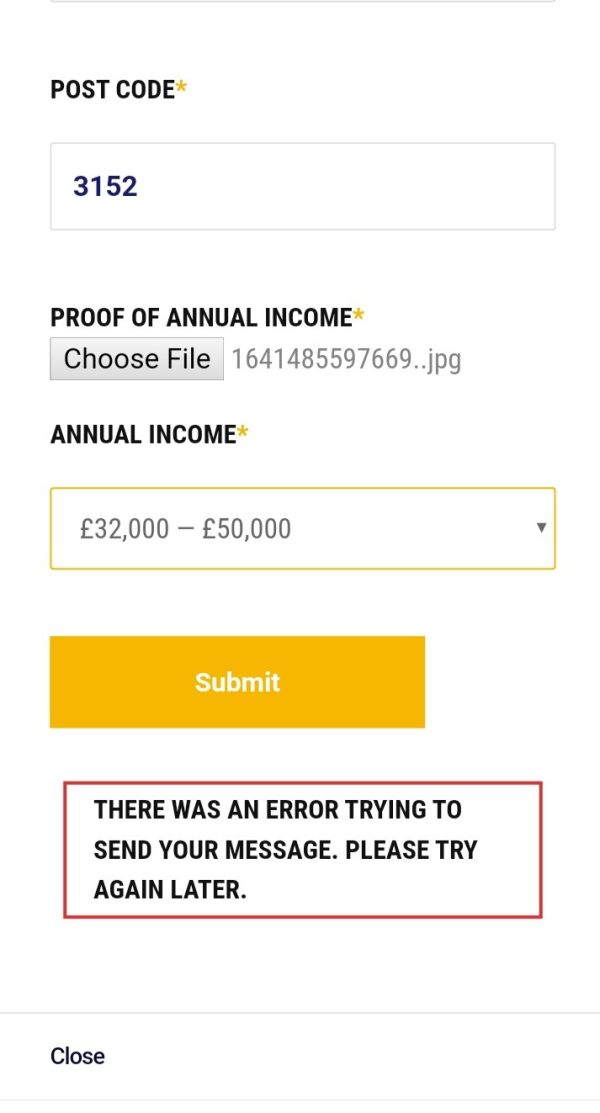

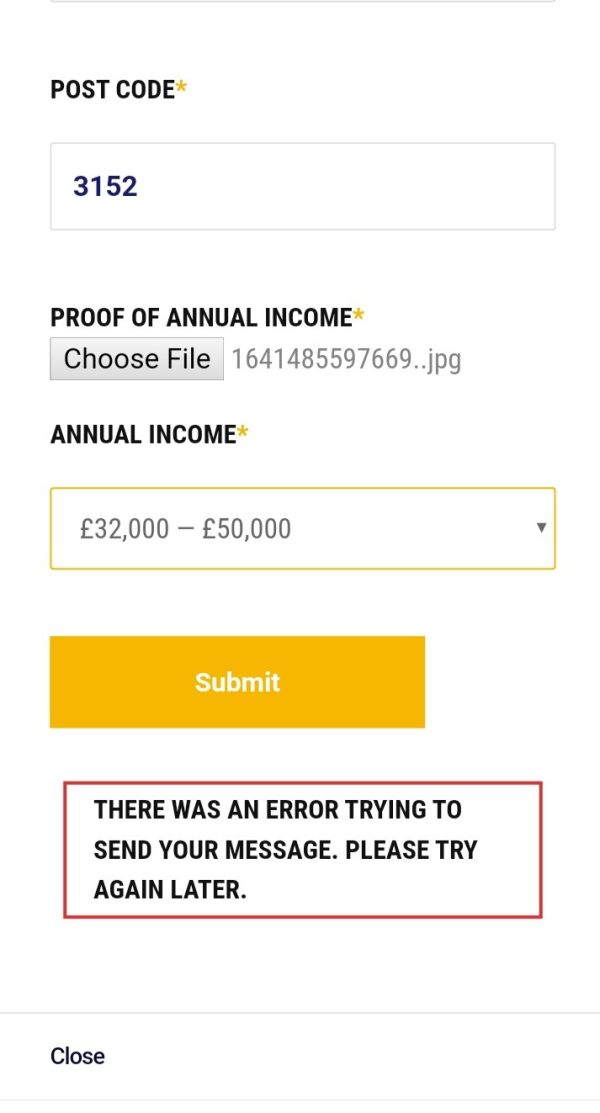

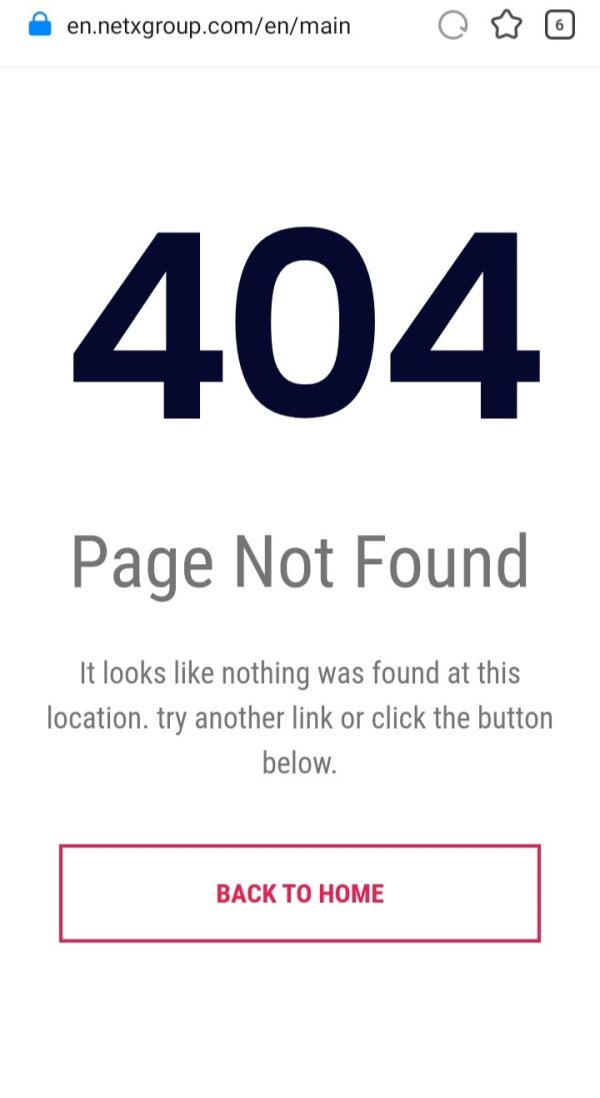

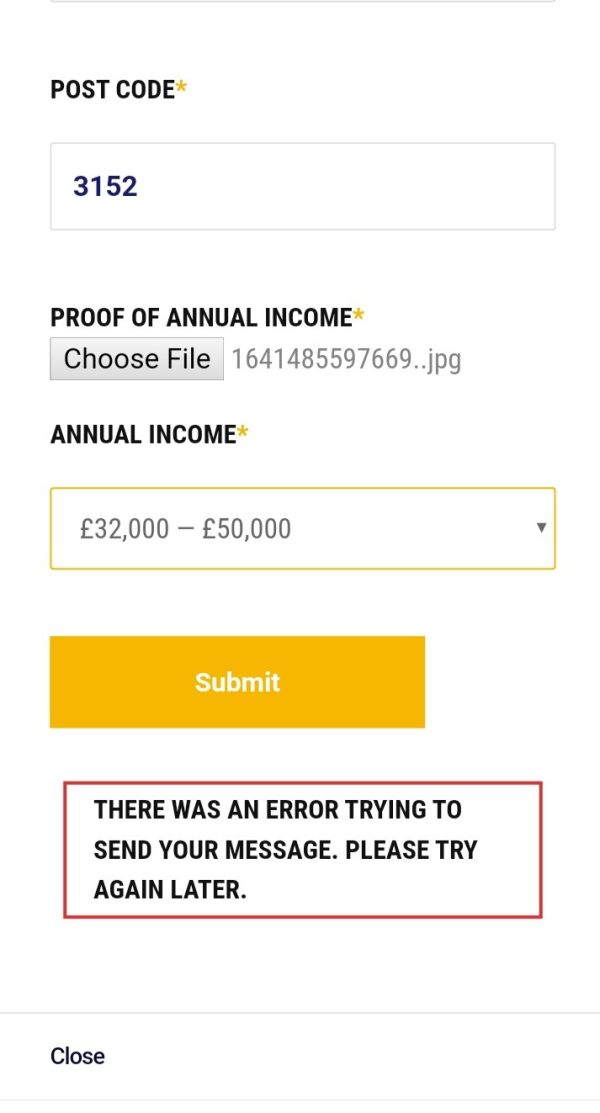

When I entered my account at this broker, I got a 404 error, but i when I invested my money, I can do absolutely nothing, because it was stolen. I want to make a call to this company, but nobody answered it.

NETX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

When I entered my account at this broker, I got a 404 error, but i when I invested my money, I can do absolutely nothing, because it was stolen. I want to make a call to this company, but nobody answered it.

This netx review gives you a complete look at NetX's financial technology solutions and investment management platforms. NetX works through two main platforms: NetX Software for digital asset management and NetXInvestor for investment account management. The company has helped over 1 million businesses with their digital asset management needs. This makes it a major player in the financial technology sector.

NetX focuses on providing secure platforms for managing investments and accessing account information through their modern custodial experience framework. The company targets both enterprise clients who need advanced digital asset management solutions and individual investors who want reliable investment account management services. However, this review stays careful because there's limited public information about specific regulatory details, trading conditions, and complete service offerings.

The platform uses technology designed to help advisors serve more clients effectively. This suggests a business-to-business focus alongside their direct investor services. NetXInvestor provides a secure environment for investment management, though detailed regulatory compliance information was not easy to find in current documentation.

This netx review uses publicly available information and user feedback analysis. Readers should know that specific regulatory details, regional restrictions, and complete service terms were not fully detailed in available sources. The evaluation method combines platform functionality analysis with available user testimonials and company documentation.

Current information sources did not provide detailed regulatory compliance data or specific jurisdictional differences. This limits the scope of this assessment. Potential users should verify regulatory status and service availability in their regions before using NetX services.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Insufficient information available |

| Tools and Resources | 8/10 | Strong digital asset management platform and investment tools |

| Customer Service | N/A | Limited information on support services |

| Trading Experience | N/A | Insufficient platform performance data |

| Trust and Reliability | N/A | Limited regulatory information available |

| User Experience | N/A | Insufficient user feedback data |

NetX works as a financial technology company that provides digital asset management solutions and investment account management services. The company's business model centers around two primary platforms: NetX Software, which serves as a complete digital asset management solution, and NetXInvestor, which functions as an investment account management platform designed for secure access to investment information and portfolio management.

The company has built its market position by helping over 1 million businesses with their digital asset management requirements. This large client base shows significant market reach in the enterprise digital asset management sector. NetX positions itself as a technology provider focused on empowering modern custodial experiences and enabling advisors to serve more clients through better technological capabilities.

NetX's platform design supports both institutional and individual users. NetXInvestor specifically handles investment management needs while NetX Software addresses broader digital asset management requirements. The company emphasizes transformation and enhanced environmental adaptation in the financial services sector, suggesting a forward-looking approach to financial technology development.

However, specific details about company establishment dates, regulatory oversight, and detailed operational frameworks were not fully available in current documentation. This limits the depth of background analysis possible for this netx review.

Regulatory Jurisdiction: Current available documentation does not specify primary regulatory authorities or jurisdictional compliance details for NetX operations.

Deposit and Withdrawal Methods: Specific payment processing methods and financial transaction procedures are not detailed in available sources.

Minimum Deposit Requirements: Minimum account funding requirements are not specified in current documentation.

Promotional Offers: Information about bonus structures or promotional campaigns is not available in reviewed sources.

Tradeable Assets: While digital asset management is mentioned, specific asset categories and investment instruments are not fully detailed.

Cost Structure: Fee schedules, commission rates, and pricing models are not clearly outlined in available documentation.

Leverage Options: Leverage ratios and margin trading capabilities are not specified in current sources.

Platform Selection: NetX operates primarily through NetX Software for digital asset management and NetXInvestor for investment account management.

Geographic Restrictions: Regional availability and service limitations are not detailed in available information.

Customer Support Languages: Multilingual support capabilities are not specified, though some interface language options appear available.

This netx review acknowledges these information limitations while focusing on available platform functionality and service descriptions.

The evaluation of NetX's account conditions faces major limitations because there's not enough publicly available information about account types, structures, and requirements. Current documentation does not provide detailed specifications about different account categories, minimum deposit thresholds, or account opening procedures that would typically inform this assessment.

Available sources show that NetXInvestor provides secure platform access for investment management. But specific account tier structures, eligibility requirements, or specialized account features such as Islamic-compliant options are not documented in reviewed materials. The platform appears designed to accommodate both individual investors and institutional clients, given the emphasis on advisor-client relationships and enterprise digital asset management capabilities.

Without complete account condition details, potential users cannot properly assess whether NetX's offerings align with their specific requirements or compare terms against industry standards. The absence of clear minimum deposit information, account maintenance fees, or tier-based benefit structures represents a significant information gap in this netx review.

Industry best practices typically require transparent disclosure of account terms, conditions, and requirements. The limited availability of such information may concern potential clients seeking detailed service comparisons before platform selection.

NetX shows strong capabilities in the tools and resources category, earning an 8/10 rating based on their complete digital asset management platform and investment management solutions. The company's NetX Software platform serves as a robust digital asset management solution, reportedly supporting over 1 million businesses in managing their digital assets effectively.

NetXInvestor adds to the tool suite by providing secure investment account management capabilities. This enables users to access investment information and manage portfolios through a dedicated platform. The emphasis on "technology designed to help advisors help more people" suggests advanced tools aimed at enhancing advisor productivity and client service capabilities.

The platform design appears built for scalability and modern custodial experiences. This indicates investment in contemporary financial technology infrastructure. However, specific details about analytical tools, research resources, automated trading capabilities, or educational materials are not fully documented in available sources.

While the core platform functionality appears robust based on the substantial client base and business focus, the lack of detailed tool specifications limits the ability to provide more specific analysis. This includes analysis of specific features, integrations, or advanced functionality that sophisticated users might require.

The assessment of NetX's customer service and support capabilities is significantly limited by the absence of detailed information about support channels, availability, response times, and service quality metrics in available documentation. Current sources do not provide complete details about customer support infrastructure, staffing, or service level commitments.

While NetXInvestor emphasizes secure platform access and investment management capabilities, specific information about user support mechanisms, troubleshooting assistance, or client onboarding support is not readily available. The platform's focus on serving advisors and enterprise clients suggests some level of professional support infrastructure, but details remain unspecified.

Industry standards typically include multiple support channels such as phone, email, live chat, and complete help documentation. The availability and quality of these services for NetX users cannot be properly assessed based on current information sources. Response time commitments, support availability hours, and multilingual capabilities are similarly undocumented.

The absence of readily available customer service information may indicate either limited transparency in service communication or gaps in publicly accessible support documentation. Potential users would benefit from direct inquiry about support capabilities before platform adoption.

Evaluating NetX's trading experience presents challenges due to limited specific information about platform performance, execution quality, and trading functionality in available documentation. While NetXInvestor provides investment account management capabilities, detailed specifications about trading execution, platform stability, order processing speeds, and trading environment characteristics are not fully available.

The platform's emphasis on modern custodial experiences and advisor-focused technology suggests attention to user experience design. But specific performance metrics, uptime statistics, or execution quality data are not documented in reviewed sources. Mobile platform capabilities, cross-device synchronization, and trading interface features remain unspecified.

NetX's focus on serving over 1 million businesses implies substantial platform capacity and reliability requirements. This could indicate robust infrastructure supporting trading operations. However, without specific performance data, execution speed metrics, or user experience testimonials, the trading experience quality cannot be properly assessed in this netx review.

Industry best practices include transparent reporting of execution statistics, platform performance metrics, and user satisfaction data. The limited availability of such information represents a significant gap for potential users seeking to evaluate trading experience quality against alternative platforms.

The assessment of NetX's trust and reliability faces substantial limitations due to insufficient information about regulatory compliance, oversight mechanisms, and transparency measures in available documentation. Current sources do not provide detailed regulatory status, licensing information, or compliance frameworks that typically inform trust evaluations.

While NetX reports serving over 1 million businesses, which suggests operational stability and market acceptance, specific details about regulatory oversight, fund security measures, audit procedures, or compliance certifications are not readily available. NetXInvestor's emphasis on secure platform access indicates attention to security considerations, but complete security infrastructure details remain unspecified.

Industry trust factors typically include regulatory compliance verification, segregated fund management, regular auditing, and transparent operational reporting. The absence of readily available information about these critical trust elements limits the ability to provide complete reliability assessment. Third-party evaluations, regulatory standing, or independent security assessments are not documented in current sources.

The company's substantial client base suggests some level of market confidence. But without detailed regulatory and security information, potential users cannot properly assess trustworthiness against industry standards or regulatory requirements in their jurisdictions.

User experience evaluation for NetX is limited by the lack of complete user feedback, interface design details, and usability assessments in current documentation. While the platform emphasizes modern custodial experiences and advisor-focused technology, specific user satisfaction metrics, interface design principles, or usability testing results are not documented in available sources.

NetXInvestor's focus on secure investment account access suggests attention to user experience considerations, particularly regarding security and accessibility. The platform's ability to serve over 1 million businesses implies scalable user experience design capable of accommodating diverse user requirements and usage patterns.

However, specific information about registration processes, account verification procedures, platform navigation, mobile experience quality, or common user challenges is not readily available. User testimonials, satisfaction surveys, or experience improvement initiatives are similarly undocumented in reviewed materials.

The absence of detailed user experience information limits the ability to assess platform usability, learning curves, or user satisfaction levels that would typically inform platform selection decisions. Potential users would benefit from trial access or direct user feedback collection before committing to platform adoption.

This netx review reveals a financial technology company with significant market presence, having reportedly assisted over 1 million businesses through their digital asset management solutions. NetX's dual-platform approach, featuring NetX Software for digital asset management and NetXInvestor for investment account management, demonstrates a complete service offering designed for both enterprise and individual users.

The platform's strongest attribute appears to be its tools and resources capabilities, earning high marks for robust digital asset management functionality and investment management solutions. The emphasis on modern custodial experiences and advisor-enabling technology suggests forward-thinking platform development aligned with industry evolution trends.

However, this evaluation identifies significant information gaps regarding regulatory compliance, specific service terms, customer support infrastructure, and detailed user experience data. The absence of transparent regulatory information, fee structures, and complete service documentation limits the ability to provide complete assessment for potential users. NetX may be suitable for users prioritizing digital asset management capabilities and investment account management, but prospective clients should conduct thorough due diligence regarding regulatory status, service terms, and support capabilities before platform adoption.

FX Broker Capital Trading Markets Review