CoinFirst 2025 Review: Everything You Need to Know

Executive Summary

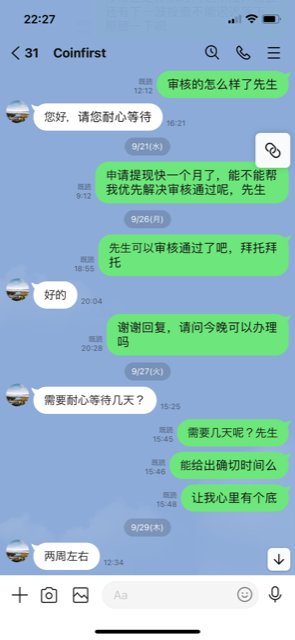

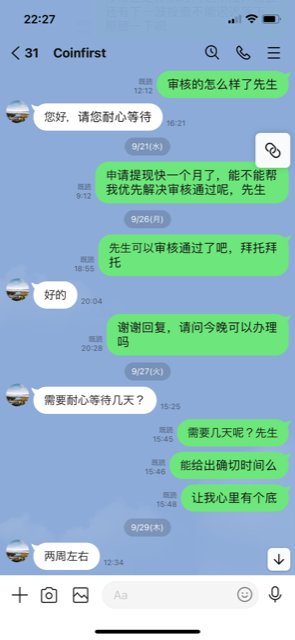

This coinfirst review shows concerning findings about the broker's legitimacy and operational status. CoinFirst's trust ratings vary significantly across different domains, with coinfirst.vip showing particularly low trust scores of only 25%, indicating potential risks for investors. The broker allegedly operates as a financial brokerage company registered in China. However, verification of this claim remains problematic.

Key concerns emerge from our analysis, including the lack of valid regulatory oversight and questionable website accessibility. According to available reports, CoinFirst allegedly does not fall under any valid regulations, which raises serious questions about investor protection and fund security. The inconsistent trust ratings across different CoinFirst domains suggest users should exercise extreme caution. CoinFirst.us scores 74 points and coinfirst.io appears potentially legitimate while coinfirst.vip scores poorly.

This broker may appeal to investors interested in high-risk trading opportunities. However, the absence of clear regulatory compliance and transparent operational information makes it unsuitable for most retail traders seeking secure trading environments.

Important Notice

CoinFirst operates through multiple domains with varying legitimacy and regulatory status across different regions. Users must carefully evaluate which specific CoinFirst entity they are considering, as legal compliance and safety standards may differ significantly between platforms. The coinfirst.vip domain shows particularly concerning trust indicators that warrant serious consideration.

This review is based on publicly available information and user feedback. Due to limited access to comprehensive operational details and the broker's questionable website accessibility, we were unable to verify all aspects of their services. Potential users should conduct additional due diligence before making any financial commitments.

Rating Framework

Broker Overview

CoinFirst presents itself as a financial brokerage company allegedly registered in China. The exact founding date and comprehensive company background remain unclear from available sources. The broker's corporate structure and ownership details are not transparently disclosed, which raises initial concerns about operational transparency. According to reports, the company operates through multiple domain variants, each potentially offering different services or targeting different geographical markets.

The broker's business model and core operational focus are not clearly defined in available documentation. This lack of clarity extends to their primary service offerings, target market segments, and competitive positioning within the financial services industry. Such opacity in fundamental business information typically indicates either a very new operation or potential concerns about legitimacy.

Regarding trading infrastructure, specific information about CoinFirst's trading platforms, available asset classes, and execution models is notably absent from accessible sources. Most established brokers provide detailed information about their MetaTrader offerings, proprietary platforms, or web-based solutions, but this coinfirst review finds such details lacking. The absence of clear information about tradeable instruments, whether forex, CFDs, cryptocurrencies, or other assets, further complicates any assessment of the broker's actual capabilities and market focus.

Regulatory Status: CoinFirst allegedly does not fall under any valid regulations, according to available reports. This absence of regulatory oversight represents a significant concern for potential clients seeking protected trading environments.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources. This makes it difficult for potential clients to understand funding options.

Minimum Deposit Requirements: The minimum initial deposit amount required to open accounts with CoinFirst is not specified in accessible documentation. This prevents accurate cost assessment for entry-level traders.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not provided in available materials. This suggests either absence of such programs or lack of transparent marketing practices.

Available Trading Assets: The range of tradeable instruments, including currency pairs, commodities, indices, or other financial products, is not clearly outlined in accessible broker information.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs remains undisclosed. This makes cost comparison with other brokers impossible. This coinfirst review cannot provide specific fee analysis due to information unavailability.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in available documentation.

Platform Options: Specific trading platform availability, whether MetaTrader 4, MetaTrader 5, or proprietary solutions, is not detailed in accessible sources.

Regional Restrictions: Geographic limitations or country-specific access restrictions are not clearly outlined.

Customer Support Languages: Available support languages and communication channels are not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for CoinFirst receives a concerning 3/10 rating primarily due to the complete absence of detailed account information in available sources. Established brokers typically provide comprehensive details about different account tiers, minimum deposit requirements, and specific features associated with each account type. However, this coinfirst review finds no such transparency from CoinFirst.

Standard account opening procedures, verification requirements, and documentation needed for different account types are not outlined in accessible materials. This lack of clarity makes it impossible for potential clients to understand what they're committing to before beginning the registration process. Most legitimate brokers clearly explain their KYC procedures, acceptable identification documents, and timeline for account approval.

The absence of information about special account features, such as Islamic accounts for Muslim traders, VIP accounts for high-volume clients, or demo accounts for practice trading, suggests either limited service offerings or poor communication of available options. Additionally, no information is available about account maintenance fees, inactivity charges, or minimum balance requirements that might apply to different account types.

Without clear account terms and conditions, potential clients cannot make informed decisions about whether CoinFirst's offerings align with their trading needs and risk tolerance levels.

CoinFirst receives a disappointing 2/10 rating for tools and resources due to the complete lack of information about trading tools, analytical resources, and educational materials. Professional brokers typically offer comprehensive suites of trading tools including technical indicators, charting packages, economic calendars, and market analysis resources.

The absence of details about research capabilities, daily market commentary, or expert analysis suggests either minimal resource allocation to client education or poor presentation of available materials. Most established brokers provide regular market updates, trading signals, and educational webinars to support client success.

Educational resources, which are crucial for developing trader skills, appear to be either non-existent or not properly communicated. This includes the absence of information about trading guides, video tutorials, risk management education, or platform training materials that responsible brokers typically provide.

Automated trading support, including Expert Advisor compatibility, API access, or copy trading features, is not mentioned in available sources. This limitation could significantly impact traders who rely on algorithmic strategies or social trading approaches.

Customer Service and Support Analysis

The customer service evaluation yields a 3/10 rating due to insufficient information about support quality, availability, and communication channels. Reliable customer support is fundamental to successful broker-client relationships, yet CoinFirst provides minimal transparency about their support infrastructure.

Contact methods, including phone numbers, email addresses, live chat availability, and support ticket systems, are not clearly outlined in accessible materials. This lack of clear communication channels raises concerns about how clients would resolve issues or seek assistance when needed.

Response time expectations, support availability hours, and service level commitments are not specified. This makes it impossible to assess whether CoinFirst can provide timely assistance during critical trading situations. Professional brokers typically guarantee response times and maintain 24/5 or 24/7 support during market hours.

Multi-language support capabilities, which are essential for international brokers, are not detailed in available sources. This could indicate limited geographic reach or inadequate support for non-English speaking clients.

The absence of user testimonials about support experiences or case studies demonstrating problem resolution effectiveness further contributes to concerns about service quality and reliability.

Trading Experience Analysis

CoinFirst receives a 2/10 rating for trading experience due to the lack of concrete information about platform performance, execution quality, and user satisfaction. Trading experience encompasses platform stability, order execution speed, slippage rates, and overall user interface quality - none of which are adequately documented.

Platform reliability data, including uptime statistics, server response times, and system maintenance schedules, are not provided in available sources. This information is crucial for traders who need consistent access to markets, especially during volatile periods or major economic announcements.

Order execution quality metrics, such as average execution speeds, rejection rates, and slippage statistics, are not disclosed. Professional brokers typically provide transparency about their execution quality to demonstrate commitment to fair trading conditions.

Mobile trading capabilities and cross-device synchronization features are not detailed in accessible materials. Modern traders expect seamless experiences across desktop, web, and mobile platforms, but CoinFirst's mobile offerings remain unclear.

This coinfirst review cannot provide specific user experience feedback due to limited availability of verified user testimonials and performance data from independent sources.

Trust and Safety Analysis

The trust and safety evaluation reveals significant concerns, resulting in a 4/10 rating. The most critical issue is CoinFirst's alleged lack of valid regulatory oversight, which fundamentally undermines investor protection and fund security. Regulatory compliance provides essential safeguards including segregated client funds, compensation schemes, and dispute resolution mechanisms.

The mixed trust scores across different CoinFirst domains create additional confusion and concern. While CoinFirst.us receives a moderate score of 74 and coinfirst.io appears potentially legitimate, coinfirst.vip shows alarming trust indicators with only 25% credibility rating. This inconsistency suggests potential fragmentation or varying operational standards across different platforms.

Fund security measures, including client money segregation, bank partner relationships, and deposit protection schemes, are not detailed in available sources. Established brokers typically provide clear information about how client funds are protected and which banks hold segregated accounts.

Company transparency regarding ownership structure, financial statements, and corporate governance is notably lacking. Professional brokers usually provide comprehensive company information, including registration details, key personnel, and audited financial reports.

Third-party security certifications, data protection compliance, and cybersecurity measures are not documented in accessible materials. This raises concerns about platform security and personal information protection.

User Experience Analysis

The user experience evaluation receives a 3/10 rating due to insufficient feedback and limited accessibility information. User experience encompasses website navigation, account management interfaces, trading platform usability, and overall client journey satisfaction.

Overall user satisfaction metrics and testimonials are notably absent from available sources. This makes it difficult to assess real-world client experiences. Legitimate brokers typically showcase client feedback and maintain review systems to demonstrate service quality.

Website accessibility issues, including reports of inaccessible domains, suggest potential technical problems or operational instability. Reliable brokers maintain consistent website availability and professional online presence across all their platforms.

Registration and verification process experiences are not documented, leaving potential clients uncertain about onboarding complexity and timeline expectations. Smooth account opening procedures are essential for positive first impressions and client retention.

The absence of detailed user interface screenshots, platform demonstrations, or guided tours suggests either limited platform development or poor marketing communication. Professional brokers typically provide comprehensive platform overviews to help clients understand available features and functionality.

Conclusion

This coinfirst review reveals substantial concerns about the broker's legitimacy, regulatory compliance, and operational transparency. The absence of valid regulatory oversight, combined with inconsistent trust ratings across different domains and limited disclosure of essential trading information, makes CoinFirst unsuitable for most retail investors seeking secure trading environments.

While the broker might appeal to investors specifically interested in high-risk, unregulated trading opportunities, the significant information gaps and safety concerns outweigh any potential benefits. The lack of clear account conditions, trading tools, customer support details, and user experience feedback creates an environment of uncertainty that responsible traders should avoid.

Potential users should prioritize regulated brokers with transparent operations, clear fee structures, and proven track records of client protection. The financial services industry offers numerous well-established alternatives that provide the security and reliability that CoinFirst currently lacks.