Is CoinFirst safe?

Business

License

Is CoinFirst Safe or a Scam?

Introduction

CoinFirst is a financial brokerage that has emerged in the forex market, positioning itself as a platform for trading various assets, including cryptocurrencies and forex pairs. With the increasing popularity of online trading, it is crucial for traders to carefully evaluate the legitimacy and safety of brokers before investing their hard-earned money. The forex market, while offering potential profits, also harbors risks, especially when dealing with unregulated or poorly regulated brokers. This article aims to provide a comprehensive analysis of CoinFirst, utilizing various sources and criteria to assess its safety and reliability.

To conduct this investigation, we employed a multi-faceted approach that considers regulatory status, company background, trading conditions, customer experience, and risk factors. By examining these aspects, we aim to provide traders with a balanced view of whether CoinFirst is a safe trading option or if red flags indicate potential scams.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its legitimacy and safety. A well-regulated broker is typically subject to strict oversight, ensuring compliance with financial laws and providing a level of protection for traders' funds. In the case of CoinFirst, the findings are concerning. The broker has been reported to have no valid regulatory licenses, which raises significant questions about its operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | No valid regulation |

The absence of regulatory oversight for CoinFirst places it in a high-risk category. According to sources, it has been indicated that CoinFirst operates without any legitimate regulatory framework, which can expose traders to various risks, such as fraudulent activities or mismanagement of funds. This lack of regulation is a crucial point for potential investors to consider when evaluating is CoinFirst safe for trading.

Company Background Investigation

CoinFirst claims to be a financial brokerage registered in China, but details about its ownership structure and management team are sparse. The company has reportedly been in operation for around 2 to 5 years, yet there is little information available regarding its history or development. This lack of transparency is alarming, as reliable brokers typically provide detailed information about their corporate structure and key personnel.

A thorough investigation into the management team reveals a lack of professional experience in the financial sector, which raises further concerns about the broker's credibility. Additionally, the absence of a clear ownership structure and contact information for customer support can lead to skepticism regarding the broker's operations. Without transparency, it is challenging to determine is CoinFirst safe for potential investors looking for a trustworthy trading environment.

Trading Conditions Analysis

When assessing a brokerage's trading conditions, it is essential to evaluate the fee structure and any potential hidden costs. CoinFirst's trading conditions appear to be opaque, with limited information available regarding spreads, commissions, and overnight interest rates.

| Fee Type | CoinFirst | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies (0-10 USD) |

| Overnight Interest Range | N/A | Varies (0.5%-3%) |

The lack of clarity surrounding these costs may indicate that there are hidden fees that traders could encounter. Furthermore, the absence of standard trading conditions, such as competitive spreads and transparent commission structures, raises questions about the broker's integrity. Therefore, potential investors should be cautious and consider whether is CoinFirst safe for their trading activities.

Customer Funds Security

The safety of customer funds is paramount when choosing a brokerage. CoinFirst's reported lack of regulatory oversight raises significant concerns regarding its fund security measures. Reliable brokers typically implement strict protocols for fund segregation, investor protection, and negative balance protection. However, there is no evidence to suggest that CoinFirst adheres to such practices.

Without adequate fund security measures, traders risk losing their investments without recourse. Additionally, the absence of documented incidents related to fund safety or disputes further complicates the assessment of CoinFirst's reliability. As such, potential investors must carefully consider is CoinFirst safe when it comes to the security of their funds.

Customer Experience and Complaints

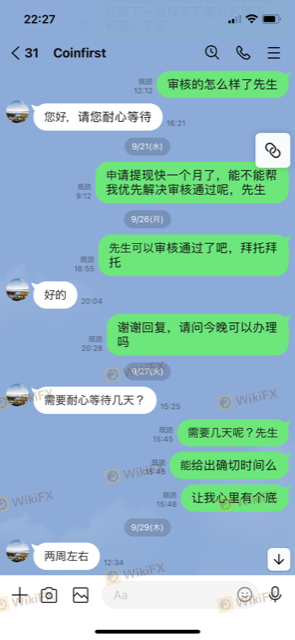

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of CoinFirst, reviews and user experiences are mixed, with numerous complaints highlighting issues related to withdrawals, customer support, and overall service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Availability | Medium | Poor |

| Account Management Issues | High | Poor |

Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and challenges in managing accounts. These issues can significantly impact the trader's experience, leading to frustration and financial losses. Given the severity of these complaints, potential investors should critically evaluate whether is CoinFirst safe for their trading needs.

Platform and Execution

The performance of a trading platform plays a crucial role in a trader's experience. CoinFirst's platform has been described as lacking in stability and user-friendliness, which can hinder effective trading. Moreover, reports of poor order execution quality, including slippage and rejections, raise additional concerns about the broker's reliability.

A reliable trading platform should provide seamless execution and minimal downtime. However, if CoinFirst's platform is prone to issues, it could negatively affect trading outcomes. Therefore, traders need to consider these factors when questioning is CoinFirst safe for their trading activities.

Risk Assessment

Using CoinFirst carries inherent risks, primarily due to its lack of regulation and transparency. Traders must be aware of the potential for financial loss and fraud.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Security Risk | High | Lack of protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

Given the high-risk factors associated with CoinFirst, it is essential for traders to implement risk mitigation strategies, such as limiting investment amounts and conducting thorough research before engaging with the broker. Understanding these risks is crucial for evaluating whether is CoinFirst safe for trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that CoinFirst raises several red flags regarding its safety and legitimacy as a forex broker. The lack of regulatory oversight, transparency, and negative customer feedback significantly undermine its credibility. Therefore, potential investors should approach CoinFirst with caution and consider alternative brokers that offer better regulatory protection and customer service.

For traders seeking reliable options, it is advisable to explore brokers regulated by reputable authorities such as the FCA, ASIC, or SEC. These brokers typically provide a safer trading environment, ensuring that traders' funds are protected and that they have access to responsive customer support. Ultimately, ensuring that is CoinFirst safe is paramount for traders looking to safeguard their investments and achieve their trading goals.

Is CoinFirst a scam, or is it legit?

The latest exposure and evaluation content of CoinFirst brokers.

CoinFirst Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CoinFirst latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.