CLSA Premium 2025 Review: Everything You Need to Know

Executive Summary

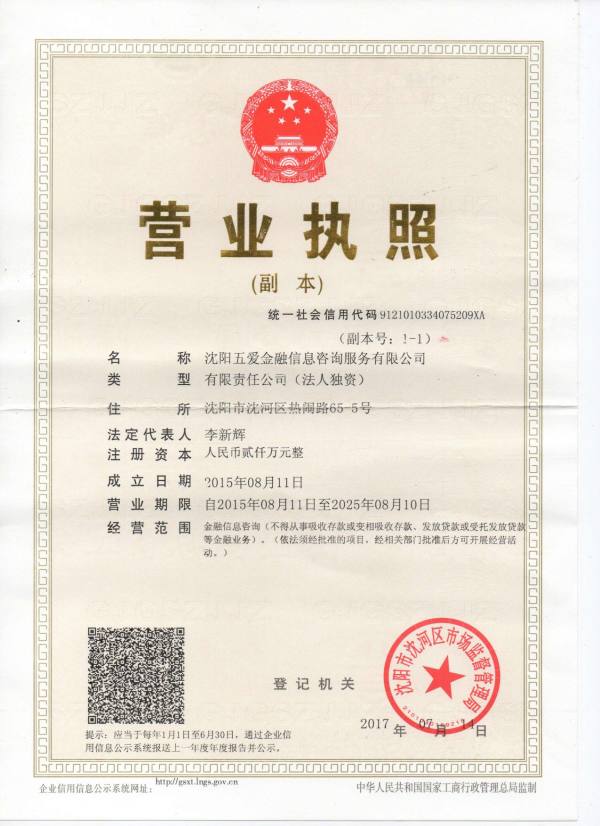

This clsa premium review gives you a complete analysis of CLSA Premium Limited. CLSA Premium is a Hong Kong-based forex broker that started in 2019, operating under the regulatory oversight of the Securities and Futures Commission of Hong Kong and positioning itself as a provider of foreign exchange trading services, commodities, and precious metals trading.

Our evaluation shows mixed results for this young broker. The company has legitimate regulatory status in Hong Kong, but significant information gaps and 86 risk warnings raise concerns about transparency and operational clarity that potential clients should carefully consider. The broker targets traders who want to participate in forex and related financial markets. Specific details about trading conditions, platforms, and user experiences remain largely hidden in available public information.

The overall assessment reflects a neutral stance due to limited user feedback and insufficient detailed information about core trading services. Traders evaluating CLSA Premium should conduct thorough research given the current information limitations and proceed with appropriate caution, understanding that regulatory warnings exist that require careful consideration.

Important Notice

Regulatory Variations: CLSA Premium operates primarily in Hong Kong under local regulatory supervision by the Securities and Futures Commission. Clients considering cross-border trading activities should be aware of compliance requirements in their respective jurisdictions and understand that regulatory protections may vary depending on their location and the specific services utilized, which can create complex legal situations for international traders.

Review Methodology: This evaluation is based on publicly available information, regulatory filings, and user feedback collected from various sources. The assessment does not reflect personal trading experience with the broker and should be considered alongside independent research and professional advice when making trading decisions that could significantly impact your financial situation.

Rating Framework

Broker Overview

CLSA Premium Limited emerged in the Hong Kong financial services landscape in 2019. The company established itself as a forex brokerage firm offering various financial trading services, operating within the competitive Asian financial markets and focusing on providing liquidity and trading support for foreign exchange, commodities, and precious metals trading. According to available information from regulatory sources, CLSA Premium positions itself as a service provider for traders seeking access to international financial markets through Hong Kong's established financial infrastructure.

The broker's business model centers on facilitating forex trading activities while maintaining compliance with Hong Kong's regulatory framework. Operating under the oversight of the Securities and Futures Commission, CLSA Premium must adhere to local financial services regulations, though specific details about their operational structure, client segregation policies, and risk management procedures are not extensively documented in publicly available materials that would help potential clients make informed decisions. This clsa premium review notes that while the company maintains legitimate regulatory status, transparency regarding core business practices could be enhanced.

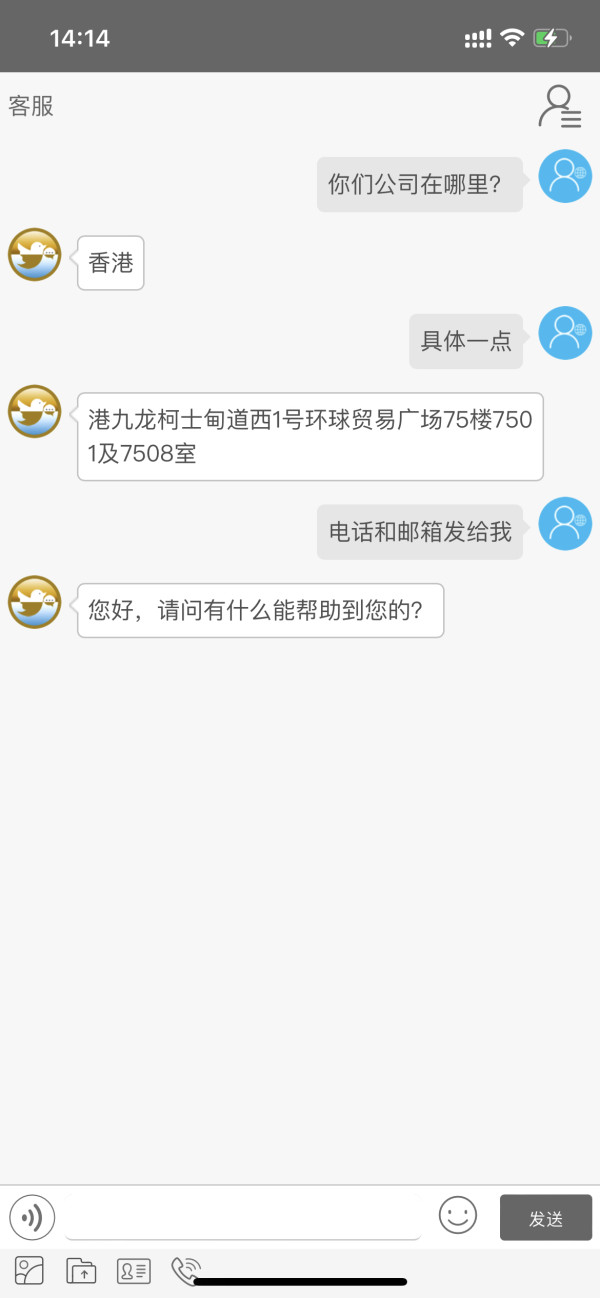

Regulatory Jurisdiction: CLSA Premium operates under the regulatory authority of Hong Kong's Securities and Futures Commission, which provides oversight for financial services firms operating within Hong Kong's jurisdiction.

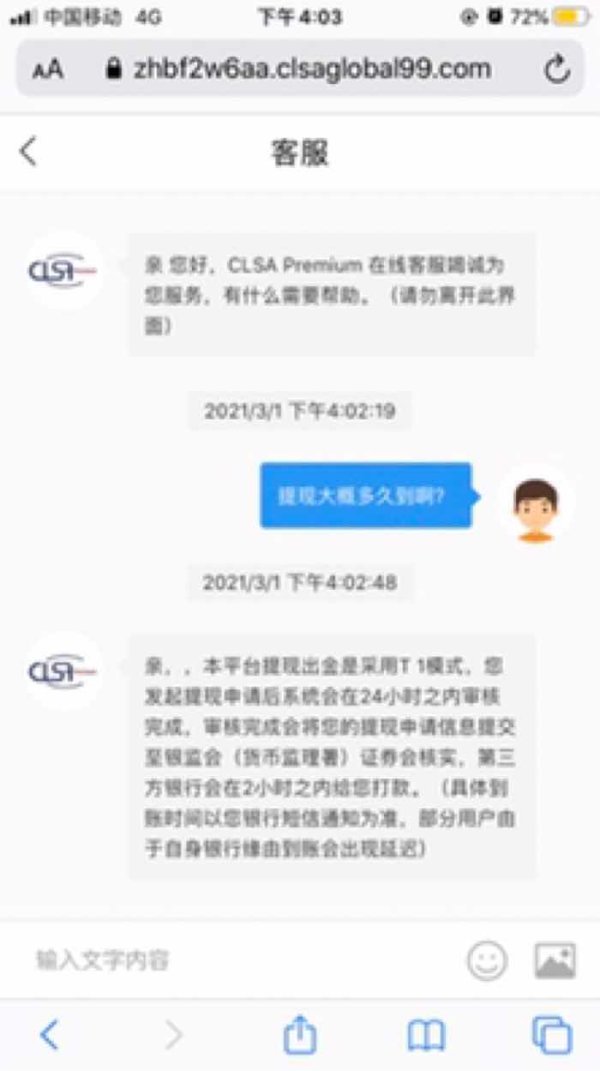

Deposit and Withdrawal Methods: Specific information about available funding methods, processing times, and associated fees is not detailed in available public documentation that would help clients understand transaction procedures.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit amounts for different account types or trading categories.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not specified in available information sources that could attract new clients.

Tradeable Assets: The broker offers access to foreign exchange markets, commodities trading, and precious metals trading. Specific instruments and market depth are not comprehensively detailed in available documentation.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs is not readily available in public documentation.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available broker information that would help traders understand risk exposure.

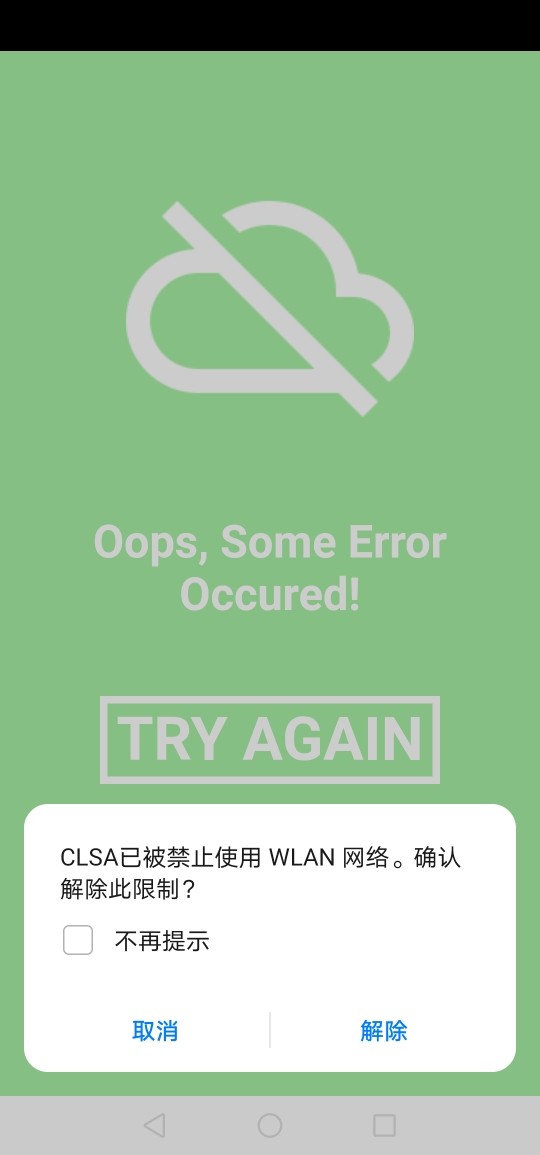

Platform Selection: Trading platform options, software compatibility, and technological infrastructure details are not comprehensively documented.

Geographic Restrictions: Specific jurisdictional limitations or restricted territories are not clearly outlined in available materials that would inform international clients.

Customer Support Languages: Available language support options for client services are not specified in current documentation.

This clsa premium review highlights the significant information gaps that potential clients should consider when evaluating this broker for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The evaluation of CLSA Premium's account conditions reveals significant information limitations that impact our ability to provide a comprehensive assessment. Available documentation does not specify the range of account types offered, whether the broker provides standard, premium, or specialized account categories, or what distinguishes different account tiers if multiple options exist for various client needs.

Minimum deposit requirements remain unspecified across available sources. This makes it difficult for potential clients to understand entry-level investment thresholds, representing a notable gap in essential trading information that most established brokers readily provide to help clients make informed decisions.

The account opening process is not detailed in accessible materials. This includes required documentation, verification procedures, and timeline expectations that new clients would need to understand before beginning their trading journey with the broker.

Additionally, specialized account features such as Islamic accounts, corporate trading accounts, or other customized solutions are not mentioned in available broker information. Without clear information about account conditions, trading terms, or client categorization procedures, potential users face uncertainty about what to expect when engaging with CLSA Premium's services, which creates additional barriers to making informed trading decisions.

The assessment of CLSA Premium's trading tools and resources reveals considerable gaps in available information. This limits our ability to evaluate the broker's technological offerings comprehensively, making it difficult for potential clients to understand what analytical support they would receive.

Research and analytical resources are not described in available materials. This includes market analysis, economic calendars, technical indicators, or fundamental research reports that many traders rely on for making informed trading decisions.

Educational resources are not mentioned in current documentation. Such resources include trading guides, webinars, tutorials, or market education programs that could help traders develop their skills and understanding of financial markets.

Automated trading support is not addressed in available broker information. This includes expert advisor compatibility, algorithmic trading capabilities, or API access for institutional clients who require advanced trading functionality. The lack of detail about technological infrastructure and tool availability suggests potential clients should conduct direct inquiries to understand what resources the broker actually provides for successful trading operations.

Customer Service and Support Analysis (5/10)

Evaluating CLSA Premium's customer service capabilities proves challenging due to limited available information about support structures. Service quality metrics and client feedback are notably absent from accessible documentation, making it difficult to assess the broker's commitment to client satisfaction.

Available documentation does not specify customer service channels. This includes whether support is provided through phone, email, live chat, or other communication methods that clients might need when issues arise.

Response time expectations, service availability hours, and support quality standards are not documented in accessible sources. This lack of transparency about service commitments makes it difficult for potential clients to understand what level of support they can expect when problems occur during their trading activities.

Multilingual support capabilities are not specified in available materials. This is particularly important for an Asian-based broker serving international clients, and given Hong Kong's international financial center status, clarity about language support options would be valuable for diverse client bases seeking assistance in their preferred languages.

User feedback about service experiences is notably absent from available sources. Without substantial client testimonials or service quality indicators, this evaluation relies primarily on the general expectation that regulated brokers maintain basic service standards for their clients.

Trading Experience Analysis (4/10)

The analysis of trading experience with CLSA Premium faces significant limitations due to insufficient information about platform performance. Execution quality and user satisfaction data are not readily available in current documentation, making it challenging to evaluate the broker's actual trading environment.

Available sources do not provide details about trading platform stability. Order execution speeds and system reliability during various market conditions remain unspecified, which are crucial factors for traders evaluating potential broker relationships.

Order execution quality is not documented in accessible materials. This includes slippage rates, requote frequency, and execution transparency that are particularly important for active trading strategies or volatile market conditions where precise execution becomes critical.

Platform functionality remains unspecified in available documentation. This includes charting capabilities, order types, risk management tools, and interface design that directly impact the daily trading experience for clients.

Mobile trading experience, cross-device compatibility, and platform accessibility features are similarly not addressed in current sources. Trading environment factors such as market depth, liquidity provision, and price feed quality are not detailed, leaving potential clients without comprehensive information about the actual trading experience they would encounter with this broker.

Trust and Reliability Analysis (6/10)

CLSA Premium's trust and reliability assessment reflects a mixed evaluation based on regulatory status and concerning warning indicators. The broker operates under the legitimate oversight of Hong Kong's Securities and Futures Commission, which provides a foundation of regulatory credibility and suggests adherence to established financial services standards that offer some protection for clients.

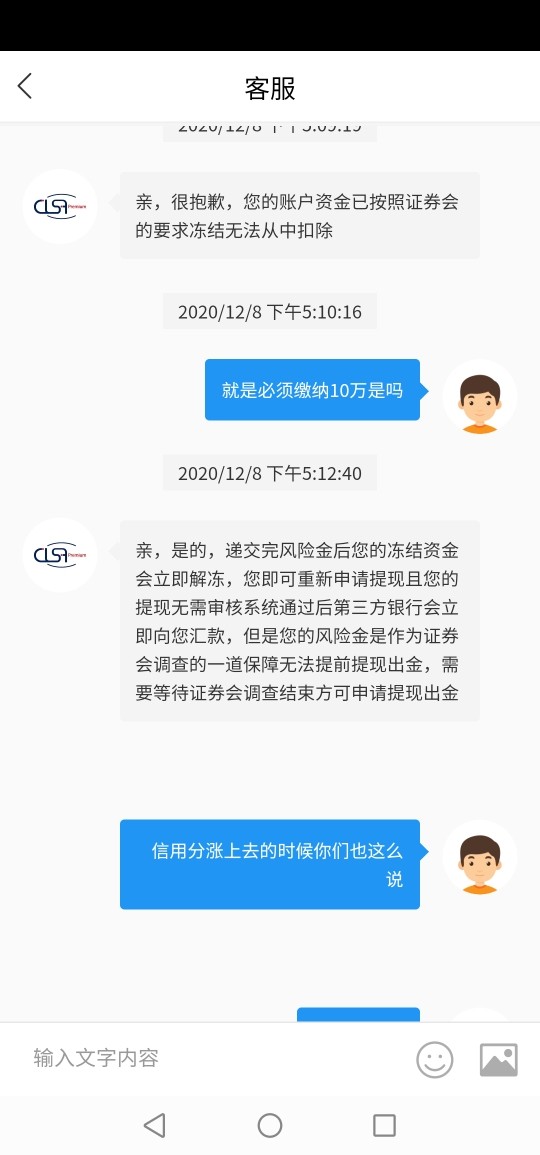

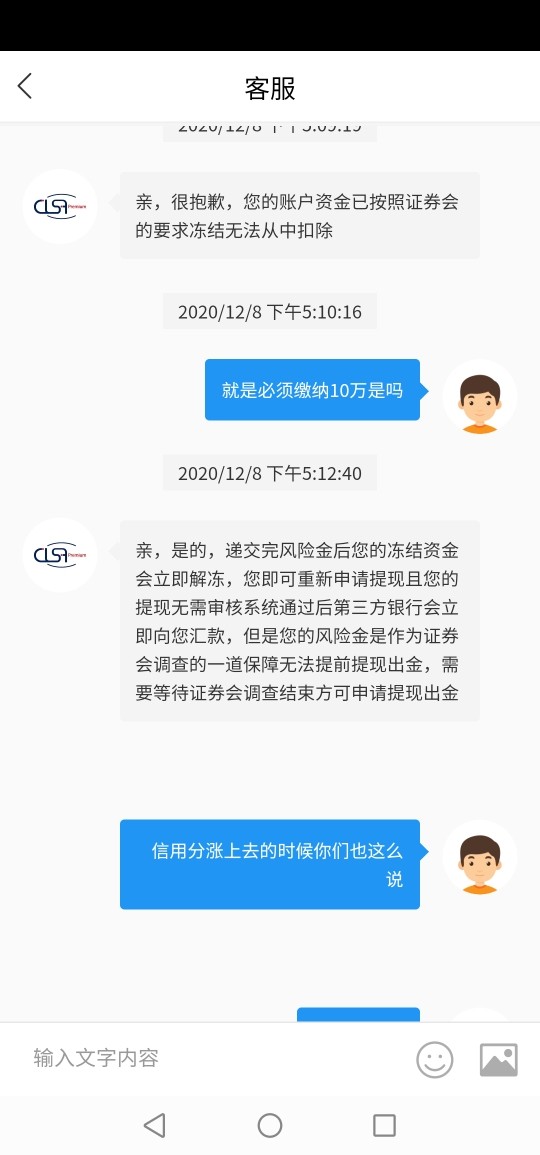

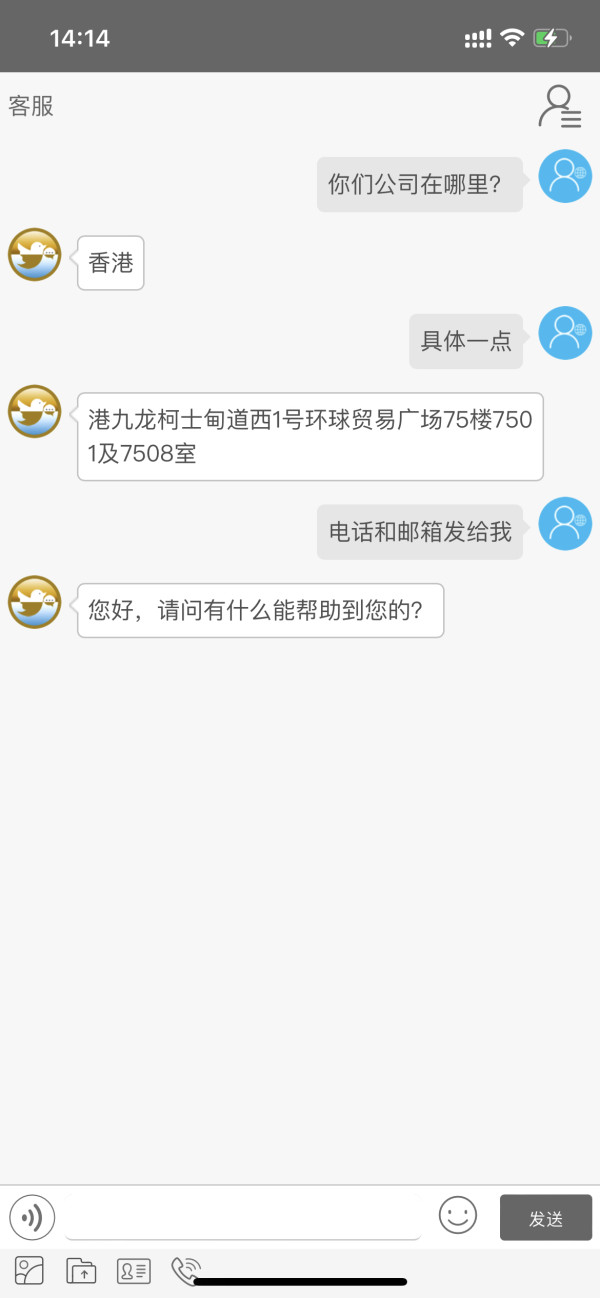

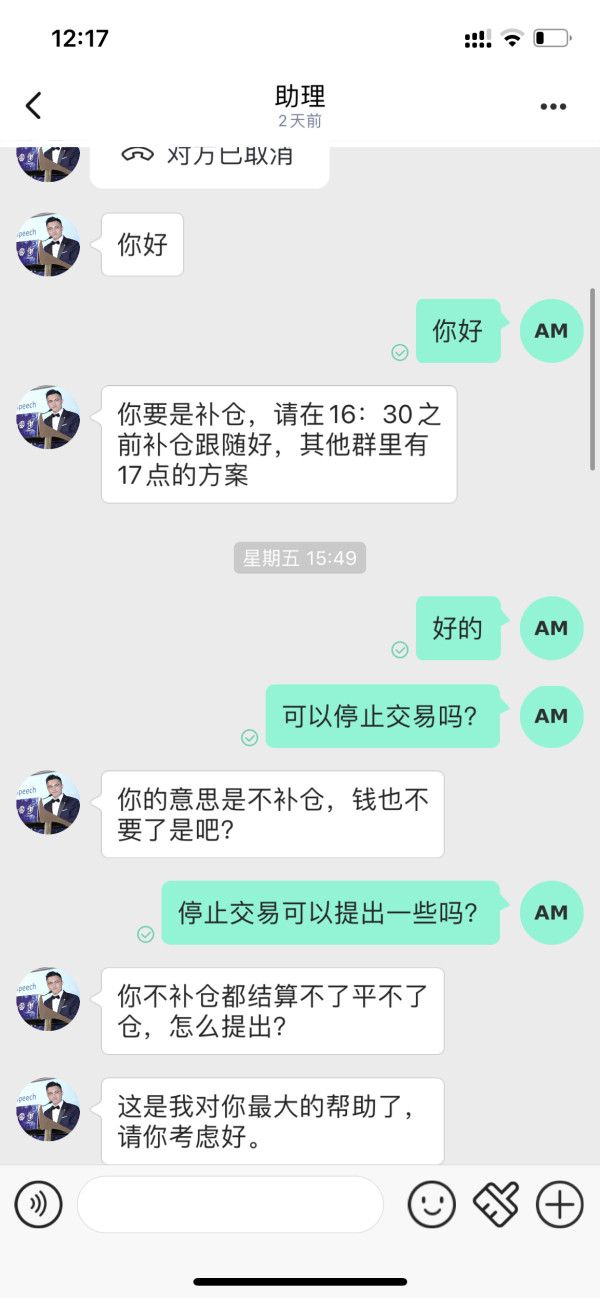

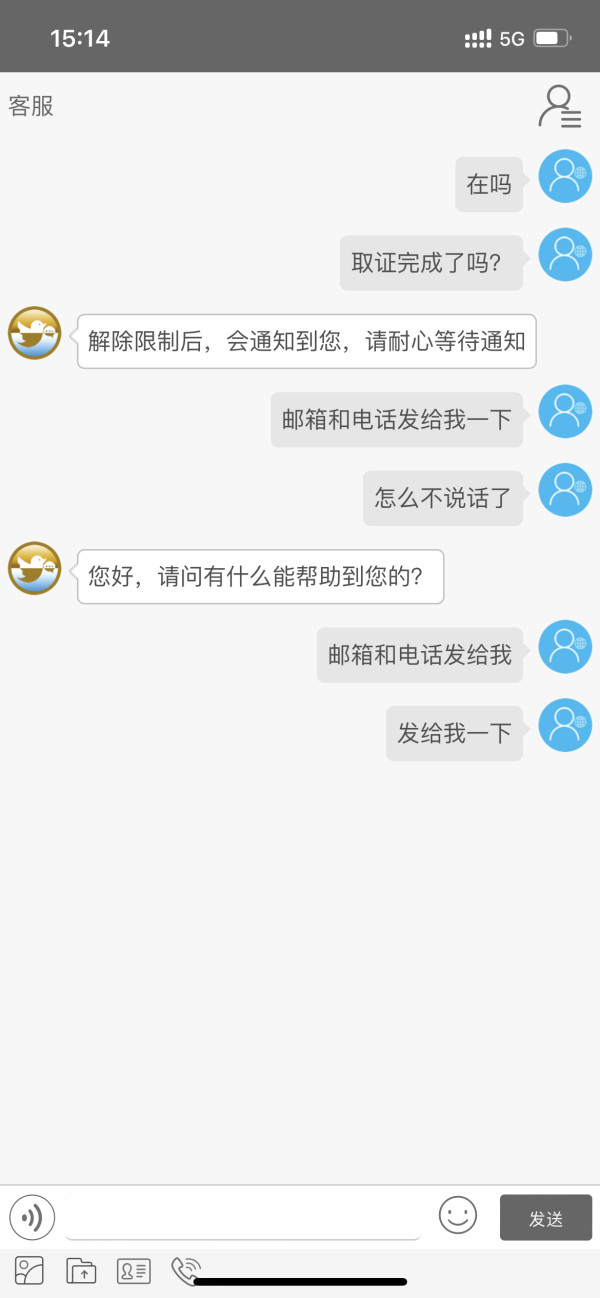

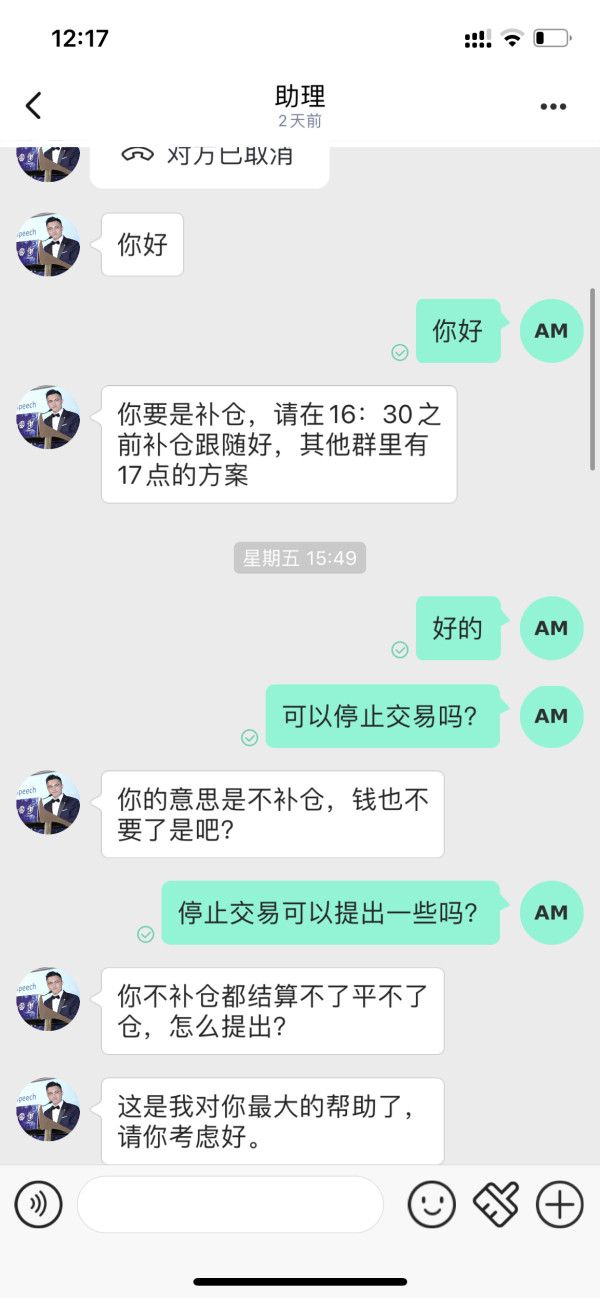

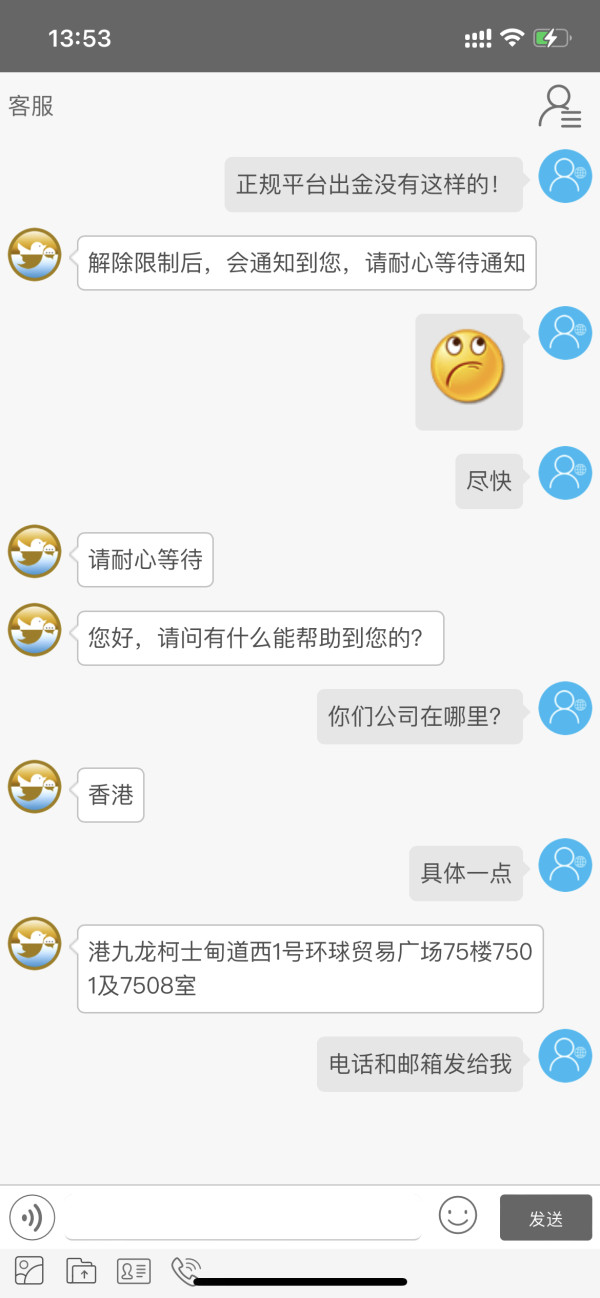

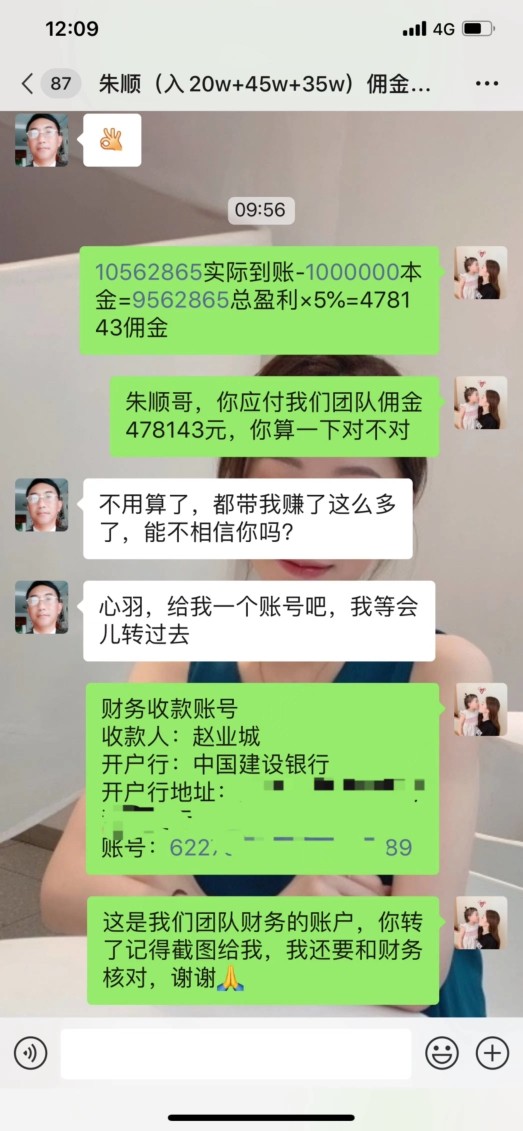

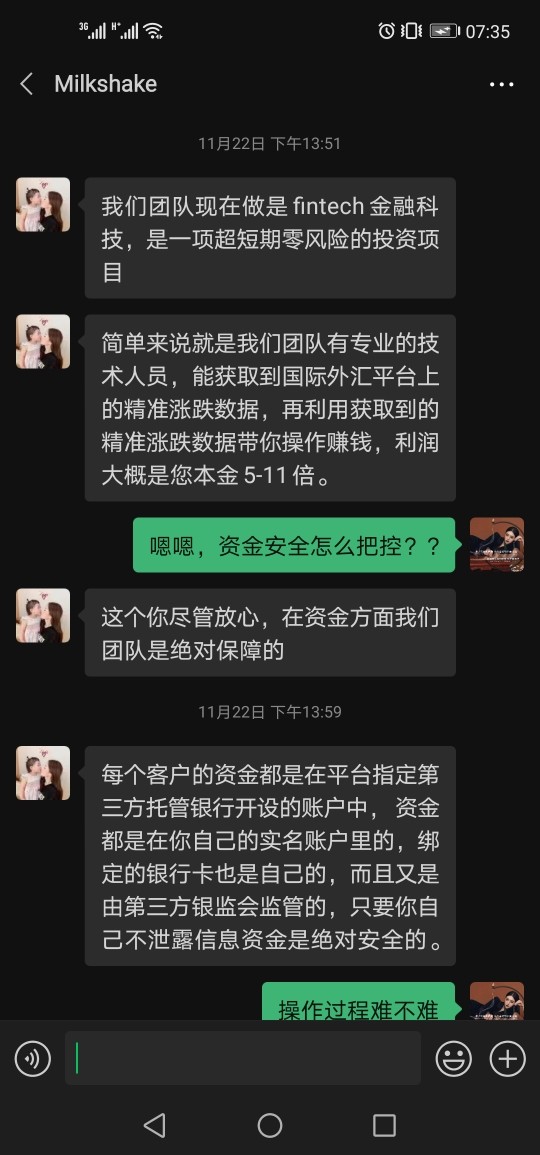

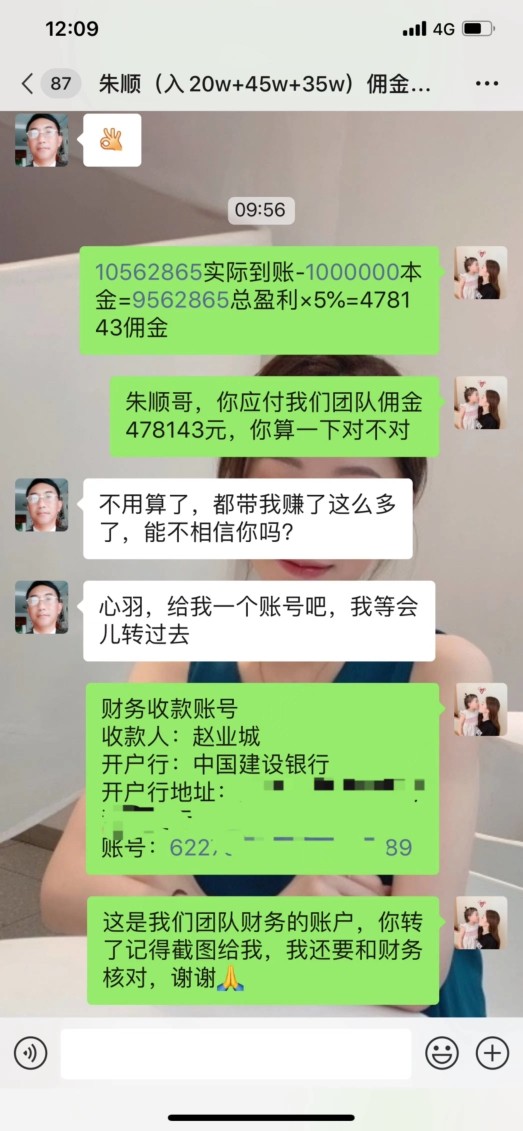

However, the presence of 86 risk warnings associated with the broker raises significant concerns. These warnings relate to operational practices, client experiences, or regulatory compliance issues that potential clients should investigate thoroughly before making any commitments.

While the specific nature of these warnings is not detailed in available sources, the volume suggests potential areas of concern. This creates a complex situation where regulatory legitimacy exists alongside substantial warning indicators that require careful evaluation.

Fund safety measures are not comprehensively detailed in available documentation. This includes client money segregation, deposit protection schemes, and institutional safeguards that should exist for a Hong Kong-regulated entity but are not transparently communicated to potential clients.

Company transparency regarding ownership structure, financial backing, operational history, and business practices could be enhanced significantly. The combination of legitimate regulatory status with substantial risk warnings creates a complex trust profile that requires careful individual evaluation by each potential client considering this broker.

User Experience Analysis (5/10)

The evaluation of user experience with CLSA Premium encounters substantial limitations due to scarce user feedback. Limited satisfaction data and insufficient detail about client interaction processes make it difficult to assess the quality of the client experience comprehensively.

Overall user satisfaction metrics, client retention rates, and experience quality indicators are not available in current documentation. This absence of feedback makes it challenging to understand how satisfied existing clients are with the broker's services and whether they would recommend the platform to other traders.

Interface design quality, platform usability, and user-friendly features are not described in accessible sources. For traders evaluating broker options, understanding the ease of platform navigation, learning curve requirements, and overall user interface quality represents important decision factors that can significantly impact their daily trading activities.

Registration and account verification processes are not detailed in available materials. This includes required documentation, approval timelines, and onboarding experience quality that new clients would encounter when starting their relationship with the broker.

Similarly, funding operation experiences, withdrawal processing efficiency, and transaction management capabilities lack comprehensive documentation in available sources. Common user complaints, frequently encountered issues, or typical client concerns are not documented, limiting the ability to identify potential problem areas or user satisfaction patterns that could inform potential clients about what to expect from their experience with CLSA Premium's services.

Conclusion

This clsa premium review concludes with a neutral assessment of CLSA Premium Limited. The assessment reflects the significant information limitations and mixed indicators encountered during evaluation, creating uncertainty about the broker's overall quality and suitability for different types of traders.

While the broker maintains legitimate regulatory status through Hong Kong's Securities and Futures Commission, the presence of 86 risk warnings and substantial gaps in publicly available information create uncertainty. These factors raise questions about operational quality and client experience that potential traders should carefully consider before making any commitments.

The broker appears most suitable for traders seeking Hong Kong-regulated forex and commodities trading services. Prospective clients should approach with considerable caution and conduct thorough research to understand the broker's actual capabilities and limitations.

The lack of detailed information about trading conditions, costs, platforms, and user experiences necessitates direct broker contact for essential decision-making information. This requirement places additional burden on potential clients to gather necessary information through direct communication rather than transparent public disclosure.

Primary advantages include regulated status and access to Asian financial markets that may appeal to certain traders. Significant disadvantages encompass information transparency issues, substantial risk warnings, and limited user feedback availability that create barriers to informed decision-making.

Potential clients should carefully weigh these factors and consider alternative broker options with more comprehensive public information and stronger user satisfaction indicators. The current information limitations make it difficult to recommend CLSA Premium without significant additional research and direct verification of trading conditions and service quality.