Regarding the legitimacy of CLSA Premium forex brokers, it provides SFC, ASIC and WikiBit, (also has a graphic survey regarding security).

Is CLSA Premium safe?

Business

License

Is CLSA Premium markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

CLSA Premium International (HK) Limited

Effective Date:

2004-10-20Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.clsapremium.comExpiration Time:

--Address of Licensed Institution:

香港香港金鐘道88號太古廣場1座8樓810室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

CA PREMIUM PTY LIMITED

Effective Date: Change Record

2003-03-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2022-11-17Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CLSA Premium Safe or a Scam?

Introduction

CLSA Premium is a financial services provider based in Hong Kong, primarily known for its offerings in the forex trading market. Established in 2019, the broker has aimed to cater to institutional clients, providing access to a wide range of financial instruments. However, the forex market is notorious for its volatility and the presence of unscrupulous operators. Thus, traders need to exercise caution and conduct thorough evaluations before engaging with any broker. This article aims to assess whether CLSA Premium is a safe trading option or if it raises red flags that could indicate fraudulent activities. Our investigation utilizes a comprehensive evaluation framework that includes regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining the safety of a forex broker. CLSA Premium claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong. However, it is essential to scrutinize the details of this regulation and its implications for traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | ALB 893 | Hong Kong | Active (but ceased regulated activities) |

Despite being regulated, it is concerning that CLSA Premium has ceased its regulated activities, which raises questions about its operational integrity. The SFC's oversight is intended to protect investors, but the cessation of these activities suggests potential instability or strategic shifts within the company. Moreover, for traders from Australia and the UK, additional licenses from local regulators such as ASIC or FCA would be necessary for compliance, and CLSA Premium does not hold these licenses, further complicating its legitimacy.

Company Background Investigation

CLSA Premium Limited has a relatively short history, having been established only in 2019. The company is a subsidiary of CLSA Group, which is known for its investment banking and brokerage services. However, the rapid establishment of the broker raises questions about its operational maturity and experience in handling client funds.

The management team of CLSA Premium comprises individuals with backgrounds in finance and investment. However, specific details regarding their experience and track record in the forex industry remain sparse. Transparency in corporate governance is critical for building trust, and the lack of detailed disclosures about the management team and ownership structure can be a cause for concern.

Furthermore, the companys website does not provide extensive information regarding its operational history or performance metrics, which could help potential clients gauge its reliability. This lack of transparency is a red flag for traders who value clear and open communication regarding their brokers.

Trading Conditions Analysis

When evaluating whether CLSA Premium is safe to trade with, it is essential to analyze the broker's trading conditions, including fees and spreads. The broker offers a range of financial instruments, including forex, commodities, and indices, but the specifics of its fee structure are not clearly outlined.

| Fee Type | CLSA Premium | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.9 pips | 1.0 pips |

| Commission Model | Not specified | $5 per lot |

| Overnight Interest Range | Not disclosed | Varies by asset |

The absence of clear information regarding commissions and overnight fees could indicate a lack of transparency that might not be in the best interest of traders. Moreover, the absence of a demo account is concerning, as it prevents potential clients from testing the platform before committing funds. This situation may lead to unexpected costs for traders who might not be fully aware of the fees associated with their trading activities.

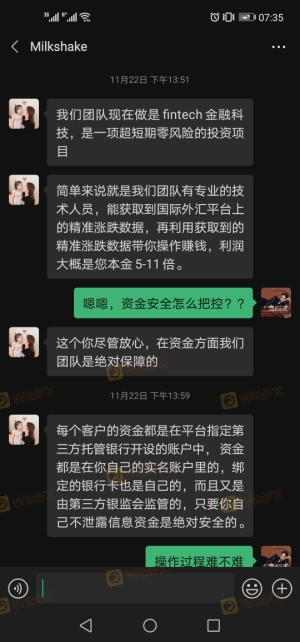

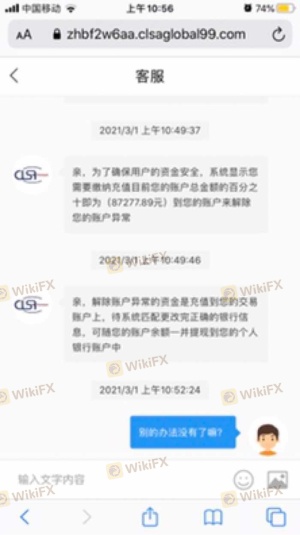

Client Funds Safety

The safety of client funds is paramount when considering whether CLSA Premium is safe. The broker claims to implement various safety measures, including segregated accounts for client funds. However, the lack of a compensation scheme or negative balance protection raises significant concerns.

Historically, CLSA Premium has faced issues related to fund security, with complaints from clients regarding difficulties in withdrawing funds. Such issues can severely impact the trustworthiness of a broker. It is crucial for traders to have assurance that their investments are secure and that they can access their funds without undue complications.

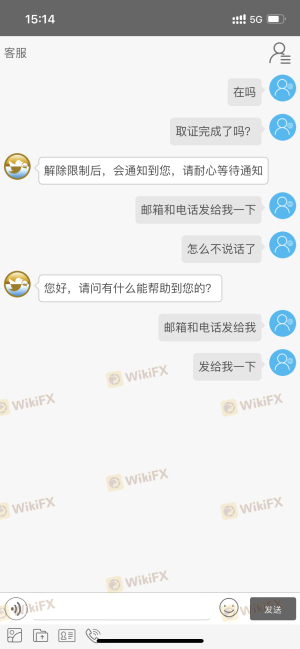

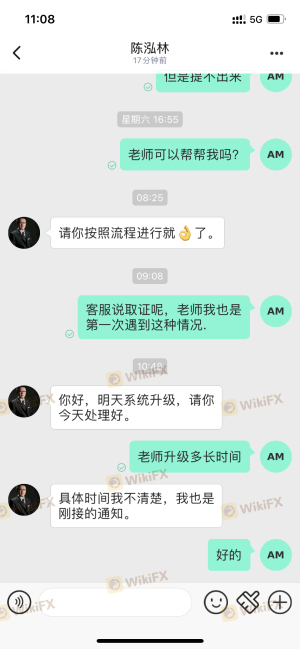

Customer Experience and Complaints

Client feedback provides valuable insights into the operational integrity of a broker. Reviews of CLSA Premium reveal a mixed bag of experiences, with several users reporting difficulties in fund withdrawals and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response, no resolution |

| Lack of Communication | Medium | Inconsistent replies |

| Hidden Fees | High | Ignored by customer support |

Common complaints include clients being unable to withdraw their funds, often citing various reasons provided by the broker. In some cases, these complaints suggest that the broker may employ tactics to delay or deny withdrawals, which is a significant red flag for any potential investor.

Platform and Execution

Evaluating the trading platform is another critical aspect of assessing whether CLSA Premium is safe. The broker offers the MT4 and MT5 platforms, which are widely recognized for their reliability and functionality. However, user experiences indicate that there may be issues with order execution, including slippage and rejections.

The platform's performance can significantly affect trading outcomes, and any signs of manipulation or irregularities in execution should be closely examined. Traders have reported instances of orders being executed at unfavorable prices, which raises concerns about the broker's operational integrity.

Risk Assessment

Using CLSA Premium carries inherent risks that potential traders should be aware of. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Ceased regulated activities raise concerns. |

| Financial Stability | High | Reports of financial difficulties and operational suspensions. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with CLSA Premium. It may also be wise to start with smaller investments until they establish a better understanding of the broker's operations.

Conclusion and Recommendations

In conclusion, while CLSA Premium presents itself as a legitimate forex broker, several factors raise significant concerns regarding its safety and reliability. The cessation of regulated activities, combined with numerous client complaints and a lack of transparency, suggest that potential traders should exercise caution.

For those considering trading with CLSA Premium, it is crucial to weigh the risks carefully. Traders who prioritize regulatory oversight and transparent operations may want to explore alternative brokers with stronger reputations and proven track records. Examples of reliable alternatives include brokers regulated by ASIC or FCA, which offer robust investor protections and clearer fee structures.

Ultimately, the question remains: Is CLSA Premium safe? The evidence suggests that potential investors should approach with caution and conduct further research before making any commitments.

Is CLSA Premium a scam, or is it legit?

The latest exposure and evaluation content of CLSA Premium brokers.

CLSA Premium Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CLSA Premium latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.