Betensh 2025 Review: Everything You Need to Know

Executive Summary

This betensh review shows major concerns about the broker's legitimacy and how it operates. Betensh Financial LTD claims to be an independent financial derivatives and forex trading service provider registered in the United Kingdom, but our investigation found no record of the company in the UK's Financial Conduct Authority registry. The broker targets forex traders and investors who want financial derivatives investment opportunities. However, user feedback shows a troubling picture.

Many sources report that Betensh has received substantial complaints and negative reviews from users who have serious doubts about the platform's credibility. The absence of proper regulatory oversight, combined with widespread user dissatisfaction, raises red flags about the broker's operational integrity. While the company claims UK registration, the lack of FCA authorization represents a critical gap in regulatory protection for potential clients. This review examines all available evidence to provide traders with essential information before considering this platform.

Important Notice

Regional Entity Differences: Betensh Financial LTD claims registration in the United Kingdom but has failed to provide valid regulatory information or demonstrate compliance with FCA requirements. Traders should know that regulatory claims without proper documentation may indicate operational irregularities.

Review Methodology: This evaluation is based on user feedback, publicly available information, and regulatory database searches. No direct platform testing was conducted due to safety concerns regarding the broker's legitimacy.

Rating Framework

Broker Overview

Betensh Financial LTD presents itself as an independent financial derivatives and forex trading service provider. The company claims registration in the United Kingdom, but the company's background raises immediate concerns as verification attempts through official UK regulatory channels have failed to confirm its legitimate status. The broker targets the forex and derivatives trading market. It appeals to investors seeking exposure to currency pairs and financial instruments, but the absence of verifiable regulatory credentials suggests potential operational issues that traders should carefully consider.

The company's business model centers on providing forex and financial derivatives trading services. However, specific details about their operational framework remain unclear, and according to available information, Betensh offers trading in forex and CFD assets, but the lack of transparency regarding their platform specifications, execution methods, and risk management protocols creates additional uncertainty. This betensh review emphasizes that the broker's failure to secure FCA regulation, despite claiming UK registration, represents a fundamental concern for potential clients seeking legitimate trading opportunities.

Regulatory Status: Betensh Financial LTD claims UK registration but lacks FCA authorization. This creates a significant regulatory gap that exposes traders to potential risks without proper oversight protection.

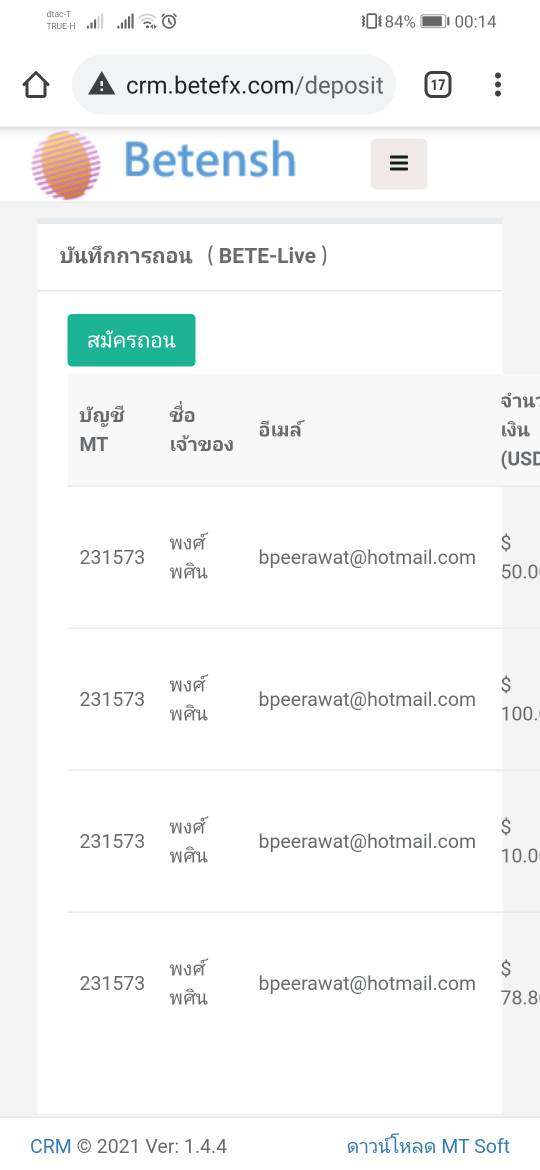

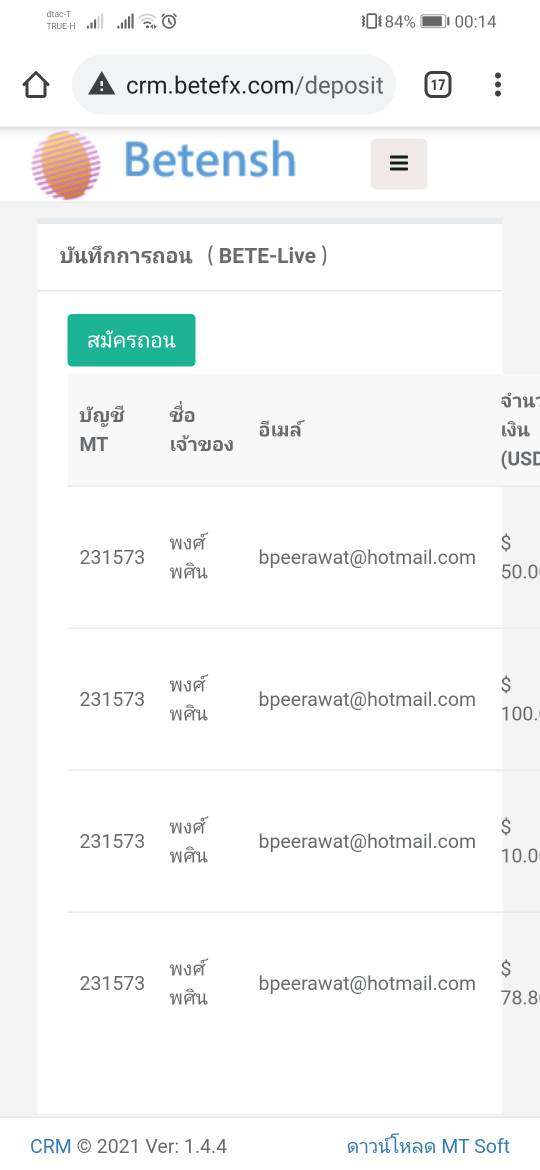

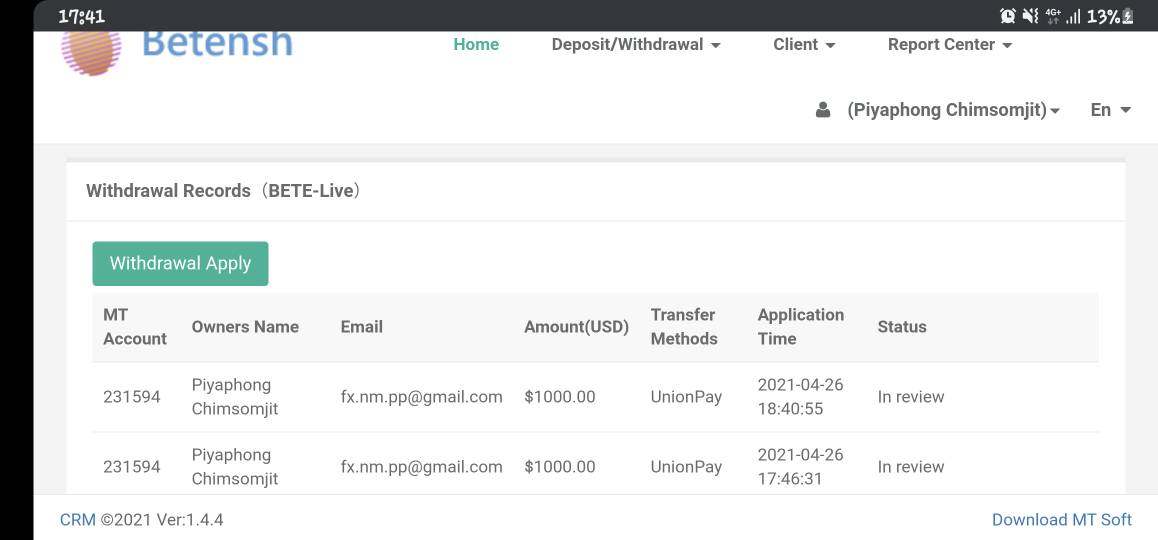

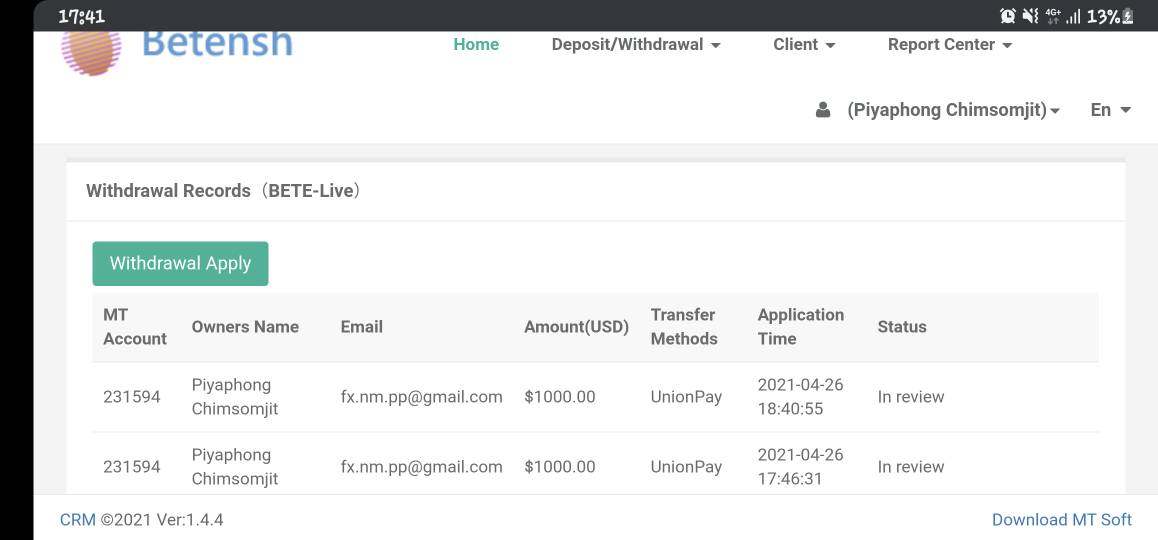

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures was not detailed in available materials. This raises questions about operational transparency.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts. This makes it difficult for potential clients to assess entry requirements.

Bonus and Promotions: No promotional offers or bonus structures were identified in available documentation. This suggests limited marketing incentives.

Tradeable Assets: The platform reportedly offers forex and financial derivatives trading. However, specific asset catalogs and available instruments remain unspecified.

Cost Structure: Detailed information about spreads, commissions, and trading fees was not available in reviewed materials. This prevents accurate cost assessment for potential traders.

Leverage Ratios: Specific leverage offerings and margin requirements were not disclosed in available information.

Platform Options: Trading platform specifications and available software solutions were not detailed in accessible materials.

Geographic Restrictions: Information about regional limitations and service availability was not specified in reviewed documentation.

Customer Service Languages: Available support languages and communication options were not identified in accessible materials. This betensh review highlights these information gaps as additional concerns for potential clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by Betensh remain largely undisclosed. This creates significant transparency issues for potential traders, and available information fails to specify account types, their distinctive features, or the requirements for accessing different service levels. This lack of clarity regarding account structures represents a fundamental operational concern. Legitimate brokers typically provide detailed account specifications to help clients make informed decisions.

The absence of clear minimum deposit requirements further complicates the evaluation process. Traders cannot assess the financial commitment needed to begin trading, and additionally, the account opening process lacks detailed documentation, making it difficult to understand verification requirements, documentation needs, and approval timelines. User feedback consistently indicates doubts about the platform's credibility. Many express concerns about the legitimacy of account-related services.

The lack of information about special account features, premium services, or institutional offerings suggests limited product development and potentially inadequate service differentiation. This betensh review emphasizes that the combination of poor user feedback and insufficient account condition transparency creates substantial risks for potential clients considering this platform.

Betensh's trading tools and educational resources appear virtually non-existent based on available information. This represents a critical deficiency in modern forex trading services, and the platform fails to provide details about analytical tools, charting capabilities, or research resources that traders typically expect from legitimate brokers. This absence of fundamental trading infrastructure raises serious questions about the platform's ability to support effective trading activities.

The lack of educational resources, market analysis, and trading guides further undermines the platform's value proposition. This is particularly problematic for newer traders who rely on broker-provided education to develop their skills, and additionally, no information exists regarding automated trading support, algorithm integration, or advanced trading features that experienced traders often require.

User complaints and negative reviews consistently highlight the platform's inadequate support infrastructure. Many express frustration about the lack of available resources, and the absence of research reports, market commentary, or analytical insights suggests minimal investment in client support services, which legitimate brokers typically prioritize to maintain competitive positioning.

Customer Service and Support Analysis (Score: 2/10)

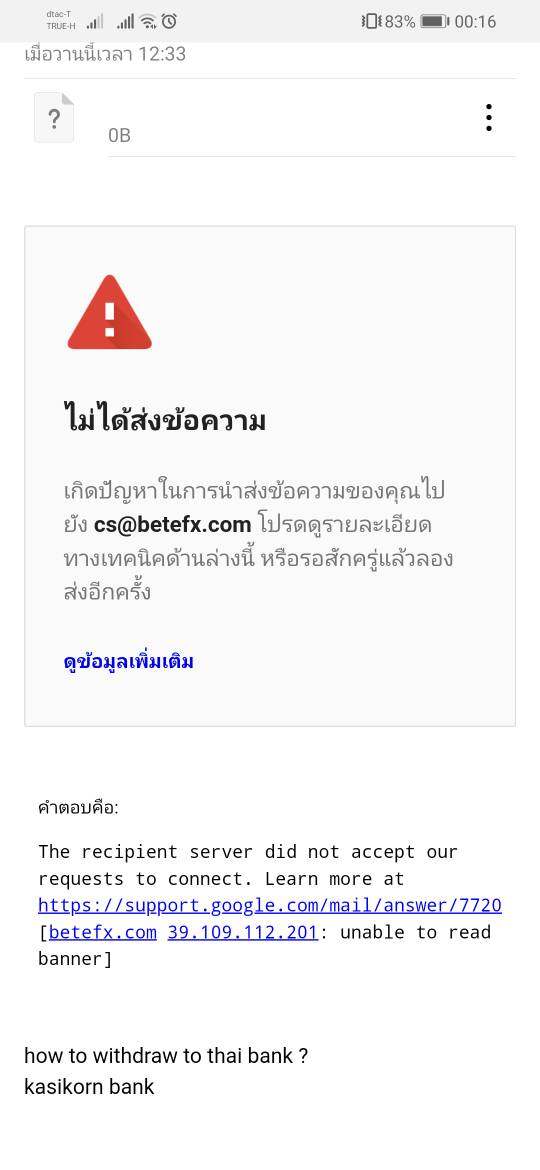

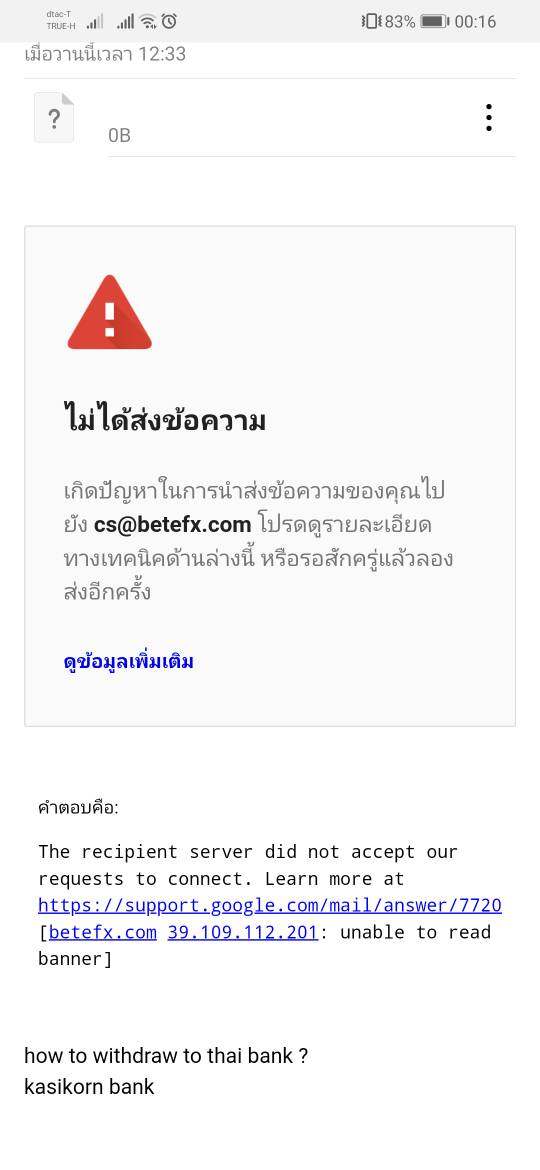

Customer service quality at Betensh appears severely compromised based on extensive user complaints and negative feedback patterns. Available information suggests that users consistently express doubts about the platform's credibility. Many report unsatisfactory experiences when attempting to resolve issues or seek assistance, and the lack of detailed information about customer service channels, availability hours, and response protocols indicates potential operational deficiencies.

Response time information remains unavailable. This prevents assessment of service efficiency and support quality standards, and the absence of documented service level agreements or customer support guarantees suggests minimal commitment to client satisfaction. Multiple user complaints point to persistent service quality issues. Many question the platform's ability to provide adequate support when needed.

The lack of information about multilingual support capabilities further limits the platform's accessibility for international clients. Additionally, no evidence exists of effective problem resolution mechanisms or customer advocacy programs that legitimate brokers typically implement to maintain client relationships and address concerns promptly.

Trading Experience Analysis (Score: 2/10)

The trading experience offered by Betensh appears fundamentally compromised based on available user feedback and operational transparency issues. Platform stability and execution speed information remains unavailable. This prevents assessment of critical performance metrics that determine trading success, and the absence of documented execution quality standards raises concerns about order processing reliability and market access capabilities.

Platform functionality details remain undisclosed. This makes it impossible to evaluate feature completeness, interface design, or trading tool integration, and mobile trading experience information is similarly absent, limiting assessment of accessibility and convenience factors that modern traders consider essential. User feedback consistently indicates credibility concerns. This suggests that trading experience quality falls significantly below industry standards.

The lack of documented trading environment specifications, including server locations, execution models, and liquidity provider relationships, creates additional uncertainty about platform reliability. This betensh review emphasizes that the combination of poor user feedback and insufficient operational transparency creates substantial risks for traders seeking reliable execution and platform stability.

Trust Level Analysis (Score: 1/10)

Betensh's trust level represents the most critical concern in this evaluation. The platform potentially operates as a fraudulent entity based on available evidence, and the company's failure to secure FCA regulation despite claiming UK registration creates a fundamental credibility gap that legitimate brokers would address through proper regulatory compliance. Verification attempts through official UK regulatory channels have failed to confirm the company's legal status. This raises serious questions about operational legitimacy.

The absence of documented fund safety measures, client protection protocols, and regulatory oversight exposes potential clients to significant financial risks without recourse mechanisms. Company transparency remains severely compromised. Minimal operational information is available for public verification, and industry reputation assessment reveals widespread concerns about the platform's legitimacy, with many sources identifying it as a potential scam operation.

Third-party evaluations consistently highlight regulatory deficiencies and operational concerns. User trust feedback overwhelmingly indicates negative experiences and credibility doubts, and the extensive complaints and negative reviews create a pattern suggesting systematic operational issues that legitimate brokers would address through improved transparency and regulatory compliance.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Betensh appears extremely low based on extensive negative feedback and credibility concerns expressed by platform users. The widespread complaints and negative reviews create a clear pattern of user dissatisfaction that extends across multiple operational areas. Interface design and usability information remains unavailable. This prevents assessment of platform accessibility and user-friendliness factors.

Registration and verification process details lack transparency. This makes it difficult for potential users to understand account setup requirements and approval procedures, and fund operation experience information similarly remains undisclosed, creating uncertainty about deposit and withdrawal processes that directly impact user satisfaction. Common user complaints consistently focus on credibility concerns and operational transparency issues.

User demographic analysis suggests the platform targets forex investment seekers. However, the extremely high risk profile makes it unsuitable for most trader categories, and the extensive negative feedback indicates systematic user experience problems that legitimate brokers would address through improved service delivery and operational transparency. Improvement recommendations include enhanced transparency measures and robust user feedback mechanisms to address persistent satisfaction issues.

Conclusion

This comprehensive evaluation reveals that Betensh represents an extremely high-risk forex trading platform that lacks essential regulatory oversight and user trust. The combination of unverified regulatory claims, extensive negative user feedback, and operational transparency deficiencies creates substantial risks for potential clients. The platform's failure to secure proper FCA authorization despite claiming UK registration represents a critical red flag that traders should not ignore.

Based on available evidence, this platform is not recommended for ordinary investors or any trader category seeking legitimate forex trading opportunities. The risk profile remains unacceptably high due to regulatory deficiencies and widespread credibility concerns. While no specific advantages were identified in available materials, the disadvantages include lack of proper regulation, extensive negative reviews, and fundamental transparency issues that compromise trader safety and operational reliability.