CGFX 2025 Review: Everything You Need to Know

Summary: CGFX, an offshore forex broker, has garnered mixed reviews, with many users expressing concerns about its regulatory status and withdrawal processes. While it offers competitive trading conditions and access to popular platforms like MetaTrader 4, the lack of robust regulation raises significant red flags for potential investors.

Note: Its essential to consider that CGFX operates under various entities across different regions, which can complicate its regulatory standing and user experiences. This review aims for fairness and accuracy, drawing from multiple sources.

Rating Overview

We score brokers based on a comprehensive analysis of user reviews, expert opinions, and factual data.

Broker Overview

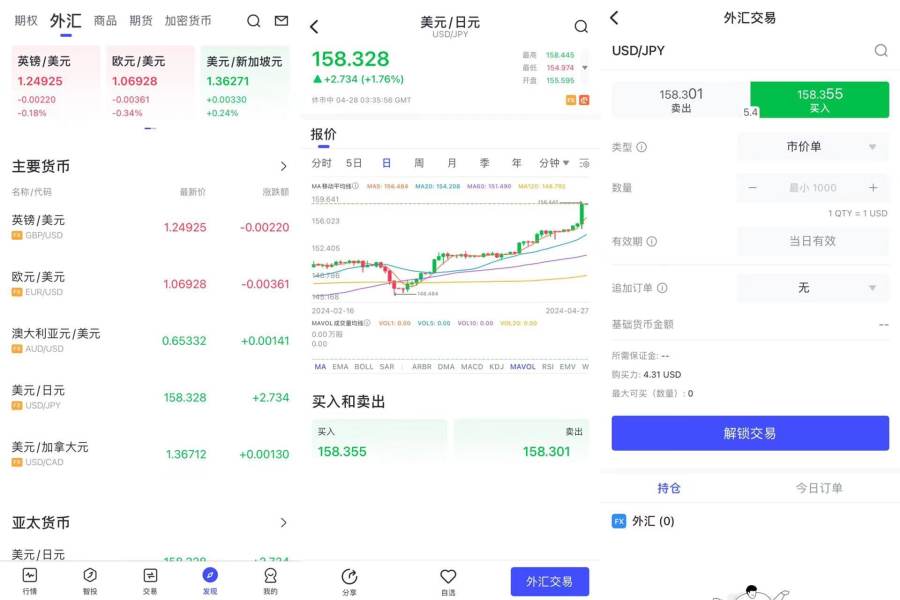

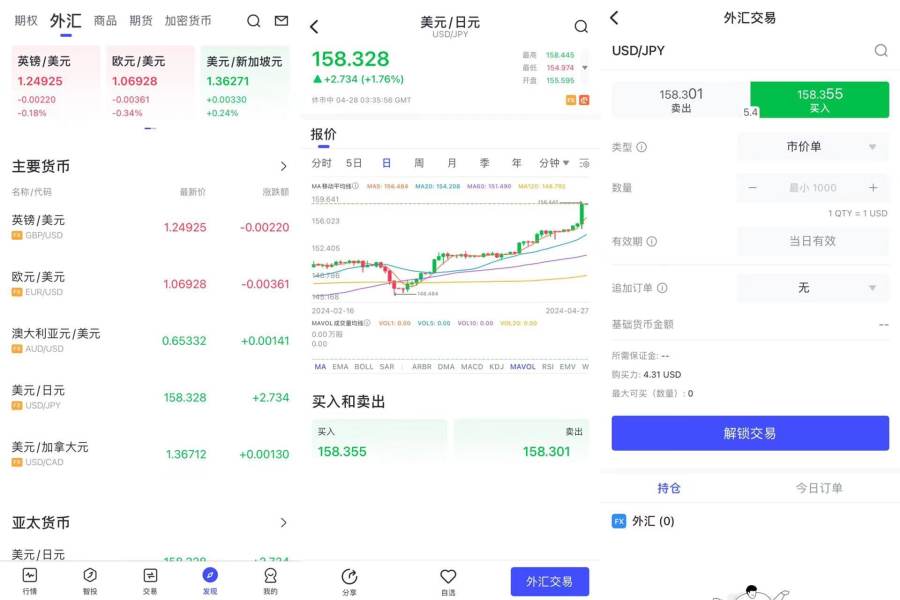

Founded in 1998 and operating under the name Commercial Group FX, CGFX is an online trading broker based in Saint Vincent and the Grenadines, with claims of regulation by the Financial Services Commission (FSC) of Mauritius. The broker primarily offers trading through the widely-used MetaTrader 4 platform and provides access to various asset classes, including forex, commodities, and indices. However, its regulatory status has raised significant concerns among users and experts alike.

Detailed Breakdown

-

Regulatory Regions: CGFX claims to be regulated by the FSC of Mauritius; however, this regulation is considered loose compared to stricter jurisdictions like the UK or Australia. The broker also mentions a connection to ASIC, but this is misleading as the entity listed is merely a technology provider, not a licensed financial service provider.

Deposit/Withdrawal Currencies: CGFX accepts deposits primarily via bank wire transfers, which can be slow and costly. Users have reported difficulties in withdrawing funds, raising concerns about the broker's reliability.

Minimum Deposit: The minimum deposit to open a live account with CGFX is reportedly $50, which is relatively accessible compared to many brokers. However, some reviews indicate that higher minimums exist for certain account types, which may limit access for smaller traders.

Bonuses/Promotions: Information regarding bonuses or promotional offers is scarce, with no significant incentives highlighted in user reviews.

Tradable Asset Classes: CGFX offers a selection of over 25 forex pairs, commodities like gold and silver, and indices. However, it lacks a broader range of assets, such as stocks and ETFs, which may limit trading opportunities for some investors.

Costs (Spreads, Fees, Commissions): The broker's spreads start from around 1.0 pips, with some accounts offering lower spreads at the cost of commissions. This pricing structure has been deemed competitive, but users have noted inconsistencies in spread offerings.

Leverage: CGFX offers leverage up to 1:400, which is significantly higher than what is permitted in many regulated markets. While this can amplify profits, it also increases the risk of substantial losses, making it a double-edged sword for inexperienced traders.

Allowed Trading Platforms: The primary trading platform is MetaTrader 4, which is well-regarded for its user-friendly interface and robust features. However, the absence of MetaTrader 5 may be a drawback for some traders looking for advanced features.

Restricted Regions: CGFX is not permitted to operate in several jurisdictions, including the United States and certain countries under economic sanctions. This limitation may affect potential clients from these regions.

Available Customer Service Languages: Customer support is primarily offered in English, with some reviews mentioning limited responsiveness and support quality.

Repeated Rating Overview

Detailed Breakdown of Ratings

-

Account Conditions (5/10): CGFX's account conditions are relatively accessible, but the minimum deposit and withdrawal difficulties have raised concerns among users.

Tools and Resources (6/10): The availability of MetaTrader 4 is a plus, but the lack of educational resources and trading tools limits the overall offering.

Customer Service and Support (4/10): User reviews indicate a lack of responsiveness and support quality, which can be frustrating for traders seeking assistance.

Trading Setup (5/10): While the trading conditions can be competitive, the high leverage and limited asset classes may not suit every trader's needs.

Trustworthiness (3/10): The lack of robust regulation and numerous user complaints about withdrawal issues significantly undermine CGFX's trustworthiness.

User Experience (4/10): Overall user experiences are mixed, with many expressing concerns about the broker's operational transparency and reliability.

In conclusion, while CGFX offers some competitive trading conditions and a popular trading platform, the concerns surrounding its regulatory status and user experiences make it a broker that requires careful consideration. Potential investors are advised to weigh these factors against their trading needs and risk tolerance before proceeding.