CASA Review 1

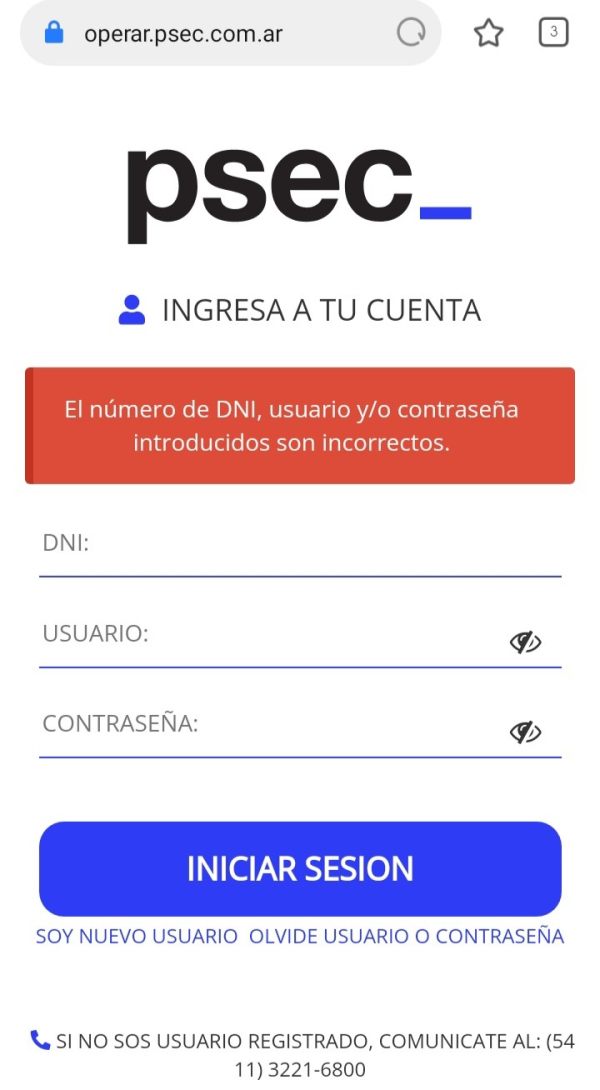

9600 pesos have been taken from me. From one moment to another, they have not allowed me to access my account and it says that the data is incorrect. This happened after I withdraw my money

CASA Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

9600 pesos have been taken from me. From one moment to another, they have not allowed me to access my account and it says that the data is incorrect. This happened after I withdraw my money

This casa review presents a comprehensive analysis of what appears to be a confusing situation in the online trading space. Our investigation reveals that CASA, while referenced in various contexts, does not appear to operate as a traditional forex or CFD broker. The available information primarily relates to CASA as an educational testing program and property management services, rather than financial trading services.

Based on the limited information available, CASA was mentioned in connection with testing services as of 2014, with examination fees of $38 per subtest. However, no concrete evidence supports CASA's operation as a regulated financial services provider or forex broker. This lack of transparency and clear business model raises significant concerns for potential traders seeking reliable trading platforms.

The absence of regulatory information, trading conditions, platform details, and customer testimonials makes it impossible to recommend CASA for forex trading purposes. Traders should exercise extreme caution and seek well-established, properly regulated brokers instead.

Due to the fragmented nature of available information about CASA, this review is based on limited data sources. Users should be aware that regulatory requirements and business operations may vary significantly across different jurisdictions. The information presented here reflects what could be verified through available sources, and potential users should conduct additional due diligence before considering any financial services.

This evaluation methodology acknowledges the substantial information gaps present in publicly available materials about CASA's trading services, if they exist at all.

Based on available information, we cannot provide meaningful scores for CASA across standard broker evaluation criteria:

| Criteria | Score | Status |

|---|---|---|

| Account Conditions | N/A | Information not available |

| Tools and Resources | N/A | Information not available |

| Customer Service | N/A | Information not available |

| Trading Experience | N/A | Information not available |

| Trust Factor | N/A | Information not available |

| User Experience | N/A | Information not available |

The entity known as CASA presents a puzzling case in the financial services landscape. While various references exist to CASA in different contexts, none clearly establish it as a functioning forex or CFD broker. The most concrete information available relates to CASA as an educational testing service, with historical data showing examination fees of $38 per subtest as of 2014.

The confusion surrounding CASA's actual business model raises immediate red flags for potential traders. Legitimate forex brokers typically maintain comprehensive websites detailing their services, regulatory status, trading conditions, and platform offerings. The absence of such fundamental information suggests that CASA may not operate as a traditional online broker at all.

Furthermore, the lack of regulatory transparency is particularly concerning in an industry where client fund protection and operational oversight are paramount. This casa review finds no evidence of registration with major financial regulators such as the FCA, CySEC, ASIC, or other recognized authorities that typically oversee forex and CFD trading operations.

No specific regulatory information is available for CASA as a financial services provider. This represents a significant concern for potential traders, as regulatory oversight is crucial for client protection and operational integrity.

Specific information about deposit and withdrawal methods is not available in the source materials, further highlighting the lack of transparency regarding CASA's trading services.

No minimum deposit information has been identified, making it impossible to assess accessibility for different trader categories.

No promotional offers or bonus structures are mentioned in available materials, which is unusual for active forex brokers who typically use such incentives to attract clients.

The range of tradeable instruments offered by CASA remains unclear, with no specific mention of forex pairs, commodities, indices, or other financial instruments typically available through online brokers.

Critical information about spreads, commissions, overnight fees, and other trading costs is absent from available sources. This casa review cannot provide guidance on the competitiveness of CASA's pricing structure.

No information about available leverage ratios has been identified, which is essential information for traders assessing risk management capabilities.

Trading platform details, including whether CASA offers MetaTrader, proprietary platforms, or web-based solutions, are not specified in available materials.

Information about geographic limitations or restricted countries is not available.

No details about multilingual support capabilities have been identified.

The absence of detailed account information represents a fundamental problem for this casa review. Legitimate forex brokers typically offer multiple account types designed for different trader categories, from beginners to professional traders. These usually include varying minimum deposit requirements, different spread structures, and specialized features such as Islamic accounts for clients requiring Sharia-compliant trading conditions.

Without access to CASA's account specifications, potential traders cannot assess whether the broker meets their specific needs. Standard industry practice includes clear documentation of account opening procedures, verification requirements, and available account currencies. The lack of such basic information raises serious questions about CASA's legitimacy as a trading services provider.

Professional traders particularly require detailed information about account conditions to make informed decisions about broker selection. The absence of this information makes it impossible to recommend CASA for serious trading activities.

Trading tools and educational resources are essential components of modern forex brokers' offerings. Successful traders rely on technical analysis tools, economic calendars, market research, and educational materials to make informed trading decisions. The complete absence of information about CASA's tools and resources represents a significant deficiency.

Established brokers typically provide comprehensive trading tools including advanced charting capabilities, technical indicators, automated trading support, and market analysis. Educational resources such as webinars, tutorials, and market commentary are standard offerings that help traders develop their skills and stay informed about market developments.

The lack of any mention of trading tools or educational resources in available materials about CASA suggests either a very limited service offering or the absence of trading services altogether. This represents a major disadvantage compared to established brokers in the market.

Quality customer service is crucial for forex traders who may need assistance with technical issues, account problems, or trading questions. Professional brokers typically offer multiple contact channels including live chat, telephone support, and email assistance, often available 24/5 during market hours.

The absence of specific customer service information for CASA makes it impossible to assess the quality and availability of support services. Traders require confidence that they can reach knowledgeable support staff when needed, particularly during volatile market conditions or when experiencing platform difficulties.

Without information about response times, available languages, or support channels, potential CASA clients cannot evaluate whether the broker meets their service expectations. This lack of transparency regarding customer support represents a significant concern for trader satisfaction and problem resolution.

The trading experience encompasses platform stability, execution speed, order types, and overall functionality. Modern forex traders expect fast, reliable platforms with minimal downtime and competitive execution speeds. The absence of any information about CASA's trading infrastructure makes it impossible to assess the quality of the trading experience.

Key factors such as platform uptime, execution speeds, slippage rates, and available order types are essential considerations for active traders. Professional traders particularly require advanced order management capabilities and reliable platform performance during high-volatility periods.

This casa review cannot provide meaningful analysis of the trading experience due to the complete lack of available information about CASA's trading platforms and execution quality. This represents a fundamental barrier to recommending CASA for trading activities.

Trust and reliability are paramount in forex trading, where clients deposit significant funds with brokers. Regulatory oversight, segregated client accounts, compensation schemes, and transparent business practices are essential elements of trustworthy brokers. The absence of regulatory information for CASA represents a critical trust deficit.

Established brokers typically hold licenses from respected financial regulators and participate in investor compensation schemes that protect client funds in case of broker insolvency. They also maintain segregated client accounts and provide regular financial disclosures to demonstrate stability and transparency.

The lack of verifiable regulatory status, financial transparency, or client protection measures makes it impossible to establish CASA's trustworthiness as a financial services provider. This represents the most significant concern identified in this review.

Overall user experience encompasses everything from initial account opening through ongoing trading activities and customer interactions. Modern brokers focus heavily on user-friendly interfaces, streamlined processes, and comprehensive self-service capabilities. The absence of user feedback or detailed service descriptions for CASA prevents meaningful analysis of the user experience.

Successful brokers typically receive extensive user reviews and maintain active customer communities. The lack of identifiable user testimonials or reviews for CASA's trading services raises questions about the broker's market presence and customer base.

Without access to user experiences, interface screenshots, or process descriptions, this review cannot assess whether CASA provides a satisfactory user experience for traders at any level.

This casa review concludes that CASA does not appear to operate as a legitimate forex or CFD broker based on available information. The absence of regulatory transparency, trading conditions, platform details, and user testimonials creates insurmountable concerns for potential traders.

Traders seeking reliable forex brokers should focus on well-established, properly regulated providers that offer transparent information about their services, competitive trading conditions, and robust customer protection measures. The lack of basic information about CASA's trading services makes it impossible to recommend for any trading activities.

The primary recommendation is for traders to avoid CASA until comprehensive information about its regulatory status, trading conditions, and business operations becomes available through verified sources.

FX Broker Capital Trading Markets Review