Capital Fx 2025 Review: Everything You Need to Know

Executive Summary

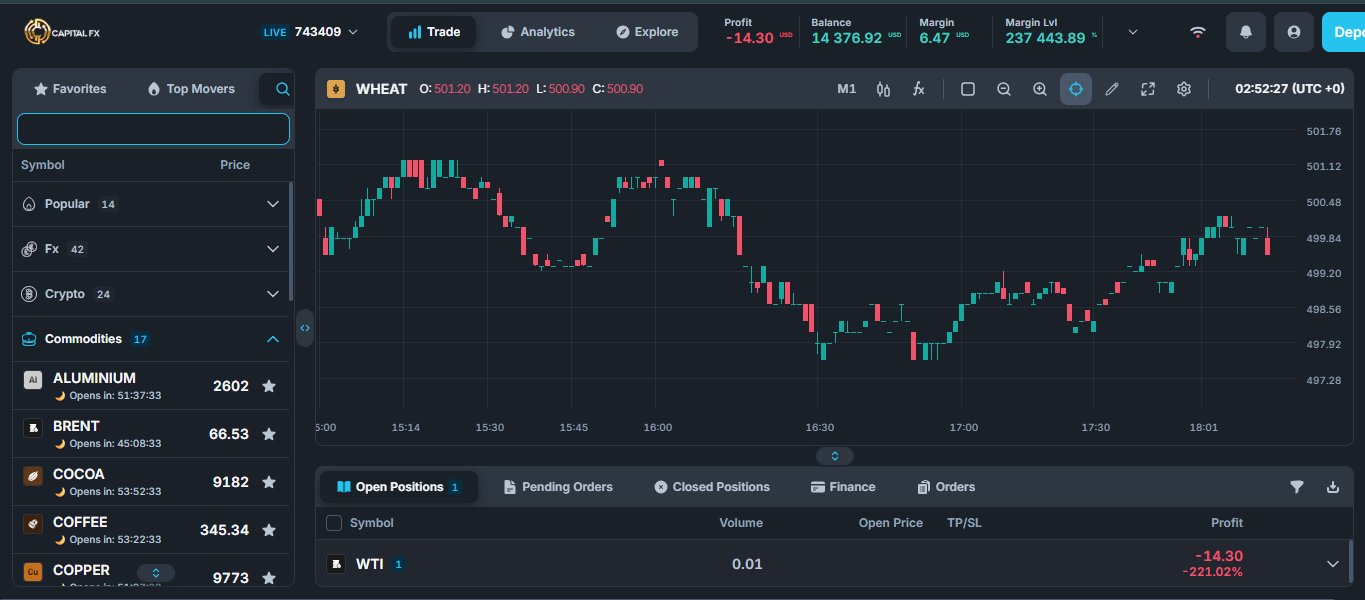

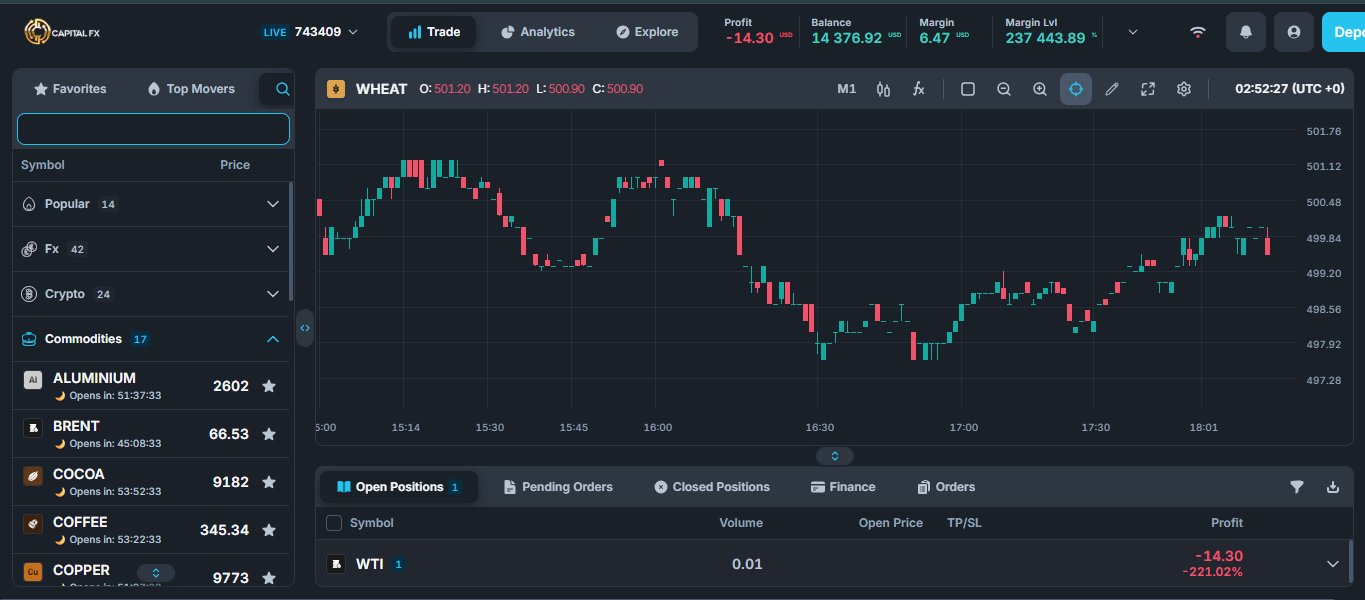

This Capital Fx review gives you a neutral look at the brokerage platform based on available information and user feedback. Capital Fx provides clients with access to financial markets, offering trading opportunities across multiple asset classes including currency pairs, stocks, indices, and commodities. The platform stands out by including built-in trading tools and analytical data access, alongside comprehensive educational materials designed to enhance trader skills and knowledge.

The broker targets both beginners seeking to improve their trading capabilities and experienced traders looking for diverse market access. However, our evaluation shows significant information gaps, particularly regarding regulatory oversight and specific trading conditions. While the platform offers variety in tradeable assets and educational resources, the lack of transparent regulatory information and detailed trading terms creates uncertainty for potential clients.

Based on available data, Capital Fx may suit traders who prioritize educational development and multi-asset trading capabilities. However, prospective clients should exercise caution due to limited regulatory transparency and incomplete disclosure of trading conditions.

Important Notice

This review is compiled based on available user evaluations and publicly accessible information. Our assessment method relies on extracted data from various sources, and specific evaluation criteria are applied according to the information obtained. Readers should note that some critical information regarding Capital Fx remains unavailable in current sources, which may impact the comprehensiveness of this evaluation.

The scoring framework applied in this review reflects the available data, and areas where information is insufficient are clearly marked. Traders are advised to conduct additional due diligence before making any investment decisions.

Rating Framework

Broker Overview

Capital Fx operates as a financial brokerage platform facilitating access to various financial markets. According to available sources, the platform enables trading across multiple asset categories, though specific details regarding the company's establishment date, founding background, and primary business model structure are not detailed in current information sources. The broker's operational approach appears focused on providing comprehensive market access combined with educational support systems.

The platform's asset offering spans currency pairs, stocks, indices, and commodities, providing traders with diversified investment opportunities across different market sectors. This multi-asset approach positions Capital Fx as a potentially suitable option for traders seeking portfolio diversification. However, critical information regarding the specific trading platform technology, primary regulatory oversight bodies, and detailed operational structure remains unavailable in current source materials, limiting the depth of this Capital Fx review.

Regulatory Jurisdiction: Regulatory information is not specified in available source materials, creating uncertainty regarding oversight and compliance standards.

Deposit and Withdrawal Methods: Specific payment processing options and withdrawal procedures are not detailed in current information sources.

Minimum Deposit Requirements: Minimum deposit thresholds are not specified in available materials.

Bonus and Promotional Offers: Information regarding promotional campaigns or bonus structures is not provided in current sources.

Tradeable Assets: The platform offers access to currency pairs, stocks, indices, and commodities, providing diverse trading opportunities across major market categories.

Cost Structure: Detailed information regarding spreads, commission rates, overnight fees, and other trading costs is not available in current source materials.

Leverage Ratios: Specific leverage offerings and maximum leverage limits are not detailed in available information.

Platform Options: Trading platform specifications and technology details are not provided in current sources.

Regional Restrictions: Geographic limitations and restricted territories are not specified in available materials.

Customer Support Languages: Available language support options are not detailed in current information sources.

This Capital Fx review highlights significant information gaps that potential clients should consider when evaluating the broker.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of Capital Fx's account conditions faces substantial limitations due to insufficient information in available sources. Specific details regarding account type varieties, their distinctive features, and associated benefits are not provided in current materials. This information gap prevents a comprehensive evaluation of how the broker structures its client offerings and whether different account tiers provide varying levels of service or trading advantages.

Minimum deposit requirements, which typically serve as a key consideration for potential clients, are not specified in available documentation. This absence of financial threshold information makes it difficult for prospective traders to assess accessibility and plan their initial investment accordingly. Additionally, the account opening process, including required documentation, verification procedures, and timeline expectations, lacks detailed explanation in current sources.

Specialized account features are not mentioned in available materials. The lack of transparency regarding account conditions represents a significant concern for potential clients seeking to understand their options and obligations before committing to the platform.

Without access to comprehensive account condition details, this Capital Fx review cannot provide definitive guidance on account suitability for different trader profiles.

Capital Fx demonstrates strength in its tools and resources offering, earning a solid rating in this category. According to available information, the platform provides built-in trading tools designed to support trader decision-making and market analysis. These integrated tools suggest a commitment to providing clients with essential trading infrastructure without requiring external software or additional subscriptions.

The platform's provision of analytical data access represents another valuable resource for traders. Access to market analysis and data feeds can significantly impact trading effectiveness, particularly for traders who rely on technical analysis or fundamental research in their decision-making processes. This feature indicates that Capital Fx recognizes the importance of information access in successful trading.

Educational materials constitute a notable strength of the Capital Fx platform. The broker offers various educational resources specifically designed to improve trader skills and knowledge. This educational focus suggests an investment in client development and long-term success rather than merely facilitating transactions.

However, specific details regarding the depth and quality of these educational materials, the frequency of updates, and the range of topics covered are not available in current sources, limiting the completeness of this assessment.

Customer Service and Support Analysis

The evaluation of Capital Fx's customer service and support capabilities faces significant constraints due to limited information availability. Essential details regarding customer service channels are not specified in current source materials. This information gap prevents assessment of accessibility and convenience for clients requiring assistance.

Response time expectations, which serve as crucial indicators of service quality, are not detailed in available documentation. Understanding typical response times for different inquiry types helps clients set appropriate expectations and evaluate service efficiency. Similarly, service quality indicators are not provided in current sources.

Multilingual support capabilities, particularly important for international brokers serving diverse client bases, are not specified in available materials. The absence of information regarding supported languages may indicate limited international service capabilities or simply reflect incomplete documentation.

Operating hours for customer support services are not detailed in current sources, preventing evaluation of availability for traders in different time zones. Without comprehensive customer service information, potential clients cannot adequately assess whether Capital Fx's support infrastructure meets their needs and expectations.

Trading Experience Analysis

Assessment of the trading experience offered by Capital Fx encounters substantial limitations due to insufficient technical and operational information in available sources. Platform stability and execution speed, which represent fundamental aspects of trading experience quality, are not documented in current materials. These factors directly impact trader success and satisfaction, making their absence in available information particularly concerning.

Order execution quality lacks documentation in current sources. Understanding execution characteristics helps traders evaluate whether a platform suits their trading style and strategy requirements. Similarly, information regarding platform functionality completeness is not detailed in available materials.

Mobile trading experience details, increasingly important for modern traders requiring flexibility and mobility, are not specified in current documentation. The absence of mobile platform information may indicate limited mobile offerings or simply reflect incomplete source materials.

Trading environment characteristics are not provided in current sources. Without comprehensive trading experience information, this Capital Fx review cannot adequately assess the platform's suitability for different trading approaches and requirements.

Trust and Safety Analysis

The trust and safety evaluation of Capital Fx reveals significant concerns primarily stemming from limited regulatory transparency. Available sources do not specify regulatory oversight bodies, licensing jurisdictions, or compliance frameworks governing the broker's operations. This regulatory information gap represents a substantial concern for potential clients seeking assurance of proper oversight and protection.

Fund safety measures are not detailed in current source materials. Understanding fund protection mechanisms is crucial for traders evaluating the security of their invested capital. The absence of such information raises questions about transparency and client protection priorities.

Company transparency indicators are not provided in available documentation. Transparent communication regarding company structure and operations typically indicates commitment to client trust and regulatory compliance.

Industry reputation and standing are not documented in current sources. Additionally, information regarding how the company handles negative events, disputes, or regulatory issues is not available, preventing assessment of crisis management capabilities and client protection measures.

User Experience Analysis

The user experience evaluation of Capital Fx presents a mixed picture based on available information. While specific user satisfaction metrics are not detailed in current sources, the platform appears to attract traders interested in skill development and educational advancement. The broker's focus on educational materials suggests recognition of user development needs, which may contribute positively to overall user experience.

Interface design and usability details are not specified in available documentation, preventing assessment of platform navigation, visual design quality, and user-friendly features. Registration and verification process information is similarly absent, making it difficult to evaluate the initial user experience and onboarding efficiency.

Fund operation experiences are not detailed in current sources. These operational aspects significantly impact user satisfaction and platform convenience. Available information indicates the presence of one neutral review, suggesting mixed user feedback, though specific details of user complaints or praise are not provided.

The platform appears suitable for beginners seeking trading skill improvement and experienced traders interested in educational resources. However, the limited availability of specific user feedback and experience details constrains the comprehensiveness of this user experience assessment.

Conclusion

This Capital Fx review concludes with a neutral assessment primarily due to significant information gaps regarding regulatory oversight and detailed trading conditions. While the broker demonstrates strengths in educational resources and multi-asset trading opportunities, the absence of crucial operational details creates uncertainty for potential clients.

Capital Fx appears most suitable for beginners seeking comprehensive educational support and experienced traders interested in diverse asset access combined with learning opportunities. The platform's emphasis on trader education and skill development represents a notable positive aspect.

However, the primary concerns center on limited regulatory transparency and insufficient disclosure of trading conditions, costs, and operational procedures. Prospective clients should exercise caution and conduct additional due diligence before committing to the platform, particularly regarding regulatory status and fund safety measures.