BT Global 2025 Review: Everything You Need to Know

Executive Summary

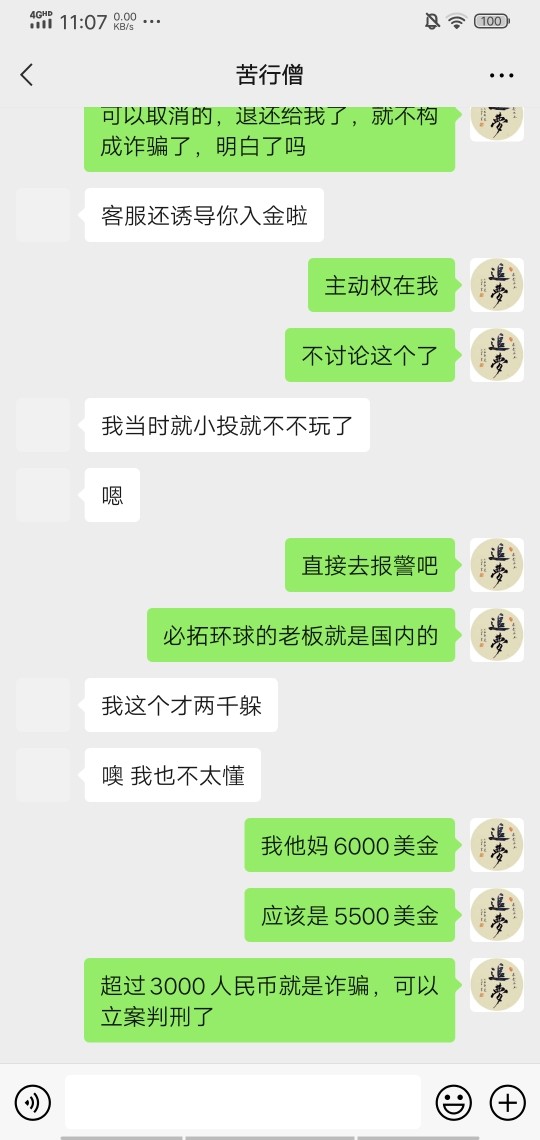

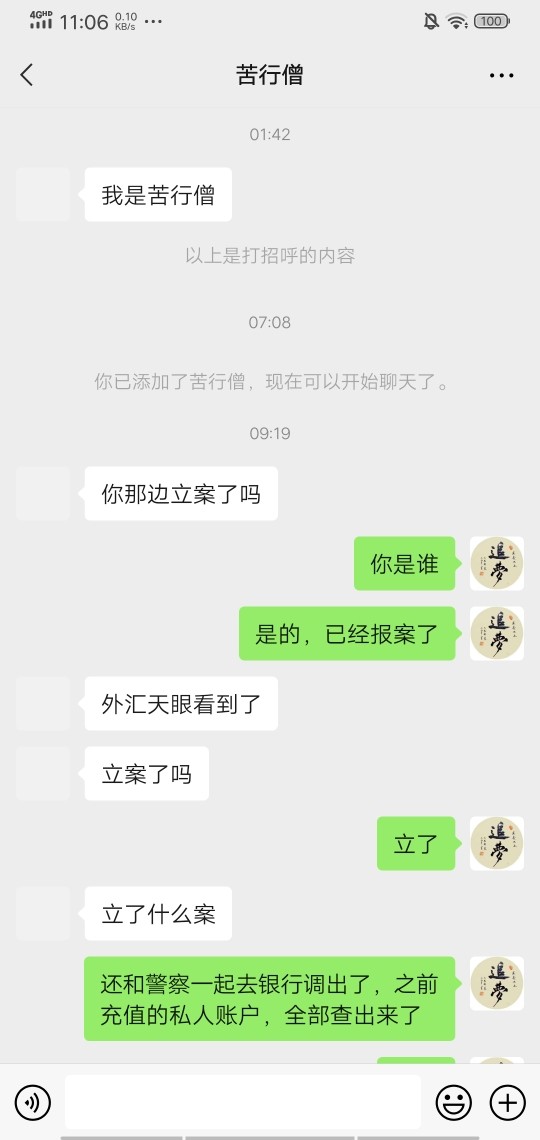

This bt global review shows a detailed look at BT Global Services. The company has big differences between how happy employees are and how customers feel about their service. BT Global has good employee satisfaction with a 3.8 out of 5 rating on Glassdoor and 81% of workers would recommend the company to others. Customer feedback tells a very different story though. Trustpilot data shows that 90% of customer reviews give just 1-star ratings, which means there are serious problems with service quality that traders need to think about carefully.

The company seems to want traders who expect high-quality service. Current performance numbers suggest these expectations might not be met consistently though. BT Global Services works as BT Global Business Services Pvt. Ltd. and tries to compete in the financial services market. The big difference between happy employees and unhappy customers raises important questions about how they deliver service and manage customer relationships.

This review matters a lot for traders who might choose BT Global as their trading partner. The many negative customer reviews suggest there could be problems with service delivery, support quality, and overall trading experience that might hurt trading success and satisfaction.

Important Notice

This complete review uses available user feedback, market ratings, and public information about BT Global Services. Our method includes data from multiple review sites like Trustpilot and Glassdoor to give a balanced view of how the broker performs with different groups of people.

You should know that specific regulatory information, detailed trading conditions, and complete service offerings were not well explained in available sources. Potential clients should do their own research and check all trading conditions, regulatory status, and service terms directly with BT Global before making any trading decisions. The big difference between employee and customer satisfaction ratings shown in this review needs careful thought by future traders.

Rating Framework

Broker Overview

BT Global works under the name BT Global Business Services Pvt. Ltd. and presents itself in the financial services sector. The company shows an interesting split in how different groups feel about it, with internal numbers showing fairly positive employee experiences while external customer feedback shows big challenges. Employee satisfaction data from Glassdoor shows that 81% of employees would recommend the company to others, which suggests reasonable internal operations and workplace culture.

The company's customer-facing operations seem to have major problems though. The business model and specific service delivery methods were not explained in available sources, making it hard to judge the complete operational framework. This lack of clarity in operational details, combined with very negative customer feedback, raises questions about the company's approach to customer service and satisfaction.

The trading platform setup, asset class offerings, and specific business model details stay unclear from available sources. This bt global review must rely mainly on user experience data and satisfaction numbers to judge the broker's performance. The missing detailed operational information becomes a factor in the overall assessment, as transparency is crucial for trader confidence and decision-making.

Regulatory Status: Specific regulatory oversight information was not explained in available sources, which is a big concern for potential traders seeking regulated trading environments.

Deposit and Withdrawal Methods: Available sources did not give complete information about funding options, processing times, or fees for deposits and withdrawals.

Minimum Deposit Requirements: Specific minimum deposit amounts and account funding requirements were not explained in accessible information.

Promotions and Bonuses: Information about promotional offers, welcome bonuses, or ongoing incentive programs was not available in reviewed sources.

Tradeable Assets: The range of available trading instruments, including forex pairs, commodities, indices, and other financial products, was not fully explained.

Cost Structure: Important information about spreads, commissions, overnight fees, and other trading costs was not provided in available sources, making cost comparison difficult.

Leverage Options: Maximum leverage ratios and margin requirements were not specified in accessible documentation.

Platform Options: Details about trading platform software, mobile applications, and technical capabilities were not extensively covered.

Geographic Restrictions: Information about service availability in different jurisdictions was not clearly outlined.

Customer Support Languages: Supported languages for customer service were not specified in available sources.

This bt global review highlights the significant information gaps that potential traders should address through direct inquiry with the broker before proceeding with account opening.

Detailed Rating Analysis

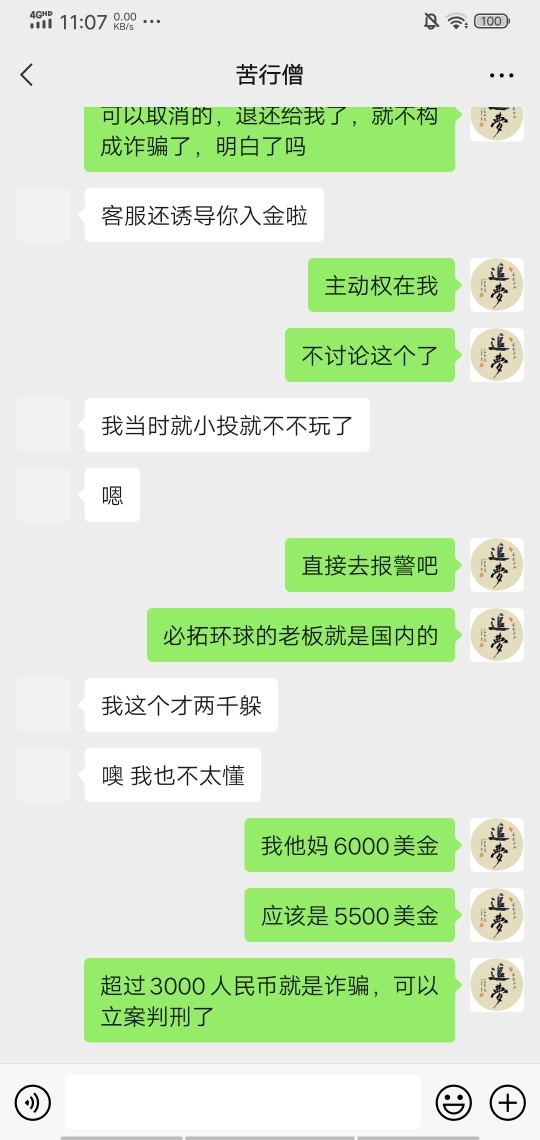

Account Conditions Analysis (4/10)

The account conditions evaluation for BT Global shows big information limitations that impact the overall assessment. Available sources did not give complete details about account types, tier structures, or specific features associated with different account levels. This lack of transparency makes it challenging for potential traders to understand what account options might be available and how they align with different trading strategies and capital levels.

The missing clear information about minimum deposit requirements, account maintenance fees, or special account features represents a big gap in available information. Typically, good brokers provide detailed account specifications to help traders make informed decisions. The limited availability of such information in this bt global review suggests either poor marketing transparency or potential issues with information accessibility.

Without specific user feedback about account opening processes, verification requirements, or account management experiences, it's difficult to assess the practical aspects of maintaining an account with BT Global. The 4/10 rating reflects these information limitations and the potential challenges traders might face in understanding their account options and associated conditions.

The evaluation of trading tools and resources available through BT Global shows big information gaps that greatly impact the assessment. Available sources did not provide detailed information about analytical tools, charting capabilities, market research resources, or educational materials that might be offered to traders. This lack of complete tool information represents a critical limitation for traders who depend on strong analytical resources for their trading decisions.

Modern trading environments typically offer extensive technical analysis tools, fundamental analysis resources, economic calendars, and educational content to support trader development and decision-making. The missing detailed information about these resources in available sources makes it impossible to assess BT Global's competitive position in this crucial area.

Information about automated trading support, API access, or advanced trading features was not available in reviewed sources either. The 3/10 rating reflects these significant information limitations and the uncertainty they create for traders seeking comprehensive trading support tools and resources.

Customer Service and Support Analysis (3/10)

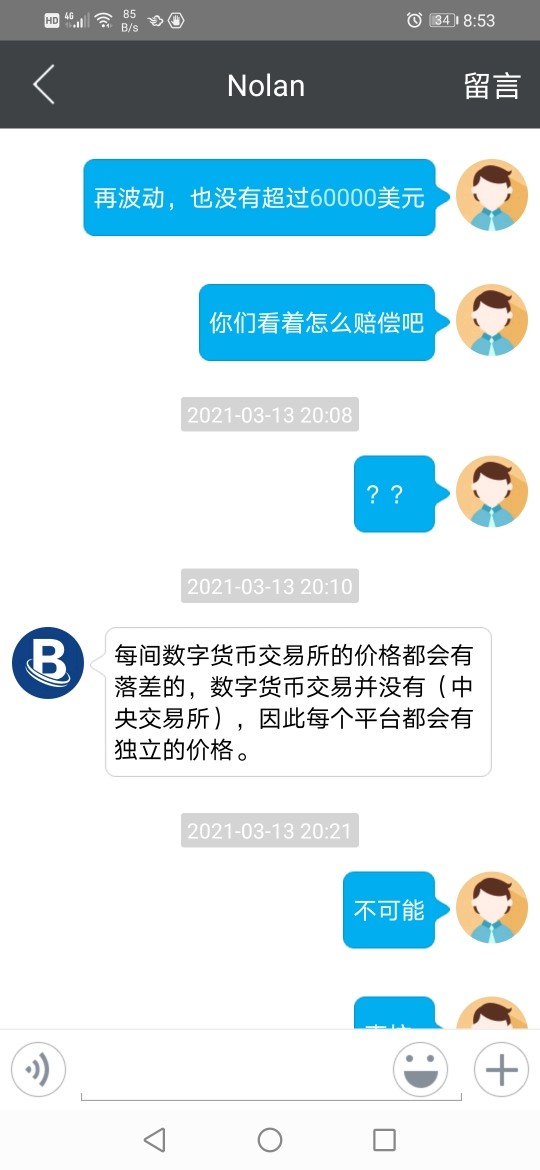

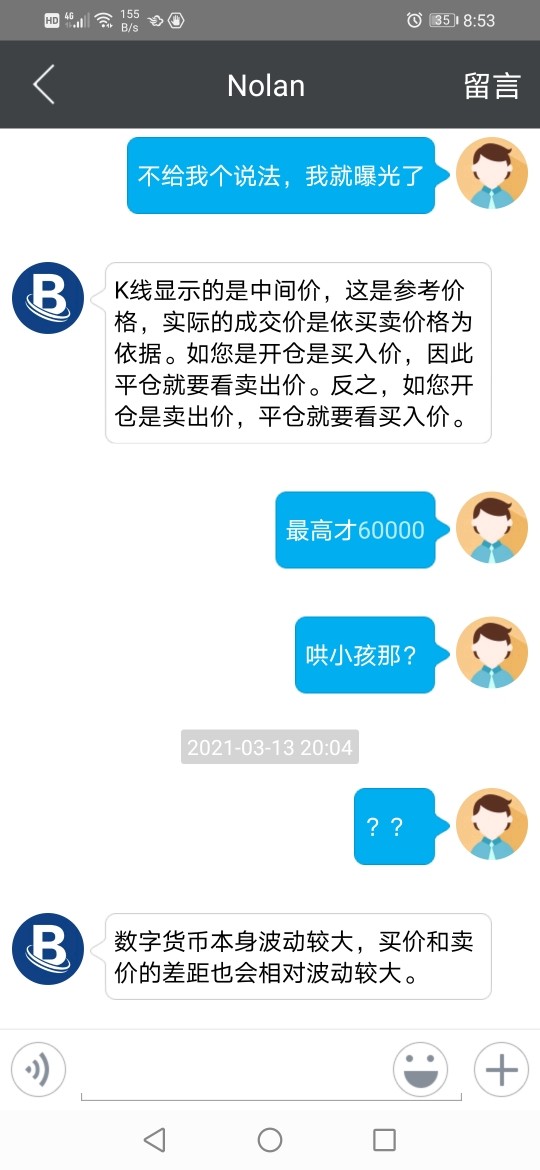

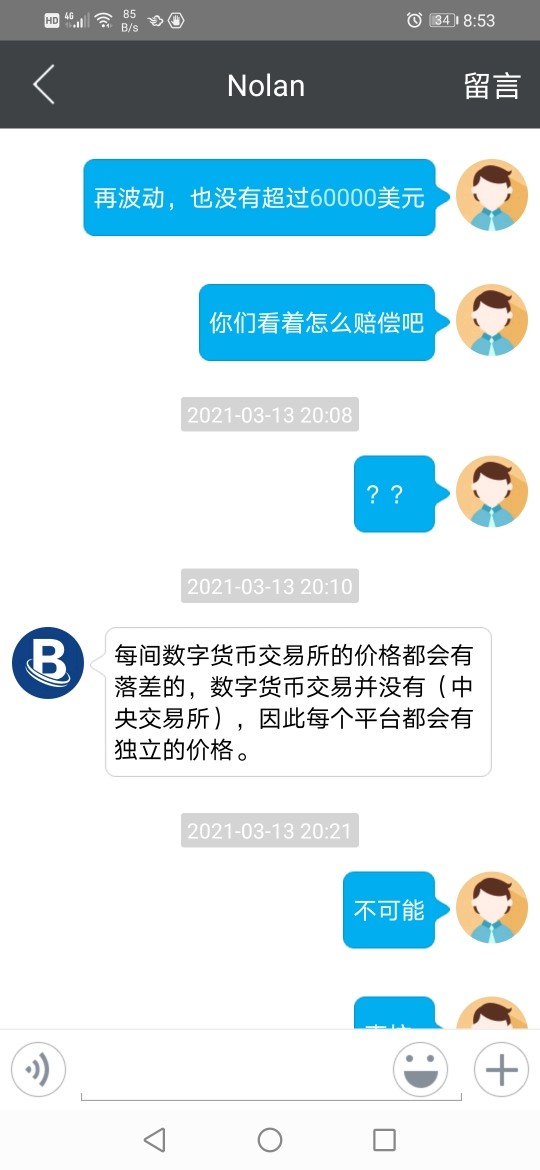

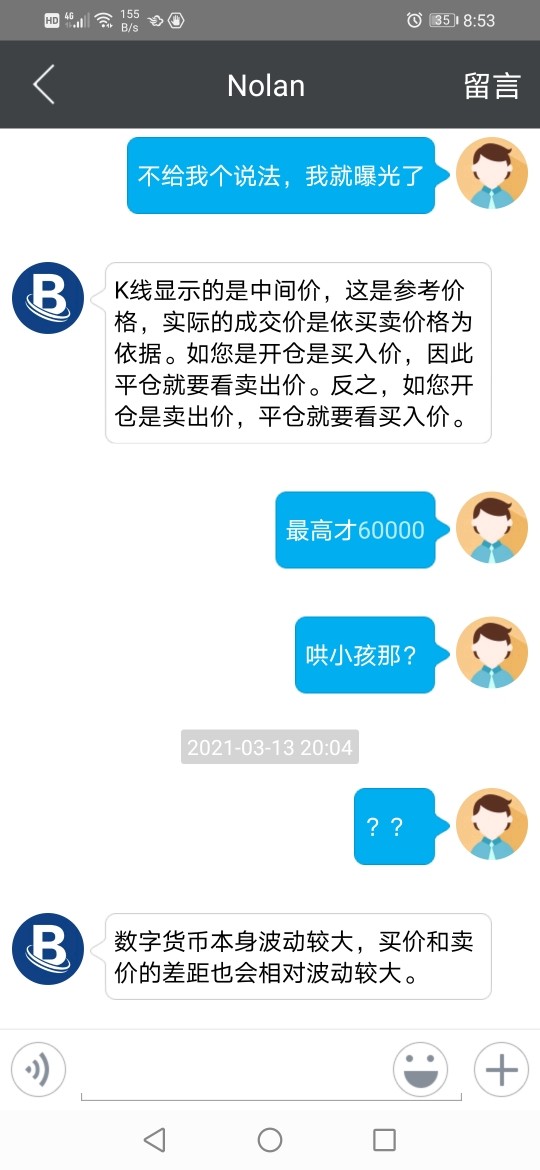

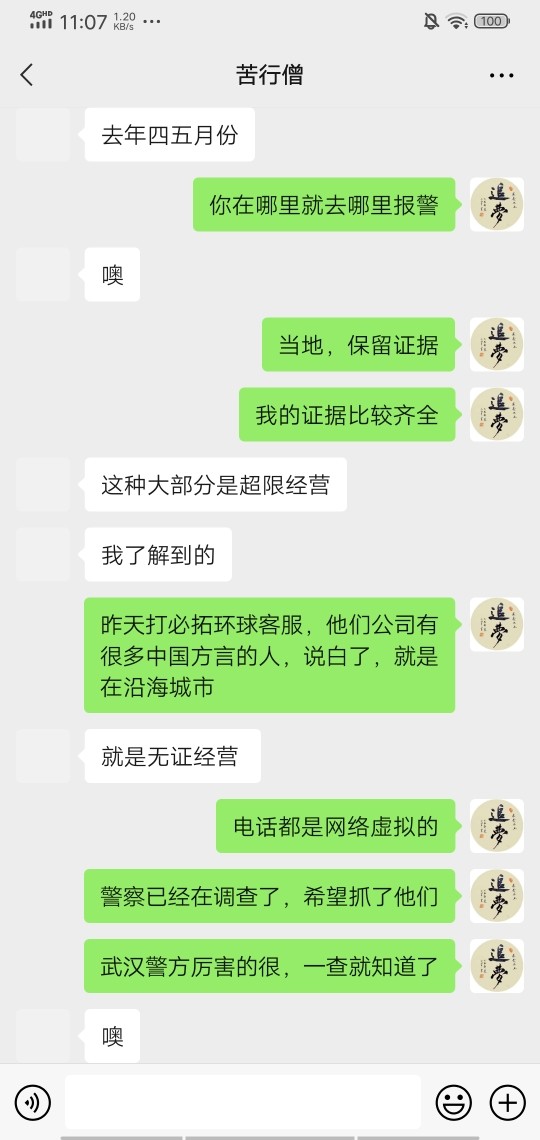

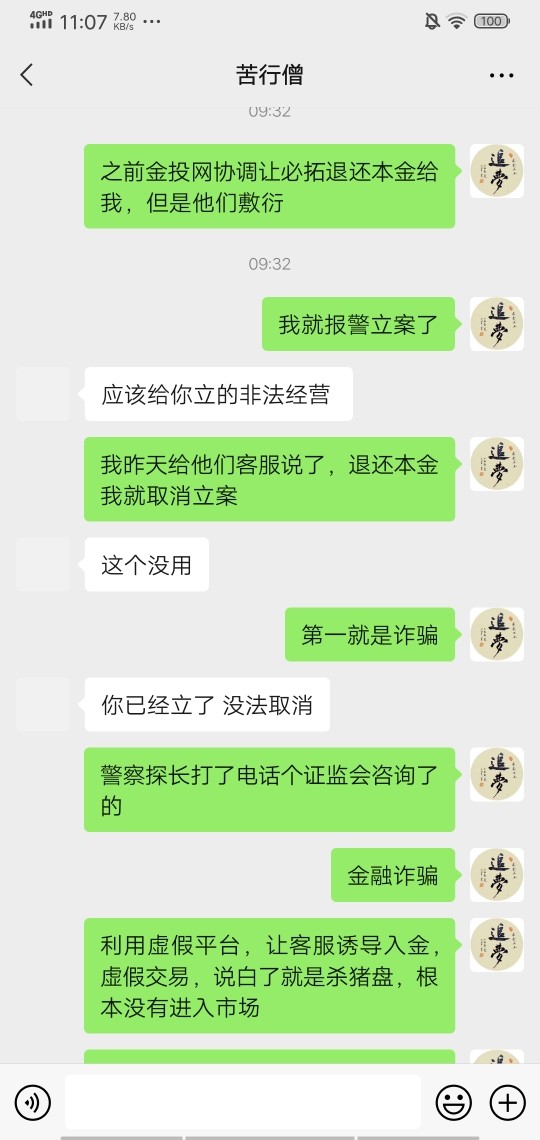

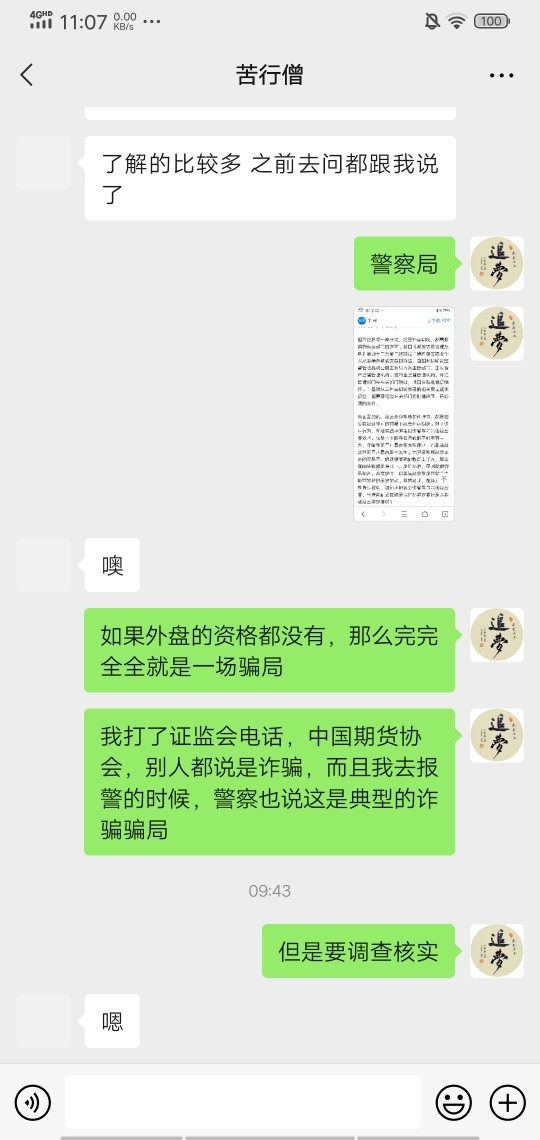

Customer service represents one of the most concerning aspects revealed in this evaluation, with Trustpilot data showing that 90% of customer reviews are rated at just 1-star. This overwhelming negative feedback pattern suggests systematic issues with customer service delivery, response quality, or problem resolution capabilities. Such consistently poor customer feedback indicates potential challenges in communication, support accessibility, or service effectiveness.

The stark contrast between employee satisfaction and customer satisfaction suggests possible disconnects between internal operations and customer-facing service delivery. This difference raises questions about training, resource allocation, or systematic issues in customer service processes.

Available sources did not provide specific information about customer service channels, response times, availability hours, or multilingual support options. The missing detailed customer service information, combined with very negative customer feedback, results in the 3/10 rating and suggests significant room for improvement in customer support operations.

Trading Experience Analysis (5/10)

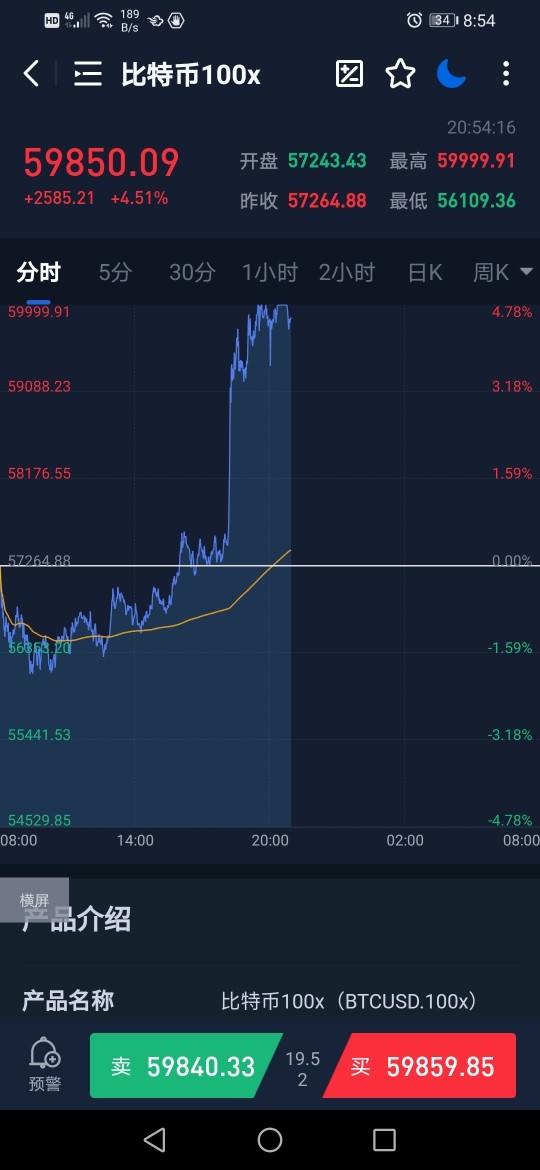

The trading experience evaluation for BT Global receives a neutral rating due to the missing specific information about platform performance, execution quality, or user interface design. Available sources did not provide detailed feedback about trading platform stability, order execution speeds, slippage rates, or overall trading environment quality. This information gap makes it challenging to assess the practical trading experience that users might expect.

Critical aspects of trading experience, including platform reliability during market volatility, mobile trading capabilities, and advanced order types, were not detailed in available sources. Without specific user testimonials about trading performance or platform functionality, it's difficult to evaluate how BT Global's trading infrastructure compares to industry standards.

The 5/10 rating reflects this information uncertainty and the neutral position needed by the lack of specific trading experience data. This bt global review emphasizes the importance of potential traders conducting thorough platform testing and seeking detailed information about trading conditions before committing to the service.

Trust and Reliability Analysis (2/10)

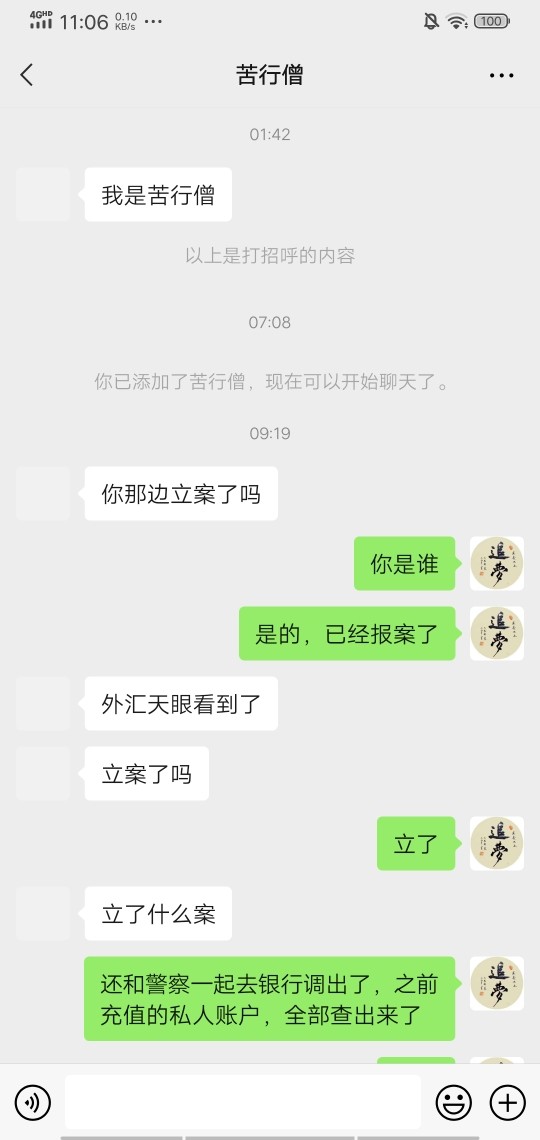

Trust and reliability represent perhaps the most concerning aspects of this evaluation, with the 2/10 rating reflecting multiple factors that impact trader confidence. The missing clear regulatory information in available sources raises immediate questions about oversight, compliance, and trader protection measures. Regulatory transparency is fundamental to trader confidence and represents a critical factor in broker selection.

The overwhelmingly negative customer feedback pattern, with 90% of Trustpilot reviews rated at 1-star, suggests systematic issues that could impact trader trust and confidence. Such consistently poor customer experiences raise questions about service reliability, problem resolution capabilities, and overall operational effectiveness.

The lack of detailed information about fund security measures, segregation policies, or insurance protections creates uncertainty about asset safety. The missing clear company background information, regulatory compliance details, or third-party certifications further contributes to trust concerns highlighted in this assessment.

User Experience Analysis (4/10)

User experience evaluation reveals mixed signals, with available data showing challenges in customer satisfaction despite reasonable employee satisfaction metrics. The AmbitionBox rating of 3.2/5 for customer service advisors suggests moderate performance in customer-facing roles, though this conflicts with the overwhelmingly negative Trustpilot feedback showing 90% 1-star reviews.

The significant difference between different satisfaction metrics indicates potential inconsistencies in user experience delivery. While employee satisfaction suggests reasonable internal operations, customer satisfaction data reveals substantial challenges in service delivery or expectation management. This disconnect suggests possible issues with customer communication, service processes, or problem resolution capabilities.

Available sources did not provide specific information about user interface design, registration processes, account verification procedures, or fund management experiences. The 4/10 rating reflects both the negative customer feedback patterns and the information limitations that prevent a more comprehensive user experience assessment.

Conclusion

This bt global review reveals a complex picture characterized by significant disparities between internal employee satisfaction and external customer experiences. While employee metrics suggest reasonable internal operations, the overwhelming negative customer feedback pattern raises substantial concerns about service delivery and customer satisfaction. The missing detailed regulatory information, trading conditions, and operational transparency creates additional uncertainty for potential traders.

BT Global may be most suitable for traders who are willing to conduct extensive due diligence and can tolerate potential service inconsistencies. However, the 90% negative customer review rate on Trustpilot suggests that most traders have experienced significant challenges with the service. The main advantages appear to be internal employee satisfaction, while the primary disadvantages include poor customer satisfaction, limited transparency, and unclear regulatory status.

Potential traders should carefully consider these factors and conduct thorough independent research before making any trading decisions with BT Global Services.