PBFX 2025 Review: Everything You Need to Know

Executive Summary

PBFX is a forex broker that started in 2018. The company has gotten mixed attention from traders in the community. PBFX offers forex, indices, and commodities trading through the MT4 platform, but this pbfx review shows big concerns about its rules and regulations. The broker works mainly from Hong Kong. It also has business in New Zealand, China, Malaysia, Thailand, Indonesia, Vietnam, and Singapore.

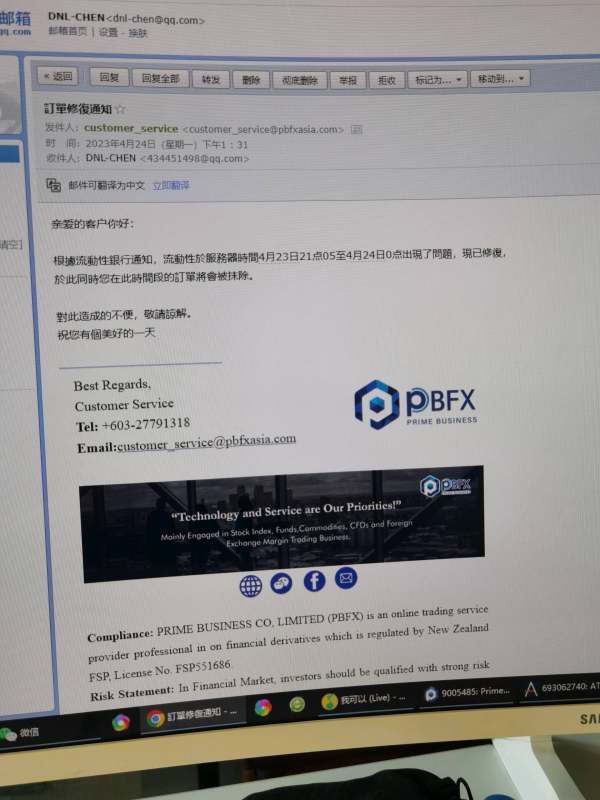

The company gives traders three different account types. They also support customer service in English. However, traders should know that PBFX has received warnings from financial authorities. An FMA warning raises questions about how well the company follows rules. User reviews show a mixed picture with some positive and neutral feedback. Still, detailed user experiences are hard to find in available sources.

PBFX targets traders who want to trade foreign exchange markets, stock indices, and commodities. The broker focuses on the MT4 platform, which appeals to traditional forex traders who like established trading tools. However, the regulatory concerns and limited transparency about trading conditions make this broker suitable mainly for experienced traders. These traders need to be able to handle potential risks.

Important Notice

This review uses information from various sources and may not show the complete current status of PBFX. The broker operates in multiple regions, which may result in different regulatory treatments across different areas. Traders should check the current regulatory status in their specific region before using the platform.

The analysis here focuses on publicly available information. It does not include direct testing of trading conditions or customer service experiences. PBFX has regulatory warnings, so potential clients should do extra research and consider talking with financial advisors before making trading decisions.

Rating Framework

Broker Overview

PBFX entered the forex brokerage market in 2018. The company positions itself as a multi-regional trading platform with headquarters in Hong Kong. PBFX has established business operations across several Asian markets and Oceania, including New Zealand, China, Malaysia, Thailand, Indonesia, Vietnam, and Singapore. This geographic spread suggests an ambitious expansion strategy that targets the Asia-Pacific trading community.

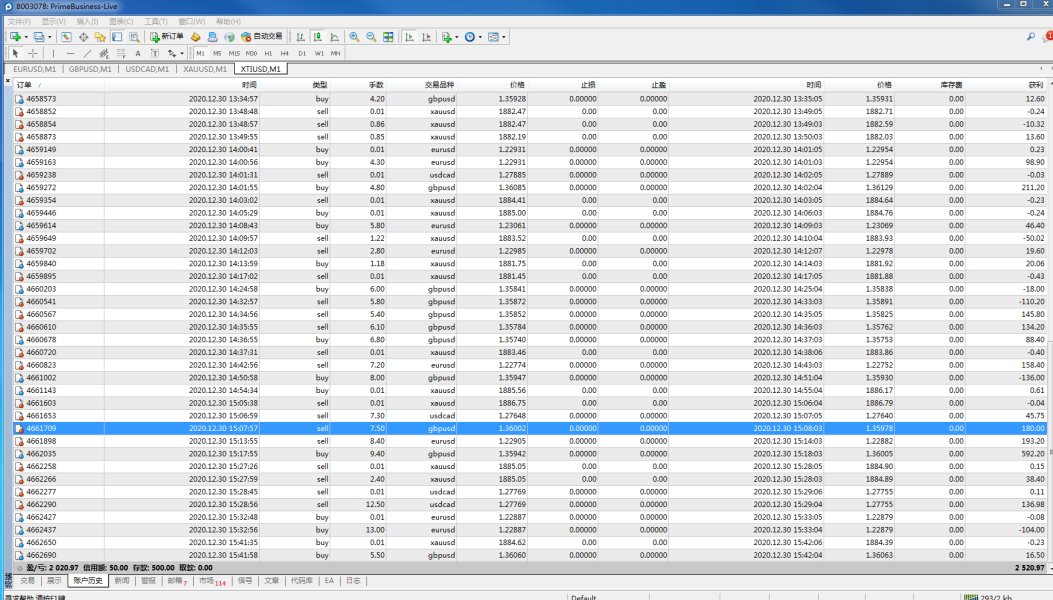

The broker operates mainly as a forex and CFD provider. It offers trading services in foreign exchange pairs, stock indices, and commodity markets. PBFX uses a business model focused on providing access to global financial markets through established trading infrastructure. The company specifically uses the MetaTrader 4 platform.

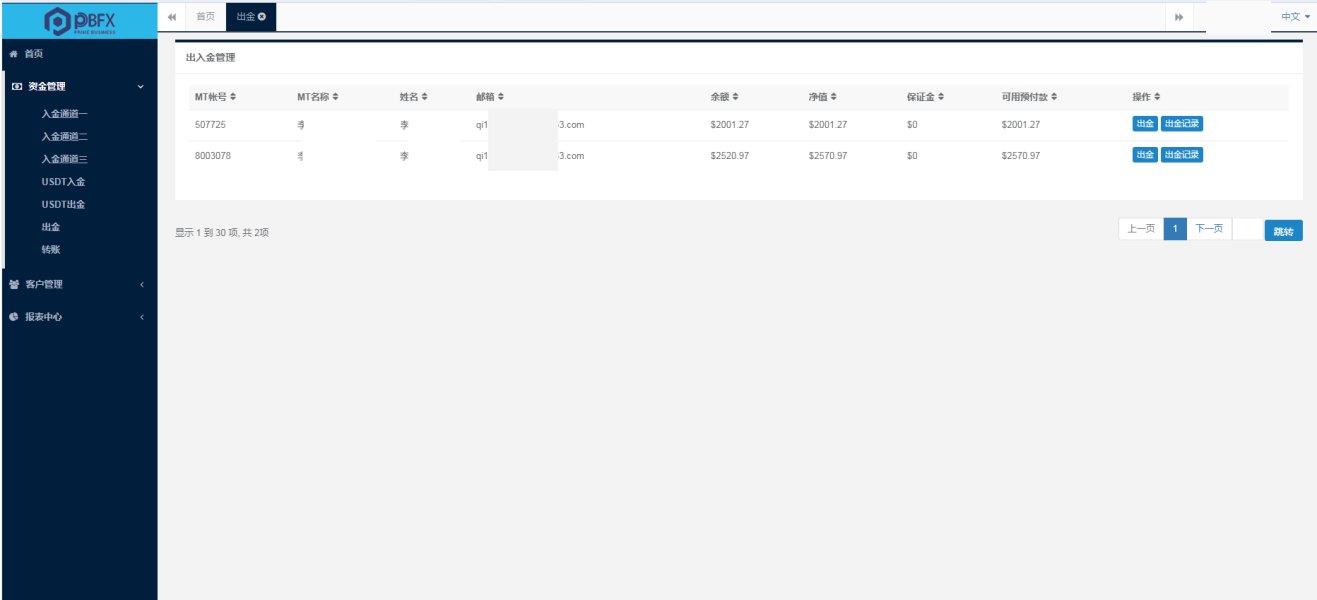

The company's approach appears to target both retail and potentially institutional clients. However, specific details about minimum capital requirements and client segmentation remain unclear from available sources. The broker's multi-jurisdictional presence raises questions about regulatory compliance across different markets. This is particularly concerning given the regulatory warnings that have emerged regarding its operations.

PBFX's trading infrastructure centers around the MT4 platform. This platform provides standard forex trading capabilities including technical analysis tools, automated trading support, and real-time market data. The broker offers three different account types. However, specific details about the differences between these accounts are not readily available in current documentation.

Regulatory Status: PBFX operates without clear regulatory oversight from major financial authorities. The company has received warnings from the Financial Markets Authority, which raises significant concerns about its compliance with financial regulations.

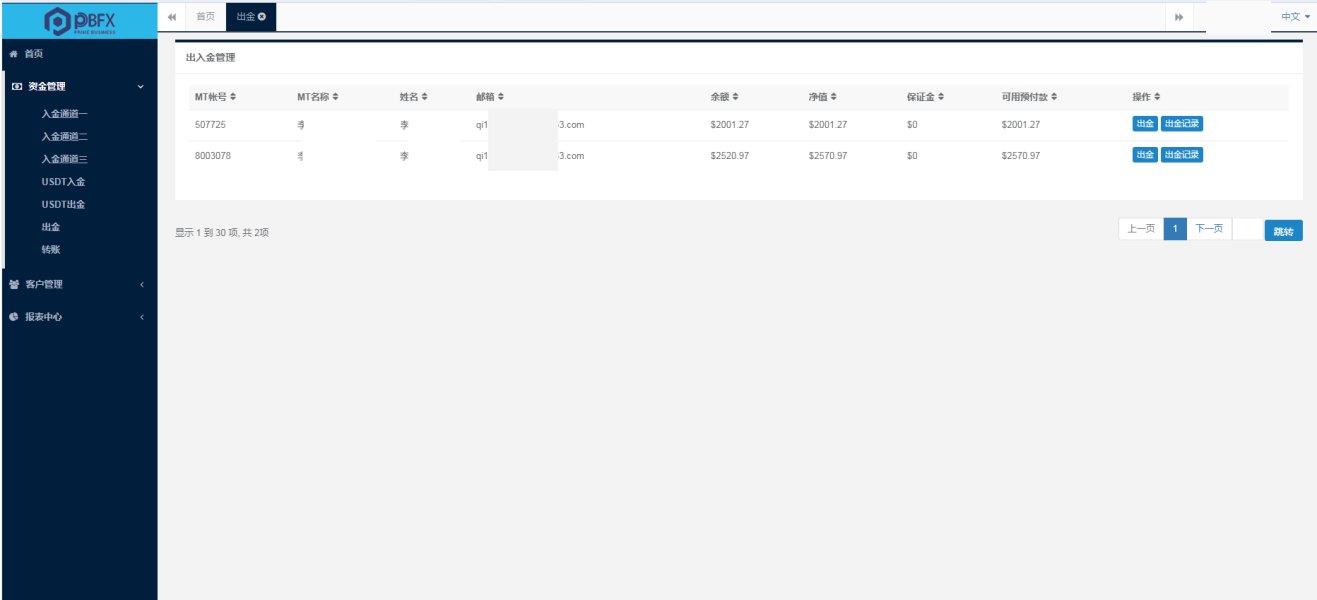

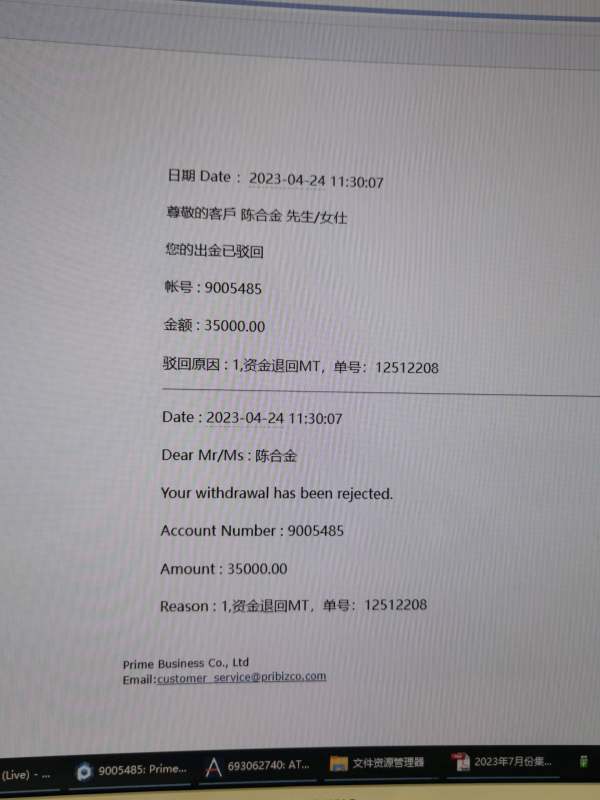

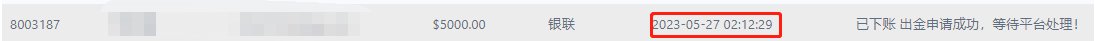

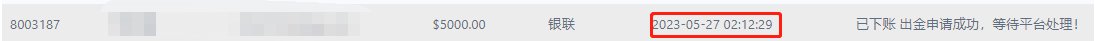

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and associated fees is not detailed in available sources. This represents a transparency gap that potential clients should address directly with the broker.

Minimum Deposit Requirements: The minimum capital requirements for opening accounts with PBFX are not specified in current documentation. This makes it difficult for potential traders to assess accessibility.

Promotional Offers: Current promotional campaigns, welcome bonuses, or trading incentives are not documented in available materials. This suggests either absence of such programs or limited marketing transparency.

Tradeable Assets: PBFX provides access to forex currency pairs, stock indices, and commodity markets. The specific number of instruments and market coverage details remain unspecified in available documentation.

Cost Structure: Detailed information about spreads, commissions, overnight financing rates, and other trading costs is not available in current sources. This represents a significant information gap for cost-conscious traders.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in available documentation. This is concerning given regulatory requirements for leverage disclosure.

Platform Options: The broker exclusively supports the MetaTrader 4 platform. There is no mention of proprietary platforms, web-based trading, or MT5 availability.

Geographic Restrictions: Specific information about restricted jurisdictions or regional limitations is not detailed in available sources.

Customer Support Languages: English language support is confirmed. However, availability of additional language options remains unclear.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

PBFX offers three distinct account types. However, the specific features and benefits of each account tier remain poorly documented in available sources. This lack of transparency regarding account specifications represents a significant weakness in the broker's client communication strategy. The absence of detailed information about minimum deposits, maximum leverage, spread structures, and account-specific benefits makes it challenging for potential clients to make informed decisions. Traders cannot easily determine which account type might suit their trading needs.

The account opening process details are not readily available. This raises questions about the broker's onboarding procedures and verification requirements. Industry best practices typically involve clear documentation of account features, trading conditions, and eligibility criteria. The limited information available suggests that PBFX may require direct contact for account specification details. This could indicate either a personalized service approach or insufficient marketing transparency.

Without specific data on trading conditions across different account types, this pbfx review cannot provide detailed comparisons with industry standards. The 6/10 rating reflects the availability of multiple account options while acknowledging the significant information gaps. These gaps prevent a more comprehensive evaluation of the broker's account offerings.

PBFX's trading infrastructure relies exclusively on the MetaTrader 4 platform. This provides standard forex trading capabilities but represents a limited technological offering compared to brokers providing multiple platform options. MT4 offers essential features including technical analysis tools, automated trading support through Expert Advisors, and real-time market data feeds. However, the absence of additional platforms such as MT5, proprietary trading software, or web-based alternatives limits trader choice. This potentially restricts access to newer trading technologies.

The broker's research and analytical resources are not detailed in available documentation. This suggests either limited provision of market analysis or poor communication of available services. Modern forex brokers typically provide daily market commentary, technical analysis reports, economic calendars, and educational resources to support trader development. The absence of information about such services represents a notable gap in PBFX's value proposition.

Educational resources, trading guides, and skill development materials are not mentioned in available sources. This is concerning for brokers targeting retail clients who often require ongoing education and support. The limited platform offering and absence of documented analytical resources result in a moderate rating. This rating reflects basic trading capability without enhanced features that distinguish leading brokers in the competitive forex market.

Customer Service and Support Analysis (5/10)

PBFX provides customer service support in English. However, the specific channels, availability hours, and response quality remain undocumented in available sources. The confirmation of English language support suggests basic communication capability for international clients. However, the absence of information about additional language options may limit accessibility for traders in the broker's stated operational regions. This is particularly concerning in Asia where multiple languages are commonly required.

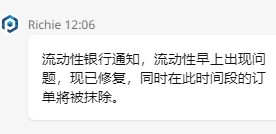

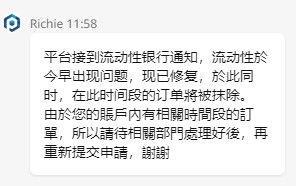

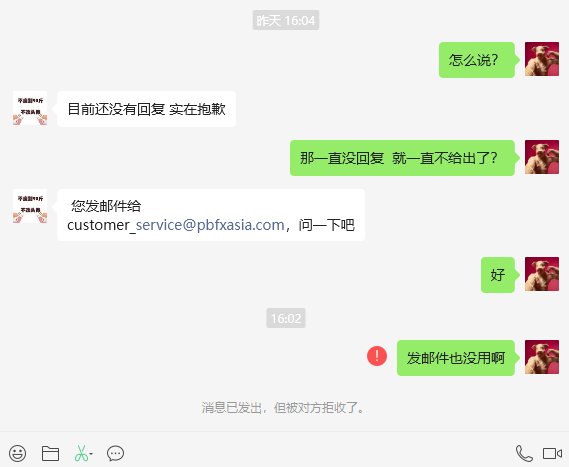

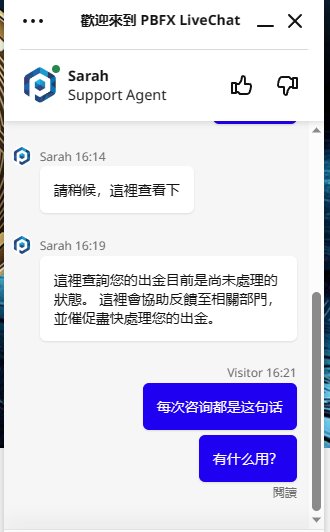

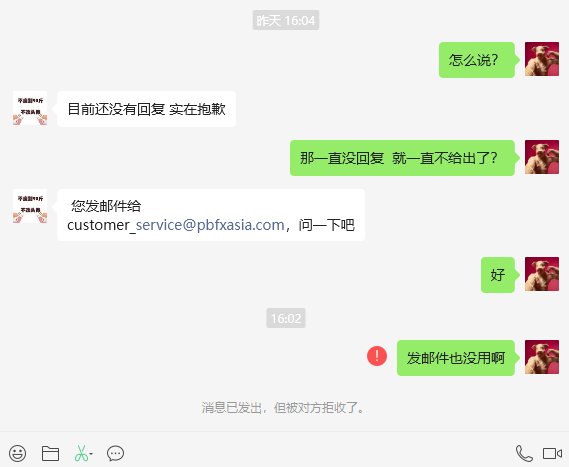

The availability of customer service channels such as live chat, telephone support, email assistance, or dedicated account management is not specified in current documentation. Modern forex brokers typically provide multiple contact methods with clearly stated availability hours and expected response times. The lack of such information raises questions about the broker's commitment to customer service transparency and accessibility.

Response time expectations, service quality standards, and problem resolution procedures are not documented. This makes it difficult for potential clients to assess the level of support they might expect. The absence of customer testimonials or service quality feedback in available sources further limits the ability to evaluate PBFX's customer service effectiveness. The moderate rating reflects confirmed English language capability while acknowledging significant information gaps regarding service delivery and quality.

Trading Experience Analysis (6/10)

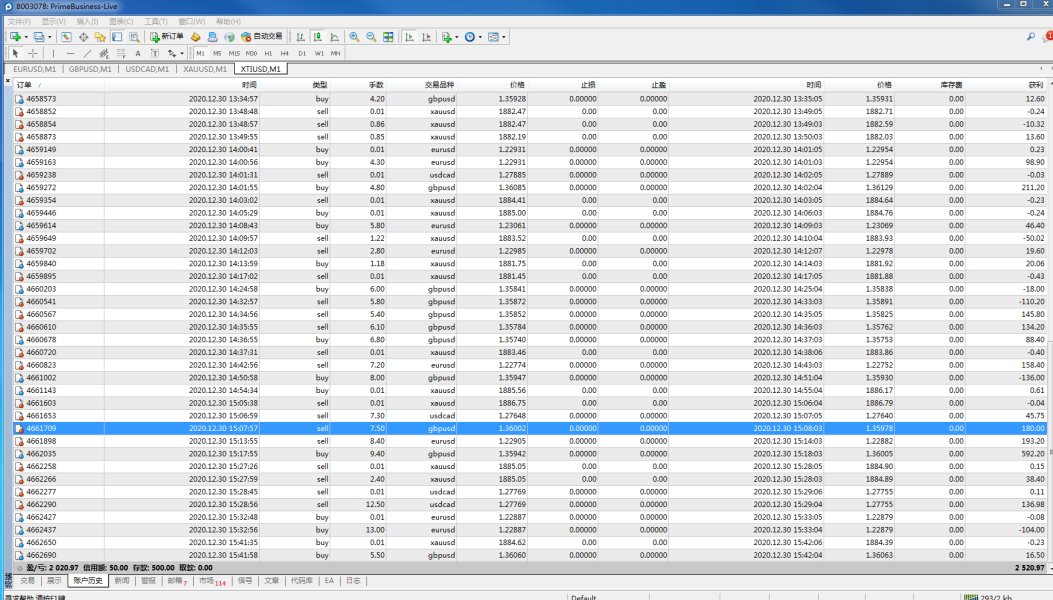

PBFX offers trading access to forex, indices, and commodities through the MT4 platform. This provides a standard trading environment for multi-asset portfolio construction. The broker's focus on these core asset classes aligns with typical retail forex broker offerings. However, specific details about instrument availability, market coverage, and trading conditions remain unclear from available documentation.

Platform stability, execution speed, and order processing quality are not addressed in available sources. This represents critical information gaps for traders who require reliable trade execution. The absence of data regarding slippage rates, requote frequency, and execution statistics makes it difficult to assess the broker's operational quality compared to industry standards. These factors are crucial for determining whether PBFX can provide competitive trading conditions.

Mobile trading capabilities, advanced order types, and platform customization options are not detailed in current documentation. The MT4 platform provides standard mobile access, but specific features and performance optimization for mobile trading remain unspecified. The moderate rating acknowledges multi-asset trading availability while reflecting concerns about transparency regarding execution quality and platform performance. These factors are essential for comprehensive trading experience evaluation.

This pbfx review finds that while basic trading functionality appears available, the lack of detailed performance data and user experience feedback limits confidence in the broker's trading environment quality.

Trust and Reliability Analysis (3/10)

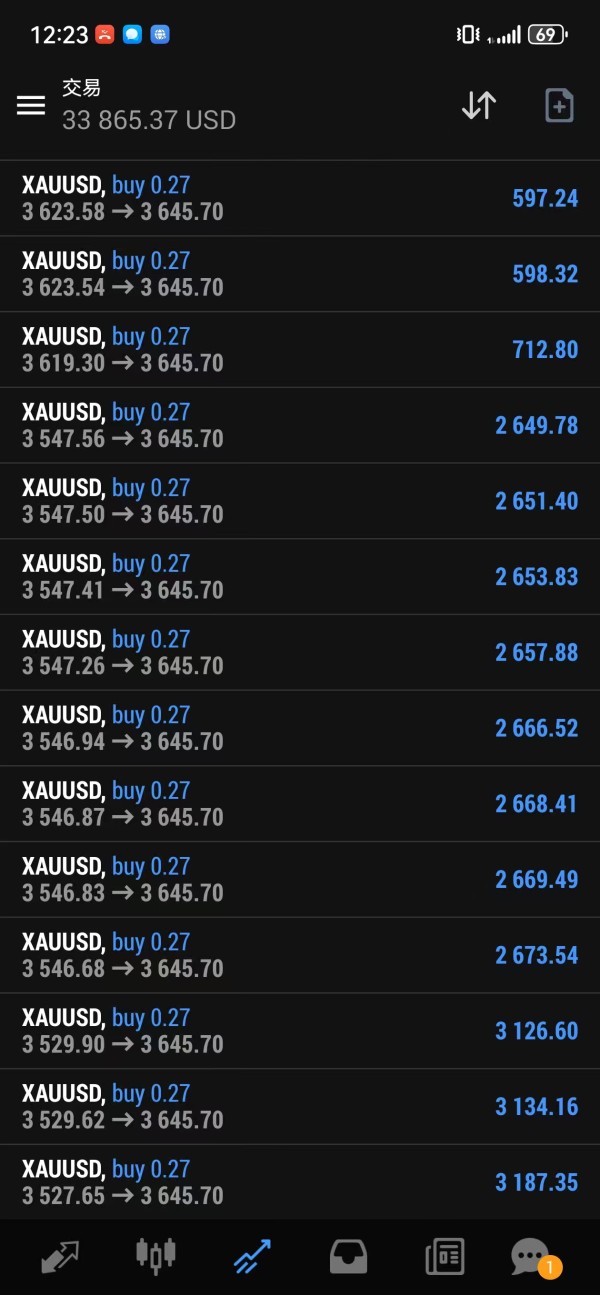

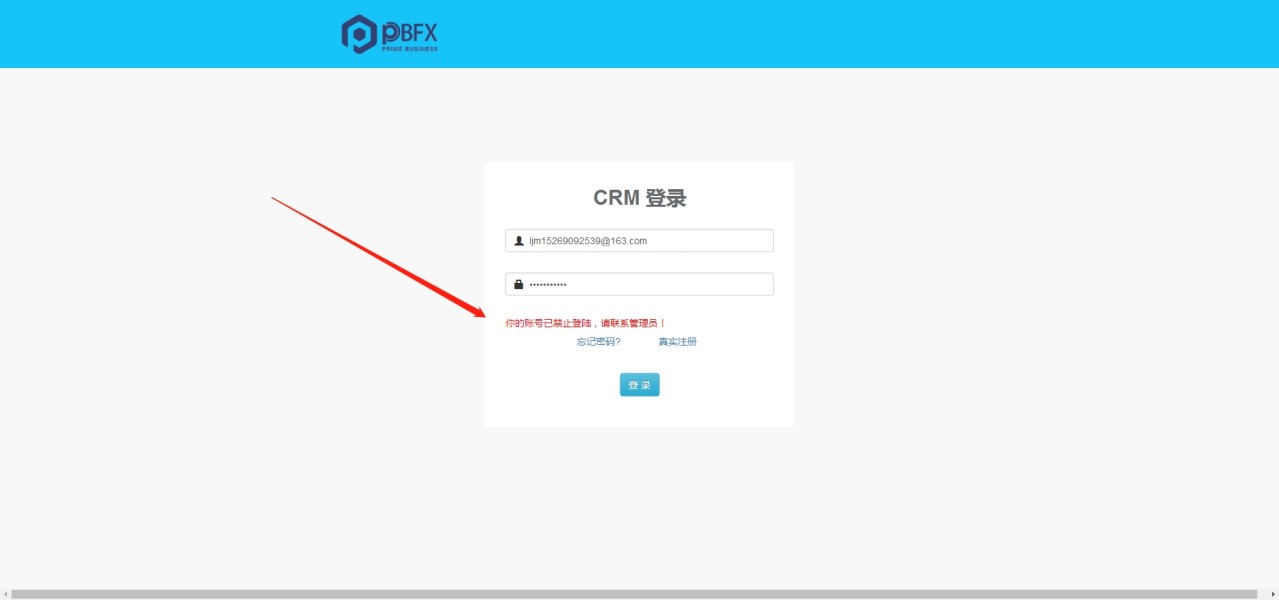

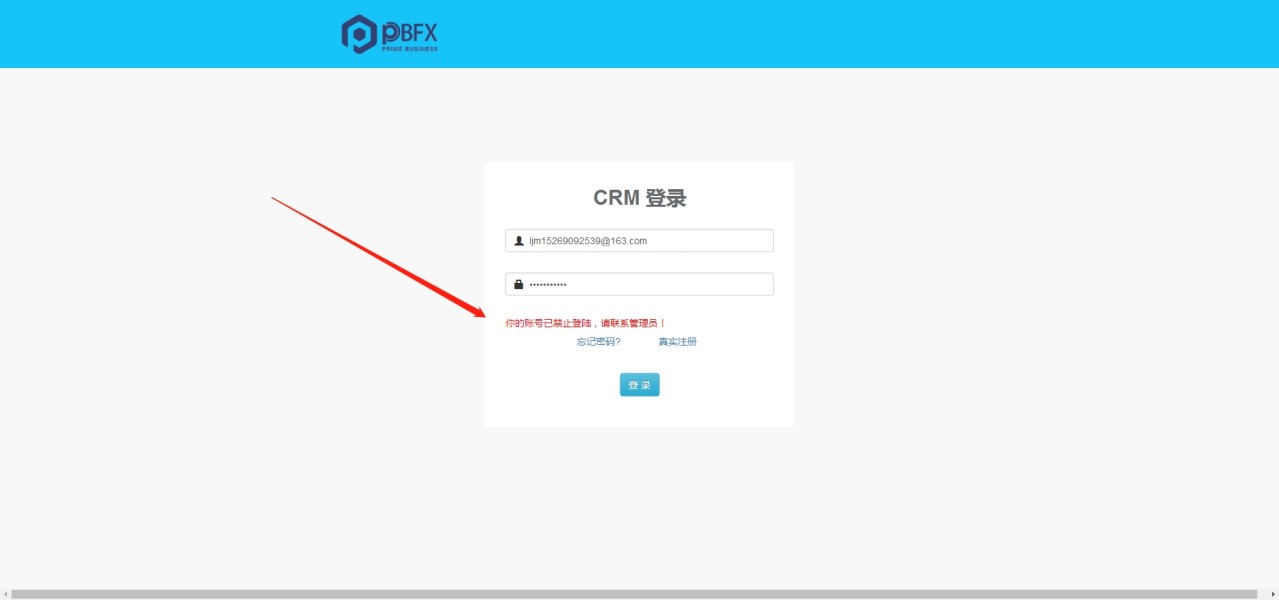

PBFX faces significant trust and reliability concerns primarily due to warnings issued by the Financial Markets Authority. These warnings represent serious red flags for potential clients. Regulatory warnings typically indicate non-compliance with financial services regulations, unauthorized operations, or other activities that may pose risks to client funds and trading operations. The presence of such warnings substantially undermines confidence in the broker's operational legitimacy and regulatory compliance.

The broker's regulatory status remains unclear. There is no mention of authorization from recognized financial authorities such as the FCA, ASIC, CySEC, or other major regulatory bodies. This absence of clear regulatory oversight represents a fundamental concern for traders who require regulatory protection for their investments. Licensed brokers typically provide regulatory authorization numbers, regulatory body contact information, and compliance documentation. PBFX appears to lack these important credentials.

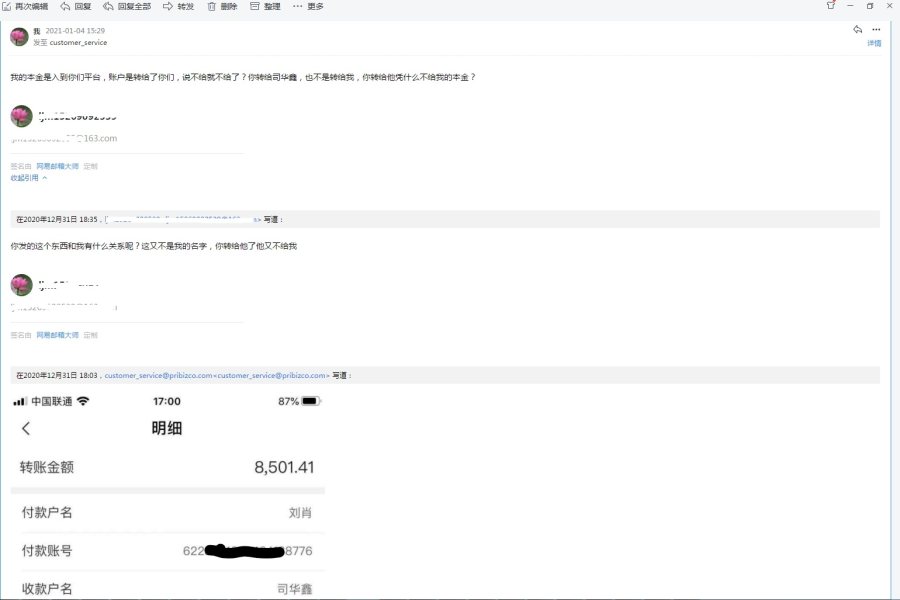

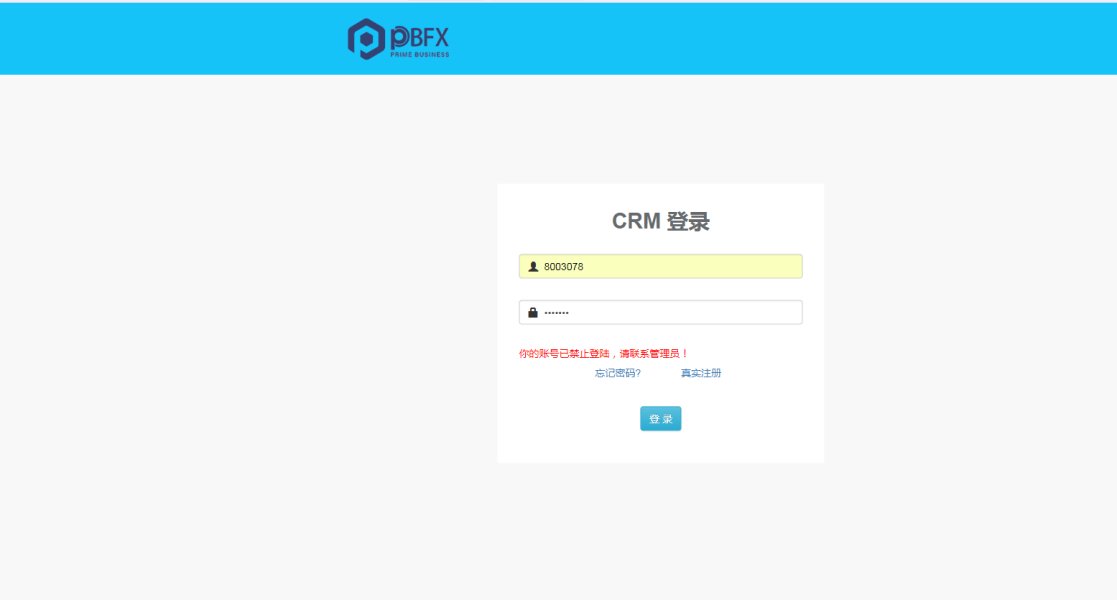

Client fund protection measures, segregated account policies, and financial compensation schemes are not documented in available sources. Regulated brokers typically provide clear information about client money protection, insurance coverage, and regulatory safeguards that protect trader deposits. The absence of such information, combined with regulatory warnings, creates substantial concerns about fund safety and operational transparency.

The low trust rating reflects the serious impact of regulatory warnings and the absence of clear regulatory authorization. These factors significantly outweigh other operational considerations for risk-conscious traders.

User Experience Analysis (5/10)

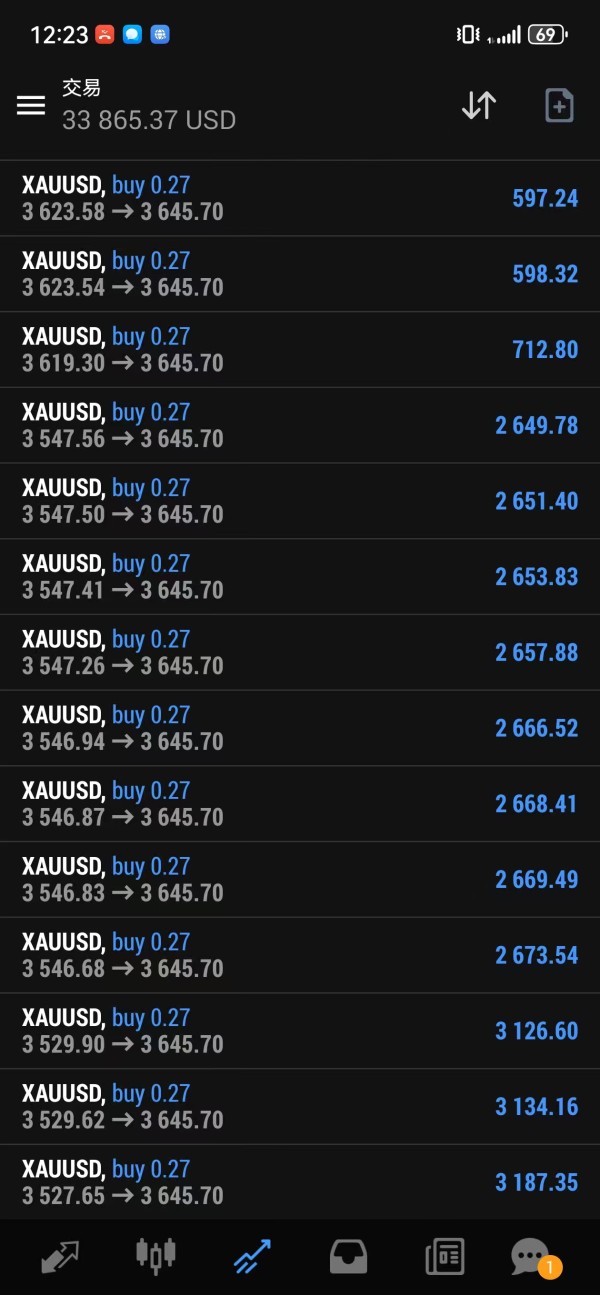

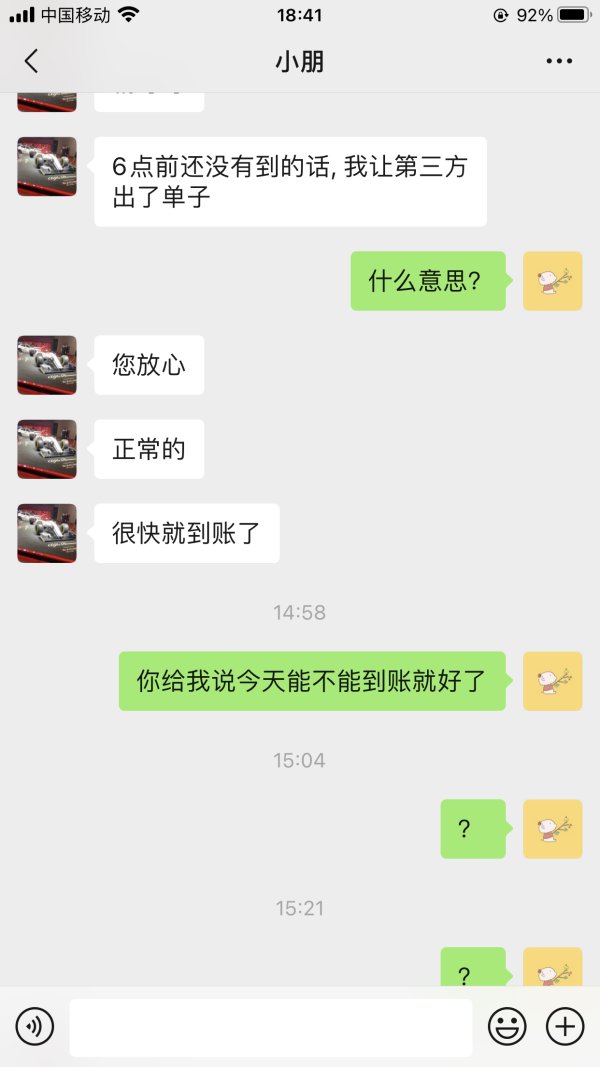

Available information indicates that PBFX has received mixed user feedback. Some reviews are positive and neutral, though detailed user testimonials and experience reports are not readily available in current sources. The limited availability of comprehensive user feedback makes it challenging to assess overall client satisfaction. It also makes it difficult to identify common user experience patterns.

Interface design, platform usability, and navigation efficiency are not specifically addressed in available documentation. User experience typically encompasses account registration processes, platform learning curves, customer service interactions, and overall operational satisfaction. The absence of detailed user feedback regarding these aspects represents a significant information gap. Potential clients seeking peer insights cannot easily find this important information.

Account opening procedures, verification processes, and onboarding experiences are not documented. This makes it difficult to assess the broker's user-friendliness for new clients. Modern brokers typically streamline these processes and provide clear guidance. However, PBFX's approach to client onboarding remains unclear from available sources.

The moderate rating reflects the presence of some positive user feedback while acknowledging the limited availability of comprehensive user experience data. This data would enable more detailed evaluation of client satisfaction patterns and common operational experiences.

Conclusion

PBFX presents as a forex broker with basic trading capabilities but significant concerns that potential clients must carefully consider. The company offers multi-asset trading through the established MT4 platform and maintains operations across several markets. However, the presence of regulatory warnings and limited operational transparency create substantial risk factors. These risk factors overshadow potential benefits.

The broker may appeal to experienced traders seeking access to forex, indices, and commodities markets. This is particularly true for those comfortable navigating regulatory uncertainties. However, the absence of clear regulatory authorization, combined with FMA warnings, makes PBFX unsuitable for risk-averse traders. It is also not suitable for those requiring robust regulatory protection for their investments.

Key advantages include multi-asset trading availability and MT4 platform support. Significant disadvantages encompass regulatory concerns, limited transparency regarding trading conditions, and insufficient documentation of client protection measures. Potential clients should exercise extreme caution and conduct thorough due diligence before considering PBFX for their trading activities.