Is BT Global safe?

Business

License

Is BT Global Safe or Scam?

Introduction

BT Global is a forex broker that has recently entered the trading market, primarily positioning itself to cater to traders in China and Hong Kong. As the forex market continues to attract a diverse range of participants, it is essential for traders to conduct thorough due diligence before engaging with any broker. A broker's regulatory status, company background, trading conditions, and overall reputation play critical roles in determining its trustworthiness. This article aims to provide a comprehensive analysis of BT Global, examining its regulatory standing, company history, trading conditions, client safety measures, and customer experiences. The information presented here is derived from various online sources, including regulatory databases and user reviews, to ensure a balanced and factual assessment.

Regulation and Legitimacy

The regulatory framework within which a broker operates is one of the most critical factors influencing its safety. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific operational standards and practices. A lack of regulatory oversight raises red flags and can indicate potential risks associated with trading with that broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0525929 | United States | Suspicious Clone |

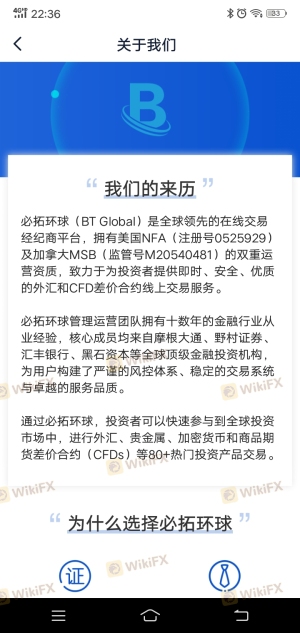

BT Global claims to be regulated by the National Futures Association (NFA) in the United States. However, there are significant concerns regarding the legitimacy of this claim, as many sources label BT Global as a "suspicious clone." This term refers to entities that falsely claim to be affiliated with legitimate regulatory bodies to mislead potential clients. The absence of valid regulatory oversight for BT Global raises serious questions about its operational transparency and the safety of traders' funds. Without a credible regulatory framework, traders may face substantial risks, including fraud and loss of capital.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its credibility. BT Global was established in 2020, making it a relatively new player in the forex market. Its headquarters are located in China, a region often associated with lax regulatory standards and potential risks for investors. The broker operates under the name "BT Global Limited," but detailed information about its ownership and management team remains scarce.

The lack of transparency regarding the company's management raises concerns about its operational integrity. A well-established broker typically provides information about its founders, management team, and their professional backgrounds. In the case of BT Global, there is insufficient information to evaluate the expertise and experience of its leadership. This lack of transparency can be a significant red flag for potential investors.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. BT Global's fee structure appears to be competitive; however, the specifics of its trading costs remain unclear.

| Fee Type | BT Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

BT Global's spreads for major currency pairs are reported to be around 2 pips, which is higher than the industry average of 1-1.5 pips. Additionally, while the broker claims to have no commission fees, the existence of high overnight interest rates can significantly impact trading costs. Traders should be cautious of any hidden fees or unfavorable trading conditions that could erode their profits over time.

Client Funds Safety

The safety of client funds is paramount when evaluating a broker's reliability. BT Global's approach to fund security is concerning, as it lacks clear policies on fund segregation and investor protection. In regulated environments, brokers are typically required to maintain client funds in segregated accounts, ensuring that these funds are protected in the event of insolvency.

BT Global's failure to provide information on such safety measures raises alarms about the potential risks traders face when depositing funds with this broker. Additionally, there have been no reports of negative balance protection, which is crucial for safeguarding traders from incurring debts beyond their initial investment. The absence of these protective measures indicates that traders might be exposed to significant risks when trading with BT Global.

Customer Experience and Complaints

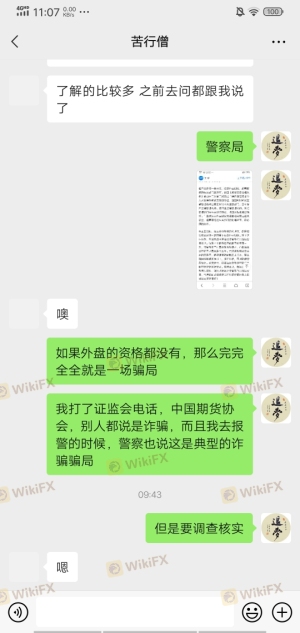

Customer feedback is a valuable indicator of a broker's reliability and service quality. A review of user experiences with BT Global reveals a pattern of dissatisfaction and complaints. Common issues reported by clients include difficulties in withdrawing funds, poor customer service, and allegations of manipulation in trade execution.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Slippage and Rejections | Medium | Limited Support |

Several traders have reported being unable to withdraw their capital, which is a serious concern that points to potential fraud or mismanagement. In some cases, clients have described their experiences as being trapped in a system that does not allow them access to their funds. The company's lack of responsiveness to complaints further exacerbates the situation, leaving traders feeling unsupported and vulnerable.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a trader's success. BT Global offers its proprietary trading platform; however, there is little information available regarding its functionality and user experience. Reports suggest that users have experienced issues with order execution quality, including significant slippage and rejections of orders.

The lack of established trading platforms, such as MetaTrader 4 or 5, which are widely recognized for their reliability and features, raises concerns about BT Global's commitment to providing a robust trading environment. The absence of transparency regarding platform performance and execution quality is a significant drawback for potential traders.

Risk Assessment

Engaging with BT Global presents various risks that traders should consider before opening an account.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises fraud concerns. |

| Fund Safety Risk | High | Lack of fund segregation and protection policies. |

| Customer Support Risk | Medium | Poor responsiveness to complaints. |

Given the high-risk levels associated with regulatory and fund safety issues, potential clients should exercise extreme caution when considering BT Global as their trading partner. It is advisable to seek alternatives that offer robust regulatory protections and transparent operational practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that BT Global is not a safe broker for trading. The numerous red flags, including its suspicious regulatory status, lack of transparency, poor customer feedback, and inadequate safety measures, strongly indicate that traders should be wary of engaging with this broker.

For those considering forex trading, it is recommended to opt for well-established and regulated brokers that provide comprehensive protections and have a proven track record of reliability. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA, ASIC, or CFTC. By choosing a safer broker, traders can significantly reduce their risks and enhance their trading experience.

Is BT Global a scam, or is it legit?

The latest exposure and evaluation content of BT Global brokers.

BT Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BT Global latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.