Summary

This comprehensive blooms markets limited review reveals concerning findings about a broker that has raised significant red flags within the trading community. Blooms Markets Limited was established in 2023. The company is registered in the United Kingdom and operates as an unregulated financial services provider offering over 40 trading instruments across forex pairs, stocks, indices, and precious metals. However, extensive analysis indicates that this entity lacks proper regulatory oversight from major financial authorities such as the Financial Conduct Authority.

User feedback consistently portrays Blooms Markets Limited as unreliable. Widespread negative reviews question the company's legitimacy and trustworthiness. The broker's business model centers on providing access to various financial markets, yet the absence of regulatory protection creates substantial risks for potential investors. Industry experts and user testimonials alike suggest extreme caution when considering this platform. This is particularly true for risk-averse traders seeking secure investment environments. The combination of unregulated status and predominantly negative user experiences positions Blooms Markets Limited as a high-risk option that fails to meet standard industry benchmarks for reliability and client protection.

Important Notice

Due to Blooms Markets Limited's unregulated status, investors across different jurisdictions may face varying levels of legal protection and risk exposure. The absence of oversight from recognized financial regulatory bodies means that standard investor protections typically available through licensed brokers may not apply. This review is based on available public information, user feedback, and industry analysis rather than direct testing of the platform's services.

Readers should note that regulatory frameworks differ significantly between regions. The lack of proper licensing may result in limited recourse options for dispute resolution or fund recovery. All information presented reflects the current understanding of the broker's operations as of 2024, and potential users are strongly advised to conduct independent verification before making any investment decisions.

Rating Overview

Broker Overview

Blooms Markets Limited emerged in the financial services sector in 2023 as a UK-registered entity attempting to establish itself within the competitive online trading landscape. According to available company information, the broker positions itself as a provider of diverse trading opportunities across multiple asset classes. The company targets retail investors seeking access to international financial markets. However, the company's operational framework lacks the fundamental regulatory foundation that characterizes legitimate financial service providers.

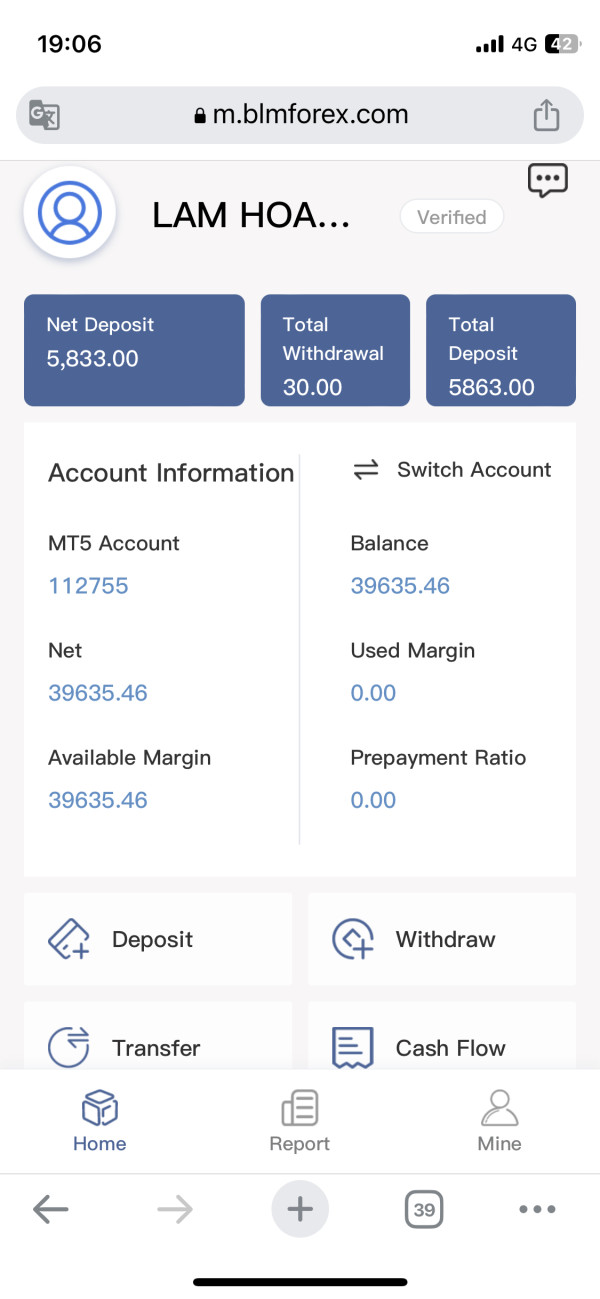

The broker's business model revolves around offering trading services for over 40 different financial instruments. These include major and minor currency pairs, equity indices, individual stocks, and precious metals trading opportunities. Despite this seemingly comprehensive offering, the absence of proper regulatory oversight raises substantial questions about the company's operational legitimacy and commitment to industry standards.

Blooms Markets Limited operates without supervision from any major financial regulatory authority. This includes the FCA, ASIC, CySEC, or other recognized bodies that typically oversee retail trading operations. This blooms markets limited review emphasizes that such regulatory absence represents a critical deficiency in meeting basic industry requirements for client protection, fund segregation, and operational transparency that experienced traders expect from legitimate brokers.

Regulatory Status: Blooms Markets Limited operates without valid regulation from any recognized financial authority. This creates significant compliance and protection gaps for potential clients.

Deposit and Withdrawal Methods: Specific information regarding available payment methods, processing times, and associated fees is not detailed in available documentation.

Minimum Deposit Requirements: Concrete minimum deposit amounts and account funding requirements are not specified in accessible materials.

Promotional Offers: Details regarding welcome bonuses, trading incentives, or promotional campaigns are not mentioned in current available information.

Tradeable Assets: The platform reportedly provides access to over 40 trading instruments spanning forex pairs, stock indices, individual equities, and precious metals. However, specific instrument lists and trading conditions remain unclear.

Cost Structure: Comprehensive information about spreads, commissions, overnight financing charges, and other trading costs is not detailed in available resources. This represents a significant transparency concern for this blooms markets limited review.

Leverage Ratios: Maximum leverage offerings and margin requirements across different asset classes are not specified in accessible documentation.

Platform Options: Information regarding trading platform availability, mobile applications, and technical analysis tools remains unspecified in current materials.

Geographic Restrictions: Specific jurisdictional limitations or service availability by region is not clearly outlined in available information.

Customer Support Languages: Details about multilingual support options and communication channels are not mentioned in accessible resources.

Account Conditions Analysis

The account structure and conditions offered by Blooms Markets Limited remain largely opaque. Critical information about account types, minimum balance requirements, and specific terms is conspicuously absent from available documentation. This lack of transparency represents a significant concern for potential clients seeking to understand their trading environment and associated obligations.

Standard industry practice involves clear disclosure of account tiers, each with distinct features, minimum deposit requirements, and associated benefits. However, available information fails to provide such clarity. This leaves potential users without essential details needed for informed decision-making. The absence of detailed account information contrasts sharply with legitimate brokers who typically provide comprehensive breakdowns of their offering structure.

User feedback consistently highlights negative experiences. Many reviewers question the company's worthiness as an investment platform. These concerns extend to account opening procedures, verification processes, and ongoing account management, suggesting systemic issues with client onboarding and service delivery.

The lack of information regarding specialized account options, such as Islamic accounts for Sharia-compliant trading or institutional accounts for larger investors, further demonstrates the platform's limited sophistication compared to established industry players. This blooms markets limited review finds that the absence of clear account conditions represents a fundamental transparency failure that undermines client confidence and decision-making capabilities.

Blooms Markets Limited claims to offer over 40 trading instruments across multiple asset classes, including forex pairs, stocks, indices, and precious metals. While this suggests a reasonably diverse trading environment, the lack of detailed information about specific instruments, trading conditions, and market access arrangements raises questions about the actual depth and quality of these offerings.

The absence of information regarding research and analysis resources represents a significant limitation for traders who rely on market insights, economic calendars, and technical analysis tools to inform their trading decisions. Legitimate brokers typically provide comprehensive research departments, daily market commentary, and educational resources to support client success.

Educational resources, which serve as crucial support mechanisms for both novice and experienced traders, appear to be either absent or inadequately documented. The lack of trading guides, webinars, video tutorials, or other educational materials suggests limited commitment to client development and success.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, remains unspecified in available documentation. This represents another area where the broker falls short of industry standards. Most modern platforms provide robust automation options for sophisticated trading strategies.

User reviews consistently express negative sentiments about the company's overall value proposition. This suggests that even the claimed 40+ instruments may not be delivered with the quality and reliability that traders expect from professional trading environments.

Customer Service and Support Analysis

Customer service quality represents one of the most critical aspects of any trading relationship, yet Blooms Markets Limited appears to fall significantly short in this area based on available user feedback and documented experiences. The absence of detailed information about support channels, availability hours, and response protocols suggests a fundamental lack of commitment to client service excellence.

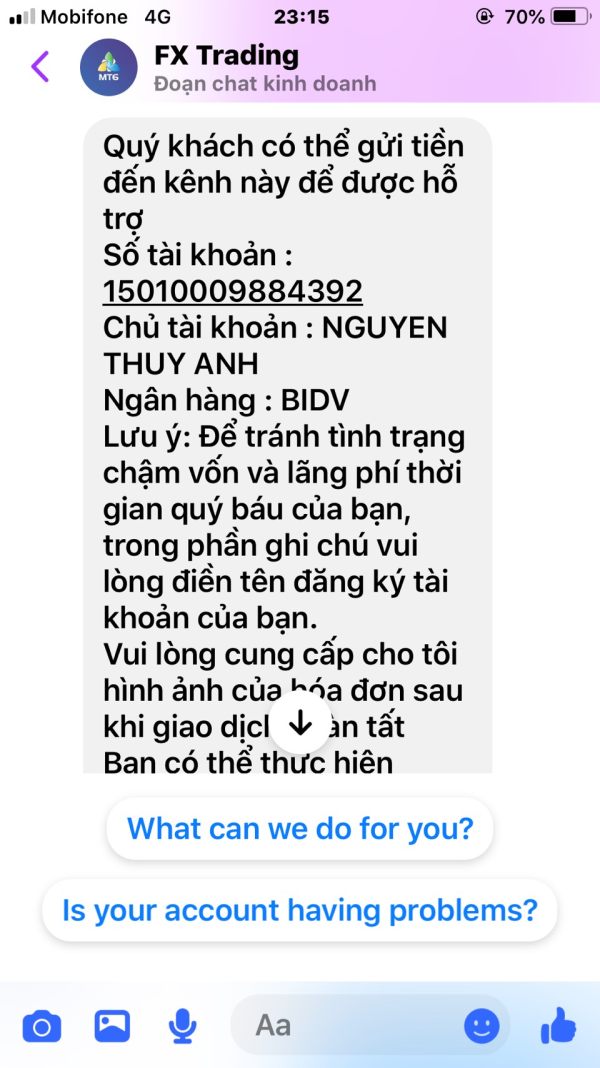

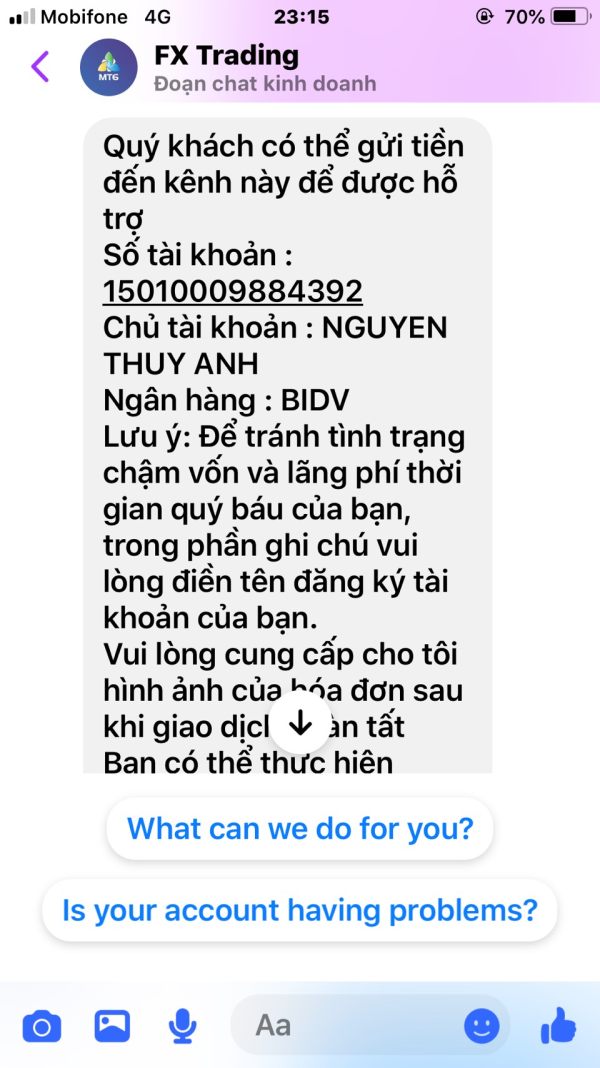

Available user reviews consistently paint a negative picture of the company's customer service capabilities. Multiple sources indicate that the broker is "not worth investing" based on client experiences. Such widespread negative sentiment typically indicates systemic issues with communication, problem resolution, and overall client relationship management.

The lack of information regarding multiple communication channels—such as live chat, telephone support, email assistance, and callback services—contrasts sharply with industry standards where legitimate brokers provide comprehensive support infrastructure. Professional trading platforms typically offer 24/5 support during market hours, multilingual assistance, and dedicated account management for larger clients.

Response time commitments and service level agreements are not documented in available materials. This leaves potential clients without clear expectations for support accessibility and problem resolution timeframes. The absence of service standards represents a significant concern for traders who require reliable assistance for technical issues, account inquiries, or trading-related questions.

The overall negative user feedback regarding customer service quality suggests that even when support is available, the quality and effectiveness of assistance provided may be inadequate for meeting client needs and resolving issues satisfactorily.

Trading Experience Analysis

The trading experience offered by Blooms Markets Limited appears to be problematic based on user feedback and the absence of detailed platform information. While specific technical performance data is not available, user reviews consistently indicate negative experiences that suggest issues with platform reliability, execution quality, and overall trading environment stability.

Platform stability and execution speed represent fundamental requirements for successful trading operations. Yet available information provides no concrete data about server uptime, latency performance, or order execution statistics. The absence of such technical specifications raises concerns about the broker's infrastructure capabilities and commitment to providing professional-grade trading conditions.

Order execution quality, including fill rates, slippage statistics, and requote frequency, remains undocumented in available materials. Professional traders require transparent disclosure of execution statistics to evaluate whether a broker can meet their performance requirements. This is particularly important for high-frequency or scalping strategies.

Mobile trading capabilities and cross-platform synchronization are not detailed in accessible documentation. This is concerning since mobile trading represents an essential component of modern trading operations. The lack of information about mobile apps, tablet compatibility, and responsive web platforms suggests limited technological sophistication.

User feedback consistently indicates negative trading experiences, with reviewers expressing concerns about the platform's overall reliability and questioning whether the company represents a worthwhile investment opportunity. This blooms markets limited review finds that such widespread negative sentiment typically correlates with significant operational deficiencies in trading infrastructure and execution quality.

Trust and Reliability Analysis

Trust and reliability represent the cornerstone of any legitimate financial services relationship, yet Blooms Markets Limited demonstrates significant deficiencies in these critical areas. The most concerning aspect is the complete absence of regulatory oversight from any recognized financial authority. This includes the FCA, ASIC, CySEC, or other major regulatory bodies that typically supervise retail trading operations.

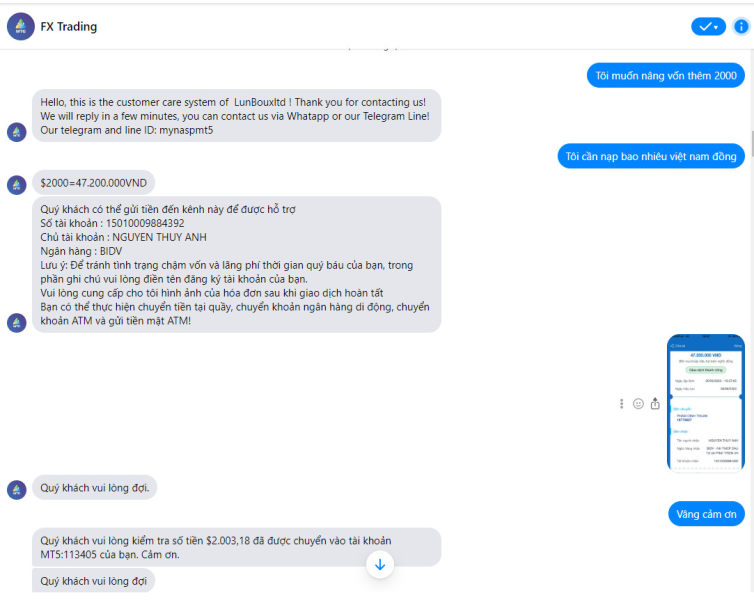

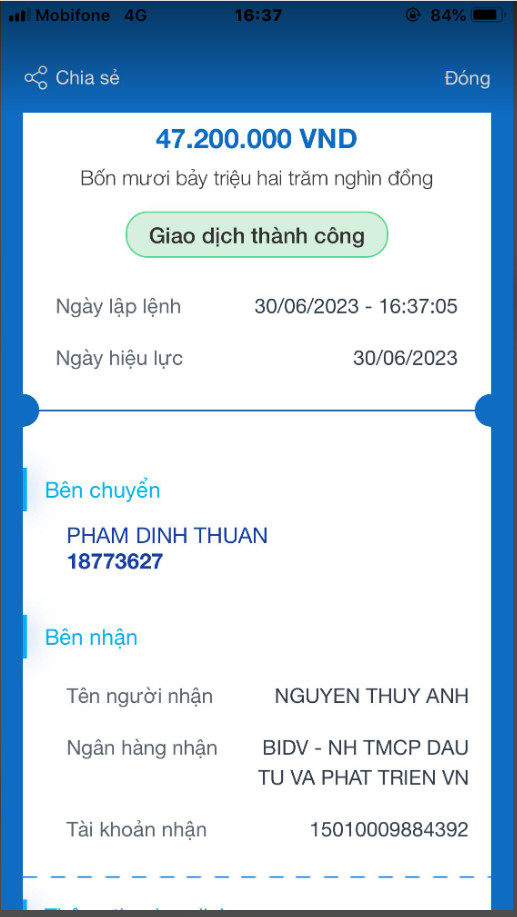

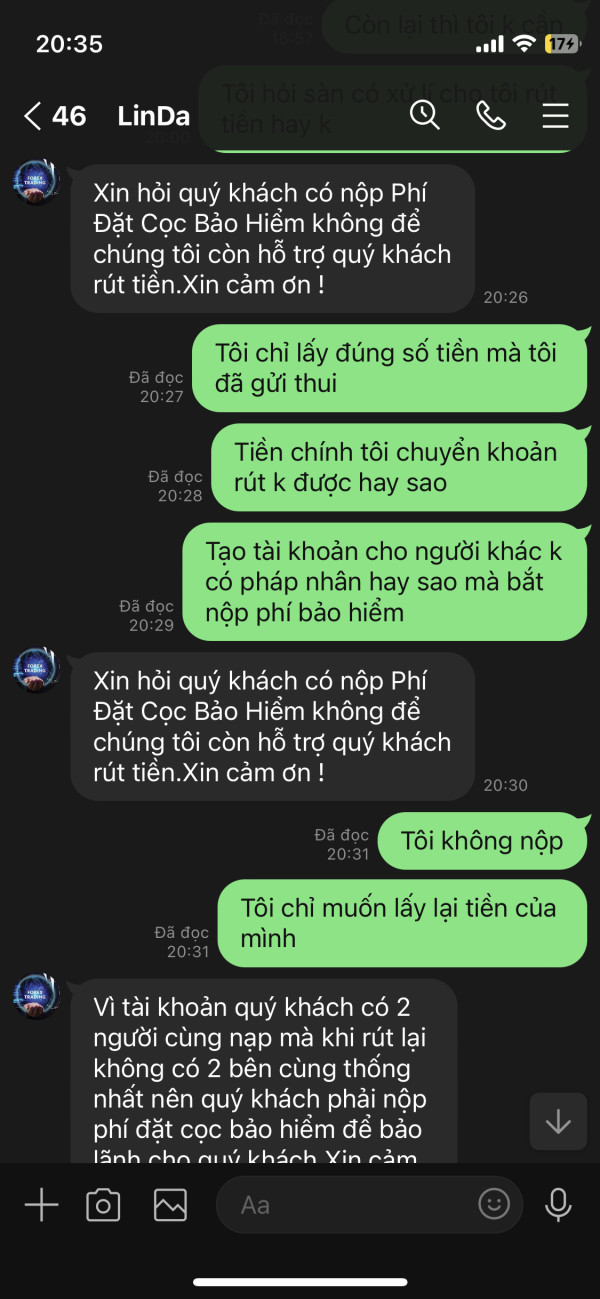

The lack of valid regulation means that standard investor protections—such as segregated client funds, compensation schemes, and regulatory dispute resolution mechanisms—are not available to clients. This regulatory vacuum creates substantial risks for investors, as there are no external oversight mechanisms to ensure proper business conduct or fund security.

Company transparency appears limited, with insufficient disclosure about operational procedures, fund handling practices, and corporate governance structures. Legitimate brokers typically provide comprehensive information about their regulatory status, financial backing, and operational procedures. They do this to build client confidence and demonstrate compliance with industry standards.

Industry reputation based on user feedback is overwhelmingly negative. Multiple sources indicate that the company is not considered a worthwhile investment opportunity. Such widespread negative sentiment from the trading community represents a significant red flag regarding the broker's operational integrity and client treatment practices.

The absence of information about negative event handling, dispute resolution procedures, and client protection measures further undermines confidence in the broker's ability to manage client relationships professionally and ethically. Without proper regulatory oversight and transparent operational procedures, clients have limited recourse for addressing potential issues or recovering funds in case of disputes.

User Experience Analysis

Overall user satisfaction with Blooms Markets Limited appears to be extremely poor based on available feedback and reviews from the trading community. Multiple sources indicate that users consistently rate the company negatively and advise against investment. This suggests systematic issues with service delivery and client satisfaction.

The user interface design and platform usability remain undocumented in available materials. This prevents potential clients from understanding the trading environment they would encounter. Modern traders expect intuitive interfaces, customizable layouts, and efficient navigation systems that enhance rather than hinder their trading activities.

Registration and verification processes are not detailed in accessible documentation. This leaves potential users without clear expectations about account opening requirements, documentation needs, and approval timeframes. Professional brokers typically provide transparent information about onboarding procedures to facilitate smooth client acquisition.

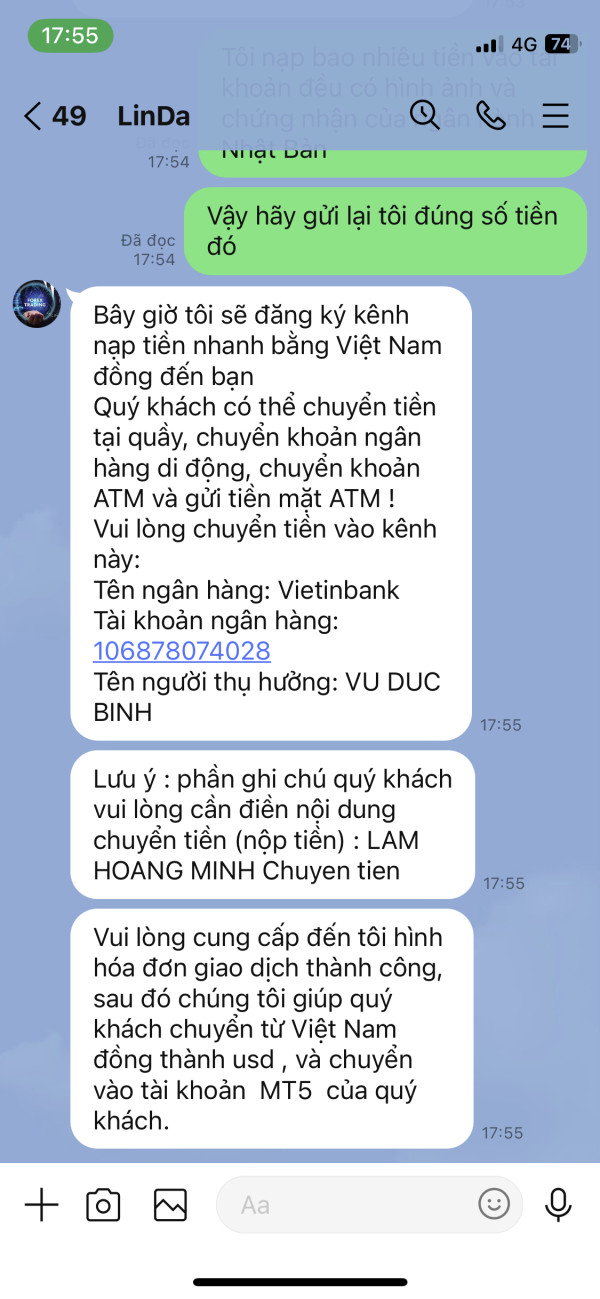

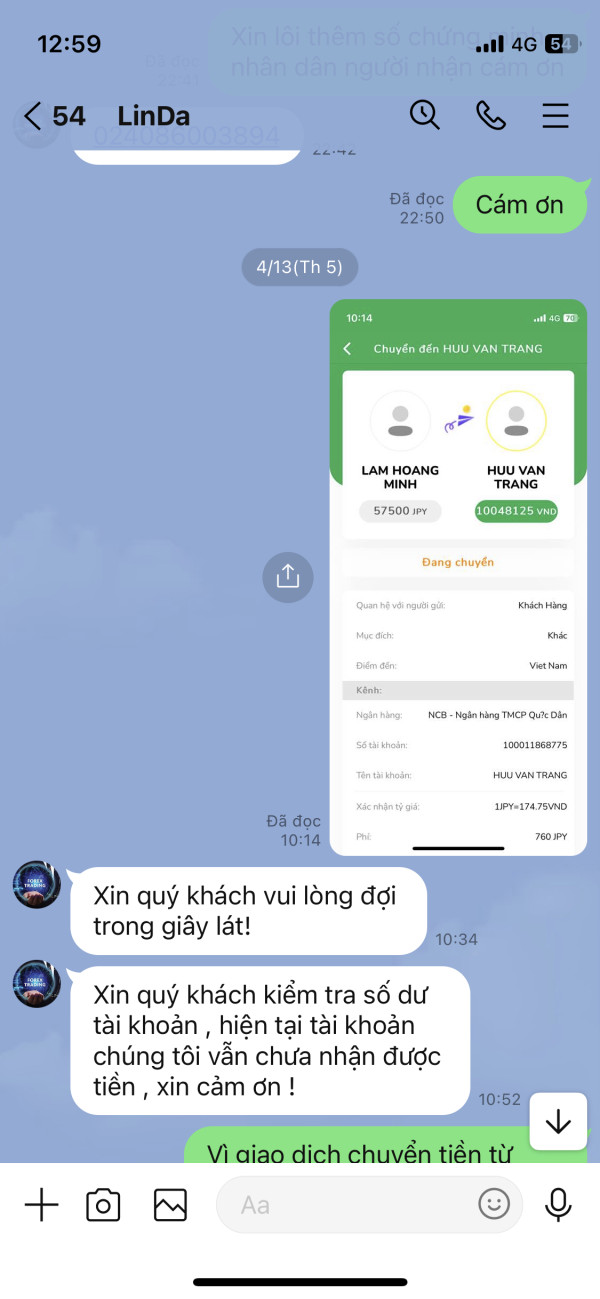

Fund management experiences, including deposit processing, withdrawal procedures, and account funding options, are not adequately documented. The absence of clear information about financial transaction procedures represents a significant transparency gap. This undermines user confidence and decision-making capabilities.

Common user complaints center around the overall reliability and worthiness of the platform as an investment vehicle. Reviewers consistently advise against engagement with the company. Such widespread negative sentiment suggests fundamental issues with the broker's service delivery model and client relationship management practices.

The recommendation profile for this broker is overwhelmingly negative. Industry sources and user feedback consistently advise against platform usage, particularly for risk-averse investors seeking secure and reliable trading environments.

Conclusion

This comprehensive blooms markets limited review reveals a broker that fails to meet basic industry standards for regulatory compliance, transparency, and client service. Blooms Markets Limited operates without proper regulatory oversight, lacks transparency in its operational procedures, and has generated consistently negative feedback from the trading community.

The broker is not suitable for any investor category, particularly those with low risk tolerance who require secure, regulated trading environments. While the company claims to offer over 40 trading instruments, the absence of regulatory protection and widespread negative user experiences overshadow any potential advantages.

The primary disadvantages include complete lack of regulatory oversight, poor user satisfaction ratings, insufficient transparency in operations and costs, and limited information about essential trading conditions. The minimal advantage of instrument variety is vastly outweighed by fundamental deficiencies in trust, reliability, and regulatory compliance that characterize legitimate financial service providers.