Is BLOOMS MARKETS LIMITED safe?

Business

License

Is Blooms Markets Limited Safe or Scam?

Introduction

Blooms Markets Limited is a forex brokerage that positions itself as a reputable player in the online trading landscape. With promises of competitive trading conditions and a wide array of financial instruments, it aims to attract both novice and experienced traders. However, the importance of conducting thorough due diligence before engaging with any forex broker cannot be overstated. Traders need to be cautious and assess the legitimacy and safety of their chosen broker, as the forex market is fraught with unregulated entities and potential scams. In this article, we will systematically evaluate Blooms Markets Limited by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment.

Regulatory Status and Legitimacy

The regulatory environment is crucial for any financial service provider, especially in the forex trading sector. A broker's regulatory status affects its credibility and the safety of client funds. Blooms Markets Limited claims to operate under various regulatory frameworks; however, investigations reveal a different story. The broker is not listed with major regulatory bodies such as the UK's Financial Conduct Authority (FCA) or the US Commodity Futures Trading Commission (CFTC).

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Registered |

| CFTC | N/A | USA | Not Registered |

The absence of a valid license from a reputable regulatory authority raises significant concerns regarding the safety of traders' investments. Operating without oversight means that Blooms Markets Limited is not subject to the stringent regulations that govern legitimate brokers, increasing the risk of fraudulent practices. Given the lack of regulatory compliance, it is evident that Blooms Markets Limited is not safe for traders looking for a secure trading environment.

Company Background Investigation

Understanding the companys history, ownership structure, and operational transparency is essential in assessing its reliability. Blooms Markets Limited appears to have a relatively short operational history, having been established in 2022. The lack of a substantial track record raises questions about its experience and stability in the market. Furthermore, the company's claims regarding its headquarters and global presence seem dubious, with several reports indicating that its registered address may be fictitious.

The management team's background is another critical factor. Unfortunately, there is limited information available about the individuals behind Blooms Markets Limited, which further complicates the assessment of its credibility. Transparency in the management structure is crucial for building trust; however, the opaqueness surrounding Blooms Markets Limited is alarming. Without clear information about the management team and their qualifications, it is difficult to ascertain whether they possess the necessary expertise to operate a forex brokerage effectively.

Trading Conditions Analysis

When evaluating a broker, it is vital to consider the overall trading conditions, including fees, spreads, and commissions. Blooms Markets Limited advertises competitive trading conditions, but the specifics are often vague or misleading. The absence of clear information about spreads and commissions can be a red flag, indicating that traders may face unexpected costs.

| Fee Type | Blooms Markets Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 1.5 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The lack of transparency in fee structures can lead to frustration and financial loss for traders. Additionally, reports of hidden charges and excessive withdrawal fees have surfaced, suggesting that the broker may not have the best interests of its clients at heart. Therefore, the trading conditions at Blooms Markets Limited warrant caution, as they may not be as favorable as advertised.

Customer Fund Security

The safety of customer funds is paramount when choosing a forex broker. Blooms Markets Limited's measures for ensuring fund security are questionable. The broker does not provide clear information about fund segregation or investor protection schemes, which are standard practices among regulated brokers.

Without the assurance of segregated accounts, traders' funds may be at risk in the event of the broker's insolvency. Moreover, the absence of negative balance protection means that traders could potentially lose more than their initial investment. Historical complaints about difficulty in withdrawing funds and allegations of account restrictions further highlight the risks associated with trading with Blooms Markets Limited.

Customer Experience and Complaints

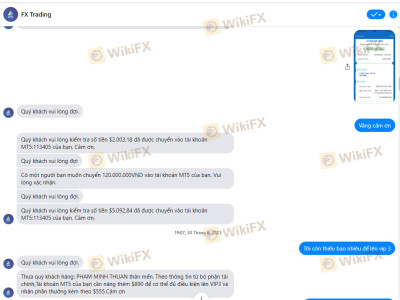

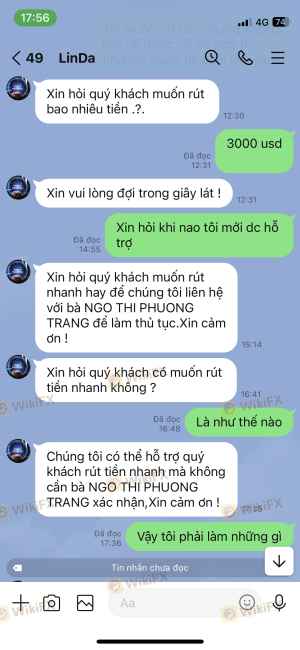

Customer feedback is a valuable resource for assessing a broker's reputation. Unfortunately, Blooms Markets Limited has garnered a significant number of negative reviews from users. Common complaints include difficulties with fund withdrawals, poor customer service, and unresponsive support teams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

| Account Restrictions | High | No Resolution |

For instance, several users have reported being unable to withdraw their funds, often being told that additional fees or taxes must be paid before withdrawals can be processed. This pattern of complaints raises serious concerns about the broker's operational integrity and customer service quality.

Platform and Execution

The trading platform is a critical component of the trading experience. Blooms Markets Limited claims to offer a standard trading platform; however, user reviews indicate that the platform may not perform as expected. Issues such as slow order execution, slippage, and potential manipulation have been reported.

A reliable trading platform should provide seamless execution and user-friendly navigation. Unfortunately, the lack of transparency and user complaints suggest that Blooms Markets Limited may not deliver on these expectations.

Risk Assessment

Engaging with Blooms Markets Limited poses several risks that should not be overlooked.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | Potential loss of funds without recourse |

| Operational Risk | Medium | Complaints about platform reliability |

Given these risks, traders should exercise extreme caution. It is advisable to consider alternative brokers with established reputations and regulatory compliance to mitigate potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Blooms Markets Limited is not safe for traders. The lack of regulatory oversight, questionable company background, unclear trading conditions, and poor customer experiences indicate that this broker may not be trustworthy. For traders seeking a secure and reliable trading environment, it is recommended to explore alternative options that are regulated and have positive user feedback.

For those who may have already engaged with Blooms Markets Limited, it is crucial to monitor your investments closely and consider seeking professional advice on how to recover any lost funds. Always prioritize safety and due diligence when selecting a forex broker to mitigate the risks associated with online trading.

Is BLOOMS MARKETS LIMITED a scam, or is it legit?

The latest exposure and evaluation content of BLOOMS MARKETS LIMITED brokers.

BLOOMS MARKETS LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BLOOMS MARKETS LIMITED latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.