Bithoven 2025 Review: Everything You Need to Know

Executive Summary

Bithoven is a new trading platform in the financial markets. It operates under the name Fortis Ltd. and started in 2019. This bithoven review shows a broker that gets attention mainly for its cryptocurrency trading services, along with regular forex and CFD services. The platform has an overall rating of 4 out of 10 from 13 user reviews. This shows mixed feelings among traders.

The broker focuses heavily on cryptocurrency trading. It also supports regular forex and CFD instruments. Bithoven targets both individual and institutional clients. It especially focuses on those with strong interest in digital asset trading. The platform emphasizes fast and secure trading execution as one of its main selling points. However, detailed regulatory information is missing from public documents.

Bithoven is new to the market. It has tried to establish itself through its own trading platform and multi-asset approach. However, the lack of detailed regulatory oversight may concern conservative traders. Limited transparency about operational details is also a problem. Traders seeking established, heavily regulated alternatives may have concerns.

Important Notice

This review is based on publicly available information and user feedback from various sources. Readers should note that Bithoven operates from Saint Vincent and the Grenadines. This may present different regulatory standards compared to major financial jurisdictions like the UK, EU, or Australia. The regulatory environment in this jurisdiction typically offers less strict oversight than top regulatory bodies.

Our evaluation relies on user testimonials, publicly disclosed company information, and industry standard assessment criteria. This review does not include direct trading experience with the platform. Potential clients should conduct additional research before making investment decisions.

Rating Framework

Broker Overview

Company Background and Establishment

Bithoven entered the financial services market in 2019. It operates under the legal entity Fortis Ltd. The company established its headquarters in Saint Vincent and the Grenadines. This jurisdiction is known for accommodating financial services firms. Since starting, Bithoven has focused on developing a complete trading system that bridges regular forex trading with the rapidly expanding cryptocurrency market.

The broker's business model centers on providing multi-asset trading capabilities to both retail and institutional clients. Bithoven has positioned itself as a technology-forward platform. It emphasizes developing its own trading infrastructure rather than relying on third-party solutions like MetaTrader platforms. This approach allows the company to maintain greater control over user experience and platform functionality.

Platform and Asset Coverage

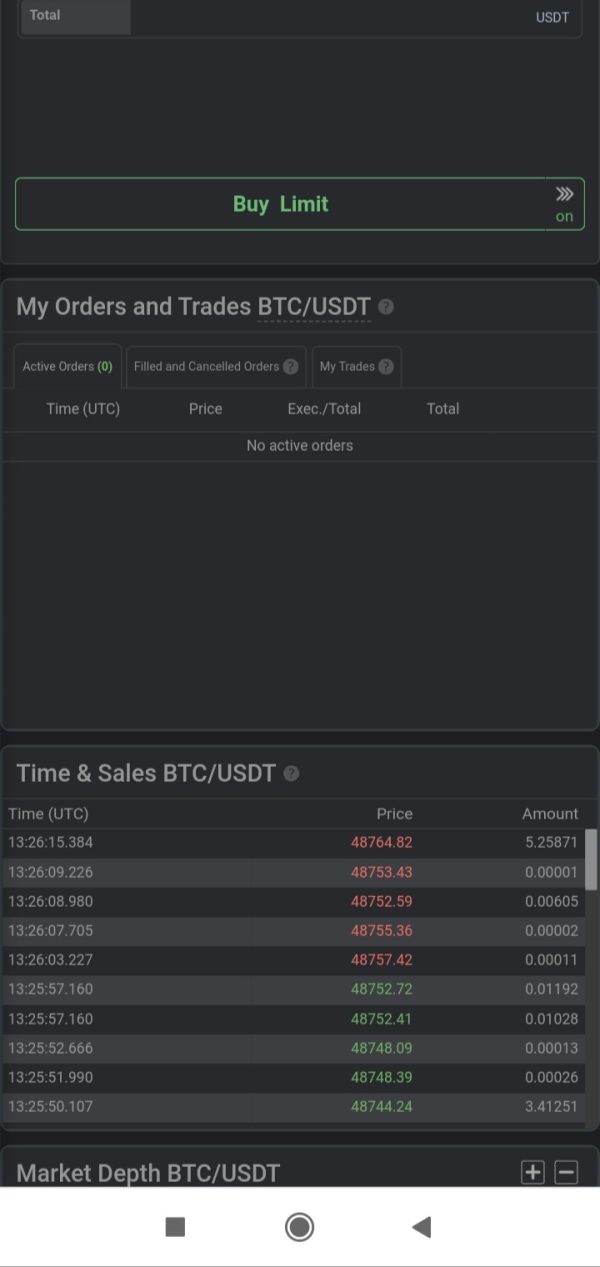

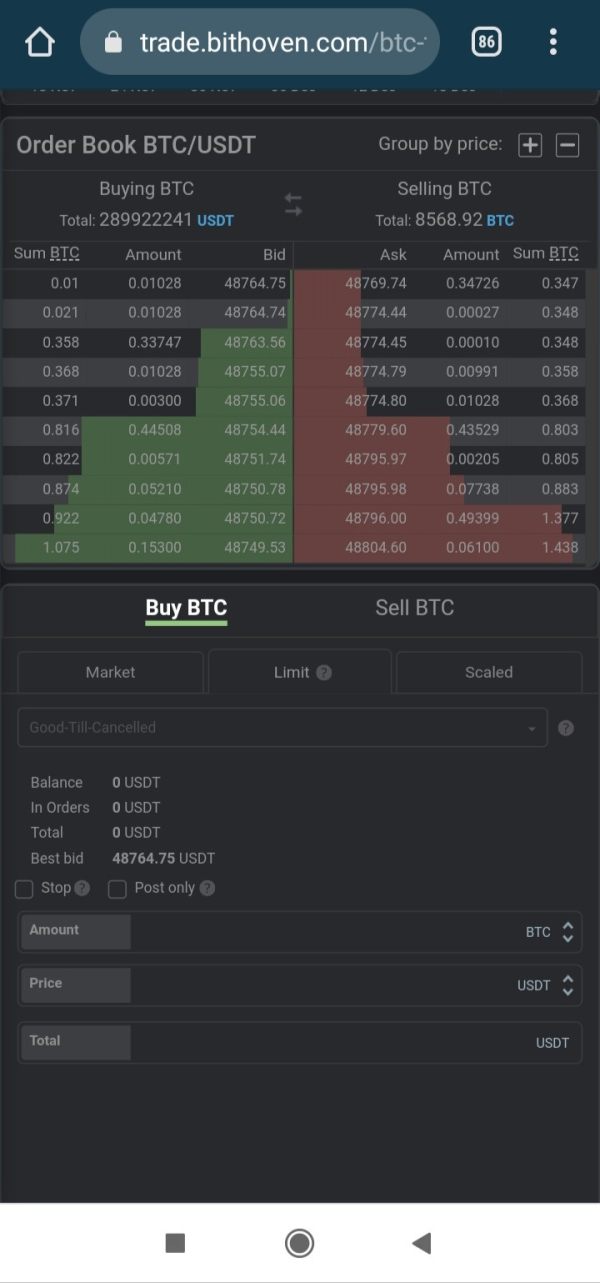

Bithoven operates through its own trading platform. This distinguishes it from brokers that use industry-standard platforms such as MetaTrader 4 or MetaTrader 5. The platform supports trading across three main asset categories: cryptocurrencies, foreign exchange pairs, and contracts for difference. This multi-asset approach reflects the broker's strategy to capture diverse trading interests within a single platform environment.

The platform's design appears built to accommodate the unique requirements of cryptocurrency trading. It also maintains functionality for regular forex operations. However, specific details about platform features, charting capabilities, and analytical tools remain limited in publicly available documentation. This bithoven review notes that the proprietary platform approach may appeal to traders seeking integrated multi-asset trading. However, it could present learning curves for those used to standard industry platforms.

Regulatory Environment

Available documentation does not specify concrete regulatory oversight from recognized financial authorities. The Saint Vincent and the Grenadines jurisdiction provides operational flexibility. However, it may not offer the comprehensive investor protection mechanisms found in top regulatory environments such as FCA, ASIC, or CySEC oversight.

Deposit and Withdrawal Methods

Bithoven does not support traditional fiat currency deposits according to available information. This suggests a primary focus on cryptocurrency-based funding methods. This approach aligns with the platform's emphasis on digital asset trading. However, it may limit accessibility for traders preferring conventional banking methods.

Minimum Deposit Requirements

Specific minimum deposit thresholds are not detailed in accessible platform documentation. Direct inquiry with the broker is required for precise funding requirements.

Promotional Offerings

Current bonus structures and promotional campaigns are not specified in available materials. This indicates either absence of such programs or limited public disclosure of incentive offerings.

Tradeable Assets

The platform supports cryptocurrency trading, forex pairs, and CFD instruments across multiple markets. This bithoven review identifies the multi-asset approach as a key differentiator. However, specific asset counts and market coverage details require further clarification.

Cost Structure

Detailed information about spreads, commissions, and additional trading costs is not comprehensively disclosed in public documentation. Direct communication with the broker is necessary for complete fee transparency.

Leverage Provisions

Leverage ratios and margin requirements are not specified in available materials. This represents a significant information gap for traders requiring specific risk management parameters.

Platform Options

Bithoven exclusively offers its own trading platform without support for third-party solutions. Traders must adapt to the company's specific interface and functionality.

Geographic Restrictions

Specific country restrictions and service availability limitations are not detailed in accessible documentation.

Customer Support Languages

Supported languages for customer service are not specified in available platform information.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of Bithoven's account conditions faces significant limitations due to insufficient publicly available information. Standard account features such as account type variations, minimum balance requirements, and special account provisions remain undisclosed in accessible documentation. This lack of transparency creates challenges for potential clients attempting to evaluate whether the platform meets their specific trading requirements.

Traditional forex brokers typically offer multiple account tiers with varying features, minimum deposits, and trading conditions. However, this bithoven review cannot provide comparative analysis due to the absence of detailed account structure information. The platform's focus on cryptocurrency trading may indicate simplified account structures. However, without official documentation, definitive conclusions remain unclear.

Account opening procedures and verification requirements are not detailed in available materials. This leaves questions about the onboarding process and compliance measures. Potential clients would need to engage directly with the platform to understand specific account terms, conditions, and available options.

The absence of detailed account information may reflect the platform's relatively recent market entry. It could also indicate strategic focus on direct client communication rather than comprehensive public disclosure. However, this approach may disadvantage traders who prefer thorough preliminary research before platform engagement.

Bithoven's trading tools and resources receive a moderate assessment based on the platform's multi-asset trading capabilities. The broker provides access to cryptocurrency, forex, and CFD trading instruments. This suggests a comprehensive toolset for diverse trading strategies. However, specific details about analytical tools, charting capabilities, and research resources remain limited in public documentation.

The proprietary platform approach indicates potential for customized trading tools designed specifically for the broker's target market. This could include specialized cryptocurrency analysis features and integrated multi-asset portfolio management capabilities. However, without detailed platform demonstrations or comprehensive feature lists, the actual quality and functionality of these tools cannot be thoroughly assessed.

Educational resources and market analysis provisions are not specifically outlined in available materials. Many established brokers provide extensive educational content, market commentary, and trading guides to support client development. The absence of detailed information about such resources represents a potential area for platform improvement.

Automated trading capabilities and third-party tool integration possibilities are not addressed in accessible documentation. This information gap may concern traders who rely on algorithmic trading strategies or external analytical software for their trading operations.

Customer Service and Support Analysis

Customer service evaluation for Bithoven faces substantial limitations due to the absence of detailed support information in available documentation. Standard customer service metrics such as available contact channels, response time commitments, and support availability hours are not specified in accessible materials.

The platform's regulatory environment in Saint Vincent and the Grenadines may influence customer service standards and dispute resolution procedures. However, without specific information about support protocols and service level commitments, potential clients cannot adequately assess the platform's customer care capabilities.

Multilingual support availability remains unspecified. This could impact international client accessibility. Given the global nature of cryptocurrency and forex markets, comprehensive language support typically represents a significant service differentiator among competing platforms.

Technical support capabilities for the proprietary trading platform are not detailed in available information. Platform-specific technical issues may require specialized support expertise. This makes the quality of technical assistance crucial for user experience. The absence of detailed support information represents a significant transparency gap that may concern potential clients seeking reliable customer service assurance.

Trading Experience Analysis

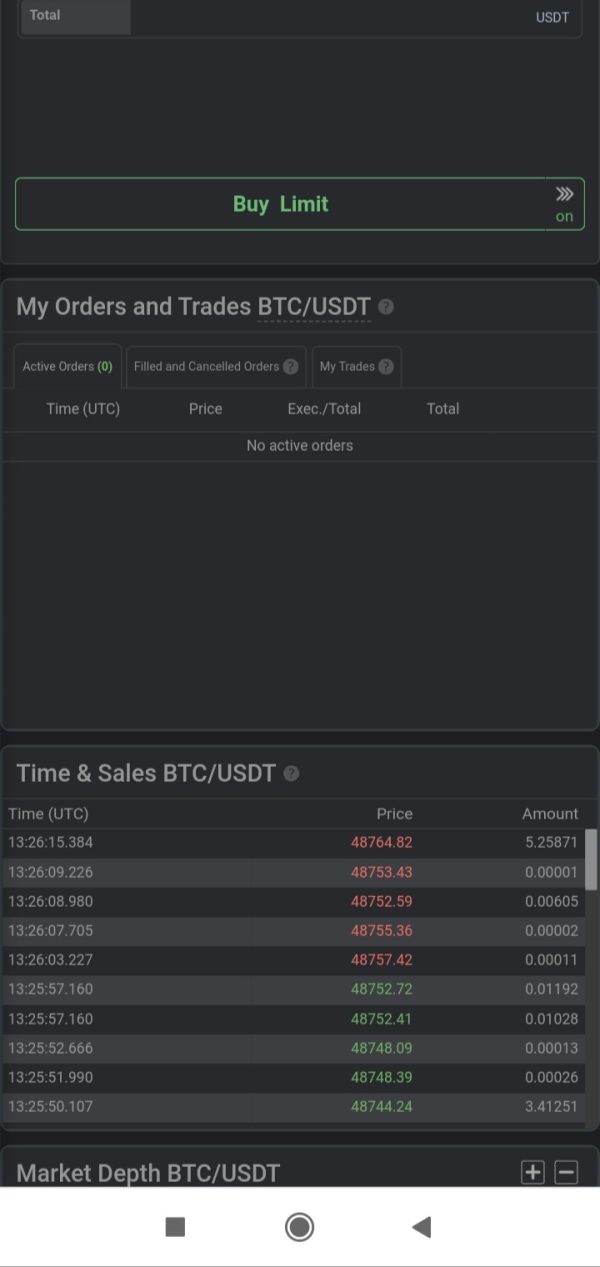

User feedback suggests that Bithoven provides a generally positive trading experience. It emphasizes fast and secure transaction processing. The platform's focus on cryptocurrency trading appears to align well with user expectations for quick execution and reliable order processing. However, specific performance metrics such as execution speeds, slippage rates, and system uptime statistics are not provided in available documentation.

The proprietary platform architecture may offer advantages in terms of integrated multi-asset trading capabilities. Users can potentially manage cryptocurrency, forex, and CFD positions within a single interface. This streamlines portfolio management and trading operations. This integrated approach could enhance trading efficiency for users working across multiple asset classes.

Mobile trading capabilities and platform accessibility across different devices are not specifically detailed in available materials. Modern traders increasingly require robust mobile trading solutions. This makes this information gap potentially significant for user experience assessment.

Platform stability and reliability during high-volume trading periods remain unaddressed in accessible documentation. This bithoven review notes that cryptocurrency markets often experience significant volatility and trading volume spikes. This requires robust platform infrastructure to maintain consistent performance during critical trading periods.

Trust and Reliability Analysis

Bithoven's trust assessment reveals significant concerns primarily related to regulatory transparency and oversight limitations. The absence of clear regulatory authority supervision from recognized financial regulators creates uncertainty about investor protection mechanisms and operational oversight standards.

The Saint Vincent and the Grenadines operational base provides legal framework for business operations. However, it may not offer the comprehensive regulatory protections found in major financial jurisdictions. This regulatory environment typically features less stringent oversight requirements. It may also provide limited recourse options for client disputes or operational issues.

Fund security measures and client asset protection protocols are not detailed in available documentation. Established brokers typically provide clear information about segregated client accounts, insurance coverage, and fund protection mechanisms. The absence of such information represents a significant transparency gap affecting trust assessment.

Company financial transparency and operational disclosure remain limited in publicly accessible materials. Potential clients cannot readily assess the company's financial stability, operational track record, or business continuity measures based on available information.

User Experience Analysis

Based on available user feedback, Bithoven receives mixed reviews with an overall rating of 4 out of 10 from 13 user evaluations. This moderate rating suggests that while some users find value in the platform's offerings, significant areas for improvement exist across the user experience spectrum.

The platform interface and usability aspects are not comprehensively detailed in available materials. User experience quality often depends heavily on platform design, navigation efficiency, and feature accessibility. Without detailed interface information, potential users cannot adequately assess whether the platform meets their usability preferences and requirements.

Registration and account verification processes are not specifically outlined in accessible documentation. Streamlined onboarding procedures typically contribute significantly to positive initial user experiences. Complex or lengthy verification processes may create user frustration.

The cryptocurrency-focused approach may appeal to users specifically interested in digital asset trading. However, it could potentially limit appeal for traditional forex traders seeking conventional trading environments. This specialization represents both a potential strength for target users and a limitation for broader market appeal.

Conclusion

This comprehensive bithoven review reveals a trading platform that occupies a unique position in the financial services landscape through its cryptocurrency-focused approach and proprietary platform technology. While Bithoven demonstrates certain strengths in trading execution and multi-asset capabilities, significant transparency limitations and regulatory concerns affect its overall assessment.

The platform appears most suitable for traders with strong interest in cryptocurrency trading who are comfortable operating within less regulated environments. Individual and institutional clients seeking integrated multi-asset trading capabilities may find value in Bithoven's offerings. This is particularly true for those prioritizing cryptocurrency access alongside traditional forex instruments.

However, the platform's main limitations include insufficient regulatory oversight transparency, limited public disclosure of operational details, and moderate user satisfaction ratings. Potential clients should carefully consider these factors against their individual risk tolerance and trading requirements before platform engagement.