Regarding the legitimacy of SAF Financial forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is SAF Financial safe?

Business

License

Is SAF Financial markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

GTC GLOBAL (AUSTRALIA) PTY LTD

Effective Date: Change Record

2017-07-07Email Address of Licensed Institution:

hy@gtcau.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 73 L 1 8 CLUNIES ROSS CT EIGHT MILE PLAINS QLD 4113 AUSTRALIAPhone Number of Licensed Institution:

0433412271Licensed Institution Certified Documents:

Is SAF Financial Safe or Scam?

Introduction

SAF Financial is a forex broker that has recently attracted attention in the trading community. As an entity operating within the highly competitive forex market, SAF Financial positions itself as a platform for traders looking to engage in currency trading. However, with the rise of online trading platforms, the need for traders to carefully evaluate the credibility of brokers has never been more critical. Many traders have fallen victim to scams that exploit their desire for lucrative trading opportunities. Therefore, it is essential to assess the safety and legitimacy of SAF Financial before considering it as a trading partner.

This article employs a comprehensive evaluation framework that includes regulatory compliance, company background, trading conditions, client fund security, customer experiences, platform performance, and risk assessment. By synthesizing data from various sources, we aim to provide a balanced analysis of whether SAF Financial is safe or potentially a scam.

Regulatory and Legitimacy

When evaluating the safety of any forex broker, regulatory oversight is a crucial factor. A well-regulated broker is typically held to strict standards, ensuring that they operate transparently and fairly. In the case of SAF Financial, the regulatory landscape appears concerning. According to multiple sources, SAF Financial operates without robust regulatory oversight, which raises flags regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | USA | Not Verified |

| ASIC | Suspicious Clone | Australia | Not Verified |

The lack of a verified license from a reputable regulatory body such as the U.S. Securities and Exchange Commission (SEC) or the UK's Financial Conduct Authority (FCA) suggests that SAF Financial may not adhere to industry standards. Furthermore, the presence of a "suspicious clone" under the Australian Securities and Investments Commission (ASIC) indicates that there may be other entities masquerading as SAF Financial, further complicating the broker's legitimacy. Given these regulatory concerns, it is imperative for potential clients to ask: is SAF Financial safe?

Company Background Investigation

The history and ownership structure of SAF Financial provide additional insights into its credibility. Established within the last few years, the company claims to have a team of experienced professionals. However, the lack of detailed information about its founders and management team raises questions about transparency.

A thorough investigation reveals that SAF Financial has not disclosed adequate information regarding its operational history, which is vital for assessing its reliability. Transparency in company operations is a hallmark of trustworthy brokers, and the absence of such information could indicate potential risks for investors.

Furthermore, the company's communication channels and customer service responsiveness are vital components of its operational integrity. Several user reviews suggest that clients often face challenges in reaching customer support, which is a significant red flag for any trading platform. This lack of transparency and communication further complicates the question of whether SAF Financial is safe for traders.

Trading Conditions Analysis

The trading conditions offered by SAF Financial are another critical aspect to consider. A transparent fee structure is essential for traders to understand the costs associated with their trading activities. However, feedback from users indicates that SAF Financial has a complex and potentially misleading fee structure.

| Fee Type | SAF Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1.5 pips |

| Commission Model | High | Low |

| Overnight Interest Range | Variable | Fixed |

The spread of 3 pips on major currency pairs is notably higher than the industry average of 1.5 pips, which could significantly eat into traders' profits. Additionally, the high commission model may deter new traders from engaging with the platform. Such unfavorable trading conditions may lead one to question the overall integrity of SAF Financial.

Traders must be cautious and consider whether these costs align with their trading strategies. The potential for hidden fees or unfavorable trading conditions could pose risks, leading to the conclusion that SAF Financial may not be safe for all traders.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. SAF Financial's approach to safeguarding client funds is another area of concern. Reports suggest that the broker does not provide adequate measures for fund segregation or investor protection.

Client funds should be kept in separate accounts to ensure that they are not used for the broker's operational expenses. Additionally, a robust negative balance protection policy is crucial to prevent clients from losing more than their initial investment. Unfortunately, SAF Financial has not clearly communicated its policies regarding these essential security measures.

The absence of such protective measures could expose traders to significant financial risks, especially in volatile market conditions. Historical complaints regarding fund withdrawal issues further exacerbate concerns about SAF Financial's commitment to client fund security. These factors lead to a pressing question: is SAF Financial safe for your trading capital?

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Many users have reported negative experiences with SAF Financial, particularly regarding withdrawal issues and unresponsive customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | High | Unresponsive |

| Customer Support Issues | Medium | Slow Response |

Several users have expressed frustration over their inability to withdraw funds, with some claiming that their accounts were blocked without explanation. This pattern of complaints raises serious concerns about the broker's operational practices and responsiveness.

For instance, one user reported that despite multiple attempts to contact customer service, they received no response regarding their withdrawal request. Such experiences are alarming and highlight the need for potential clients to be cautious. The frequency and severity of these complaints strongly suggest that SAF Financial may not be safe for traders seeking a reliable forex broker.

Platform and Trade Execution

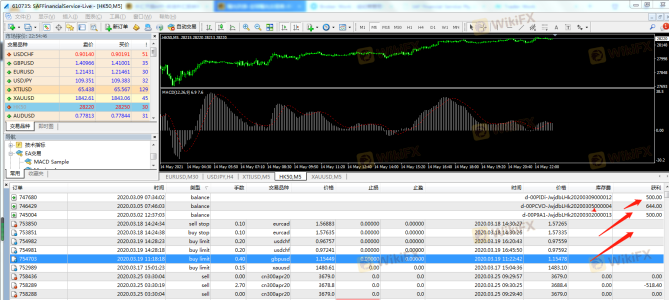

The trading platform's performance and execution quality are essential for a satisfactory trading experience. SAF Financial reportedly offers a standard trading platform; however, user reviews indicate issues with stability, order execution, and slippage.

Traders have reported instances of significant slippage during high volatility, which can lead to losses. Additionally, some users have experienced rejected orders, raising concerns about the platform's reliability. Any signs of platform manipulation or execution issues could severely impact a trader's profitability.

In summary, the overall user experience on SAF Financial's platform raises further questions about its safety and reliability. Traders must consider whether they are willing to risk their capital on a platform that may not provide the execution quality they require.

Risk Assessment

Overall, the risks associated with trading through SAF Financial are significant. The combination of regulatory concerns, unfavorable trading conditions, inadequate client fund security, and negative customer reviews paints a concerning picture.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of proper regulatory oversight |

| Trading Costs | High | High spreads and commissions |

| Client Fund Security | High | Insufficient fund protection measures |

| Customer Support | Medium | Poor responsiveness and service issues |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with better regulatory standing and customer service. Seeking brokers regulated by top-tier authorities can significantly lower the risks associated with trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that SAF Financial may not be a safe choice for forex traders. The combination of regulatory concerns, unfavorable trading conditions, inadequate client fund security, and negative customer experiences indicates potential risks that traders should not overlook.

For those considering entering the forex market, it is advisable to seek brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Reliable alternatives include brokers such as Interactive Brokers and OANDA, which have established reputations for safety and customer service.

Ultimately, the question remains: is SAF Financial safe? Given the available information, it is prudent for traders to exercise caution and consider other options before committing their capital to this broker.

Is SAF Financial a scam, or is it legit?

The latest exposure and evaluation content of SAF Financial brokers.

SAF Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SAF Financial latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.