Bux Markets 2025 Review: Everything You Need to Know

Bux Markets has emerged as a notable player in the online trading arena, particularly appealing to new investors looking for a user-friendly platform. However, while the broker boasts a variety of features, it also presents several drawbacks that potential users should be aware of. This review will delve into the key aspects of Bux Markets, including its trading platform, asset offerings, and user experience.

Note: It is essential to highlight that Bux Markets operates under different entities across regions, which may affect regulatory oversight and user experience. This review synthesizes information from multiple sources to ensure a fair and accurate representation.

Ratings Overview

We rate brokers based on a combination of user feedback, expert analysis, and regulatory information.

Broker Overview

Founded in 2014, Bux Markets is part of the Bux Group, which aims to democratize trading by making it accessible to a broader audience. The broker is regulated by the UK's Financial Conduct Authority (FCA), providing a sense of security for traders. Bux Markets operates its proprietary platform known as TradeHub, which is available on both desktop and mobile devices. Traders can access a diverse range of assets, including CFDs, forex, stocks, indices, commodities, and ETFs.

Detailed Analysis

Regulated Geographical Regions

Bux Markets primarily operates in the UK and is regulated by the FCA, ensuring that client funds are held in segregated accounts and that the broker adheres to strict compliance standards. However, users outside the UK may encounter different regulatory conditions depending on the local entity they are dealing with.

Deposit/Withdrawal Currencies and Cryptocurrencies

Bux Markets supports deposits and withdrawals in GBP, EUR, and USD, with a minimum deposit requirement of $100 for credit card transactions. For bank wire transfers, there is no minimum deposit, making it more accessible for traders. However, its worth noting that Bux Markets does not currently support cryptocurrency trading, which may deter some investors looking to diversify their portfolios.

Minimum Deposit

The minimum deposit at Bux Markets is set at $100 for credit card transactions, while bank wire transfers do not have a minimum requirement. This low entry point makes it appealing for new traders who may want to start with a smaller amount.

As of now, Bux Markets does not offer any bonuses or promotional incentives. This aligns with FCA regulations, which prohibit brokers from offering trading bonuses to clients in the UK. This lack of promotional offers may be a downside for some users looking for additional benefits.

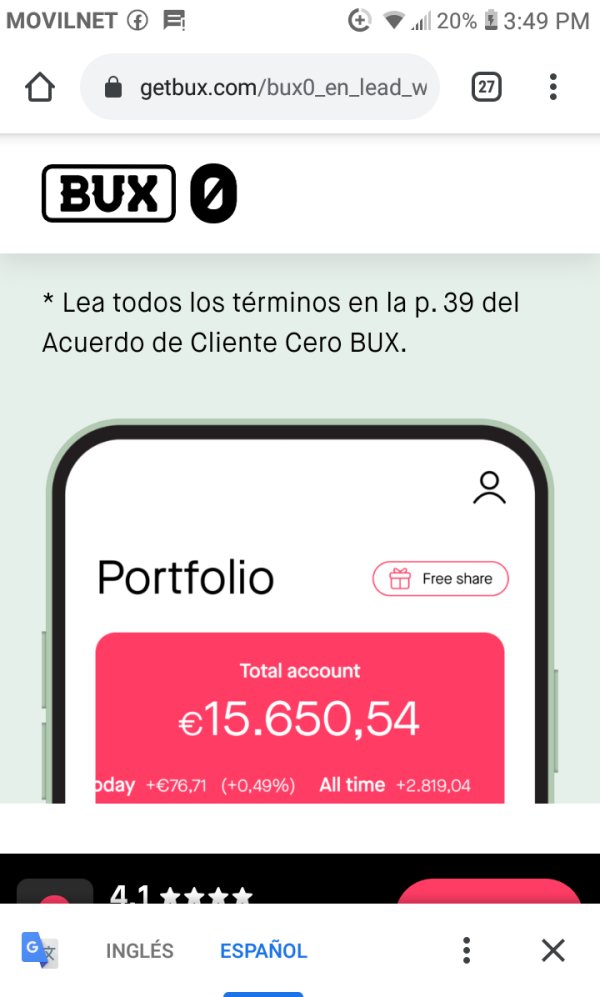

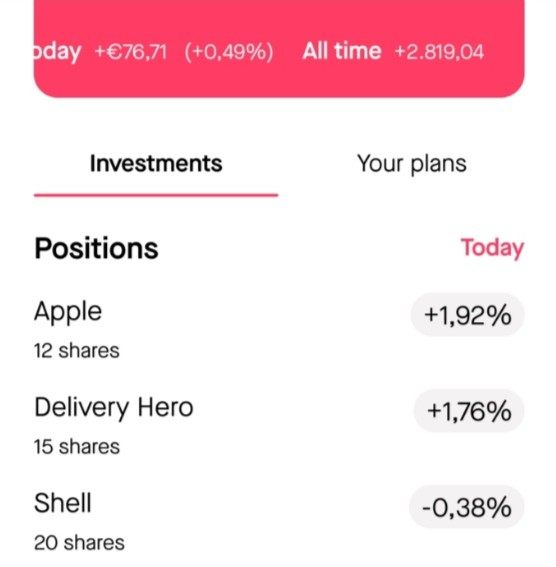

Tradable Asset Classes

Bux Markets provides access to a wide range of asset classes, including over 1,000 CFDs, forex pairs, stocks, indices, commodities, and ETFs. This diversity allows traders to build a varied portfolio, but it is essential to note that the absence of cryptocurrency trading may limit options for some investors.

Costs (Spreads, Fees, Commissions)

The brokers cost structure is somewhat mixed. While the spreads for major pairs like EUR/USD start at 0.7 pips, which is competitive, there are additional costs associated with overnight financing and inactivity fees. Users have reported that the inactivity fee is charged after 180 days of inactivity, which may be a concern for those who trade infrequently.

Leverage

Bux Markets offers a maximum leverage of 1:30, which is standard for FCA-regulated brokers. While this limit may be lower than some offshore brokers, it is designed to protect retail investors from excessive risk.

Bux Markets exclusively offers its proprietary TradeHub platform, which is available on web browsers and mobile devices. Unfortunately, popular platforms like MetaTrader 4 or 5 are not supported, which may disappoint traders who prefer those established tools for automated trading.

Restricted Regions

While Bux Markets is primarily available to UK clients, it also services customers in several European countries. However, users from the United States and other regions may find access restricted, which could limit the broker's global reach.

Available Customer Service Languages

Bux Markets provides customer support in English, which may be a limitation for non-English speaking users. The support can be reached via email and phone, but the absence of live chat may hinder quick resolutions for urgent queries.

Ratings Revisited

Detailed Breakdown

Account Conditions

Bux Markets offers a single account type, which simplifies the onboarding process for new traders. However, the lack of multiple account options may not cater to the diverse needs of experienced traders.

The educational resources provided by Bux Markets are limited, with few materials available for traders looking to enhance their skills. This could be a significant drawback for beginners who require more support.

Customer Service and Support

While Bux Markets offers customer support via email and phone, the absence of live chat can be a drawback. Users have reported mixed experiences with response times, which can affect overall satisfaction.

Trading Experience

The TradeHub platform is user-friendly but lacks some advanced features found in other trading platforms. This could limit the trading experience for more seasoned traders who rely on sophisticated tools.

Trustworthiness

As an FCA-regulated broker, Bux Markets enjoys a level of trustworthiness that many offshore brokers lack. However, potential users should remain vigilant and conduct thorough research to ensure they understand the risks involved.

User Experience

The overall user experience is mixed, with some users praising the platform's simplicity while others criticize its limitations. The absence of cryptocurrency trading and advanced trading tools may deter some investors.

In conclusion, Bux Markets presents a viable option for new traders seeking a straightforward trading experience. However, the limitations in educational resources, customer support, and asset offerings may prompt more experienced traders to consider alternative brokers. As always, prospective users should conduct their due diligence and weigh the pros and cons before committing to any trading platform.