Is AMTD safe?

Pros

Cons

Is AMTD Safe or Scam?

Introduction

AMTD, a Hong Kong-based brokerage established in 2004, has made a name for itself in the forex market by offering a range of financial services, including forex trading, asset management, and digital solutions. As the forex market continues to grow in popularity, traders must exercise caution when selecting a broker, particularly due to the prevalence of scams and unregulated entities. A thorough evaluation of brokers like AMTD is essential to ensure the safety of traders' funds and to maintain a secure trading environment. This article aims to provide an objective analysis of AMTD's legitimacy, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety and reliability. AMTD is regulated by the Securities and Futures Commission (SFC) of Hong Kong, a reputable regulatory body that oversees financial institutions in the region. Regulation by a recognized authority is essential as it ensures that brokers adhere to strict guidelines designed to protect investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AJH 488 | Hong Kong | Verified |

The SFC imposes various requirements on regulated brokers, including maintaining adequate capital, segregating client funds, and providing transparent information about fees and services. AMTD has been licensed since December 3, 2004, and during its operational history, there have been no significant regulatory breaches reported against it. This compliance history suggests that AMTD is a legitimate broker, operating within the legal frameworks established by the SFC.

However, it is crucial to note that while AMTD is regulated, the quality of oversight can vary significantly among different regulatory bodies. The SFC is recognized for its stringent regulations, which adds a layer of security for traders. Nonetheless, traders should remain vigilant and conduct their own due diligence before engaging with any broker, including verifying the latest updates on regulatory compliance. In summary, the evidence points to AMTD being a regulated entity, which supports the claim that AMTD is safe for trading.

Company Background Investigation

AMTD was founded in 2004 and has since evolved into a multifaceted financial services provider. Initially focusing on brokerage services, the company has expanded its offerings to include asset management and digital solutions. The company's headquarters is located at the Nexxus Building in Central Hong Kong, a strategic location that reinforces its presence in the Asian financial market.

The ownership structure of AMTD is relatively transparent, with the company being publicly listed and governed by a board of directors with extensive experience in finance and investment. This leadership team brings a wealth of knowledge from various sectors, including investment banking, asset management, and digital finance. The management's background is crucial, as it reflects the company's capacity to navigate the complexities of the financial markets and ensure compliance with regulatory standards.

In terms of transparency, AMTD provides a range of resources and information on its website, including details about its services, fees, and trading conditions. However, some users have reported a lack of clarity regarding specific fees and account types. Overall, the company's history, management expertise, and commitment to transparency suggest that AMTD is safe for traders looking for a reputable broker.

Trading Conditions Analysis

When evaluating a brokerage, understanding its trading conditions is vital. AMTD offers a competitive trading environment with various financial instruments, including forex, CFDs, commodities, and indices. The fee structure is an essential aspect of the trading conditions, as it directly impacts traders' profitability.

AMTD's overall fee structure includes commissions, spreads, and overnight interest rates. Heres a concise overview of the core trading costs compared to industry averages:

| Fee Type | AMTD | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | 0.25% per trade | 0.10% - 0.30% |

| Overnight Interest Range | 2.5% - 3.5% | 2.0% - 3.0% |

While AMTD's commission structure appears competitive, some users have expressed concerns regarding the variability of spreads, particularly during high volatility periods. This variability may lead to increased trading costs, which can be detrimental to traders, especially those employing high-frequency trading strategies.

Additionally, the overnight interest rates may vary significantly, and traders should be aware of these costs when holding positions overnight. Overall, while AMTD does provide a range of trading instruments and a competitive fee structure, potential traders should carefully assess these costs to ensure they align with their trading strategies. It is crucial to remain informed and cautious, as any unexpected fees could indicate a lack of transparency, potentially leading to the conclusion that AMTD is not entirely safe for all traders.

Customer Funds Safety

The safety of customer funds is paramount when selecting a forex broker. AMTD claims to implement several measures to protect traders' funds, including segregating client accounts from company funds and maintaining them in reputable banks. This practice is essential, as it ensures that clients' money is not used for the company's operational expenses, thereby safeguarding it in the event of financial difficulties.

Moreover, AMTD operates under the regulatory oversight of the SFC, which mandates that brokers must adhere to strict guidelines regarding capital requirements and risk management practices. This regulatory framework enhances the safety of client funds, as it compels AMTD to maintain sufficient capital reserves to cover its obligations.

Despite these safeguards, there have been isolated complaints from users regarding withdrawal issues, with some claiming they faced difficulties in accessing their funds. Such complaints, although not widespread, raise concerns about the effectiveness of AMTD's customer service and operational transparency. In assessing whether AMTD is safe, it is essential for potential clients to consider these factors and stay informed about any ongoing issues related to fund withdrawals.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. AMTD has received mixed reviews from users, with some praising its trading platform and customer support, while others have reported issues related to fund withdrawals and slow response times from the support team.

Common patterns in complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

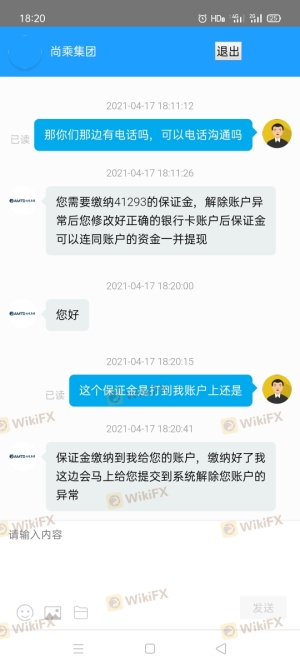

| Withdrawal Issues | High | Slow response, unresolved |

| Customer Support Availability | Medium | Delayed responses |

| Platform Stability | Low | Generally stable |

One notable case involved a trader who reported being unable to withdraw funds while other platforms allowed withdrawals without issue. This experience highlights potential operational inefficiencies within AMTD, which could deter potential clients.

While AMTD does have a responsive customer support team, the reported delays and unresolved issues indicate that improvements are necessary. Potential traders should weigh these experiences when considering whether AMTD is safe for their trading needs.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. AMTD offers a proprietary trading platform that supports various financial instruments. Users have reported that the platform is generally stable and user-friendly, providing essential tools for both novice and experienced traders.

However, some traders have raised concerns about order execution quality, particularly during high volatility periods. Instances of slippage and order rejections have been noted, which can significantly impact trading outcomes.

The absence of clear evidence indicating platform manipulation is a positive sign; however, the reported issues with execution quality warrant caution. Traders should remain vigilant and monitor their experiences closely to determine whether AMTD is safe for their trading strategies.

Risk Assessment

Using AMTD as a trading platform comes with inherent risks, as with any forex broker. The following risk assessment summarizes key risk areas associated with AMTD:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | Regulated by the SFC, with no major breaches reported. |

| Fund Safety | Medium | Segregated accounts, but issues reported with withdrawals. |

| Customer Support | Medium | Mixed reviews regarding response times. |

| Trading Costs | Medium | Variable spreads and commissions may affect profitability. |

To mitigate these risks, potential clients should conduct thorough due diligence, including reading reviews, understanding the fee structure, and testing the platform with a demo account.

In conclusion, while AMTD does possess regulatory oversight and a range of services, the presence of withdrawal issues and mixed customer feedback suggests that traders should exercise caution.

Conclusion and Recommendations

In summary, while AMTD is regulated and offers a variety of financial services, there are several areas of concern that potential traders should consider. The complaints regarding withdrawal issues and customer support response times indicate that AMTD is not entirely safe for all traders.

For those considering AMTD, it is advisable to start with a small investment and monitor the trading experience closely. Additionally, traders seeking alternatives may consider brokers with stronger reputations for customer service and fund safety, such as:

- IG Group

- OANDA

- Forex.com

These brokers are known for their regulatory compliance and positive customer feedback, making them safer options for forex trading.

In conclusion, while AMTD has some merits, the presence of complaints and operational inefficiencies raises concerns about its overall safety. Traders should remain vigilant and informed to ensure a secure trading experience.

Is AMTD a scam, or is it legit?

The latest exposure and evaluation content of AMTD brokers.

AMTD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AMTD latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.