Alfa Success Corp 2025 Review: Everything You Need to Know

Executive Summary

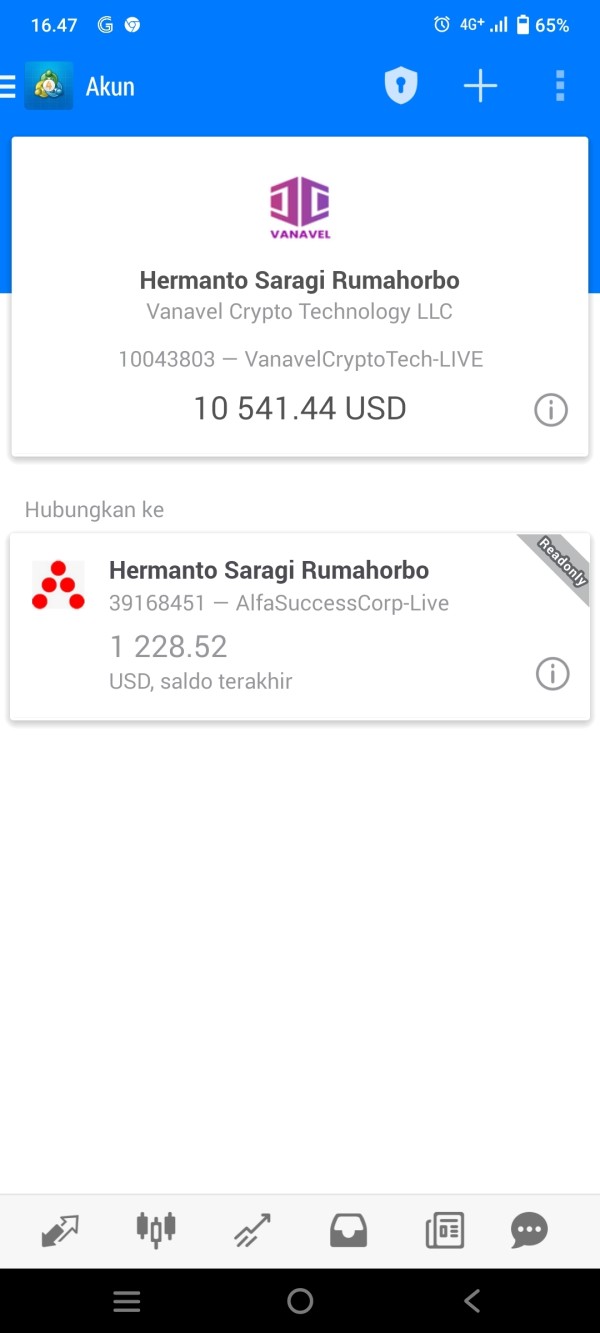

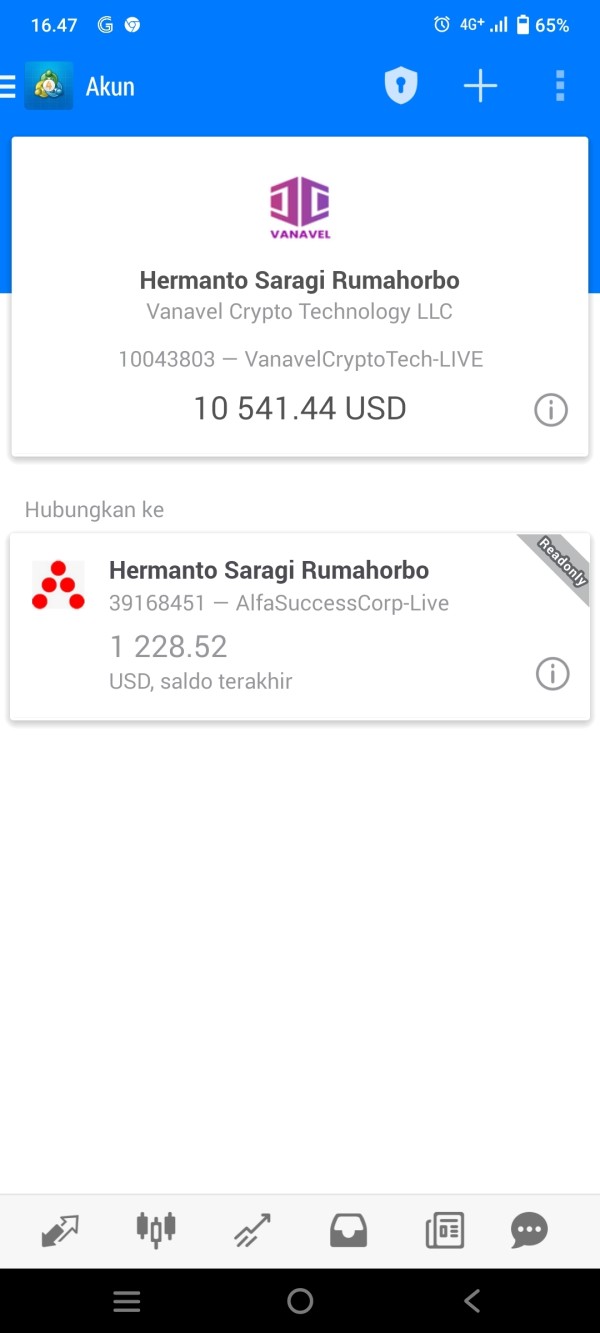

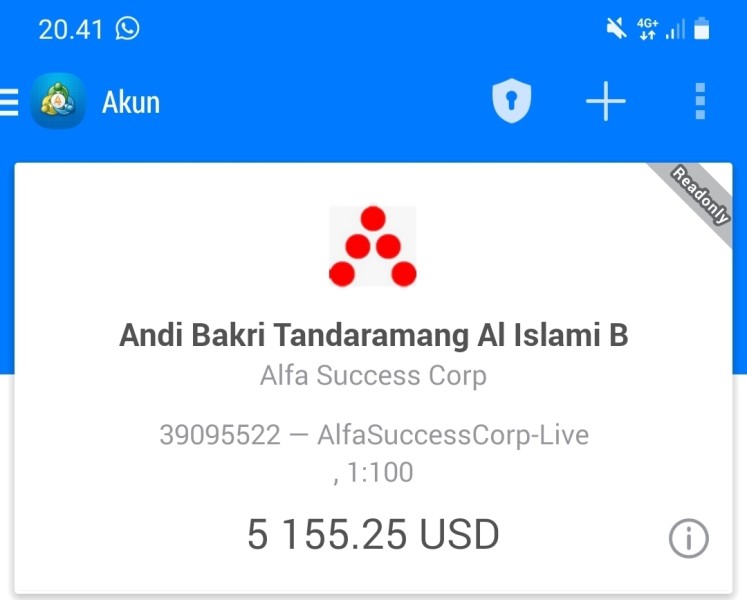

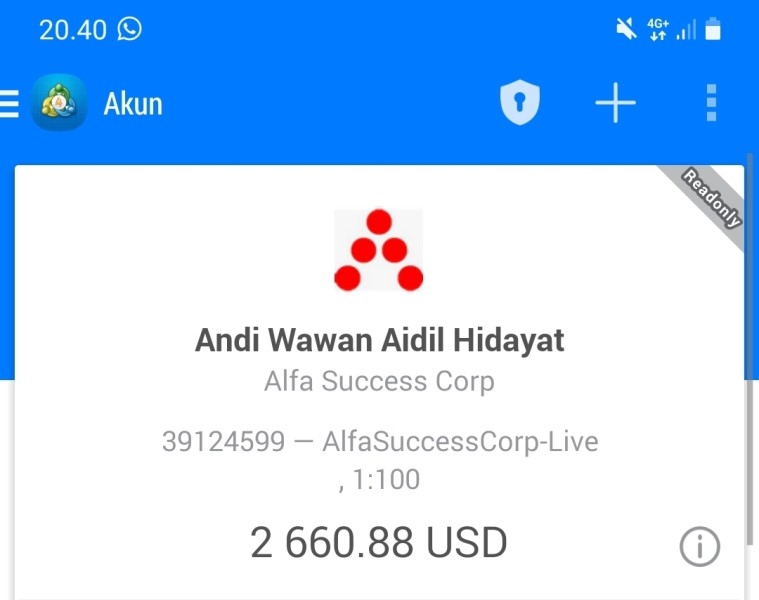

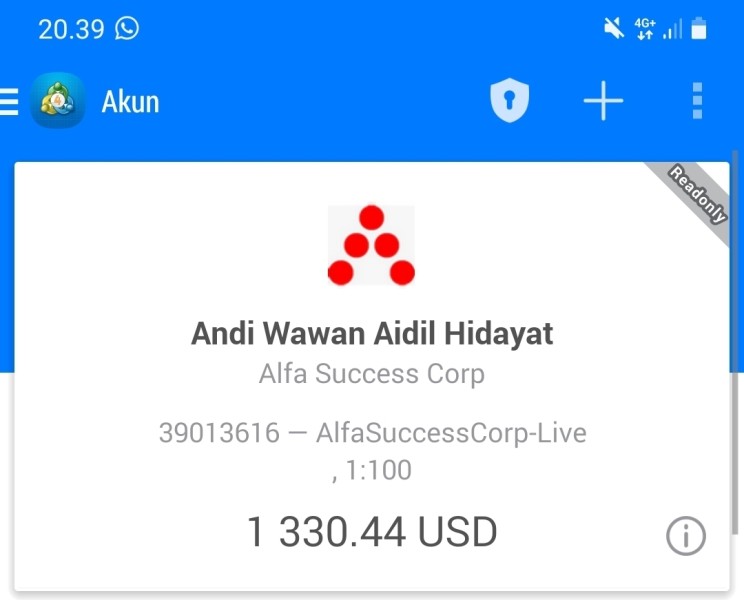

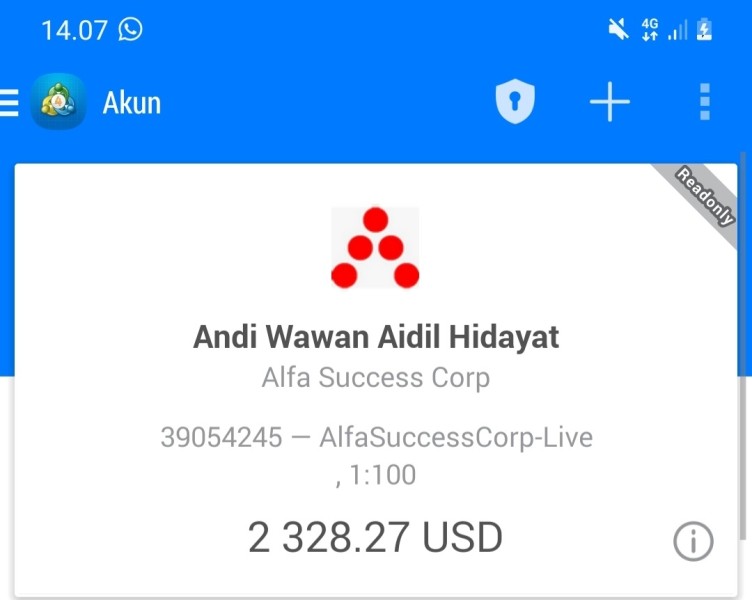

Alfa Success Corp is a new forex broker in the online trading world. However, its track record raises big concerns for potential clients who might want to trade with them. The company started in 2020 and registered in the British Virgin Islands, which means it operates with limited regulatory oversight and has received mostly negative feedback from traders. This alfa success corp review shows a broker that many people in the trading community do not trust.

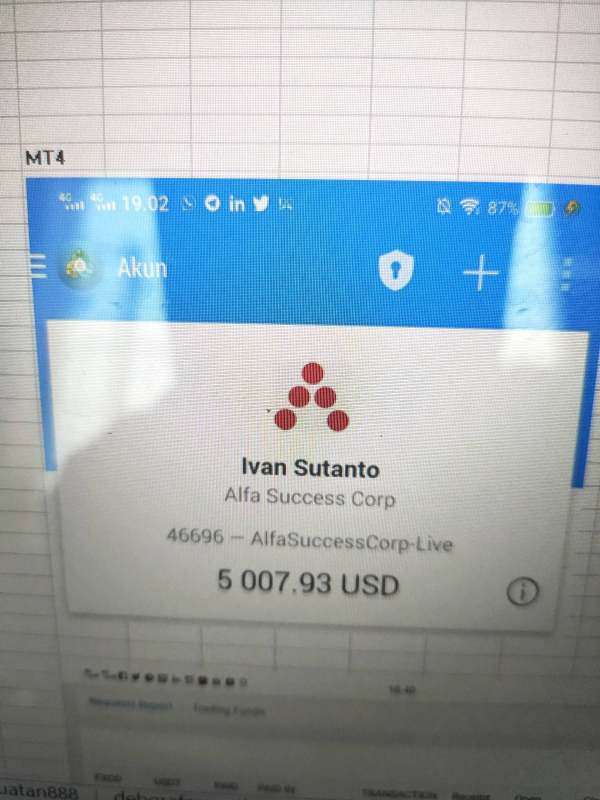

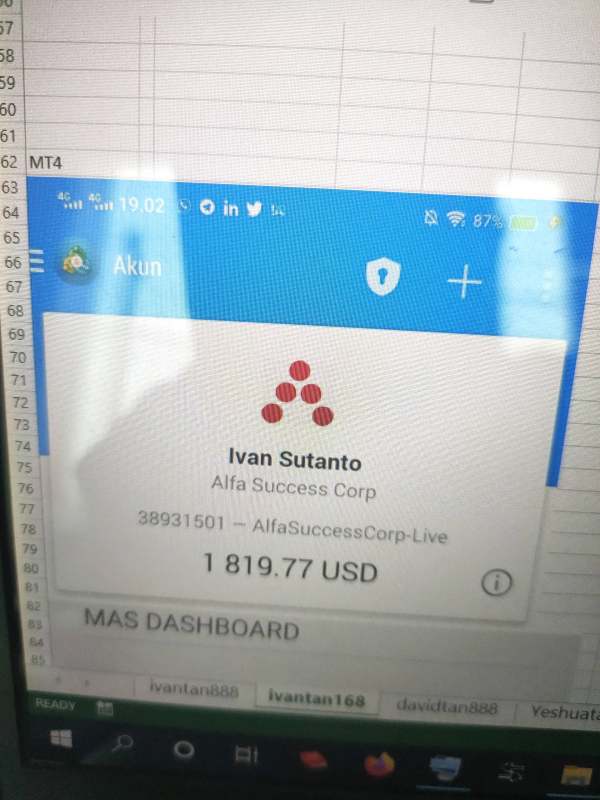

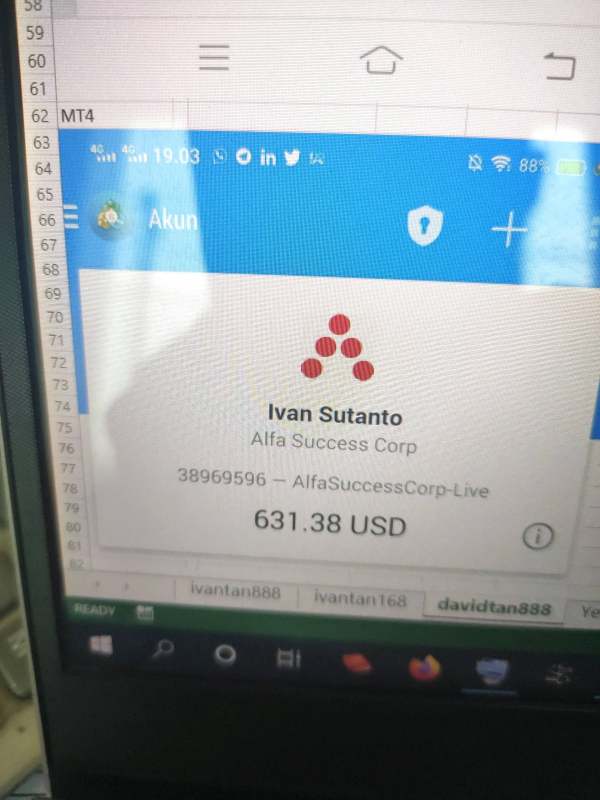

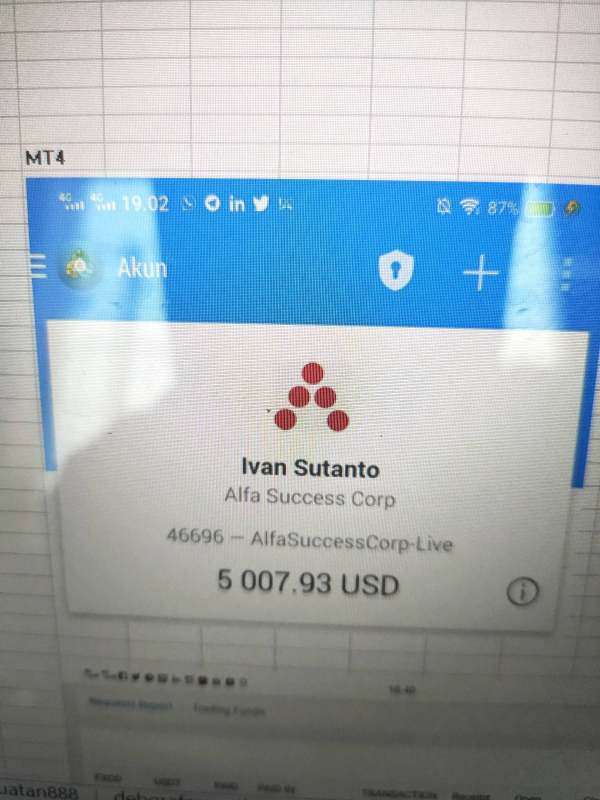

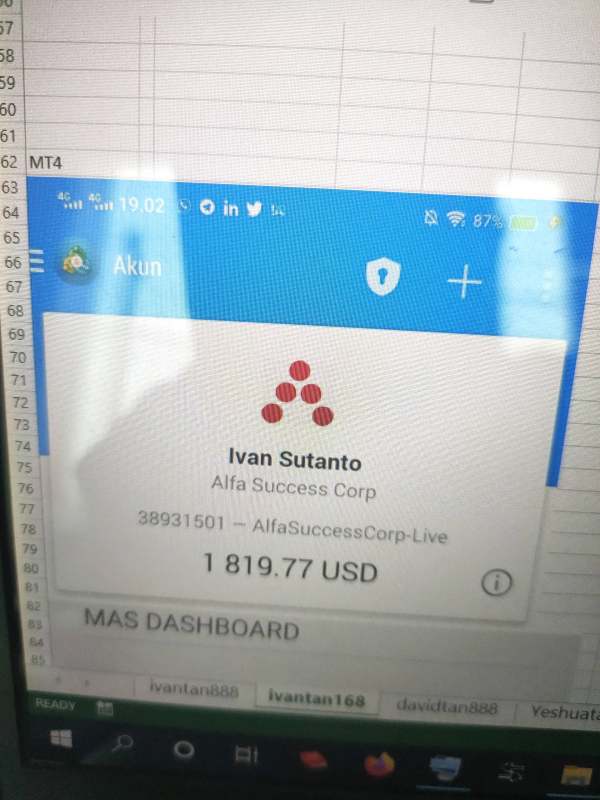

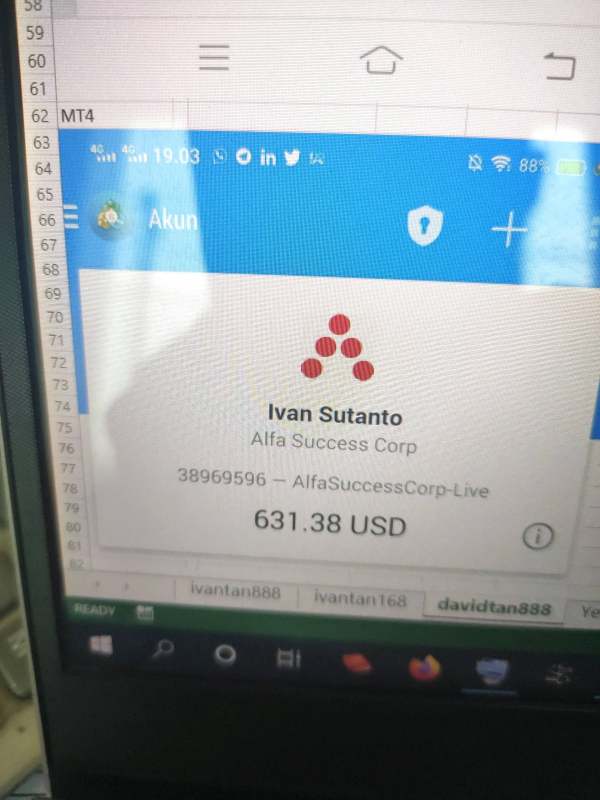

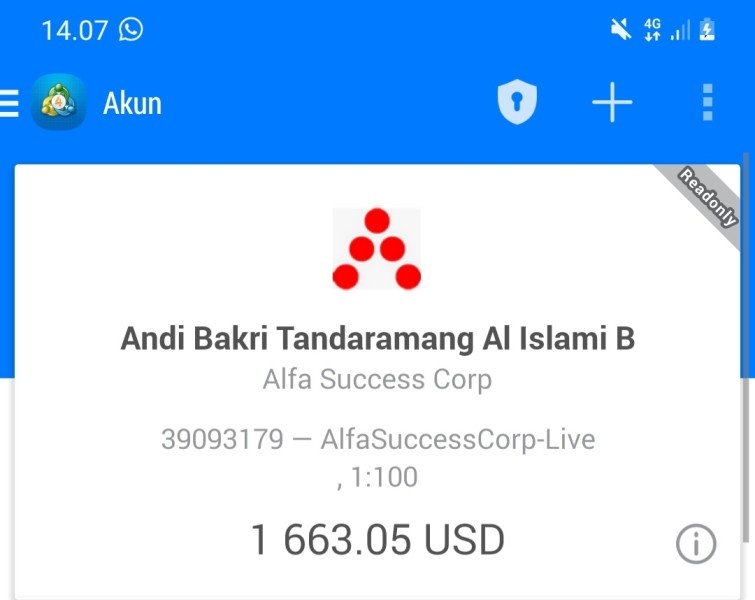

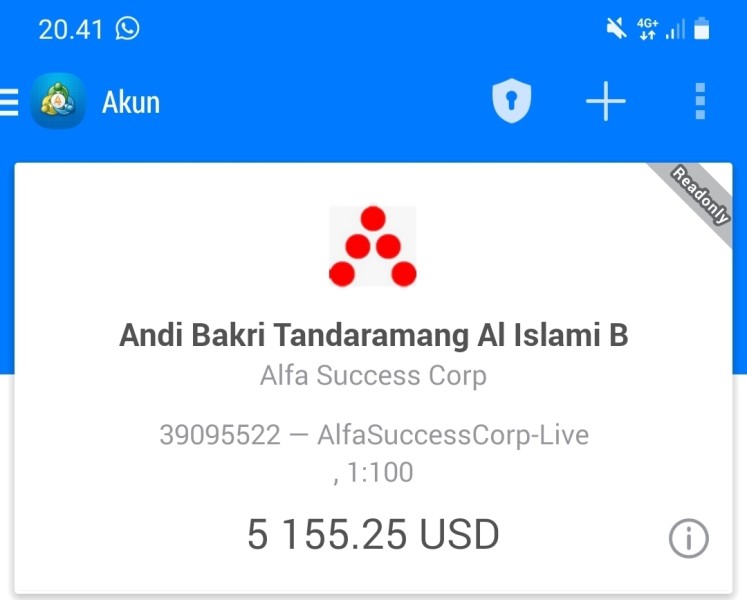

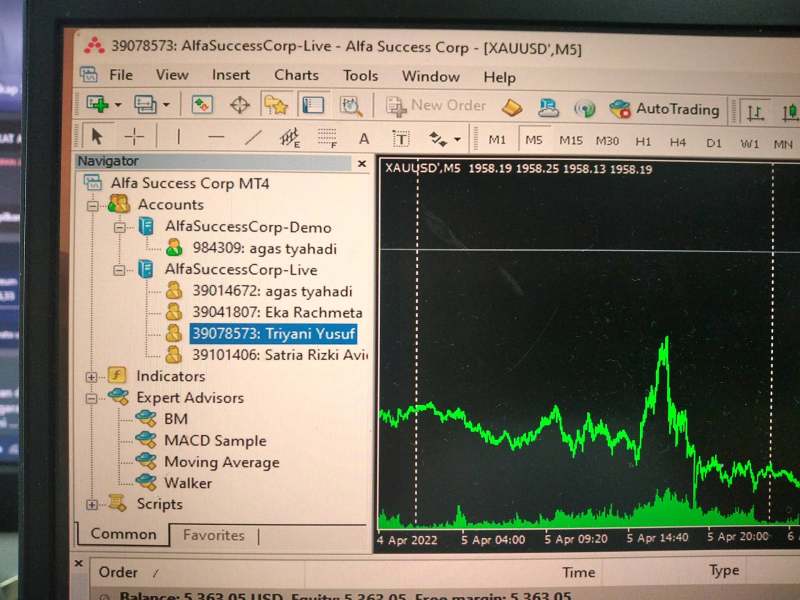

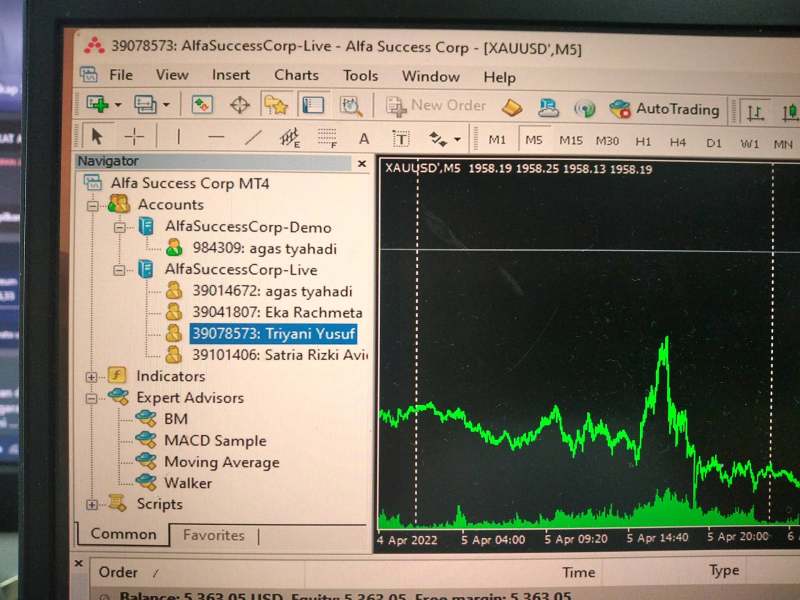

The broker gives access to the MT4 trading platform. It also claims to provide trading opportunities across multiple asset classes including forex, stocks, indices, and commodities, but our detailed analysis shows big gaps in transparency with critical trading conditions and operational details remaining undisclosed or unclear. Many important details about how they operate are either hidden or confusing.

According to various industry monitoring platforms, Alfa Success Corp has received a very concerning rating of just 1 out of 10. Multiple sources flag potential scam risks, which should worry any trader thinking about using their services. The broker targets traders who want to trade different types of assets, but the overwhelming evidence suggests you should be extremely careful before considering any engagement with this platform.

The lack of comprehensive regulatory protection, combined with negative user experiences and insufficient operational transparency, makes Alfa Success Corp a high-risk option in the competitive forex brokerage landscape.

Important Notice

Alfa Success Corp operates from the British Virgin Islands. This jurisdiction may offer different regulatory protections and service terms compared to more established financial centers like New York or London. Traders should know that regulatory standards and consumer protections in offshore jurisdictions may vary a lot from those in major financial hubs like the UK, US, or EU.

This review uses comprehensive analysis of available public information, user feedback from multiple sources, and regulatory data. Our evaluation method focuses on objective assessment while acknowledging the limitations of available information, though we recognize that some details may not be publicly accessible. Given the concerning nature of user reports and regulatory warnings, potential clients should exercise extreme caution and conduct thorough research before considering any financial engagement with this broker.

Rating Framework

Broker Overview

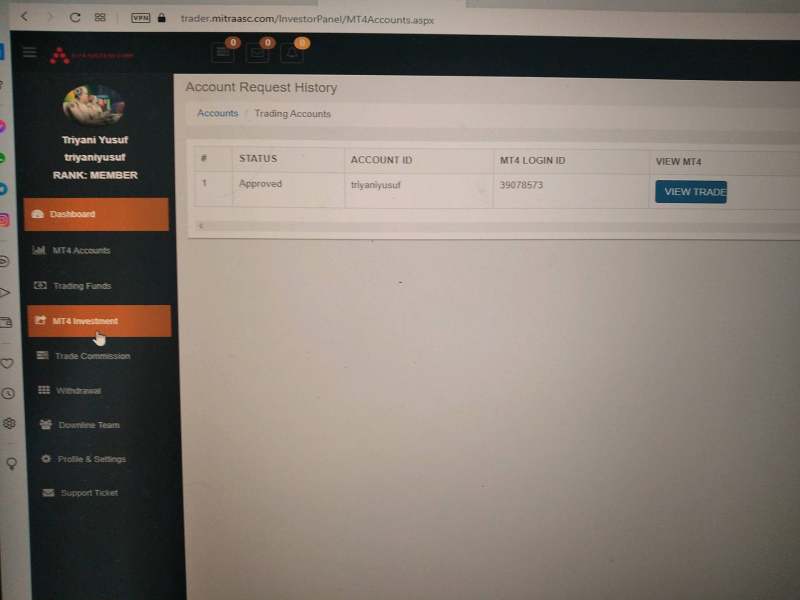

Alfa Success Corp entered the forex brokerage market in 2020. The company positions itself as an online trading platform that serves international clients who want to trade various financial instruments. It registered in the British Virgin Islands, so the company operates under the regulatory framework of this offshore jurisdiction, which provides much less oversight compared to major financial regulatory bodies.

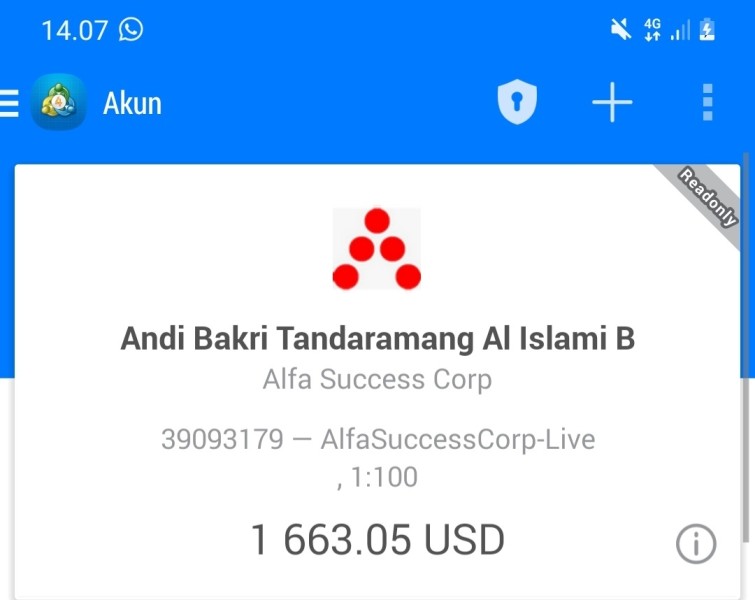

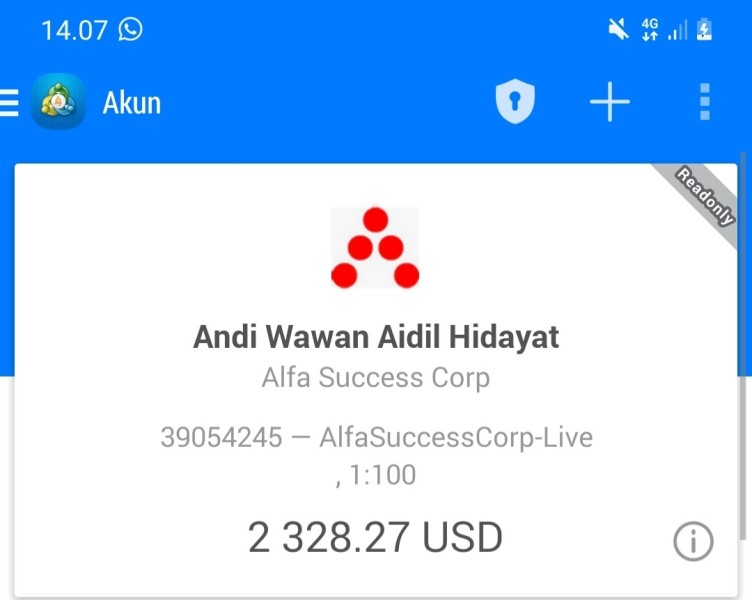

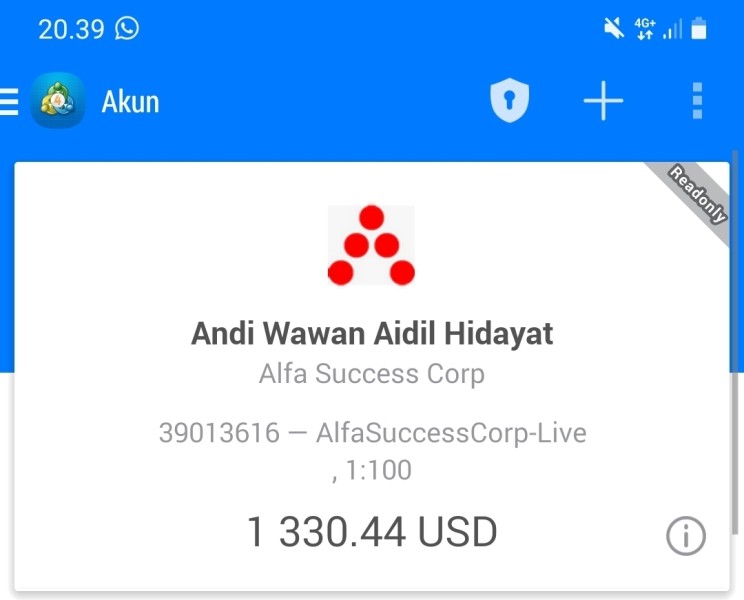

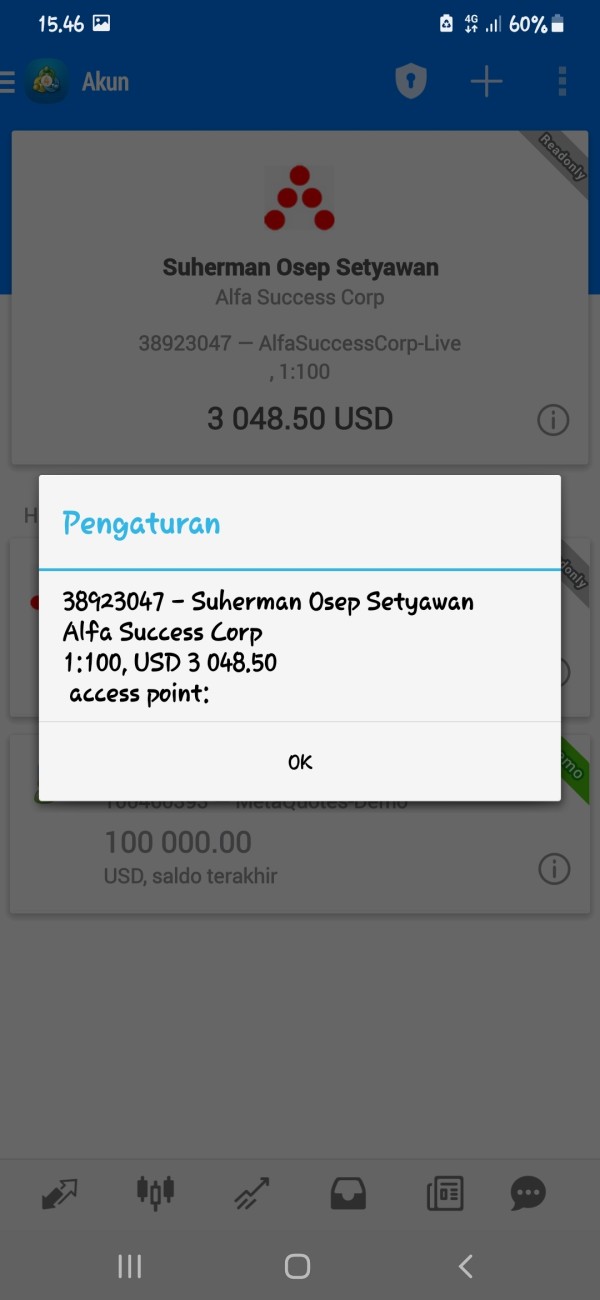

The broker's business model centers around providing online trading services through the MT4 platform. It targets retail traders who want exposure to various financial instruments, but the company's operational transparency remains very questionable with many fundamental business details either undisclosed or inconsistently reported across different sources. Many basic facts about how they do business are either hidden or reported differently in various places.

According to available information, alfa success corp review data shows the broker offers trading access to forex pairs, stocks, indices, and commodities. However, specific details about trading conditions, spreads, and execution methods remain largely undisclosed, which makes it hard for traders to know what they're getting into. The platform primarily serves international clients but lacks clear information about geographical restrictions or compliance with various national regulations.

The broker's market presence has been marked by controversy. Multiple industry watchdogs and user review platforms have raised red flags about its operational practices and client treatment, which has significantly damaged its reputation in the trading community.

Regulatory Jurisdiction: Alfa Success Corp operates under British Virgin Islands registration. This provides limited regulatory oversight compared to major financial centers, and the offshore nature of this jurisdiction raises serious questions about investor protection and regulatory compliance standards.

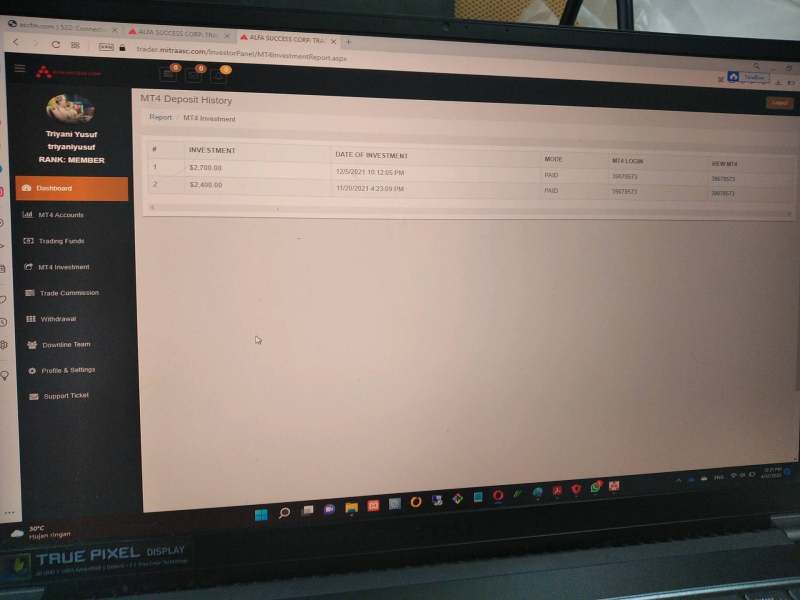

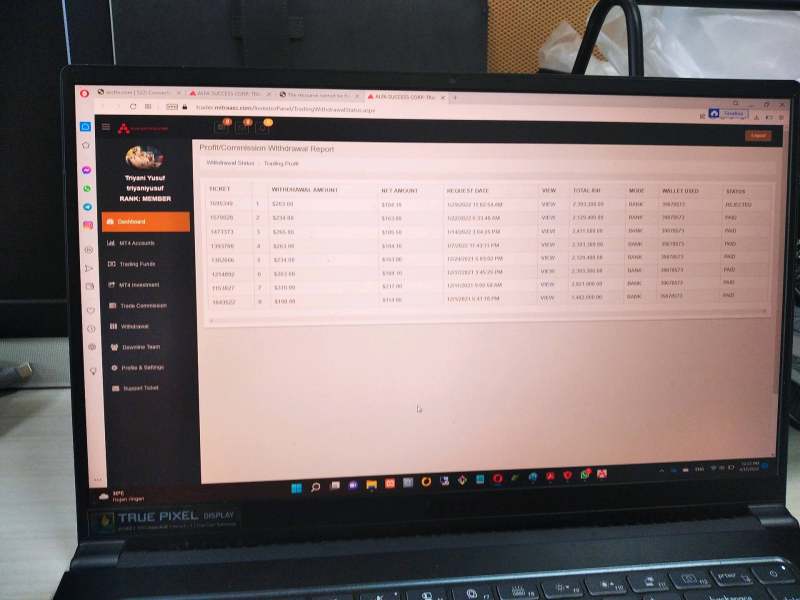

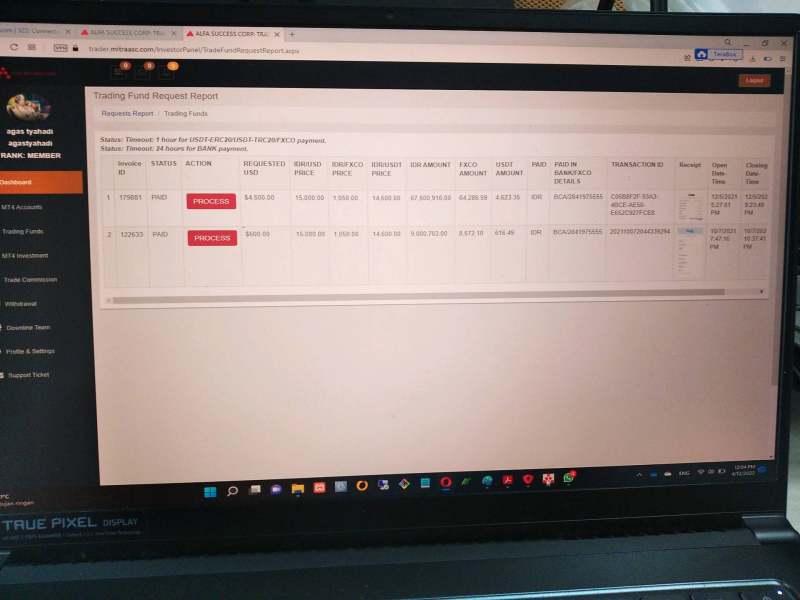

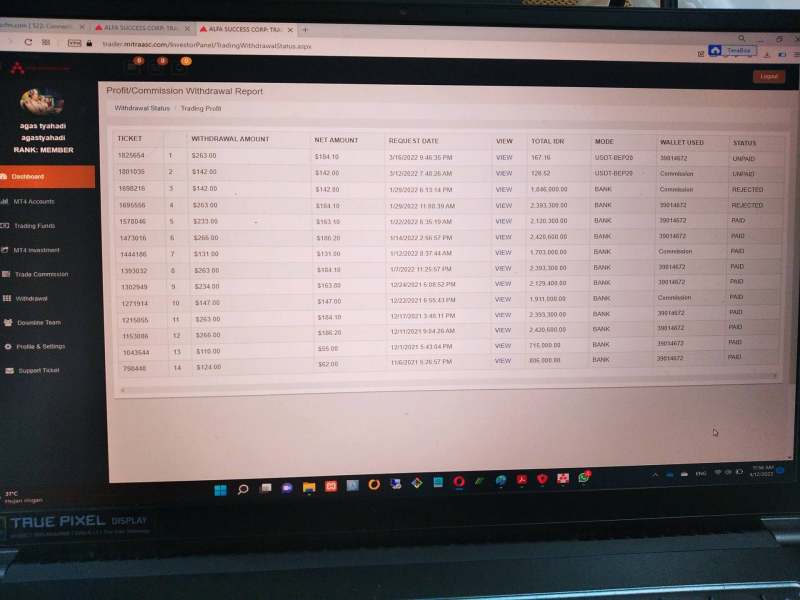

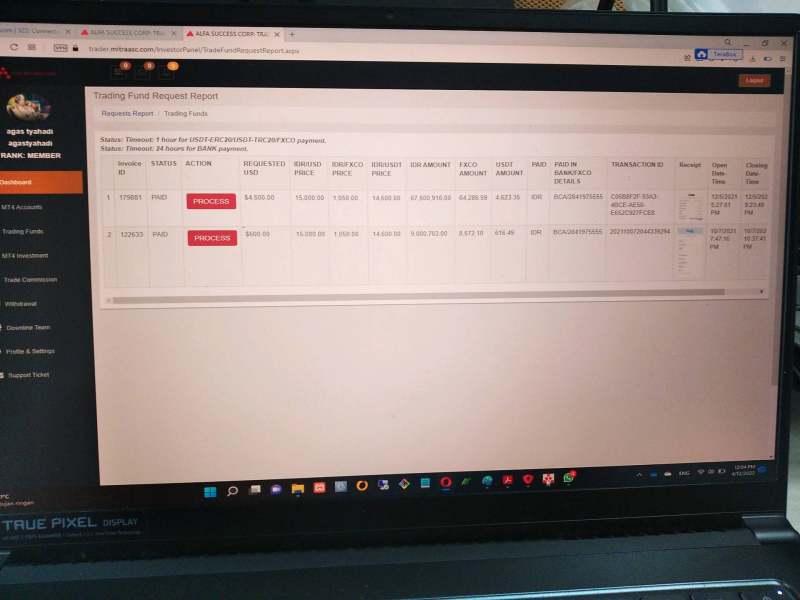

Deposit and Withdrawal Methods: Specific information about available funding methods remains undisclosed in available documentation. This represents a significant transparency gap for potential clients who need to know how they can fund their accounts.

Minimum Deposit Requirements: The broker has not clearly published minimum deposit requirements. This makes it difficult for traders to understand entry-level investment expectations before they start the account opening process.

Bonus and Promotional Offers: No specific information about promotional offerings or bonus structures has been identified in available sources. This suggests either absence of such programs or poor marketing transparency that leaves potential clients in the dark.

Tradeable Assets: The platform reportedly provides access to forex currency pairs, stock CFDs, index trading, and commodity markets. However, detailed specifications about available instruments remain limited, which makes it hard to compare their offerings with other brokers.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is notably absent from public documentation. This creates uncertainty about the true cost of trading with this broker and makes it impossible to budget for trading expenses.

Leverage Ratios: Specific leverage offerings have not been clearly disclosed. This represents another significant information gap in the alfa success corp review process that makes it hard to assess risk levels.

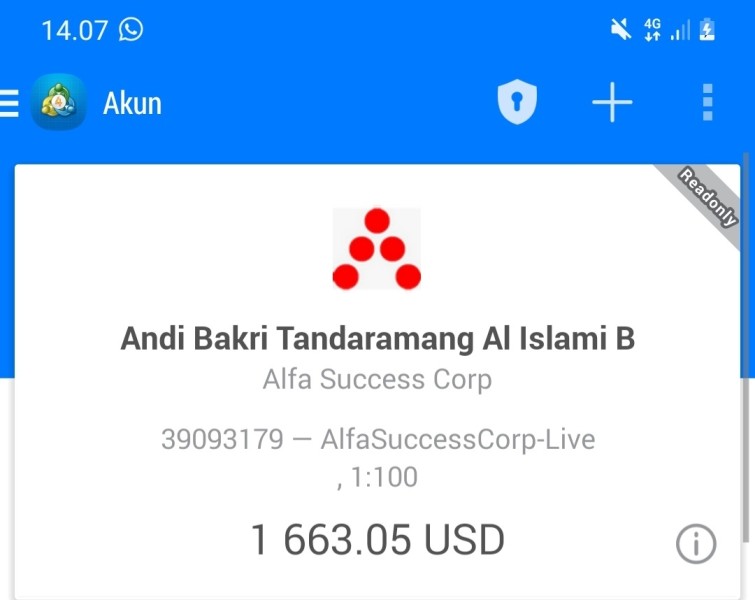

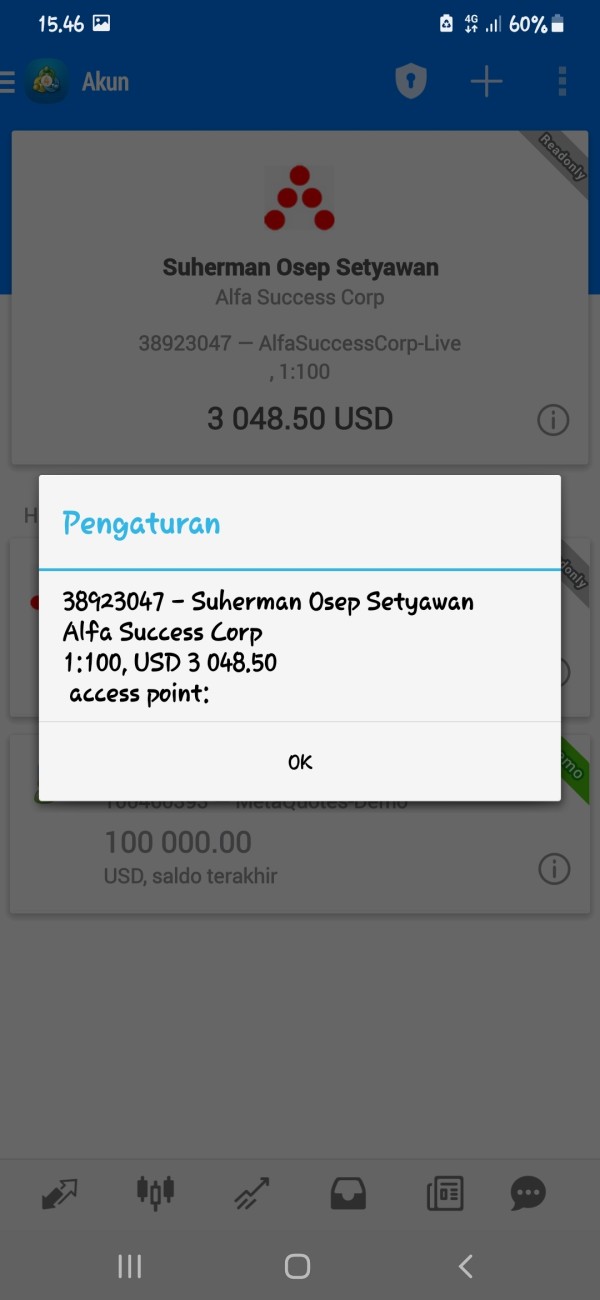

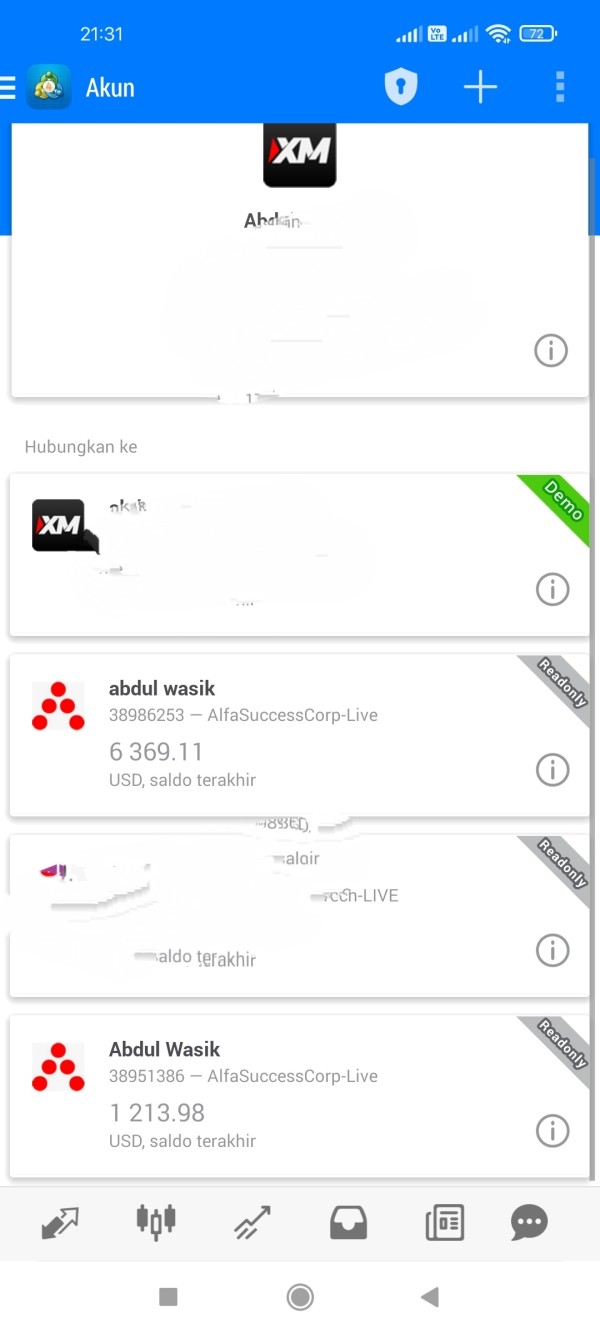

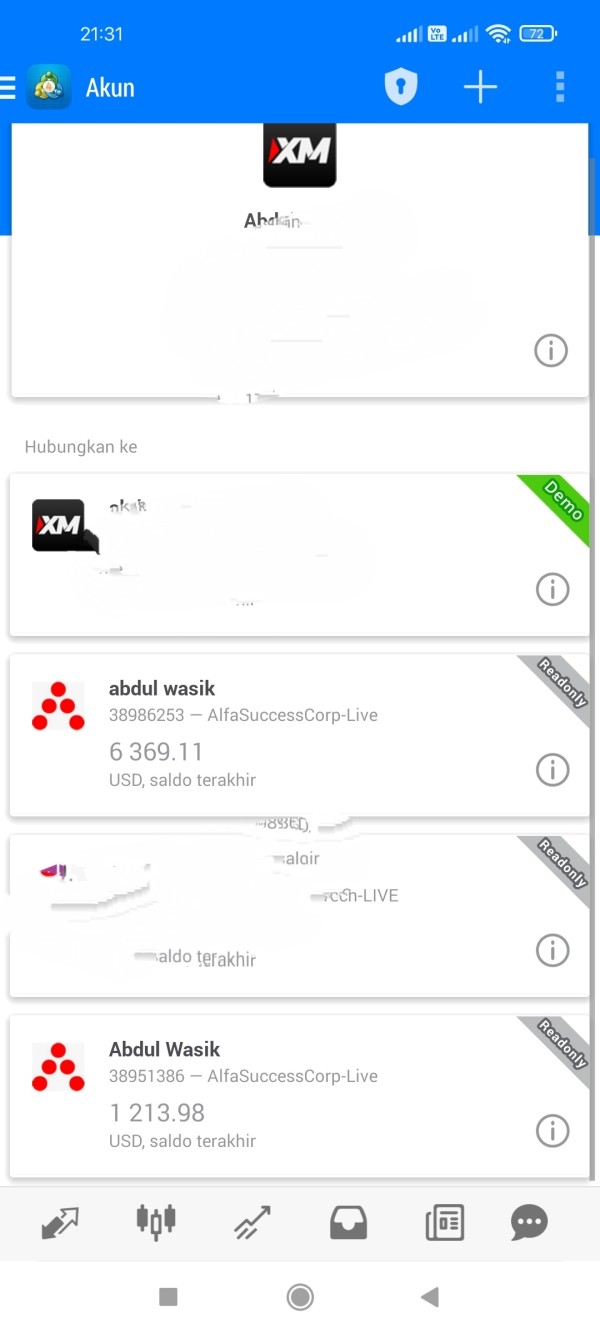

Platform Options: The broker primarily offers MT4 platform access. However, mobile trading capabilities and platform customization options remain unclear to potential users.

Geographic Restrictions: Specific information about restricted territories or compliance with various national regulations has not been clearly communicated. This could create legal problems for traders in certain countries.

Customer Support Languages: Available customer service languages and support channels remain undisclosed in publicly available information. This makes it hard for international clients to know if they can get help in their native language.

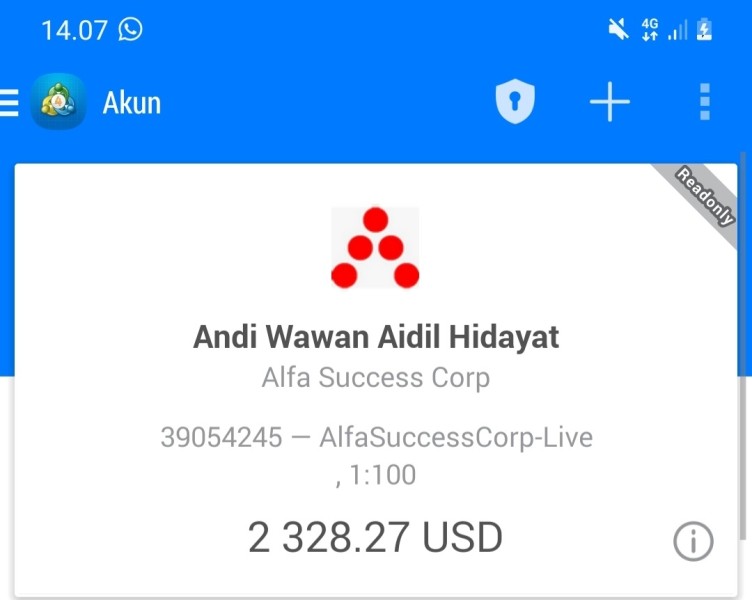

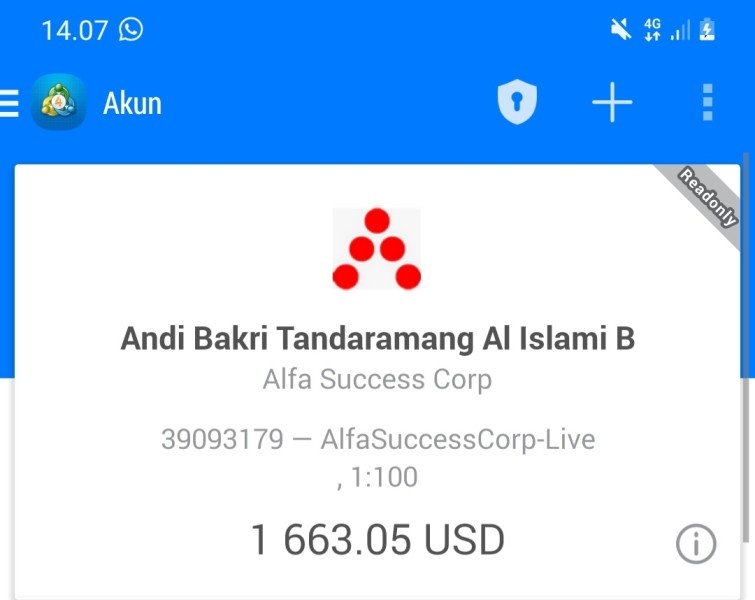

Account Conditions Analysis

The account conditions offered by Alfa Success Corp present significant transparency challenges. These issues immediately raise concerns for potential traders who need clear information to make informed decisions. Unlike established brokers who clearly outline their account types, minimum deposits, and trading specifications, this broker provides minimal information about fundamental account features that traders need to know.

The absence of clearly defined account tiers or trading conditions makes it impossible to assess whether the broker offers competitive terms. Most reputable brokers provide detailed information about different account types, each with specific benefits, minimum deposit requirements, and trading conditions that help traders choose the right option for their needs. The lack of such transparency in this alfa success corp review suggests either poor business practices or intentional hiding of terms that might not be favorable to clients.

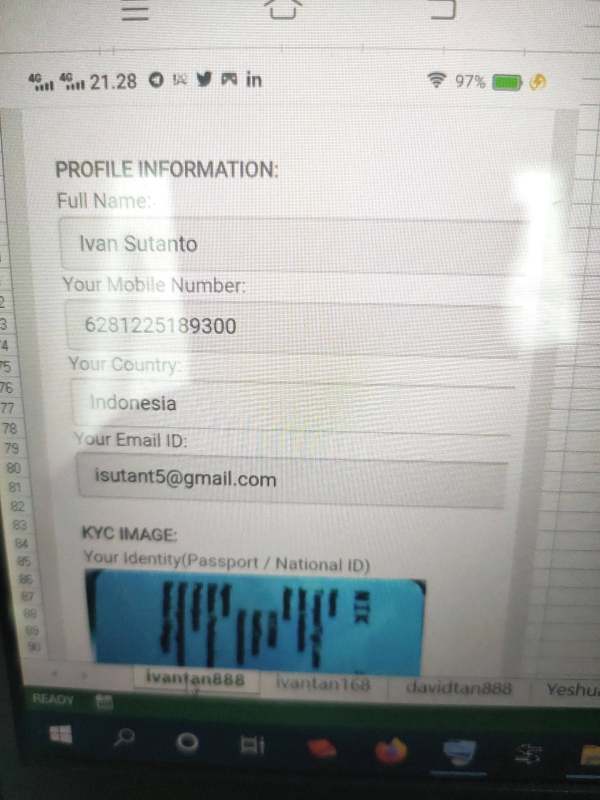

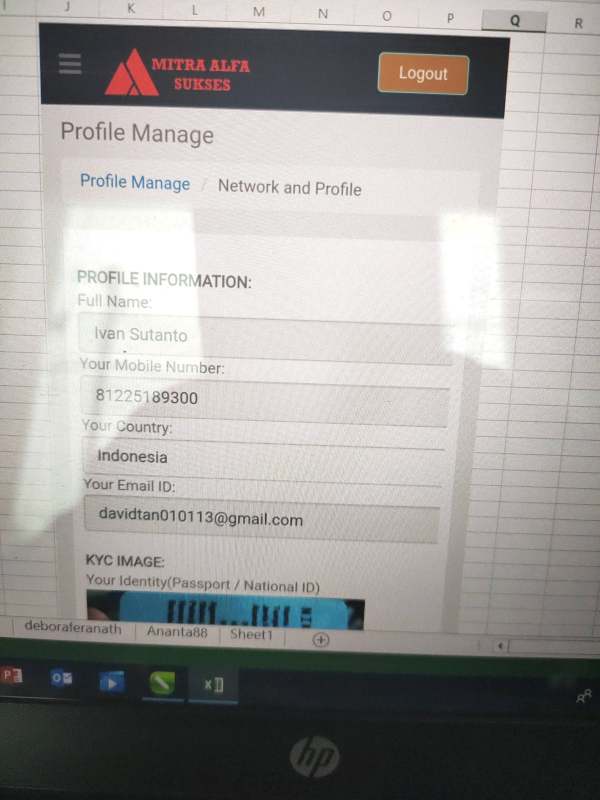

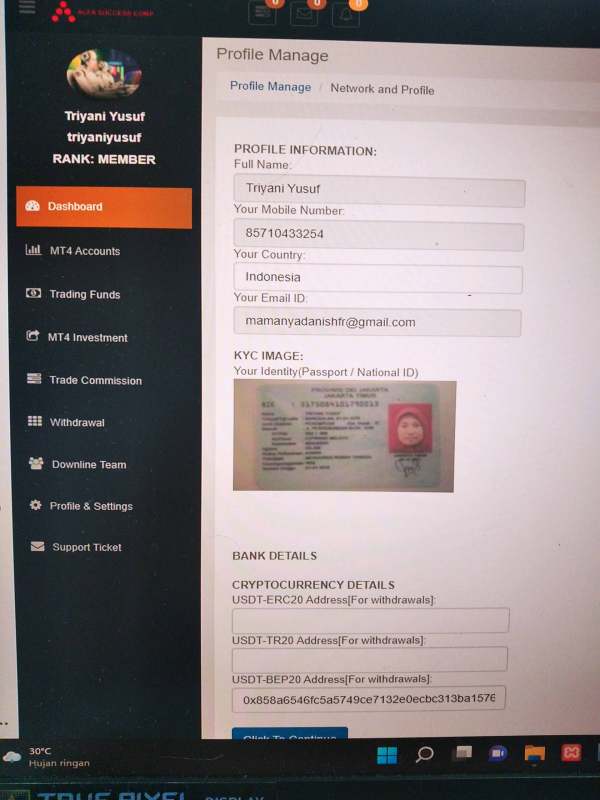

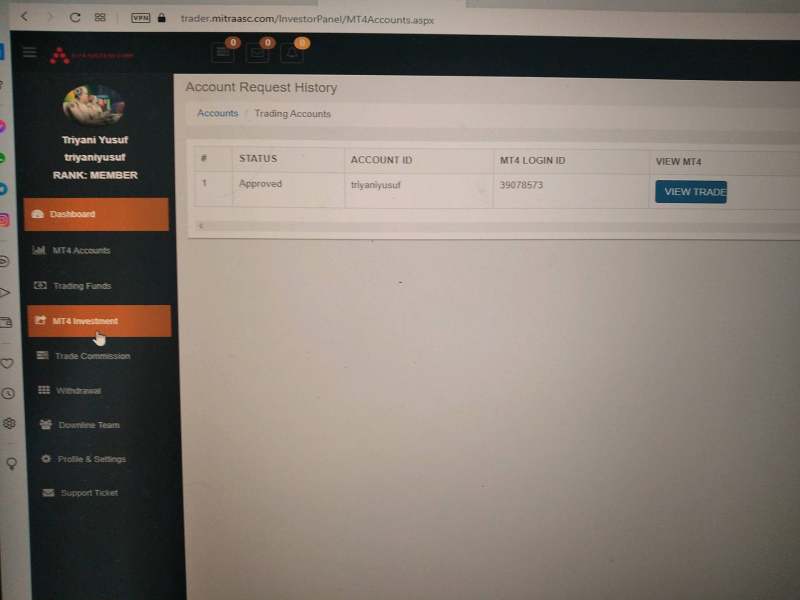

Account opening procedures remain unclear. There is no publicly available information about verification requirements, documentation needs, or approval timelines, which creates confusion for potential clients. This opacity contrasts sharply with industry standards where brokers typically provide clear guidance about onboarding processes so new clients know what to expect.

Special account features such as Islamic accounts, professional trader classifications, or institutional account options are not mentioned in available documentation. This suggests either a limited service offering or inadequate communication of available features that might be important to certain types of traders.

The scoring of 2/10 for account conditions reflects these substantial information gaps. It also shows the concerning lack of transparency that characterizes this broker's approach to client communication.

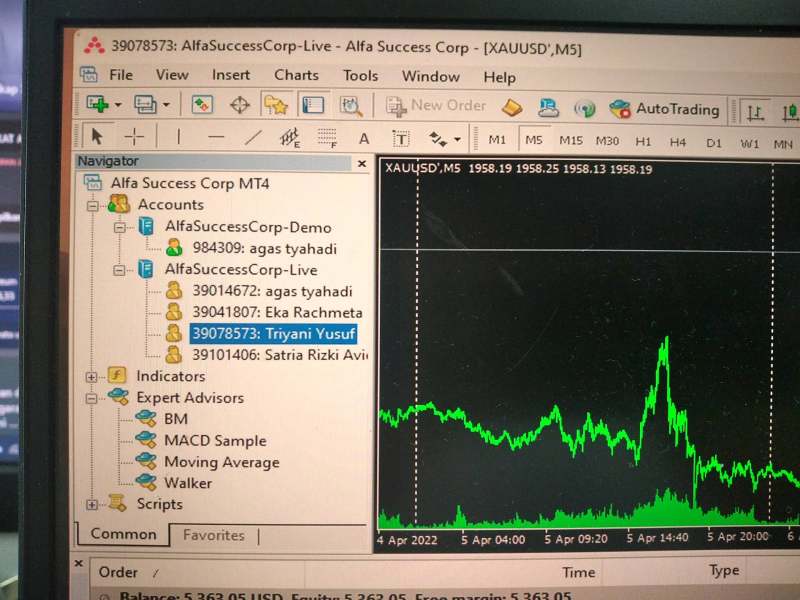

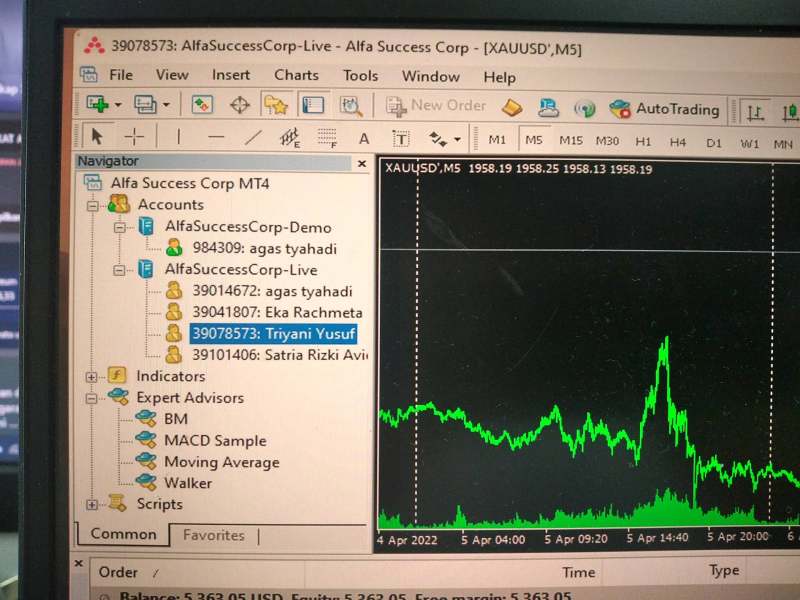

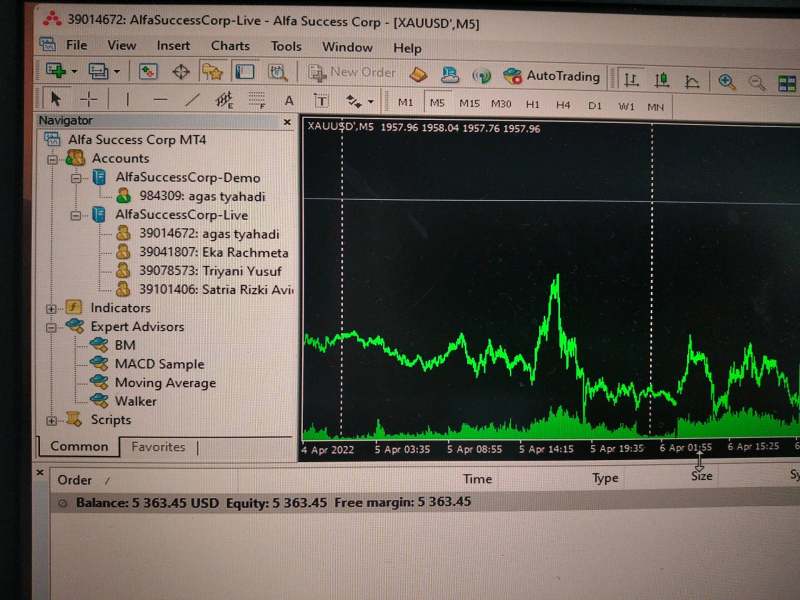

Alfa Success Corp's trading infrastructure centers around the MT4 platform. This represents a standard but basic offering in today's competitive brokerage environment where traders expect more advanced options. While MT4 provides essential trading functionality that most traders are familiar with, the broker appears to offer limited additional tools or resources that would enhance the trading experience beyond the basic platform.

The platform selection is notably restricted. There is no evidence of proprietary trading software, advanced charting packages, or modern web-based trading interfaces that many contemporary brokers provide to give their clients more options. This limitation may particularly impact traders who prefer more advanced or mobile-optimized trading environments that offer better functionality and user experience.

Research and analysis resources appear to be minimal or non-existent based on available information. Established brokers typically provide market analysis, economic calendars, trading signals, and research reports to support client decision-making and help them make more informed trades. The absence of such resources suggests a bare-bones service offering that leaves traders without important market insights.

Educational materials and trader development resources are not evident in the broker's public information. Quality brokers usually invest significantly in educational content, webinars, tutorials, and mentoring programs to support client success and retention, which benefits both the trader and the broker. The lack of educational support suggests this broker may not be committed to helping clients succeed.

Automated trading support through Expert Advisors may be available given the MT4 platform. However, specific policies, restrictions, or support for algorithmic trading remain unclear, which could be problematic for traders who rely on automated systems. The 4/10 rating reflects the basic platform availability while acknowledging the significant limitations in comprehensive trading support tools.

Customer Service and Support Analysis

Customer service represents one of the most critical aspects of broker evaluation. However, Alfa Success Corp provides minimal information about its support infrastructure, which should concern any potential client. The absence of clearly published customer service channels, operating hours, or response time commitments raises immediate concerns about client support quality and whether traders can get help when they need it.

Most reputable brokers prominently display multiple contact methods including phone support, live chat, email systems, and sometimes social media channels. The lack of visible customer service information suggests either inadequate support infrastructure or poor communication of available services, both of which are problematic for traders who may need assistance. This makes it very difficult for potential clients to know how they can reach the company if problems arise.

Response time expectations and service quality standards remain completely unclear. This makes it impossible for potential clients to understand what level of support they might receive when they have questions or encounter problems. This is particularly concerning for active traders who may need immediate assistance with technical issues or account problems that could affect their trading.

Multi-language support capabilities are not documented. This could significantly limit accessibility for international clients who may not be comfortable communicating in English. Given the broker's apparent international focus, the absence of clear language support information represents a notable service gap that could leave many clients without proper support.

The 2/10 rating for customer service reflects the substantial lack of transparency. It also shows the concerning absence of visible support infrastructure that would be expected from a legitimate brokerage operation.

Trading Experience Analysis

The trading experience offered by Alfa Success Corp appears limited and potentially problematic. This assessment is based on available information and user feedback that raises serious concerns about platform quality. The reliance solely on the MT4 platform, while functional for basic trading, represents a narrow offering compared to brokers who provide multiple platform options and modern trading interfaces that give traders more flexibility and better tools.

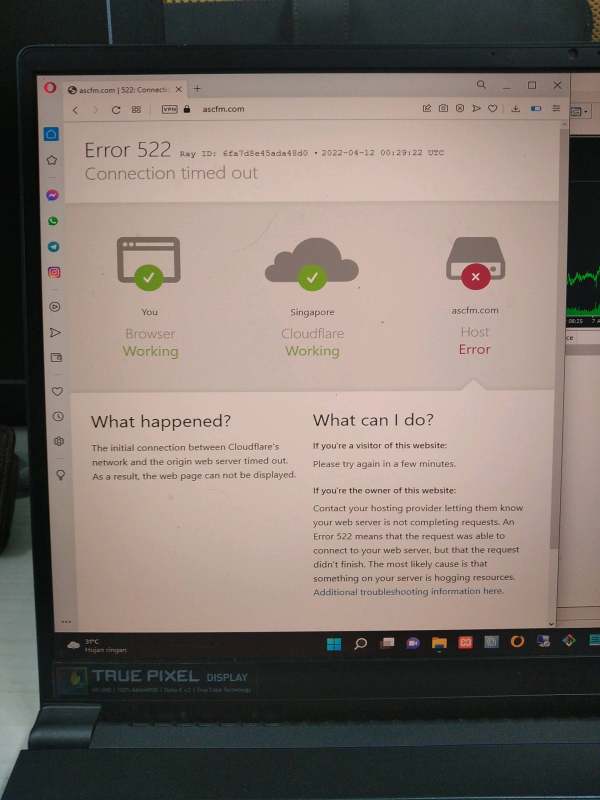

Platform stability and execution quality remain questionable given the negative user reviews and low overall ratings from industry monitoring sites. Reliable order execution represents a fundamental requirement for any trading platform, and concerns about execution quality significantly impact the overall alfa success corp review assessment since poor execution can cost traders money. When traders place orders, they need confidence that those orders will be executed properly and at fair prices.

Mobile trading capabilities are unclear. In today's trading environment, this represents a significant limitation since most traders expect to be able to monitor and manage their positions from their smartphones. Most active traders expect seamless mobile access with full functionality, and the absence of clear mobile trading information suggests potential limitations in this area that could frustrate modern traders.

Trading environment features such as one-click trading, advanced order types, or risk management tools are not clearly documented. These features have become standard expectations among traders who need efficient ways to manage their positions and control risk. Their absence or unclear availability impacts the overall trading experience quality and may leave traders without important tools they need to trade effectively.

The limited information about trading conditions, combined with concerning user feedback, results in a 3/10 rating. This rating reflects significant reservations about the platform's ability to provide a satisfactory trading experience that meets modern standards.

Trust and Reliability Analysis

Trust and reliability represent the most concerning aspects of this alfa success corp review. Multiple red flags indicate significant risks for potential clients who are considering using this broker for their trading activities. The broker's registration in the British Virgin Islands, while legal, provides limited regulatory protection compared to major financial jurisdictions that have stronger oversight and better consumer protections.

Regulatory oversight from BVI authorities typically offers less comprehensive investor protection than regulators like the FCA, ASIC, or CySEC. These major regulators have strict rules and strong enforcement mechanisms that protect traders, while BVI regulation is generally much weaker. This lighter regulatory environment may appeal to brokers seeking operational flexibility but often provides reduced client protections that leave traders more vulnerable to problems.

Fund safety measures and segregation policies remain unclear. This represents a critical transparency gap that should worry any potential client who wants to know their money will be safe. Reputable brokers typically provide detailed information about client fund protection, segregated accounts, and insurance coverage to ensure client money security and give traders peace of mind about their deposits.

The broker's industry reputation has been severely damaged by multiple negative reviews and warnings from industry monitoring platforms. Several sources have flagged potential scam risks, with user ratings consistently showing extremely low satisfaction scores that suggest widespread problems with the broker's operations. This pattern of negative feedback is particularly concerning because it comes from multiple independent sources.

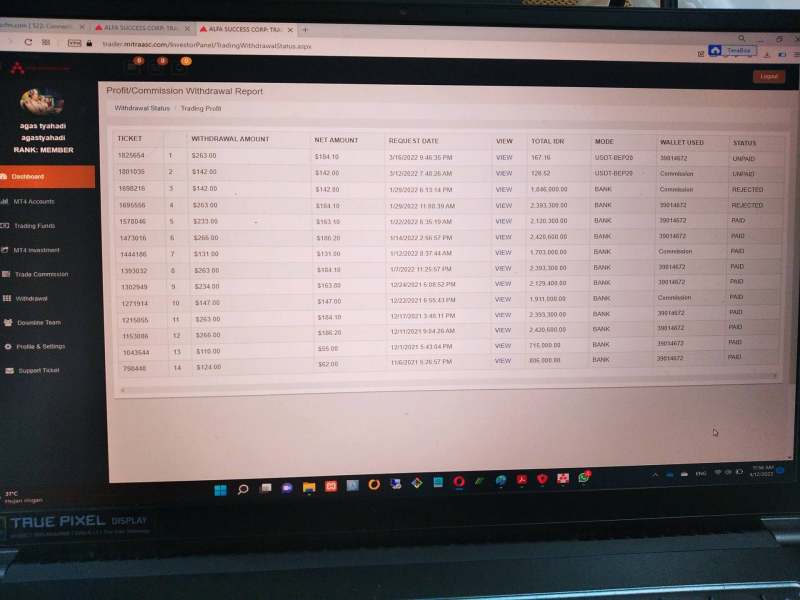

Negative incident handling and dispute resolution procedures are not clearly documented. This leaves clients uncertain about recourse options if problems arise with their accounts or trading. The combination of regulatory concerns, negative user feedback, and transparency issues results in a 1/10 trust rating, which indicates extreme caution is warranted for anyone considering this broker.

User Experience Analysis

User experience with Alfa Success Corp has been predominantly negative according to available feedback and industry ratings. The consistently low user satisfaction scores across multiple review platforms indicate systematic problems with the broker's service delivery and client treatment rather than just isolated incidents. This pattern of negative feedback should be a major warning sign for potential clients.

Overall user satisfaction appears severely compromised. Many traders report negative experiences and recommend others avoid the platform, which suggests widespread service issues that affect most clients. This pattern of negative feedback is particularly concerning as it suggests systematic service problems rather than isolated incidents that might be expected with any broker.

Interface design and platform usability information is limited. However, the basic MT4 offering suggests a standard but potentially outdated user interface compared to modern trading platforms that emphasize user experience design and intuitive navigation. Modern traders often expect more sophisticated interfaces that make trading easier and more efficient.

Registration and account verification processes remain unclear. This can create frustration for new clients trying to understand onboarding requirements and timelines, which is a basic service expectation. Clear, efficient account opening procedures represent basic service expectations that appear to be inadequately addressed by this broker.

Common user complaints appear to center around platform reliability, customer service responsiveness, and concerns about fund security. The prevalence of negative feedback across multiple sources strongly suggests systematic service problems rather than isolated issues that might be resolved easily. This consistent pattern of complaints indicates fundamental problems with how the broker operates.

The 2/10 user experience rating reflects the overwhelming negative feedback. It also shows the apparent failure to meet basic client service expectations that characterize legitimate brokerage operations.

Conclusion

This comprehensive alfa success corp review reveals a broker that presents significant risks and fails to meet basic industry standards. The broker falls short in areas of transparency, regulation, and client service that are essential for safe trading. While the company offers access to popular trading instruments through the MT4 platform, the numerous red flags and concerning user feedback strongly suggest potential clients should seek alternatives from more reputable brokers.

The broker's primary weaknesses include inadequate regulatory oversight that leaves clients vulnerable to problems. It also has poor transparency regarding trading conditions and costs, concerning user feedback indicating potential scam risks, and insufficient customer support infrastructure that may leave traders without help when they need it. The few potential advantages, such as MT4 platform availability and multi-asset trading access, are completely overshadowed by fundamental trust and reliability concerns that make this broker unsuitable for most traders.

Based on this analysis, Alfa Success Corp appears unsuitable for traders seeking a reliable, transparent, and well-regulated trading environment. The overwhelming evidence suggests extreme caution, and potential clients would be much better served by considering established brokers with stronger regulatory oversight, transparent operating conditions, and positive user feedback records that demonstrate real commitment to client success.