Tyler Capital 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Tyler Capital has established itself as a trading platform operating for over two decades, drawing attention from experienced traders seeking low-cost trading options. However, this legacy is currently overshadowed by significant risks stemming from its revoked regulatory status, particularly following its removal from the FCA's approved list. While Tyler Capital may appeal to seasoned traders comfortable navigating high-risk environments, potential investors must consider the trade-offs between the attractive low trading costs and the inherent dangers associated with trading under an unregulated platform. Reports highlighting challenges related to fund recovery further complicate the brokerage's appeal, suggesting that while some may perceive opportunity, others could easily fall into a trap.

⚠️ Important Risk Advisory & Verification Steps

Attention Prospective Investors:

- Risk Statement: Due to its revoked regulatory status, Tyler Capital poses significant risks.

- Potential Harms: Investors may face challenges in fund recovery.

- Verification Steps:

- Check the FCA's official site for the latest regulatory information.

- Review user feedback on platforms like WikiFX and PediaFX.

Broker Overview

Company Background and Positioning

Founded in 2003, Tyler Capital is headquartered in London, UK, and was designed primarily as a proprietary trader of global financial markets. Historically, Tyler Capital presented itself as a reputable platform, leveraging systematic and quantitative methods to engage in electronic markets. However, recent regulatory challenges, particularly the revoked status by the FCA, have put the brokerage's reliability into question.

Core Business Overview

Tyler Capital offers access to a range of financial instruments, including forex, contracts for difference (CFDs), and commodities. The broker utilizes its proprietary Omega trading platform, which connects with various global exchanges. Historically marketed as FCA-regulated, the current landscape reveals that Tyler Capital no longer holds this authorization, a critical piece of information for potential clients.

In-depth Analysis of Each Dimension

Trustworthiness Analysis

In an age where regulatory compliance is paramount, particularly for trading platforms, Tyler Capital's revoked FCA status injects considerable doubt into its trustworthiness. Users face challenges due to discrepancies in available regulatory information, revealing potential risks in trusting the platform.

Regulatory Information Conflicts:

The brokerage's claims of FCA regulation were rendered moot when their license was revoked. This stark reality raises issues concerning fund safety and general compliance practices.

User Self-Verification Guide:

To independently verify the current status of Tyler Capital, users can follow these steps:

- Visit the FCA's official website.

- Use the appropriate search tools to confirm the regulatory status by entering the firm's name or firm reference number.

- Cross-reference findings with recognized user feedback platforms.

- Industry Reputation and Summary:

User testimonials illustrate a troubling scene wherein many express grievances about fund safety. One user noted,

"I went through a frustrating experience trying to withdraw money, only to realize the firm lacked oversight."

This emphasizes the critical need for potential investors to conduct thorough self-verification.

Trading Costs Analysis

Tyler Capital's structure of trading fees melds attractive advantages with hidden drawbacks, illustrating a classic "double-edged sword" scenario for traders.

Advantages in Commissions:

Tyler Capital positions itself as a competitive player in terms of low commission rates, appealing to cost-conscious traders. As evidenced, users often appreciated lower transaction costs compared to other brokers.

The "Traps" of Non-Trading Fees:

However, users have reported shocking costs associated with withdrawals, with some voicing that fees could reach as high as $30:

"I was surprised to see a $30 withdrawal fee pop up—it felt unnecessary for the service."

- Cost Structure Summary:

While Tyler Capital's low trading commissions can attract certain types of traders, the hidden fees can undermine the overall financial efficiency, prompting users to weigh the costs carefully.

The platform and tools offered by Tyler Capital reveal a contrast between potential and performance, appealing disproportionately to professional traders.

Platform Diversity:

Tyler Capital's proprietary Omega trading platform lacks support for widely utilized interfaces like MT4 or MT5, impacting general usability and accessibility. This absence can deter novice traders seeking familiar platforms.

Quality of Tools and Resources:

Users have expressed concerns about the quality of analytical and support material available. Lacking robust educational resources or sufficient financial analysis tools, Tyler Capital appears underqualified when compared to its regulated counterparts.

Platform Experience Summary:

Many users have criticized the usability of the Omega platform. One user conveyed disappointment by stating:

"Navigating the Omega platform is not as intuitive as I'd hoped."

This feedback highlights the challenges faced by traders seeking optimal functionality.

User Experience Analysis

The overall user experience at Tyler Capital teeters between satisfactory and subpar, heavily influenced by its regulatory environment.

User Reviews Overview:

The platform has garnered mixed reviews, with traders often noting their apprehension stemming from regulatory voids. Issues related to fund withdrawals and general trust factor significantly into user sentiment.

Reported Issues and Feedback:

While some traders mention satisfactory experiences regarding their trading activities, many echo growing concerns over communication and reliability from the brokerage.

User Experience Summary:

The overarching sentiment suggests that while trading may be satisfactory, the lack of regulatory oversight has created an environment laden with worry about safety and security.

Customer Support Analysis

Customer support is vital in trading; at Tyler Capital, this area seems to require improvement.

Response Efficiency:

User feedback consistently highlights slow response times, leading to frustrations when attempting to resolve account or withdrawal-related inquiries.

User Statements on Support Quality:

One user mentioned significant delays in receiving critical responses, stating:

"Their support team is far from efficient. It took days to get a simple withdrawal question answered."

This not only reflects poor service but can also jeopardize user confidence in handling trades.

- Customer Support Summary:

The overall perception indicates that, while there are positives, the deficiencies in customer support may be enough to dissuade new traders looking for dependable service.

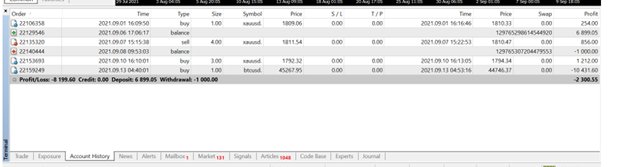

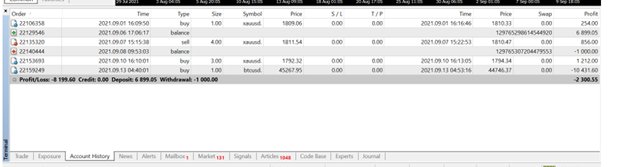

Account Conditions Analysis

The conditions tied to accounts at Tyler Capital run a potentially gruesome landscape that investor types need to navigate carefully.

Fee Structures:

Users express distress regarding account-related fees, especially withdrawal fees perceived as excessive and unclear processes that hinder ease of access to funds.

Account Management Challenges:

Many traders have voiced concerns over unclear withdrawal timelines, leading to frustrations in retrieving funds or understanding the process fully.

Account Conditions Summary:

In evaluating Tyler Capital, potential investors must be wary of potential pitfalls lurking within account conditions, emphasizing the need for careful due diligence before opening an account.

Conclusion

Tyler Capital serves as a case study in the balance of low-cost trading conveniences precariously juxtaposed against severe regulatory deficiencies. As the brokerages foothold in the market continues to be destabilized, the implications for potential investors remain daunting. Tyler Capital may be an alluring option for experienced traders seeking affordable trading, yet the inherent risks render it unsuitable for novice traders. Thus, this platform represents a contentious decision for any trader willing to navigate its treacherous waters.

In closing, verifying the broker's current status and weighing the benefits versus the risks becomes paramount for any potential investor.