AITO 2025 Review: Everything You Need to Know

Executive Summary

AITO has emerged as a topic of interest in the financial services sector. However, comprehensive information about this entity remains limited in available public sources, which creates challenges for thorough evaluation. Based on our research, AITO appears to operate in multiple contexts - from automotive manufacturing to potential financial services, though the connections between these different business areas are not entirely clear. When examining AITO specifically as a financial broker, the available information suggests a relatively new or emerging presence in the market.

This aito review aims to provide an objective assessment based on currently available information. While AITO may offer certain services that could appeal to traders seeking alternative platforms, several concerns arise from our investigation. The limited transparency and lack of comprehensive regulatory information present challenges for thorough evaluation, which should concern potential users. Potential users should exercise caution and conduct additional due diligence before engaging with any services offered by AITO.

The platform appears to target users interested in exploring newer market entrants. However, the specific features, trading conditions, and regulatory status require further clarification from official sources, which may be difficult to obtain.

Important Notice

This evaluation is based on limited publicly available information about AITO as a financial services provider. Different regions may have varying regulatory frameworks that could affect the availability and legality of AITO's services, so users must be particularly careful about compliance issues. Users should verify the regulatory status of AITO in their specific jurisdiction before considering any engagement.

This review methodology acknowledges the information limitations and potential gaps in available data. Readers should treat this assessment as preliminary and seek additional verification from official sources and regulatory bodies in their respective countries, though such verification may prove challenging given the limited available information.

Rating Framework

Broker Overview

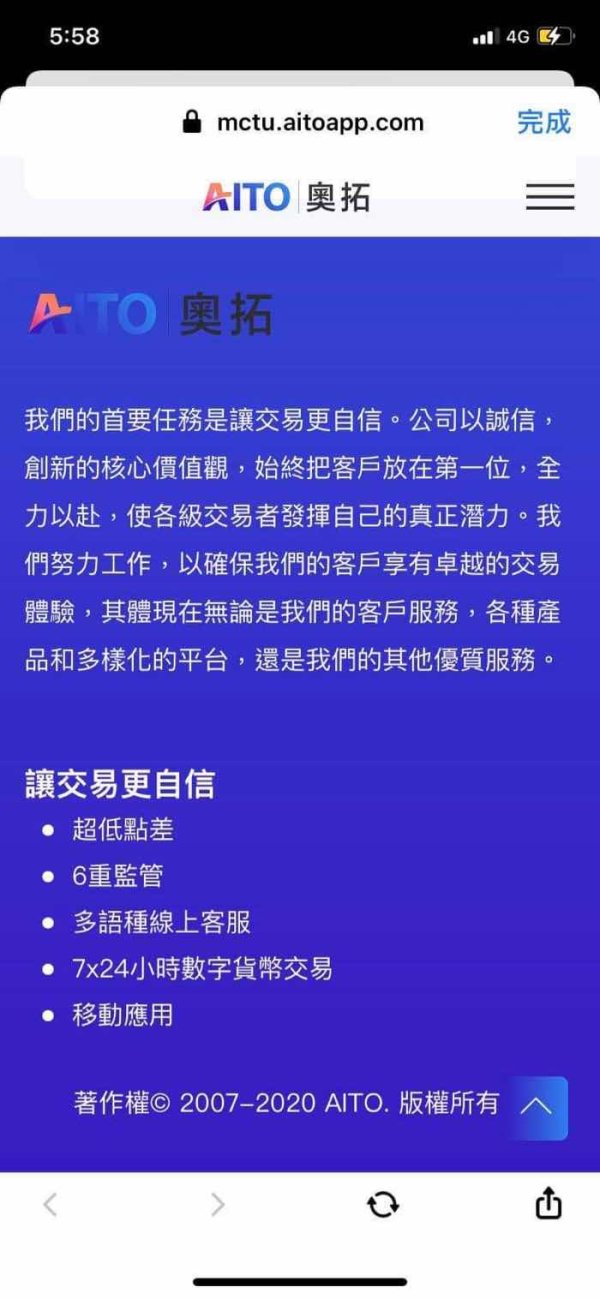

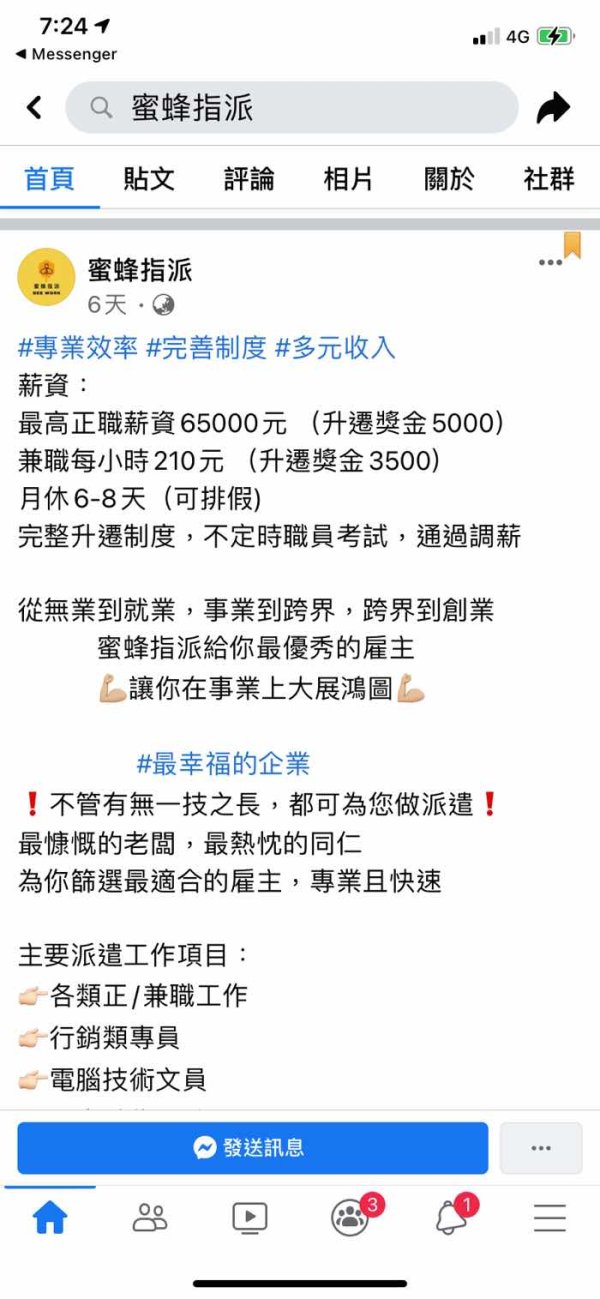

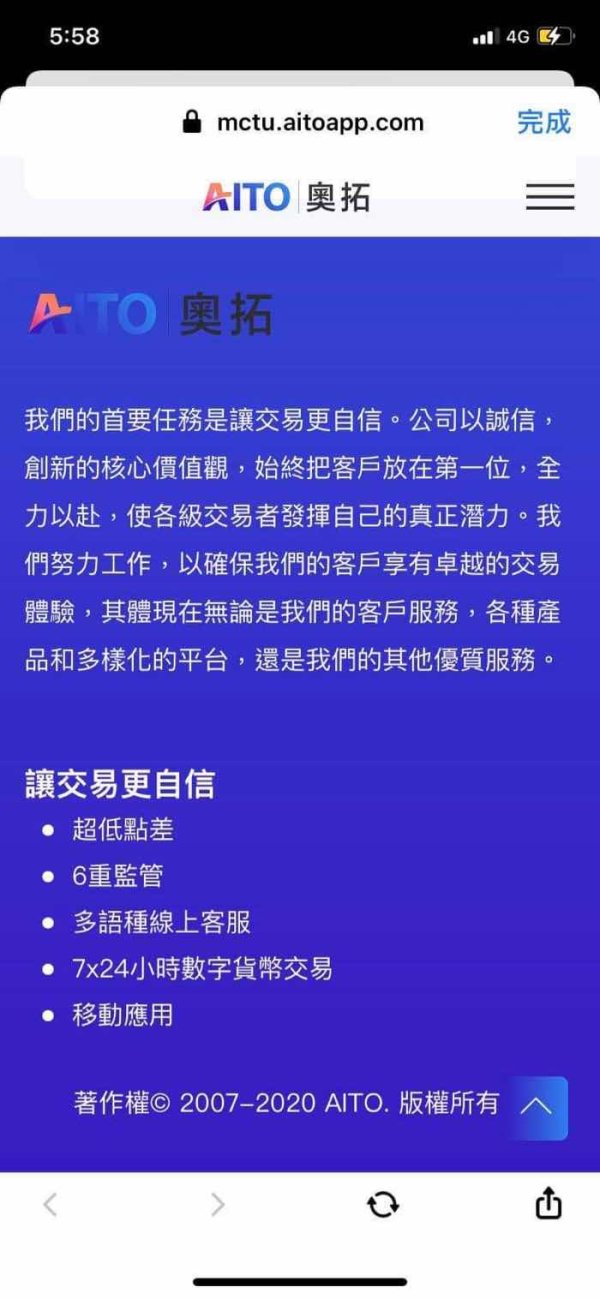

AITO's presence in the financial services sector appears to be relatively recent or limited in scope. The available information suggests potential operations in broker services, though specific details about the company's establishment date, founding team, and primary business model remain unclear from public sources, which raises questions about transparency. The entity seems to operate across different sectors, which may include automotive and potentially financial services.

The company's business approach appears to focus on providing services that may appeal to users seeking alternatives to established market players. However, the lack of comprehensive public information about AITO's specific financial services offerings, regulatory compliance, and operational structure presents challenges for thorough assessment, making it difficult for potential users to make informed decisions. This aito review must therefore rely on limited available data and general industry standards for evaluation.

Trading platform specifications, asset coverage, and regulatory oversight details are not clearly documented in accessible sources. Potential users should seek direct communication with AITO representatives to obtain specific information about trading conditions, platform features, and regulatory status before making any commitments, though even this direct approach may not yield complete information.

Regulatory Status: Available information does not clearly specify AITO's regulatory oversight or licensing details. Users should verify regulatory compliance in their jurisdiction, though this verification process may prove challenging.

Deposit and Withdrawal Methods: Specific payment processing options and procedures are not detailed in available sources.

Minimum Deposit Requirements: Exact minimum deposit amounts and account funding requirements are not specified in accessible documentation.

Promotional Offers: Current bonus structures or promotional campaigns are not clearly outlined in available materials.

Tradeable Assets: While AITO may offer various financial instruments, specific asset classes, currency pairs, and trading products require direct confirmation from official sources.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available in public sources.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible documentation.

Platform Options: Specific trading platform software, mobile applications, and technical features require verification from official sources.

Geographic Restrictions: Service availability by region and country-specific limitations are not clearly documented.

Customer Support Languages: Available support languages and communication channels are not specified in this aito review due to limited source information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of AITO's account conditions faces significant limitations due to insufficient publicly available information. Standard broker assessment criteria including account type variety, minimum deposit requirements, account opening procedures, and special features cannot be thoroughly analyzed based on current sources, which is concerning for potential users seeking transparency.

Industry standards typically expect brokers to offer multiple account tiers catering to different trader experience levels and capital requirements. However, AITO's specific account structure, whether offering standard, premium, or professional account types, remains unclear from available documentation, making it impossible to assess their competitiveness in the market.

The absence of clear information about Islamic accounts, demo account availability, and account verification procedures represents a significant gap in this aito review. Potential users would need to contact AITO directly to understand their account options, funding requirements, and any special conditions or benefits associated with different account levels, though such direct contact may not guarantee comprehensive information.

Without specific user feedback or official documentation, assessing the competitiveness of AITO's account conditions against industry standards proves challenging. The rating reflects this information limitation rather than confirmed deficiencies in service quality, though the lack of transparency itself is a concern for potential users.

Assessment of AITO's trading tools and educational resources encounters substantial limitations due to sparse publicly available information. Modern forex brokers typically provide comprehensive analytical tools, market research, educational materials, and automated trading support to enhance trader capabilities, but AITO's offerings in these areas remain unclear.

Standard industry expectations include access to technical analysis indicators, economic calendars, market news feeds, and educational webinars or tutorials. However, specific details about AITO's offering in these areas are not documented in accessible sources, preventing thorough evaluation of their tools and resources portfolio and making it difficult for traders to assess whether the platform meets their needs.

The availability of third-party trading tools, research partnerships, or proprietary analytical software remains unclear. Additionally, information about educational programs, trading guides, or market analysis resources that AITO may provide to users is not readily available for assessment, which could be problematic for traders who rely on such resources.

Without concrete information about AITO's commitment to trader education and analytical support, this evaluation must rely on general industry standards and the assumption that emerging brokers may have more limited resources compared to established market players.

Customer Service and Support Analysis

Evaluating AITO's customer service capabilities proves challenging due to limited available information about their support infrastructure. Industry standards typically require multiple communication channels, reasonable response times, and multilingual support to serve international clients effectively, but AITO's performance in these areas cannot be verified.

Standard expectations for broker customer service include live chat, email support, telephone assistance, and potentially social media engagement. However, specific details about AITO's customer service hours, available languages, response time commitments, and support quality are not documented in accessible sources, which makes it impossible to assess whether they meet basic industry standards.

The absence of user testimonials or reviews specifically addressing customer service experiences with AITO limits the ability to assess their support effectiveness. Additionally, information about specialized support for technical issues, account problems, or trading disputes is not readily available, which could be problematic for users who encounter difficulties.

Without concrete data about customer service performance metrics, user satisfaction ratings, or specific support policies, this evaluation must acknowledge the significant information gaps that prevent comprehensive assessment of AITO's customer service capabilities.

Trading Experience Analysis

The assessment of AITO's trading experience faces substantial limitations due to insufficient information about their platform performance, execution quality, and overall trading environment. Modern traders typically expect stable platforms, fast execution speeds, comprehensive functionality, and reliable mobile access, but AITO's performance in these critical areas cannot be verified from available sources.

Industry standards for trading experience evaluation include platform uptime statistics, order execution speeds, slippage rates, and mobile platform functionality. However, specific performance data for AITO's trading infrastructure is not available in accessible sources, preventing detailed analysis of their trading environment quality and making it impossible to compare their offerings with established competitors.

Platform stability, which is crucial for successful trading operations, cannot be evaluated without user feedback or technical performance data. Similarly, the quality of order execution, presence of requotes, and overall platform reliability remain unclear from available information, which creates significant uncertainty for potential users who depend on reliable trading infrastructure.

This aito review must acknowledge that without concrete user experiences, technical specifications, or performance benchmarks, assessing AITO's trading experience quality relies on limited information and cannot provide definitive conclusions about platform performance or user satisfaction levels.

Trust and Security Analysis

Evaluating AITO's trustworthiness and security measures encounters significant challenges due to limited publicly available information about their regulatory status, security protocols, and industry standing. Trust assessment typically relies on regulatory licensing, fund segregation practices, company transparency, and track record analysis, but AITO falls short in most of these areas based on available information.

Regulatory oversight represents a fundamental aspect of broker trustworthiness, yet specific details about AITO's licensing, regulatory compliance, or oversight by recognized financial authorities are not clearly documented in accessible sources. This absence of regulatory clarity raises questions about investor protection and operational legitimacy, which should be major concerns for potential users considering the platform.

Fund security measures, including client money segregation, insurance coverage, and banking partnerships, are not detailed in available information. Additionally, company transparency regarding ownership, financial statements, and operational procedures appears limited based on public sources, which creates additional uncertainty about the company's legitimacy and financial stability.

Without verified regulatory status, clear security protocols, or established industry reputation, assessing AITO's trustworthiness requires caution. The limited information available prevents comprehensive evaluation of their security measures and overall reliability as a financial services provider, suggesting that potential users should consider more transparent alternatives.

User Experience Analysis

Assessment of AITO's user experience faces substantial limitations due to the absence of comprehensive user feedback and detailed platform information. User experience evaluation typically encompasses interface design, ease of use, registration processes, and overall satisfaction metrics, but reliable data in these areas is not available for AITO.

Modern trading platforms are expected to provide intuitive interfaces, streamlined registration procedures, efficient verification processes, and user-friendly fund management systems. However, specific information about AITO's platform design, user interface quality, and operational efficiency is not readily available from accessible sources, making it impossible to assess whether they meet current industry standards for user experience.

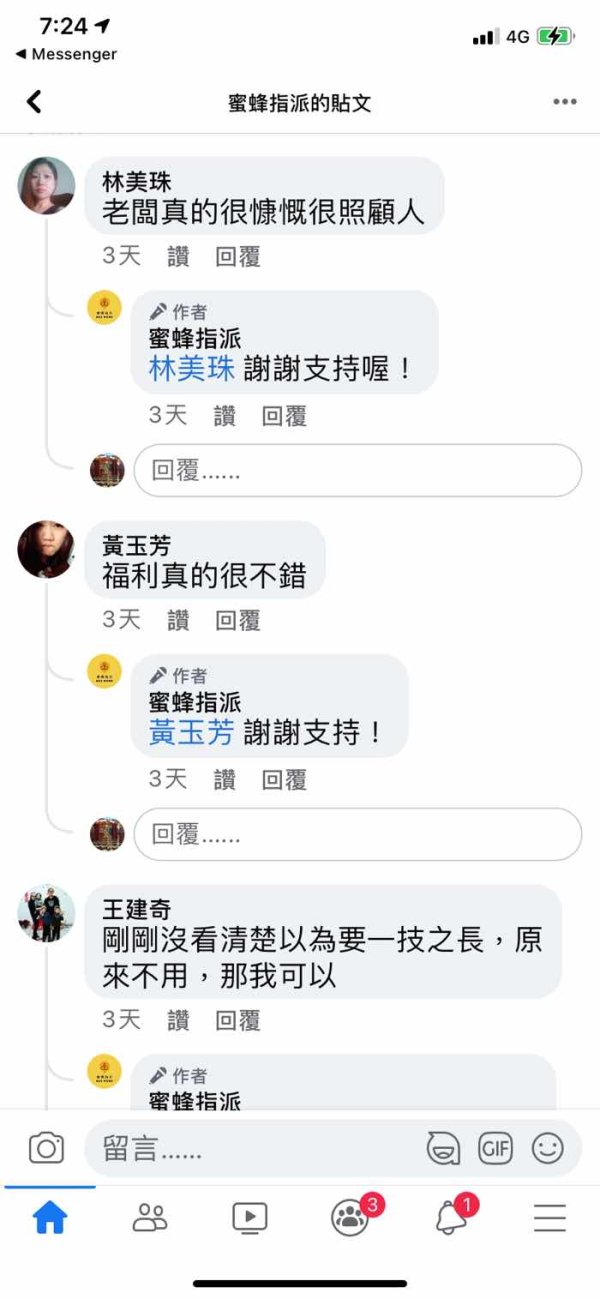

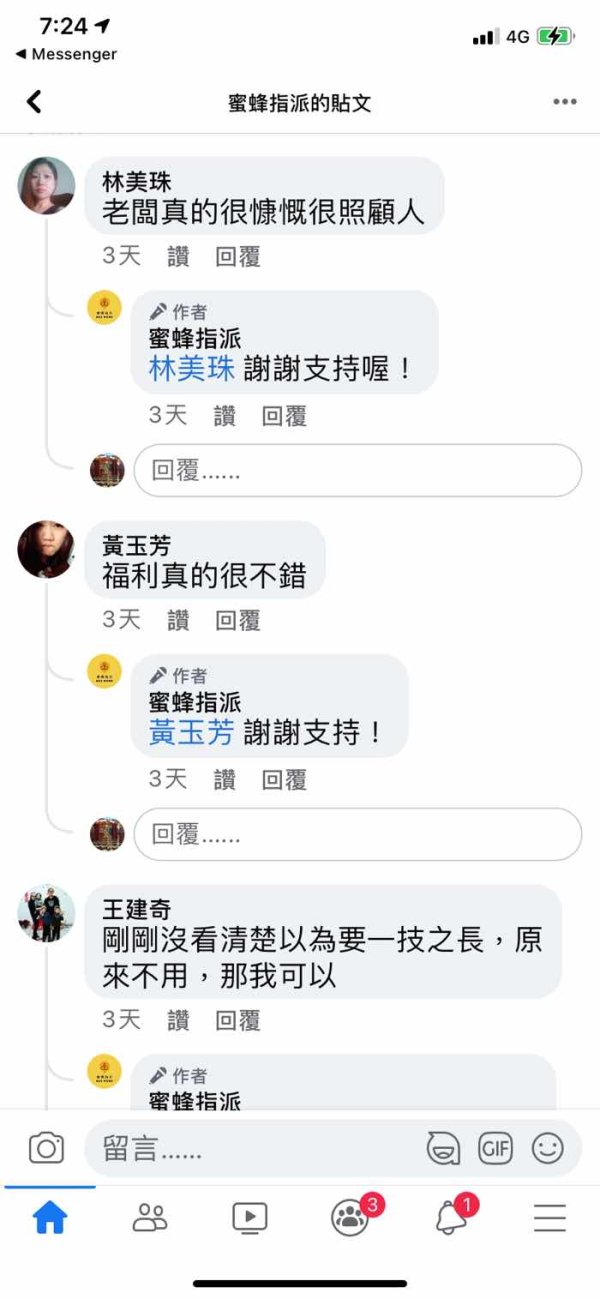

The lack of substantial user reviews, testimonials, or feedback data prevents thorough analysis of actual user experiences with AITO's services. Additionally, information about common user complaints, platform usability issues, or positive user experiences is not documented in available sources, which creates uncertainty about the quality of service that users can expect.

Without concrete user feedback, satisfaction surveys, or detailed platform demonstrations, this evaluation cannot provide definitive conclusions about AITO's user experience quality. The rating reflects the information limitation rather than confirmed deficiencies in user experience design or implementation, though the absence of user feedback itself raises questions about the platform's actual usage and popularity.

Conclusion

This aito review reveals significant information limitations that prevent comprehensive evaluation of AITO as a financial services provider. While the entity appears to have some presence in various sectors, the lack of detailed information about trading conditions, regulatory status, and user experiences necessitates a cautious approach that prioritizes user safety over potential opportunities.

Based on available information, AITO may appeal to users interested in exploring emerging platforms, though the absence of clear regulatory oversight and limited transparency present considerable concerns. Potential users should prioritize thorough due diligence and direct communication with AITO representatives before considering any engagement with their services, though even this approach may not provide sufficient information for informed decision-making.

The overall assessment must remain neutral due to insufficient data, though the information gaps themselves suggest that more established, transparent brokers may offer greater security and clarity for most traders.