EIG 2025 Review: Everything You Need to Know

Executive Summary

This eig review examines a company with a complex identity in the financial landscape. EIG Global Energy Partners was established in 1982 and operates primarily as an investment management firm specializing in energy sector investments. Based in Washington, D.C., the company manages approximately $23 billion in assets under management. However, available information regarding EIG as a forex or trading broker remains extremely limited, making a comprehensive evaluation challenging.

The company's long-standing presence since 1982 demonstrates institutional stability and market experience spanning over four decades. While EIG Global Energy Partners has established itself in the investment management space with a focus on energy infrastructure and related sectors, specific details about retail trading services, platform offerings, or traditional brokerage operations are not readily available in current market documentation. For potential clients seeking a traditional forex or CFD trading experience, the lack of detailed information about trading conditions, regulatory compliance for retail services, and platform specifications presents significant limitations in making informed decisions about EIG's suitability as a trading partner.

Important Disclaimer

When evaluating any financial services provider, particularly one with limited publicly available information about retail trading operations, potential clients should exercise considerable caution. Different regional entities may operate under varying regulatory frameworks. The services offered by EIG Global Energy Partners may differ significantly from traditional retail forex brokers.

This eig review is based on limited available information, primarily focusing on the company's investment management operations rather than comprehensive retail trading services. The absence of detailed user reviews, trading condition specifications, and regulatory compliance information for retail trading activities means this evaluation cannot provide the depth of analysis typically expected for forex broker assessments. Prospective clients should conduct additional due diligence and seek direct communication with the company to clarify available services and regulatory compliance.

Rating Framework

Broker Overview

Company Background and History

EIG Global Energy Partners represents an established presence in the investment management sector. The company was founded in 1982 and operates from its headquarters in Washington, D.C., positioning itself strategically within the United States' financial and political center. With over four decades of operation, EIG has developed expertise primarily in energy sector investments, managing substantial institutional capital totaling approximately $23 billion in assets under management. The company's business model centers on investment management services, particularly focusing on energy infrastructure, natural resources, and related sectors.

This specialization distinguishes EIG from traditional multi-asset retail brokers, as their core competency lies in institutional investment management rather than providing comprehensive retail trading platforms for individual investors.

Service Model and Market Position

Unlike conventional forex brokers that cater to retail traders with accessible platforms and diverse asset classes, EIG Global Energy Partners appears to operate primarily as an institutional investment manager. The company's focus on energy sector investments suggests a specialized approach targeting institutional clients, pension funds, and high-net-worth individuals seeking exposure to energy infrastructure and related investment opportunities. The absence of readily available information about traditional forex trading services, CFD offerings, or retail-focused trading platforms indicates that EIG may not operate as a conventional retail broker.

This positioning places the company in a different category from typical forex brokers evaluated for individual trading activities.

Detailed Service Analysis

Regulatory Framework and Compliance

Available documentation does not provide specific information about regulatory oversight for retail trading operations. While EIG Global Energy Partners operates as an established investment management firm, the regulatory framework governing their potential retail trading services remains unclear. The company's primary operations as an investment manager likely fall under different regulatory requirements than those governing retail forex brokers.

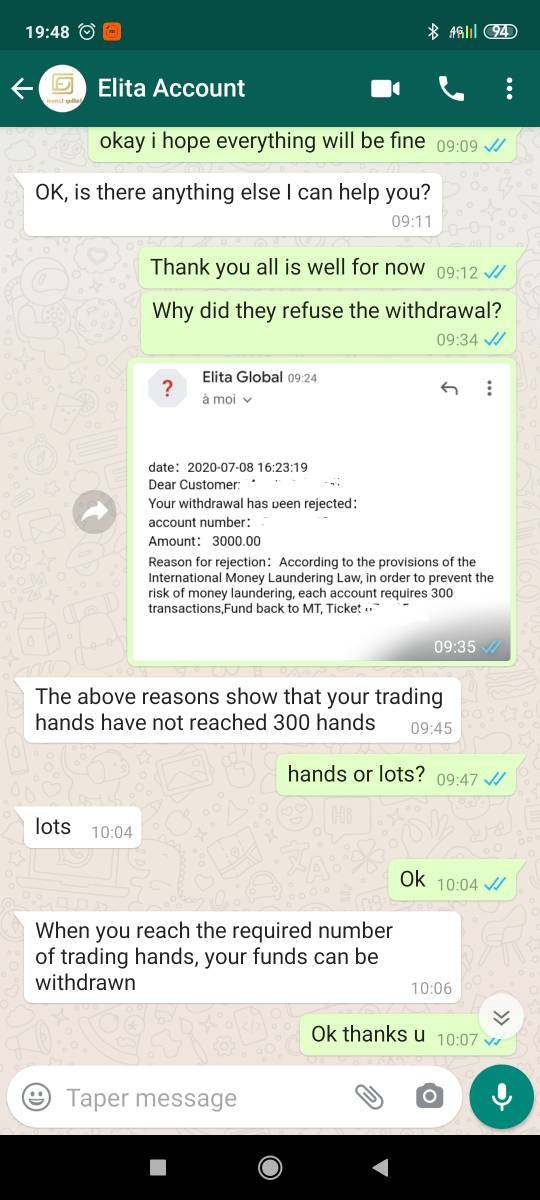

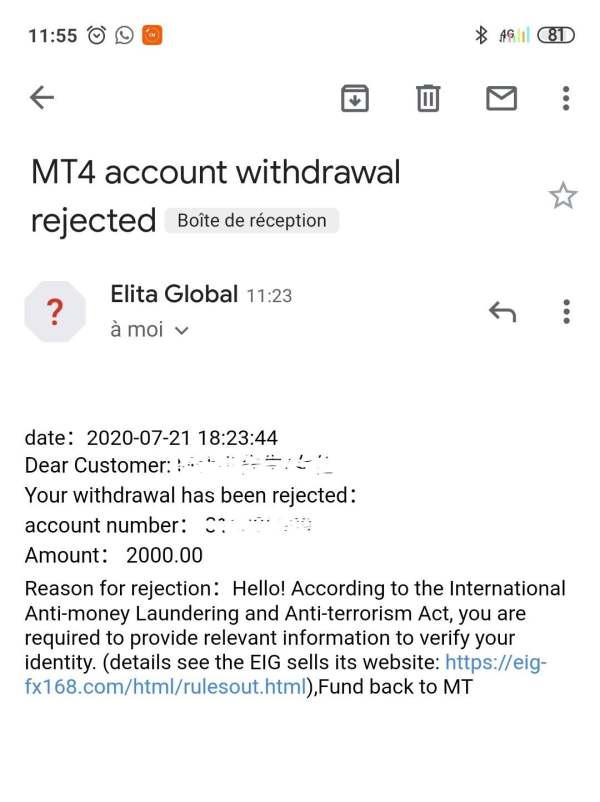

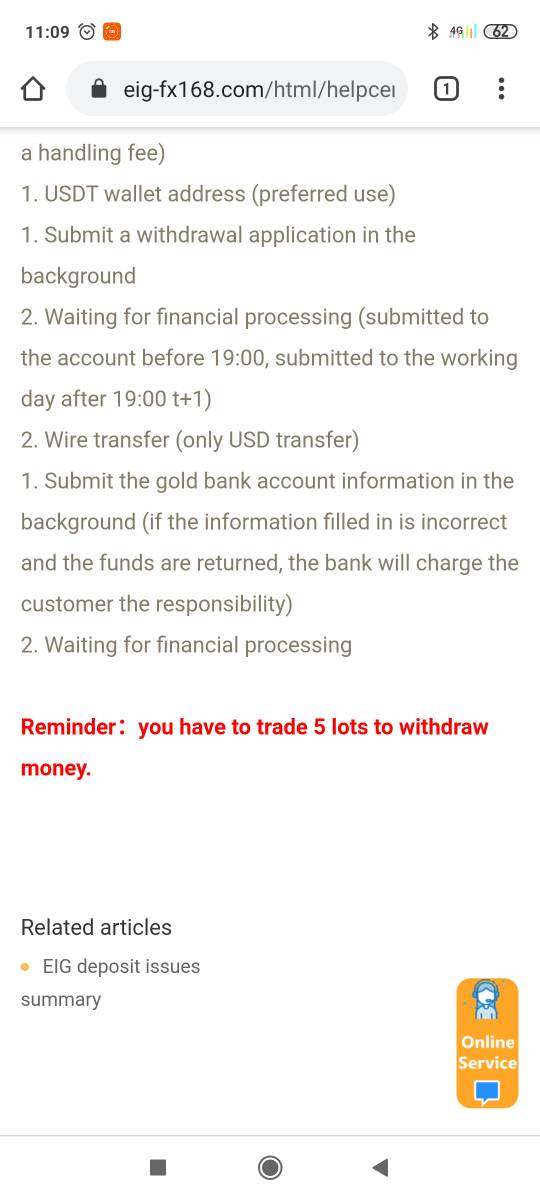

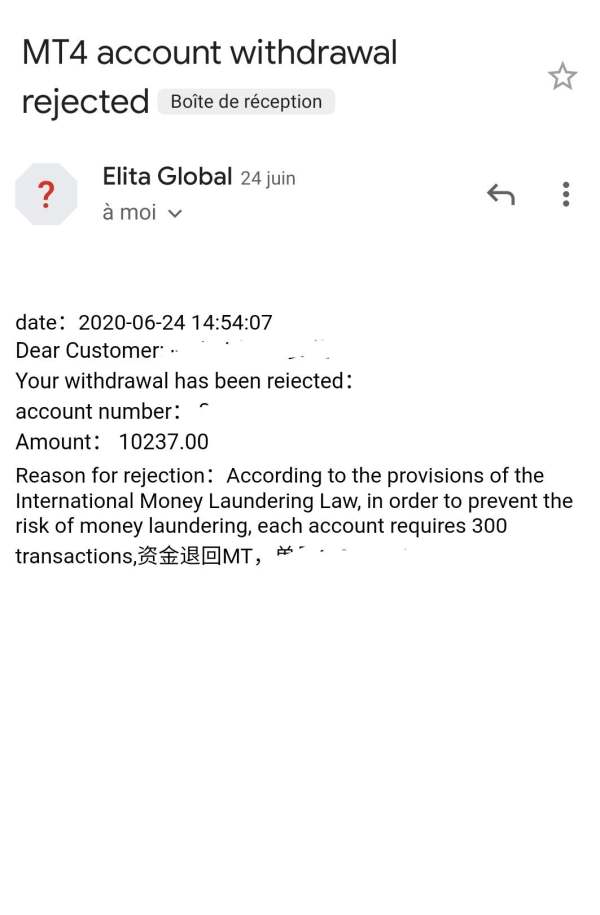

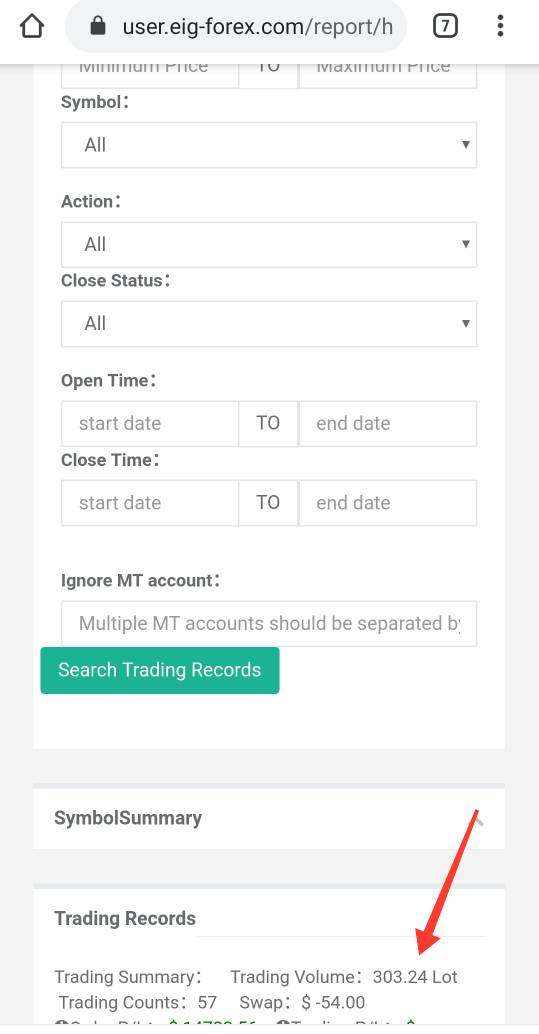

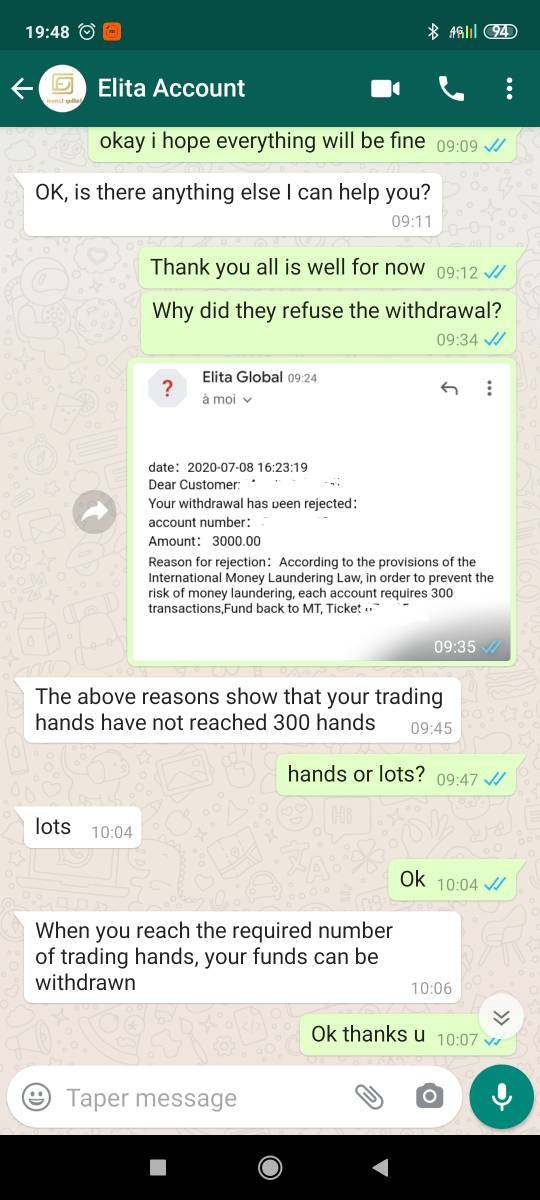

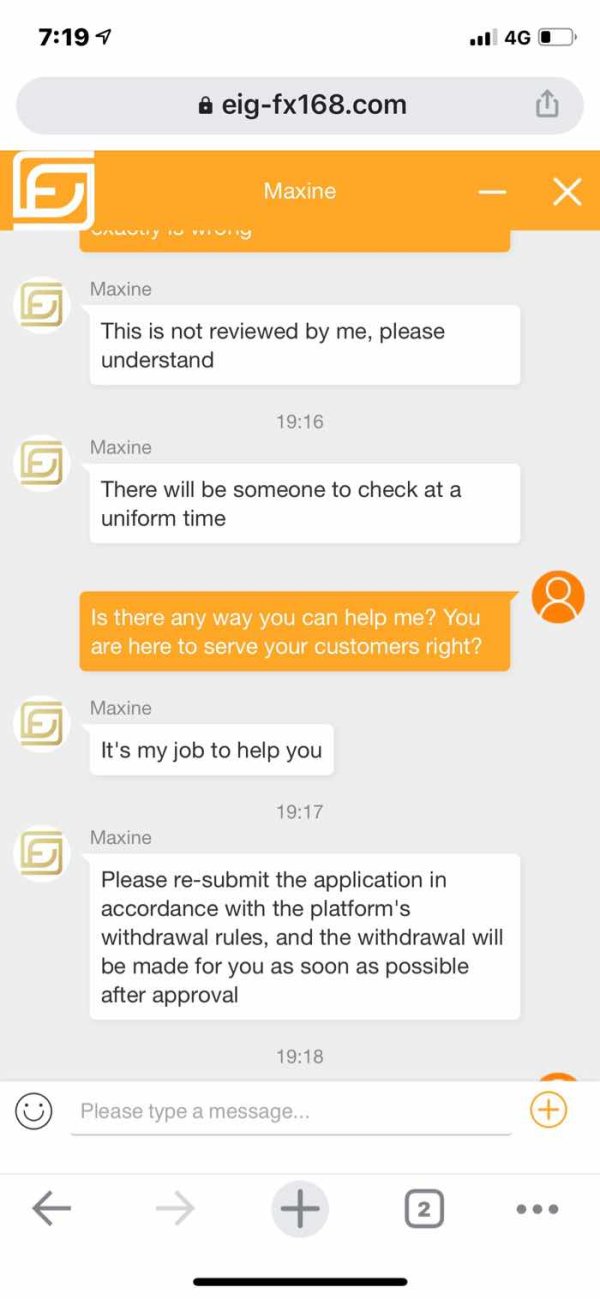

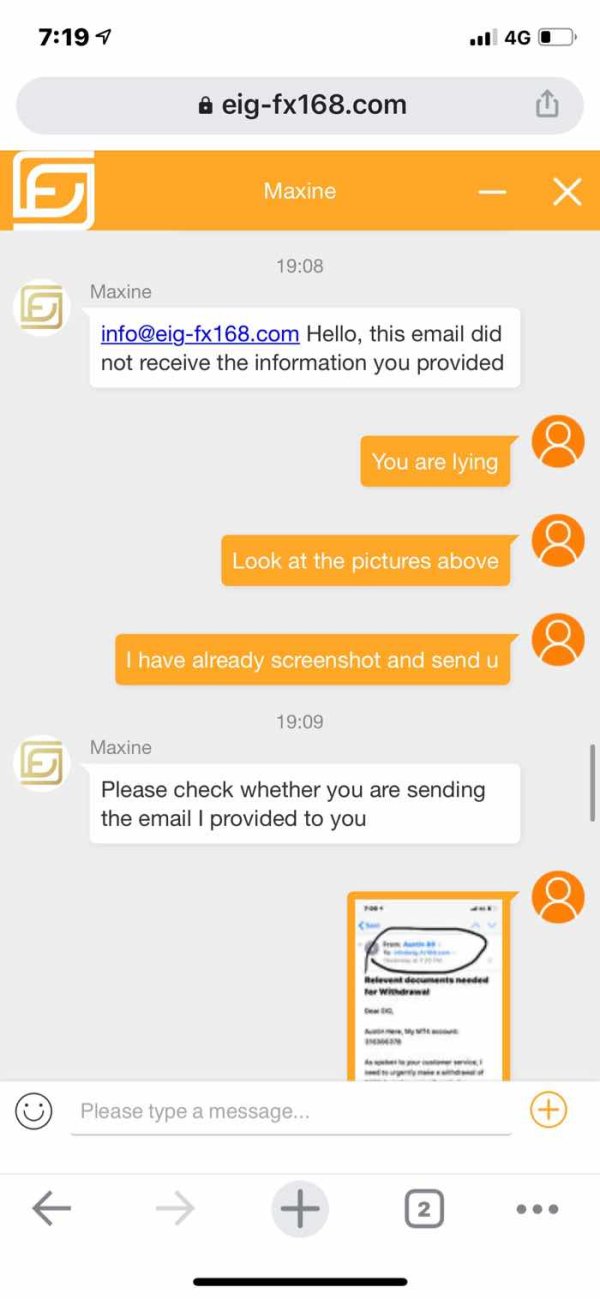

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods for retail trading accounts is not available in current documentation. Traditional retail brokers typically offer multiple funding options including bank transfers, credit cards, and electronic payment systems. EIG's available services in this regard remain unspecified.

Account Requirements and Minimums

Minimum deposit requirements and account opening procedures for retail trading services are not detailed in available sources. Given the company's focus on institutional investment management, account minimums may significantly exceed those typically offered by retail forex brokers.

Trading Assets and Instruments

The range of tradeable assets, including forex pairs, commodities, indices, or CFDs, is not specified in available documentation. EIG's primary focus on energy sector investments suggests potential access to energy-related instruments. Comprehensive asset coverage remains unclear.

Cost Structure and Fees

Detailed information about spreads, commissions, overnight fees, and other trading costs is not available. The fee structure for any potential retail trading services remains unspecified in current documentation.

Platform Technology

Specific trading platforms, whether proprietary or third-party solutions like MetaTrader, are not mentioned in available sources. Platform features, mobile accessibility, and trading tools remain undocumented.

Comprehensive Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for this eig review faces significant limitations due to insufficient available information. Traditional forex brokers typically offer multiple account types ranging from basic retail accounts to premium services with enhanced features. However, EIG Global Energy Partners does not provide clear documentation about retail account structures, minimum deposit requirements, or tiered service levels.

Account opening procedures, verification requirements, and onboarding processes remain unspecified. Most retail brokers offer streamlined digital account opening with document verification, but EIG's approach to client onboarding is not detailed in available sources. The absence of information about demo accounts, which are standard offerings among retail forex brokers, further complicates the assessment.

Islamic or Sharia-compliant account options, commonly available among comprehensive retail brokers, are not mentioned in EIG's available documentation. The lack of detailed account condition information makes it impossible to assess competitiveness against industry standards or suitability for different trader profiles. Given the company's focus on institutional investment management, retail account conditions may follow different structures than traditional forex brokers, potentially requiring higher minimum investments and different service approaches.

Professional trading tools and analytical resources represent crucial components for serious traders. Yet specific information about EIG's offerings in this area remains unavailable. Established retail brokers typically provide comprehensive charting packages, technical analysis tools, economic calendars, and market research resources.

Educational resources, including webinars, tutorials, and market analysis, are standard offerings among competitive retail brokers but are not documented for EIG's services. The absence of information about research capabilities, market insights, or educational support materials limits the ability to assess the company's commitment to client development and market education. Automated trading support, including expert advisors, algorithmic trading capabilities, and API access, represents increasingly important features for advanced traders.

However, EIG's technological infrastructure for such services is not detailed in available documentation. Third-party integrations, social trading features, and advanced analytical tools that distinguish premium brokers from basic service providers cannot be evaluated due to insufficient information.

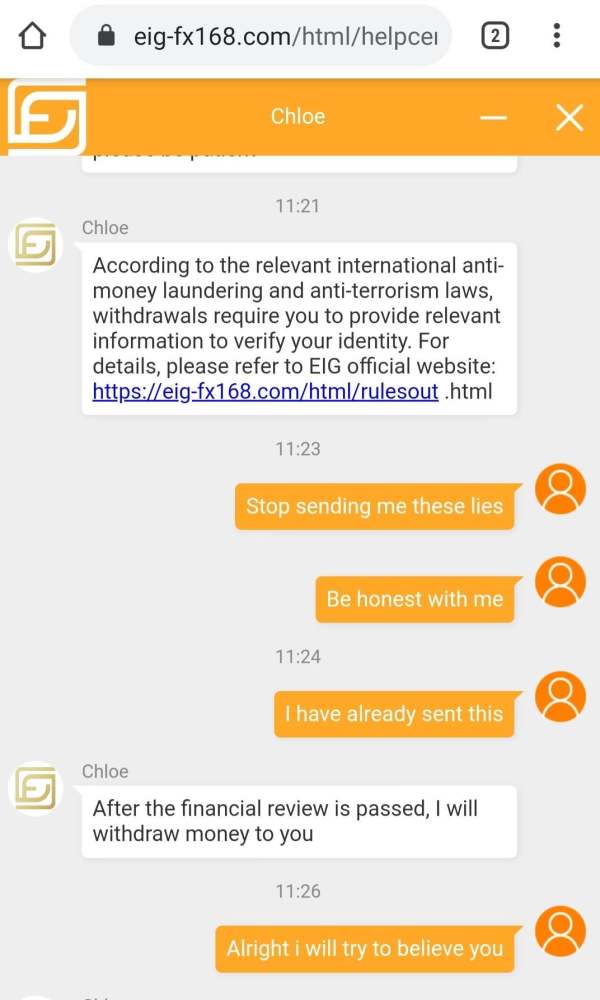

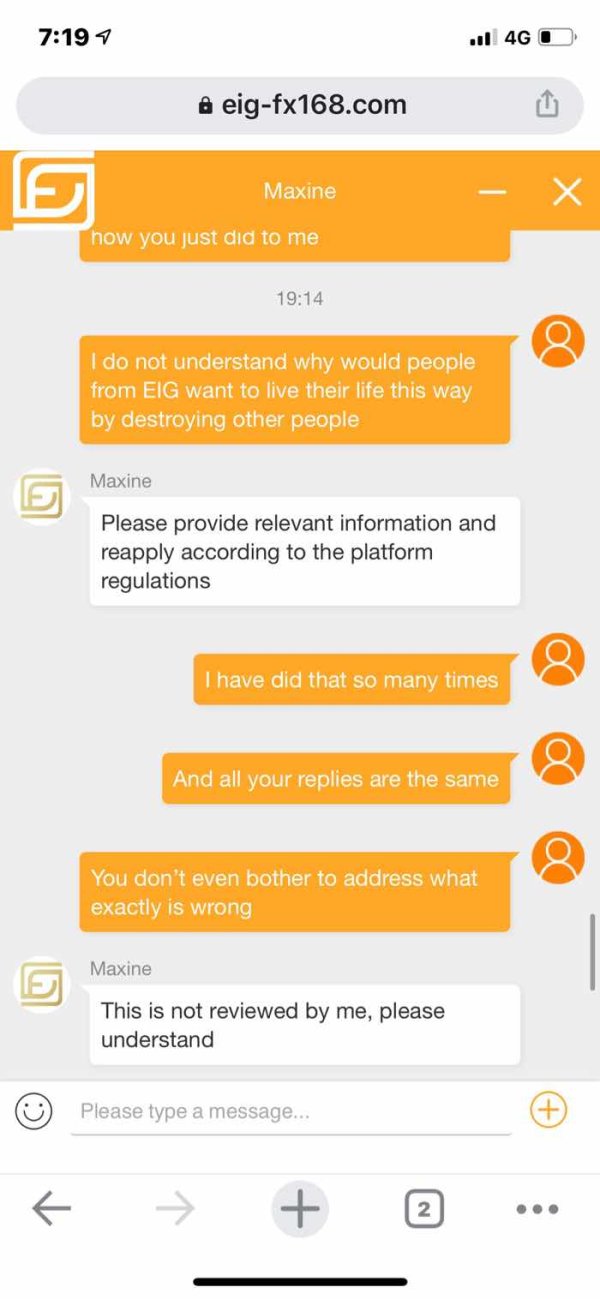

Customer Service and Support Analysis

Customer service quality and accessibility represent fundamental aspects of broker evaluation. Yet specific information about EIG's support infrastructure remains limited. Professional brokers typically offer multiple communication channels including live chat, phone support, email assistance, and comprehensive FAQ resources.

Response times, service availability hours, and support quality metrics are not documented for EIG's operations. The absence of user feedback about customer service experiences makes it impossible to assess support effectiveness or problem resolution capabilities. Multilingual support capabilities, which are essential for international brokers serving diverse client bases, are not specified in available documentation.

Account management services, technical support quality, and educational assistance levels cannot be evaluated based on current information. The lack of documented customer service infrastructure raises questions about the company's retail service orientation and commitment to individual client support.

Trading Experience Analysis

Platform performance, execution quality, and overall trading environment assessment faces significant limitations in this eig review due to insufficient available information. Professional trading platforms require reliable connectivity, fast execution speeds, and comprehensive functionality to meet trader expectations. Order execution quality, including slippage rates, requote frequency, and execution speed metrics, are not documented for EIG's potential trading services.

These factors critically impact trading profitability and user satisfaction but cannot be evaluated based on available information. Platform stability during high-volatility periods, system uptime statistics, and technical reliability measures are not specified. Mobile trading capabilities, which are essential for modern traders requiring market access across devices, remain undocumented.

Trading environment features such as one-click trading, advanced order types, risk management tools, and customizable interfaces cannot be assessed due to insufficient information about platform specifications.

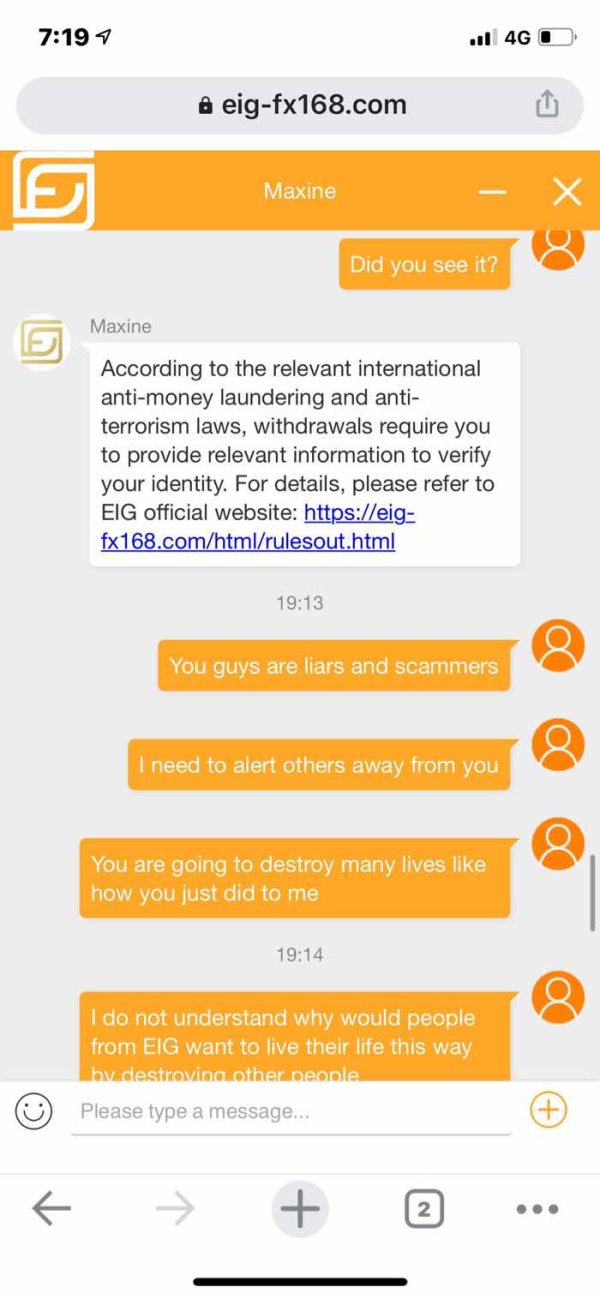

Trust and Security Analysis

Regulatory compliance and security measures represent fundamental trust factors for any financial services provider. Yet specific information about EIG's retail trading oversight remains limited. While EIG Global Energy Partners operates as an established investment management firm, regulatory framework details for potential retail trading services are not clearly documented.

Asset protection measures, including client fund segregation, insurance coverage, and regulatory compensation schemes, are not specified for retail trading operations. These protections are standard among regulated retail brokers but cannot be verified for EIG's services. Company transparency regarding ownership structure, financial statements, and regulatory relationships is limited in available documentation.

Industry reputation and regulatory standing, while generally positive for the investment management operations, cannot be directly applied to retail trading service evaluation. The absence of detailed regulatory information makes it difficult to assess compliance with international trading standards and client protection measures.

User Experience Analysis

Overall user satisfaction and platform usability assessment remains challenging due to limited available user feedback and interface documentation. Retail trading platforms require intuitive design, efficient navigation, and comprehensive functionality to support effective trading activities. Registration and account verification processes are not detailed in available sources, making it impossible to assess onboarding efficiency or user-friendliness.

Fund management procedures, including deposit processing times and withdrawal efficiency, cannot be evaluated based on current information. User interface design, platform customization options, and accessibility features remain unspecified. The absence of user reviews and satisfaction ratings prevents comprehensive user experience assessment.

Common user complaints, platform limitations, and improvement suggestions cannot be identified due to insufficient feedback documentation in available sources.

Conclusion

This eig review reveals significant limitations in evaluating EIG Global Energy Partners as a traditional retail forex broker. While the company demonstrates substantial credibility as an established investment management firm with over $23 billion in assets under management since 1982, specific information about retail trading services remains insufficient for comprehensive assessment. The company appears more suitable for institutional investors and high-net-worth individuals seeking energy sector investment exposure rather than retail traders looking for comprehensive forex and CFD trading platforms.

The absence of detailed information about trading conditions, platforms, regulatory compliance for retail services, and user experiences prevents a thorough evaluation against industry standards. Potential clients interested in EIG's services should conduct direct inquiries to clarify available offerings, regulatory compliance, and service structures before making investment decisions.