firstgold 2025 Review: Everything You Need to Know

Abstract

The firstgold review shows a neutral picture of the broker based on user feedback and market information. While several users like the fixed spread of 5 pips—especially good for those trading precious metals like gold and silver—others stay careful because of possible scam risks. The broker seems to help traders who want to invest in gold and silver, offering steady costs though many important details are missing. In our review, the lack of clear rules and details about deposits, fees, and platform services creates uncertainty. However, the fixed spread helps traders who want predictable trading costs in changing markets. This firstgold review uses current user comments and market comparisons to give an unbiased evaluation, showing the broker's strengths in precious metals trading while also pointing out areas where more transparency and information would help future investors.

Cautions and Considerations

It is important to note that there are differences between regions, as specific rule information is not provided in the available data. As such, potential risks may happen because of the lack of detailed oversight information. This review is based on user comments and public market details, and readers should consider that not all operational parts—such as exact account types, minimum deposit needs, or complete service details—are clearly documented. The absence of clear regulatory insights may affect the trust factor among certain trader groups. We urge users to do additional research before working with the broker. These points are key to understanding both the advantages and limits, making sure that any decision to proceed is well-informed and matches personal risk comfort levels.

Rating Framework

Broker Overview

FirstGold works mainly in the precious metals market, focusing on spot trading in gold and silver. Although its exact start year is not given in the provided sources, the company's background shows a strong focus on offering precious metal investment opportunities. The business model centers on giving traders a simple trading approach, especially in the area of physical metals. This operational focus makes it appealing for investors who value predictability, as shown by the fixed 5-pip spread. However, the absence of clear details about commission structures, account minimums, and specific regulatory credentials requires a careful assessment by potential users. Overall, this part of the firstgold review highlights the basics but also shows the need for additional transparency.

In addition to its main focus on gold and silver, the broker's service offering seems to revolve around traditional trading methods without going into innovative platform features or advanced analytics. Details about the trading interface, available platforms, or any mobile trading capabilities were not detailed in the available summaries. The lack of complete descriptions of account types and operational procedures leaves future traders with unanswered questions about the overall functionality and user-friendliness of the broker's setup. As such, while the fixed spread remains an appealing benefit, the absence of extra details suggests that more in-depth research and direct user inquiry may be needed before fully committing. This second mention of the firstgold review underlines that while the broker has specific strengths in its niche, certain aspects of its operational transparency remain unclear.

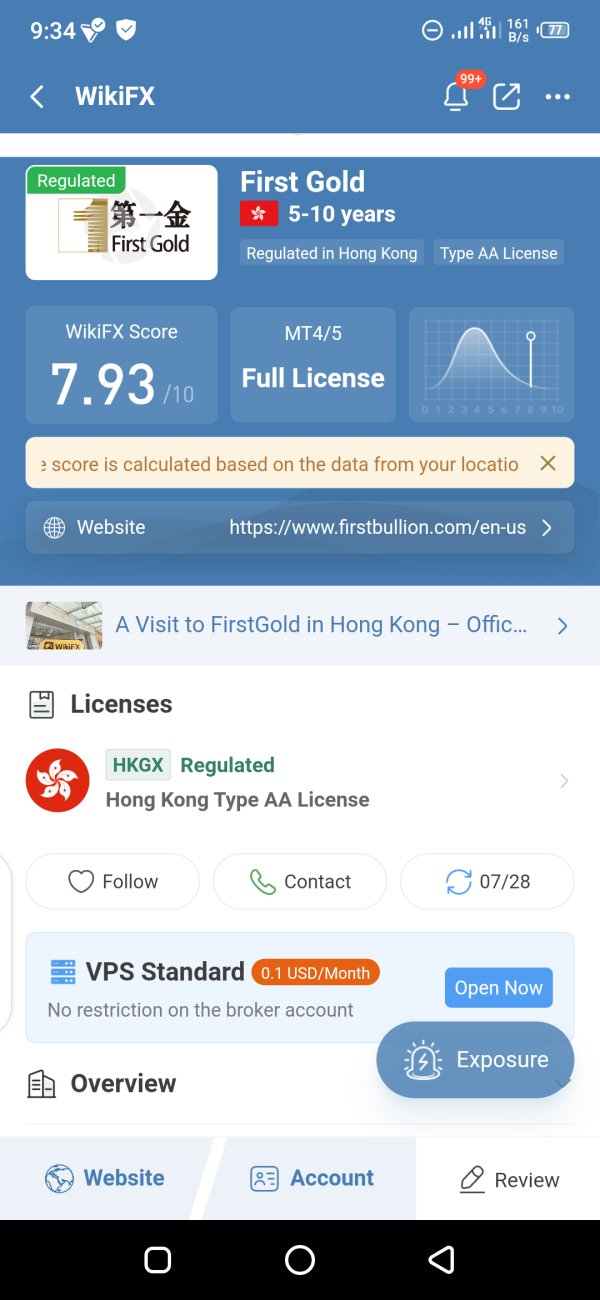

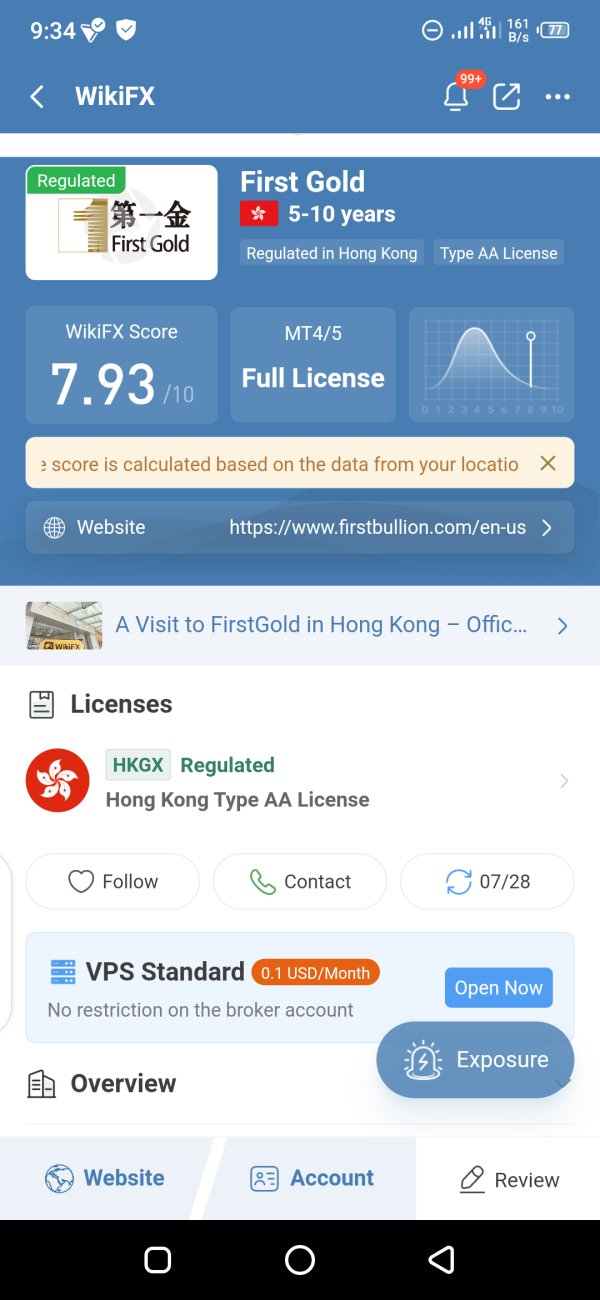

According to the available market summaries, there is no clear regulatory information provided about firstgold's oversight or areas of operation. As a result, any details about regulatory jurisdictions or supervisory bodies remain unspecified.

Deposit and withdrawal methods are not clearly detailed in the accessible sources, leaving users without clarity on the available options for funds movement. Similarly, no clear mention of a minimum deposit requirement is provided, which can be a significant consideration for new traders evaluating their entry threshold.

Bonus promotions or additional incentives are also not discussed, thus potential clients should assume that such offers, if available, have not been clarified in the current materials.

The range of tradable assets is clearly defined, with the broker focusing only on spot gold and spot silver. This specialization is both a strength and a limitation as it caters specifically to precious metals traders.

About the cost structure, the broker advertises a fixed spread of 5 pips, which provides consistency in trading costs. However, commission details are not given, leaving a gap in understanding the complete cost implications.

Information on leverage ratios is similarly lacking, as the summaries do not specify whether margin levels differ by asset or account type.

Furthermore, details about platform choices remain vague; the type of trading platforms available—be it desktop, web-based, or mobile—is not outlined.

Regional restrictions and supported languages are both areas where the data is insufficient, and hence, any specifics on these aspects remain undisclosed.

This complete overview in our third firstgold review highlights both the clearly communicated specialization in precious metals and the significant areas where further transparency is required to enhance trader confidence.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

A closer look at the account conditions reveals several points that contribute to the overall evaluation of firstgold. While the broker does advertise a fixed spread of 5 pips—a consistent benefit that can appeal to traders seeking predictability in trading costs—there is a significant lack of information about other crucial aspects. Details such as account types, minimum deposits, and commission fees are clearly absent from the available summaries. This lack of clarity complicates the process of determining whether existing account conditions meet the demands of different trader profiles. Furthermore, the account opening process, including required documentation and verification timelines, is not outlined, which could lead to delays or confusion for new users. In addition, there is no information on the availability of specialized accounts like Islamic accounts, which are a critical aspect for some market participants. Without these details, the overall conditions remain unclear. User feedback, which is not specifically detailed, seems mixed, suggesting that while the fixed spread is a notable advantage, significant gaps in account conditions prevent a higher rating. This section repeats the need for further transparency in the firstgold review.

The analysis of trading tools and resources available at firstgold reveals similarly limited information. The available data does not provide a clear picture of the range and quality of trading instruments offered by the broker. There is no reference to proprietary or third-party platforms being used, and details on automation features or algorithmic trading support remain unspecified. Additionally, firstgold does not appear to offer strong research or analytical resources; there is no mention of technical or fundamental analysis tools accessible to traders, which is often a hallmark of competitive brokers. The absence of educational material, such as webinars, tutorials, or market analysis reports, suggests that the broker may not be sufficiently supporting its clients in enhancing their trading skills. The overall lack of detailed, user-friendly resources limits the capacity for traders to fully prepare and compete in the markets. As a result, based on the evaluation of available materials, this section of the firstgold review strongly indicates that enhancements in trading tools and educational support are necessary to provide a more complete trading environment. The deficiency in transparency about available trading resources gives a tentative score, showing the need for improvement.

2.6.3 Customer Service and Support Analysis

Customer service and support are critical dimensions in any brokerage review. In the case of firstgold, the feedback is mixed. Users have reported varying experiences about the responsiveness and quality of support offered. Some traders have expressed satisfaction with the assistance provided, appreciating the availability of support during trading hours; however, other users report slow response times and unsatisfactory resolution of issues. Moreover, the publicly available information does not clarify whether support channels include multiple communication methods such as email, telephone, or live chat. There is also no specific mention of whether the customer service team offers multilingual support, which is a significant factor for an international clientele. The absence of detailed service metrics, such as average response time or escalation procedures, further complicates efforts to gauge the overall effectiveness of the broker's support structure. Although the fixed trading conditions and focused asset range might streamline service demands, the existing gaps in service description and user feedback contribute to a moderate score. This analysis shows that while some aspects of customer support at firstgold are functional, overall there is ample room for improvement to boost client satisfaction and trust further.

2.6.4 Trading Experience Analysis

The overall trading experience with firstgold is defined mainly by a limited set of features detailed in the available information. A fixed spread of 5 pips presents a clear advantage by offering predictable trading costs, which can be beneficial in volatile market conditions. However, numerous aspects of the trading experience remain insufficiently described. There is no detailed information about the stability and speed of the trading platforms, the quality of order execution, or the availability of advanced charting tools and technical indicators. The lack of information on whether the platform is available on mobile devices or operates only on a desktop environment further complicates the assessment. In addition, specifics about any additional features, such as risk management tools or integrated news feeds, are not mentioned. User feedback on the execution speed and interface usability is not clearly documented, making it difficult to derive a complete picture of the daily trading experience. This gap in detail results in an evaluation that, while acknowledging the benefit of a fixed spread, remains cautious about fully endorsing the platform's overall performance. This detailed analysis reinforces that, despite the straightforward cost structure, the actual trading environment requires additional refinement and clarity, as highlighted in this instance of the firstgold review.

2.6.5 Trust Analysis

Trust and credibility are paramount when evaluating any brokerage, and the available data on firstgold leaves significant questions unanswered. The primary concern stems from the absence of clear regulatory oversight; no specific regulatory bodies or jurisdictions are associated with the broker in the provided information. This lack of regulatory details can raise alarms for security-conscious traders, especially in a market where trust and compliance are critical. User-generated content and third-party reviews have raised the possibility of scam risks, further reducing the level of confidence potential investors might have. Additionally, there is no confirmation of detailed capital protection measures or segregated account practices, which are typically indicators of strong risk management. Without clear information on the broker's history of compliance or any independent audits and certifications, the trust score remains inherently weak. Various sources indicate that while there may be isolated positive experiences, the overall picture is clouded by uncertainty about the firm's regulatory status and operational transparency. This lack of assurance is a significant factor in our trust evaluation, showing the need for further clarity to improve confidence among potential users.

2.6.6 User Experience Analysis

User experience for firstgold is characterized by a mix of positive and negative feedback, resulting in an overall moderate score. On one hand, users appreciate the clear and consistent cost structure provided by the fixed 5-pip spread, which simplifies the cost considerations for trading precious metals. However, several users have reported issues about the usability of the trading platform, including a lack of intuitive navigation and incomplete information on some functionalities. The registration and verification processes have not been described in detail, and there are no clear guidelines about account maintenance or fund management procedures. Moreover, while the user interface appears to be straightforward, the absence of modern features such as mobile trading apps and integrated analytical tools limits the overall utility and convenience, especially for traders accustomed to technologically advanced platforms. Common user complaints seem to focus on these areas of interface rigidity and the need for enhanced customer support responsiveness. In summary, while there is a distinct advantage in cost consistency, the overall user experience suffers from gaps in platform innovation and service transparency. This balanced overview of user feedback reinforces the moderate rating in this segment.

Conclusion

In summary, this review of firstgold presents a neutral outlook, noting both strengths and the need for enhanced transparency. The fixed 5-pip spread stands out as a significant benefit, especially for traders focused on gold and silver. However, the absence of detailed regulatory information and complete service descriptions remains a substantial shortcoming. Accordingly, firstgold may suit those who appreciate straightforward precious metals trading but require careful due diligence about risk management and support. Overall, while the broker offers a clear cost advantage, prospective users should undertake thorough research before engaging, as highlighted throughout this firstgold review.