Dollars Markets foreign exchange brokers specializing in providing foreign exchange trading services, the company's official website https://vault.dollarsmarketsmy.com/account/register, about the company's legal and temporary regulatory information, the company's address Suite 305, Grifth Corporate Center P.O. Box 1510, Beachmont, Kingstown St. Vincent and the Grenadines.

Dollars Markets Forex Broker

Basic Information

Mauritius

MauritiusCompany Summary

Pros

Cons

Dollars Markets Forex Broker - Comprehensive Information Guide

1. Broker Overview

Dollars Markets, established in 2020, is an online forex and CFD broker designed to cater to a diverse clientele seeking to engage in global trading. The company is headquartered in Mauritius and operates under the regulatory oversight of the Financial Services Commission (FSC) of Mauritius. As a private entity, Dollars Markets focuses on providing retail forex trading services to individual traders and investors worldwide.

Since its inception, Dollars Markets has made significant strides in the financial services industry, positioning itself as a reliable platform for trading various financial instruments. The broker has developed a reputation for offering a user-friendly trading environment, appealing to both novice and experienced traders. The company operates under the umbrella of the Dollars Markets Group, which encompasses different registered entities, including its registration in Saint Vincent and the Grenadines.

Dollars Markets primarily serves retail clients, providing access to a wide range of trading instruments, including currency pairs, commodities, indices, and cryptocurrencies. The broker employs a business model that emphasizes direct market access, allowing traders to execute orders with minimal delays. Through its robust trading platform, Dollars Markets aims to empower its clients to navigate the complexities of the financial markets effectively.

2. Regulation and Compliance Information

Dollars Markets is regulated by the Financial Services Commission (FSC) of Mauritius, holding the license number GB 21026297. The FSC is responsible for overseeing non-banking financial institutions, ensuring that they adhere to the relevant laws and regulations governing financial services in Mauritius. The regulatory framework helps to enhance the credibility and trustworthiness of the broker, although it is essential to note that Mauritius is classified as an offshore jurisdiction, which may not provide the same level of investor protection as more established regulatory bodies.

The broker's license is valid for conducting business in the forex and CFD trading sectors, and it is committed to maintaining compliance with local laws. Dollars Markets implements a client fund segregation policy, ensuring that clients funds are kept separate from the company's operational funds. However, it does not participate in any investor compensation schemes that provide additional security for clients in the event of insolvency.

Dollars Markets adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, implementing measures to verify the identity of its clients and prevent illicit activities. These compliance protocols are designed to enhance the security of the trading environment and protect both the broker and its clients from potential fraud.

3. Trading Products and Services

Dollars Markets offers a diverse range of trading products, catering to various trading preferences and strategies. The broker provides access to over 400 financial instruments, including:

- Forex Currency Pairs: The broker offers more than 107 currency pairs, including major, minor, and exotic pairs, allowing traders to engage in global forex markets.

- CFDs on Indices: Traders can access 14 different indices, enabling them to speculate on the performance of major stock markets around the world.

- CFDs on Commodities: The broker provides trading opportunities in various commodities, including precious metals like gold and silver.

- Cryptocurrencies: With access to 104 cryptocurrencies, traders can invest in popular digital currencies, enhancing their portfolio diversification.

- Stocks and ETFs: Dollars Markets offers 158 stocks and 7 exchange-traded funds (ETFs), allowing clients to invest in individual companies and diversified portfolios.

Dollars Markets continuously updates its product offerings, ensuring that traders have access to the latest market opportunities. The broker's retail trading services are designed to be user-friendly, with a focus on providing competitive spreads and favorable trading conditions. While it does not currently offer services for institutional clients or white-label solutions, the broker remains committed to enhancing its platform and expanding its service offerings in the future.

4. Trading Platforms and Technology

Dollars Markets supports two of the most popular trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are known for their robust features, advanced charting capabilities, and user-friendly interfaces, making them suitable for traders of all skill levels.

MetaTrader 4 (MT4): This widely used platform provides a range of tools for technical analysis, automated trading through Expert Advisors (EAs), and multiple order types. It is accessible on desktop, web, and mobile devices, allowing traders to manage their accounts and execute trades from anywhere.

MetaTrader 5 (MT5): As the successor to MT4, this platform offers additional features, including more timeframes, advanced order management, and improved analytical tools. It also supports trading in a broader range of financial instruments, including stocks and futures.

Dollars Markets does not currently offer a proprietary trading platform, but its reliance on MT4 and MT5 ensures that traders have access to industry-standard technology. The broker provides web-based trading options, enabling clients to trade directly from their browsers without the need for software installation. Additionally, mobile applications for both MT4 and MT5 are available for iOS and Android devices, providing flexibility for traders on the go.

The broker utilizes a market execution model, ensuring that orders are filled at the best available prices in real-time. With servers located in strategic regions, Dollars Markets aims to minimize latency and enhance trade execution speeds, providing a seamless trading experience.

5. Account Types and Trading Conditions

Dollars Markets offers two primary account types tailored to different trading needs:

Standard Account: This account is designed for beginner and intermediate traders, requiring a minimum deposit of $15. It features floating spreads starting from 0.1 pips and allows for a range of trading strategies, including hedging and scalping. There are no commissions on trades executed through this account.

Pro Account: Targeted at experienced traders, the Pro account requires a minimum deposit of $50 and offers tighter spreads starting from 0.0 pips. This account type is ideal for high-frequency traders who require low trading costs to maximize their profitability. Similar to the standard account, the Pro account also allows for various trading strategies without any commissions.

Both account types provide leverage of up to 1:2000, enabling traders to control larger positions with a smaller capital outlay. The minimum trade size for both accounts is 0.01 lots, allowing for flexibility in position sizing.

Dollars Markets does not offer Islamic accounts or PAMM/MAM accounts for passive investment strategies at this time. However, the broker provides a demo account option for traders to practice their strategies and familiarize themselves with the trading platform before committing real funds.

6. Fund Management

Dollars Markets supports several deposit and withdrawal methods to facilitate seamless fund management for its clients. The available methods include:

- Bank Transfers: Clients can deposit and withdraw funds via bank transfers, which typically take 3-5 business days for processing.

- Credit/Debit Cards: The broker accepts deposits via MasterCard, with instant processing times.

- Cryptocurrency: Clients can also utilize B2BinPay for cryptocurrency deposits and withdrawals, which generally process faster than traditional banking methods.

The minimum deposit requirement varies by account type, with the standard account requiring a minimum of $15 and the Pro account requiring $50. While there are no deposit fees, withdrawal methods may incur fees depending on the selected method. The processing time for withdrawals can range from 1-5 business days, depending on the method chosen.

Dollars Markets does not charge inactivity fees, which is advantageous for traders who may not be active every month. However, clients are advised to check for any potential fees associated with specific withdrawal methods, particularly bank transfers.

7. Customer Support and Educational Resources

Dollars Markets provides customer support through multiple channels to assist clients with their inquiries and issues. The available support options include:

- Live Chat: Accessible directly from the broker's website, allowing for real-time assistance.

- Email Support: Clients can reach out via email at support@dollarsmarkets.com for non-urgent inquiries.

- Phone Support: The broker offers phone support, although specific details on availability may vary.

Customer support is available 24/7, ensuring that traders can receive assistance at any time. The broker also provides multilingual support, catering to a diverse global clientele.

In terms of educational resources, Dollars Markets offers a limited selection of materials, including basic trading guides and market analysis. While there is a blog section featuring articles on trading strategies and market trends, the depth and breadth of educational content may not be as extensive as that offered by more established brokers in the industry.

Traders seeking comprehensive educational resources may find the offerings somewhat lacking compared to competitors who provide webinars, video tutorials, and in-depth market analysis reports.

8. Regional Coverage and Restrictions

Dollars Markets primarily serves clients from various regions, with its operations focused on the global forex trading market. However, the broker is not available in certain countries, including:

- United States

- North Korea

- Iran

- Syria

- Belarus

- Afghanistan

- Myanmar

- Vanuatu

- Uganda

The restrictions are primarily due to regulatory compliance and licensing constraints imposed by various jurisdictions. Potential clients should verify their eligibility to trade with Dollars Markets based on their country of residence.

In conclusion, while Dollars Markets offers a range of trading products and competitive trading conditions, potential clients are encouraged to conduct thorough research and consider the broker's regulatory status, customer reviews, and available support options before making a decision. The broker's focus on providing a user-friendly trading experience and access to a diverse range of financial instruments positions it as a viable option for traders looking to enter the forex and CFD markets.

Dollars Markets Similar Brokers

Latest Reviews

FX1404335932

Malaysia

1. Unable to Withdraw for more than 3 weeks due to system maintenance(as their reason) 2. Every deposit appear different company accounts (only gambling company will use many bank account to evading Bank Negara’s detection) 3. A huge flaw occurred few week ago -During that time they offered digital wallet payments -When make a deposit, a QR code will appear. But the words "for casino" appeared in the upper right corner of the QR code. After I asked the customer service, they cancelled the digital wallet service within 5 minutes. From that day on, my trading account had problems. (deduction of funds, delay of severe). When I make a trade there is a delay of more than 10 seconds, this is a serious mistake in today's XAUUSD market. 4. This may be their warning and threat to me, making me 100% believe that this is an illegal online gambling company. There is no legal online gambling company in Malaysia. I have submitted the relevant evidence to Country hope to save other investor

Exposure

2025-04-15

sansa-6

Turkey

This company wiped out all my internal profits with various excuses, do not invest in this company, they only gave me my principal and it took 1.5 months

Exposure

2025-04-13

Reynaldi

Indonesia

I started trading on Dollars markets on January 11th, with my first trade being news trading using their platform. Initially, my withdrawals were processed very quickly, taking less than an hour. Recently, however, my withdrawals have started taking almost three days to process before reaching my bank account. Last month, on October 9th, I attempted to withdraw my money, but my request was declined and my account getting “under review”. I decided to wait for a review, finally completed on October 16th. I tried to withdraw again but I got declined again and my account got under review again. I can't withdraw my money from dollars markets

Exposure

2024-11-12

Ryandra

Indonesia

I started trading on Dollarsmarkets on February 21st, with my first trade being news trading using their platform. Initially, my withdrawals were processed very quickly, taking less than an hour. Impressed, I continued using the platform. Recently, however, my withdrawals have started taking almost three days to process before reaching my bank account. Last month, on October 8th, I attempted to withdraw my winnings, but my request was declined without explanation. I decided to wait for a review, which was finally completed on November 5th. When I tried to withdraw again, customer service informed me that the withdrawal gateways were under maintenance. I canceled that withdrawal and attempted to use my USDT wallet instead, but now my account is under review again for a month. This has brought my total waiting time to two months.

Exposure

2024-11-11

FX2341972464

Turkey

They confiscated my account under the name of Under Review and confiscated it, including my principal, I don't think they are an ethical company. If that was the case, why did they make such a decision after such a long time? It is unethical to treat the customer in this way.

Exposure

2024-11-04

Dollars Markets

News

Exposure Dollars Markets Review: Is Your Money Safe?

Dollars Markets is a brokerage established in 2019 with headquarters in Mauritius. It is very popular in Southeast Asia, specifically Malaysia and Indonesia. They offer trading on MT4 and MT5 platforms with low entry costs (accounts start at $15).

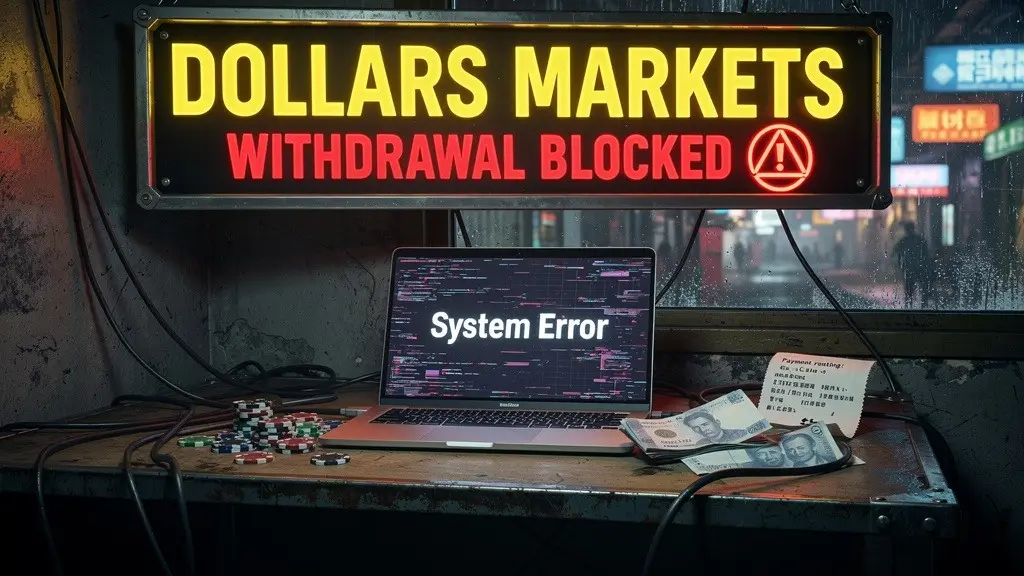

Exposure Dollars Markets Exposed: Inflicting Scams Across the Global Forex Landscape

Finding it virtually impossible to withdraw funds from Dollars Markets? Has your trading account been suspended without any reason? Do you fail to receive any positive response from the customer support officials? Firstly, make sure to get all your money back to your account. This is because Dollars Markets has been grabbing headlines for scamming investors around the globe, including those in South Asia. Many traders have heavily criticized the broker on several review platforms. In this article, we will share their negative reviews. Keep reading!

Exposure Global Traders Sound Alarm Over Dollars Markets' Shady Practices

This article exposes the alarming experiences of global traders with Dollars Markets, a low-rated and blacklisted broker, highlighting serious issues such as withdrawal delays, suspicious payment methods, and possible links to illegal online gambling.

News Dollars Markets Wins Prestigious "Best Trade Execution – Global" Award at Global Forex Awards 2024

26/9/2024 – Dollars Markets is proud to announce that we have been awarded the coveted “Best Trade Execution – Global” accolade at the Global Forex Awards 2024 in the Retail category. This prestigious

News Dollars Markets Introduces New Forex Branding Leadership

Dollars Markets rebrands with a new logo and enhanced identity, emphasizing innovation, transparency, and exceptional trading experiences for all clients.

News Dollars Markets Unveils a Bold New Look

Dollars Markets Announces Rebranding with New Logo and Enhanced Brand IdentityDollars Markets, a leader in the forex trading industry, is excited to announce its rebranding initiative. This transforma

News Bank of England Maintains Rates, Warns of Economy

The quarterly meeting of the Financial Policy Committee (FPC) of the Bank of England (BoE) took place on Tuesday, with a focus on highlighting the strength of Britain's economy despite challenging risks and limited growth expectations in the near term. Despite some members of the committee advocating for an increase in the counter-cyclical capital buffer (CCyB) from 2% to enhance banks' ability to withstand low loan losses, the decision was made to maintain the CCyB at its current level. However, the committee remains flexible and ready to modify the rate depending on future economic and financial fluctuations.

News Bank of England Maintains Rates, Warns of Economy

The quarterly meeting of the Financial Policy Committee (FPC) of the Bank of England (BoE) took place on Tuesday, with a focus on highlighting the strength of Britain's economy despite challenging risks and limited growth expectations in the near term.

News WikiFX Reviews Dollars Markets in Depth

In this article, we'll examine Dollars Markets' key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

News Can We Trust Dollars Markets??

In today's comprehensive review, WikiFX will delve into the details of Dollars Markets, examining its features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service to help you decide whether to use this platform. Keep reading to find out more!

Scorpion91

Indonesia

17 May 2025 21.24 I received email from Dollars Markets about my account in MT4 disabled and all position closed automatically.. After that, my fund returned to my wallet only $35.56, I suffered quite a lot of losses How the responbility from the broker? Yesterday I tried to chat customer service and they said 13 may send email to all clients, and I didn't get any email, howw??

Exposure

2025-05-18