Is Xianglin safe?

Pros

Cons

Is Xianglin Safe or Scam?

Introduction

Xianglin is a relatively new player in the forex market, having been established in 2023 and headquartered in the United States. As an international forex broker, it claims to offer a diverse range of trading instruments including forex, stocks, cryptocurrencies, global indices, and commodities. However, the rapid growth of online trading platforms has led to an increase in the number of scams, making it imperative for traders to carefully assess the legitimacy of brokers like Xianglin. This article aims to provide an objective analysis of Xianglin's safety and legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this investigation, we analyzed various sources, including online reviews, regulatory information, and trader experiences. We will utilize a structured framework to evaluate the broker, focusing on key aspects that are crucial for determining whether Xianglin is a safe choice for traders or a potential scam.

Regulation and Legitimacy

Regulation is a critical aspect of any financial broker's legitimacy. A well-regulated broker is subject to oversight by financial authorities, ensuring that they adhere to strict operational standards and provide a level of consumer protection. Unfortunately, Xianglin operates without any valid regulatory licenses, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders have little recourse if issues arise, such as withdrawal problems or disputes. Furthermore, the lack of a specified minimum deposit can deter potential traders who might be wary of investing in an unregulated environment. Historical compliance records and regulatory quality are essential indicators of a broker's reliability, and Xianglin's unregulated status is a red flag.

Company Background Investigation

Xianglin's brief history indicates that it is a newly established entity, having been founded in 2023. The company's ownership structure and management team details are somewhat opaque, which adds to the skepticism surrounding its operations. A thorough examination of the management team's background and professional experience is essential for assessing the company's credibility.

While the broker claims to provide a user-friendly trading experience, the lack of transparency regarding its ownership and operational structure raises concerns. Without clear information on the management team and their qualifications, it is challenging to evaluate the company's commitment to ethical trading practices and customer service.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for traders. Xianglin claims to offer a competitive trading environment, but its overall fee structure and any unusual or problematic fee policies need to be scrutinized.

| Fee Type | Xianglin | Industry Average |

|---|---|---|

| Spread for Major Pairs | Not Specified | Varies |

| Commission Structure | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

The absence of specified fees can be concerning, as traders may encounter hidden costs that are not disclosed upfront. Additionally, without a clear understanding of the spreads and commissions, traders may find themselves facing unexpected expenses that could affect their profitability.

Client Fund Safety

The security of client funds is paramount when evaluating a broker. Xianglin's measures for safeguarding client funds require careful examination. Effective fund safety protocols typically include segregating client funds from company operating funds, offering investor protection schemes, and implementing negative balance protection policies.

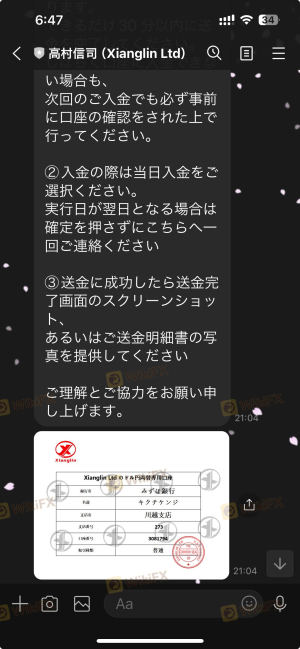

However, due to Xianglin's unregulated status, there are no guarantees regarding the safety of client funds. There have been reports of users facing difficulties withdrawing their funds, which further highlights the potential risks associated with trading through this broker. Historical incidents related to fund security can also provide insights into a broker's reliability.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. Reviews of Xianglin reveal a concerning trend of complaints, particularly regarding withdrawal difficulties and lack of communication from the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Communication Problems | Medium | Poor |

Several users have reported being unable to withdraw their funds, with some claiming that their accounts were frozen unless additional deposits were made. This pattern of complaints raises significant concerns about the broker's operational practices and customer support quality.

Platform and Execution

The performance and stability of a trading platform are critical for a positive trading experience. Xianglin promotes its trading web platform, but user experiences regarding platform performance and order execution quality need to be thoroughly assessed.

Traders have reported issues with order execution, including slippage and order rejections, which can significantly impact trading outcomes. The potential for platform manipulation is also a concern, particularly in an unregulated environment where oversight is lacking.

Risk Assessment

Using Xianglin as a trading platform comes with inherent risks that traders need to be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation, high potential for fraud. |

| Fund Security Risk | High | Reports of withdrawal issues and fund access problems. |

| Operational Risk | Medium | Concerns regarding platform reliability and execution. |

To mitigate these risks, traders are advised to exercise caution, conduct thorough research, and consider using regulated brokers with a proven track record.

Conclusion and Recommendations

In conclusion, the analysis of Xianglin raises significant concerns about its legitimacy and safety. The absence of regulation, coupled with numerous complaints regarding fund withdrawals and lack of transparency, suggests that traders should approach this broker with caution.

For those seeking to trade forex, it is advisable to consider regulated alternatives that provide a higher level of consumer protection and operational transparency. Brokers with established regulatory oversight, robust customer support, and a solid reputation should be prioritized to ensure a safer trading experience.

Is Xianglin a scam, or is it legit?

The latest exposure and evaluation content of Xianglin brokers.

Xianglin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Xianglin latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.