Xianglin Review 7

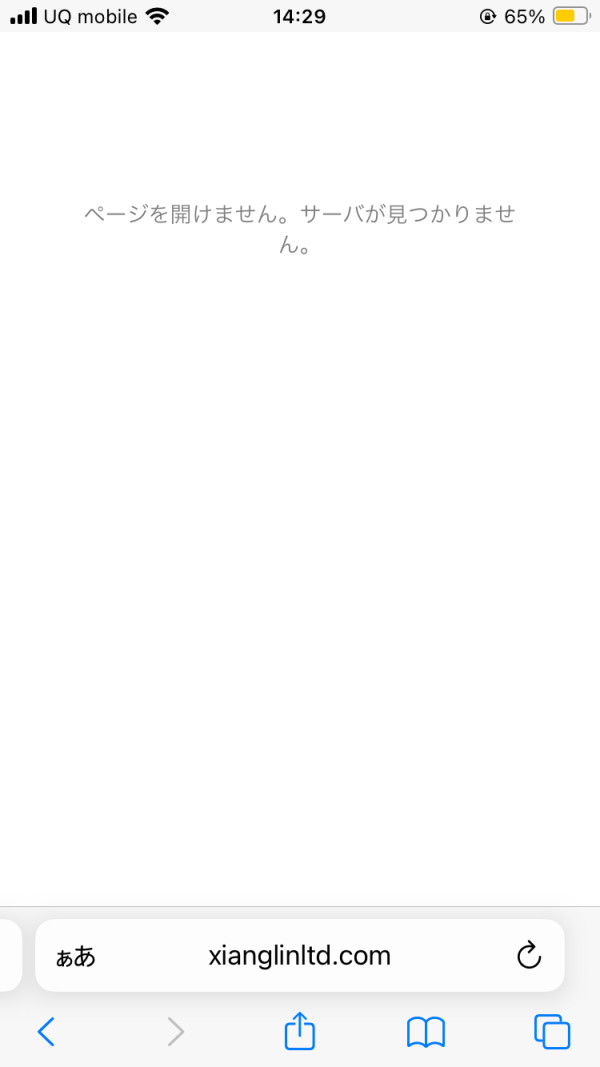

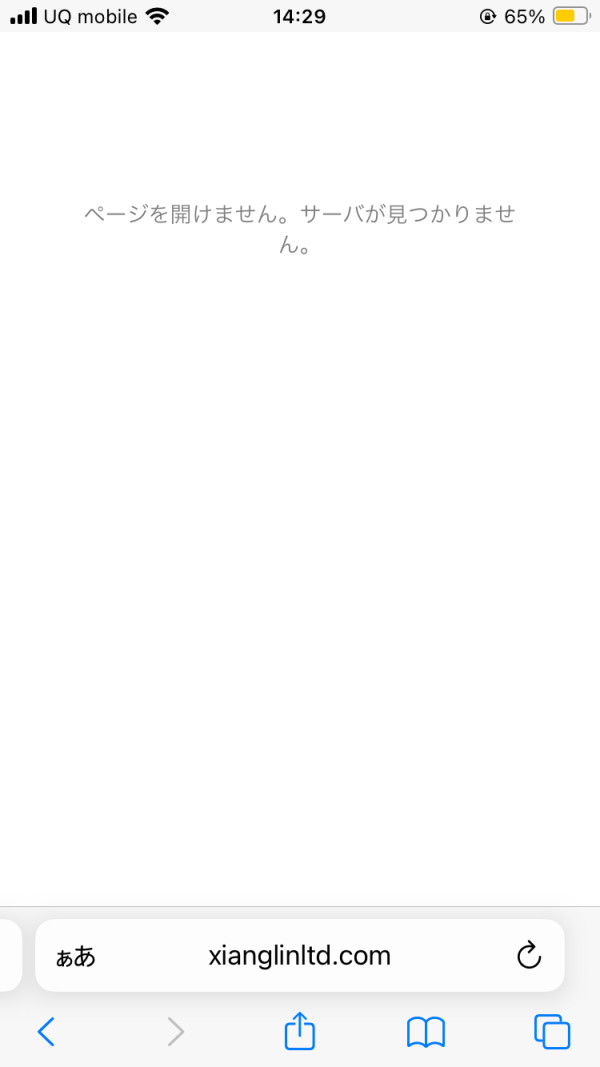

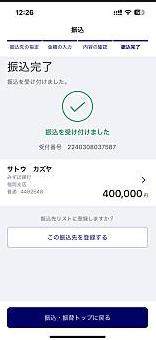

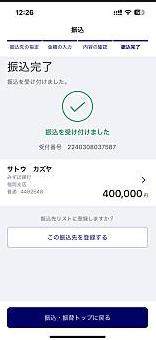

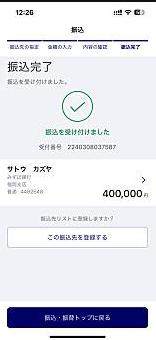

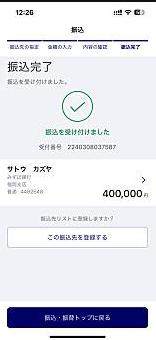

I was introduced to this exchange via LINE from Instagram and transferred a large amount of money, but I was unable to withdraw the money and reported it here. Exchanges that were available until recently can no longer be opened, and withdrawal accounts no longer even exist. It is clearly an exchange connected to a fraudulent group.

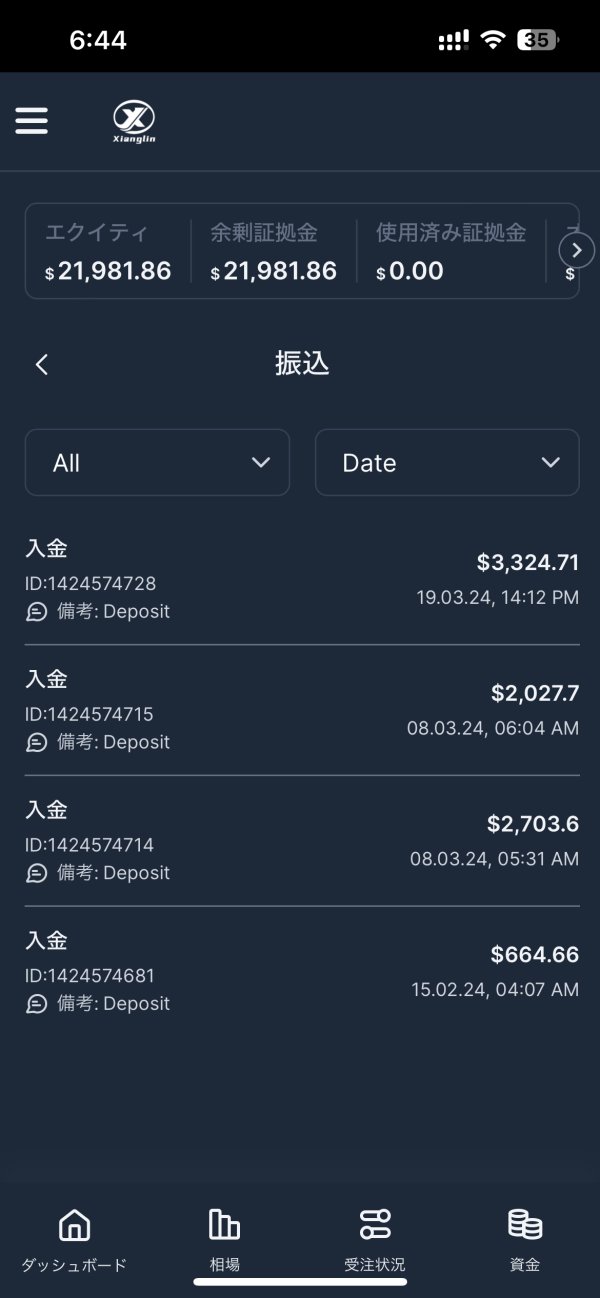

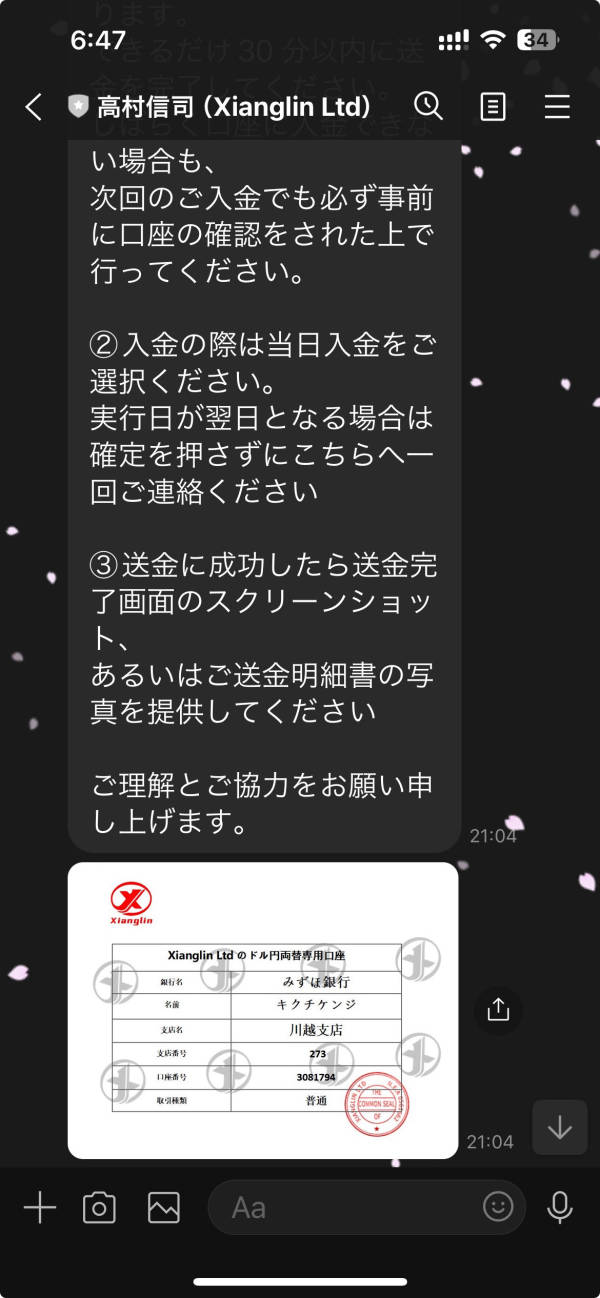

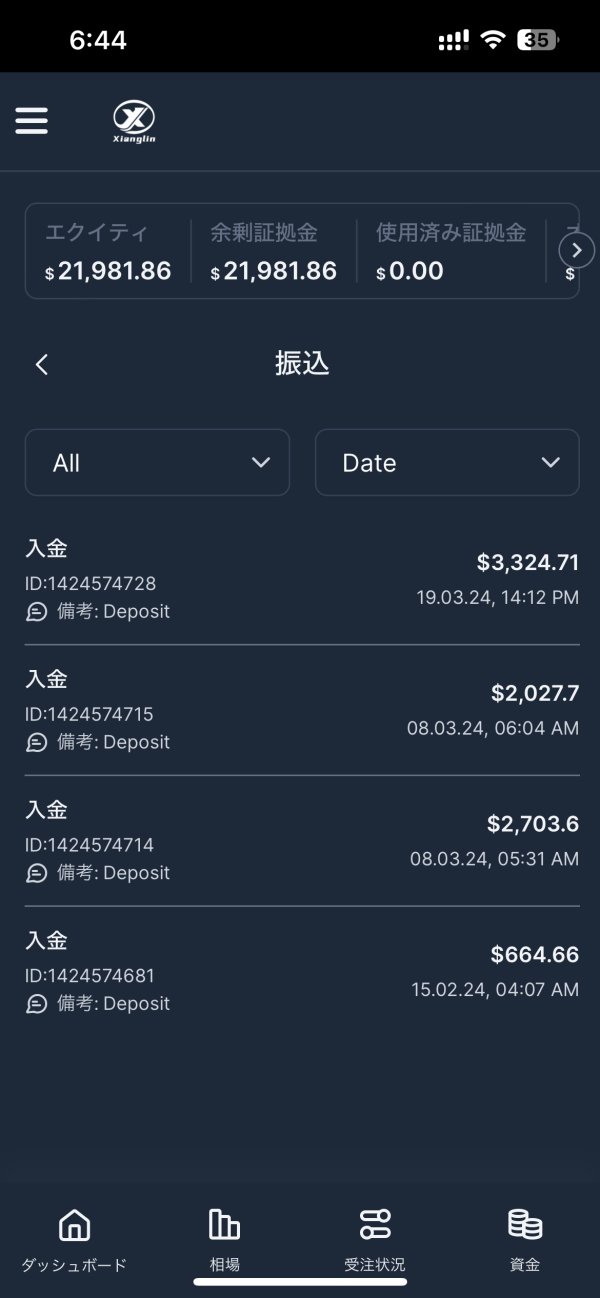

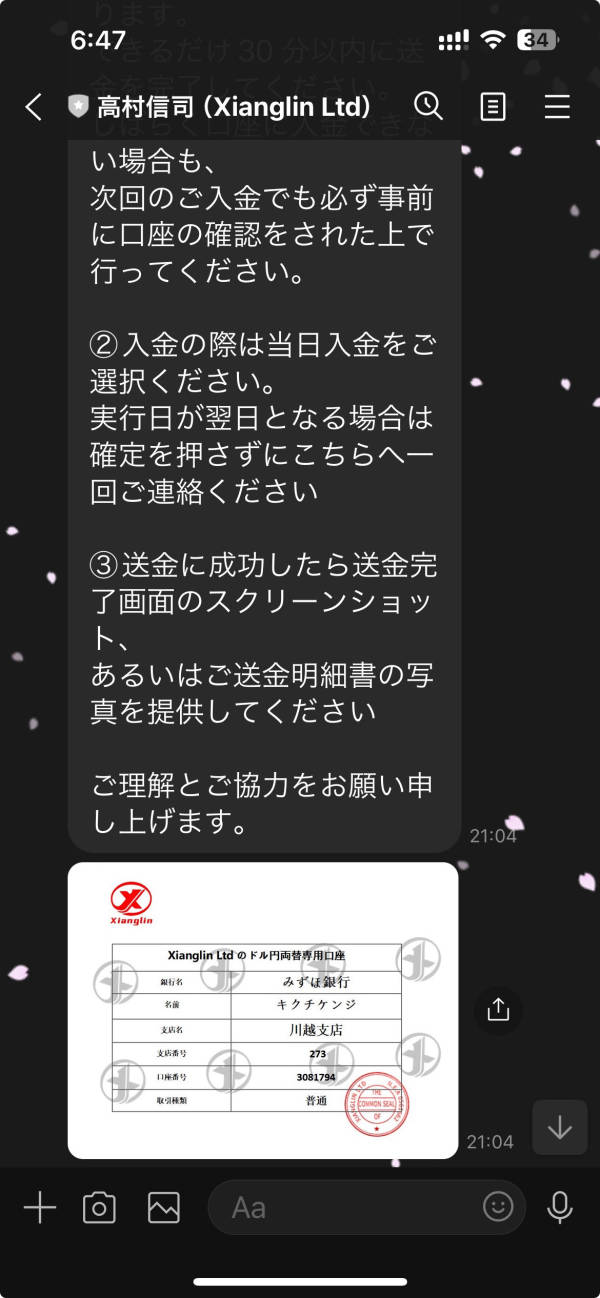

We would like to send you an important warning. I recently came across a scam pretending to be a Forex transaction. From this experience, I would like to warn others not to make the same mistake. ■Details of damage Impossibility of withdrawals: It became impossible to withdraw funds from FX transactions conducted through the platform "Xianglin." Even if you can see the profit, you can't get it. ■ Loss of contact with the person in charge: We have completely lost contact with the person in charge of the platform, including Mr. Shinji Takamura. All means of communication with me have been cut off, and I am exposed to the opacity of one-sided information. ■Suspicious LINE group: We also feel that the LINE group consisting of Hirofumi Matasugano, Takahiko Tosaka, and Minami Sugiyama is very suspicious. This group may be used to induce or manipulate information in fraudulent activities. ■Doubts about crude oil projects: We also judge that the crude oil projects proposed through Xianglin lack credibility. Although these types of projects claim high returns, they are often a mechanism to trap investors. ■Call out This notice is to prevent innocent investors like me from falling victim to fraud. If any of these names or projects sound familiar to you, please pay close attention. Please spread this message to help protect your safety and property. Please make your investments with caution and after checking the information carefully.

We would like to send you an important warning. I recently came across a scam pretending to be a Forex transaction. From this experience, I would like to warn others not to make the same mistake. ■Details of damage Impossibility of withdrawals: It became impossible to withdraw funds from FX transactions conducted through the platform "Xianglin." Even if you can see the profit, you can't actually get it. ■ Loss of contact with the person in charge: We have completely lost contact with the person in charge of the platform, including Mr. Shinji Takamura. All means of communication from me have been cut off, and I am exposed to the opacity of one-sided information. ■Suspicious LINE group: We also feel that the LINE group consisting of Hirofumi Matasugano, Takahiko Tosaka, and Minami Sugiyama is very suspicious. This group may be used to induce or manipulate information in fraudulent activities. ■Doubts about crude oil projects: We also judge that the crude oil projects proposed through Xianglin lack credibility. Although these types of projects claim high returns, they are often a mechanism to trap investors. ■Call out This notice is to prevent innocent investors like me from falling victim to fraud. If any of these names or projects sound familiar to you, please pay close attention. Please spread this message to help protect your safety and property. Please make your investments with caution and after checking the information carefully.

All are experience are excellent like trade deposited easy withdrawal easy.

The whole service (welcoming / introduction / registration / answer speed to questions / website interface, especially FAQ segment) is totally satisfying for now and i hope it's goes like this. Only reason I'm not giving 5 stars is because I haven't made a profit withdrawal yet, but everything is fine.

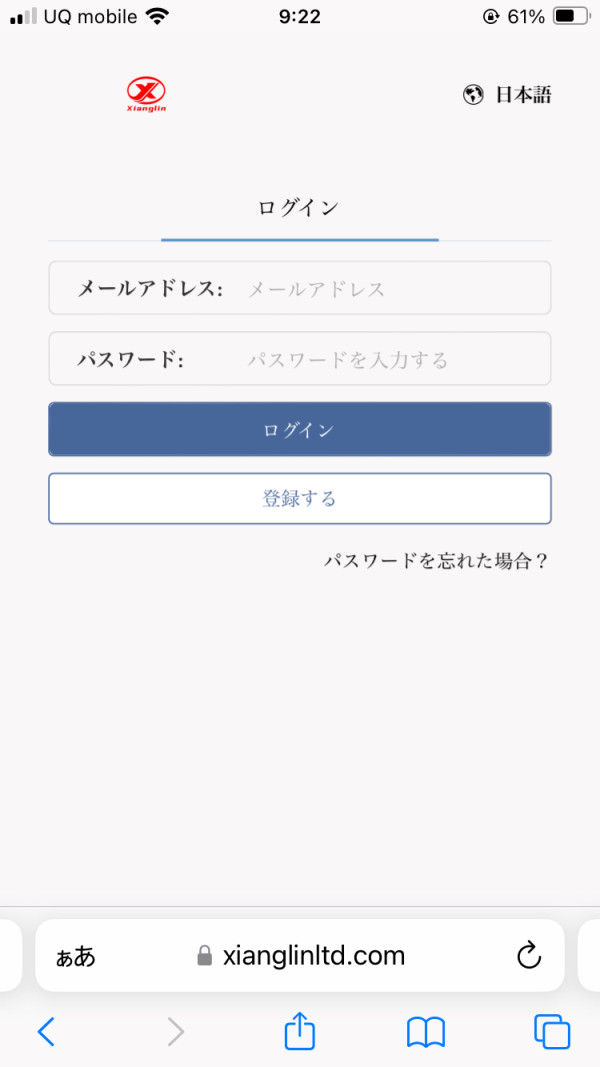

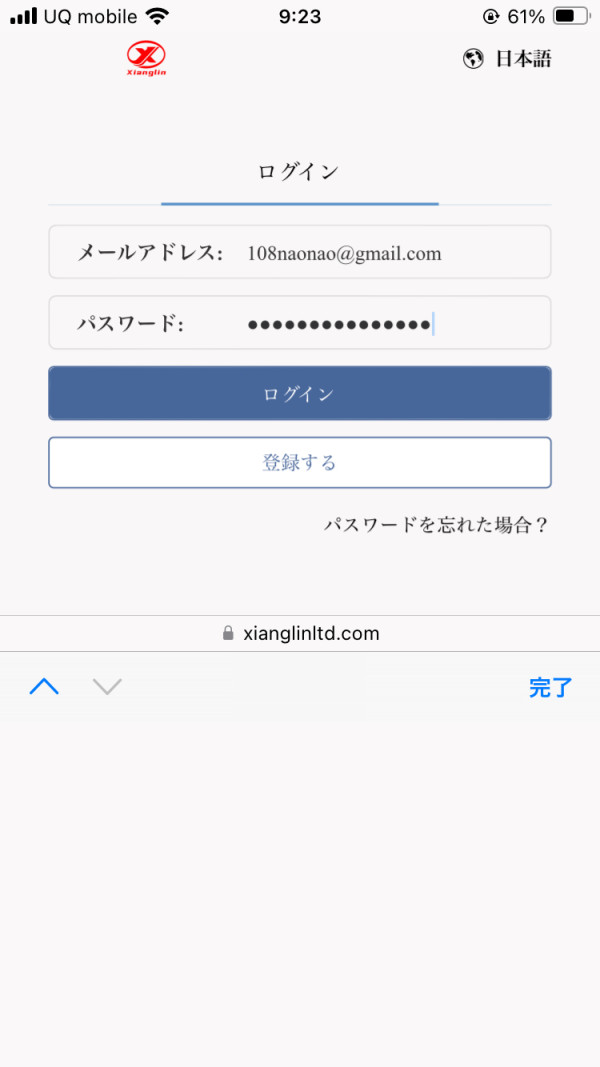

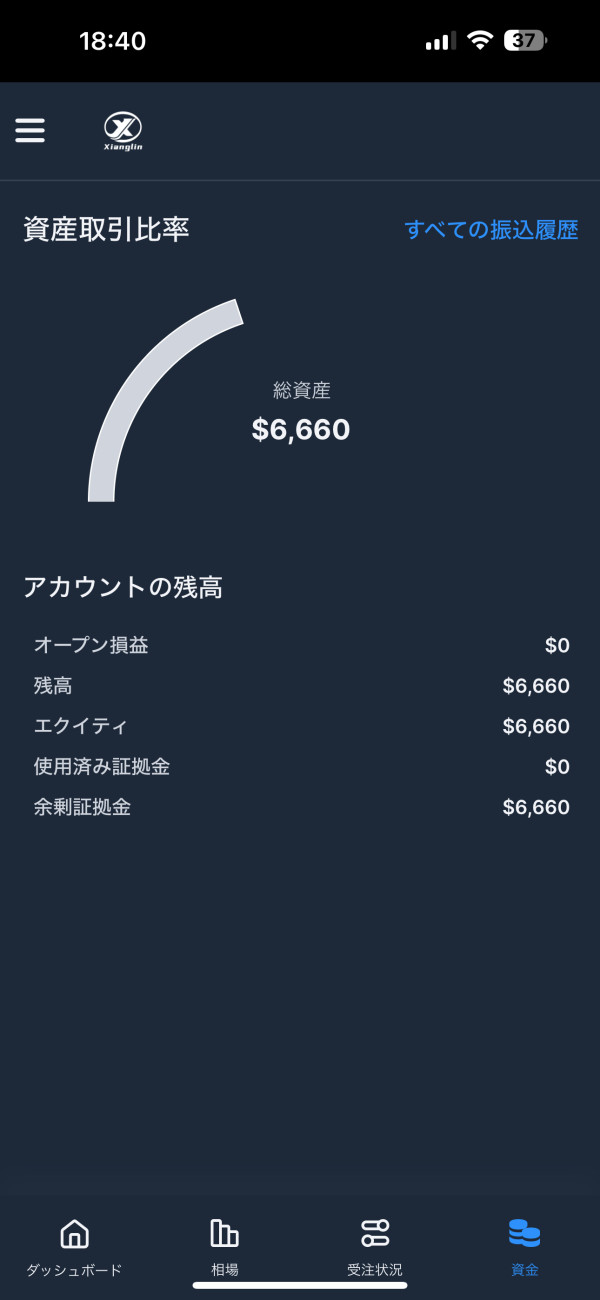

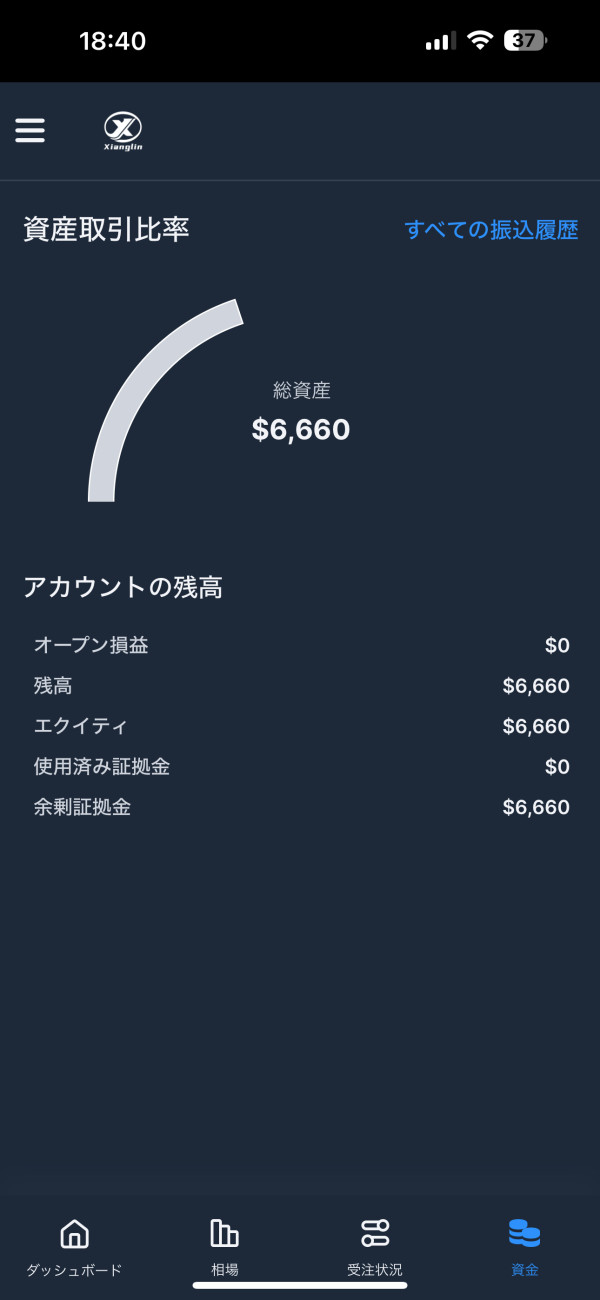

I was invited by Instagram to a LINE group and instructed to do his Forex trading on xianglin. I had a total of 6,600💲 in assets, and when I tried to make a withdrawal, my account was frozen. I was told that my account could not be unfrozen unless I deposited an additional 5% of the withdrawal amount. I want to withdraw it as soon as possible. https://m.xianglinltd.com/#/

He moved from Instagram to an assistant, then to a group, then from stock trading to FX trading, and now to crude oil for futures trading, and at first, he was able to withdraw money, but due to trading reasons, he couldn't withdraw anymore. Crude oil trading will end on March 12th, and there is a high possibility that contact will be lost after that.