Is Pivot Broker safe?

Pros

Cons

Is Pivot Broker Safe or Scam?

Introduction

Pivot Broker has emerged as a notable player in the forex market, attracting traders with its promises of high returns and a user-friendly trading platform. As the trading landscape becomes increasingly competitive, it is essential for traders to exercise caution and thoroughly evaluate any broker before committing their funds. This article aims to analyze whether Pivot Broker is a safe choice or potentially a scam. The assessment is based on a comprehensive investigation of regulatory compliance, company background, trading conditions, client experiences, and overall risk factors associated with this broker.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors influencing its legitimacy and safety. Pivot Broker operates without the oversight of any recognized financial regulatory authority, which raises significant concerns about its credibility. Regulatory bodies serve to protect investors by ensuring that brokers adhere to strict operational standards and provide transparency in their dealings.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Pivot Broker is not subject to regular audits or compliance checks, leaving clients vulnerable to potential fraud. Furthermore, the Financial Conduct Authority (FCA) in the UK has issued warnings regarding unregulated brokers like Pivot Broker, indicating that it may pose a risk to investors. The lack of regulatory oversight also means there is no recourse for traders in case of disputes or financial losses. This lack of accountability is a significant red flag for anyone considering trading with Pivot Broker.

Company Background Investigation

Pivot Broker's history and ownership structure are crucial in assessing its reliability. Unfortunately, detailed information about the company's origins, management team, and ownership is scarce. This lack of transparency can be a warning sign, as reputable brokers typically provide clear information about their history and the individuals running the firm.

The management teams expertise is another vital aspect to consider. A well-qualified team with a strong background in finance and trading can instill confidence in potential clients. However, the absence of publicly available information about the management team raises concerns about the broker's legitimacy. Additionally, the company's website does not provide sufficient details about its operational structure, which further complicates the evaluation of its credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by Pivot Broker is essential for potential traders. The broker claims to provide competitive spreads and a variety of trading instruments. However, the lack of transparency regarding fees and commissions can lead to unexpected costs for traders.

| Fee Type | Pivot Broker | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | N/A |

| Commission Model | N/A | N/A |

| Overnight Interest Range | N/A | N/A |

The absence of specific figures in the table indicates a significant lack of clarity in Pivot Broker's fee structure. Traders may find themselves facing hidden charges or unfavorable trading conditions that are not initially disclosed. This opacity can be detrimental to traders, especially those who are new to the forex market and may not fully understand the implications of various fee structures.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Pivot Broker's approach to fund security is unclear, as there is little information available on its website regarding fund segregation, investor protection, or negative balance protection policies.

Without proper measures in place, traders risk losing their investments in case of operational failures or financial mismanagement. Historical data on any past incidents involving fund security can provide insight into how the broker has handled such situations. However, the lack of documented cases raises concerns about the broker's commitment to safeguarding client assets.

Customer Experience and Complaints

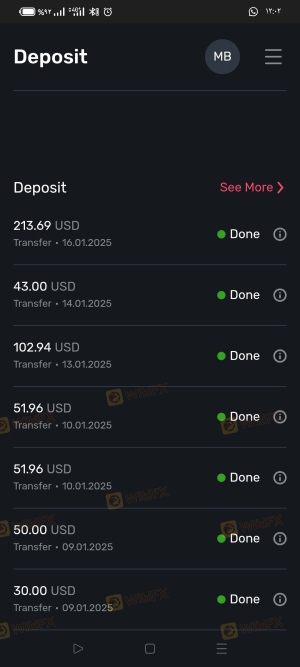

Analyzing customer feedback is crucial in understanding the overall experience with Pivot Broker. Numerous reviews and complaints suggest that clients have faced issues ranging from withdrawal difficulties to poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Fair |

Common complaints include delayed withdrawals, lack of communication from customer support, and difficulty in recovering funds. A few case studies highlight these issues, with clients reporting that their withdrawal requests were either ignored or met with unreasonable delays. Such patterns of complaints are concerning and indicate a potential lack of reliability and client support from Pivot Broker.

Platform and Trade Execution

The performance of the trading platform is another critical factor in evaluating Pivot Broker. Users have reported mixed experiences regarding platform stability, order execution quality, and instances of slippage.

A reliable trading platform should provide seamless execution without significant delays or rejections. However, reports of slippage and rejected orders may indicate underlying issues with the brokers infrastructure, potentially impacting trading outcomes for clients. Furthermore, any signs of platform manipulation could be a cause for concern, leading traders to question the broker's integrity.

Risk Assessment

Using Pivot Broker comes with a range of risks that traders should be aware of. The absence of regulation, unclear trading conditions, and a lack of transparency all contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Financial Risk | Medium | Lack of transparency in fees can lead to unexpected losses. |

| Operational Risk | High | Reports of withdrawal issues and poor customer service indicate operational weaknesses. |

To mitigate these risks, potential traders should conduct thorough research, consider starting with a small investment, and remain vigilant regarding any unusual practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that Pivot Broker may not be a safe choice for traders. The lack of regulation, transparency, and a history of customer complaints raises significant concerns about the broker's legitimacy. Traders should approach Pivot Broker with caution and consider alternative options that are well-regulated and have a proven track record of client satisfaction.

For those seeking reliable trading options, it is advisable to explore brokers that are regulated by reputable authorities and have positive reviews from existing clients. By prioritizing safety and transparency, traders can protect their investments and enhance their trading experience.

Is Pivot Broker a scam, or is it legit?

The latest exposure and evaluation content of Pivot Broker brokers.

Pivot Broker Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pivot Broker latest industry rating score is 1.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.