Is Wrich safe?

Pros

Cons

Is Wrich Safe or a Scam?

Introduction

Wrich is a forex broker that has emerged in the competitive landscape of online trading, positioning itself as a platform for traders seeking to engage in the foreign exchange market. Given the proliferation of online trading platforms, it is crucial for traders to carefully assess the credibility and safety of brokers before committing their funds. The forex market is not only vast but also fraught with risks, making it essential for traders to distinguish between legitimate brokers and potential scams. This article aims to evaluate the safety of Wrich by examining its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks. Our investigation relies on a thorough analysis of various online sources, including user reviews, regulatory databases, and expert opinions.

Regulation and Legitimacy

The regulatory framework surrounding a broker is one of the most critical factors in determining its legitimacy and safety. Wrich has been noted for its lack of robust regulatory oversight, which raises concerns for potential investors. Regulatory bodies play an essential role in ensuring that brokers adhere to industry standards and protect investors' interests. Below is a summary of Wrich's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Not Verified |

Wrich currently operates without a valid license from any recognized financial authority, which is a significant red flag. The absence of regulation means that there are no stringent checks on its operations, potentially exposing traders to risks such as fraud or mismanagement of funds. Moreover, past reports indicate that Wrich has a suspicious regulatory license, with warnings issued regarding its operational practices. This lack of oversight can lead to a loss of funds without recourse for recovery, making it imperative for traders to exercise caution when considering Wrich as their broker.

Company Background Investigation

Wrich's company history and ownership structure provide further insight into its credibility. The broker appears to have been established for several years, but specific details about its founding and ownership remain unclear. This opacity can contribute to a lack of trust among potential clients.

The management team behind Wrich is another critical aspect to consider. A strong and experienced management team can significantly impact a broker's operations and reliability. However, information regarding the qualifications and backgrounds of Wrich's management is scarce, raising concerns about the expertise guiding the company.

In terms of transparency, Wrich has been criticized for not providing adequate information about its operations, which is essential for potential clients to make informed decisions. The lack of clear communication and disclosure about the company's practices can be indicative of an untrustworthy broker, leading to further skepticism regarding its safety.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. Wrich offers various trading options, but the overall fee structure and any unusual policies warrant close examination.

| Fee Type | Wrich | Industry Average |

|---|---|---|

| Spread for Major Pairs | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | High | Low to Moderate |

Wrich's variable spreads for major currency pairs can be concerning, especially if they exceed industry averages. Additionally, the broker's commission model is not clearly defined, which can lead to unexpected costs for traders. High overnight interest rates can also impact profitability, particularly for those engaging in long-term trades.

Without transparent information about trading fees, traders may find themselves facing hidden costs that can erode their capital. As such, potential clients should approach Wrich with caution, ensuring they fully understand the fee structure before committing funds.

Customer Fund Security

The security of customer funds is paramount when selecting a forex broker. Wrich's measures for safeguarding client funds are crucial to assess. A reputable broker typically employs strict protocols for fund segregation, investor protection, and negative balance protection. However, Wrich's practices in these areas are not well-documented.

Traders should be aware that the absence of robust security measures can lead to significant risks. If a broker does not segregate client funds, there is a risk that these funds could be misappropriated. Furthermore, without investor protection mechanisms in place, traders may find it challenging to recover their funds in the event of a broker's insolvency.

Reports of past security issues or disputes involving Wrich can further exacerbate concerns regarding fund safety. It is crucial for potential clients to investigate any historical incidents related to fund security before deciding to trade with Wrich.

Customer Experience and Complaints

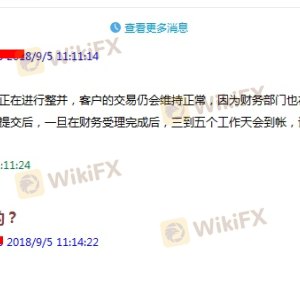

Customer feedback is a valuable indicator of a broker's reliability and service quality. Analyzing user experiences with Wrich reveals a mix of opinions, with some clients expressing dissatisfaction with the broker's services. Common complaints often include issues related to withdrawal difficulties, lack of customer support, and unclear communication.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Inadequate |

| Communication Clarity | High | Poor |

The severity of complaints regarding withdrawal issues is particularly concerning, as it indicates potential problems with accessing funds. A broker should facilitate smooth withdrawal processes, and any delays or complications can signal deeper operational issues.

Additionally, the quality of customer support is critical for traders, especially when they encounter problems. Wrich's inadequate response to client inquiries can lead to frustration and a lack of trust, further reinforcing the need for caution when considering this broker.

Platform and Trade Execution

The performance of a trading platform can significantly influence a trader's experience. Wrich's platform has been evaluated for its functionality, stability, and user experience. However, there are concerns regarding order execution quality, including instances of slippage and order rejections.

Traders have reported experiencing delays in trade execution, which can be detrimental, especially in a fast-paced market like forex. The possibility of platform manipulation or unfair practices is another area of concern that potential clients should consider.

A reliable trading platform should provide fast execution speeds and a seamless user experience. If Wrich's platform fails to meet these standards, it could hinder traders' ability to respond effectively to market movements.

Risk Assessment

Engaging with Wrich entails several risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases exposure to fraud. |

| Financial Risk | Medium | Unclear fee structure may lead to unexpected costs. |

| Operational Risk | High | Reports of withdrawal issues and platform instability. |

To mitigate these risks, potential clients should conduct thorough due diligence before engaging with Wrich. This includes seeking out user reviews, verifying the broker's claims, and considering alternative brokers with stronger regulatory oversight and better customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Wrich raises several red flags regarding its safety and legitimacy. The absence of proper regulation, coupled with a lack of transparency and numerous customer complaints, indicates that traders should exercise caution when considering this broker.

For traders seeking a reliable forex broker, it is advisable to explore alternatives that offer robust regulatory oversight, transparent fee structures, and positive customer experiences. Brokers regulated by top-tier authorities, such as the FCA or ASIC, typically provide a safer trading environment.

In summary, while Wrich may present itself as a viable trading option, the risks associated with using this broker suggest that it may not be the safest choice for traders looking to protect their investments.

Is Wrich a scam, or is it legit?

The latest exposure and evaluation content of Wrich brokers.

Wrich Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Wrich latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.