Is WETUOKE safe?

Business

License

Is Wetuoke Safe or a Scam?

Introduction

Wetuoke is an online trading platform that has emerged in the forex market, attracting attention for its competitive trading conditions and wide range of available financial instruments. However, with the increasing number of fraudulent schemes in the trading industry, it is crucial for traders to exercise caution and conduct thorough evaluations of any brokerage firm before committing their funds. This article aims to explore the legitimacy of Wetuoke by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall safety measures. Our investigation is based on a comprehensive review of available online resources, including user feedback and expert analyses.

Regulatory Status and Legitimacy

One of the most critical aspects when assessing the safety of a trading platform is its regulatory status. A well-regulated broker is more likely to adhere to industry standards and protect its clients' interests. Unfortunately, Wetuoke lacks clear regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Regulated | N/A | N/A | Unverified |

The absence of regulation means there is no governmental body overseeing Wetuoke's operations, which can lead to potential risks for traders. Regulatory authorities are essential for ensuring compliance with financial laws and safeguarding client funds. Without such oversight, Wetuoke may not be held accountable for any misconduct or malpractice. This lack of regulation is a significant red flag, as traders typically prefer to work with brokers that are licensed and regulated by reputable financial authorities.

Company Background Investigation

Wetuoke's company history and ownership structure are also pivotal in evaluating its trustworthiness. The platform appears to be relatively new, with limited information available regarding its founding and operational history. The lack of transparency surrounding the company's ownership raises questions about its accountability and reliability.

Furthermore, the management team's background and experience in the financial sector are crucial factors that can influence the firm's operations. Unfortunately, details about the key personnel behind Wetuoke are scarce, which can lead to concerns about the firm's ability to manage client funds effectively. A transparent brokerage should provide information about its leadership team, including their qualifications and relevant experience in the trading industry.

Overall, Wetuoke's lack of transparency regarding its ownership and management raises doubts about its credibility. This is particularly important for potential clients who need assurance that their funds are in capable hands.

Trading Conditions Analysis

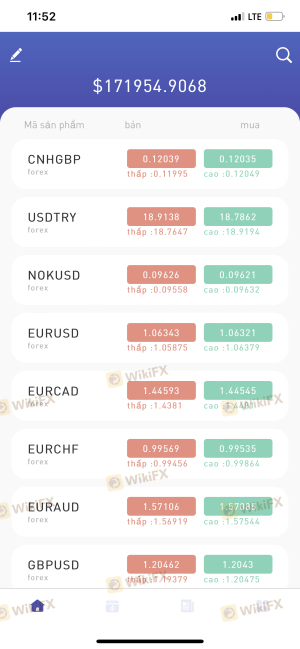

When evaluating whether Wetuoke is safe, it is essential to consider its trading conditions, including fees, spreads, and commissions. A broker's fee structure can significantly impact a trader's profitability, making it crucial to understand the costs involved.

Wetuoke offers a variety of trading instruments, including forex, commodities, and cryptocurrencies, but it is vital to scrutinize its fee policies. Traders have reported that Wetuoke employs a competitive pricing model, but there are concerns regarding hidden fees that may not be immediately apparent.

| Fee Type | Wetuoke | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Structure | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The table above illustrates that Wetuoke's spreads may be higher than the industry average, which could affect traders' overall returns. Additionally, the absence of a clear commission structure raises questions about potential hidden costs that could arise during trading. Traders must be vigilant and read the fine print to avoid unexpected charges.

Client Funds Security

The safety of client funds is paramount when considering whether Wetuoke is safe. A reputable broker should implement robust measures to protect clients' investments and ensure the security of their funds. Unfortunately, Wetuoke's measures in this regard are not well-documented.

Traders should look for features such as segregated accounts for client funds, which ensure that traders' money is kept separate from the broker's operational funds. Additionally, investor protection schemes, such as those provided by regulatory authorities, offer an extra layer of security for clients.

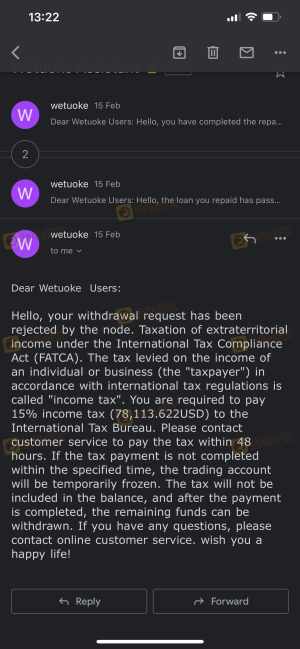

Wetuoke's lack of clear information regarding its fund security measures is concerning. Historical issues related to fund safety can also tarnish a broker's reputation. If Wetuoke has faced any past controversies regarding fund mismanagement or withdrawal issues, it would be a significant factor in determining its safety.

Customer Experience and Complaints

Understanding customer experiences with Wetuoke is vital in assessing whether it is safe or a scam. Analyzing user feedback can provide insights into the broker's reliability and the quality of its services.

Many users have reported mixed experiences with Wetuoke. While some traders appreciate the platform's user-friendly interface and range of trading options, others have raised concerns about withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Lack of Transparency | Medium | No Clarification |

| Poor Customer Support | High | Unresolved Issues |

The table above highlights common complaints associated with Wetuoke. Withdrawal delays and poor customer support are significant issues that can deter potential clients. A broker's ability to respond effectively to customer concerns is crucial for building trust and maintaining a positive reputation.

Platform and Execution Quality

The performance of a trading platform plays a crucial role in a trader's overall experience. Wetuoke claims to offer a reliable trading platform with fast execution speeds and minimal slippage. However, user reviews suggest that there may be inconsistencies in order execution quality, which could impact trading outcomes.

Traders should be wary of any signs of platform manipulation or excessive slippage, as these can indicate a lack of integrity in the broker's operations.

Risk Assessment

Using Wetuoke comes with inherent risks that traders should be aware of before engaging with the platform.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns about accountability. |

| Financial Risk | Medium | Potential for hidden fees and higher spreads. |

| Operational Risk | High | User reports of withdrawal delays and poor support. |

The risk assessment table summarizes key areas of concern when using Wetuoke. Traders should consider these risks carefully and take appropriate measures to mitigate them, such as only investing funds they can afford to lose and conducting thorough research before trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that Wetuoke raises several red flags that warrant caution. The lack of regulation, transparency issues, and mixed customer feedback indicate that traders should approach this broker with skepticism.

For those considering trading with Wetuoke, it is essential to weigh the potential risks against the benefits. If you prioritize safety and regulatory oversight, it may be wise to explore alternative brokers that are well-regulated and have a proven track record of reliability.

Overall, while Wetuoke may offer appealing trading conditions, the potential risks and lack of transparency make it a questionable choice for traders. Always conduct thorough due diligence and consider your trading goals before making a decision.

Is WETUOKE a scam, or is it legit?

The latest exposure and evaluation content of WETUOKE brokers.

WETUOKE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WETUOKE latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.