Is WALSUN safe?

Business

License

Is Walsun Safe or a Scam?

Introduction

Walsun, a forex broker operating in the online trading space, has attracted attention in recent years. As traders increasingly seek opportunities in the foreign exchange market, the importance of selecting a trustworthy broker cannot be overstated. Is Walsun safe? This question is critical as it directly impacts the financial security and trading success of its clients. Given the prevalence of scams in the forex industry, traders must conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive analysis of Walsun, focusing on its regulatory status, company background, trading conditions, client experiences, and overall safety. The investigation draws on multiple sources, including user reviews, regulatory databases, and industry reports, to present a balanced view of whether Walsun is a safe choice for traders.

Regulation and Legitimacy

The regulatory landscape is a vital aspect of assessing any forex broker's legitimacy. Walsun's regulatory status is particularly concerning, as it has been flagged for operating without proper oversight. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | None | United States | Unauthorized |

Walsun operates without a license from recognized regulatory bodies, which raises significant red flags. Regulatory oversight is crucial as it ensures that brokers adhere to strict standards of conduct, providing a level of protection for traders. In Walsun's case, the absence of regulatory compliance suggests a higher risk of potential fraud or mismanagement. Additionally, the lack of historical compliance records further compounds concerns regarding its operational practices.

Company Background Investigation

Walsun's history and ownership structure are important factors in evaluating its reliability. Founded in 2013, Walsun has positioned itself within the forex market, but there is limited publicly available information regarding its ownership and management team. The company's transparency is questionable, as it does not provide detailed insights into its operational practices or the qualifications of its leadership.

The management team's background is critical in determining the broker's credibility. A team with extensive experience and a solid track record in the financial services industry often indicates a more trustworthy operation. However, Walsun's lack of information on its management raises concerns about its commitment to transparency and accountability. Without a clear understanding of who is running the company, potential clients may find it difficult to trust Walsun as a reliable trading partner.

Trading Conditions Analysis

When evaluating whether Walsun is safe, it's essential to consider its trading conditions. The broker's fee structure and trading costs can significantly impact a trader's profitability. Walsun's overall fees appear to be competitive, but there are indications of potential hidden costs that could affect traders adversely. Heres a comparison of core trading costs:

| Fee Type | Walsun | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | High | Low to Medium |

The spread on major currency pairs offered by Walsun varies, which can be a disadvantage for traders looking for consistency. Additionally, the absence of a clear commission structure may lead to confusion, and traders should be wary of potential overnight interest charges that could be higher than industry standards. Such fees can erode profits, making it essential for traders to fully understand the cost implications before engaging with Walsun.

Client Fund Safety

The security of client funds is paramount when assessing any broker's safety. Walsun's approach to safeguarding client deposits is a critical factor in determining whether Walsun is safe. It is essential to evaluate their policies regarding fund segregation, investor protection, and negative balance protection. Unfortunately, Walsun does not provide clear information on these safety measures, which is concerning for potential clients.

Typically, reputable brokers maintain segregated accounts for client funds, ensuring that traders' money is kept separate from the broker's operational funds. This practice protects clients in case of the broker's insolvency. Moreover, negative balance protection is a critical feature that prevents traders from losing more than their initial investment. However, without transparency from Walsun regarding these policies, traders may face significant risks regarding the safety of their funds.

Customer Experience and Complaints

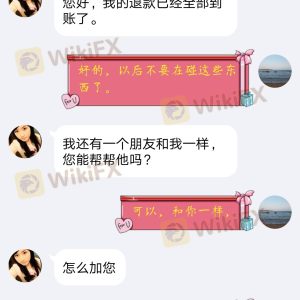

Understanding customer experiences and common complaints is vital in evaluating whether Walsun is safe. Feedback from users indicates a mixed experience, with several complaints related to withdrawal issues and poor customer service. Below is a summary of key complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow to respond |

| Poor Customer Support | Medium | Inconsistent |

| Unclear Fee Structures | Medium | Limited clarity |

Many users have reported delays in withdrawing funds, which is a significant red flag for any broker. A broker's ability to process withdrawals efficiently is a strong indicator of its reliability. Additionally, complaints regarding customer support suggest that traders may struggle to receive timely assistance when issues arise, further exacerbating concerns about Walsun's overall safety.

Platform and Trade Execution

The performance of the trading platform is another critical factor in determining whether Walsun is safe. Traders rely on a stable and efficient platform for executing trades, and any issues with execution quality can lead to significant losses. Feedback on Walsun's platform indicates mixed reviews, with some users experiencing slippage and order rejections.

Slippage occurs when a trade is executed at a different price than expected, often during volatile market conditions. High slippage rates can hinder trading performance and lead to frustration among traders. Additionally, any signs of platform manipulation or irregularities in order execution would raise serious concerns about Walsun's integrity as a broker.

Risk Assessment

Evaluating the risks associated with trading through Walsun is essential for prospective clients. A comprehensive risk assessment can help traders make informed decisions. Below is a summary of key risk categories:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates without proper regulation |

| Fund Safety Risk | High | Lack of transparency on fund protection |

| Execution Risk | Medium | Reports of slippage and order rejections |

Given the high regulatory and fund safety risks, prospective traders should exercise caution when considering Walsun as their broker. It is advisable to implement risk mitigation strategies, such as limiting initial deposits and conducting thorough research before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Walsun is not a safe choice for forex trading. The lack of regulatory oversight, coupled with poor customer feedback and transparency issues, raises significant concerns for potential clients. Traders should be especially wary of the risks associated with fund safety and execution quality.

For those seeking reliable alternatives, it is recommended to consider brokers that are regulated by top-tier authorities and have a proven track record of customer satisfaction. Brokers such as OANDA, IG, or Forex.com offer robust regulatory frameworks and positive user experiences, making them more trustworthy options for traders. Ultimately, conducting thorough research and understanding the risks involved is crucial for success in the forex market.

Is WALSUN a scam, or is it legit?

The latest exposure and evaluation content of WALSUN brokers.

WALSUN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WALSUN latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.